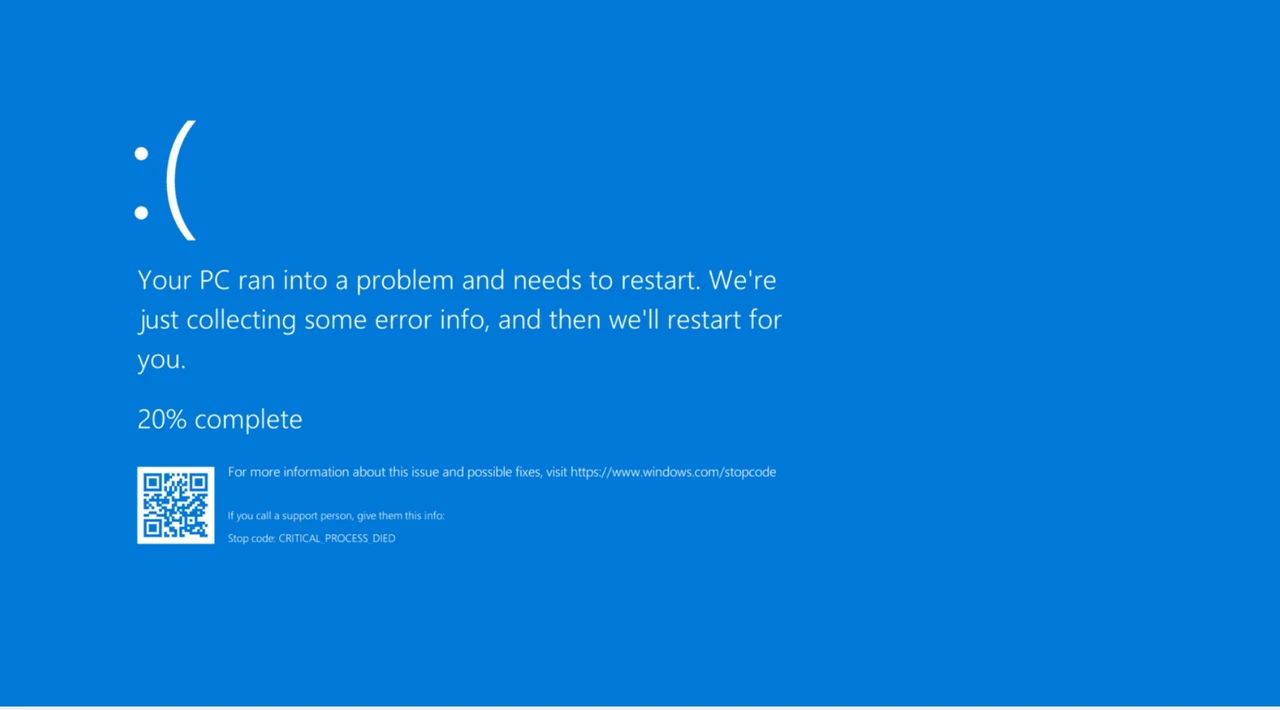

The failure of a Cloudstrike update has caused serious damage to global systems, leading to crashes in enterprise logins, banking systems, flights, and countless other systems that rely on Windows. The tech industry once again realizes the danger of over-centralization and reliance on a single node.

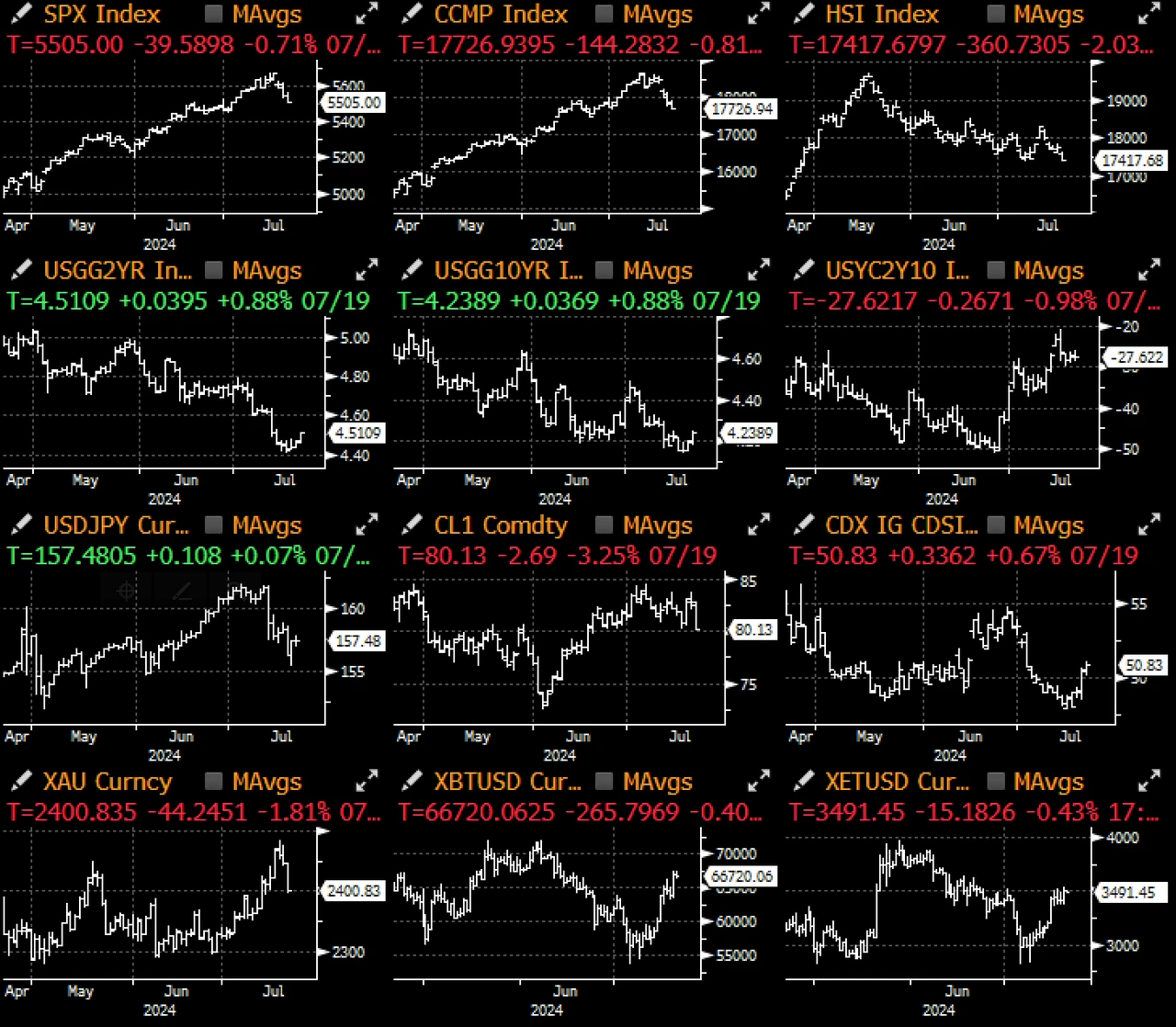

Even though it was later confirmed that this was not the feared cyber attack, the stock market still performed poorly, with the Nasdaq index falling by 1% on the day, and Cloudstrike opening down by 15%. Just before the latest turmoil in the US election, the stock market had just reached a new historical high and then fell into trouble.

As IT likes to say, "Have you tried rebooting?" - a fresh start seems to be a panacea for all ills (including the democratic process). Although the timing is quite sudden, President Biden has finally withdrawn from the race, and Vice President Harris is taking over. However, former President Obama and other party members have not clearly supported Harris, and may be more inclined to decide through the Democratic National Convention next month, adding more uncertainty to an already crazy election.

Although the stock market is generally optimistic about Trump's second term, chip stocks have started to decline along with long-term US bonds (due to debt-supported stimulus plans). In an interview with Bloomberg, Trump expressed strong dissatisfaction with the Taiwan issue:

"They [Taiwan] have taken away all of our chip business, they are very wealthy, the United States is like an insurance company, why should we do this?" -- Trump

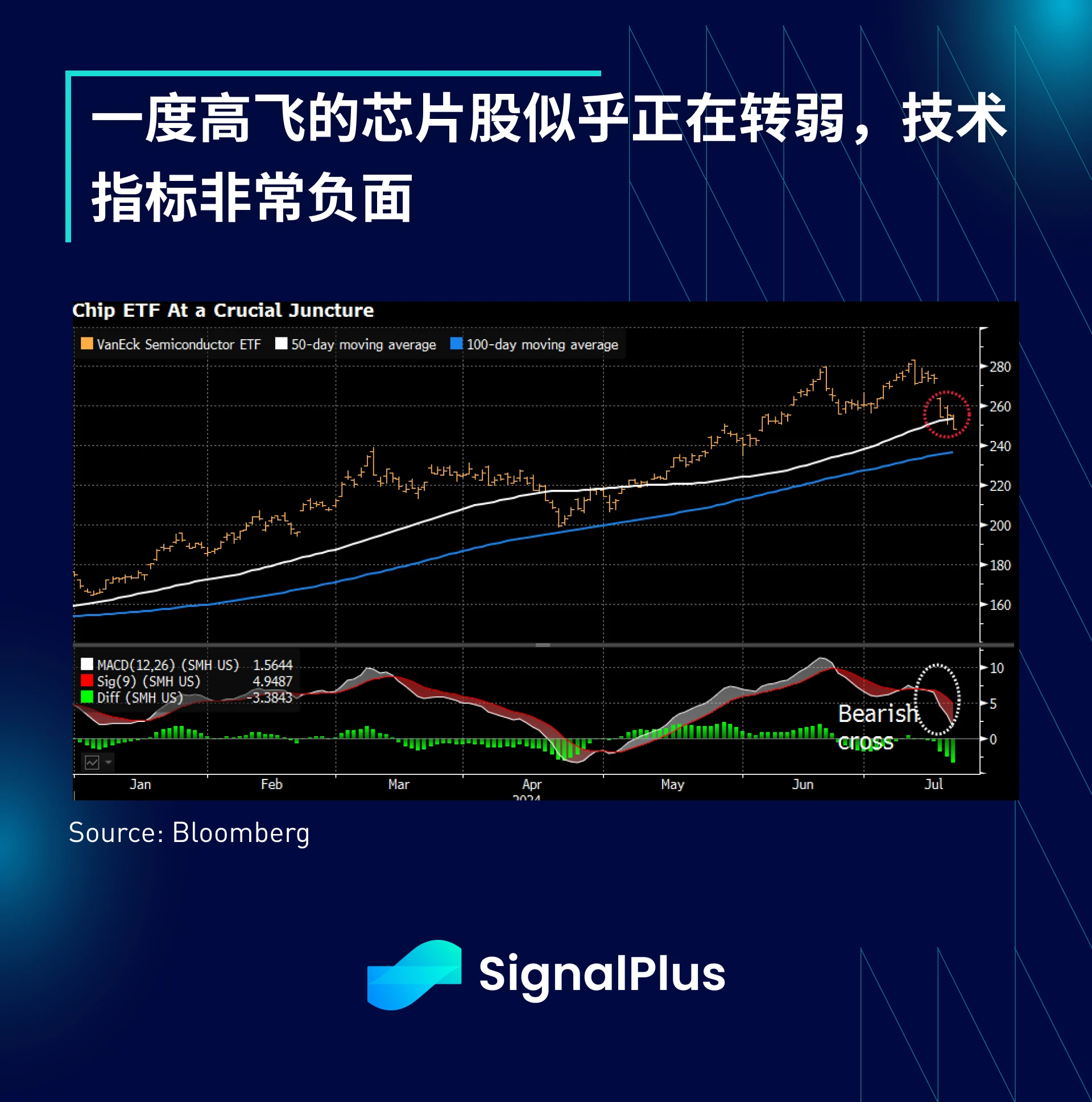

To make matters worse, even the Democratic Party is considering whether to impose stricter chip sanctions on China. As a result, TSMC fell by about 4% after the news, and the semiconductor sector fell by about 7% last week, breaking below the 50-day moving average, with the short-term stochastic indicator entering the bearish zone.

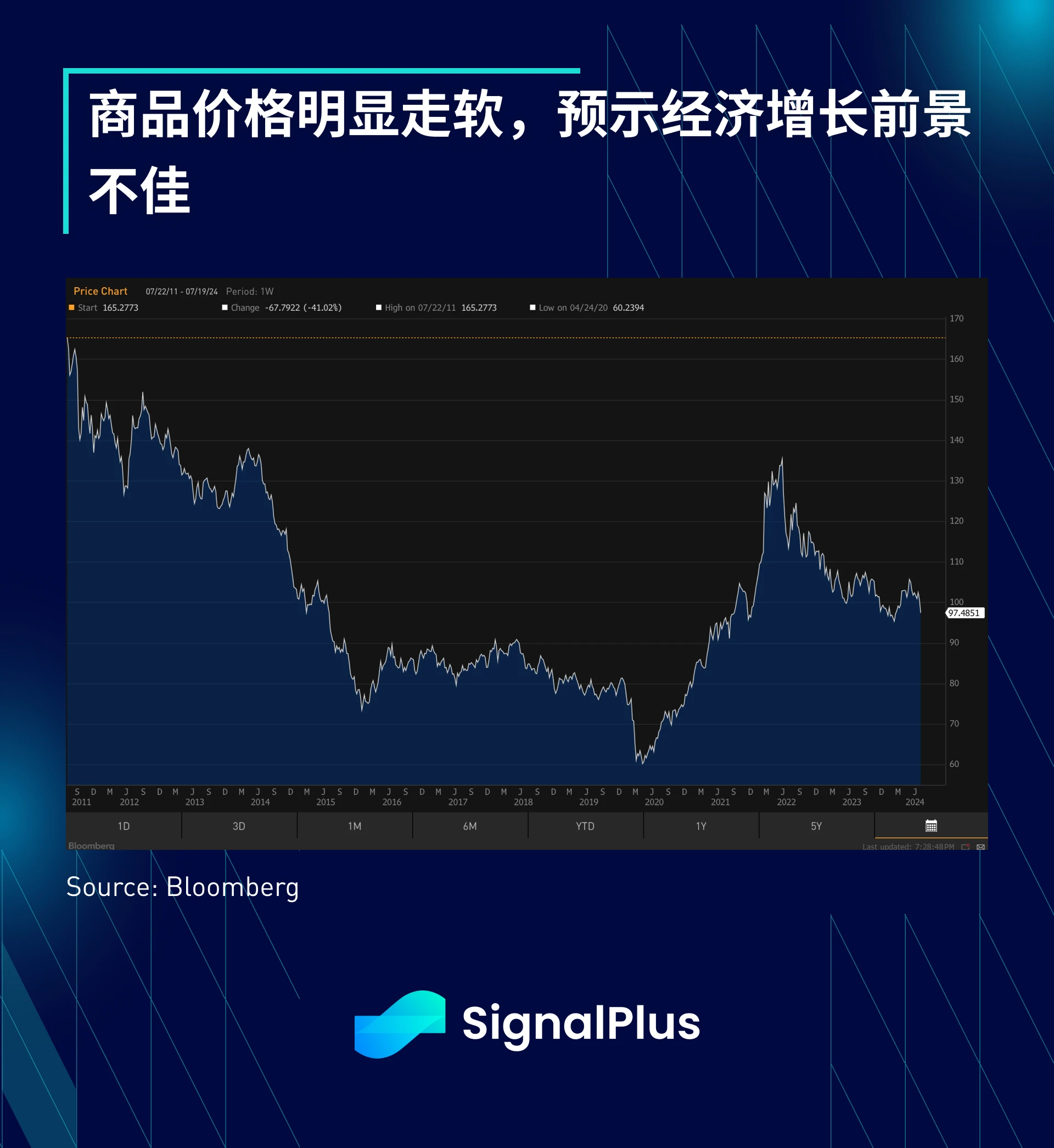

The US market's response to the news from this past weekend remains to be seen, but last Friday was undoubtedly a major sell-off day, with all major asset classes except BTC falling. With the fading optimism about global economic growth, stocks, bonds, gold, and oil all suffered losses, and the commodity index closed at its lowest point since March.

According to Bloomberg's data, in the past 40 years, only 4% of trading days have seen simultaneous sell-offs of major US stock indices, oil, gold, and US bonds, and only 0.5% of trading days have seen this happen twice in a row. The occurrence of three consecutive days of this situation is almost non-existent (0.03%), and it has only occurred in the past during the hawkish Fed period.

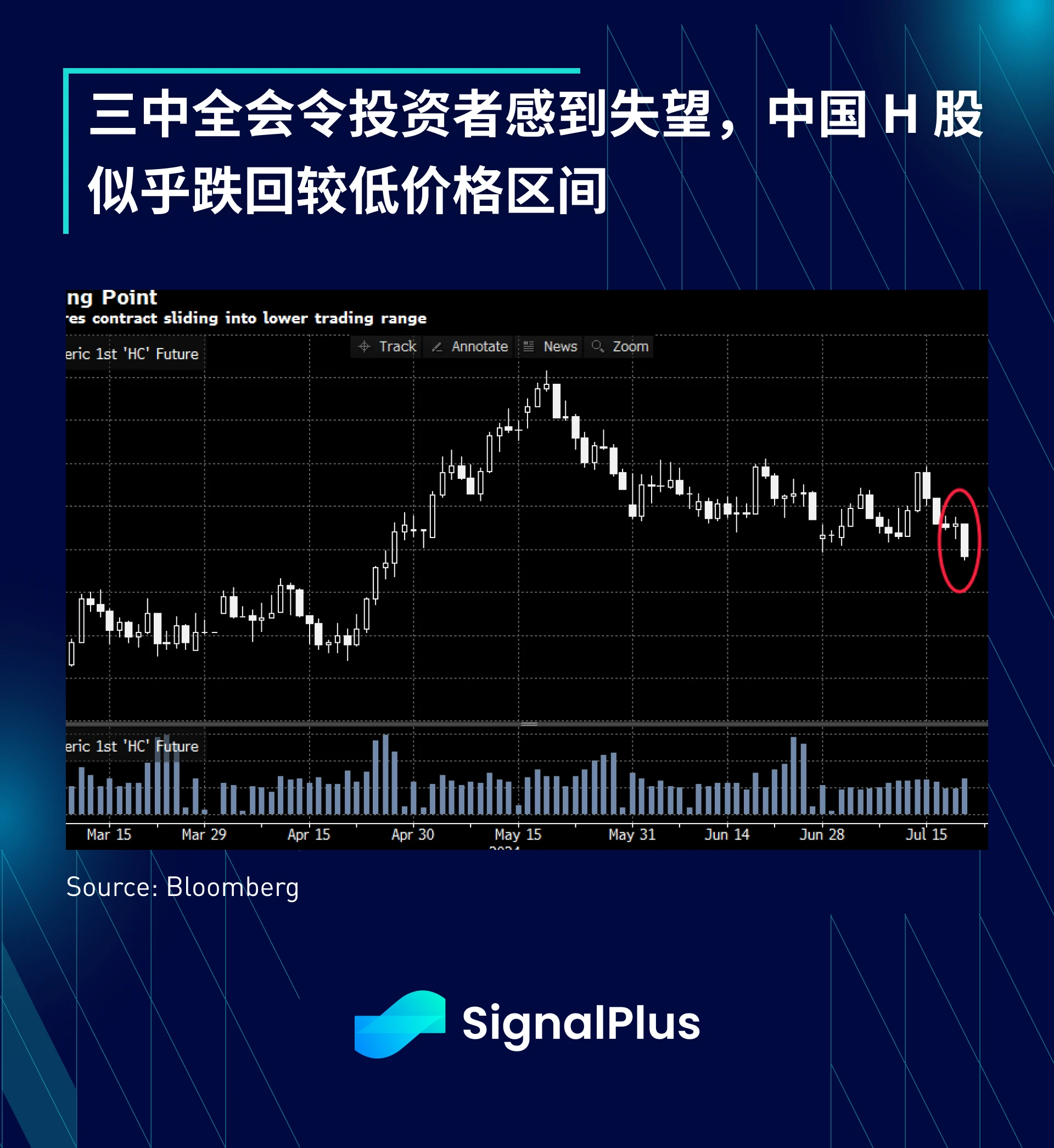

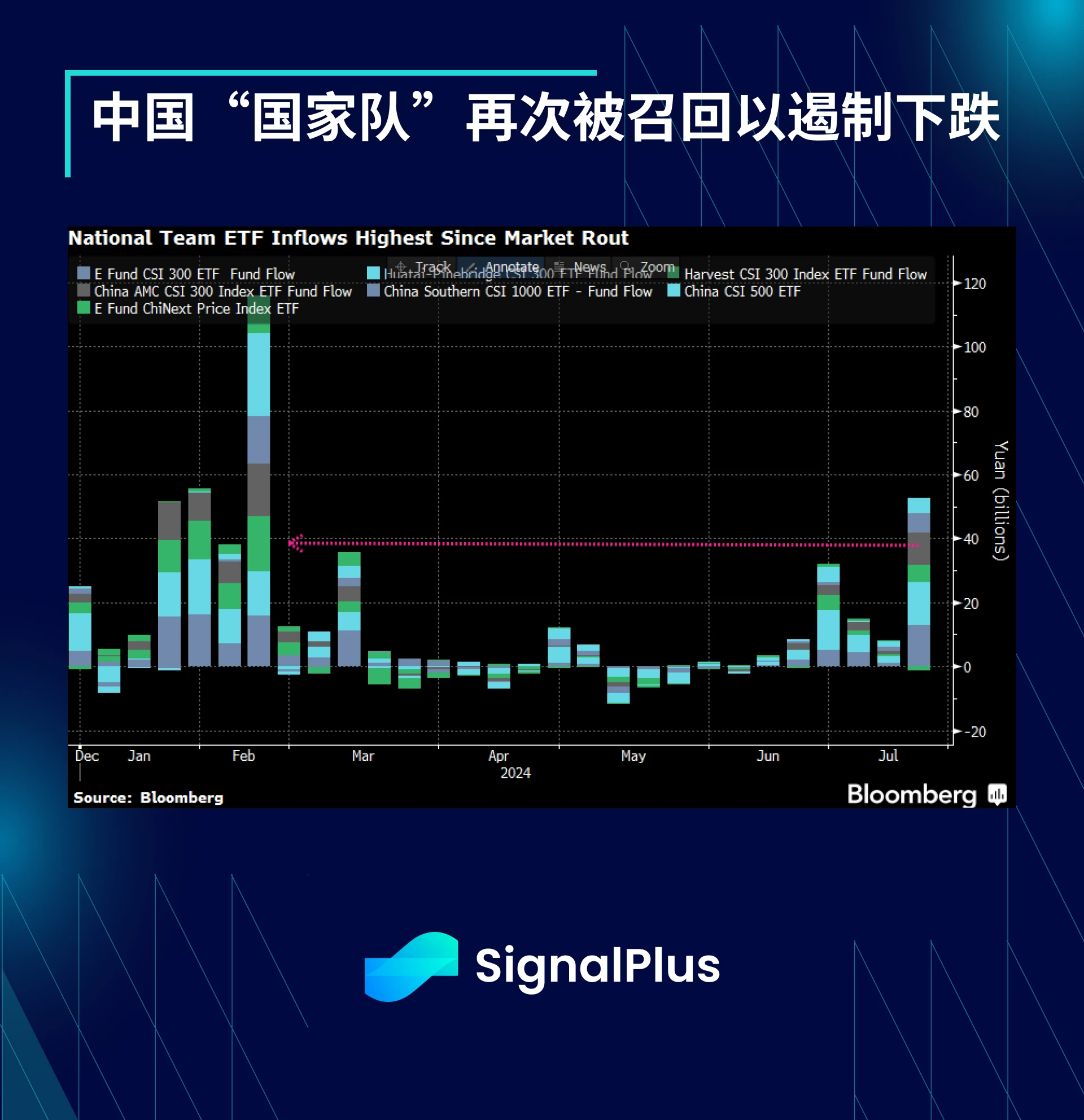

The downturn is not limited to the United States. The Third Plenum of China has not shown any significant change in direction in the face of continued economic downturn, and the lack of "exciting" stimulus measures has failed to excite investors, leading to a significant decline in the Greater China stock market.

The ongoing threat of US tariffs will continue to trouble investors. Goldman Sachs has stated that a 10% tariff could trigger a trade war retaliation, leading to US inflation rising by more than 1%, and may force the Fed to return to consecutive rate hikes.

To make matters worse, in addition to further trade wars and debt-supported stimulus plans, Trump has also explicitly stated that he prefers a weaker US dollar, especially against China and Japan, emphasizing his desire to bring manufacturing back to the US.

"I think manufacturing is very important, as you can see, we have a currency problem, when I was president, I had a very fierce battle with President Xi and Prime Minister Abe… We are facing a big currency problem, now the situation of a strong dollar and a weak yen and renminbi is quite serious." -- Trump

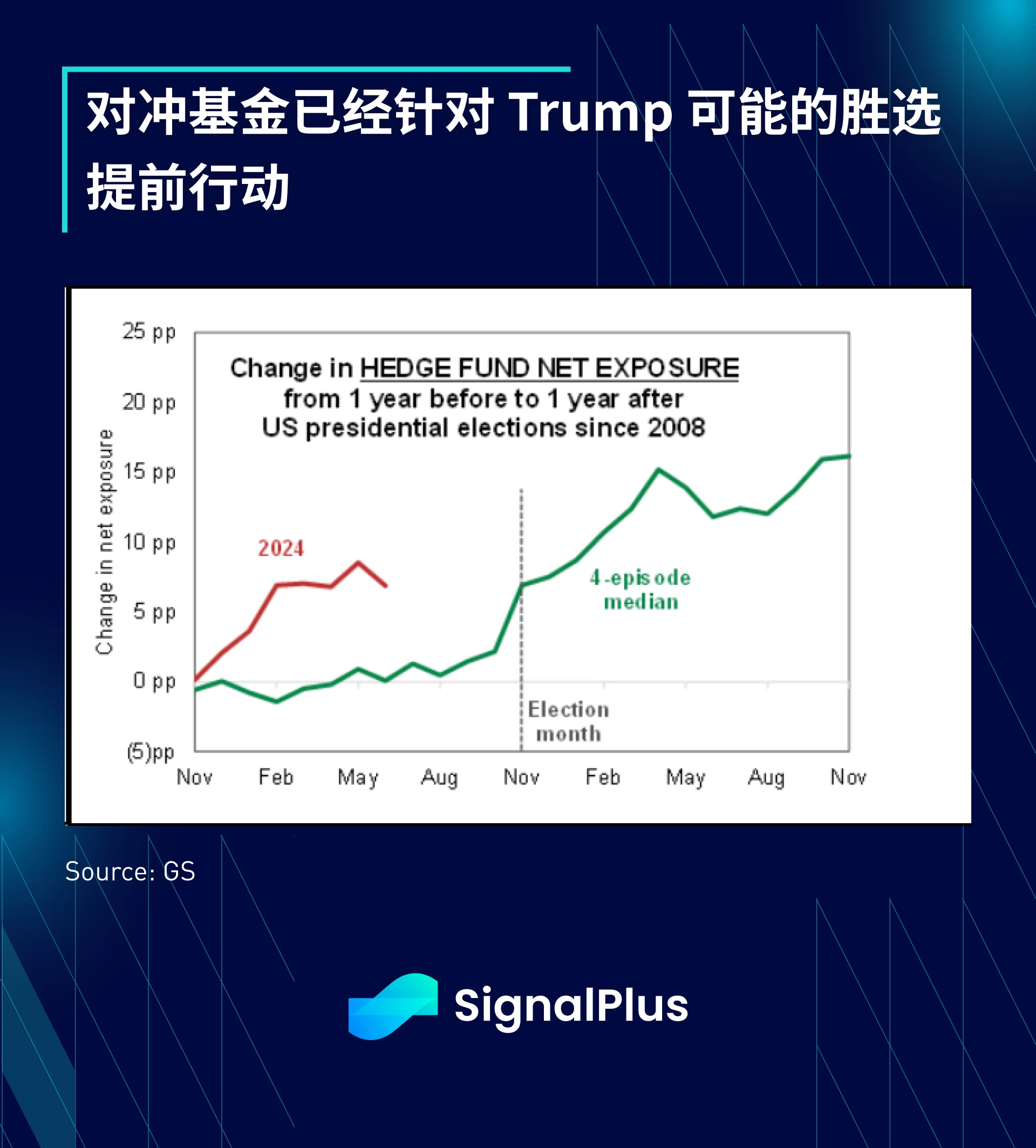

For Trump's second term, investors are generally bearish on bonds. In the context of increased fiscal spending/weaker US dollar/rising trade prices/increased bond issuance, how will inflation pressures be addressed?

Worryingly, despite the end of supply chain congestion caused by the pandemic, sea freight costs have been rising, with the Baltic Dry Index reaching the 83rd percentile of the past ten years.

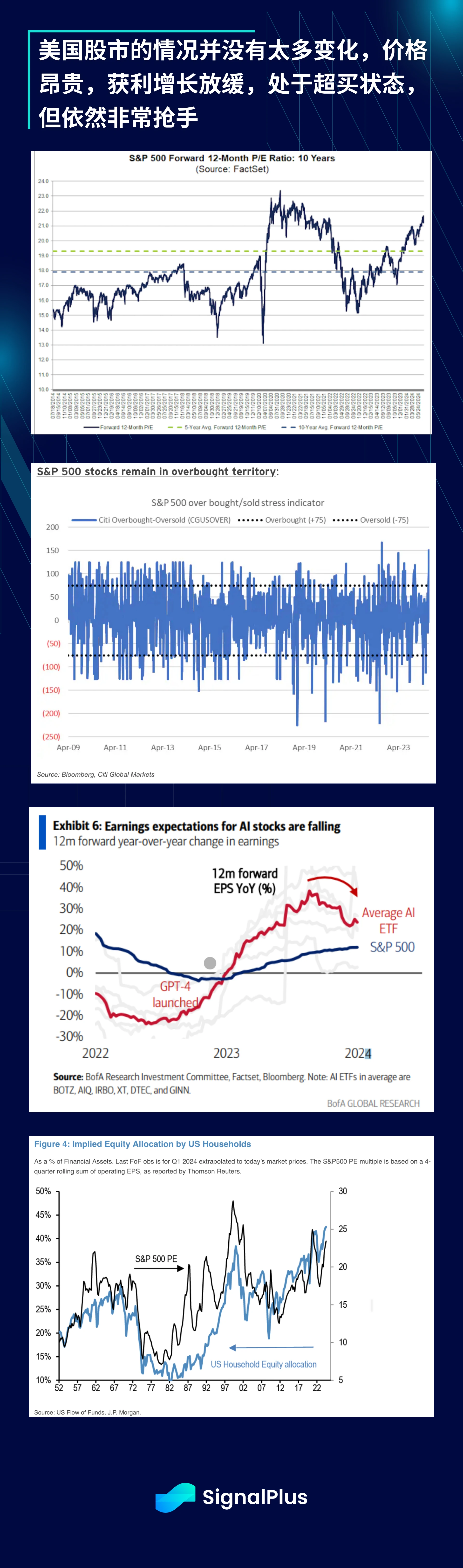

The situation in the US stock market has not changed much. From the forward P/E ratio (>21.5 times) and most other metrics, stock prices are quite expensive, the stock market is overbought, and has been so for several weeks. The stock market allocation of US households is at a historical high, even higher than during the 1999 internet bubble period. At the same time, AI stock earnings growth is expected to slow down in the coming quarters, but will still continue to drive most of the overall index profits.

Therefore, we are still in a very uncomfortable state, with investors being forced to enter the stock market in the late stage of the economic cycle. However, geopolitical tensions continue to worsen, valuations continue to rise, and the risk-return ratio continues to deteriorate. We have always emphasized that stocks are at best a coincident indicator, not a leading one. However, the macro graveyard is also full of stock shorts who have suffered huge losses (including in 2023-24), so please stay on high alert and be prepared for the Democratic candidate nomination, the first Fed rate cut, escalating trade wars, and the US election. The next few months will be very crazy.

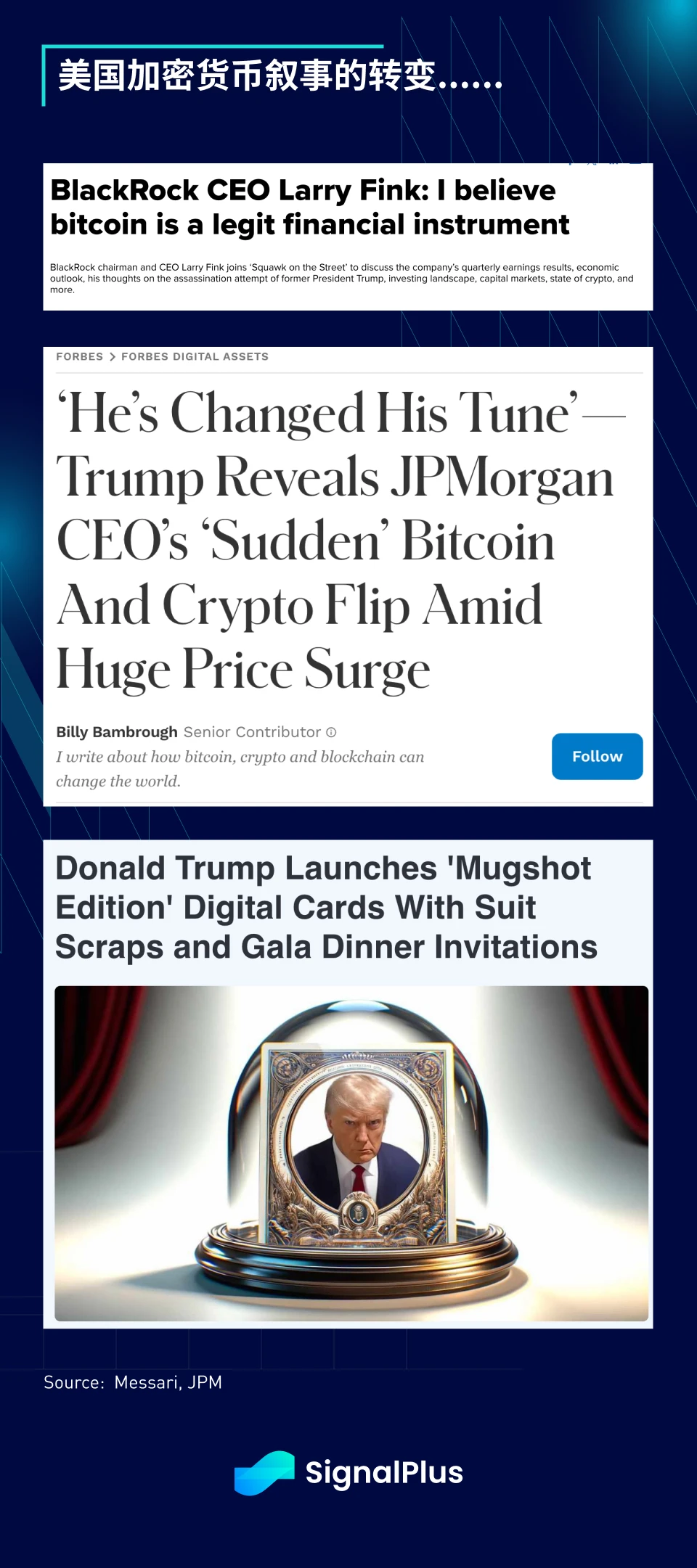

The cryptocurrency field has seen dramatic changes. A few weeks ago, due to government selling, the price of BTC plummeted to $54,000, putting the entire bull market in danger. However, the Trump camp, which supports cryptocurrencies, completely reversed the situation, and the price of BTC quickly rebounded to $68,000 in the face of severe investor underexposure.

A series of bullish (opportunistic?) remarks from the Trump campaign, US senators, Larry Fink of Blackrock, and even JPM's Jaime Dimon have greatly changed the narrative of cryptocurrencies in the US. It is certain that regardless of who takes over the White House in the next four years, TradFi's influence in the cryptocurrency field will continue to grow.

Positive news is also reflected in ETF fund inflows, with ETF fund inflows accelerating again in the past week, exceeding $1 billion.

In terms of market sentiment, perpetual funding rates are close to flat, and as prices return to the $60-70k range, implied volatility is gradually decreasing. However, the market is betting on a year-end rebound, with a significant increase in positions for year-end BTC 100k call options. Will this bet be successful? Let's wait and see.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。