Karak, as a rising star in the field of re-staking, is the result of false prosperity or long-term ecological development behind the data growth.

Author: shaofaye123, Foresight News

Karak, as a latecomer in the re-staking track, has been controversial since its launch. Despite its luxurious financing background, the project has been embroiled in a public relations crisis. With a valuation of $1 billion, the Total Value Locked (TVL) has been mediocre. Despite being labeled as modular, AI, and re-staking, the product's technological innovation is somewhat lacking.

Is Karak a rising star in the re-staking field or a quickly fading bubble? Can it compete with EigenLayer? This article will take you deep into the Karak Network.

Introduction to Karak

What is Karak

Karak Network is a re-staking network similar to EigenLayer and other re-staking projects. It incentivizes users to re-stake through a point-based model to earn multiple rewards. Karak allows users to reuse their staked assets, supporting a more diverse range of asset staking, including ETH, LST, LRT, PT, etc. In addition to the Ethereum mainnet, it also supports multiple chains such as Arbitrum, Mantle, BSC, and K2. Stakers can allocate their assets to the distributed security services (DSS) on the Karak network and agree to grant additional execution rights to their staked assets.

How does Karak work

Karak's operation mechanism is not significantly different from EigenLayer, acting as a bridge between developers and validators. In terms of the execution layer, it differs from EigenLayer by developing its own Layer2 (K2) for sandbox testing, allowing DSS to be developed and tested on Layer1 before deployment.

Karak is currently in the V2 phase. In the technical aspect, the V1 phase provided a Turnkey-like SDK + K2 sandbox, simplifying the development process. On July 23, Karak Network released the first phase of the V2 Keystone testnet, introducing a contract-based Slashing mechanism and allowing developers to deploy distributed security services (DSS) and custom re-staking mechanisms. Operators can also configure validators and native staking modules within this testnet.

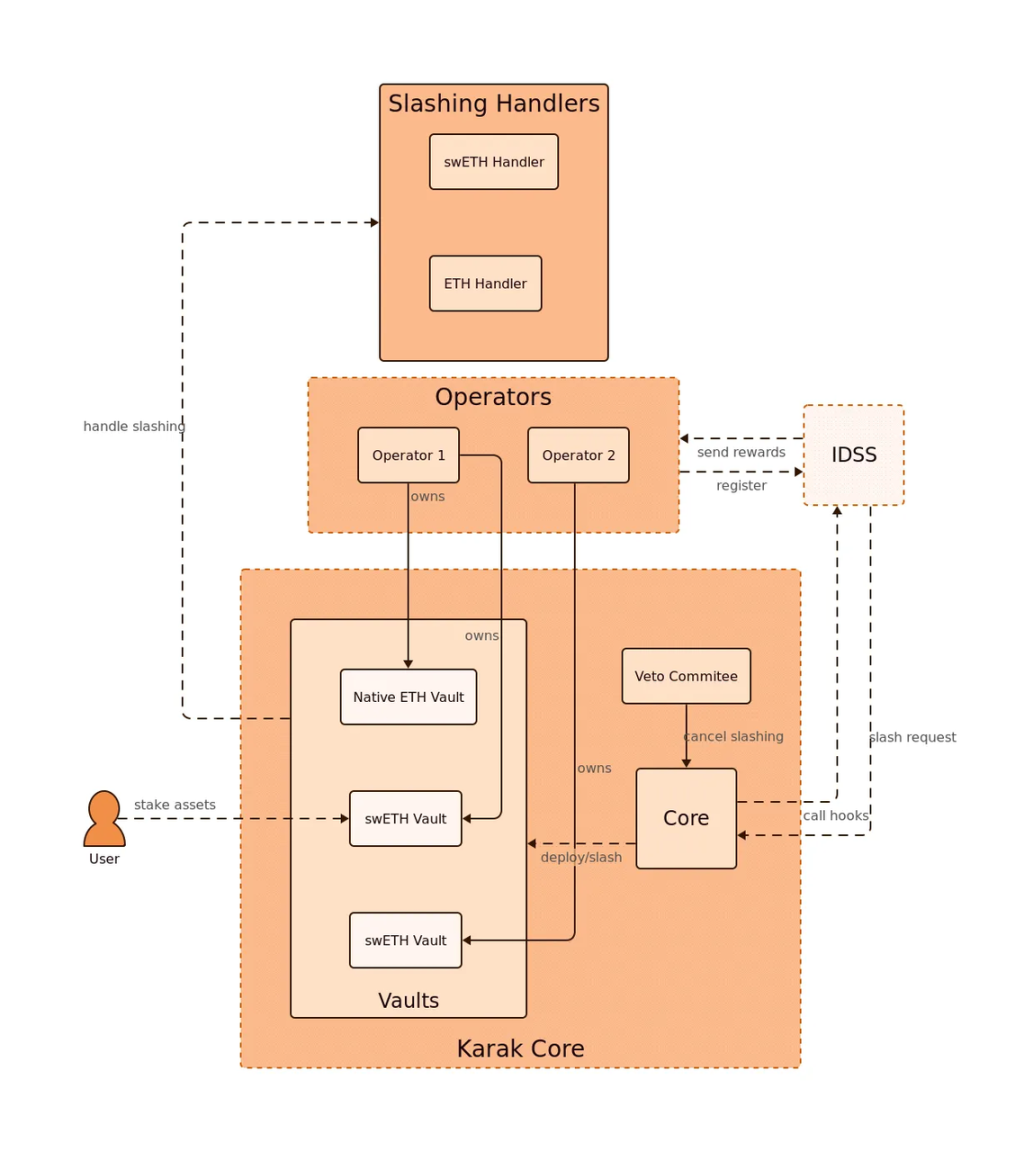

Karak Keystone is designed using four deployed contracts: Core, Vault, SlashingHandler, and DSS. The Vault contract manages deposits and withdrawals, and complies with slashing requests. The SlashingHandler contract defines how specific assets should be slashed, whether they should be destroyed, sent to a zero address, or undergo custom operations. The DSS contract, written by an external team, contains tasks and slashing conditions to be executed by operators to penalize those who fail to perform tasks. The Core contract manages other contracts, adjudicates slashing requests, and adds new assets and insurance libraries. With the Keystone testnet, developers can begin building and deploying distributed security services (DSS) and custom liquidity re-staking strategy insurance libraries. Operators can participate by registering as operators in the testnet contracts, running example DSS, and configuring their testnet validators to use native re-staking modules.

Can Karak compete with EigenLayer?

Regardless of the need for asset diversification or the demand for multi-chain staking in the market, there will not be only one winner in the re-staking track. Projects like Puffer, Swell, and Kelp are also not scarce in this track. Why is Karak receiving so much attention?

Luxurious financing background and team public relations crisis

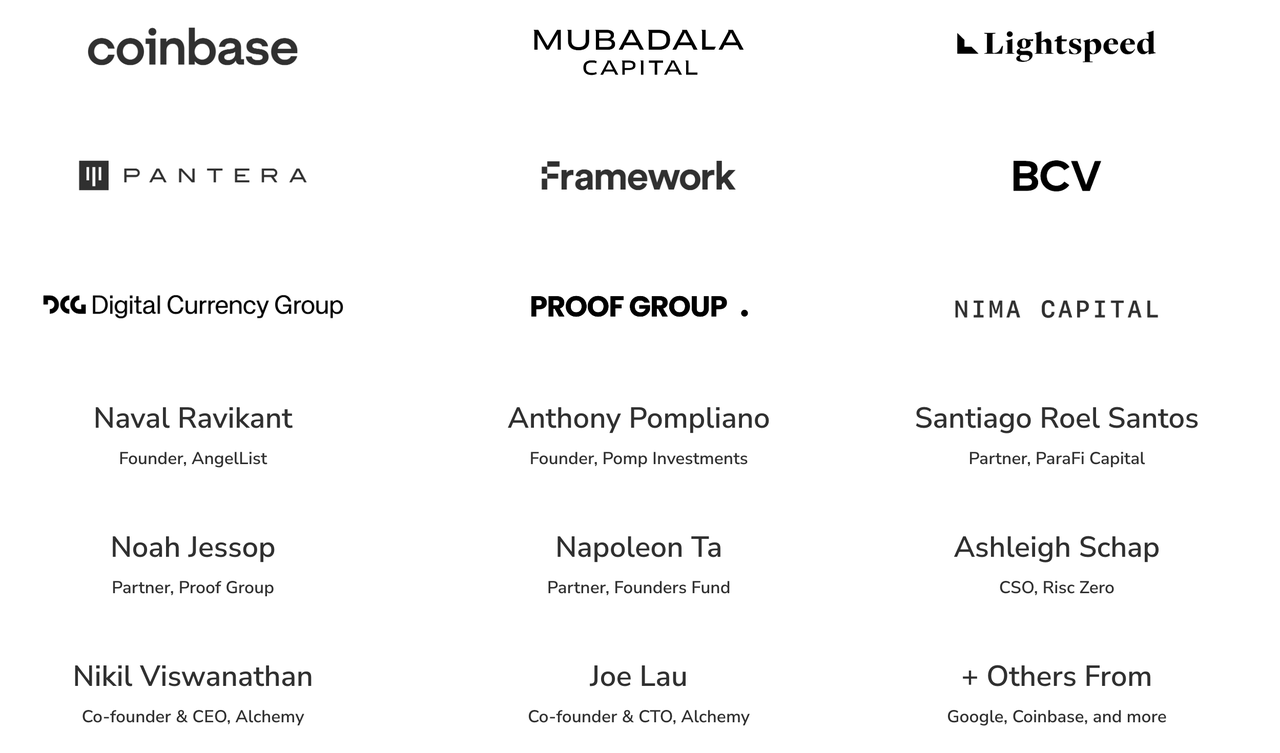

Since announcing a $48 million Series A financing in December 2023, Karak's luxurious investment background has attracted market attention. Karak was led by Lightspeed Venture Partners, with participation from Mubadala Capital (the second largest fund in Abu Dhabi), Coinbase, and other institutions, valuing it at over $1 billion. This powerful lineup of investors has not only brought market attention to Karak but also provided strong capital support for its competition in the re-staking track.

However, after its launch in February, the TVL performance was unsatisfactory until significant growth began in April. Karak's project team has also faced scrutiny, mainly revolving around two aspects:

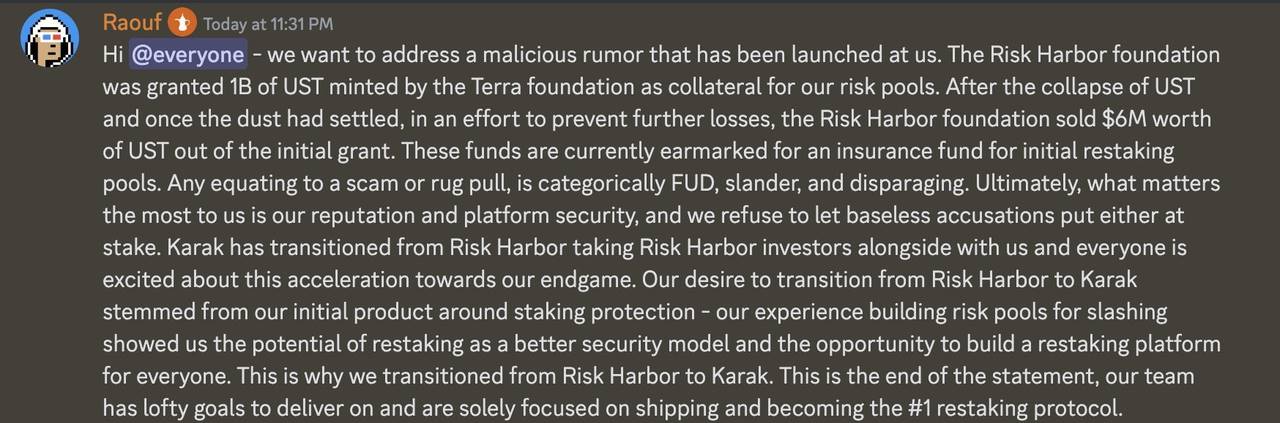

First, there are controversies surrounding the team members' backgrounds. Team members are speculated to come from the Risk Harbor within the previous Terra ecosystem, and during the collapse of LUNA, Risk Harbor directly sold the UST from the insurance pool without community voting, amounting to approximately $6 million. Market FUD voices believe this to be a rug, while supporters argue that it was justifiable to rescue funds in the face of an emergency situation.

Second, the project's technical progress is opaque. Since the financing at the end of 2023, the team hastily launched the product in February of this year. As a re-staking project, there is currently less discussion about the technology and more focus on marketing activities such as "point activities" to seize the market. The lack of disclosure of specific progress, technological development, and ecosystem construction has led to a lack of confidence in the project's transparency and future development within the community.

Technological innovation or riding on hot concepts

Karak's official website mentions almost all the popular narratives such as modularization, Layer 2, and AI. Karak claims to be "the first modular Ethereum L2, providing secure scalability required for various applications. Committed to building open infrastructure that prioritizes auditability, privacy, and verifiability. With Karak, AI models can be seamlessly integrated into various applications, allowing any developer to leverage cryptographic technology for model inference."

However, the market is not lacking in innovative L2 solutions, plug-and-play modularization, and profitable re-staking. These innovative technological solutions still tend to be homogeneous in nature, more so riding on hot narratives. Although Karak's technological path is similar to EigenLayer, there are significant differences that give it a place in the market competition.

Multi-asset re-staking: Karak has introduced multi-asset re-staking, allowing users to re-stake various assets, including Ethereum, liquidity staking tokens, stablecoins, etc., to earn rewards, greatly enhancing asset diversity.

Optimization of the re-staking process: Similar to EigenLayer, Karak also has its own version of AVS, called Distributed Secure Services. It internalizes a concept of re-staking anywhere, making secure re-staking infrastructure accessible to anyone on any chain.

However, in terms of technology itself, its innovation is still relatively limited. DSS can attract more funds from various chains, more so leveraging the advantages of market strategy and competitive landscape. Compared to Ethereum, the opportunity cost of other assets is lower, making DSS have more sustainable returns.

Short-term false prosperity or long-term real ecosystem

Karak's market strategy has achieved significant gains in the short term. Since the launch of Karak V1 Private Access in April, all data has shown comprehensive growth:

- TVL of re-staking has exceeded $1 billion within 6 weeks

- 155,000+ independent users have joined

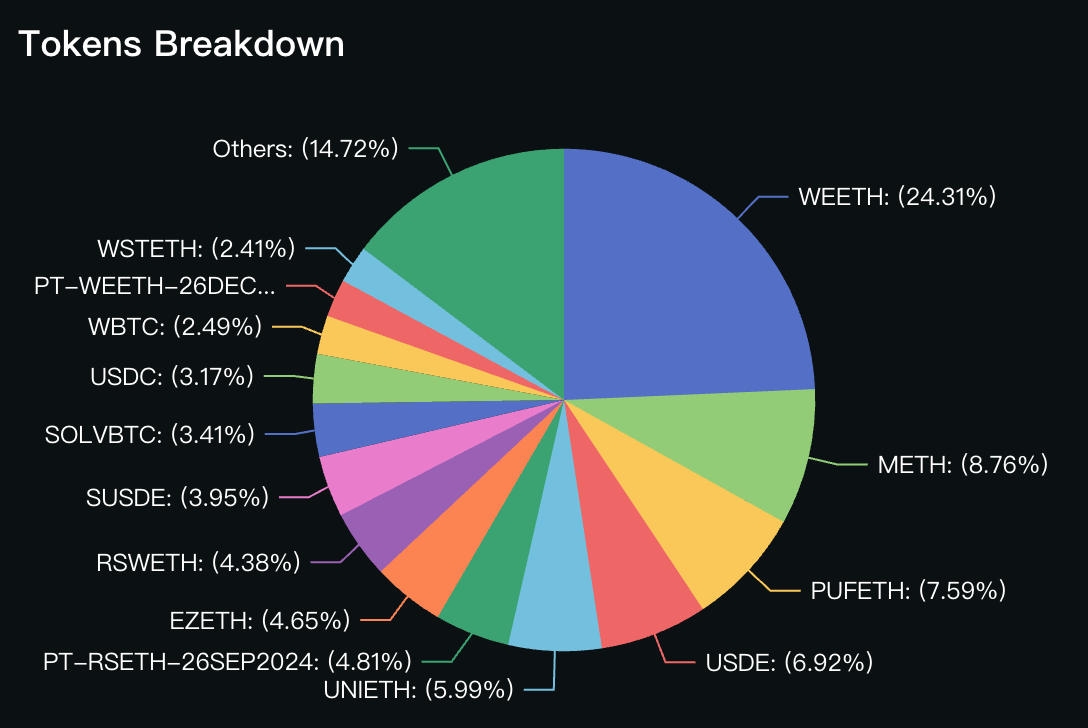

- Integration of over 45 types of assets, including stablecoins, liquidity staking tokens, and liquidity re-staking tokens

- Integration with 5+ chains, including Ethereum mainnet, Arbitrum, etc.

- Built over 10 distributed security services, and over 20 distributed security service applications

Despite Karak demonstrating strong competitiveness in technology and market strategy, it also faces some risks. EigenLayer's re-staking mechanism and security have been validated by the market, and its high TVL and widespread market recognition firmly position it as the leader in the re-staking track. While Karak's nested structure can generate short-term growth and ecological prosperity, the risks behind the short-term TVL growth cannot be ignored. How many networks or projects will truly use the re-staked assets built by Karak? Can its security withstand market scrutiny? Can assets other than Ethereum sustain the re-staking narrative? Are users truly willing to sustain ecosystem development? The answers will be revealed after the spring breeze of the re-staking track fades.

Conclusion

As a newcomer in the re-staking track, Karak has demonstrated strong market competitiveness with its multi-chain and multi-asset re-staking. Whether it can challenge the dominant position of established re-staking projects like EigenLayer depends not only on its continuous efforts in user trust, security, and market promotion but also on whether its ecosystem development truly meets market demand. Who chooses to build on Karak, aside from users seeking multi-asset returns, is what deserves more attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。