Author: Biteye Core Contributor Viee

Editor: Biteye Core Contributor Crush

Community: @BiteyeCN

Can the dumbbell strategy make money in this bull market?

Today, I want to share with you a strategy that can make big profits while avoiding losing everything: the dumbbell strategy.

👇 Analyzed the performance of the following crypto assets through indicators:

BTC, the eternal king: BTC.D index

ETH lags behind BTC in this stage: ETH/BTC exchange rate

Overall weakness of altcoins: (1) Altseason index (2) Altcoin market cap

Meme coins, high risk and high return, outperforming BTC and ETH: Memecoin index

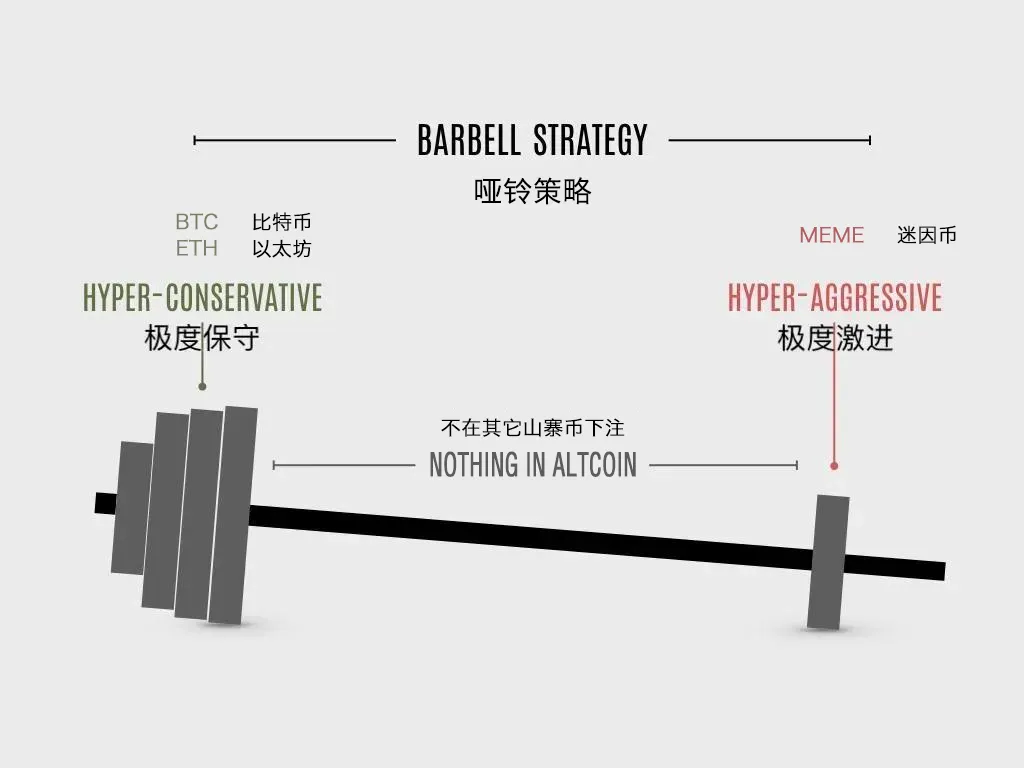

01 What is the dumbbell strategy?

The dumbbell strategy, mentioned by Taleb in "Antifragile", involves adopting a conservative strategy in one area and an open strategy in another, abandoning the middle ground. In simple terms, it means "mostly conservative, a little aggressive".

In the crypto market, most of the assets can be invested in relatively safe assets such as BTC and ETH, while a small portion of funds can be invested in high-risk assets such as Meme coins, with minimal participation in altcoins.

This approach can help maintain stability in the highly volatile crypto market while also providing the opportunity for high returns through high-risk assets (such as Meme coins).

Next, let's objectively assess the performance of BTC, ETH, most altcoins, and Meme coins through some indicators.

02 BTC, the eternal king: Refer to BTC.D index (Bitcoin Dominance)

The Bitcoin dominance index reflects the market value ratio of Bitcoin and is often used to judge whether the altcoin season is beginning. From the chart, it can be seen that during the last bull market in 2021, the BTC.D index was significantly declining during the altcoin season.

The logic can be explained as follows: BTC.D index declines ➡️ Bitcoin dominance decreases ➡️ Increased risk ➡️ Altcoins regain market share ➡️ Altcoins start to surge. (And vice versa)

Currently, it is still the Bitcoin season, with the index rising since the beginning of this year, reaching 56% as of July 26th. The performance of altcoins still lags behind Bitcoin, indicating that Bitcoin maintains its dominance.

03 ETH lags behind BTC in this stage: Refer to ETH/BTC exchange rate

Generally, the larger the ETH/BTC exchange rate, the smaller the price difference between the two, indicating strong performance of ETH. Conversely, a smaller ratio indicates a larger price difference, suggesting weaker performance of ETH.

Additionally, this indicator is also used to assess market interest in altcoins. If this ratio starts to outperform BTC, it may be a sign of funds flowing into altcoins.

Currently, the ETH/BTC exchange rate is still relatively low, indicating weaker performance of ETH. Even the approval of ETFs has not been able to reverse the trend for Ethereum. However, due to its low position, if there is confidence in ETH, it may be considered to gradually build positions and wait for subsequent increases.

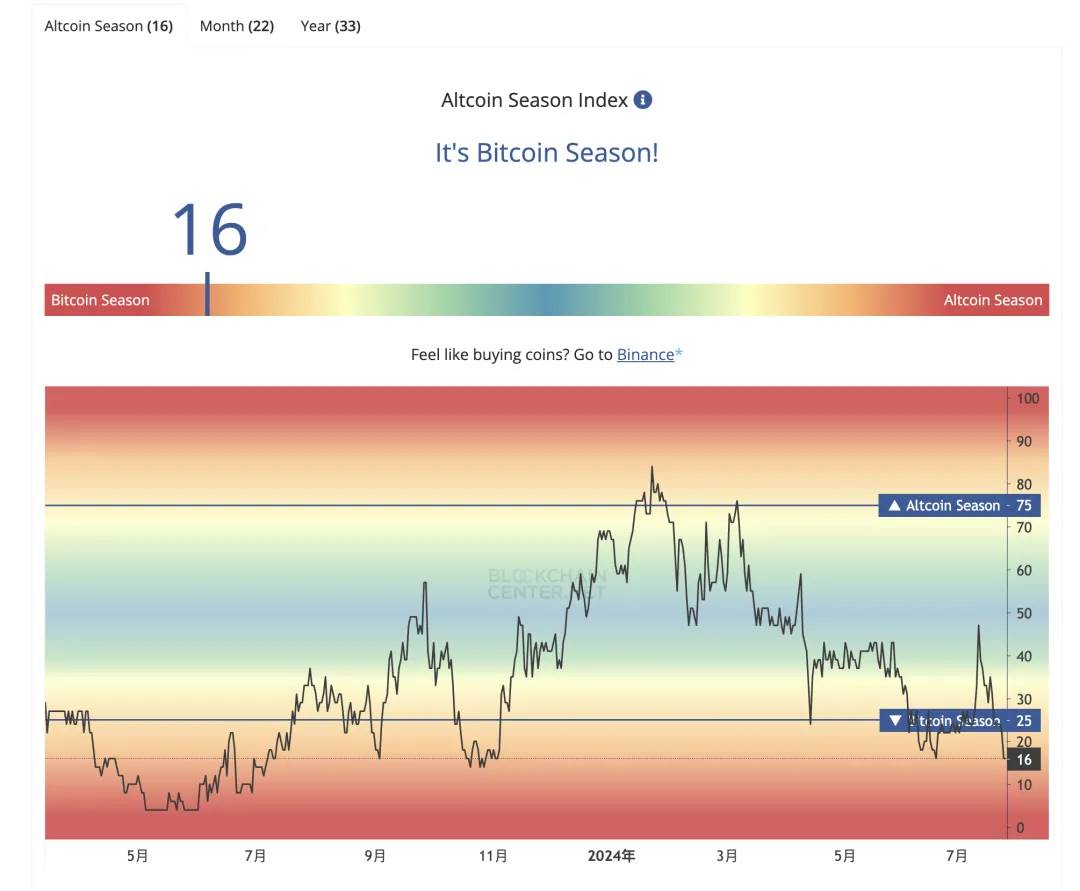

04 Overall weakness of altcoins: Refer to (1) Altseason index

The Altseason index tracks the sentiment of the altcoin market, calculating the proportion of the top 50 altcoins outperforming Bitcoin over a period of time. An index greater than 75 indicates the altcoin season, while less than 25 indicates the Bitcoin season.

It is clear that we are currently in the Bitcoin season, with the index at 16, indicating relatively weak momentum for altcoins. Since the beginning of this year, the index has only been greater than 75 at the end of January, lasting only half a month. Compared to the period from the end of March to the end of June in 2021, when the index exceeded 75 for a continuous 3 months, it is not yet a true altcoin season.

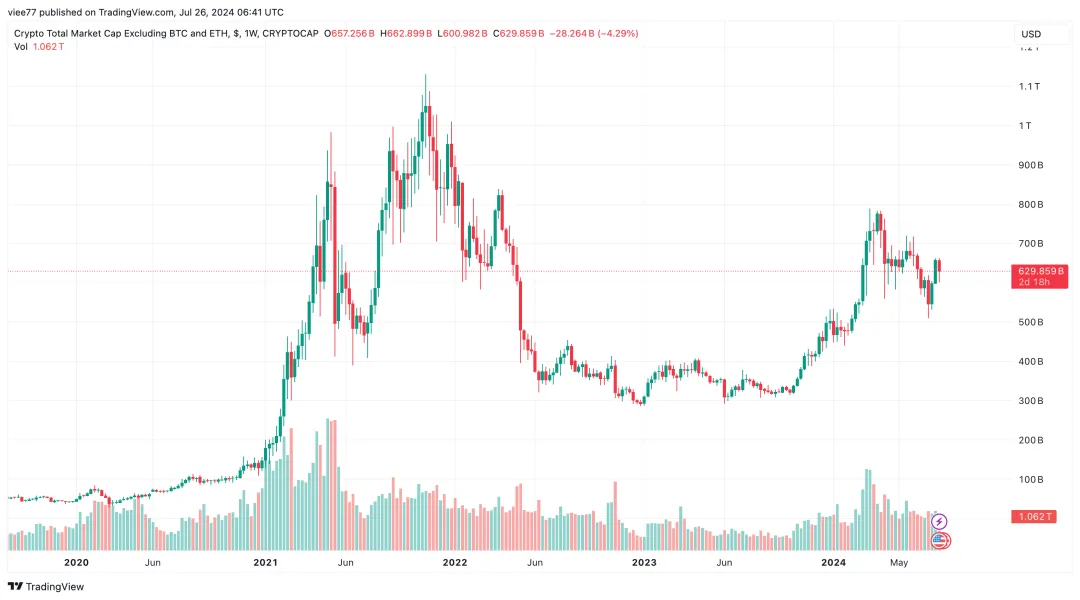

05 Overall weakness of altcoins: Refer to (2) Altcoin market cap

This indicator, Crypto Total Market Cap Excluding BTC & ETH, reflects the total market value of tokens in the crypto market excluding BTC and ETH, indicating the overall situation of funds flowing into the altcoin market.

After a significant increase in the total altcoin market cap at the beginning of the year, it has not continued the trend and has fluctuated repeatedly in recent months. There is currently no clear breakthrough signal, indicating that altcoins as a whole are still relatively weak.

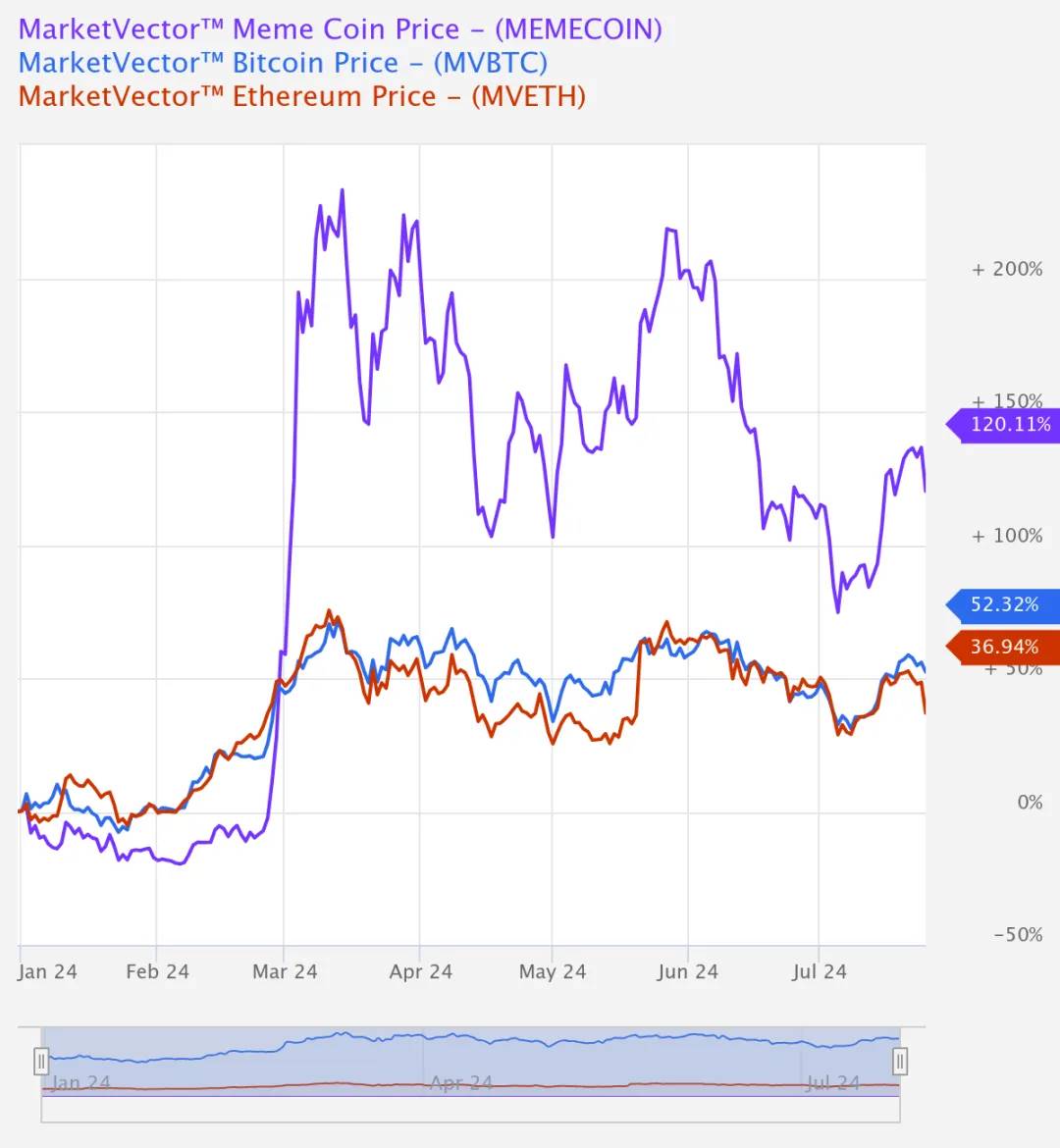

06 Meme coins, high risk and high return, outperforming BTC, ETH: Refer to Memecoin index

The MarketVector's Meme Coin Index tracks the performance of the top 6 meme tokens by market value.

The main components include $DOGE, $SHIB, $PEPE, $FLOKI, $WIF, and $BONK, which best represent the overall performance of Meme coins.

By comparison, it can be seen that Meme coins have performed remarkably well since the beginning of the year, with a 120% increase, surpassing the 52% increase of BTC and the 37% increase of ETH.

07 Summary & Risk Warning

Combining the dumbbell strategy, the above indicators show that currently in the market, BTC and ETH are indeed deserving of being considered safe assets, with high market share.

Especially BTC, which is even stronger than ETH. From the comparison of returns, it can be seen that Meme coins still represent high-risk, high-return assets. On the other hand, most altcoins are still relatively weak overall, offering limited opportunities, so it's okay to allocate fewer chips to them.

Here, a risk warning is also necessary. Allocating crypto assets is a very challenging task and cannot be simply accomplished by using a few indicators.

However, regardless, please remember that only when most of the funds are very safe is it meaningful to take risks. Those who have experienced multiple bull and bear markets will surely understand this! As the old saying goes, as long as the green hills remain, there will be no shortage of firewood.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。