Introduction

Prediction and gambling have been an ancient industry that has been prevalent throughout the entire history of human social development. Predicting and betting on future events have fascinated and actively engaged everyone, thus giving rise to the prediction and gambling industry. Since ancient times, this industry has attracted attention due to its lucrative profits and large number of participants, as evidenced by phenomena such as Las Vegas, Macau, and even sports lotteries. Although Web 3 is an emerging industry, many of its sectors overlap significantly with the Web 2 world, so the prediction and gambling industry is bound to exist within it.

As a leading project in the prediction and gambling industry in the Web 3 world, Polymarket has not only been sought after and widely participated in by industry investors, but has also successfully crossed over into the Web 2 society. Due to the necessity of using real money to make predictions on Polymarket, some media outlets even consider Polymarket's prediction results to be more accurate than those of experts. Therefore, many media outlets will cite Polymarket's prediction results, saying, "According to the prediction results on Polymarket…". For example, the US presidential election was the most recent hot topic, and even domestic media such as Sina News would cite Polymarket's support results for Trump and Biden. It is evident that Polymarket's influence has extended beyond the cryptocurrency field and has a very strong impact in the Web 2 world as well.

As a project in the prediction and gambling field, Polymarket has been very successful. It has quickly become an industry leader by increasing the liquidity of various markets through a combination of automated market makers (AMM) and order book mechanisms.

Basic Project Information

Project Team

Shayne Coplan: Founder & CEO. He studied computer science at New York University, dropped out to start a business, and was an early follower of Ethereum. In June 2016, he interned at Chronicled in the San Francisco Bay Area, and in June 2020, he founded Polymarket.

Liam Kovatch: Engineering Lead at Polymarket. He was previously Vice President and CEO of Paradigm Labs, and a software engineer at 0x Labs. He graduated from Columbia University with a degree in engineering.

David Rosenberg: Vice President of Strategic Operations. He was an intern at Silicon Valley Bank, business development manager at Foursquare, and strategic director at Snap Inc. He graduated from the University of Cambridge with a degree in law.

Financing Situation

Polymarket has completed three rounds of financing, with a total amount of $74 million.

Seed Round

In October 2020, Polychain Capital and Naval Ravikant led the investment, with participation from 1confirmation, ParaFi, Coinbase's former CTO Balaji Srinivasan, and Aave founder Stani Kulechov, totaling $4 million.

Series A

In 2023, Polychain Capital and Joe Gebbia invested in this round, totaling $25 million.

Series B

In May 2024, Founders Fund, along with existing investors 1confirmation and ParaFi, led the investment, with participation from Ethereum co-founder Vitalik Buterin, Dragonfly, and Eventbrite co-founder Kevin Hartz, totaling $45 million.

As a Dapp that focuses on a single business, the $74 million financing reflects its strong market appeal.

Development Strength

Polymarket was established in 2020 by founder Shayne Coplan. The development of Polymarket has encountered regulatory obstacles, as shown in the key events of the project's development:

From the key events in Polymarket's development, it can be seen that although it has encountered many obstacles in its development, such as being sanctioned by the US Commodity Futures Trading Commission and facing criticism for betting on sensitive topics, Polymarket has not retreated but actively addressed these issues. It not only successfully dealt with the sanctions from the US Commodity Futures Trading Commission but also demonstrated excellent crisis PR capabilities in the face of public opinion crises. In addition, users did not encounter liquidity issues when betting on Polymarket, fully demonstrating the strong operational and technical capabilities of the Polymarket team.

Operating Model

Polymarket belongs to the prediction market track, but fundamentally falls within the category of decentralized exchanges (DEX), with its trading targets being the "probability of event outcomes."

As an alternative trading target DEX, Polymarket deploys smart contracts on the Layer 2 Polygon chain of Ethereum to provide liquidity to the market through automated market makers (AMM) and order book systems. When users provide liquidity for a particular event, they receive a 2% economic reward for each order amount, and the closer the liquidity provision price is to the final transaction price, the greater the reward.

Polymarket has chosen UMA's Optimistic Oracle (OO), which includes market contracts, CTF adapter contracts, and OO, with all external data accessed by OO to ensure the fairness of prediction results.

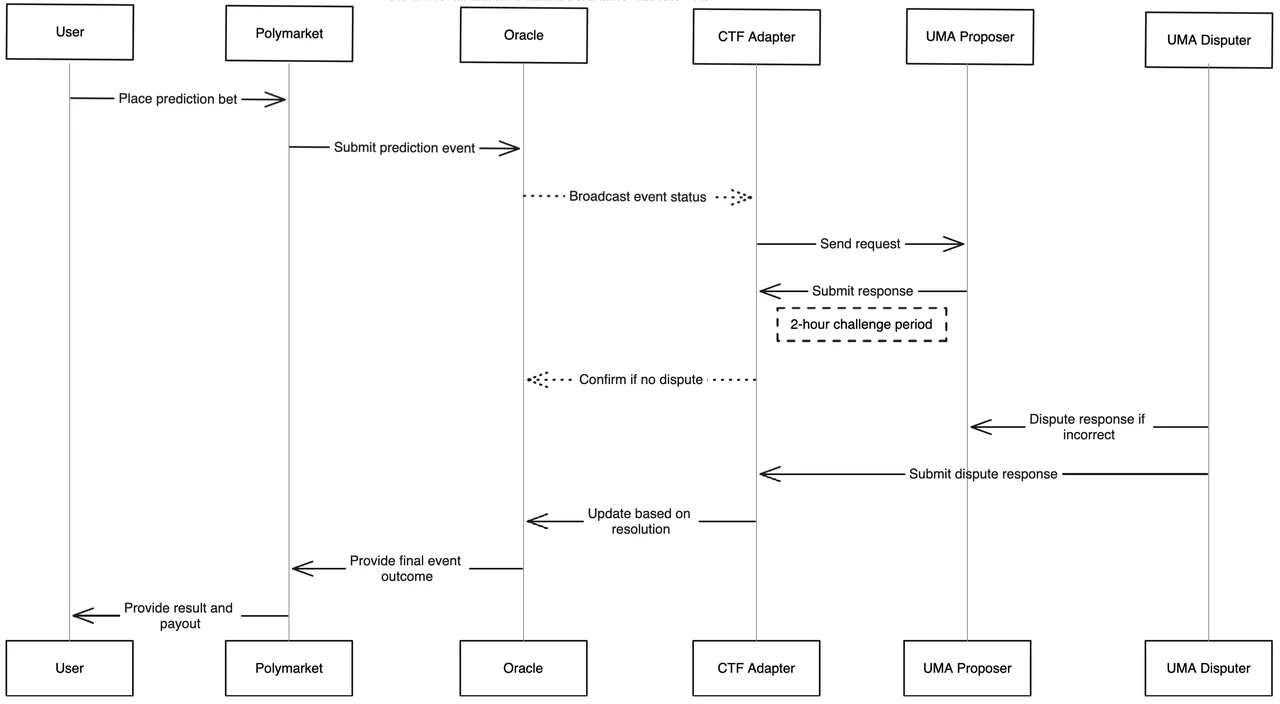

The main prediction category for Polymarket is binary prediction markets, where users can predict whether an event will or will not occur. Users express their predictions by purchasing "yes" or "no" shares. The outcome of the predicted event is accessed in real time by the Optimistic Oracle through external events, and the CTF adapter automatically sends requests to the OO, which can be responded to by proposers in the UMA system. If there is no dispute, this response will be considered correct and submitted to the CTF adapter after a two-hour challenge period. If the answer is incorrect, or if other participants in UMA dispute the answer, other participants can act as challengers to debate the response to ensure the correctness of the external data obtained by the Optimistic Oracle. When the outcome of the event that users bet on is revealed, users who predicted correctly will receive profits, while those who predicted incorrectly will lose their bet amount. The price (odds) represents the probability of the current event occurring, incentivizing users to make accurate predictions. The operating mechanism of the Polymarket protocol is shown in the following figure.

Operating Mechanism of the Polymarket Protocol

In summary, Polymarket participates in the market by providing liquidity to traders through automated market makers (AMM) or order book systems.

Advantages Compared to Competing Projects in the Same Track

As a leading decentralized prediction market project, Polymarket's main competitors include Augur, Gnosis, and Azuro. In comparison, Polymarket has clear advantages in the following aspects:

Broader Range of Assets: Polymarket covers event predictions in multiple areas such as politics, economics, current affairs, sports, and entertainment. It can add more flexible prediction assets based on market demand, such as whether the price of ETH will reach $3600 the next day. This flexibility increases investor participation and enthusiasm, promoting the growth of prediction trading volume.

Higher Acceptance: Polymarket is not only a star project in the crypto community but is also widely accepted in the traditional Web 2 world, with its prediction results often quoted by major media outlets. Because making predictions on Polymarket requires investors to use real money, its predictions are considered more professional and reliable compared to subjective predictions by some experts and KOLs. Even some domestic media outlets quote its prediction results. This indicates that Polymarket has established a presence in the Web 2 world, and its reputation and acceptance serve as important moats that are difficult for other projects to replicate.

In summary, Polymarket significantly outperforms other projects in the same track with a broader range of investment assets and higher market acceptance. It is not only popular in the crypto community but also has a presence in the Web 2 world, giving it an advantage in attracting new users.

Project Model

Dynamic Trading Fee Model

Polymarket's trading fee rates may be adjusted based on market conditions and platform policies. This adjustment can be based on several factors:

Market demand and trading volume: When market demand and trading volume increase, the platform may adjust trading fee rates to optimize revenue and liquidity.

Incentives for liquidity providers: To incentivize liquidity providers (LP) to provide more liquidity, the platform may adjust the fee structure.

Platform operating costs: Polymarket needs to cover its operating costs, including expenses for technology development, maintenance, security, and more. Therefore, the platform may adjust trading fee rates based on changes in operating costs.

To maintain transparency, Polymarket typically announces fee rate adjustments on the platform or in help documentation, and explains the reasons for the adjustments. Users can stay informed about the latest trading fee information through these channels.

Protocol Revenue

Polymarket's protocol revenue = Trading fee revenue - Liquidity reward costs - Other operating expenses. At the current stage, Polymarket has not publicly disclosed its core financial data.

Operational Data

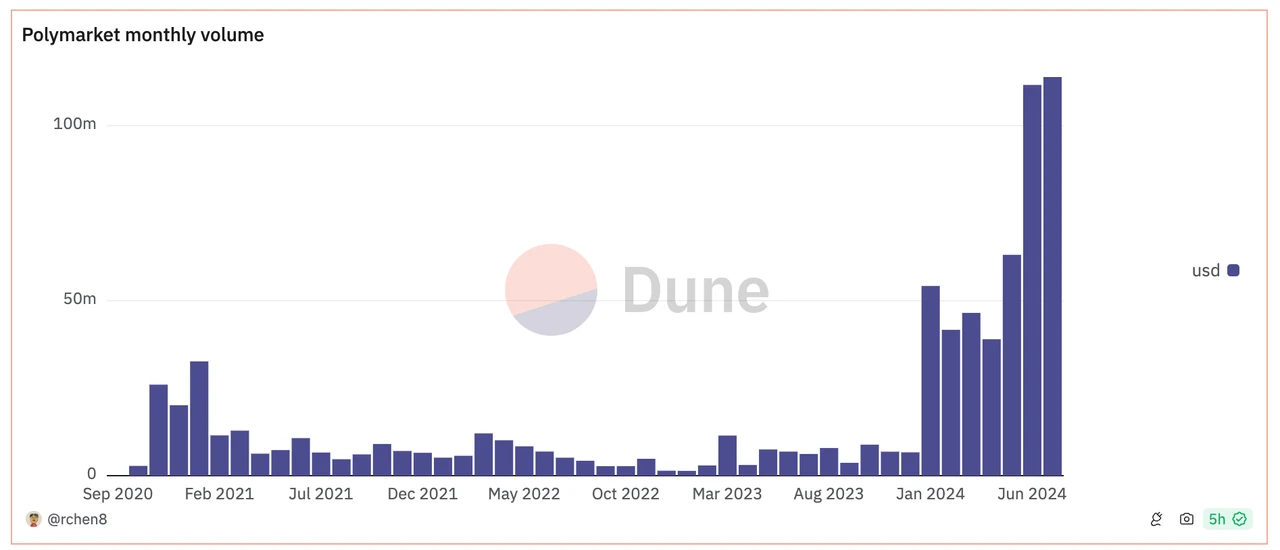

Monthly Trading Volume:

Polymarket Monthly Trading Volume (Source: https://dune.com/rchen8/polymarket)

As shown in the above chart, with the gradual intensification of the US presidential election, Polymarket's trading volume maintained a high growth trend in 2024, entering a phase of rapid development along with continuous market hot events.

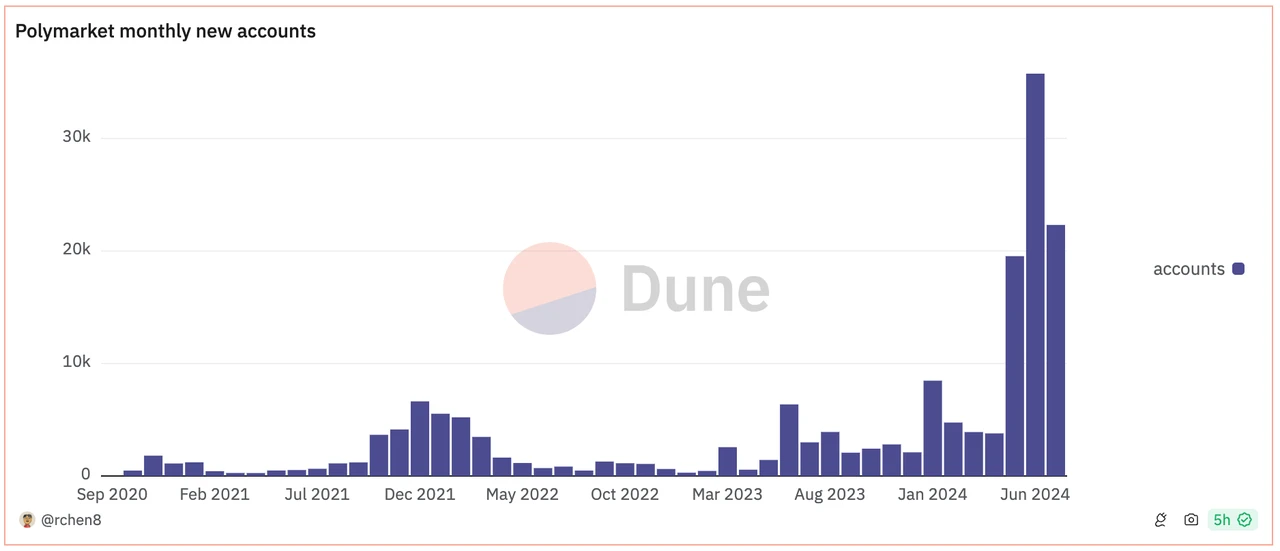

Monthly New Accounts:

Polymarket Monthly New Accounts (Source: https://dune.com/rchen8/polymarket)

Polymarket's monthly new accounts experienced explosive growth after 2024 and have consistently maintained a high growth trend.

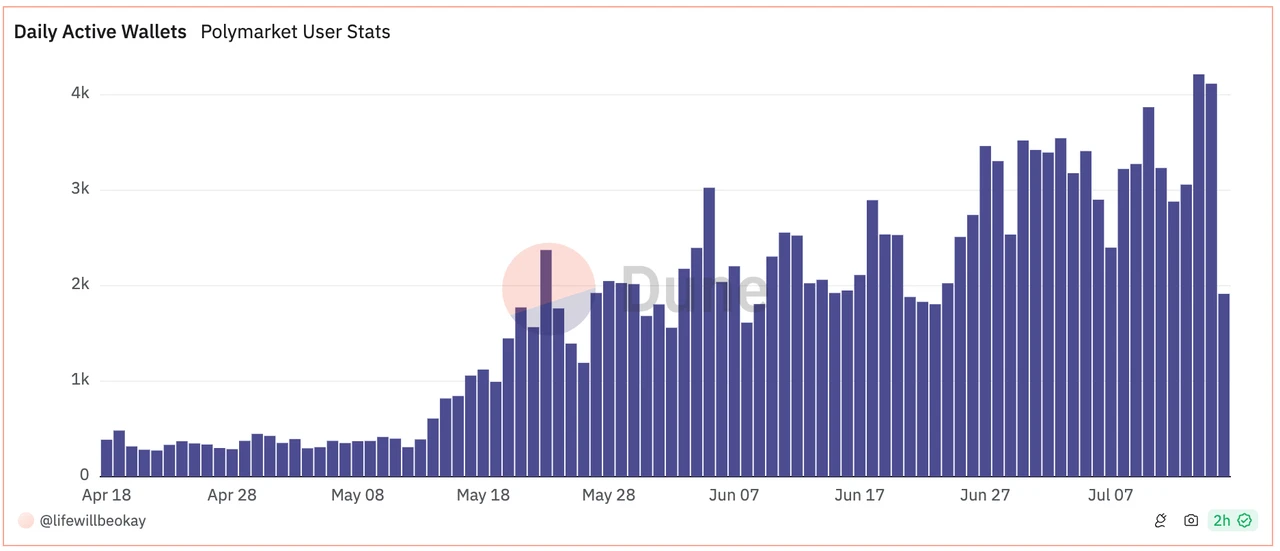

Daily Active Wallets:

Polymarket Daily Active Wallets (Source: https://dune.com/lifewillbeokay/polymarket-clob-stats)

The number of daily active wallets on Polymarket is rapidly increasing, proving the authenticity and reliability of Polymarket's current data growth.

Project Risks

Insufficient Liquidity: Liquidity issues are a key concern for any trading market. Although Polymarket provides some liquidity support through AMM and order book systems, it may still face liquidity issues for emerging markets or unpopular events. This could lead to difficulties for users during trading, affecting the trading experience and potential profits.

Regulatory Risks: Decentralized prediction markets face regulatory uncertainty. Although Polymarket has been striving to comply with relevant regulations and reached a settlement with the US Commodity Futures Trading Commission, it may still face the risk of legal challenges and regulatory changes in the future. As the market develops and innovates, regulatory policies may adjust, bringing uncertainty to the project.

Conclusion

Polymarket is a project based on binary prediction markets, dynamically accessing external event data through UMA's Optimistic Oracle. The platform provides liquidity to the market through automated market makers (AMM) or order book systems, ensuring liquidity for all prediction assets. Compared to other similar projects, Polymarket has a broader range of investment assets and market acceptance, being popular not only in the crypto community but also in the Web 2 world.

Although Polymarket provides some liquidity support through AMM and order book systems, it may still face liquidity issues for emerging markets or unpopular events, which could lead to difficulties for users during trading. Additionally, based on the current legal and regulatory environment, decentralized prediction markets face regulatory uncertainty.

In summary, Polymarket provides an attractive choice for users seeking to make market predictions in an open and transparent environment. They can not only participate in global event predictions but also experience the innovation brought by blockchain and potentially profit. With continuous technological optimization and an expanding user base, the future of Polymarket is full of possibilities, making it the preferred platform for "event trading".

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。