BTC has been oscillating at a high level for 5 months, and there is still about a week left to close the monthly line this month. The high point has been continuously moving downwards, with 73,777 in March, around 72,000 in May and June, and the highest in July being 68,474, while the low points have also been continuously moving downwards to 56,552 and 53,485. Why can't Bitcoin rise to the top? Has the bull market ended?

First point of view: The bull market has not ended, and it is still in an upward trend!!!

This round is an ETF bull market as well as an institutional bull market. The dominance of American institutions will become more and more serious, represented by traditional financial giants such as BlackRock. BTC spot ETF and ETH spot ETF have both been launched, which is a milestone breakthrough. Previous bull markets were more or less related to ETFs. The earliest Bitcoin ETF can be traced back to 2013. That year, the later Bitcoin billionaire Winklevoss brothers announced the upcoming launch of a Bitcoin ETF, but the ETF was rejected by the SEC. Subsequently, attempts were made to establish a Bitcoin ETF in different ways, but none were successful. In 2017, the cryptocurrency market welcomed a bull market, with the price of Bitcoin rising from less than $900 at the beginning of the year to $19,000 at the end of the year, an increase of more than 20 times. Influenced by market sentiment, Bitcoin ETFs attracted the attention of many institutions that year. The applicants for Bitcoin ETFs that year included SolidX, BTC Investment Trust, VanEck, Exchange Listed Funds Trust, Pro Shares, REX BTC, First Trust, etc., but none were successful. In February 2021, Canada approved the world's first Bitcoin spot ETF. On October 20, 2021, the first Bitcoin futures ETF in the United States was officially listed. On August 15, 2023, the first Bitcoin ETF in the European Union was listed on the Amsterdam-based pan-European exchange. Spot Bitcoin ETFs have been established in 10 countries/regions around the world: the United States, Canada, Germany, Brazil, Australia, the United Kingdom, Thailand, etc. A spark can start a prairie fire. ETFs will flourish everywhere, so the bull market will not end in the short term. This may be a long bull market… You can refer to the previous article "Impact of Spot ETFs: Future of Gold ETFs and Bitcoin ETFs."

The total market value of gold is $12 trillion vs. the market value of Bitcoin is $1.26 trillion. The asset management scale of gold ETF is $233 billion vs. the asset management scale of Bitcoin is $52.4 billion. If the market value of Bitcoin is expected to be the same as that of gold, there is a 10-fold space, and the asset management scale has a 4.4-fold space. So it is not unreasonable for ARK under the leadership of Cathie Wood to predict that the price of Bitcoin will reach $1 million. Of course, their prediction model is definitely more complex, and Robert Kiyosaki predicts $300,000. In this bull market, I personally think that reaching $120,000 to $150,000 by 2025-2026 is already very good.

The Bitcoin halving has already been completed, and the next thing to look at is the timing of interest rate cuts. Since 1994, the United States has experienced the largest single interest rate hike, with 11 interest rate hikes since March 2022, with a cumulative increase of 525 basis points. The United States has experienced seven interest rate reduction cycles, with an average duration of 26 months and a reduction of 6.35 percentage points. If we look back at the 18 policy cycles since the 1950s, the average time interval between the last interest rate hike and the first interest rate cut is shorter, at 3 months. However, the average time interval of the last five cycles is 7.6 months, more than twice that of the former. The longest interval was 16 months. It has been 12 months since the last interest rate hike in July 2023, even if there are still two months until the interest rate cut in September. Will Powell wait until the end of the year to make history again?

Technical aspect

The current bull market is different from the bull markets in 2017 and 2020-2021. The high point in 2017 reached 19,666 from the previous high of 1,163 in 2013, which took 3-4 years to digest, and the bull market in 2020-2021 took 18 years to digest the small bull market, while the current bull market itself is a rebound market but eventually formed the main uptrend. Except for the half-year box oscillation from April to September 2023, the rest are upward trends.

The monthly line has been oscillating at a high level for 5 consecutive months, which can only be temporarily regarded as a box oscillation waiting for direction selection. It is also the digestion of the previous bull market. It can be seen that these 5-month candles are all at the top of the 2020-2021 bull market candles. If they completely fall back and cannot stand back, the risk will be greater.

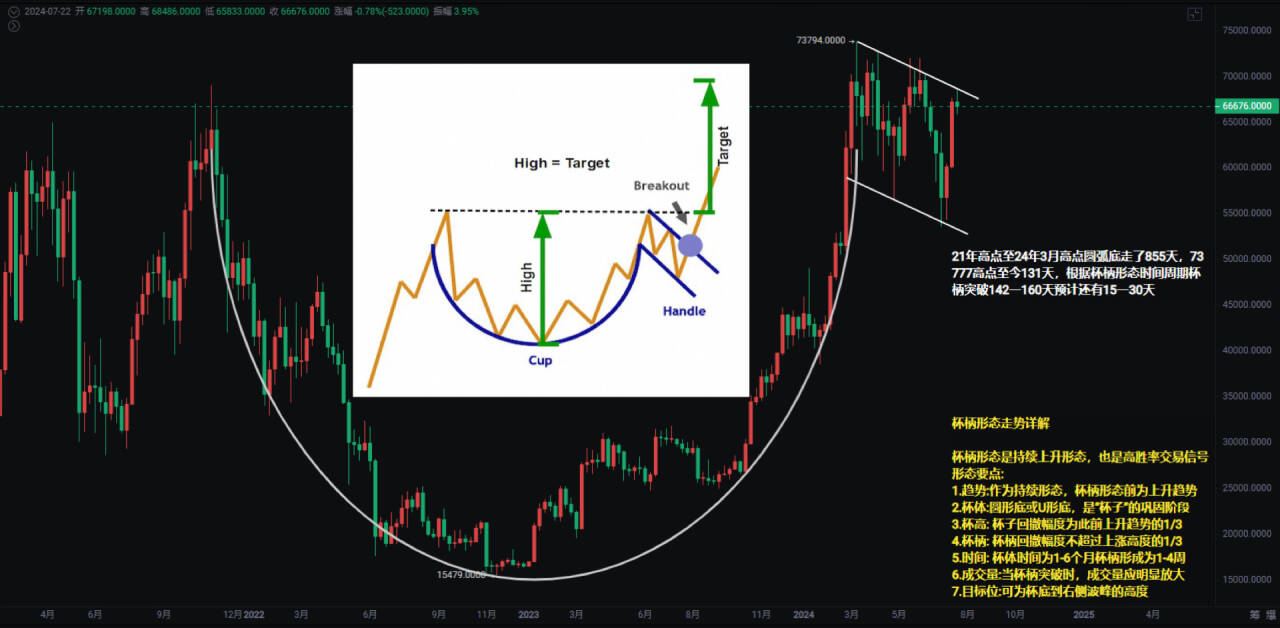

The weekly line cup and handle pattern from 69,000 to 73,777 has formed a cup pattern for nearly 2 years, and from March 2024 to the present, it has formed a cup and handle pattern. The retracement does not exceed one-third of the uptrend, and the time for the cup is from January to June, and the handle is formed from 1 to 4 weeks. From the high point in 2021 to the high point in March 2024, it took 855 days, and from 73,777 to the present, it has been 133 days. According to the cup and handle pattern time cycle, the handle breakthrough is expected to be 142 to 160 days, which is estimated to be another 15 to 30 days.

The ascending flag shape on the daily line has been continuously observed since March-April, and the previous several high and low points also coincide. Therefore, if the shape coincides, there is a chance to reach 50,000-52,000, which is a good second bottoming opportunity. First, pay attention to the daily line box bottom support at 60,600-62,300, which is the first bottoming opportunity.

If you like my views, please like, comment, and share. Let's go through the bull and bear markets together!!!

The article is time-sensitive and is for reference only, with real-time updates.

Focus on candlestick technical research, win-win global investment opportunities. WeChat public account: 交易公子扶苏

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。