The shooting incident is a positive for the cryptocurrency market, but it's also a double-edged sword.

On July 13, 2024, a shocking incident occurred at a campaign rally in Pennsylvania, where former U.S. President Trump was shot at from a rooftop over 100 meters away. The bullet grazed the right side of his head, and the assassination attempt failed. Such incidents targeting political figures are not uncommon in U.S. history, and fortunately, Trump only suffered minor injuries. For investors, the key is how such sudden political events will affect the financial markets. This article will review the short-term impact of similar historical events on the market and explore the long-term effects of political turmoil.

The Relationship Between U.S. Presidential Assassination Events and the Risk Market

On the first trading day after the assassination attempt on July 15, the U.S. stock market rose across the board and closed at a new high. The assassination of political figures often has an unclear relationship with the risk market. In U.S. history, a total of ten presidents have been assassinated, with four of them killed. The last assassination attempt on a U.S. president occurred 43 years ago in 1981, when President Reagan survived the attack. There was also the assassination of the 35th President, John F. Kennedy, in 1963, making him the fourth U.S. president to be assassinated.

Such sudden major events of a president's death usually lead to short-term drastic fluctuations in the risk market. For example, in September 1955, after Eisenhower suffered a heart attack during exercise, the stock market plummeted by 6.5% in a single day. When Kennedy was assassinated in November 1963, the U.S. stock market immediately fell by 3%, and the market closed two hours early to commemorate Kennedy.

However, after the sharp decline, there is often a rapid rebound. In late October 1963, less than a month after President Kennedy's assassination, the stock market experienced a significant surge, recovering all lost ground within a few days, with the Dow Jones Industrial Average rising by 35% within the month. Similarly, after the assassination attempt on former President Reagan in March 1981, the stock market also surged.

Trump's Assassination Attempt Significantly Increases His Chances of Winning

In a video clip captured by Twitter user @C3PMeme, Trump can be seen tilting his head towards the screen, a move that saved his life.

The shooter, Thomas, aimed a shot directly at the center of Trump's head.

Trump dodged the bullet by tilting his head towards the screen.

This fortunate escape for Trump has further strengthened the belief among his supporters that he is the chosen one. After the assassination attempt, his repeated shouts of "Fight Fight Fight" made him appear more like a brave warrior fighting for America. This heroic image of Trump has been firmly established. Even many business and social leaders who have been critical of him have come out in support of him. Elon Musk, in particular, tweeted six times in support of Trump, stating, "The last time America had such a resilient president was a hundred years ago with Theodore Roosevelt." He later tweeted, "I fully support President Trump and hope for his speedy recovery."

Similarly, Mark Zuckerberg also expressed support for Trump. Meta, the parent company of the social media platform Facebook, announced that it would restore Trump's Facebook and Instagram accounts in the coming weeks. This is significant as Trump and Zuckerberg have had conflicts in the past, with Trump himself criticizing Facebook as "the enemy of the people" on multiple occasions.

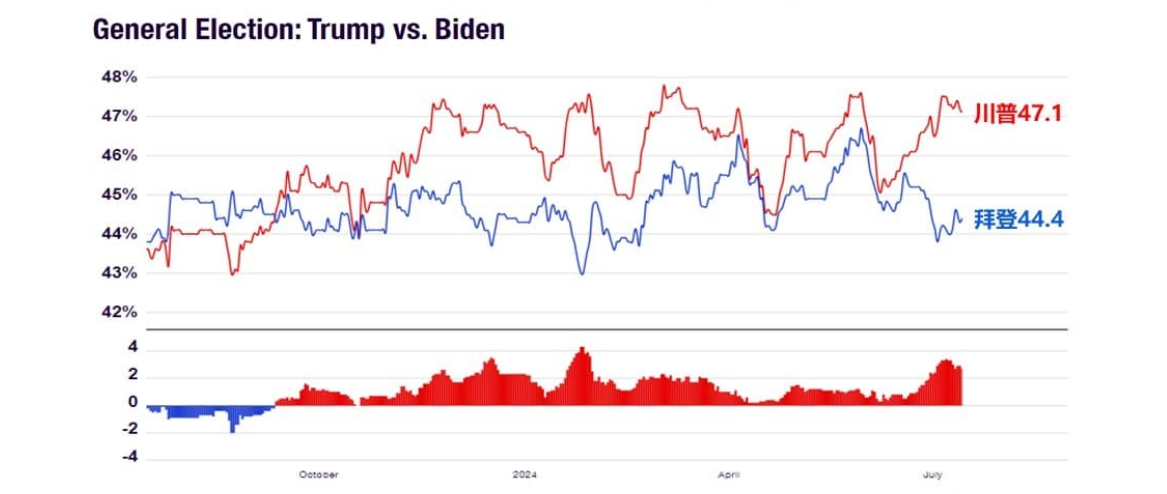

According to the cryptocurrency prediction market Polymarket, the probability of Trump winning the November U.S. election has risen from 60% before the incident to nearly 70%, reaching new highs. The latest RCP average of various polls shows Trump's election rate at 47.1%, far ahead of Biden's 44.4%. It is expected that future polls will further increase, and Trump's return to the White House seems imminent.

Polls show Trump's lead in the election rate over Biden, source: RCP

If Trump can win the national vote in November, his political ideology is likely to have a long-term impact on the U.S. stock market. As a politician who places great importance on the stock market's performance, Trump is expected to continue to promote policies such as tax cuts, strengthening tariffs, and border control. Investors need to closely monitor the impact of these policy changes on the economy and businesses and adjust their investment strategies accordingly. After all, the stock market is likely to continue its high momentum under Trump's presidency, but it also faces many uncertainties arising from his policy orientation.

Inspired Cryptocurrency Market

After experiencing a two-month decline, the assassination attempt on Trump became the most direct catalyst for the rebound in the cryptocurrency market. Bitcoin rose from $58,000 to $65,000, leading to a comprehensive surge in altcoins as well. Why did the market rise? It cannot be entirely attributed to Trump. The shooting incident occurred on a weekend when market liquidity was already poor, likely continuing the upward trend from the previous working day. Additionally, the favorable CPI data on Thursday had already driven traders to strongly bet on a rate cut environment, which was likely to continue over the weekend. Therefore, the market's rise due to the shooting incident is not entirely the main factor for the price increase. There are also other bullish factors, such as the completion of the German government's sell-off, the imminent approval of Ethereum spot ETF, and the capital inflow after the end of the European Championship. Hence, while the assassination attempt on Trump did trigger market sentiment in the short term, it was not the main reason for the price increase.

What the assassination attempt on Trump has brought us is more excitement from an emotional perspective, as well as increased support from the American people for Trump's presidential election. This incident has also deepened the support of the American people for the Republican Party represented by Trump. The Republican Party has always had a more friendly attitude towards cryptocurrencies, which will bring long-term benefits to the future development of the cryptocurrency market. Therefore, the potential impact of the assassination attempt is not limited to short-term market fluctuations but may also deepen the recognition of the Republican Party and its policy propositions at the political level, thereby having a significant long-term impact on the entire cryptocurrency industry.

Short-term Impact: Stimulating Market Sentiment, Attracting Cryptocurrency Investors

The sudden event has intensified market volatility. News of a political figure's assassination often triggers market anxiety, and some traders believe that the increased chances of Trump's election victory should strengthen the market's series of expected reactions to the fiscal, trade, and regulatory policies he may implement during his presidency. These policies include loose financial regulation, among others, and are expected to improve liquidity, benefiting the risk market. On July 13, the day of Trump's assassination attempt, Bitcoin broke through the $60,000 mark and continued to rise. During the subsequent Asian trading session on July 15, gold prices fell, stock index futures made slight changes, the U.S. dollar rose slightly against most currencies, and U.S. bond futures fell. These cross-asset category reactions echoed the rapid changes in market sentiment and expectations.

Long-term Impact: Focus on Whether Trump's Election Will Bring Substantial Benefits to Cryptocurrency Policies

During Trump's previous term, "Trumpflation" drove a significant rise in U.S. stocks, especially in the technology and financial sectors. As a public supporter of cryptocurrencies, Trump's re-election would be very favorable for the development of the cryptocurrency market. He is likely to take a series of measures such as interest rate cuts, devaluing the U.S. dollar, and promoting exports to help small and medium-sized businesses recover. These measures will also create a favorable environment for the risk market. It is expected that after the approval of the ETH spot ETF, the SOL ETF is also likely to be realized during Trump's new term, and more cryptocurrency ETFs will flourish in the future.

Emerging MEME Tokens

The concept of election-related tokens has always been a hot topic in the cryptocurrency market. Previously, there have been Trump-related concept tokens such as MAGA, MAGAHAT, and DJT. Undoubtedly, the assassination attempt on Trump has once again drawn the attention of speculators to the blockchain. The unique emotional driving force of MEME tokens has resonated strongly, igniting a frenzy of MEME token price surges. The influence of political events is permeating every corner of the cryptocurrency market. The old token MAGA surged by over 50% after the shooting incident, and the election concept token PEOPLE rose by over 60% within a day. A new batch of election concept tokens has also emerged, such as EAR, FIGHT, and FEARNOT, all of which are currently tradable on the Pionex exchange.

- EAR

The full name of Ear is "The Ear Stays On," representing Trump's injured right ear. The name is inspired by the slogan of the hat dog, "The Hat Stays On." Its market value once reached as high as $30 million, but it has since significantly declined to around $1.5 million as the hype surrounding the shooting incident has subsided.

CA: 2BUZ19fT8TYvPzhuvtCCp9ceu9eNRCmY11S4vSATpump

- FIGHT

After being injured, Trump raised his fist and repeatedly said "Fight!" to his supporters. Photos and videos of Trump raising his fist and shouting "Fight" almost flooded various social media platforms. Fight exists on both the ETH and SOL chains, with current market values of $55 million and $5 million, respectively. The SOL chain's Fight token saw a tenfold increase in just two days since its launch on the Pionex exchange.

CA (ETH): 0x8802269d1283cdb2a5a329649e5cb4cdcee91ab6

CA (SOL): KMnDBXcPXoz6oMJW5XG4tXdwSWpmWEP2RQM1Uujpump

- FEARNOT

On the second day after the assassination attempt, Trump emphasized "FEAR NOT" in a post, and later paired the "Fear Not" phrase with photos on his campaign website. This influenced the emotions of MEME traders, and its market value, like EAR, briefly surpassed $30 million but has since fallen to around $4.8 million.

CA: 0x6135177a17e02658df99a07a2841464deb5b8589

Trump and His Political Ideology

Trump and Biden have significant differences in policies related to taxation, trade, infrastructure, livelihood, and international situations. As a businessman, Trump favors a low-interest rate environment and has previously stated that if re-elected, he would not reappoint Powell as the Chairman of the Federal Reserve in 2026. Although Powell himself may not succumb to political pressure, the commissioners hoping to replace him are likely to trouble Powell at the Fed's interest rate meetings, leading to an increase in U.S. inflation expectations.

Policy Differences Between Biden and Trump:

Fiscal and Tax Policies: Biden advocates for higher tax rates on high-income individuals and businesses, while Trump tends to favor tax cuts.

Monetary Policy: Biden advocates for maintaining the independence of the central bank, while Trump leans towards demanding the Fed Chair to guide and implement looser monetary policies.

Foreign Policy: Biden advocates for restoring America's traditional leadership position in international affairs and maintaining relationships with allies. Trump, on the other hand, leans towards independence and even takes unilateral measures.

Immigration Policy: Biden supports a more lenient immigration policy, while Trump advocates for tightening border control.

Economic Policy: Biden focuses more on government regulation of the economy, while Trump tends to rely on market forces.

What is Trumpflation?

Since Trump became the 45th President of the United States, "Trumpflation" has frequently appeared in the financial markets. It usually refers to the market's series of expected reactions to the fiscal, trade, and regulatory policies that may be implemented during Trump's presidency. These policies include tax cuts, relaxed financial regulations, etc. Essentially, "Trumpflation" is a market expectation-driven trading pattern.

The loose fiscal and tight trade policies implemented by Trump have exacerbated U.S. inflation pressures and widened the economic gap between the U.S. and other countries. Some believe that these policies would strengthen the U.S. dollar, as increased fiscal deficits would push the dollar higher. However, historical data shows the opposite result. When Trump took office in 2017, the U.S. dollar index was at 101, but it had dropped to 90 by the end of his term in 2021. It was during Biden's presidency that the U.S. dollar significantly appreciated due to factors such as the pandemic.

Trump has consistently advocated for reducing market regulations. Analysts at Goldman Sachs have stated that Republican governance is favorable for business and consumer confidence, which may drive increased spending and investment, thereby boosting the profit prospects of some companies and further supporting the risk market.

The current global economic environment has undergone significant changes, and history may not repeat itself. When Trump was elected president, the U.S. was in an 8-year economic recovery period. The market immediately surged after his election victory because people bet that a Republican president could lower taxes and relax business regulations. However, history may not necessarily repeat itself. The current economy is in a global interest rate reduction environment and even faces the risk of recession. If U.S. inflation is triggered again, it will force the Fed to pause the rate-cutting process, or even jeopardize the global economic recovery. The actual direction of the capital market has always been complex and full of uncertainties.

Conclusion

The shooting incident is a positive for the cryptocurrency market, but it's also a double-edged sword. From a positive perspective, Trump has long expressed support for cryptocurrencies, and the Republican Party as a whole tends to adopt loose policies, which is undoubtedly beneficial for the development of small and medium-sized enterprises and is expected to improve the current high-interest rate environment, which is favorable for the cryptocurrency industry. However, from another perspective, excessively loose monetary policies may lead to an economic recession in the U.S., which in turn could have a negative impact on the cryptocurrency market. Overall, the main speculative clues in the market from July to September, before the dust settles on the election, are still interest rate cut expectations and political factors. It is worth looking forward to Trump's attendance at the Bitcoin conference on July 24 and his speech. Although he has a performative personality, his support for cryptocurrencies is genuine. If Trump can successfully take office, it may further enhance the official recognition of the cryptocurrency market. In our investment process, we also need to be cautious of FOMO in the short term, and we need to see if he can introduce substantial policies to benefit the cryptocurrency ecosystem.

Reference

【Disclaimer】This article is for reference only and does not constitute any investment advice. Investment involves risks, so please proceed with caution. Readers should independently evaluate the content of this article based on their own circumstances and bear the risks and consequences of investment decisions on their own.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。