Cryptocurrency News

July 20th Hot Topics:

1. XRP surged and then fell due to speculation about a settlement between SEC and Ripple

2. US President Biden: Looking forward to restarting the campaign next week, Trump's "dark vision" is not what the American people want

3. WazirX and Liminal Custody accuse each other, causing customers to be in trouble due to a $230 million cryptocurrency loophole

4. Telegram launches a mini-app store and an in-app browser that supports Web3 pages

5. Binance will suspend IoTeX token deposits and withdrawals to support network upgrades and hard forks

Trading Insights

If you must trade contracts, remember the following points! It's crucial! [Attention! Important!]

Trading contracts is about taking risks for big gains, so it's normal to experience losses. However, after setting a stop-loss, two types of people emerge: some go crazy and open new positions, while others enter a period of calm. My advice is that if you encounter frequent stop-loss situations, you should calm down, temporarily stop trading, and adjust your strategy.

Don't be impatient for success. Trading is not a get-rich-quick scheme. When facing losses in trading, maintain a calm mindset, do not rush to open new positions, and definitely do not go all in.

It's crucial to have a good understanding of the overall trend. When it's a one-way market based on the market situation, go with the trend and avoid trading against it. Trading against the trend is the root cause of losses. Both beginners and experienced traders have a habit of trading against the trend. However, once the market trend is established, trading against it often leads to painful lessons. Therefore, we need to learn to go with the trend, patiently wait for opportunities, and then take action.

The risk-reward ratio must be well managed; otherwise, it's difficult to make money. Make sure that the profit is as large as possible compared to the loss. At the very least, aim for a 2:1 ratio for each trade before considering opening a position.

Frequent trading is a big taboo in contract trading. If you are not an expert in contracts, you must restrain the impulse to blindly open new positions, especially for novice players who are passionate about the market and always want to seize every opportunity. However, most so-called opportunities often lead to losses.

Only make money within your cognitive abilities. This is very important.

Do not hold positions. Holding positions in contracts is a big taboo, especially for beginners who have just entered the market. Always set a stop-loss. Holding positions is the beginning of entering the abyss. Once again, do not hold positions.

Do not become complacent when making a profit; drifting will surely lead to losses.

LIFE IS LIKE A JOURNEY ▲

Below are the real trading signals from the Da Bai Community this week. Congratulations to the friends who followed. If your operations are not going smoothly, you can come and try it out.

Real data, each signal has a screenshot taken at the time.

Search for the public account: Da Bai Lun Bi

BTC

Analysis

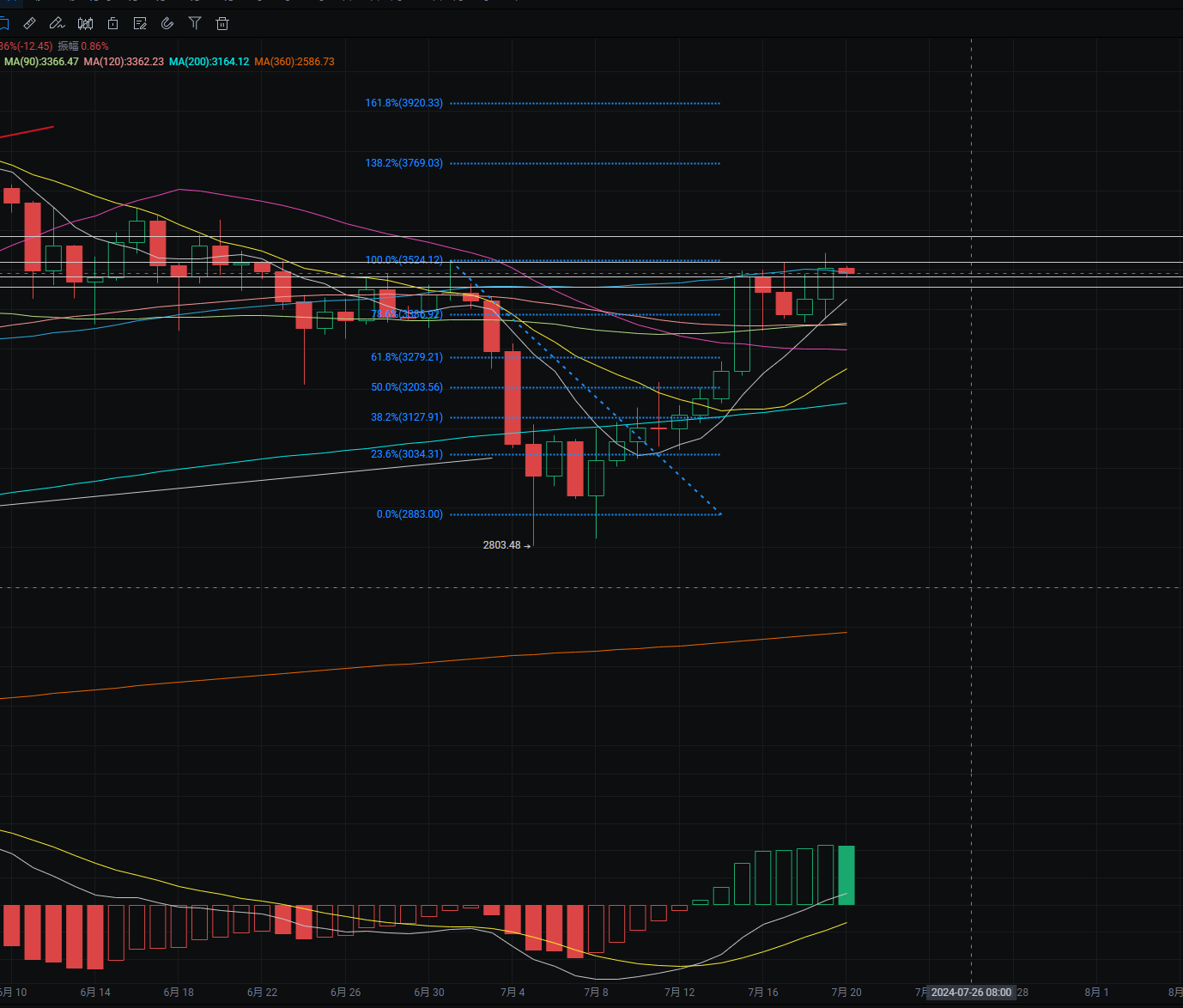

Bitcoin yesterday gave a long entry near 63780, which has perfectly reached the first profit target of 65900. The highest price difference was $2000, reaching near 67400. The next step will be to challenge the 70000 mark. The support is near the MA90. If there is a pullback, you can build a position near it. The MACD is showing bullish momentum. The support on the 4-hour chart is near the MA360 yearly line. The MACD is showing bullish momentum and forming a golden cross. A long entry can be made near 66300, and the target can be seen near 68000-69500.

ETH

Analysis

Ethereum yesterday gave a long entry near 3407, which has reached the first profit target of 3480. The daily high reached near 3540, closing above 3500. The bottom support is near the MA7. The MACD is showing bullish momentum. The support on the 4-hour chart is near the MA7. If it falls below, it may go down to near MA14. You can build a position near it for a long entry. The MACD is oscillating and flat, with the two lines sticking together. A long entry can be made near 3483-3457, and the rebound target can be seen near 3520-3585.

Disclaimer: The above content is for personal opinions and reference only. It does not constitute specific operational advice, nor does it bear legal responsibility. Market conditions change rapidly, and the article has a certain lag. If there is anything you don't understand, feel free to ask for advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。