Author: Mary Liu, BitpushNews

After the release of strong US GDP data and cooling personal consumption expenditure (PCE) inflation data on Thursday, the cryptocurrency market and tech stocks failed to rebound.

The GDP data released on Thursday showed that the US economy grew by 2.8% in the second quarter of 2024, exceeding economists' forecast of 2%. The inflation pressure measured by the Personal Consumption Expenditures (PCE) price index dropped from 3.4% to 2.6%, indicating progress towards the Federal Reserve's 2% inflation target.

James Knightly, an economist at ING Bank, stated that US consumer spending will slow down in the second half of 2024. He added, "Business surveys certainly indicate softening prospects, and today's data did not shake the market's confidence in a September rate cut by the Federal Reserve."

According to the FedWatch tool from the Chicago Mercantile Exchange (CME), the probability of a rate cut in September by interest rate traders has been raised to 85.7%.

At the close of the day, major US stock indices showed mixed movements, with the Dow Jones Industrial Average rising by 0.20%, while the S&P 500 and the Nasdaq Composite fell by 0.51% and 0.93% respectively.

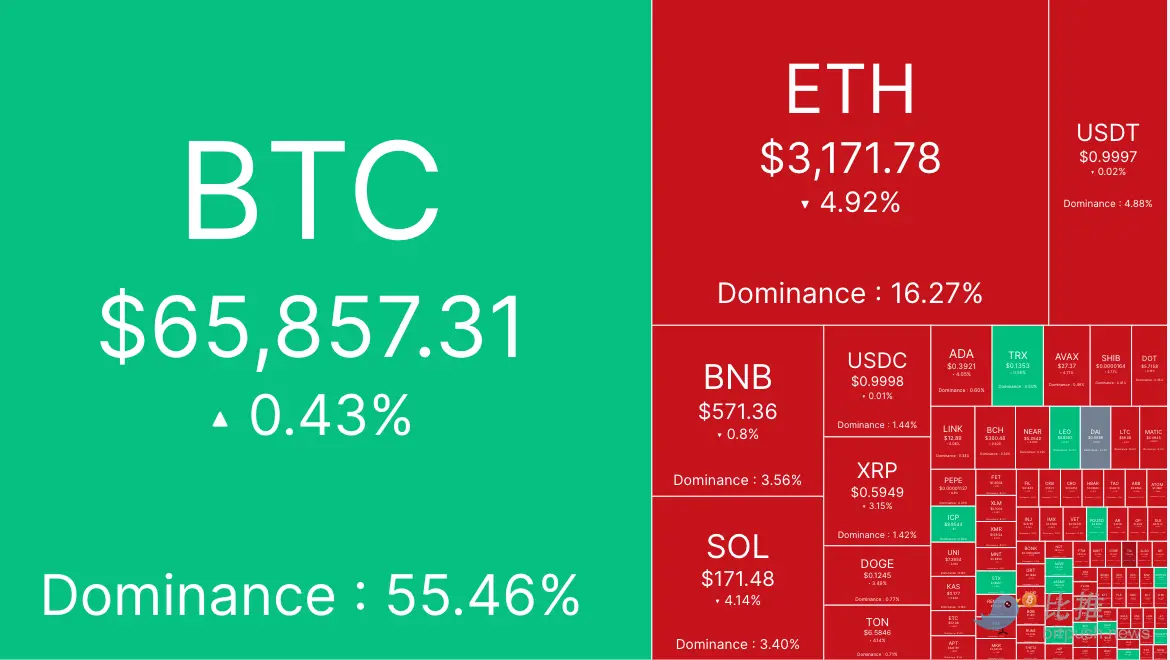

Bitpush data shows that Bitcoin broke below the $65,500 support level early on Thursday, reaching a low of $63,420 in the afternoon, before bullish momentum pushed it back above $65,000. At the time of writing, the trading price of Bitcoin is $65,857, with a 24-hour gain of 0.43%.

Ethereum experienced a nearly 5% decline over 24 hours, dropping below $3,100 at one point. Since the launch of the Ethereum spot ETF, ETH has fallen by 8.2% over the past week.

The altcoin market generally declined, with only Galxe (GAL) among the top 200 tokens achieving an increase of 15.4%, trading at $3.55. Among the declining tokens, BinaryX (BNX) led the way with a 19% decrease, followed by Blast (BLAST) with a 15.2% decline, and ether.fi (ETHFI) with a 14.2% drop.

Currently, the total market capitalization of cryptocurrencies is $2.3 trillion, with Bitcoin's dominance at 55.4%.

92,500 ETH Transferred by a Dormant Whale After 7 Years, Possibly Related to the Ethereum Foundation?

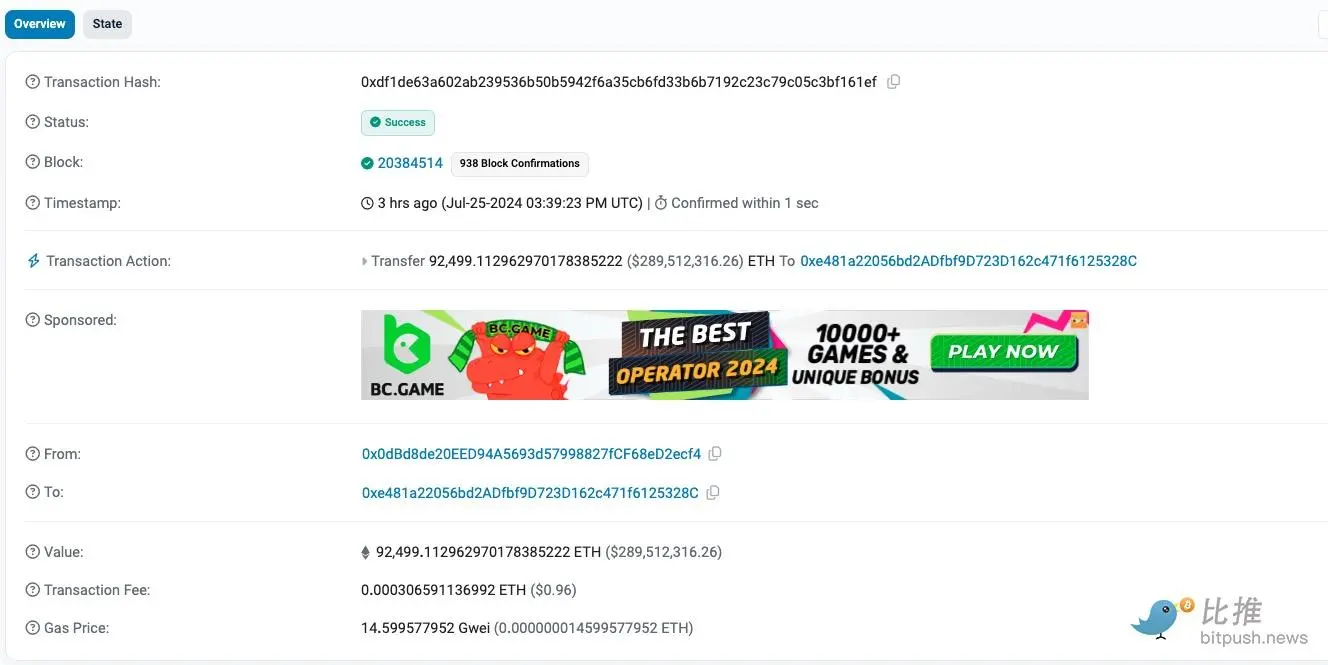

Blockchain trackers, including Whale Alert, detected that on July 25, 03:39:23 PM UTC, an address transferred over 92,000 ETH after being dormant for 7 years, worth approximately $290 million. These tokens have been held in the same address since 2017.

Data from Arkham Intelligence indicates that these funds may be related to the Ethereum Foundation, as the address has been marked as a wallet suspected to be associated with the Ethereum Foundation (0xe93232a). Other community members suggested that these funds may be related to early donors of the organization.

The wallet initially received 96,474 ETH worth $130,320 from the Ethereum Foundation on September 1, 2015, 12:21:51 UTC.

Currently, these tokens are idle in the wallet "0xe481a22". While it is not certain whether these tokens are from the Ethereum Foundation, as of the time of writing, these funds have not been sold or transferred to exchanges. This transfer occurred during a period of declining ETH prices and coincided with the launch of the Ethereum spot ETF.

BTC Re-testing Key Support Level

Market analyst TradingShot stated, "Bitcoin today tested the 1D MA50 for the first time since July 19, which is the most important 'break and retest' since October 11, 2023. This is the last retest of 1D MA50 as support after the recent breakout, following a 21-month bearish phase from April 14, 2023, to September 11, 2023, which began at the bottom of the previous bear market cycle in November 2022."

He said, "Although it slightly dipped below this level during the retest, it still managed to maintain the candle closing price above this level, initiating a rebound from October 2023 to March 2024. Therefore, if the same closing conditions are met, we expect a similar rebound, which would be a new bullish trend, ultimately reaching the psychological benchmark of $100,000."

TradingShot added, "It must be noted that the Federal Reserve's interest rate decision next week or at least the hint for the September meeting will undoubtedly have a huge impact."

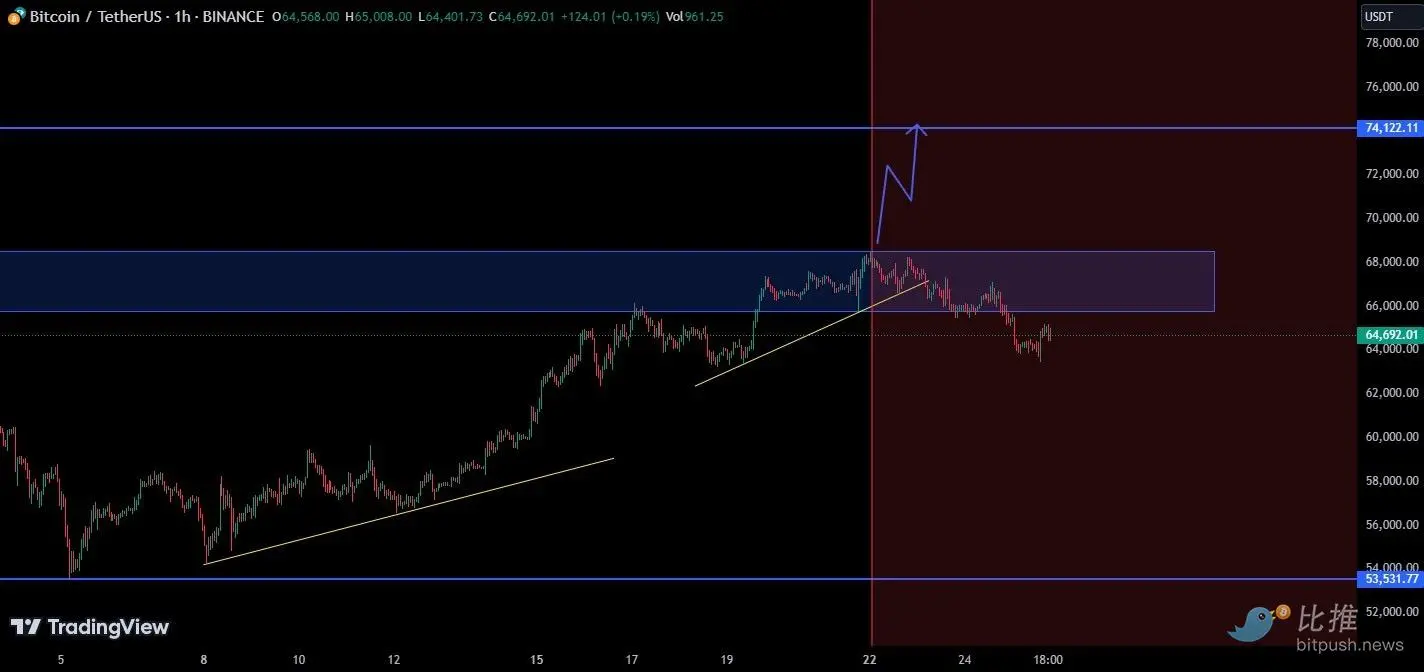

Market analyst SatochiTrader also believes that the current weakness is temporary and expects Bitcoin to start rising once the latest round of FUD (fear, uncertainty, and doubt) dissipates.

SatochiTrader on X platform stated, "BTC has a large number of Dollar Cost Averaging (DCA) whales, and they will do everything to protect the price trend. Our strategy is to hold BTC during active cycles. News about artificial intelligence, Trump, China, and miners may temporarily affect the market, but will not have a permanent impact."

He added that the outlook for Bitcoin remains "optimistic and may rise to $74,000 over time."

TradingView user TheForexXMindset urged traders to remain calm despite recent sell-offs, as technical data indicates that Bitcoin will soon rise.

He stated, "Don't panic, TA is very clear about what will happen next, and many traders are selling in panic. Once all this is over, the general rules will return. Those who hold ALTS, the price will rise. Many people sell out of fear. Greed will return."

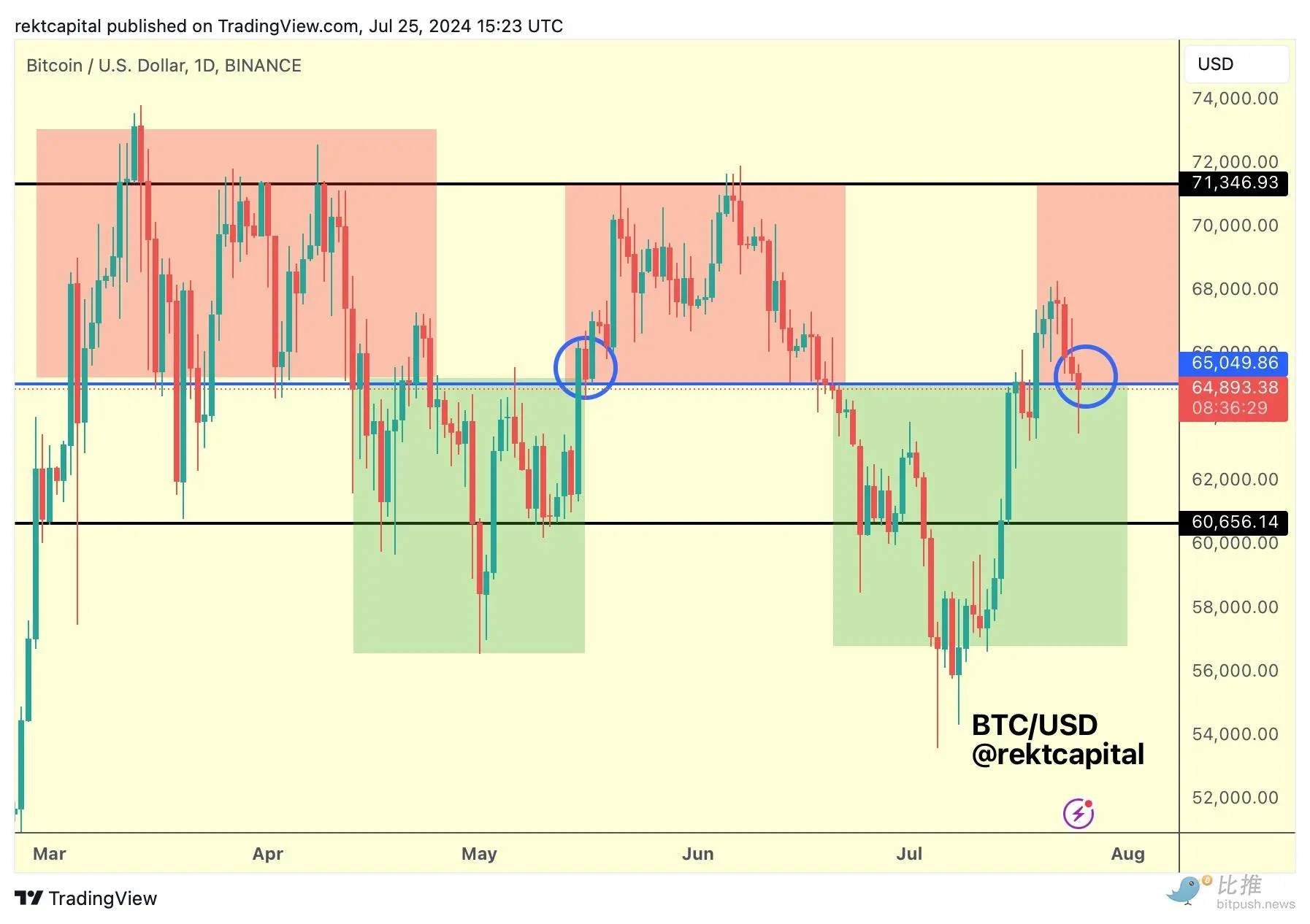

Meanwhile, market analyst Rekt Capital stated that Bitcoin is currently in the process of retesting the $65,000 level in a volatile manner.

He said, "The daily closing price now needs to be above $65,000 (blue in the chart) for the retest to be successful and to keep the price within the $65,000-71,500 range (red in the chart)."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。