Recently, a financing led by ParaFi and Greenfield Capital has attracted the attention of the author. Initially, it was thought to be just a task platform, but it managed to raise 2.5 million USD in 2021, 3.7 million USD in 2022, and a staggering 15 million USD in 2024, leading to speculation about where Layer3 is truly positioned.

1. Overview

We have witnessed the explosive growth of the on-chain community, where tokens have become the most powerful tool for the community as they provide a common purpose, goal, and interest.

However, when the prices of these tokens drop, the community becomes unsettled.

In other words, it becomes difficult to discern whether the participants are driven by common interests and values or something else when they are overwhelmed by the surge in value. As a result, they gradually detach from the community.

At the core of Web3 projects, the challenge lies in how to seize users' attention resources and marketing efforts solely through their own strength in such a fragmented environment. In the context of the prevailing airdrop culture, there is a need for a platform like Layer3, which is not referring to a specific chain but an application on the public chain, serving as an aggregation and distribution platform for attention resources. Through the construction of a full-chain identity infrastructure, it enables users and project parties to obtain the resources they need through this platform.

It not only provides a fun way for new users to enter the Web3 ecosystem but also encourages existing users to explore new protocols and applications.

Therefore, Layer3 is not just a platform but an experience of a brand-new token economic model, demonstrating the integration of Gamefi and attention economy. It aims to unlock trillions of market value through a three-pronged strategy (attention economy, full-chain identity, and token distribution protocol).

2. Current Status of Web3 Task Platforms

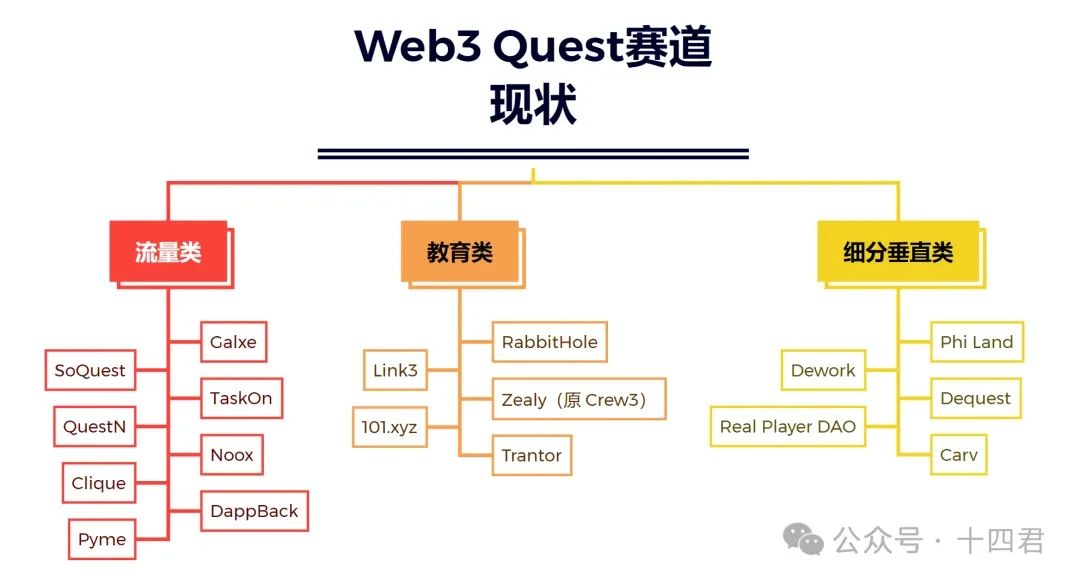

The marketing demand of Web3 task platforms has driven the rapid development of the platforms, which can be divided into three categories: traffic-based (such as Galxe, SoQuest, TaskOn), educational (such as Layer3, RabbitHole), and vertically specialized (such as Phi Land and Dework). More details can be found in the table below.

[Project Categorization]

Traffic-based platforms attract users through task-based activities, educational platforms enhance users' understanding of encrypted projects, and specialized platforms focus on specific areas. Currently, the overall market heat is declining, second-tier platforms are experiencing slower growth, and they face competition from leading platforms and homogenization challenges. Improving user activity and addressing bot issues are key to the development of task platforms. The profit model is currently not comprehensive enough, and future competition will revolve around innovation and user conversion.

Platforms need to transition into long-term traffic pools, optimize user experience, and build unique profit models. How to re-aggregate community interests and values is a key growth point that needs to be explored in the future.

Most airdrops in Web3 are essentially a combination of future incentives and community participation, increasing the value through the scarcity of tokens. However, the value built on future consumption is not enough to support the long-term development of any project.

Thomson pointed out a key issue of the current Internet: the Internet is a world of abundance, and there is an important new force: understanding this abundance, indexing it, and finding needles in the well-known haystack. This power is in the hands of Google.

Similarly, for the world of Web3, it is also a world of abundance, but before this, no one had consolidated this abundance in the vastness of Web3. However, it is difficult for the community to identify or incentivize the most active members, and the value of members is being wasted.

Interestingly, against the backdrop of continuous development, some people are gradually realizing the importance of attention. Attention is like a soul bound to tokens, consolidating high-quality resources in Web3 through recording user engagement, allowing anyone or any project to recognize each other through similarities.

Stepping back, envisioning a new economic model of attention and a social graph of attention resources is important for bringing higher value to every participant.

Why is this important?

Because creators on Web3 need to know which audience their work can attract. Let's follow the author's footsteps to see how Layer3 envisions the future:

3. Workflow of Layer3

3.1 For C-end Users

The core value of Web3 has always been: returning data and value sovereignty to individuals.

As a fundamental infrastructure platform for full-chain identity, Layer3 is realizing this vision, maximizing the commercial benefits of data while ensuring that the data originates from real individuals and the value generated returns to individuals. For ordinary users, their concerns are nothing more than:

How to find high-value income projects that suit them?

How to generate continuous income from personal data?

This is also a necessary condition for the platform to sustainably generate value. Let's briefly discuss how Layer3 accomplishes this through the layout of task arrangements:

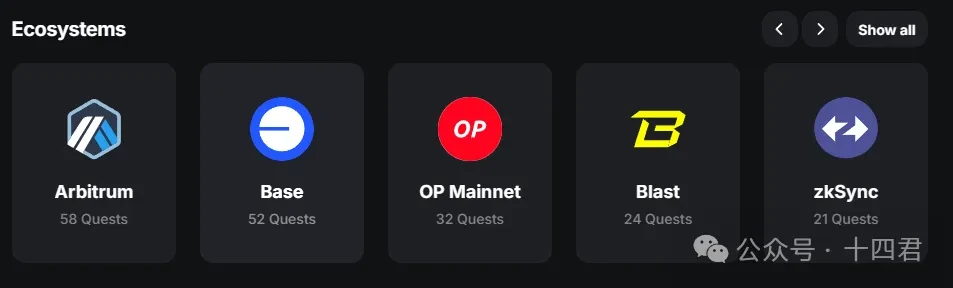

In breadth: Layer3's task system adopts an ecological classification approach, where different ecosystems form a major category, and each category has different tasks.

In depth: Similar tasks will be progressively advanced in a game-like mode, and tasks of different difficulty levels will have different experience points and rewards. Each completion of a task will result in the acquisition of an NFT CUBE for recording the data information of the challenger.

For users,

we can quickly subscribe to all projects we are interested in, and through the project's popularity and overall task progress, we can assess the development prospects of the project, enabling quick identification of high-quality projects.

As mentioned earlier, when completing a task, we can mint a CUBE as our full-chain identity. This provides us with a pathway to income. When other developers or project parties need to access this CUBE, they will need to pay a certain fee. A portion of these fees will be returned to the entire ecosystem community, and the level of income depends on our activity on the platform, emphasizing the more effort, the more luck, and the pathway to wealth.

Lastly, it allows for multiple benefits. Leveraging the Layer3 ecosystem, completing tasks on the platform can earn CUBEs, which is a factor in obtaining Layer3 airdrops. Furthermore, there are high-quality projects on Layer3 that have not yet distributed airdrops. By completing these projects in advance, it will be advantageous to obtain more shares when the airdrops are distributed in the future, enabling the operation of multiple benefits.

3.2 For B-end Users

In Web2 projects, major advertising businesses can achieve precise and user-preferred advertising based on the historical behavior of user groups on the Internet, leading to the emergence of personalized advertising.

In simple terms, this is all thanks to credential data and big data analysis, which is one of the most important application areas for data credentials.

Web3 is no exception.

Moreover, due to the traceability and tamper resistance of blockchain, it is more friendly to the creation and tracking of credential data. There are many on-chain credential data, such as records of credit in which we have not been liquidated in a lending project, and records of providing liquidity in a certain LP pool.

These credential records can contribute to the operation and promotion of project parties.

The Project Galaxy team believes: "Digital credentials are important because they have high-frequency application scenarios. Protocol developers can calculate various user credit scores, target audiences for applications, and reward community contributors based on credentials. With the development of Web3 and DAO, the behavioral data of participants in the Web3 world will experience explosive growth, and Project Galaxy will provide the necessary infrastructure to help these new participants establish crucial digital credentials."

So, how does Layer3 collect on-chain credentials? And how does it support project parties? Let's discuss from the following perspectives.

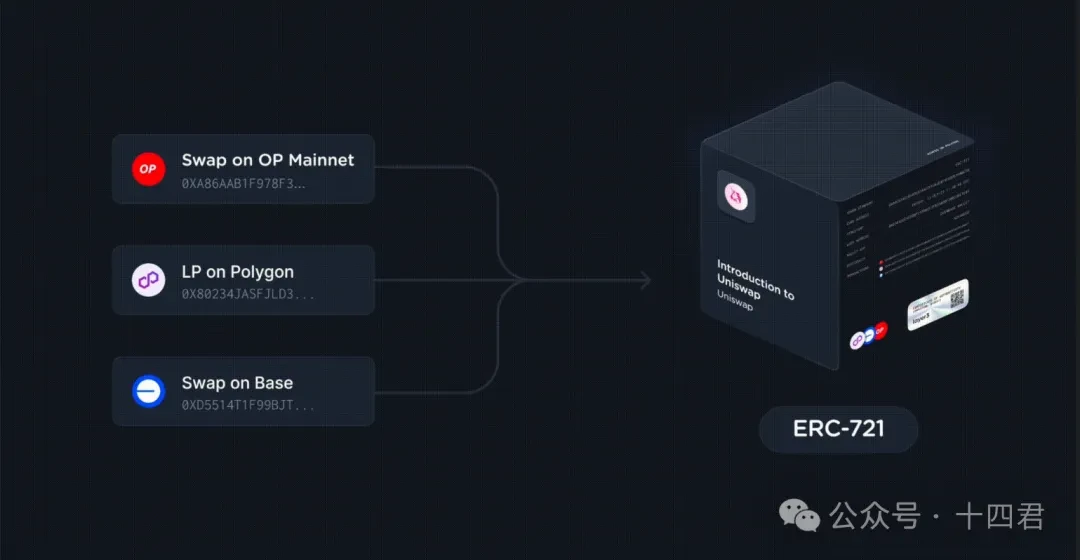

1. CUBE Credentials

On-chain data credentials are similar to real-life resumes, recording individual behaviors. On Layer3, users' resumes are recorded in the form of ERC-721 tokens through CUBEs.

Each CUBE covers different applications, chains, and ecosystems of various tasks. These credentials help explorers unlock new opportunities and enable protocols to identify high-quality users.

For users, minting CUBEs can unlock rewards in Layer3's attention economy, such as tokens and dynamic rewards for completing tasks. This incentivizes users to engage more, generating more credential data.

These CUBEs' full-chain data is a form of attention resource.

Why is this important? Because every participant on the chain has their own focus. If project parties can effectively identify and access these attention resources, they can better target promotions and reward distributions to expand their market share and solidify their position in the market.

Layer3 has built this resource into relevant infrastructure, allowing any organization in need to access these attention resources through the creation of open identities, incentives, and interface networks owned by participants.

2. More Aggregated Tools

For any project looking to integrate with Layer3, they can seamlessly integrate the Layer3 experience on their native website with just two simple lines of code.

Additionally, anyone can embed tasks or Streaks on their blogs, technical guides, or internal documents with just a link, without the need for additional code!

This is the most cost-effective promotion for small project parties, as they can directly attract users on their platform through the vibrant ecosystem of Layer3, leveraging enticing rewards, social interactions, and partnerships.

Furthermore, Layer3 integrates the entire toolchain required for tasks. For example, if we need to operate on Chain A for an official task, but there are idle assets on Chain B, we can use the cross-chain bridge integrated on Layer3 to perform asset cross-chain operations. It's worth noting that asset cross-chain operations are also primary tasks on Layer3, which helps users transition from novices to experienced users.

This will leave project parties with users who have their own insights and understanding, making them more cautious but also more sustainable and active in their approach to projects.

3.3 Conclusion

It can be said that Layer3 is not just ToC or ToB, but rather a bridge connecting ToC and ToB, providing both parties with a warm and efficient platform, allowing them to transition from acquaintance to understanding and find a suitable "partner."

The Layer3 protocol has a beautiful flywheel: new protocols bring in new users, and new users attract more protocols, forming the cornerstone of encrypted marketing solutions.

Even if plans or airdrops occur outside of Layer3's infrastructure, contributors will plan and incentivize them for users to explore, providing a global access point for each ecosystem.

4. Layer3's Token Economy

4.1 Why is the Token Economy So Important?

The development of any Web3 project is inseparable from one relationship—supply and demand.

Tokens are the foundation of this relationship, so the design of the token economic model is particularly important, affecting the short-term and long-term supply and demand relationship of the project. An excellent token economic model ensures the long-term value of the token and creates a fundamental foundation for the project's value sustainability.

For a detailed discussion of token economic theory and its role, please refer to: "Understanding Token Economics in Depth" (see the appendix).

4.2 Discussion of Layer3's Token Economic Model

As the first platform to build a full-chain identity infrastructure based on the attention economy, I would like to discuss its economic model from two perspectives:

How does Layer3's economic model ensure the long-term sustainable development of the project?

How does its economic model bring tangible benefits to users?

As a fundamental infrastructure platform for aggregating attention resources, the core of the platform's sustainable development lies in ensuring that C-end users benefit while providing high-quality user traffic to B-end project parties.

Below, I have summarized the content of the entire Layer's economic model in the table below:

Regarding the economic model, it will be viewed from three dimensions (token supply, token utility, token distribution).

There are multiple perspectives for analyzing token frameworks. For more related content, please refer to: "Token Economics: An Analysis of the Token Economic Models of Mainstream Web3 Projects" (see the appendix).

1. Token Supply

[Tips: Current market value and circulation are estimated results]

It should be noted that Layer3's economic model adopts deflation.

As mentioned earlier, the value of tokens is influenced by supply and demand. To prevent tokens from becoming worthless "air coins," these three points are particularly important, but the most crucial is the token burning mechanism: continuously reducing token supply, i.e., deflation; conversely, continuously expanding token supply, i.e., inflation.

This is also a decision made by the protocol design at the supply level. Layer3's burning mechanism can be divided into two levels:

- From the user's perspective:

Under Layer3's economic model design, user behavior in the ecosystem is linked to the burning mechanism. Users can gain privileges in the ecosystem by destroying L3 tokens. For example:

Users can access some project tasks in advance, allowing them to seize favorable timing.

There are discounts and preferential policies for fees generated by task completion or during transactions.

Users can obtain exclusive NFTs by destroying L3 tokens.

This series of designs is intended to stimulate users to destroy a certain amount of tokens. In this model, users have income, while the platform's tokens maintain the goal of deflation.

- From the community's perspective:

The community's ecological regulation is relatively heavier compared to retail investors. For a financial market, the value of tokens does not solely depend on rarity but also requires good liquidity, which is the essence of trading. So, how does the model balance liquidity and rarity?

The rarity mechanism of maintaining tokens is relatively simple. Similar to the design from the user's perspective, the community's behavior in the ecosystem also requires the destruction of L3 tokens. However, the community's behavior is reflected in the release of tasks, deployment of incentive measures, and access to CUBE credentials. Additionally, when the community initiates proposals and votes during governance, it also requires the corresponding destruction of L3 tokens.

What about liquidity? This is not difficult to understand. The essence of liquidity is buying and selling, so if user behavior is tied to destruction, then for the community, behavior is not only tied to destruction but also to buying. For this, the model stipulates that some behaviors of the community require the purchase and destruction of L3 tokens.

Buying behavior will inevitably be accompanied by a seller's market. It is worth noting that, apart from the community, the only entities with a large number of tokens are users, issuers, and investors. However, the tokens of issuers and investors have time restrictions on unlocking, meaning that the tokens currently in circulation are all in the hands of users. This results in users being the main source of sellers, opening up new possibilities for user income growth.

Here is the complete translation of the provided markdown:

For Layer3's two sets of burning mechanisms, from the perspective of token circulation and holdings, it maintains the deflation model of the token, and token deflation will provide positive feedback on the token price.

A high-value ecosystem will inevitably attract users, while the means of destruction can counteract the influx of a large number of tokens caused by linear unlocking over time, which impacts the economic system. A stable economic system also contributes to the long-term development of the project.

Furthermore, the act of deflationary burning is accompanied by the transfer of benefits, which is a concession from the project party and the community to the users. This also brings substantial profits to users on the platform, creating a new economic value.

2. Token Utility

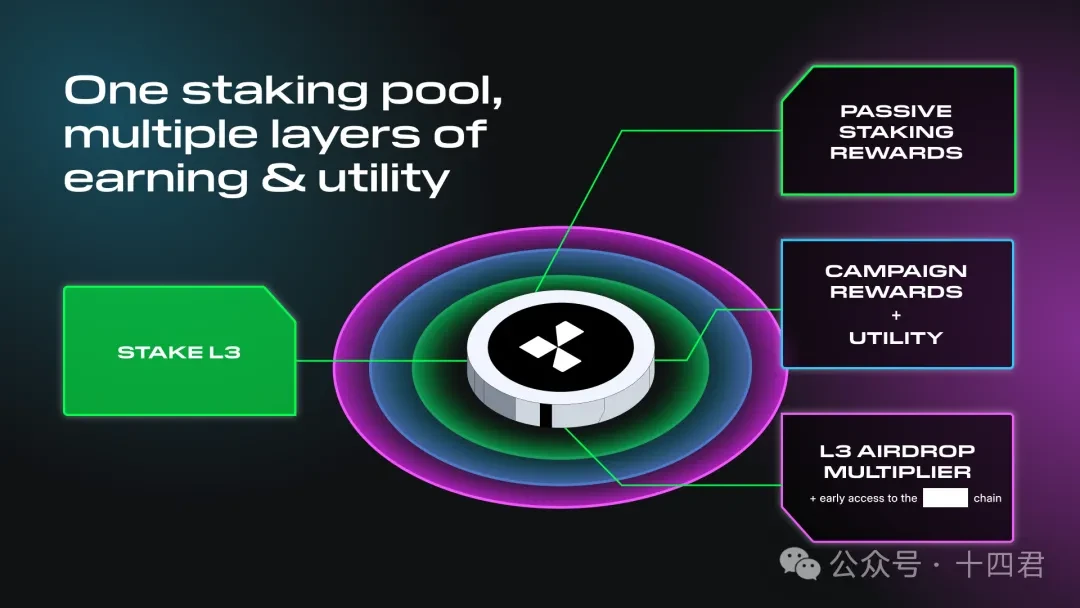

Token utility represents the value of the token, whether it has practical use cases, and whether it can attract more people to join, i.e., the demand side of the token. The accumulation of value is the most concerning aspect of the Layer3 economic model for the author, as it is the use case that most directly affects user profits. The core concept of L3's utility can be summarized as aligning the value of the token with network growth and user engagement. To achieve this, Layer3 has adopted an innovative staking model called Layered Staking. Its main design points are as follows:

- Passive income is calculated based on the combination of staking amount and staking time.

- Users actively participate in activities to increase the reward multiplier, thereby increasing community stickiness and preventing dominant users from "administrative inaction."

Regarding the first point, under the L3 design model, users can provide liquidity staking in the system, providing LP for the entire ecosystem. Users can passively earn income from the LP and the trust level of users in the platform is also taken into consideration, forming a mutually beneficial relationship. Income is no longer based solely on the staking amount; the staking duration is also an important factor in income generation. A user willing to stay long-term will inevitably earn more income than a short-term opportunist.

As for the second point, the author believes it is the most interesting aspect of the entire economic model design. While other platforms have provided income standards based on staking amount, some have also considered the factor of time. Although this can attract long-term users, it cannot guarantee access to high-quality users and more comprehensive user behavior data.

In L3's model design, the level of user participation in activities has also become a factor in income generation. This means that a dominant staker who is not active will earn less income than a less dominant but active user. This can guide users to actively participate in platform activities to gain airdrops and double income benefits, undoubtedly an innovation to improve user quality and stickiness.

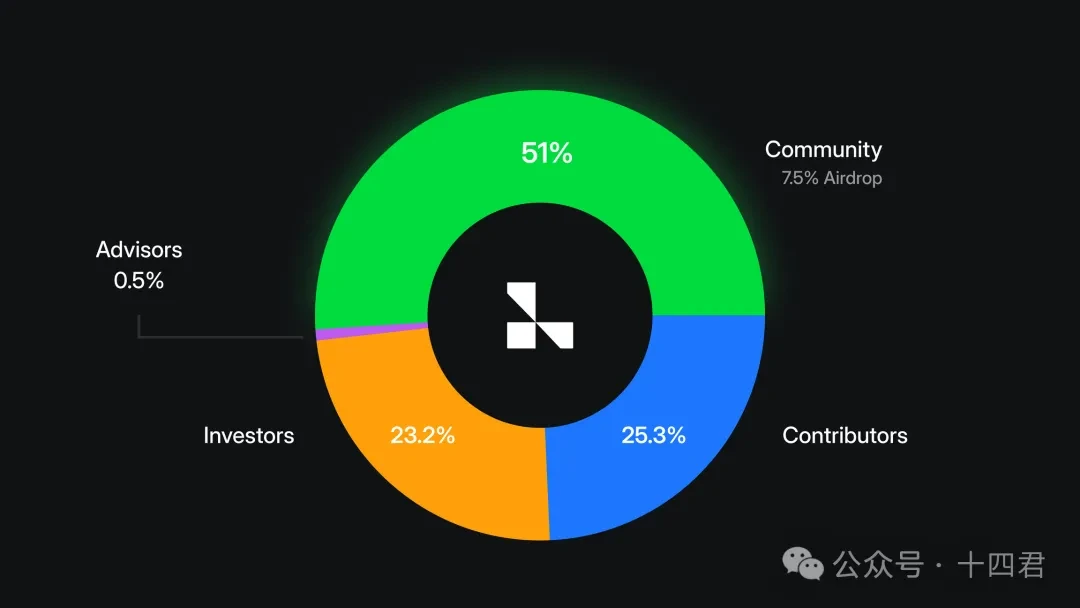

3. Token Distribution

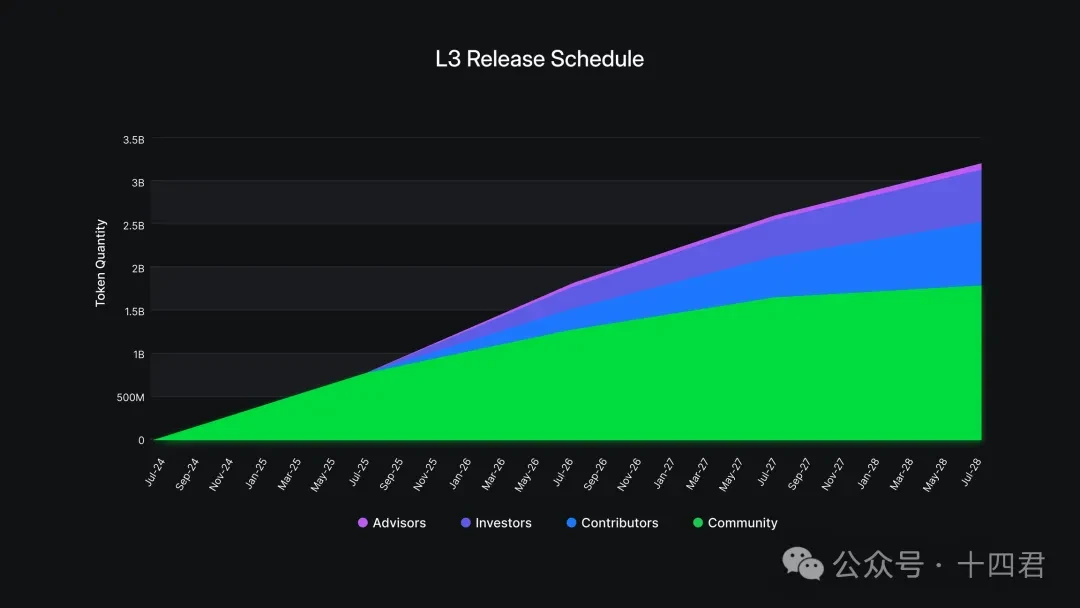

Token distribution reflects the fairness of the project and the team's confidence in the long-term success of the project. Therefore, from the distribution perspective, several aspects need to be considered: the holders and proportions of the tokens, and the release time of the tokens.

Layer3's token distribution plan takes into account the interests of the community, core contributors, investors, and advisors, ensuring the fairness and long-term development of the project. The lock-up period and gradual release mechanism effectively prevent token market fluctuations and enhance the confidence of all parties in the long-term success of the project. Overall, such a distribution system can balance the interests of all parties while ensuring the sustainable development of the project.

The detailed token distribution plan can be found in: "Distribution of Layer3 Foundation" (see the appendix).

It is worth noting that once the cliff is reached, the vesting is generally done on a daily basis rather than monthly or quarterly.

A large amount of unlocking after a long wait may trigger a prisoner's dilemma, as it may cause token holders to accelerate selling to ensure the best price.

Daily vesting allows all parties to trade to eliminate the above-mentioned risk, thus avoiding panic selling.

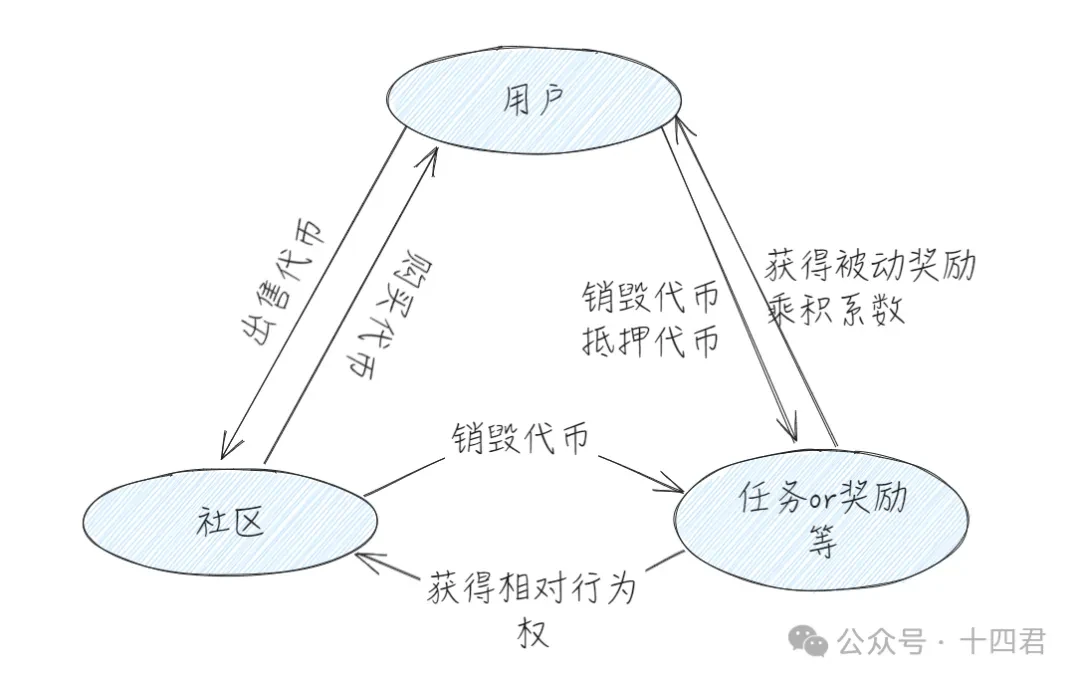

4.3 Comprehensive Review

Let's take a comprehensive view of the entire economic model from the perspective of the overall process. In the envisioned economic model of L3, it is like a stable triangular structure, with three core ideas:

- Users, communities, and institutions build a buying and selling market to achieve the token's ecological circulation, thereby giving the token certain value properties.

- From a purely buying and selling perspective, the economic model is not equipped to withstand market risks. These risks come from the linear unlocking of time, leading to a large influx of tokens into the market, impacting the stability of the token. Therefore, from the design perspective of the economic model, tasks and rewards are introduced and linked to the burning mechanism, allowing ecosystem members to burn tokens in their activity behavior to counteract the impact of this influx.

- The core of the platform lies in user traffic and providing high-quality users. Therefore, a good economic model must also consider how to achieve full-process incentives from customer acquisition to active customers. This is achieved in the model through the concept of income = passive income + other rewards * multiplier coefficient.

After discussing the entire model, we find that the token economic model of L3 must have three key elements: a reasonable staking mechanism, more application scenarios, and steadily increasing passive income.

It is worth noting that while the token economic model is very important, a good token economic model is never solely dependent on the project itself. Such a token can only be a useless "air coin." A good token model must not only be self-sufficient in the ecosystem but also continuously adapt to the various market risks brought about by the rapid evolution of Web3 projects. The relationship between the project and the economic model is not simply parasitic but complementary and progressive.

5. Conclusion

The Web3 task platform still has many dynamics and innovations worth exploring. As a cutting-edge tool driving project development, they efficiently promote the ecological prosperity of project parties, provide users with a window to access information, and, most importantly, bring tangible benefits and a sense of participation.

Realizing Web3 growth is never an overnight process. Project parties can choose to grow together with task platforms while acquiring traffic. Paying attention to the platform's own growth data helps project parties make wiser decisions and lays a solid foundation for the healthy growth of users.

With the intensification of fragmented growth and competition for user attention, the drainage methods of major project parties are still relatively single, mainly relying on joint activities between projects. These activities usually provide rewards to attract users, and some rewards even come at no cost, lacking the driving force for sustained growth. Moreover, the quality of attracted users varies, and user segmentation cannot be achieved.

Only by building a suitable bridge for keys and locks, finding a sense of belonging for both parties, can unprecedented growth and value creation be unlocked.

Appendix

"Deep Understanding of Token Economics"

https://www.coinlive.com/zh/news/deep-understanding-of-token-economics

"Distribution of Layer3 Foundation"

https://docs.layer3foundation.org/tokenomics

"Token Economics: An Analysis of the Token Economic Models of Mainstream Web3 Projects"

https://foresightnews.pro/article/detail/24604

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。