Author: Xiao Sa, Lawyer

In July 2024, the Hong Kong Treasury Department released the "Legislative Proposals for the Implementation of the Regulatory Regime for Stablecoin Issuers in Hong Kong - Summary of Consultation", which clearly stated the importance of stablecoins anchored to fiat currency in the Web3 and cryptocurrency industry ecosystem and released a sandbox list (our e-commerce old friend, Pionex, is listed, indeed doing big things quietly). It can be seen that the Hong Kong government not only recognizes the risks of cryptocurrency assets but also realizes the symbiotic relationship between them and the traditional financial system and capital markets, mutually promoting each other.

Today, the Sa team will explain in this article the current regulatory measures for stablecoins in Hong Kong and help partners understand how to get on the financial fast track of Hong Kong stablecoins in the right way.

01 Detailed explanation of the regulatory measures proposed for stablecoins in Hong Kong

According to the definition of the Hong Kong Monetary Authority (HKMA), a stablecoin is a virtual asset designed to maintain a relatively stable value with certain assets (usually currency). As the interconnectivity between the traditional financial system and the virtual asset market continues to strengthen, the HKMA is developing a regulatory regime for stablecoin issuers in Hong Kong.

1 Regulation of Stablecoin Issuers

Currently, Hong Kong has not yet legislated for the regulation of stablecoins, but the legislative approach in the future is likely to be broadly consistent with the previous consultation document. We refer to the "Legislative Proposals for the Implementation of the Regulatory Regime for Stablecoin Issuers" released by the Financial Services and the Treasury Bureau (FSTB) and the HKMA in December 2023 to briefly interpret the regulatory measures proposed for stablecoin issuers in Hong Kong and the conditions for applying to become a stablecoin issuer.

1. Licensed Regulation

Hong Kong's regulatory measures for stablecoin issuance follow the licensing model of traditional financial institutions: all qualified fiat stablecoin issuers must obtain a license issued by the Financial Commissioner. In other words, only licensed institutions can issue stablecoins. In addition, according to the consultation document, there may be two types of licenses for issuing stablecoins in Hong Kong (or one type of license with differences in the scope of permission, commonly known as "big and small licenses"). The consultation document clearly states: (1) only licensed institutions can provide services for the purchase of fiat stablecoins to the public; (2) only fiat stablecoins issued by licensed stablecoin issuers can be sold to ordinary investors. In the future, some "coin dealers" may only have administrative licenses for "selling" fiat stablecoins.

Furthermore, the consultation document also specifies that an appropriate "transition period" will be provided to allow existing stablecoin issuers and coin dealers to adapt to the new regulatory requirements. Referring to the Securities and Futures Commission of Hong Kong's "Circular on Transition Arrangements for VATP License Manual and Licensing System" for cryptocurrency platforms last year, we expect that the transition period for stablecoin issuers and coin dealers will be approximately 12 months. Note that stablecoin issuers and coin dealers who are likely to enjoy the transition period probably need to meet the condition of "operating genuine business and having genuine business premises", in accordance with the considerations of "genuine business" and "genuine business premises" in the VATP transition arrangements. Factors include: whether there is a legal entity in Hong Kong; whether there is an office in Hong Kong; whether the entity is managed and controlled by Hong Kong employees; whether key personnel are resident in Hong Kong; whether there are independent clients and genuine trading volume in Hong Kong, etc.

2. Requirements for Applying for a Stablecoin Issuer License

First, we need to clarify that the Hong Kong government does not have strict requirements for entities that can apply for a license. Basically, "all qualified entities can apply for a license", but whether a license can be obtained depends on the specific business and compliance of the platform. In short, in this emerging industry of cryptocurrency assets, the Hong Kong government values not "who you are" but "what you want to do".

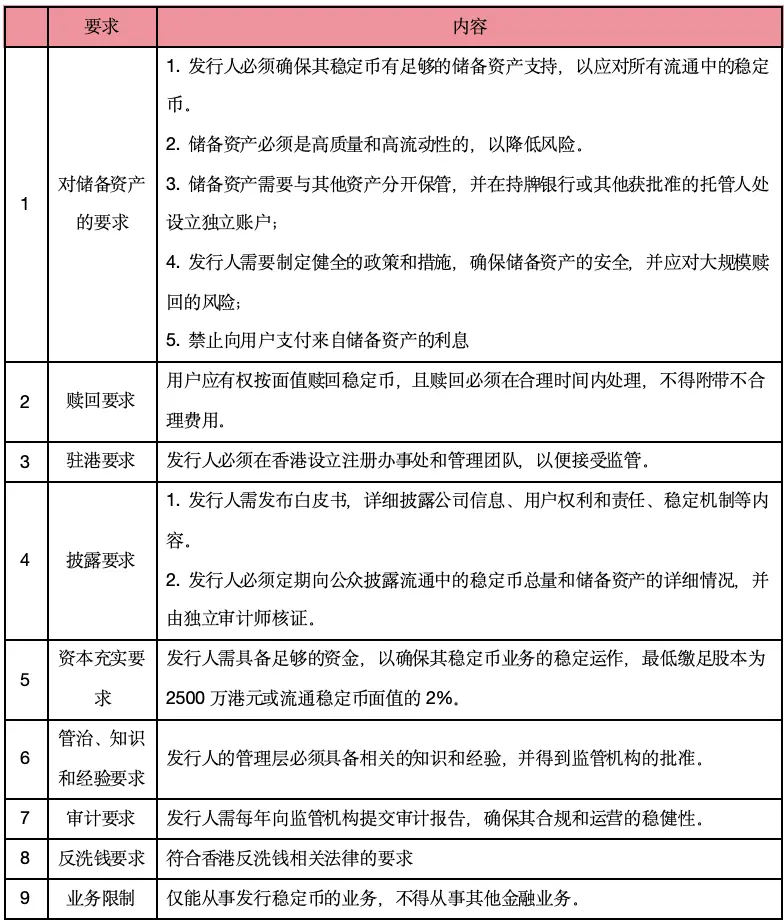

According to the consultation document, the Hong Kong government has the following compliance requirements for entities issuing stablecoins:

3. Other Matters

The consultation document specifies that the stablecoin issuance license is a continuously valid license, in other words, once issued, the license will remain valid unless revoked. In terms of business expansion, the current consultation document believes that from the perspective of risk control, licensed stablecoin issuers can provide stablecoin purchase services in Hong Kong and do not emphasize the need to sell to professional investors, which means that stablecoins issued by licensed institutions are likely to be sold to the general public to a large extent.

02 How to play in the stablecoin sandbox?

On March 12, 2024, the Hong Kong Monetary Authority released the "Hong Kong Stablecoin Sandbox Arrangement", officially launching the regulatory sandbox system for stablecoins in Hong Kong. According to the HKMA, the purpose of setting up the "sandbox" is to test the business processes of stablecoin issuers and evaluate how they can conduct stablecoin business in Hong Kong in a compliant and sustainable manner. Therefore, applicants entering the "sandbox" need to demonstrate detailed and feasible business and sandbox plans.

1 How to apply to join the stablecoin sandbox?

Currently, there is only one application channel (quite old school): express the intention to join the stablecoin regulatory sandbox to the HKMA through the official email stablecoin_sandbox@hkma.gov.hk and wait for the HKMA's contact. The time for the HKMA to process the application is uncertain and depends on the complexity of the applicant's business model, whether the data provided by the applicant is sufficient and of good quality, and the speed and thoroughness of the applicant's response to the HKMA's subsequent questions and requests.

Currently, the main factors considered in the evaluation of applications are as follows:

Whether the applicant can demonstrate a genuine intention and a reasonable plan to issue fiat stablecoins in Hong Kong.

Whether the applicant can demonstrate a specific plan to participate in the "sandbox".

Whether the applicant can provide reasonable expectations that comply with the proposed regulatory requirements.

2 Entities already in the stablecoin regulatory sandbox

Currently, according to the HKMA's information, three separate or joint entities have successfully joined the stablecoin sandbox, including the very familiar e-commerce giant from mainland China, as well as two other equally powerful entities.

According to the information obtained by the Sa team, the e-commerce giant has already put on the agenda the plan to issue a cryptocurrency stablecoin pegged to the Hong Kong dollar at a 1:1 ratio, tentatively named "E-commerce Giant Stablecoin". Technically, this is a cryptocurrency issued based on a public chain, with a price pegged to the Hong Kong dollar (HKD) at a 1:1 ratio. The underlying assets have not been disclosed, but according to the e-commerce giant's coin chain technology company, the underlying assets consist of highly liquid and credible assets, securely held in independent accounts of licensed financial institutions, and the integrity of the reserves is rigorously verified through regular disclosure and audit reports. Upon inquiry, the issuer, the e-commerce giant's coin chain technology company, has obtained licenses No. 1 (securities trading), No. 4 (advising on securities), and No. 9 (asset management) issued by the Securities and Futures Commission of Hong Kong.

3 Being in the sandbox does not mean being licensed

It is important to note that entering the sandbox does not mean that the entity has obtained a license to issue cryptocurrency stablecoins. Taking the e-commerce giant as an example, if the results of the sandbox testing for the issuance of stablecoins by the e-commerce giant are good (high stability, good compliance, and able to create a large amount of economic value) after the stablecoin issuance regime is perfected, the e-commerce giant still needs to apply for a license from the regulatory authority, but can directly use the results of the sandbox testing as the basis for applying for a licensed institution, greatly increasing the probability of obtaining the license. From this perspective, entering the sandbox is equivalent to taking the lead in the wave of stablecoins in Hong Kong.

Final Thoughts

Partners familiar with the Hong Kong financial system should know that since 1983, the Hong Kong Monetary Authority has stipulated the "linked exchange rate system" between the Hong Kong dollar and the US dollar. The right to issue currency has been delegated to three note-issuing banks: HSBC, Bank of China, and Standard Chartered. Each time the note-issuing banks issue HK$7.8 banknotes, they must submit 1 US dollar to the HKMA and obtain a certificate of indebtedness before they can start printing money. When the note-issuing banks need to withdraw banknotes, they must present the certificate of indebtedness to the HKMA to exchange for US dollars, and then exchange them back to Hong Kong dollars from the market. However, although the three banks have the right to issue currency, they do not have the "coinage right". The three banks only provide the designed banknote style and the quantity of currency to the Hong Kong Note Printing Company, which then issues the currency uniformly. This is why, except for the HK$10 banknote, all other Hong Kong banknotes are printed with the words "Payable on demand" which means that the Hong Kong banknotes issued by the note-issuing banks are essentially "exchange vouchers".

At this point, many partners should realize that the traditional financial system in Hong Kong actually has several similarities with the issuance logic of stablecoins, and it is not impossible to consider stablecoins as a kind of fiat currency "exchange voucher". Therefore, the Sa team believes that Hong Kong has a natural advantage in the regulation of stablecoins, which also means that there is less resistance to the issuance of fiat currency stablecoins in Hong Kong. From a historical perspective, obtaining a license to issue fiat currency stablecoins is likely to mean sustained prosperity for any entity for the next century.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。