- [Review] -

Haha, can you just say OK?

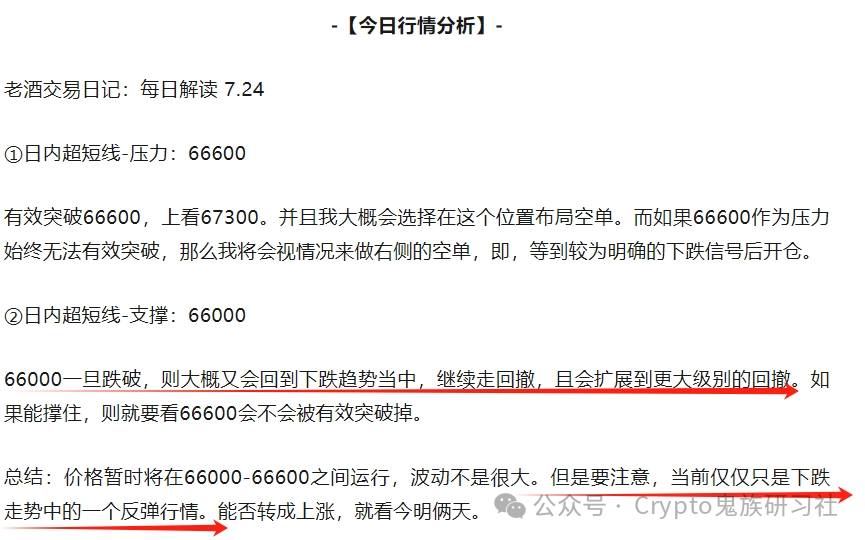

- [Today's Market Analysis] -

Old Liquor Trading Diary: Daily Analysis 7.25

① Intraday ultra-short-term - Resistance: 64400

If it effectively holds above 64400, it will target 65000. However, if it's just a false breakthrough of 64400, it will continue to search for support and then start a genuine rebound.

② Intraday ultra-short-term - Support: 63400

From this moment on, once the newly formed previous low of 63793 is broken, the market will come to the 63400 level and test the support here. If another large bearish candle breaks through, it will target the 62900 level.

Summary: The downtrend is in progress. The rebound is just a rebound.

- [Cryptocurrency News] -

Ethereum Spot ETF Sees $113 Million Outflow on Second Day.

The U.S. Ethereum spot exchange-traded fund (ETF) saw a net outflow of $113.3 million on the second trading day, mainly due to significant losses in the Grayscale Ethereum Trust Fund.

Seven out of eight "newborn" Ethereum spot ETFs saw net inflows on the second day of trading. Fidelity Ethereum Fund (FETH) and Bitwise Ethereum ETF (BITW) were the funds with the most inflows, receiving $74.5 million and $29.6 million, respectively.

BlackRock's iShares Ethereum Trust (ETHA) had the highest inflow on July 23, but only raised $17.4 million from investors on July 24.

The Ethereum ETF experienced a net outflow on the second day of trading.

Due to the recent large sell-off of the converted Grayscale Ethereum Trust Fund (ETHE), the new ETF was affected, with an outflow of $326.9 million.

ETHE, launched by Grayscale in 2017, allows institutional investors to purchase ETH. However, it imposes a six-month lock-up period on all investments. On July 22, after ETHE was converted to a spot ETH fund, investors could sell their ETH more easily.

Within two days after the conversion, ETHE's outflow reached $811 million, meaning that existing ETHE investors have sold just over 9% of the fund's shares.

The recent performance of Ethereum ETFs is not unprecedented.

At the time of writing, the price of ETH is $3,172, down more than 6.8% in the past 24 hours and 7.4% for the week.

It is worth noting that the drop in ETH is much greater than that of Bitcoin, which has only fallen by 2.6%. After the launch of ETH's ETF, the price of ETH may be extremely "sensitive" to fund inflows.

Grayscale's ETHE evaporated $484.4 million on the first day of listing as a spot Ethereum ETF. However, the strong inflows of the other eight products pushed the cumulative net inflow to $106.6 million.

Personal opinion, for reference only

Official Account ↓↓↓

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。