The upcoming two important catalysts for Ethereum: the announcement of staking standards and the next hard fork.

Author: The DeFi Investor

Translator: Deep Tide TechFlow

Outlook for the Future of Ethereum

The spot Ethereum ETF has finally been launched.

From the initial trading volume, it appears to have been quite successful.

However, as we can see, ETH started to decline after its launch.

In this article, I will discuss the reasons behind this, the future trend of ETH prices, and the two important catalysts that Ethereum is about to face.

My Expectations for the Price Trend of ETH

I believe that the main reasons why ETH is currently underperforming compared to BTC are:

- The launch of the spot ETH ETF is a "sell the news" event: This phenomenon also occurred in the short term after the launch of the spot BTC ETF.

Since the spot ETH ETF was approved several months ago, everyone who wanted to buy ETH had enough time to do so. Therefore, catalysts that are known in advance often become "sell the news" events.

- The launch of the ETH ETF unlocked $9 billion worth of ETH in the Grayscale Ethereum Trust: These ETH have been locked up for many years, and now the holders can finally sell them, so many people are selling.

So, how long will it take for this decline to end?

In the case of BTC, the spot BTC ETF hit bottom about two weeks after its launch. After that, the price traded sideways for a few days before reaching a new all-time high.

If there is high demand for the spot Ethereum ETF in the coming weeks, ETH may also experience a similar situation. However, for this to happen, the net flow of the ETH ETF needs to turn positive.

For example, yesterday, due to the selling pressure from the Grayscale Ethereum Trust, the ETH ETF saw an outflow of 133 million USD.

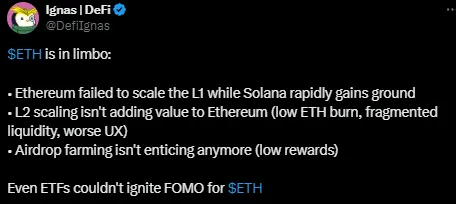

There are also some reasonable concerns about ETH in the short term:

Catalysts Coming for Ethereum

I also want to talk about the two important catalysts that Ethereum is about to face.

The first is the approval of Ethereum staking for the ETF. This may significantly increase the demand for the spot Ethereum ETF. Although an annual staking yield of about 3.2% may not seem like much, due to the low annual inflation rate of ETH and the ability to earn yields through staking, this may make ETH more attractive than BTC to certain institutions.

According to a SEC commissioner, Ethereum ETF staking "can always be reconsidered," so its approval is only a matter of time.

The second catalyst is the release of Pectra, which is Ethereum's next hard fork. This major upgrade is expected to take place at the end of the fourth quarter of this year or the first quarter of 2024. Pectra will introduce several significant changes:

Making Ethereum account addresses more programmable

Increasing the maximum staking for ETH validators from 32 to 2048 ETH

By making Ethereum account addresses more programmable, Pectra will bring significant improvements to the on-chain user experience.

For example, it will support batch transaction sending, social recovery features for wallet development, and allow dApps to pay users' gas fees. Such user experience upgrades are necessary for the widespread adoption of cryptocurrencies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。