Author: Daniel Li, CoinVoice

In recent years, as a new force in the blockchain industry, cryptocurrency prediction platforms have been rapidly rising and attracting widespread attention. This unique market form allows users to buy and sell shares related to the outcomes of future events through collective wisdom, thereby predicting the direction of events. It not only provides investors with a new investment channel but also offers valuable data resources for research institutions. According to industry reports, the scale of cryptocurrency prediction platforms is experiencing explosive growth and is expected to continue to grow rapidly in the coming years.

Among the many cryptocurrency prediction platforms, Polymarket has stood out as a leader in this field due to its unique operating mechanism and timely marketing of hot current events. As a decentralized prediction market platform based on blockchain, Polymarket allows users to use cryptocurrencies to bet on the future outcomes of various topics. It operates on the Polygon blockchain using smart contracts, significantly reducing transaction costs and speeding up transaction processing. Since its launch, Polymarket has attracted a large number of users and followers with its high transparency and user-friendly interactive experience, making it the largest cryptocurrency prediction platform at present.

This article will delve into the operation mechanism and principles of Polymarket, while analyzing the new trends in the cryptocurrency prediction market industry, aiming to provide readers with a comprehensive and in-depth insight into the cryptocurrency prediction market.

Polymarket: Understanding the Real World through Betting

Polymarket, a decentralized prediction market platform based on blockchain technology, has begun to gain attention in the public eye in recent years. The platform was founded by Shayne Coplan in 2020, and its inception is closely related to Coplan's profound insights during the pandemic. Faced with a plethora of uncertain viewpoints and opinions in the market, it is often difficult to convince each other, compounded by the proliferation of misinformation and the influence of profit-seeking algorithms, making it increasingly difficult for people to see the truth of the matter. Therefore, Coplan founded Polymarket with the aim of allowing people to understand what is happening in the real world more accurately through a new approach.

The theoretical basis of Polymarket comes from Hayek's famous paper "The Use of Knowledge in Society." Hayek believed that economic incentives are the key to driving people to understand uncertainty more accurately. When economic incentives are at work, people tend to read more and better sources of information, engage in deeper thinking, and attempt to place their money on more likely actual outcomes. Coplan put this theory into practice, simply put, by understanding the real world through betting.

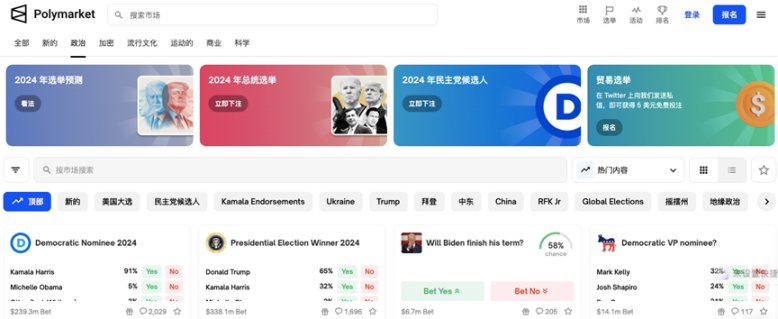

Opening the Polymarket website, the homepage prominently displays globally trending news events, such as the likelihood of Trump winning the upcoming presidential election, the possibility of conflict between Musk and Zuckerberg, and the expected number of interest rate cuts by the Fed this year. Users can select specific markets based on their personal interests and purchase "outcome shares" representing potential results of these events. The market price of these shares reflects the collective perception of the likelihood of events, providing users with an intuitive reference. Before the market resolution, users have the flexibility to sell their shares at any time, usually without paying high transaction fees. Once the results of the relevant events are officially announced, users who predicted accurately have the right to redeem their shares at a price of $1 per share, while users with inaccurate predictions will lose the value of their shares. It is worth noting that all transactions and settlements on the Polymarket platform are automatically executed through smart contracts, ensuring the fairness, transparency, and security of transactions.

By introducing a reward and punishment mechanism, Polymarket encourages each user to take responsibility for their own viewpoints, making the statistical data on the platform more reflective of the real market situation. Compared to previous platforms or social media, Polymarket's prediction results are more accurate. For example, in the case of room-temperature superconductors, despite some authoritative media being skeptical, internet celebrities confidently confirmed their realization, even fabricating evidence. However, Polymarket provided a more rational prediction, with a true-to-false ratio of one to nine, demonstrating the rationalization of user viewpoints under the reward and punishment mechanism.

Currently, social media and misinformation are rampant, and people's ways of understanding things are often limited. These institutions may not be able to remain objective due to vested interests, and social platforms may recommend information based on user interests, leading to an echo chamber effect. As a decentralized prediction market platform, Polymarket, based on blockchain technology, maintains fairness and justice, providing an opportunity for change in public opinion. Its characteristics of being apolitical, non-emotional, and objectively real, demonstrate people's true judgments and provide a new perspective for understanding the real world. As founder Coplan said, Polymarket is a platform that harnesses the wisdom of the masses through the market.

Can Polymarket's Fire Continue?

Cryptocurrency prediction platforms are not a new industry. In fact, as early as 2018, Augur established the first cryptocurrency prediction platform based on blockchain technology. However, at that time, due to technical limitations and the lack of widespread adoption of blockchain, Augur's cumbersome operation steps and unfriendly user interface prevented it from truly entering the public eye. It was not until the emergence of Polymarket that cryptocurrency prediction platforms were able to become popular in the blockchain industry and mature as an application.

According to data, Polymarket, with its unique betting prediction model, is attracting global attention and participation at an unprecedented speed. Especially during the current U.S. election period, Polymarket has not only become a popular platform for ordinary people to bet on their voting intentions but has also attracted a large number of investors hoping to profit from accurately predicting the election of candidates. Over the past few months, these active participants have invested billions of dollars on Polymarket, directly driving the platform's business scale and visibility to historic highs.

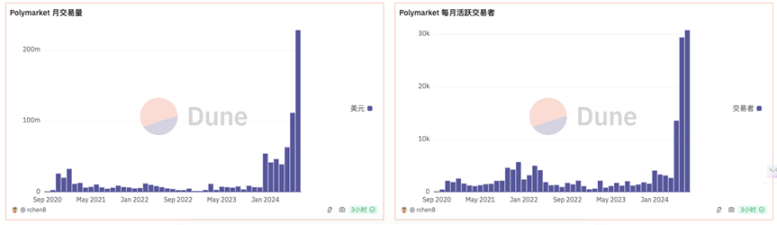

The latest data from Dune further confirms Polymarket's fiery trend. Since April of this year, Polymarket's trading volume and user numbers have shown explosive growth, especially in July when the global attention sparked by the Trump assassination event was reported widely by global media, further enhancing its visibility and influence. Influenced by this event, Polymarket's monthly trading volume in July doubled that of June, breaking the $200 million mark, with daily trading volume stabilizing at over $20 million and the number of daily active traders exceeding 6,000.

Polymarket's popularity has not only attracted enthusiastic participation from a large number of users but has also led some idealists in the cryptocurrency field to see it as an arbiter of truth. They believe that with its decentralized and transparent characteristics, Polymarket has the potential to become one of the main sources of fair information. However, behind the current popularity, we also have to face the many challenges and potential risks that Polymarket is facing.

First, the lack of sustained inflow of funds is one of the key issues for Polymarket's future sustainability. As a zero-sum game, the nature of prediction markets determines that they cannot attract sustained passive fund inflows like stocks, bonds, or cryptocurrencies in traditional financial markets. This characteristic poses a challenge for Polymarket in maintaining liquidity in the long run, which in turn affects its ability to sustain profitability and development.

Next, the liquidity constraints in the market are also an important issue that Polymarket needs to address. Currently, the top popular topics on Polymarket are almost all related to the US election, attracting the attention of the vast majority of users. However, for most markets, especially those involving non-immediate payments and niche topics, there is still a lack of sufficient attractiveness. This leads to relatively insufficient liquidity in these markets, making it difficult to form an effective market price discovery mechanism, thereby affecting the accuracy and credibility of predictions.

Additionally, the issue of the influence of market participants is also an aspect that Polymarket needs to pay attention to. In prediction markets, the lack of a sufficient number of professional market makers and other market participants may lead to the market price being manipulated or influenced by a few advantaged participants. This not only weakens the ability of the prediction market to provide accurate insights but may also lead to market unfairness and a crisis of trust. For example, some industry insiders often have advance knowledge of insider information and can place a large number of bets in advance to exploit ordinary users. Therefore, establishing a fair and just regulatory and auditing mechanism is crucial for the future development of Polymarket.

Finally, Polymarket relies on creating topics for people to bet on based on hot news, which often touches on some socially sensitive events. For example, some time ago, Polymarket faced criticism for using inappropriate language in several tweets posted by the official X account (especially the use of the offensive term "Retardio" meaning "mentally slow") for marketing purposes. Although Polymarket issued an apology and took internal review measures after the inappropriate wording incident, it still raised public doubts. Some media outlets believe that Polymarket is using negative events to make money.

Looking at the Future Development of the Cryptocurrency Prediction Market from Polymarket

The popularity of Polymarket undoubtedly reveals the unlimited potential of the cryptocurrency prediction market. Looking back, prediction markets have mostly remained in the theoretical stage, and even practical attempts have often been closely associated with gambling, and have even been used by criminals as a money laundering tool. However, the introduction of blockchain technology has brought profound changes to the prediction market, making on-chain cryptocurrency markets more easily accepted and trusted by ordinary users due to their openness and transparency.

Although Polymarket is not the pioneer of cryptocurrency prediction platforms, it is undoubtedly the most mature and influential platform at present. Its success is not only reflected in the rapid growth of user numbers and trading volume but also in its successful push of cryptocurrency prediction markets to the general public, injecting new vitality into this field. The rise of Polymarket allows us to see new application cases in the blockchain industry, as well as the unique charm and broad prospects of cryptocurrency prediction platforms.

For a long time, prediction markets have been seen as the holy grail of cognitive technology. As early as 2014, Ethereum founder Vitalik expressed strong interest in using prediction markets as a governance mechanism. However, for a long time, prediction markets have faced many challenges in practical applications, such as irrational participants, insufficient market liquidity, and a lack of incentive for "correct knowledge" holders to place bets. These issues have been constraining the development of prediction markets.

The emergence of Polymarket has successfully broken this deadlock. It has not only attracted a lot of attention from industry insiders but has also demonstrated strong vitality and broad prospects in practical applications. Vitalik himself has used Polymarket to track the event of Sam Altman's departure from the board, which undoubtedly adds more authority and influence to Polymarket. Additionally, Packy McCormick, an advisor at a16z Crypto, highly praised Polymarket, believing that its page might be the best place to start a day on the internet. This evaluation not only reflects Polymarket's outstanding performance in user experience but also highlights its unique value in information acquisition and decision support.

Richard's viewpoint provides us with another perspective. He believes that the cryptocurrency industry should move away from zero-sum games and towards providing positive experiences. The prediction market is one of the best choices to achieve this mission. It can serve as a betting platform, providing entertainment and the possibility of profit for users, while also serving as a source of information to help users make wiser decisions. This dual nature gives the prediction market a unique position and value in the cryptocurrency industry.

However, we must also be aware of the challenges that the cryptocurrency prediction market faces in its future development. The uncertainty of regulatory policies, the prevention of compliance risks, and the construction of market ethics are all issues that require our focus. Only under the premise of ensuring compliance, fairness, and transparency can the cryptocurrency prediction market achieve healthy, stable, and sustainable development. This requires joint efforts and continuous exploration within the industry.

Taking Stock of Cryptocurrency Prediction Market Platforms Worth Paying Attention to

In the race of cryptocurrency prediction markets, in addition to Polymarket, several platforms have emerged as market focuses due to their unique operating mechanisms and respective advantages. These platforms not only provide innovative prediction market models but also enhance transparency and credibility through blockchain technology, attracting more and more cryptocurrency enthusiasts and investors. Here are several cryptocurrency prediction market platforms that are currently worth special attention:

Augur:

As a pioneer in blockchain prediction markets, Augur has been dedicated to advancing the development of this field since 2014. Its operating mechanism is community-driven, allowing users not only to participate in betting but also to create their own markets, significantly increasing market participation and customization. Augur operates using the native token REP, which plays a crucial role in reward distribution, market creation, and dispute resolution, further enhancing the transparency and credibility of the market. To address Ethereum's scalability challenges, Augur has launched a Turbo version, using the Polygon network to improve transaction efficiency and scalability, significantly enhancing user experience.

In recent years, the Augur platform has continued to improve its functionality, and the community has continued to expand, attracting more and more cryptocurrency enthusiasts and investors. However, its community-driven model may lead to a certain degree of artificial influence on market results, which is a risk that investors need to be aware of when participating.

Gnosis:

Gnosis is a comprehensive blockchain ecosystem that covers a range of infrastructure tools, including prediction markets, decentralized trading, and wallet services. Its operating mechanism revolves around the GNO token, closely linking users to the platform through governance and staking mechanisms. To address Ethereum's scalability challenges, Gnosis has developed its own Layer 2 solution—Gnosis Chain, providing strong support for applications such as prediction markets based on Ethereum.

Gnosis's development model focuses on the comprehensiveness and versatility of the ecosystem, aiming to provide users with an integrated and convenient blockchain environment. Currently, Gnosis is gradually expanding the application scope of its ecosystem to meet the needs of more users. However, due to the complexity of its ecosystem, new users may need some time to familiarize themselves with and master its various functions and services.

XRADERS:

XRADERS is a decentralized market prediction and expert opinion sharing platform that uses blockchain technology for transparent data recording and trust-building. Its operating mechanism combines social price prediction, gamified elements, and community-driven cycles, providing a secure and reliable environment for user interaction. XRADERS provides carefully curated expert insights, offering actionable information to investors, and ensures transparency and integrity through a decentralized voting system.

In recent years, XRADERS has established partnerships with several well-known projects, such as UXLINK, SecondLive, and DIN. Its core gameplay, Guess2Earn, and decentralized voting system have attracted a large number of users. Additionally, XRADERS has successfully completed seed round financing, attracting the participation of several top cryptocurrency investors and institutions. However, due to its decentralized nature, the platform's information may have a certain subjectivity and uncertainty, and investors need to carefully evaluate when making decisions.

PredictIt:

PredictIt is a non-profit research project operated by Victoria University of Wellington in New Zealand. It has obtained special exemptions from the CFTC at the federal level in the United States, allowing it to operate legally in certain states in the US. PredictIt's operating mechanism is relatively straightforward, mainly relying on user predictions and bets on market events. To comply with relevant regulatory requirements, PredictIt has imposed limits on the investment amounts of users. Currently, event markets on PredictIt cover various fields such as politics, economics, and sports, attracting a large number of users to participate. However, due to its non-profit nature and regulatory restrictions, PredictIt may face certain challenges in market promotion and commercialization. Additionally, investors need to pay attention to compliance and investment risks when participating, ensuring that their rights are not compromised.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。