Solana will benefit greatly from the expansion of its staking economy.

Author: David C, Bankless

Translator: Deng Tong, Golden Finance

Staking remains one of the most active parts of the Solana network.

Staking, which involves locking up capital in exchange for network security and earning rewards, is an important component of DeFi and one of the most powerful sectors in on-chain economies. Staking requirements vary by chain; Ethereum requires native staking of 32 ETH on individual nodes, or users can choose to use liquid staking providers such as Lido or Rocket Pool. On Solana, anyone can engage in native staking through its proof-of-stake delegation system by delegating to validators rather than running their own nodes.

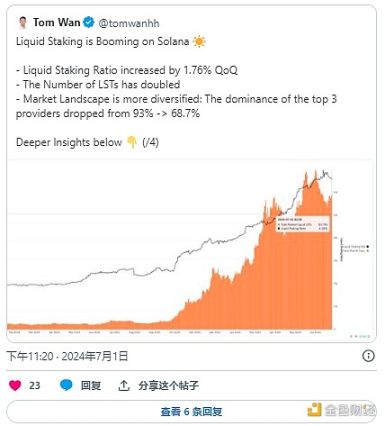

The convenience of this staking may explain the significant disparity between total staked assets and liquid staked assets for Solana and Ethereum. Solana has $61 billion in staked capital, surpassing Ethereum, but lags behind in liquid staking. Ethereum has 65% of staked ETH in liquid form, while only 6.5% of staked SOL on Solana is in the form of liquid staking tokens (LST), indicating significant growth opportunities for Solana.

In this article, we will explore the current landscape of SOL liquid staking, examine key participants, and protocols innovating and addressing this opportunity. Let's get started!

Top LST on Solana

Jito, Marinade Finance, and Jupiter dominate Solana's liquid staking, holding 80% of SOL in LST. Let's take a look at the uniqueness of each protocol and how they are increasing their staking share.

Jito's JitoSOL

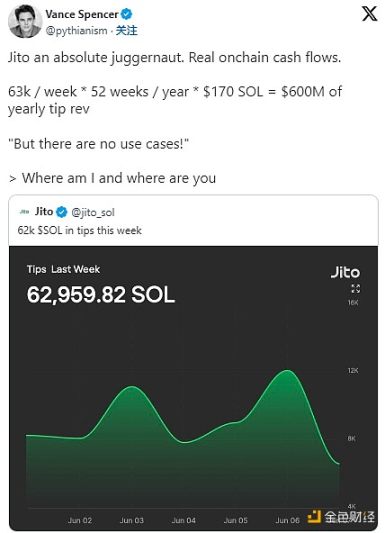

JitoSOL is not only the largest LST (holding 48% of liquid staked SOL, valued at $1.7 billion), but Jito is also the largest protocol on Solana.

Jito is known for its large-scale airdrops, allowing users to stake SOL and receive JitoSOL for use in the DeFi network.

Jito's standout feature comes from its unique approach to MEV, providing users with better returns while maintaining network health. Jito supports special validators that can optimize block space and fairly include transactions, avoiding harmful strategies such as sandwich attacks or front-running. This helps MEV perform more positively, allowing JitoSOL holders to earn approximately 15% more.

As the largest LST on the network, JitoSOL is deeply rooted in DeFi. It is a popular asset for borrowing across protocols like Solend, Drift, and Marginfi, and can be leveraged on Kamino for higher returns. These integrations create a liquidity flywheel, positioning JitoSOL as the most efficient and effective LST, increasing demand for the asset. Finally, Jito's impact on the Solana network goes beyond just increasing staking rewards. Through StakeNet, a decentralized system for optimizing validators, Jito improves performance and fairly distributes rewards, making the network more efficient and secure for all participants.

Marinade Finance's mSOL

Marinade Finance ranks second, holding 22% of the total LST market share.

mSOL was launched in August 2021 and functions similarly to JitoSOL, with staking rewards appreciating over time. In July 2023, Marinade introduced Marinade Native, allowing direct staking of SOL and earning rewards at each stage, avoiding smart contract risks while retaining control of SOL. Additionally, Marinade's protected staking rewards ensure stakers do not lose rewards due to validator performance issues by requiring validators to provide collateral.

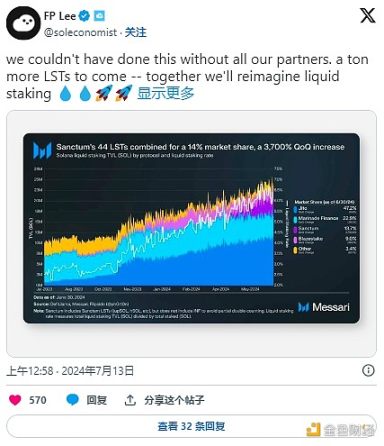

Marinade was once the largest LST, but was later overtaken by Jito, yet it remains the second-largest protocol on Solana overall. However, its TVL continues to decline, not losing share to Jito, but to Sanctum, a protocol for creating, launching, and unifying LST liquidity.

Jupiter's JupSOL

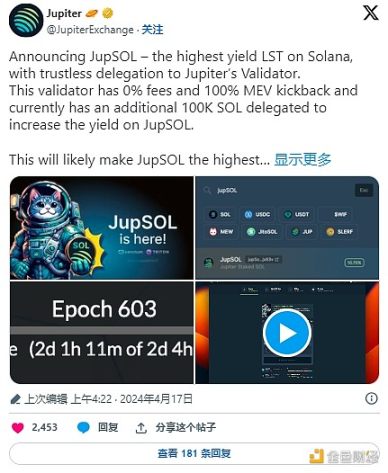

Ranked third is JupSOL, with 10% of SOL staked in LST launched by Jupiter and Sanctum.

JupSOL was released in April and quickly gained market share, offering instant liquid staked SOL validated by Jupiter. In addition to staking rewards and MEV kickbacks, JupSOL also provides high yields, thanks to Jupiter's team staking 100,000 SOL. JupSOL also increases Jupiter's inclusion rate by increasing staking by its validators. The more staked by validators, the higher priority they have for transaction processing on Solana. Therefore, even during busy periods, validators from Jupiter can process more transactions. Holding JupSOL makes Jupiter's validators more influential, thereby improving transaction efficiency and success rates on platforms like Jupiter and Sanctum.

What is Sanctum?

Sanctum was initially launched in February 2021, allowing whitelisted validators to create and launch their own liquid staking tokens while unifying the liquidity of these derivatives.

Sanctum's custom LST can be used for various purposes, from increasing returns to enabling NFT whitelisting or subscription services. Sanctum addresses critical liquid staking issues through three core functions, unifying decentralized liquidity and expanding limited LST options. The Sanctum Router enables seamless LST conversion, the Sanctum Reserve provides instant liquidity to unlock staking, and the Infinity Pool is a multi-LST liquidity pool that natively supports an unlimited number of LST, unlike traditional pools that support only a few assets. It ensures fair LST prices and dynamically adjusts swap fees to optimize returns and maintain the correct balance of each LST in the pool. Depositing LST or SOL into the Infinity Pool generates Sanctum's LST, INF, which can be used in DeFi protocols like Kamino and Meteora.

Sanctum's vision extends beyond just liquid staking. Ahead of the token launch this Thursday, Sanctum's FP Lee outlined a vision centered around three core products.

Overall, Sanctum's approach enhances liquidity, expands LST use cases, and supports the most fundamental on-chain economy through Launchpad, Profiles V2, and Pay. These developments could have a significant impact on the Solana ecosystem by improving liquidity, creating new LST distribution pathways, and providing novel LST use cases.

Re-staking on Solana

In addition to liquid staking, Solana has seen the continuous development of re-staking protocols, leveraging the activity of its main chain to expand its use cases.

Early protocols such as Cambrian, Picasso, and Solayer aim to add re-staking to Solana's modular expansion.

Solayer: Re-staking provider Solayer aims to create an application chain network secured by Solana's economic security. Leveraging Solana's multitasking and fast transaction architecture, Solayer can improve workload distribution and service customization. This extends Solana's capabilities, providing better consensus and block space customization for developers—especially useful considering the recent momentum of Solana L2s. Solayer's soft launch in May reached a $20 million deposit cap for SOL and LST within 45 minutes, demonstrating strong demand that continues to grow, with its TVL reaching approximately $127 million.

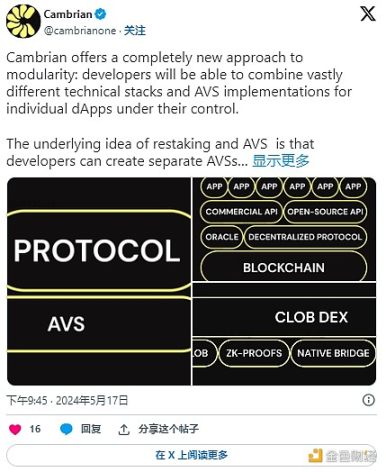

Cambrian: Cambrian is developing a modular re-staking layer for Solana to reduce costs and enhance resource allocation, benefiting decentralized oracles and AI processors. Their model allows protocols to lease security from Solana, reducing the cost of on-premises solutions and positioning it as an on-chain alternative to cloud providers like AWS. Their testnet is expected to launch this summer.

Picasso: Initially focused on connecting Solana and Cosmos, Picasso has evolved into a re-staking hub supporting other Solana projects, such as the upcoming re-staking L2 Mantis. Using the Cosmos SDK framework, Picasso connects chains that support IBC, enhancing its utility and security. Picasso's universal re-staking layer and IBC protect applications requiring temporary or permanent security. This enables re-staking of SOL and its LST, providing new staking options and facilitating liquidity exchange.

Preparing for Growth

Solana will benefit greatly from the expansion of its staking economy.

Compared to the overall staked SOL, the proportion of SOL staked in LST is relatively low, and protocols such as Jito, Marinade Finance, and Jupiter will continue to thrive as the ecosystem develops. Sanctum plays a crucial role in this evolution, addressing the issue of fragmented liquidity. Additionally, while it may be premature to develop re-staking on Solana considering the re-staking status on Ethereum, it does align with the modular development momentum we see in SVM L2 and application chains, indicating that protocols like Cambrian, Solayer, and Picasso can expand the primary functions of the chain and further drive LST growth.

Overall, driven by the potential expansion of innovative protocols, competitive yields, and the role LST plays on-chain in developing and supporting new economies, Solana's staking economy seems poised for significant growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。