On July 17th, the Chinese version of "Bloomberg Businessweek" apologized to Binance and its founder Zhao Changpeng for the cover title of its article two years ago, stating that the cover title "Zhao Changpeng's Ponzi Scheme" in the 250th issue of the magazine (July 6, 2022) was "false and unfounded." Therefore, they issued a retraction statement and apologized.

In fact, after the article with the aforementioned title was published, Zhao Changpeng stated that he would sue the publishing media for defamation. Two years later, the apology and retraction statement came, and although Zhao Changpeng could not speak out due to serving a sentence, Binance responded, "We are pleased to see the false accusations being retracted."

Legal proceedings, public refutation, correction of accusations, and self-construction. The 7 years since Binance was established have been both years of development and expansion, as well as years of proving its own value and dispelling labels after being questioned. Sometimes, not only the labels attached to itself are torn off, but also the labels attached to the entire cryptocurrency industry.

For example, "Ponzi Scheme" was once a negative label for Bitcoin. More than 10 years later, Bitcoin still exists and has become a legal tender in small countries such as El Salvador and Dominica. After Binance was "cleared" by the United States through regulatory means, Bitcoin entered the U.S. financial market in the form of an ETF.

Lawsuits, refutations, and the correction of errors often have a lagging effect. The best way to change a negative impression is to grow positive value. In the field of cryptocurrency assets, this applies to Bitcoin, and Binance as well.

Self-Construction and Counteracting Doubts

Even with 200 million registered users, which accounts for 2/3 of the cryptocurrency asset audience, various doubts surrounding Binance since its establishment 7 years ago have never dissipated. This seems to be the challenge that the world's largest cryptocurrency asset trading platform must endure.

Recent doubts have focused on "girlfriend coin," "insider trading," and "listing related assets," mainly related to the standards for listing cryptocurrency assets on Binance.

Facing doubts and transparency of information have been the ways Binance has adhered to since the era of Zhao Changpeng.

This time, his partner and co-founder, He Yi, went online again and answered questions from the community and industry media for two consecutive months. After reiterating that the listing of assets on Binance will not be a "one-man show," He Yi publicly disclosed the evaluation criteria. "First, we will consider the project's fundamentals, technology, and market popularity; second, whether there is investment endorsement is also a consideration; finally, we will look at the project's lifecycle and team capabilities. In fact, the project party often does not know whether it will be selected before listing."

Counteracting doubts is the second way Binance dispels unfavorable voices.

Two years ago, "Bloomberg Businessweek" changed the title of the English version of the article and published an article about Zhao Changpeng with the title "Ponzi Scheme." The founder of Binance and the then-CEO sued the other party for defamation. Two years later, the title was retracted, and the publishing media apologized for the harm and impact caused to Zhao Changpeng and Binance.

Apology statement from "Bloomberg Businessweek"

Apology statement from "Bloomberg Businessweek"

Media reports can bring brand reputation crises, and accusations from government agencies need to be taken seriously. Binance's choice is to respond with a lawsuit.

In June of last year, the U.S. Securities and Exchange Commission (SEC) sued several companies engaged in cryptocurrency asset business, including Binance and Coinbase. The lawsuit against Binance includes the sale of unregistered securities and improper handling of customer assets, among other things. Although the SEC's lawsuit is a civil matter and not a criminal one, Binance still chose to "fight to the death" in legal terms.

After more than a year of struggle, they have achieved interim results. In early July of this year, Coindesk reported that Judge Amy Jackson of the District of Columbia Court rejected some of the SEC's charges against Binance, including the sale of BNB tokens and the Simple Earn program on the secondary market as unregistered securities. However, the judge ruled that other charges against Binance can continue, including its initial token offering, and so on.

Proving oneself through the legal process for 1 or 2 years is effective but always full of uncertainty and expensive. No one understands this better than Binance. Most of the time, it needs to navigate through the current situation of a new industry and unclear regulations, build itself, dispel doubts, and prove positive value to users, the community, and the world.

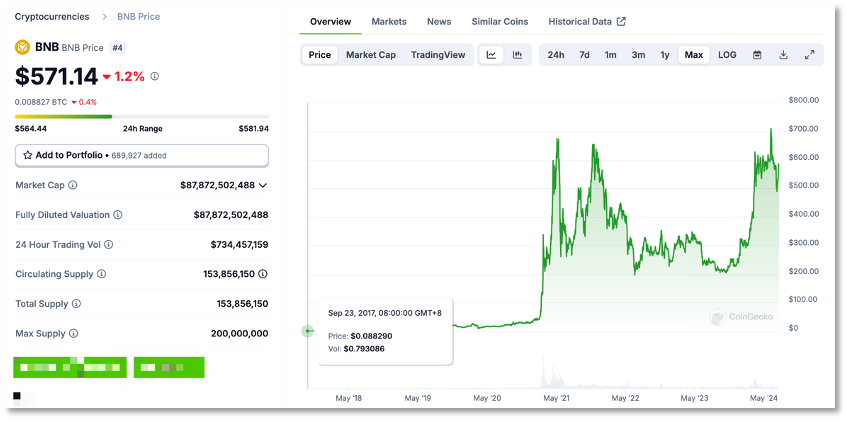

BNB is a microcosm of this process. In July 2017, this cryptocurrency token was born on the market as the platform token of Binance and was widely doubted, "What value does a token issued by an exchange have?" Following this was the wave of coin refunds under the ICO ban, and BNB fell below its initial price of $0.1.

BNB, which was not believed by the majority, rose to $1.5 at the end of 2017, driven by market cycles. As for its value, Binance first gave BNB a use case as a "fee for transactions" and designed a deflation mechanism for it through repurchase and destruction.

Price trend of BNB from 2017 to present, data from CoinGecko

Price trend of BNB from 2017 to present, data from CoinGecko

Market skepticism is always overcome by price, and competitors choose to follow suit. Subsequently, almost all cryptocurrency asset trading platforms created their own platform tokens, but none of them could match the market value of BNB (currently reported at $84.785 billion, ranking fourth in the cryptocurrency market value, after BTC, ETH, and USDT).

The use cases for BNB continue to increase. Today, it serves as the staking certificate for Binance's innovative project launch tool, LaunchPool, and the qualification certificate for the new asset issuance tool, Magadrop, as well as the donation asset for Binance Charity.

However, Binance has not locked BNB within the trading platform, so it does not represent the valuation of a traditional company. Instead, this exchange has returned BNB to the essence of blockchain.

From 2019 to 2020, BNB was converted into on-chain Gas for Binance Chain and Binance Smart Chain (now BNBChain), truly becoming a blockchain asset.

When BNBChain was born, it was also full of doubts, such as "exchange background," "21 nodes are not decentralized enough," "copycat chain," "dog chain," and so on. Binance's choice was to gradually let the community take the lead and not participate in node governance. The community strengthened infrastructure security during operation, while Binance fulfilled its obligation as the "asset gatekeeper" on the exchange. The chain and the exchange each performed their respective duties.

After BNBChain, exchanges creating chains became a trend. After a series of setbacks, BNBChain not only survived but also became a mainstream blockchain comparable to Ethereum in terms of low Gas fees, high transaction volume, and numerous applications. And BNB, which was less than $0.1 seven years ago, has risen to a high of $721 this year, a multiple of 7210 times.

Unlike Bitcoin, whose founder disappeared, the growth of BNB is to a certain extent the result of Binance's self-growth, representing the consensus of users on this platform. From the exchange to the entire ecosystem, Binance needs to continuously release credit to users, provide a friendly experience, dispel doubts through construction, and in turn enhance the "totem" of BNB.

A story of growing against the odds will always be touching. In 7 years, 200 million cryptocurrency asset users have chosen Binance.

Proving value is the only way to "bridge the gap"

Is having 200 million users enough to be stable?

He Yi doesn't think so. In recent public statements, she has been emphasizing that the 200 million refers to registered users, not active users.

Furthermore, in the industry, even giants like Binance have always had to face doubts, lawsuits, and even expulsion. The cryptocurrency market, with a total market value of 2 trillion USD, and over 14,900 types of token assets, is flooded with 1,158 trading platforms, attracting at most 600 million users.

In comparison, the global internet user base is close to 5 billion. If blockchain is considered as Web3.0, the 600 million users in the cryptocurrency market are currently not mainstream.

Even today, the only cryptocurrency that has entered the public eye is Bitcoin, which has also been accepted into the securities market in the form of an ETF, but the labels of "Ponzi scheme," "Tulip bubble," and "Pyramid scheme" have not been completely removed from Bitcoin in the public social media. Blockchain and cryptocurrency assets have been kept away from the public due to labels such as "crime," "money laundering," and "hacker's paradise," and are being scrutinized by regulatory authorities around the world.

In He Yi's view, the blockchain technology and cryptocurrency industry, which have been developing for more than 10 years, have not yet broken out of the niche market, "because our industry has not yet created more truly useful products for society."

If we count from the birth of Bitcoin in 2008, the cryptocurrency industry has reached its 15th year, and Binance has also started its eighth year. As one of the leaders in the cryptocurrency asset exchange industry, Binance has set its slogan for its seventh anniversary this year as "Be Binance."

"Be Binance" may be the dream of many exchanges in the industry because it means being the market leader in market share, trading volume, and user base. In the internet world, dominating traffic is almost equivalent to making the most money.

However, now, being Binance is not just about doing well in trading platform-related products. The higher requirement is to bear the cost of innovation and even trial and error, including external doubts and the game with regulatory authorities.

From this perspective, "Be Binance" is a call for the industry to unite and build together. For Binance itself, its long-term goal is actually its original intention at its creation—achieving financial freedom.

In the current world operating rules, this is an idealistic and adventurous goal, but it also reflects the needs of the vast majority of people in the world, and it happens to be something that blockchain technology can achieve.

In the eyes of many entrepreneurs in the cryptocurrency industry and even traditional financial practitioners, the best scenario for the practical application of blockchain technology is in finance. "The definition of Bitcoin itself is a peer-to-peer electronic cash system. The speculation of tokens has weakened the technological value. The peer-to-peer intermediary-free model can effectively eliminate the cost of cross-border payments, but this also means that the way of cryptocurrency assets must be within the regulatory framework to prevent crime," said a person in the payment industry in China.

He Yi explained that Binance's mission to "achieve financial freedom" is not in conflict with regulation; instead, it always needs to cooperate with regulation in this process, "This is the prerequisite for the cryptocurrency asset industry to move towards the mainstream world."

In recent interviews, He Yi has mentioned the phrase "bridge the gap" many times. She explained that it is only useful in the real world that can break through the dimensional barrier between Web2 and Web3, "and when we observe and look for high-quality projects, we also want to find products that are truly valuable in the scene, and grow with such projects. They must have a verified business model that can self-generate revenue, rather than just relying on issuing tokens for profit and then running away, but such excellent projects are not many."

Unfortunately, even Binance cannot influence the market's preference for highly volatile cryptocurrency assets. People are eager to achieve wealth myths from tokens that increase tenfold or a hundredfold. Even though everyone knows that the Meme coin related to Trump has no practical use, it doesn't matter, as long as it rises, it generates heat, and heat means traffic, and traffic is the battleground for exchanges.

The current cryptocurrency asset industry does not seem to be ready to "bridge the gap." Perhaps "achieving financial freedom" will ultimately depend on Binance continuing to navigate through the current situation, but it has launched the call "Be Binance," as if shouting to the industry: instead of questioning Binance, let's become Binance together.

(Disclaimer: Readers are strictly required to comply with local laws and regulations. This article does not represent any investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。