On July 19, 2024, Richard Teng, CEO of Binance, tweeted about the cyclical nature of the cryptocurrency market, emphasizing the need for a longer-term perspective. He noted that it had been three months since the last Bitcoin block reward halving and compared the price increases six and twelve months after previous halving events. His intention was to suggest that it might be too early to be anxious about the start of the bull market.

Figure 1: Richard Teng's tweet, Source: Twitter

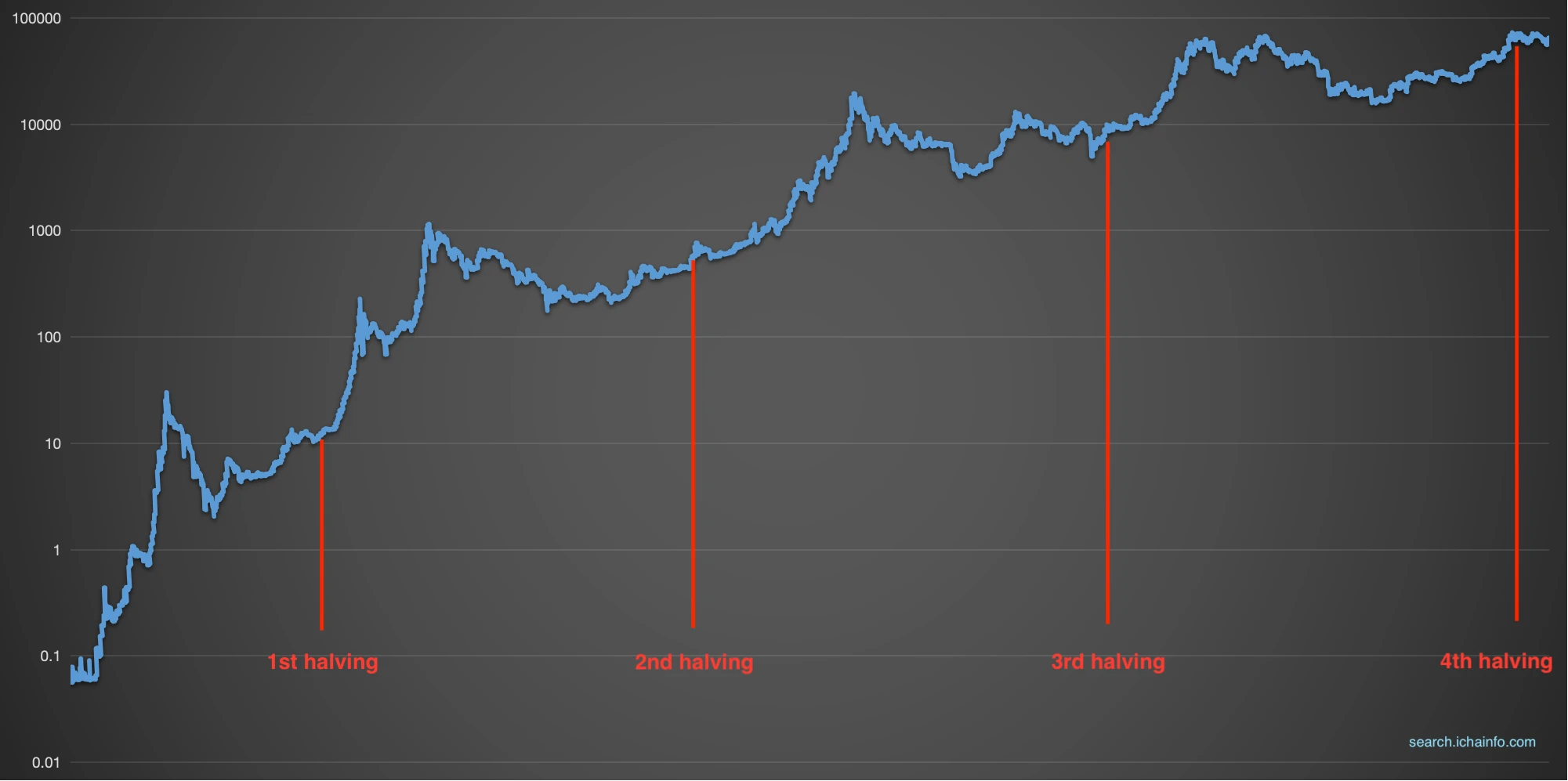

Teng's tweet makes sense, as historical data shows that Bitcoin's price tends to start climbing about six months after a halving event and reaches its peak about a year later.

Figure 2: Bitcoin price logarithmic chart, Source: search.ichainfo.com

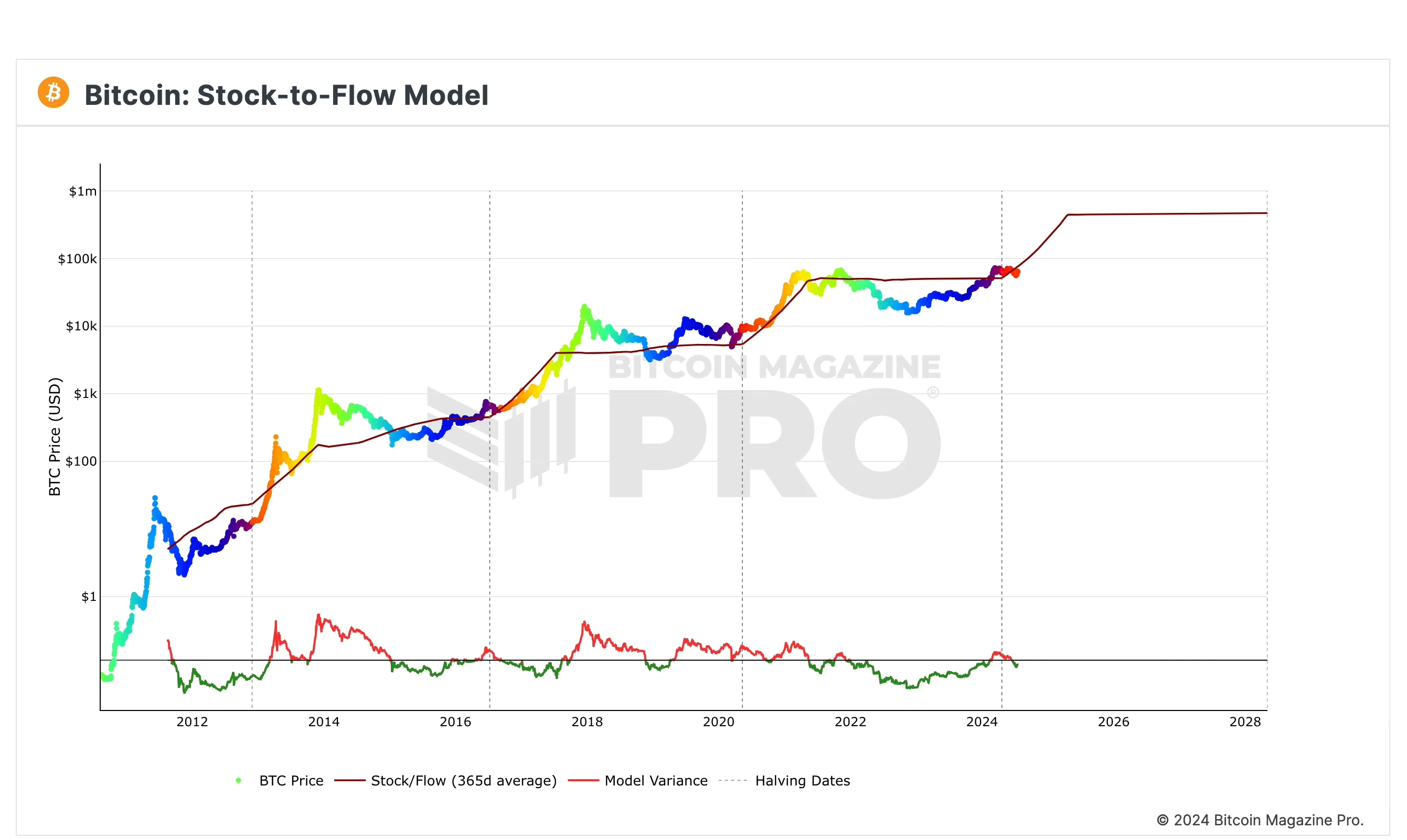

According to the classic Stock-to-Flow model, after each Bitcoin block reward halving, the market goes through a short period of consolidation, accumulating energy for the next phase. Based on this model, Bitcoin is expected to break through in 2025, with the price potentially surpassing $100,000.

Figure 3: Bitcoin Stock-to-Flow model, Source: Bitcoin Magazine

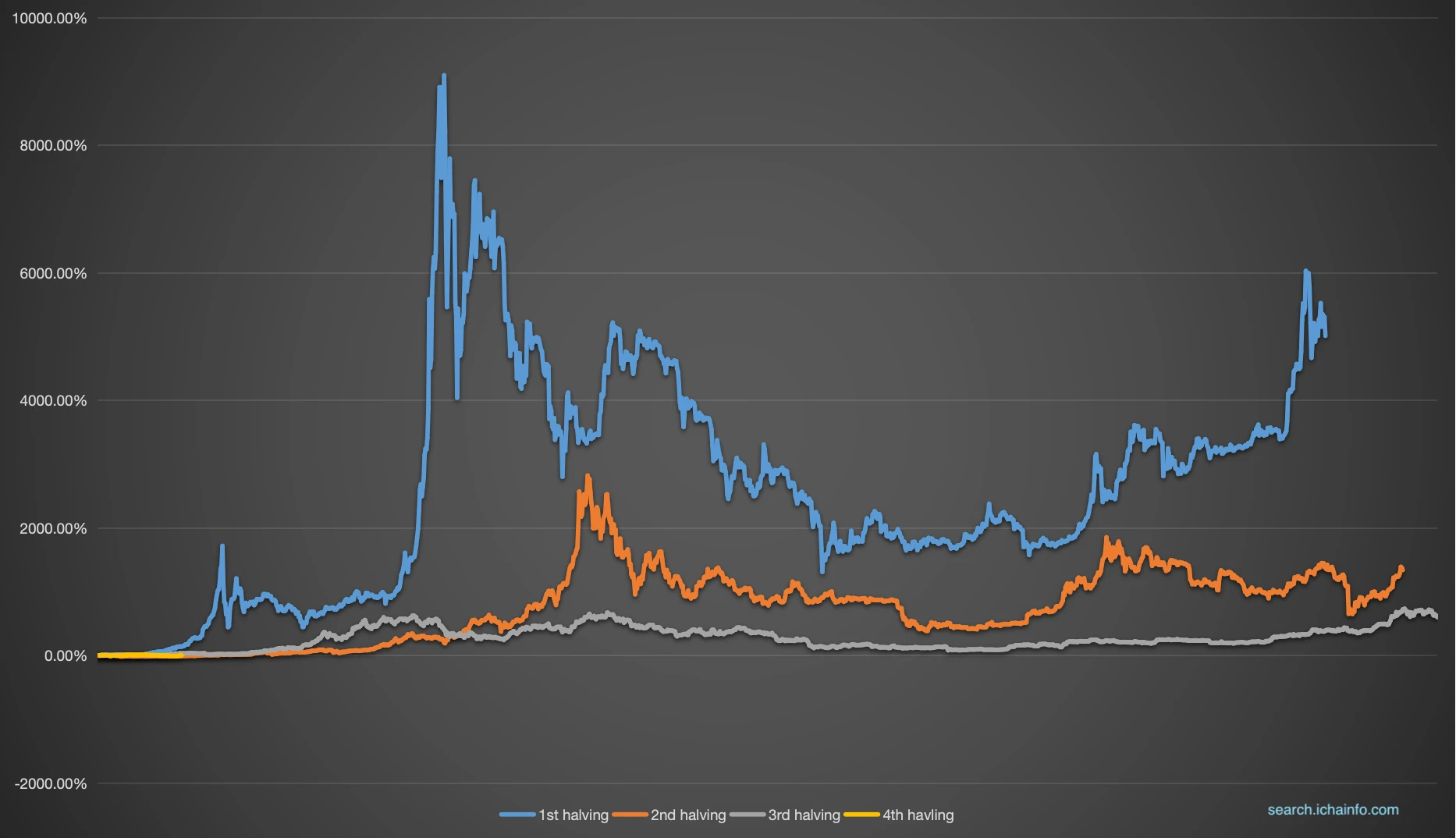

However, it's important to note that while the cryptocurrency market has its own bull and bear cycles, history does not simply repeat itself. Although the overall market trends after each halving cycle show some similarity, there are also differences.

One significant point to consider is that the price increase of Bitcoin in each market cycle tends to be lower compared to the previous one. This suggests that while the bull market may arrive as expected in about six months, the extent of the increase may be difficult to match the levels seen in previous cycles.

Figure 4: Price increase after Bitcoin's halving, Source: search.ichainfo.com

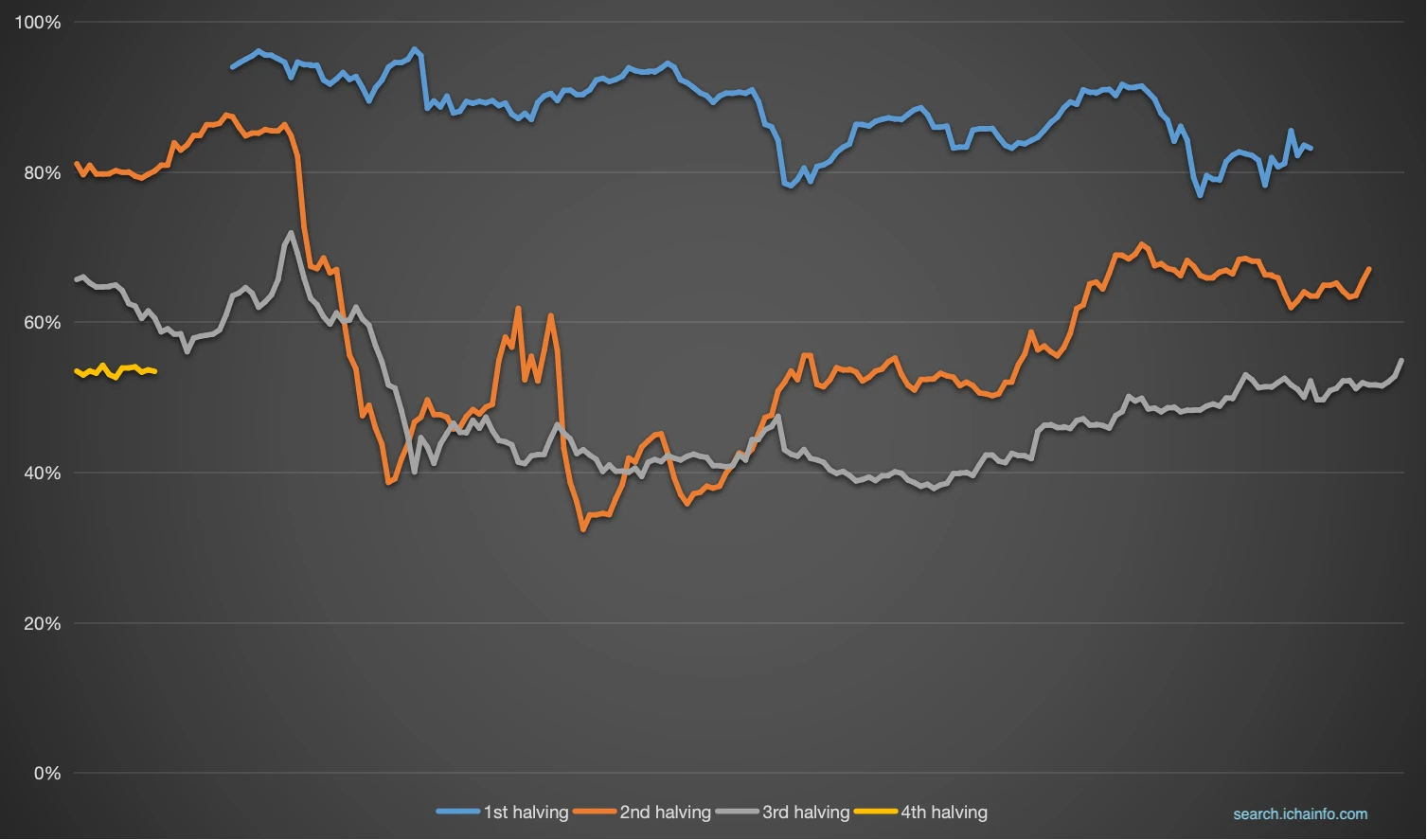

Furthermore, while Bitcoin holds a dominant position in the cryptocurrency market, the bull market is driven by the entire cryptocurrency ecosystem. In this broader context, Bitcoin's market dominance tends to decrease, as seen in the prosperity of DeFi in the last bull market and the prosperity of smart contracts and ICOs in the previous bull market.

Therefore, in the new bull market, the industry will need new driving forces to propel the cryptocurrency market to new heights alongside Bitcoin.

Figure 5: Changes in market dominance after Bitcoin's halving, Source: search.ichainfo.com

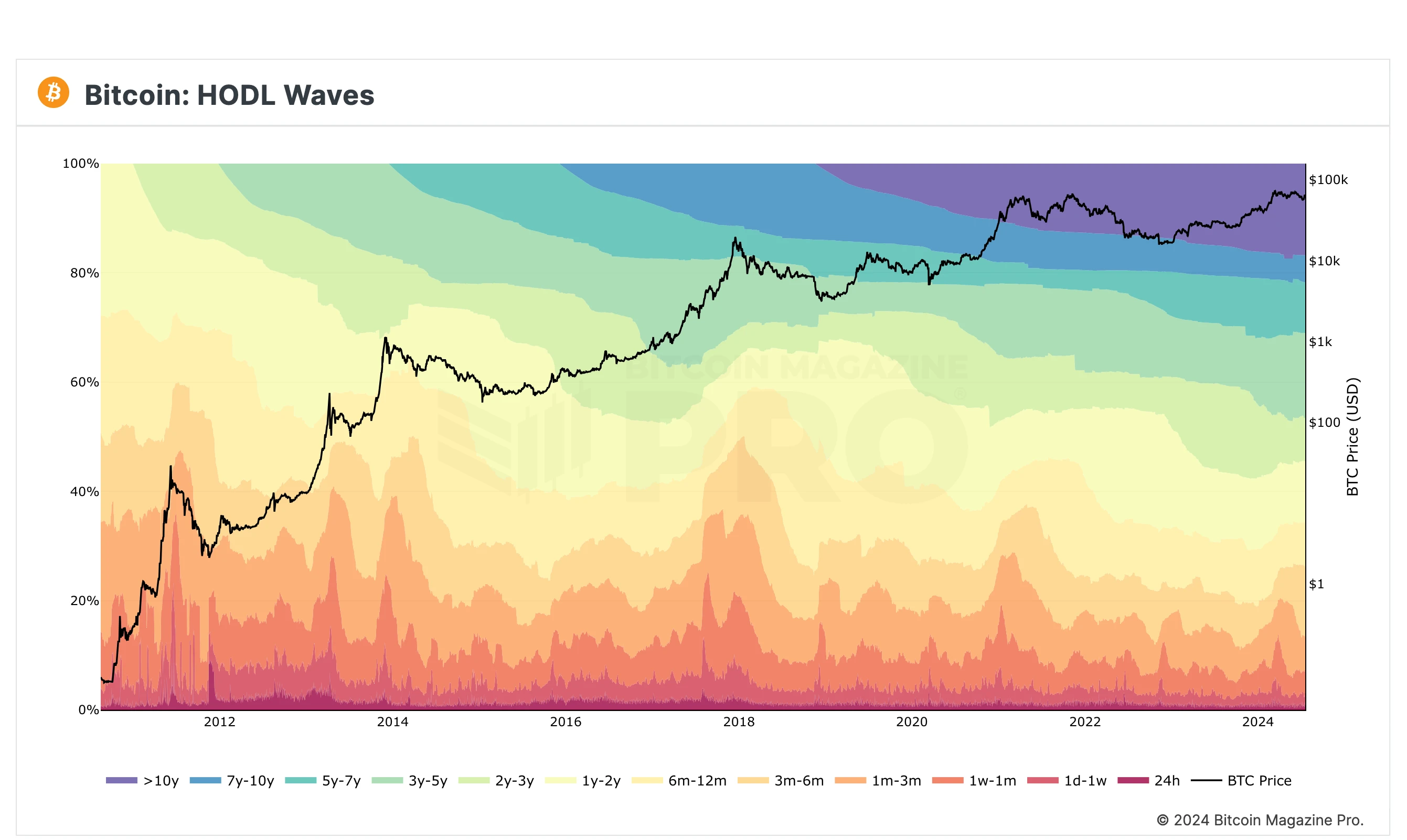

Looking at on-chain data, it's evident that each bull market in history has been accompanied by a shift in Bitcoin ownership from long-term holders to short-term holders, a trend that is becoming increasingly apparent.

Figure 6: Bitcoin HODL Waves, Source: Bitcoin Magazine

All these signs indicate that the cryptocurrency market will see significant development opportunities from the second half of 2024 to 2025. As Richard Teng suggested, it's important to take a longer-term view and evaluate the market's performance from a cyclical perspective.

By Auguste

Source: When Will the Bull Arrive After Bitcoin’s Halving Three Months Ago?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。