Author: THE DEFI INVESTOR

Translation: TechFlow

Many people have recently lost confidence in the continued bull market cycle.

Considering that many top altcoins have dropped by over 60% in the past few months, their disappointment is understandable. It is indeed not easy to survive in such a market downturn.

However, there are many signs indicating that this cycle is not over yet.

Of course, nothing is certain in the financial markets. But I do believe that the risk/reward for being bullish at this time is very attractive.

In this issue, I will explain why I expect an altcoin season later this year and the strategies I am currently adopting to maximize my profits in the next rapid upward phase.

Let's delve into it.

There are many reasons, but in short, the main reasons are as follows:

- The stock market is at an all-time high

- The Federal Reserve is expected to cut interest rates later this year

- The total stablecoin supply continues to increase

- Major U.S. presidential candidates now support cryptocurrencies

- Traditional financial institutions (such as BlackRock) are starting to pay attention to cryptocurrencies

- Approximately $16 billion in cash will be distributed to FTX creditors in the coming months—many of whom may reinvest this money in the market

The third quarter has historically been the worst-performing quarter for cryptocurrencies, which may explain the recent decline.

Source: CoinGlass

However, I am very much looking forward to the fourth quarter.

With the U.S. presidential election, Federal Reserve interest rate cuts, and FTX cash redemption plan taking place in the fourth quarter, I find it hard to imagine that BTC has already peaked.

So far in this cycle, BTC dominance has been on the rise. The altcoin season usually begins when this trend reverses, and I believe this may happen in the fourth quarter.

Betting on the Right Projects

Now that I have shared my bullish views, I also want to talk about my strategy for identifying tokens that may perform well in the next market phase.

A good way to become a better investor is to study the past of the market.

For example, I believe that the best way to capture the potential of tokens that have seen 10x growth is to first analyze the commonalities of tokens that have achieved over 10x growth.

In the last bull market, the returns of these 5 tokens exceeded 100x:

- SOL - Solana's token, the most popular non-EVM blockchain.

- LUNA - Terra Luna's token, the project behind the algorithmic stablecoin experiment that ultimately failed.

- MATIC - Polygon's token, one of the most popular Ethereum L2 projects.

- SPELL - Abracadabra.money's token, a DeFi lending platform that enables high-yield degen strategies.

- FTM - Fantom's token, one of the fastest-growing ecosystems in 2021.

I believe their tremendous success can be attributed to several key factors:

- Key Figures - Do Kwon is the key figure of LUNA. Andre Cronje is the key figure of FTM. Daniele Sesta is the key figure of SPELL.

These three individuals are charismatic and have successfully built a strong community around their projects. A founder with strong media influence and an outstanding personality can significantly promote the success of their project.

Ordinary investors like to invest in projects with strong key figures.

Most projects with key figures do not perform well in the long term, but by betting on these projects before the end of the bull market, you can earn a lot of money.

- Innovative Products

We don't need new Uniswap forks.

Your best chance is to bet on projects that continuously push boundaries rather than just copying competitors' innovative projects.

This does not mean they have to build something completely new.

But ideally, you want to bet on a project that builds a product 10 times better than its competitors and releases it faster.

One good example I can think of is Pendle.

Pendle is the first yield trading protocol to enable trading drop points, benefiting greatly from this first implementation.

Moreover, its team continues to announce integrations with popular protocols, which helps Pendle maintain its position as the leading yield trading protocol.

- Collaboration with web2 and/or web3 giants

Ordinary investors like to see their projects announce collaborations with other major web3 projects or highly popular web2 companies.

Polygon, Solana, and Terra Luna have attracted a lot of attention by doing so.

Collaboration announcements can trigger significant token price increases during the bull market.

- Reasonable token utility and low token supply

SOL, MATIC, FTM, and LUNA are used to pay gas fees and secure blockchain networks, while SPELL has a revenue-sharing model.

Simple governance tokens like UNI also performed well in the first half of the 2021 bull market.

However, I believe that most of the outperformers in this cycle will not only be simple governance tokens, but will also have some additional utility.

Some potential token use case examples:

- Fee discounts

- Revenue sharing

- Paying network fees

- Buyback and burn mechanisms

- Providing rewards to protocol users

- Access to exclusive products (e.g., access to web3 launch platforms)

Memecoins are obviously an exception, as they can perform very well even without any utility. But apart from memecoins, I generally avoid buying coins without utility.

Unlock schedules are also important. You don't want to buy a token with a circulating supply that will increase by over 300% in the next 365 days.

Significant token unlocks can significantly impact the token price, and this has happened many times this year. You can use tools like Token Unlocks to monitor upcoming unlocks and unlock schedules for over 100 tokens.

It's a good thing if a large proportion of the total token supply is already in circulation.

- Upcoming significant catalysts

Some examples of catalysts that may have a positive impact on token prices:

- A major protocol upgrade

- Tokenomics upgrade

- Listing on a major CEX

- Release of new products

- Fundraising announcements

- Major partnership announcements

Catalysts can significantly boost token price performance, which is why I usually only invest in projects with significant catalysts in the near future.

I always ask myself one question:

Why would someone buy the same token at a higher price as me?

If I can't find at least one good reason, I no longer buy that token. High-conviction bets are the ones that truly make you rich.

My plan for this cycle is to hold up to 10 tokens that meet the above criteria. Over-diversification is not worth it if you know what you're doing.

Airdrops: Are They Still Worth It?

Many people have recently been disappointed with some speculative airdrops.

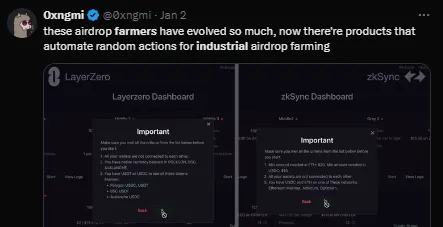

LayerZero is a recent example. As airdrop farming has become increasingly popular over the past few years, many airdrop opportunities are now highly diluted, especially due to the emergence of airdrop bots.

Therefore, most airdrops now have linear distribution and are no longer based on ranking systems (such as Jito) to avoid rewarding industrial farmers.

Is linear distribution of airdrops a bad thing?

The issue is that whales are the ones who benefit the most from linear distribution airdrops, which is not good for low-capital users.

Turning $1,000 into $50,000 through airdrop farming is now almost impossible. But I believe that by farming the right airdrops, you can still make some good money.

The main criteria I look for in a no-token protocol are as follows:

- Strong community - The more active the project community is on X, the higher the valuation of its token may be

- Fundraising from venture capitalists - The more funds the team raises, the higher the valuation of the protocol token at launch

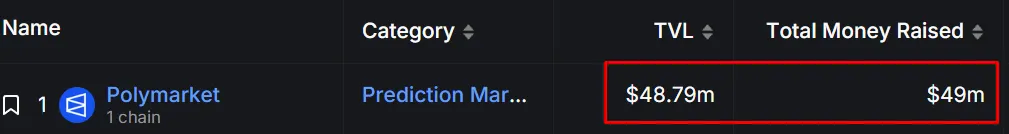

- Lower TVL/total fundraising ratio compared to other no-token projects - The lower the ratio, the better, as a high ratio may indicate over-farming of a particular airdrop opportunity

- Polymarket is a good example of a protocol with an excellent TVL/total fundraising ratio.

Ideally, airdrops should be farmed for protocols that are used because people genuinely find them useful, rather than protocols used solely for the purpose of airdrops.

What about taking profits?

Every bull market creates a new generation of millionaires.

However, data shows that over 90% of people eventually give back most of their profits to the market due to greed. That's why you need a realistic exit plan.

For long-term holdings, I mainly take profits based on fundamental trigger points.

Whenever I start to see multiple signals that indicated a top in the previous cycle, I start using a dollar-cost averaging strategy to sell.

Dollar-cost averaging strategy is the reverse of dollar-cost averaging—it involves selling the same amount of tokens at regular intervals.

Some good top signals I watch for:

- Jim Cramer constantly promoting cryptocurrencies

- Coinbase becoming the top app on the App Store

- Your friends and family starting to talk about cryptocurrencies

- Several celebrities launching their own coins

- People flaunting Rolex watches and expensive cars on your X timeline

- Useless projects raising tens of millions of dollars

- Financial YouTubers starting to talk frequently about cryptocurrencies

- Surging Google search traffic for "crypto" reaching new highs

- Ponzi farms offering five-figure APY rewards attracting billions of dollars in TVL

The only top signal we've seen in this cycle is celebrities launching memecoins. This makes me feel like we're still in the early stages.

Taking profits when BTC or your altcoins reach certain price levels can also be an effective strategy. But in my opinion, identifying the right price levels to sell at is much more difficult.

Conclusion

I always try to stay realistic, so here are my thoughts:

Success in this bull market may be harder to come by than in previous cycles. One reason is the proliferation of cryptocurrency tokens.

Source: Miles Deutscher

Finding good investments is becoming increasingly complex.

Furthermore, the price discovery for many new high FDV tokens now happens in the private VC market. Due to the overvaluation of most new tokens at launch, it's difficult for ordinary investors to find tokens that can 20x or 50x.

This doesn't mean there are no more opportunities in cryptocurrency.

But you have to put in more effort and time to identify them. If you're willing to do so, chances are you won't regret it.

That's all for now, thanks for reading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。