Hello everyone, I am your friend Lao Cui Shuobi, focusing on the analysis of the cryptocurrency market, striving to convey the most valuable market information to the majority of coin friends. Welcome to the attention and likes of the majority of coin friends, and refuse any market smoke bombs!

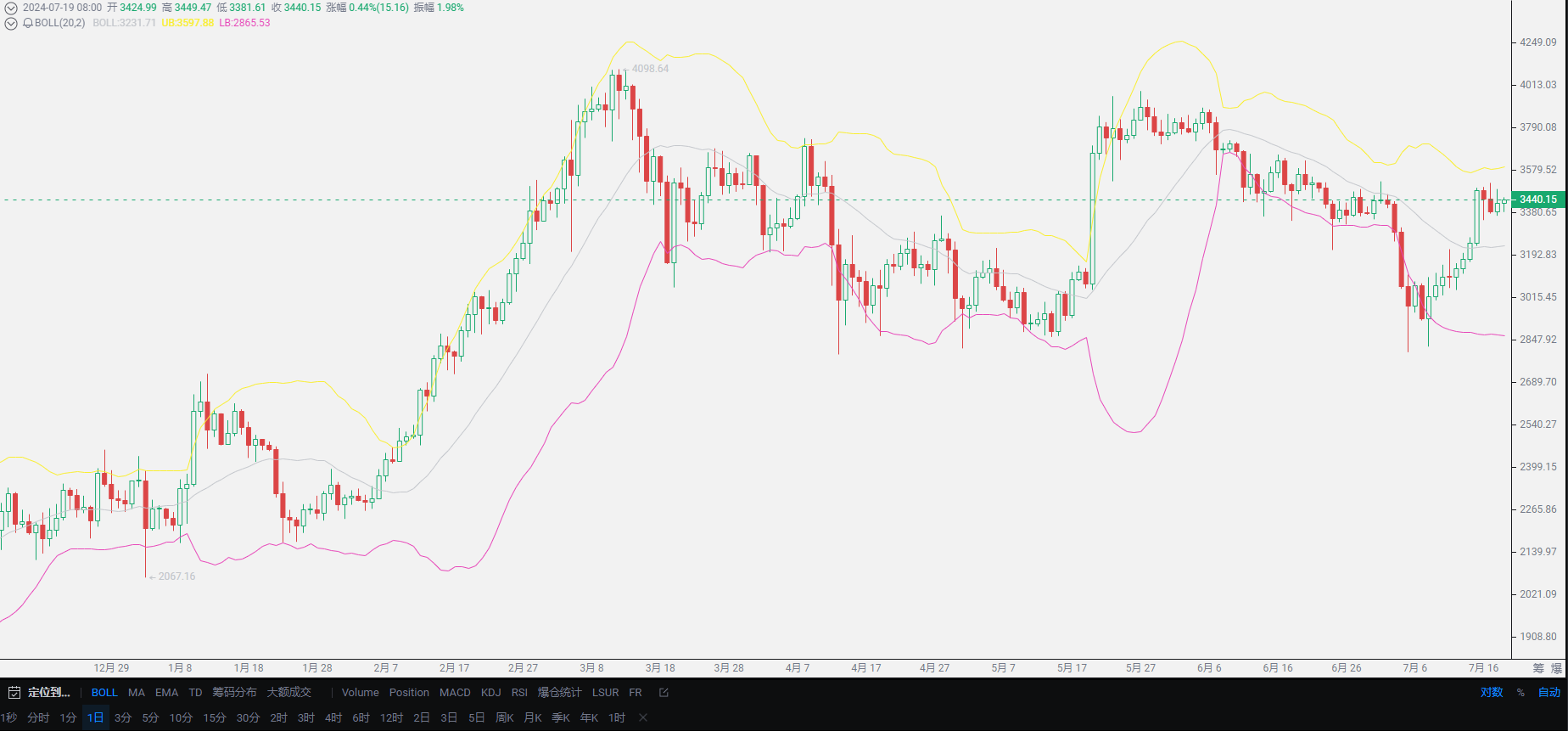

After talking about the later trend, today's article focuses on answering the topics that everyone is concerned about. In the early stage, the trend, Ethereum also broke through the suppression of 3500 in a short period of time, but the downward retracement was also very rapid. After the breakthrough, it directly showed the suppression force and has now opened a short-term retracement cycle. From the market perspective, various indicators are showing a bearish trend, but there is still a phenomenon of bullish convergence at the level of funds, and external funds are gradually converging into the coin circle. Many friends feel that Lao Cui's analysis is more accurate. Today, Lao Cui will teach everyone a few indicators to avoid everyone frequently asking Lao Cui how to judge the trend, or having expectations and fantasies about the overall environment. Lao Cui still hopes that everyone can have a new understanding after reading the article to help everyone gain more profits.

First of all, for the judgment of the cryptocurrency economy, the overall trend is definitely inseparable from the influence of the overall environment. The overall financial environment is beyond doubt, and the influence of the United States is still ranked first. Whether the United States changes its view of the coin circle or takes new measures for the economic trend of US stocks, it will affect other markets. And Trump's recent behavior has led a new round of economic trends. Many friends are puzzled why the US presidential election has such a big impact on the economy. This depends on their different economic strategies. Most of the policies of the United States are changeable, and each president has a different understanding of the economy. This is exactly the opposite of ours. Our policies are basically formulated for one term, and others are implemented. For example, the reform and opening up will not change even after a hundred years.

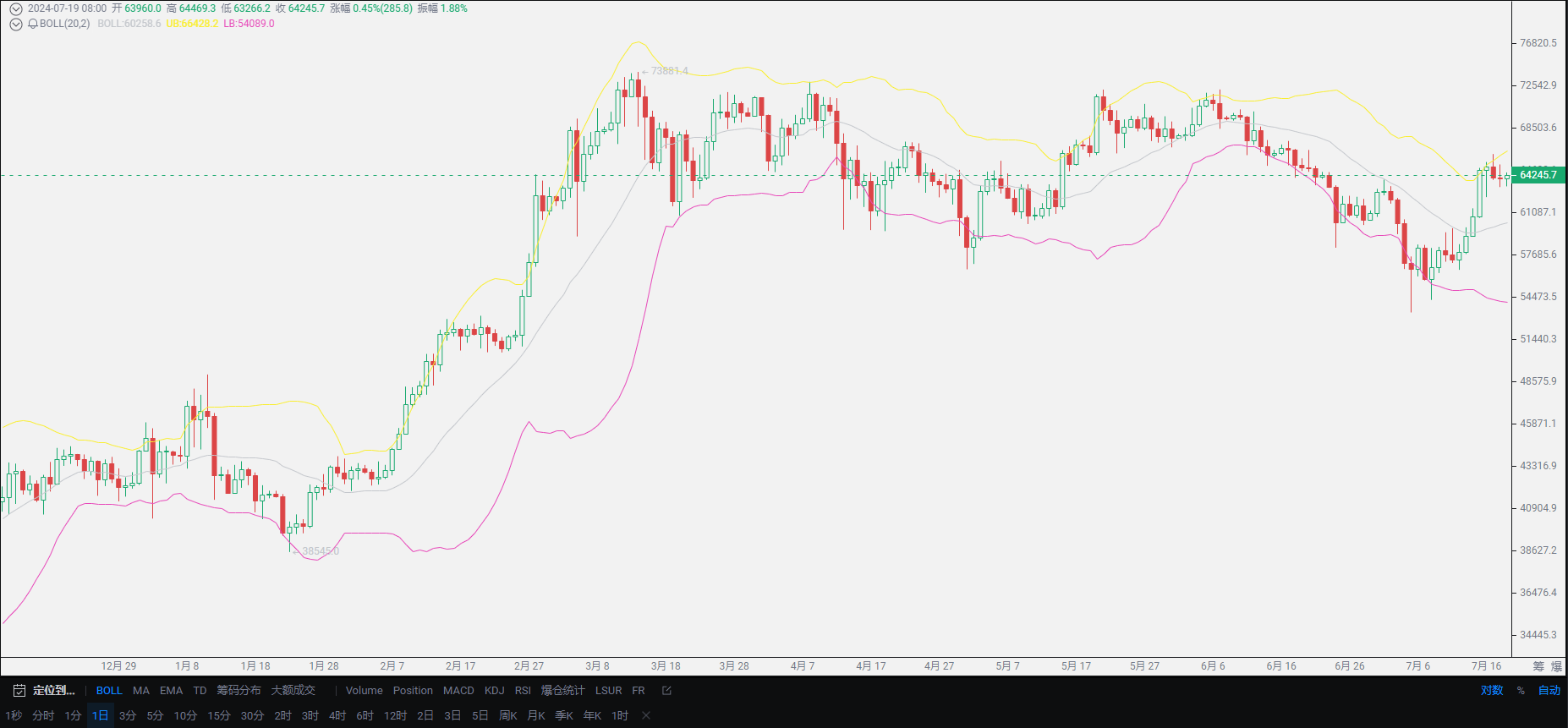

As a direct example, the biggest difference between Biden and Trump is their opposite attitudes towards the cryptocurrency market. Although Trump did not strongly support the coin circle, for the coin circle, not suppressing it is also a form of support. Biden can be said to be completely suppressing the coin circle. It is difficult for Bitcoin to go public without worrying about this year's election. In other words, if Trump were in office, the timing of the listing might be completely different, and there might have been a possibility of going public during the epidemic, and Ethereum might have been listed earlier. Therefore, the first factor will always be the economic strategy of the United States, which will lead the overall financial market trend.

The second factor is the impact of the coin circle's policies. We cannot fail to mention the suppression of the coin circle in the past two years, the freezing of bank cards, and the detection of apps. For the coin circle, this directly led to the end of a new bull market and the beginning of a bear market lasting three to four years. Everyone can recall the statements of major banks and the measures to clear all exchanges. On that day, Bitcoin directly fell by 10,000 points, which can be said to directly affect all subsequent trends of the coin circle. Not only us, but also the influence of the United States and Europe is huge. The indulgence of Japan and South Korea in the coin circle is the reason for the later bull market growth. Even a small country like El Salvador recognizing Bitcoin can drive an increase of several thousand points in the coin circle, which is still in the stage of public opinion.

The third factor is the overall impact of the financial environment. Many friends will compare it with gold. Before traditional economy intervention, that is, before Bitcoin went public, the trend of gold, especially before 2019, had a lot in common with Bitcoin. After Bitcoin went public, the trends of these two are basically unrelated. In the current coin circle market, it is almost unrelated to gold and US stocks. After going public, it has become an independent entity. It competes with almost all markets, so everyone should not have other fantasies. At present, apart from the strong performance of US stocks and the markets related to bulk commodities and gold energy, almost all other markets are in a downward trend. It is not that the US economy is so strong, but that the world economy cannot do without the leadership of the United States. The strong performance of the United States will mislead everyone into thinking that the financial environment has improved. As for the indicators of improvement, it is difficult for everyone to judge. You can focus on the military level. The cessation of wars around the world is a sign of improvement in the financial environment.

Overall, the world's economy is still in a downturn. The strong performance of the United States all comes from the support from below. The unemployment rates in various places, military, disasters, the rise of bulk commodities, the competition for energy, and inflation, everything is overproduced. Whether it is a subprime crisis or a common financial crisis, all of this is a common problem of capitalism and will always come. Buying and producing as needed is a common topic that humanity needs to face, which also makes it difficult for the coin circle to create historical highs in the near future. The whole world is trapped in a crisis, making it difficult to help the coin circle rise again. The current overall trend of the coin circle is trapped in a range of shocks, but due to the traditional capital support brought by the listing of Bitcoin, it will not cause a drastic decline in the coin circle. This is the solution that the United States should think about. What we have to do is to find a foothold in the overall trend.

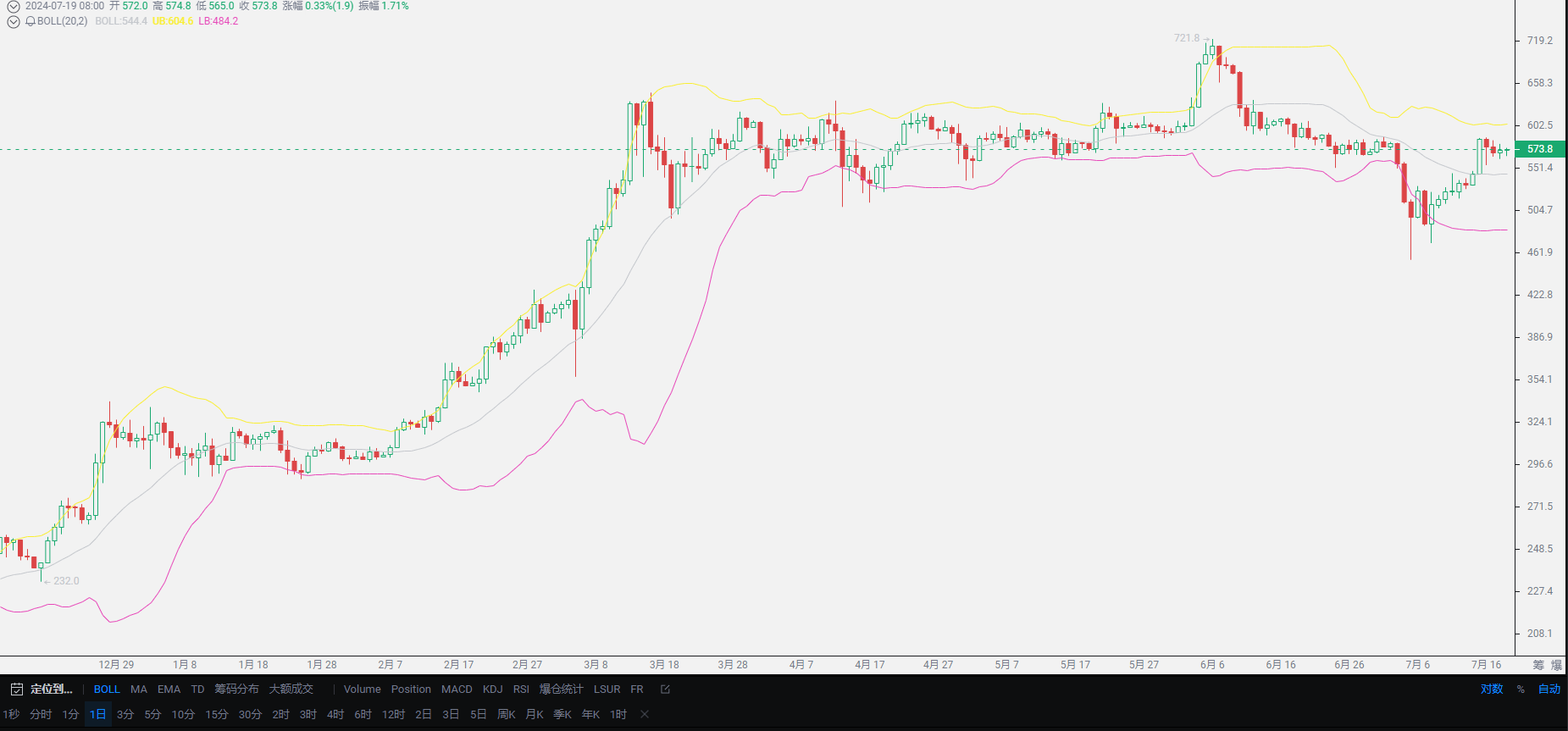

Lao Cui's conclusion: Due to space limitations, the number of words should be controlled within 2000. Today's analysis ends here. The overall trend has been explained more clearly to everyone. Spot users are believed to have been in a profitable state in the early stage, so today's spot analysis will be suspended. Let's talk about contract users. The overall box oscillation phase is relatively bullish for contract users. Ethereum basically will not experience fluctuations of more than 1000 points (this is the basis for judgment compared to the previous amplitude). Ethereum and Bitcoin have both experienced a short-term halving in half an hour before, and it is now difficult to see such extreme trends. From a short-term perspective, Ethereum is currently competing for the 3500 mark, and the pressure can be said to be not small. The decline is also very obvious, almost all in the form of low longs to help everyone profit. The exchange rate is also gradually starting to decline, and the lowest point has reached around 7.2. If 7.2 is held, it will usher in an upward trend, otherwise the impact of this wave will be completely wiped out. As long as there is no good news, the coin circle is still in a bearish stage. For users with technical needs, you can pay attention to the impact of linear aspects in the next issue.

Lao Cui's message: Investment is like playing chess. Masters can see five steps, seven steps, or even more than a dozen steps, while those with low chess skills can only see two or three steps. The high-level players consider the overall situation, plan the general trend, and do not focus on one move or one territory, but aim to win the game in the end. The low-level players fight for every inch of land, frequently switch between long and short positions, and only fight for short-term gains, often getting trapped in the end.

This material is for learning reference only and does not constitute investment advice. Buying and selling based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。