This exclusive growth belonging to Sui is not only an opportunity for market rotation, but also benefits from technological advantages, and is inseparable from the various support policies of the Sui ecosystem.

Author: Deep Tide TechFlow

In this cycle, the market has presented an unprecedented trend of simultaneous development: the increasingly low threshold for launching chains has led every project to want to launch a chain in pursuit of a higher ceiling for the chain ecosystem narrative. The liquidity, which was already insufficient in this cycle, has been further divided, causing the Matthew effect of the strong getting stronger and the weak getting weaker to become more prominent. In addition, we can also observe that several star public chain ecosystems, including Ethereum, have shown a state of sluggish growth in on-chain data.

In this liquidity battle, the community has seen an exception. Since the fourth quarter of 2023, one of the twin stars of the Move language public chain, Sui, has shown a remarkable rapid growth momentum:

According to the Sui 2023 Q4 and 2024 Q1 status report data released by Messari, Sui's daily DEX trading volume has grown by 3,689% in the past two quarters, and DeFi TVL has grown by 1,459% in the past two quarters. The peak number of daily active addresses reached 453,000, and the average number of daily active addresses was 24,000.

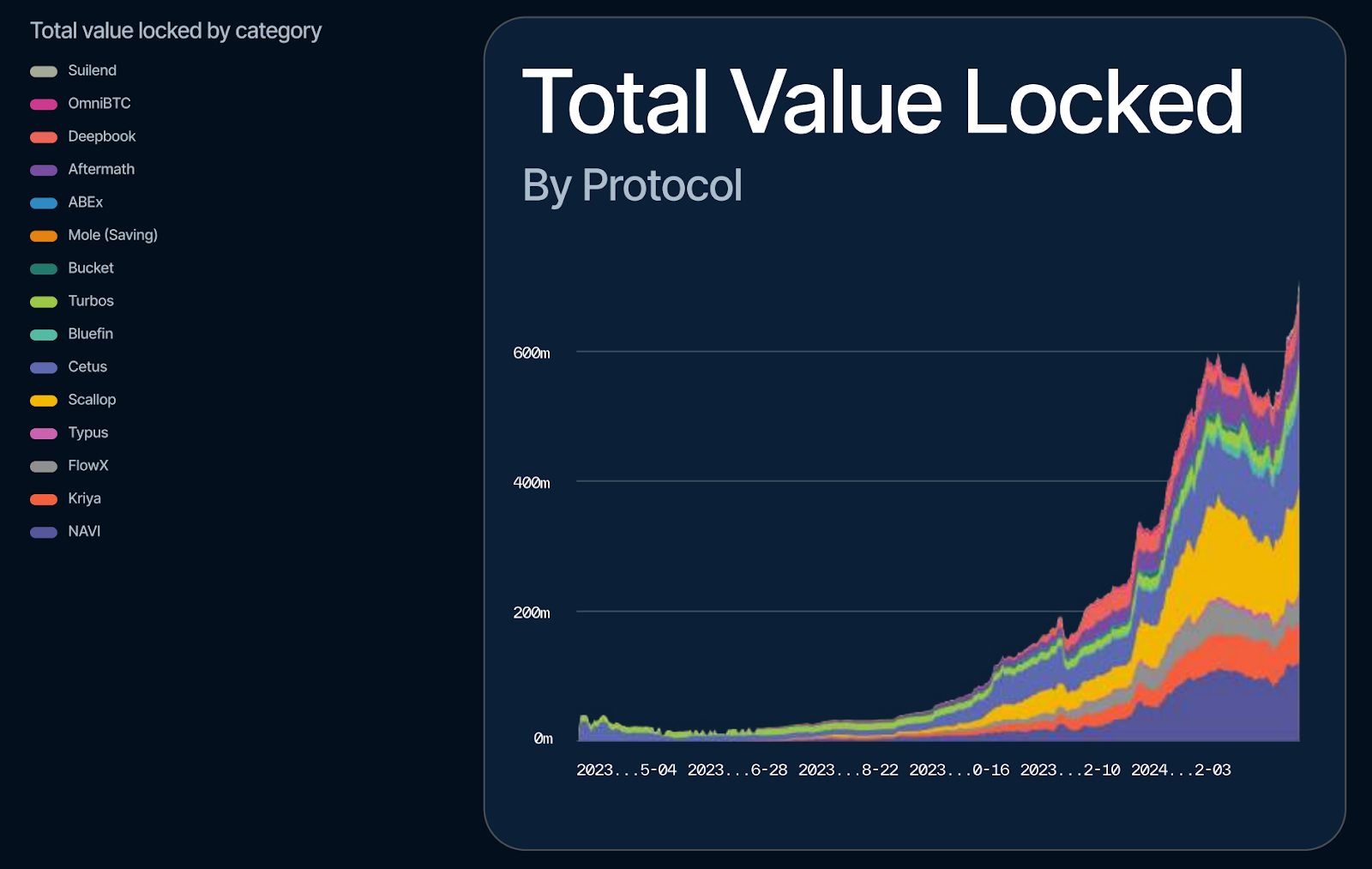

In a recent Sui DeFi report, in the past six months, Sui's TVL has grown rapidly from almost zero to a peak of $750 million, and on-chain trading volume has increased several times. Several DeFi projects within the ecosystem, such as Scallop, Navi, and BlueFin, have also reported impressive achievements.

How did they achieve this? Is this growth sustainable?

Seizing the opportunity presented by the release of the Sui DeFi report, let us analyze the driving force behind the growth of the Sui ecosystem through the rich data provided in the report, and further explore Sui's unique position in the current public chain race and its future growth potential.

The strongest growth momentum, eye-catching data analysis in the Sui DeFi report

Before delving into the specific growth drivers, let us first understand the astonishing growth curve achieved by the Sui DeFi ecosystem over the past six months through multiple sets of impressive data.

The Sui mainnet was officially launched on May 3, 2023, and experienced explosive development by the end of 2023 as the market warmed up.

In terms of TVL, we can see that over the past six months, Sui's TVL has rapidly grown from almost zero to a peak of $750 million, making it one of the top ten public chains. This kind of rapid growth, akin to pulling up onions in a drought, is unique in the current public chain growth. As an important indicator of the development of the DeFi ecosystem, higher TVL means stronger available liquidity in the network and a broader range of DeFi services.

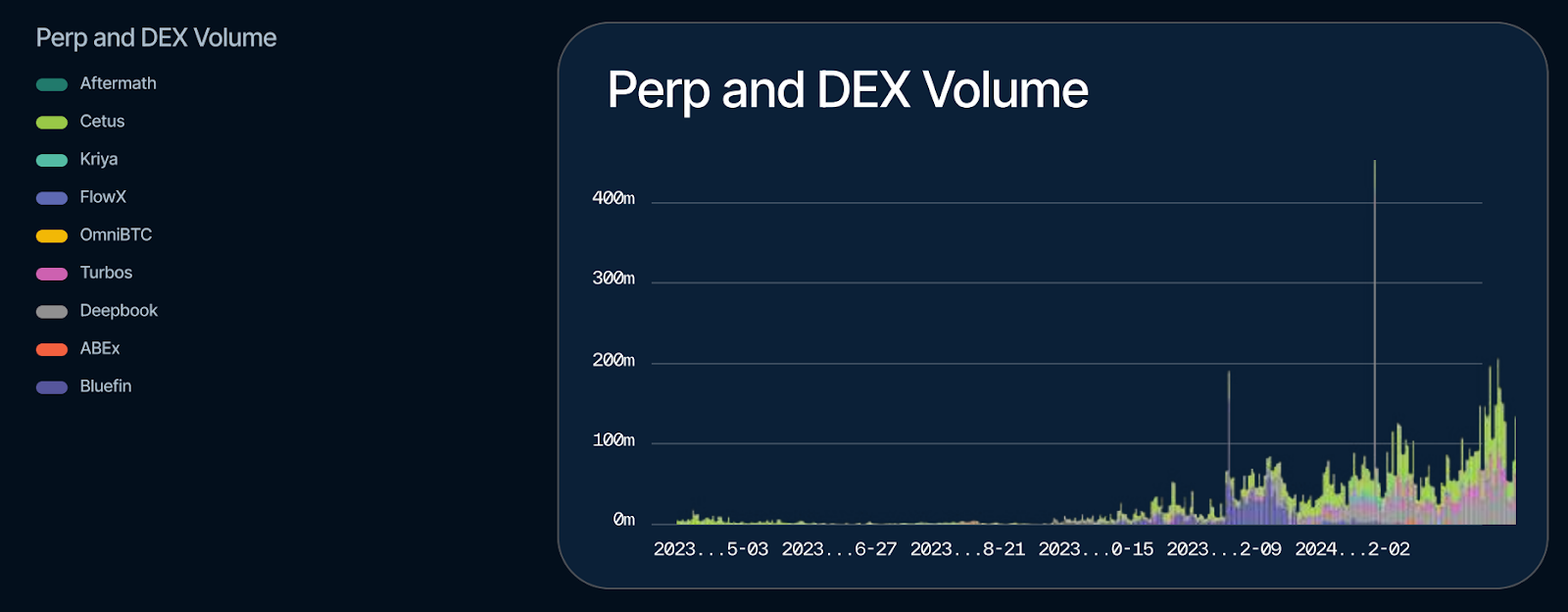

In terms of on-chain trading volume, the two-week average trading volume of derivatives and spot trading on the Sui chain was $166 million and $125 million, respectively, also ranking among the top ten in on-chain trading volume. In addition, according to statistics from Coin98 Analytics, Sui's daily trading volume reached 40 million transactions, surpassing Solana (27 million transactions) to rank first. Compared to TVL data, trading volume better reflects the level of activity of participants in the DeFi ecosystem and is an important indicator of ecosystem health. The more active on-chain transactions, the more lucrative the rewards for liquidity providers, and higher network transaction fee income also indicates a stronger ability for the network to self-generate revenue.

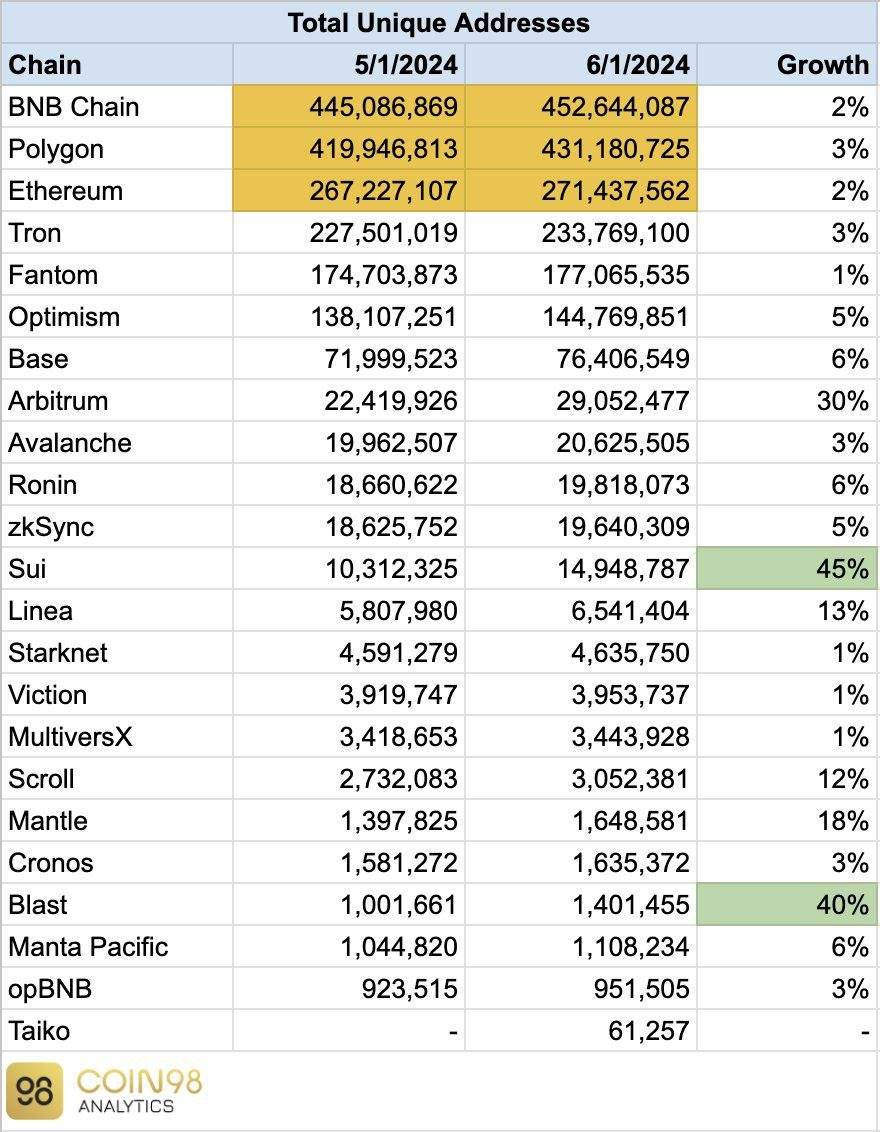

In terms of the number of addresses, according to statistics released by Coin98 Analytics in June of this year, among the 23 blockchain platforms surveyed, Sui had the fastest month-on-month growth in the total number of addresses in May, increasing by 45%. According to official data, the current total number of active accounts in Sui has surpassed the tens of millions mark, reaching 14.83 million, demonstrating Sui's broad and solid user base and rapid growth momentum.

In addition, the Sui DeFi report also specifically analyzed the distribution of on-chain assets in Sui. We can see that the main contributors to Sui's TVL are the native SUI token and stablecoin assets, while non-SUI volatile assets mainly consist of DeFi protocol tokens and memecoins.

We know that the public chain is the foundation, and dApps built on the public chain are the containers that carry ecosystem users, assets, and transactions, with DeFi being an important component. Therefore, after understanding the macro data on the Sui chain, let us take a closer look at the DeFi applications within the Sui ecosystem.

Currently, the Sui ecosystem covers 20+ active DeFi projects, including decentralized exchanges (DEX), lending protocols, liquidity staking (LST), derivatives, and collateralized debt positions (CDP). In the development of past public chain ecosystems, cases of applications driving the public chain's growth are common. Behind the rapid growth of the Sui ecosystem, we also see several "excellent products" in various DeFi sub-sectors.

In the lending field, the lending giants in the Sui ecosystem, Scallop and Navi, have made outstanding contributions in terms of liquidity and TVL: Navi Protocol's TVL exceeds $175 million; Scallop's TVL exceeds $165 million and recently announced total revenue of $1 million in July.

In the derivatives field, the trading volume is highly concentrated on BlueFin, with over 90% of the trading volume coming from perpetual contract trading of BTC, ETH, and SUI. In the DEX field, Cetus has an absolute advantage in spot trading and has contributed $120 million in TVL. In addition, there are multiple projects such as Kriya, Aftermath, and Typus in their respective sub-sectors of DeFi, contributing to further growth in on-chain data on the Sui chain.

Sui's impressive growth data is enviable and has prompted more people to explore the driving force behind this growth. In the process of understanding how Sui has built its ecosystem flywheel, many community members have found that this exclusive growth belonging to Sui is not only an opportunity for market rotation, but also benefits from technological advantages, and is inseparable from the various support policies of the Sui ecosystem.

Market rotation, seeking the next public chain alpha in the new cycle

Careful observation of Sui's growth curve reveals its alignment with the market's warming cycle.

Since October 2023, the blockchain market has entered a clear warming phase. According to Defillama data, the total on-chain lock-up volume has been increasing since October 2023, and market sentiment has gradually recovered. At the same time, Sui has also made efforts at the right time to seize this market opportunity and actively promote its DeFi ecosystem construction, attracting a large influx of users and funds, and achieving significant growth in a short period of time, becoming the focus of market attention.

Regardless of the cycle, as the underlying infrastructure that carries applications, the public chain narrative is a race that the market repeatedly mentions and focuses on. In this cycle, people are increasingly seeking the next public chain alpha.

At present, the siege of L2 has led to a continuous outflow of Ethereum assets, and although it still holds the top position in the public chain ecosystem, it is no longer the target of most public chain alpha hunters. Solana, which emerged from the impact of FTX, is undoubtedly the top public chain of 2024, with CoinGecko data showing a 616.2% increase in its token over the past year, gradually being seen as a beta project in the public chain race.

Based on various premises, Sui, which has already shown its edge in this cycle, with its outstanding performance advantages, strong financial adaptability, and extensive community support, not only brings more attention to the advantages of the Move language, but also attracts more developers to explore and utilize the Move language, rapidly gaining attention. This has made Sui, as a public chain based on the Move language, the next public chain alpha in the eyes of many, and the preferred choice for building the Move ecosystem.

It is worth mentioning that when it comes to the advantages of the Move language, no other project is more suitable to discuss this topic than Sui. As a public chain project developed by Sam Blackshear, the father of the Move programming language, Sui is considered to better inherit and promote the security, financial nature, and high performance of the Move language. In the rapid growth process, we have indeed seen the powerful empowerment of technological advantages for the development of the Sui ecosystem.

Based on continuous innovation, Sui becomes a fertile ground for DeFi development

Move is a programming language used to write secure smart contracts, originally developed by Facebook to support the Diem blockchain. Although the Diem project has faced setbacks and ultimately failed, based on the outstanding advantages in security and performance, encrypted projects built on the Move language have flourished, with Sui being one of them.

Sui uses Move as its core smart contract programming language, allowing Sui to perfectly inherit the multiple advantages of the Move language, especially in the development of DeFi and digital financial scenarios.

On one hand, the Move language gives Sui stronger security and verifiability. Compared to other languages, Move handles token assets in a more native and fundamental way. In the Move language, assets are specifically defined as a Resource, distinct from other data. Additionally, Resource data must be stored under an account, and during transactions, assets must flow to a destination, either transferred to another address or destroyed, and cannot be duplicated or "double-spent." This design effectively prevents double-spending attacks and other security vulnerabilities, ensuring the security of digital financial transactions. Furthermore, Move uses static calls, where all contract execution paths can be determined at compile time, and undergo thorough analysis through built-in security algorithms and validators, further reducing the possibility of contract vulnerabilities.

On the other hand, the strong composability brought about by the modular design of the Move language allows smart contracts in the Sui ecosystem to be like various parts of Lego toys, where developers can create new products by combining them for richer scenarios. Based on the combination of Modules, the upgrade and optimization of contracts only require upgrades to the Module, and all other contracts using this Module will automatically use the latest version. This not only saves block space occupied by contracts but also makes upgrades easier.

More importantly, since the vision of Diem was to provide a global alternative to fiat currency for Facebook's 2 billion user base, the Move language, designed to support Diem, had important considerations for high performance from the beginning. The Move virtual machine optimizes the execution of Move bytecode, ensuring efficient operation of smart contracts. This means that even under high network loads, the Move language can maintain good response times, providing a smooth experience for users.

Furthermore, based on the Move language, Sui's parallelizable architecture allows different applications and scenarios in DeFi to run independently. Whether it's applications spanning different DeFi dApps or using different liquidity pools within the same DeFi dApp, Sui's performance in these situations is not affected by traffic from other scenarios. This means that traders interested in different assets, scenarios, and strategies do not have to worry about interference, as each operation in Sui is completed independently.

Currently, according to official data, Sui has achieved a processing capacity of over 100,000 transactions per second, with a final confirmation time of only 400 milliseconds. This performance metric greatly surpasses the performance limitations of traditional blockchains, allowing Sui to support high-frequency trading and complex financial operations, greatly enhancing user experience and meeting the market's demand for fast transactions.

It is worth mentioning that as a programming language, Move has been continuously pursuing ongoing development. In the 2024 version update, Move added new features such as enumerations, macro functions, and method syntax, greatly enriching the developer's programming toolbox and making it easier for developers to implement complex business logic, attracting more and more developers to participate in building.

Since the birth of Sui, many community members have jokingly referred to Sui as the "son" of the Move language. It is undeniable that Sui's choice of the Move language has placed it on the shoulders of giants from the beginning of its development. However, over the past two years of development, Sui has continued to introduce multiple technological innovations to explore the boundaries of blockchain performance and user experience, continuously consolidating its technological advantages.

One of the powerful proofs is the announcement in May of the deployment of the new consensus protocol Mysticeti on the testnet. Based on in-depth research into the Byzantine Fault Tolerance (BFT) consensus mechanism, this major breakthrough reduced the consensus time of the Sui testnet by 80% to 390 milliseconds, while maintaining industry-leading throughput. With the launch of Mysticeti, Sui will become the fastest consensus layer in the industry. This speed is crucial for ensuring real-time transaction strategies, clearing, and portfolio rebalancing.

Earlier in March, the Sui development team, Mysten Labs, also announced the launch of a new execution scaling solution, Pilotfish. In the testing and development process of the Sui blockchain environment, Pilotfish (Sui extension prototype) increased throughput by 8 times with the support of 8 machines, shortened network response time, and kept latency below 20 milliseconds, fully proving the possibility of linear scaling.

In addition, through multiple technological iterations, Sui has further lowered the threshold for developers and users, laying a solid technical foundation for the introduction of a user base of 1 billion. For example, zkLogin, designed to provide great convenience for end users, allows users to use existing Web2 identity verification from Google and Twitch to log in to Web3 applications, eliminating the need for users to remember or record private keys. Another example is the SaaS (Software as a Service) product Enoki, which helps enterprises seamlessly integrate the Sui wallet into existing and new services. These technological advancements help Sui create a new era of interactive experience and participation for developers and users.

In addition to empowering ecosystem projects with multiple technological advantages, Sui aims to create a better ecosystem environment for developers and users, further improving project development efficiency and success rates.

On the one hand, for DeFi projects, system stability is crucial, as any brief network interruption could lead to fund loss, transaction failure, or decreased user trust. Since its launch, Sui has never experienced a minute of downtime or performance degradation, providing strong assurance for developers and users.

On the other hand, as a project developer, it is important not only to focus on how the product is implemented, but also on how the project grows. Support from the ecosystem becomes indispensable at this point, from hackathons, grants, to RFPs. Sui is further becoming the fertile ground for developers in the eyes of DeFi, by providing rich resources and support to emerging projects.

Multiple developer incentives drive rapid development of DeFi projects within the ecosystem

The development of public chains has gradually moved from the storytelling stage to implementation. With sufficiently outstanding technical advantages, another important aspect of public chain competition is the ecosystem, which is essentially reaching users through applications. Therefore, developers are key to success.

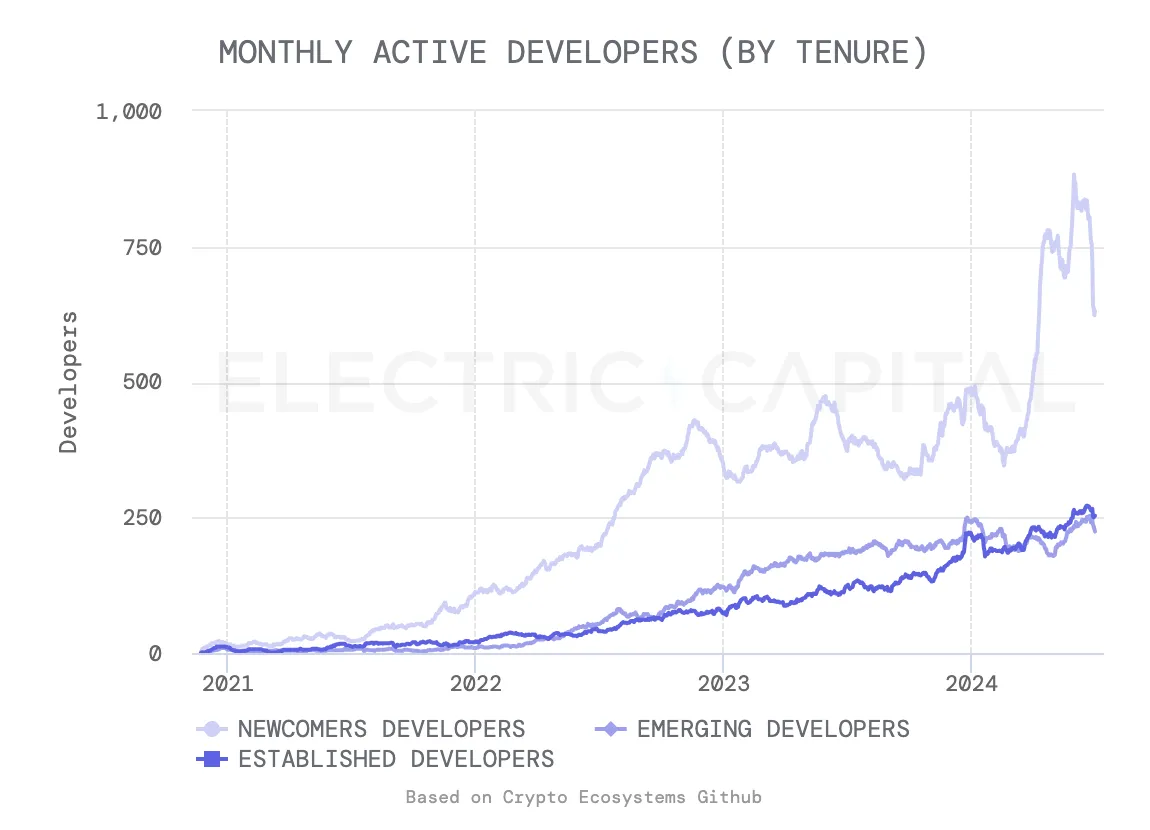

According to developer data compiled by Electric Capital, the number of Sui developers has exploded in the past six months, with Sui having the largest and fastest-growing Move developer community. From the beginning of 2024 to July 1, the number of monthly active developers on Sui increased by 219%, and over half of Sui's monthly active developers are focused on single-chain development. This significant growth not only indicates the increasing interest and participation of developers in Move development and the Sui platform, but also reflects the results of Sui's effective developer incentive programs.

Of particular note is the influx of new developers into the Sui ecosystem from March to June 2024, mainly due to the Sui Overflow hackathon. As the largest prize pool hackathon in history, Sui Overflow set up 8 tracks, including consumer and mobile applications, DeFi, gaming, infrastructure and tools, advanced Move features, multi-chain, randomness, and zkLogin. The event lasted for 8 weeks and attracted 352 projects from 79 countries, with 32 outstanding projects sharing a prize pool of $500,000.

In addition to the Sui Overflow hackathon, Sui also organized themed hackathons such as Liquid Stake and MOVE Online, and held Move HackerHouse offline events in various global cities such as Singapore and Chengdu. The aim is to further provide a platform for developers to showcase themselves, exchange ideas, and unleash creativity, driving the construction of a vibrant and flourishing diversified ecosystem.

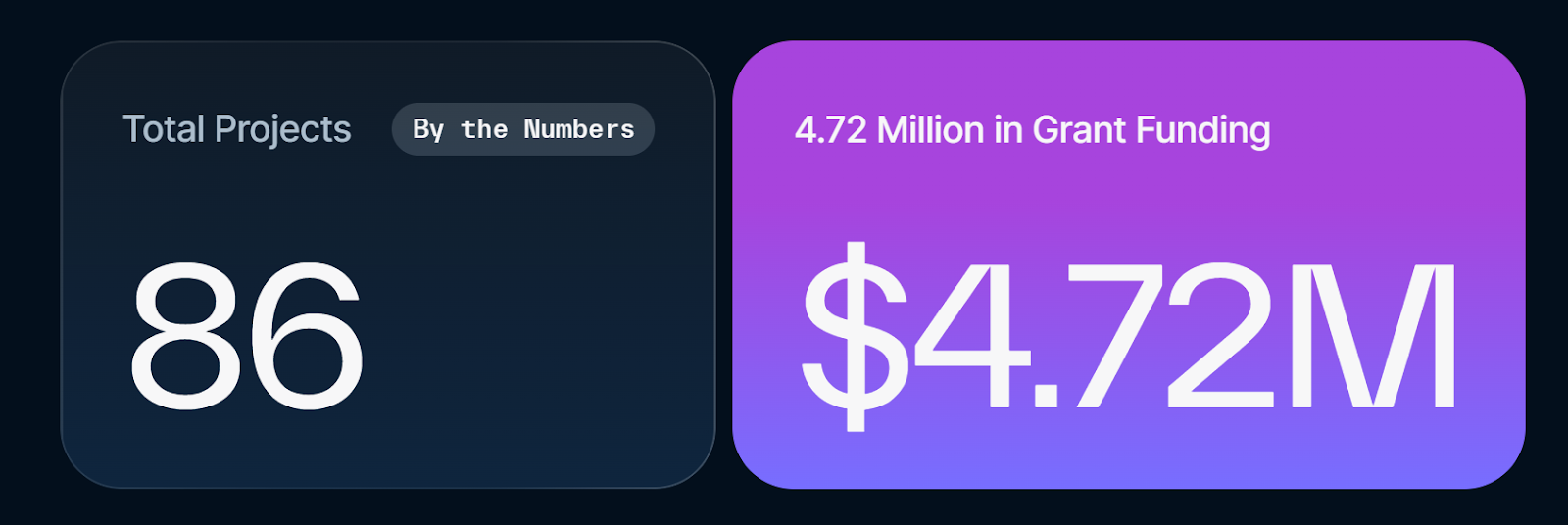

In addition to regular online and offline activities, on October 25, 2023, the Sui Foundation website officially launched and opened the application portal for the Grant developer funding program. As a long-term funding program, Sui Grants aims to provide financial support to developers and projects within the ecosystem to kick-start projects, with funding ranging from $10,000 to $100,000, and the opportunity to receive additional funding upon reaching specific milestones. Over the past nine months, Sui has received hundreds of grant proposals, with 86 projects approved for funding, totaling $4.72 million in grants. Projects such as Cetus and Navi have received support from Sui Grants and have become strong forces in the Sui ecosystem.

Furthermore, Sui has launched the RFP (Request for Proposals) program to address specific needs within the ecosystem and provide targeted support. In the first batch of RFP funding recipients announced in mid-month, the list includes Byzantion Inc, a coin minting infrastructure compatible with Sui Kiosk, HashCase, a no-code on-chain loyalty platform, Arden Labs Inc, a consumer engagement platform, and Mojito Inc, a white-label website for loyalty programs, further meeting the ecosystem's needs to create a more developer-friendly environment.

Sui's ecosystem incentives also aim to attract top scholars from around the world to explore cutting-edge research in Web3 development. The Sui Academic Research Award was created to provide $100,000 in support for each approved proposal.

In the latest announcement of the fourth batch of academic research award results, 20 outstanding proposals from universities such as the University of California, Berkeley, Yale University, New York University, École Polytechnique Fédérale de Lausanne, and the National University of Singapore have received funding. The proposals include using caching to accelerate zero-knowledge proofs (ZKP), automated risk management in the Sui DeFi ecosystem, and benchmark testing of Sui from a parallel execution perspective, aiming to further enhance the security and efficiency of the blockchain platform and Sui from an industry perspective. Due to the excellent quality of the proposals, the Sui Foundation has committed to providing an additional $1 million in funding in 2024 to support further acceleration of blockchain innovation and research.

With diverse ecosystem incentives, Sui has built a platform for rapid iteration and innovation. These incentives have not only attracted a large number of developers to participate but also provided them with rich resources and support. In such a vibrant environment, developers can freely explore various possibilities on the Sui platform, injecting more driving force into the growth of the Sui ecosystem, from financial applications to games, social platforms, and more.

Recent developments

Of course, in the face of the explosive growth of the Sui ecosystem, community members are most concerned about two questions.

First, will this momentum of growth continue?

The answer is highly likely.

On one hand, the Sui ecosystem is about to see the implementation of multiple roadmaps. According to Adeniyi Abiodun, Co-founder and Chief Product Officer of Mysten Labs, in a podcast, Sui will not only launch on-chain randomness next month, but will also complete the upgrade of the second version of the consensus mechanism this month. This means that Sui's latency will soon be upgraded to approximately 300 milliseconds, further propelling Sui to become an industry leader in latency speed. Additionally, Sui will also see the launch of local stablecoins.

On the other hand, in addition to long-standing regular ecosystem incentives, Sui will also host the Move-themed Antalpha HackerHouse event in Chengdu on August 12. Sui official mentors will provide guidance and assistance from initial ideas to code implementation on-site. Participation in this event not only offers the chance to win substantial prizes but also allows projects to participate directly in the project selection for the Move Online Hackathon. Additionally, the SUI MOVE Online Hackathon is currently open for registration, with a project submission deadline of August 25, and participants will share a prize pool of $13,000.

Furthermore, as a leading project in the Sui ecosystem, NAVI Protocol announced the establishment of the NAVI X ecosystem fund several months ago, committing to invest 10 million NAVX tokens to support the growth and innovation of the Sui blockchain DeFi and Move ecosystem.

By incentivizing ecosystem developers through multiple activities, Sui will further stimulate ecosystem innovation and growth potential.

The second question is, since the growth of the Sui ecosystem is foreseeable, how can one better participate?

In addition to obtaining SUI tokens through exchanges (SUI tokens are currently listed on mainstream exchanges such as Binance, Kucoin, OKX, and Gate), participating in the TGE and airdrop activities of several top projects in the Sui ecosystem will be a more efficient choice for ecosystem participation.

As a leading trading platform in the Sui ecosystem, Bluefin provides users with a variety of derivative and spot trading experiences with efficient transaction processing speed, transparent on-chain security mechanisms, and a user-friendly interface. Bluefin is about to conduct a TGE, where users can earn points through trading on the Bluefin platform, as well as through participating in level league activities, Bluefin Stable Pools, Open Referral, and other methods to earn higher point bonuses.

The distribution focus of the Bluefin project token BLUE will be on incentivizing ecosystem growth (52%), with 13% allocated for Bluefin airdrops, 19.5% for rewarding trading, liquidity provision, and future growth plans, and 4.5% for initial liquidity addition, all unlocked at TGE.

Currently, Bluefin has interconnected with multiple on-chain financial protocols such as CetusProtocol, Turbos Finance, KriyaDEX, AVEO, and has also partnered with well-known NFT communities such as Pudgy Penguins, MadLabs, Azuki, and will distribute BLUE tokens to community members of the partner projects during the TGE.

It is worth mentioning that users of the NAVI Protocol, a liquidity protocol in the Sui ecosystem, will receive a Bluefin airdrop. This airdrop will be distributed to 10,000 community members based on NAVI leaderboard points and the amount of NAVX held in the user's wallet, with token distribution determined by a weighted system, with 60% based on leaderboard points and 40% based on NAVX holdings.

In addition, the leading lending protocol in the Sui ecosystem, Scallop, has also launched a loyalty program, where users participating in SCA staking can share rewards of $100,000 worth of SCA tokens.

In conclusion, in addition to technical advantages, the rich ecosystem not only supports the rapid growth of the Sui ecosystem but also provides users with diverse participation choices. As more and more users join, it can further drive ecosystem growth, forming a positive feedback loop.

In the new cycle of public chain competition, Sui can be said to be the leader in this cycle, with its unique technical architecture and flexible ecosystem strategy setting it apart from many other public chain projects, attracting a lot of attention and investment.

With continuous technological iterations, Sui continues to optimize performance, security, and user experience, while the ongoing developer incentive measures encourage more developers to innovate and explore on the Sui platform, driving ecosystem diversity and richness. In the foreseeable future, Sui will continue to maintain its rapid development momentum and become the public chain alpha in the minds of more people in this cycle.

As the twin star of Move, we look forward to more exciting performances from Sui in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。