Hello everyone, I am your friend Lao Cui Shuobi, focusing on the analysis of digital currency market trends, striving to convey the most valuable market information to the majority of currency friends. Welcome to the attention and likes of the majority of currency friends, and refuse any market smokescreen!

For the past two days, I have talked to everyone about the macro and technical aspects of the market. Today's article is a practical analysis. I started from scratch, hoping that everyone can understand my train of thought. First, from a macro perspective, it is the three elements we talked about. The overall environment is still inclined to a downward phase, directly entering the policy impact of the currency circle. The official listing of Ethereum will start next Tuesday evening, and the recent growth also comes from this. The situation of this wave of growth will continue to rise, which is a medium-term level. Whether Ethereum can break the previous high point depends on the accumulation of funds. The current funding in the currency circle has been continuously increasing. It is expected that the consumption will probably be close to the listing date, and there may not be a significant upward trend after the listing. Now it is consuming the aftermath of the listing.

Clearly, the second element shows that the currency circle will continue to grow. Let's move on to the third element, which is the influence of the financial market. The strong points of the financial market at present are gold and US stocks. Both have shown a relatively deep correction trend recently, with gold experiencing a correction depth of nearly one hundred points. Both have shown a weak trend, and it is likely that some of the funds will enter the currency circle in the future. This trend is basically consistent with my previous analysis, and those who have been paying attention for a long time should be able to easily reach this conclusion. In the short term, the market competition has shifted to a strong position in the currency circle. From a financial perspective, the currency circle is also in a favorable position. Both major elements are basically in favor of the bulls, with only the big trend being in a bearish phase.

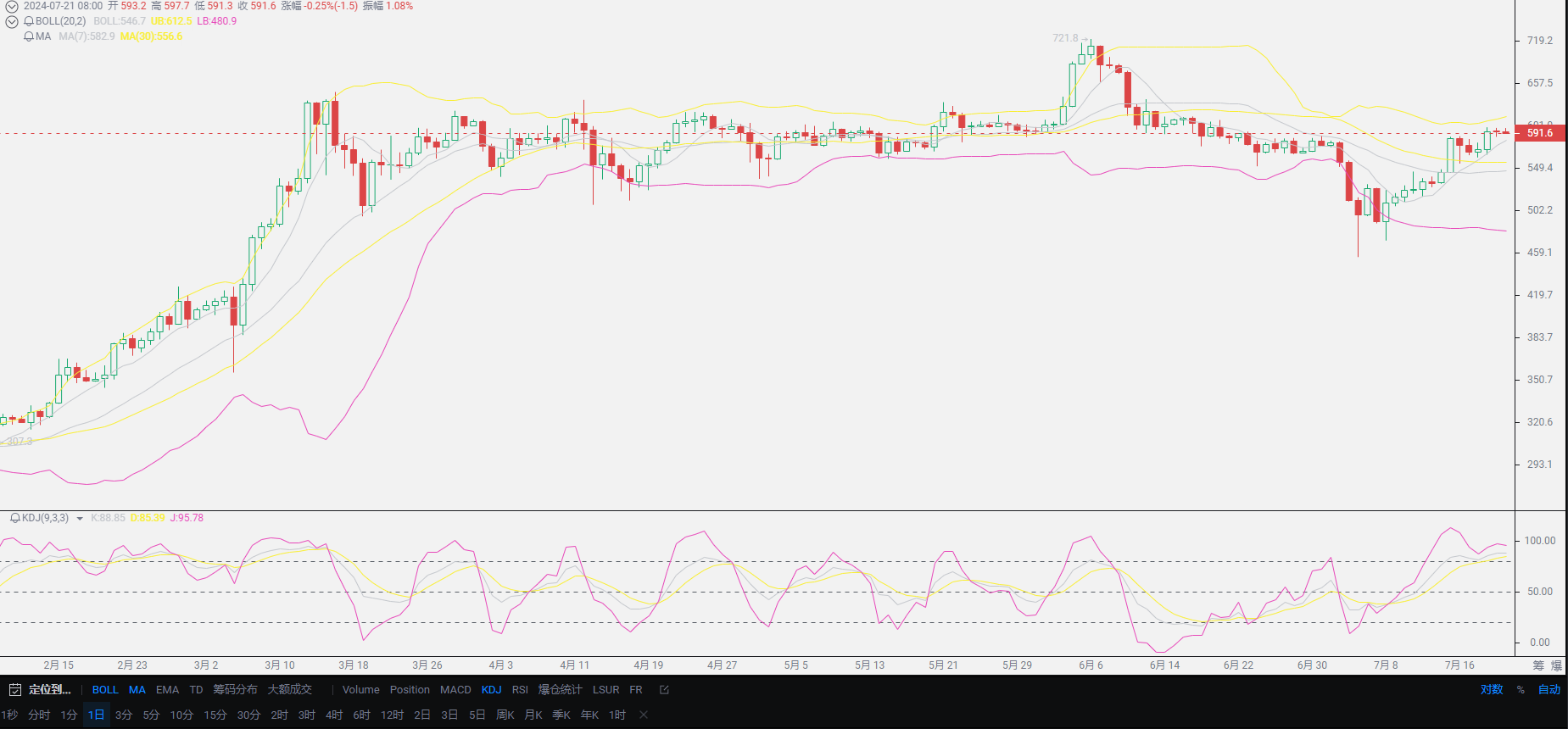

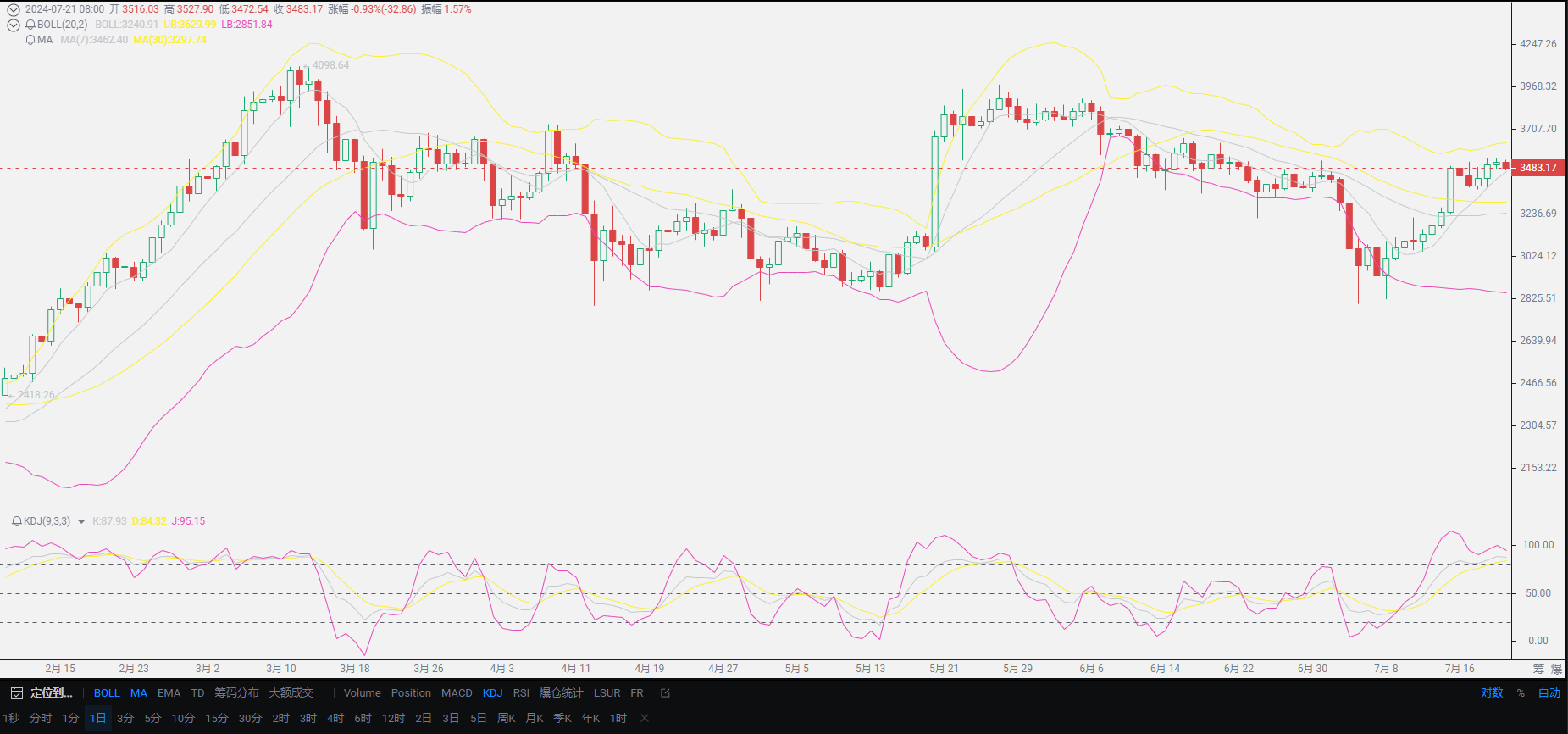

Next, let's look at the technical aspect. Many friends feel that I talk less about the technical aspect, so they have always felt that I am relatively weak in this aspect. I rarely talk about it and feel that the technical aspect can only play a supporting role, so I mention it less. Today, let's take a look at the technical indicators. Starting with the Bollinger Bands, it is obvious that the upper and lower bands are not consistent. The current operating range is between the middle and upper bands, showing a pattern of accumulating strength for growth. Looking at the KDJ three lines, these three lines are slightly different. The K line has a clear downward trend, showing a pressure-bearing posture, indicating a sell signal with a trend from upward to downward. Both D and J are in the overbought zone, which may be a buy signal for the short term. As for the moving average, there is no need to mention it. In an upward trend, it is impossible to have a downward area. The moving average is definitely a signal for higher buying. (This is for the daily level of Ethereum, so I won't talk about the hourly level. It's probably hard to stop once I start without 500 words.)

Finally, let's talk about the news aspect. The recent major news is the listing of Ethereum, which has already been discussed. The next one is Trump's Bitcoin conference. This conference has always been organized by private organizations, and the topics discussed every year are mostly about the history and development of Bitcoin, with little discussion of political influence. However, this year is slightly different. The difference is Trump's identity. With the fermentation of the assassination event, it is almost certain that he will be the next president. His participation in the conference sends a signal of optimism for the Bitcoin market. It is important to remember that being optimistic about Bitcoin is not the same as being optimistic about the currency circle. These two viewpoints are completely different. His optimism may not necessarily be completely favorable for us. A businessman's perspective will always do things that are beneficial to himself. More likely, he is participating from the perspective of wanting to control the Bitcoin market. As for whether he will propose a series of measures, we do not know, so we should wait and see and be prepared for a deep correction in the currency circle before the election.

Lao Cui's conclusion: Overall, from the macroeconomic perspective, the trend is generally favorable, except for the impact of the overall environment. This will limit the height of the currency circle. It does not mean that there will be an impact in the short term. In simple terms, it means that the current trend of Bitcoin should be above 70,000, but with the impact of the overall environment, it is currently running below 70,000. For the future trend, once all the favorable news is released, there will probably be a new round of downward trends. Both the medium-term and short-term levels are in favor of the bulls. This can be clearly seen in the linear level, with the convergence of funds, the opening form of the Bollinger Bands, and the two lines of KDJ all indicating a buy signal, with only the K line indicating a sell signal, and the reference value of the K line may be in the short term. Considering all viewpoints, what we need to do is to focus on buying low. After a short-term correction, Ethereum's 3500 will definitely gather strength for another surge. As long as the short-term correction ends, we can directly enter the market with a low position in the future.

Lao Cui's message: Investment is like playing chess. A master can see five steps, seven steps, or even a dozen steps ahead, while a novice can only see two or three steps. The master focuses on the overall situation, plans for the big trend, and does not focus on individual moves or territories, with the goal of ultimately winning the game. The novice fights for every inch, frequently switching between long and short positions, only focusing on short-term gains, and frequently ends up in trouble.

This material is for learning and reference only and does not constitute investment advice. Buying and selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。