In the second quarter, Solana continued to be one of the main platforms for cryptocurrency activities.

Author: Peter Horton

Translator: DeepTechFlow

Key Insights

Pump.fun is a gamified token issuance platform that collected a total of $48 million in fees in the second quarter. Raydium is the main beneficiary of pump.fun—its daily trading volume increased by 77% to $867 million, and TVL (Total Value Locked) increased by 46% to $991 million.

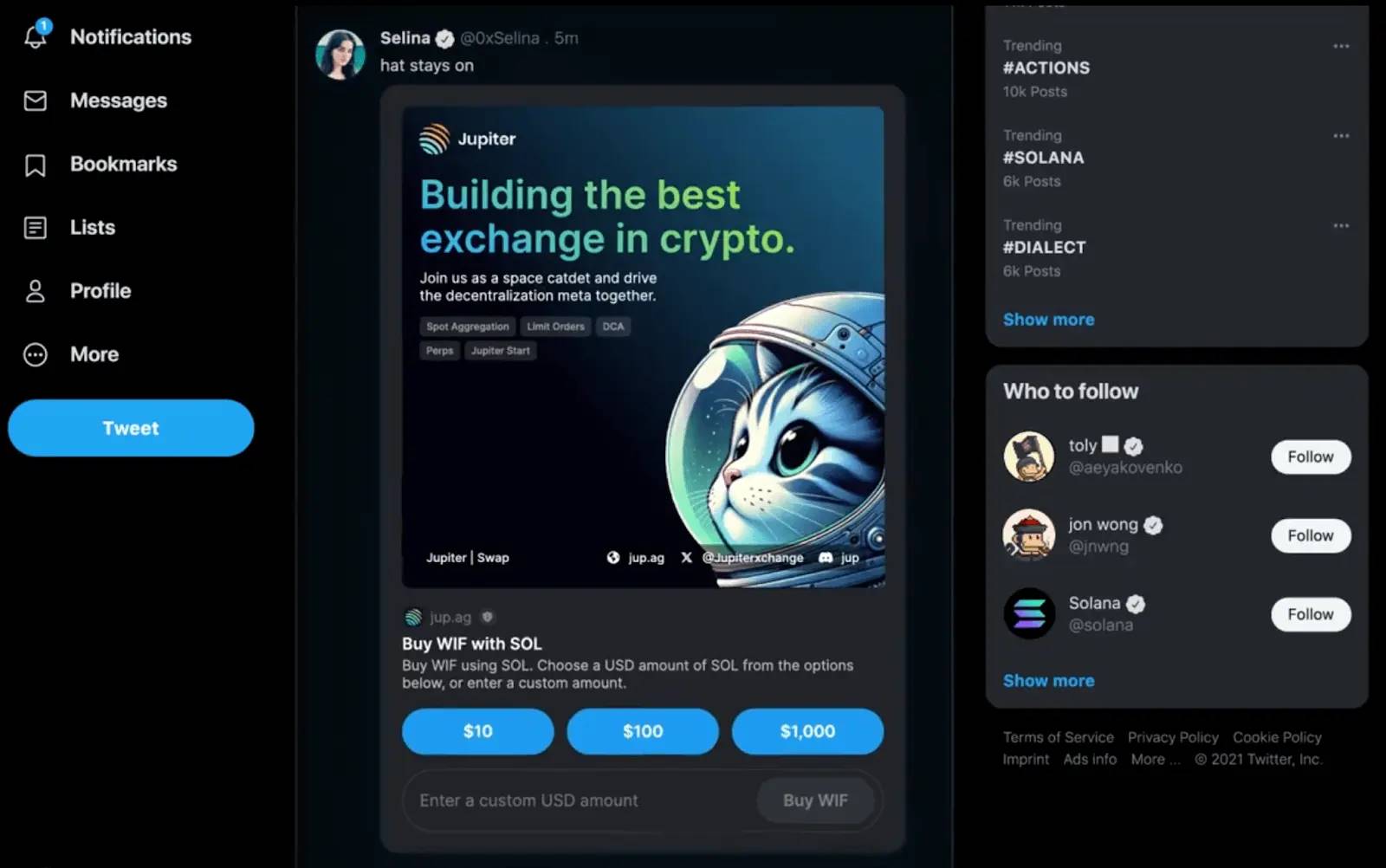

Dialect and the Solana Foundation launched Solana Actions and Blockchain Links (Blinks), allowing users to directly preview and execute transactions in various digital environments, first launched on X (formerly Twitter).

Institutional builders continue to choose Solana for payment use cases. PayPal extended PYUSD to Solana, utilizing token extension features such as confidential transfers, and Stripe announced support for payments on Solana.

Several Solana ecosystem teams have launched scaling solutions, allowing users to stay on L1, including Light Protocol and Helius' ZK compression, as well as MagicBlock's MagicBlock Engine.

Congestion in the network at the beginning of the second quarter was caused by meme coin activities and Ore mining, leading to junk transactions. This issue was mitigated by the introduction of Agave, which utilizes stake-weighted Quality of Service (QoS), and introduced new structural demands for SOL.

Primer

Solana (SOL) is an integrated open-source blockchain that aims to synchronize global information at the speed of light. Solana optimizes for latency and throughput, sacrificing some verifiability. It achieves this through its novel timestamp mechanism (called Proof-of-History, PoH), block propagation protocol Turbine, and parallel transaction processing. Since its mainnet launch in March 2020, several network upgrades have further improved network performance and resilience, including QUIC, Stake-weighted Quality of Service (QoS), and on-chain fee markets.

The development and growth of the network and ecosystem are supported by non-profit organizations such as the Solana Foundation, Solana Labs, and many third-party organizations including Anza, Colosseum, Helius, and Superteam. Solana Labs has raised over $335 million through private and public token sales. The Solana ecosystem has seen continuous growth in various areas, including DeFi, consumer, DePIN, and payments.

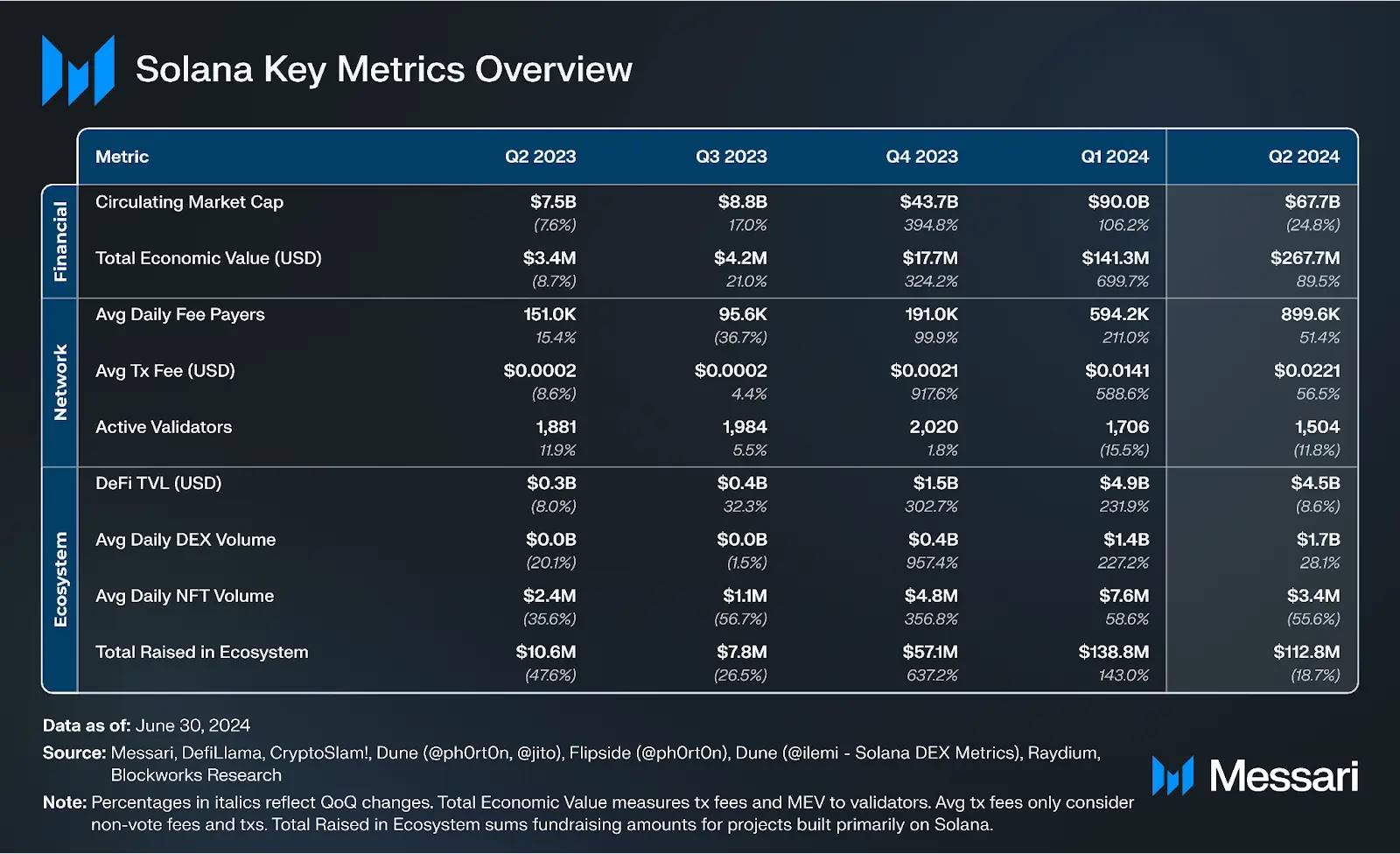

Key Metrics

Ecosystem Analysis

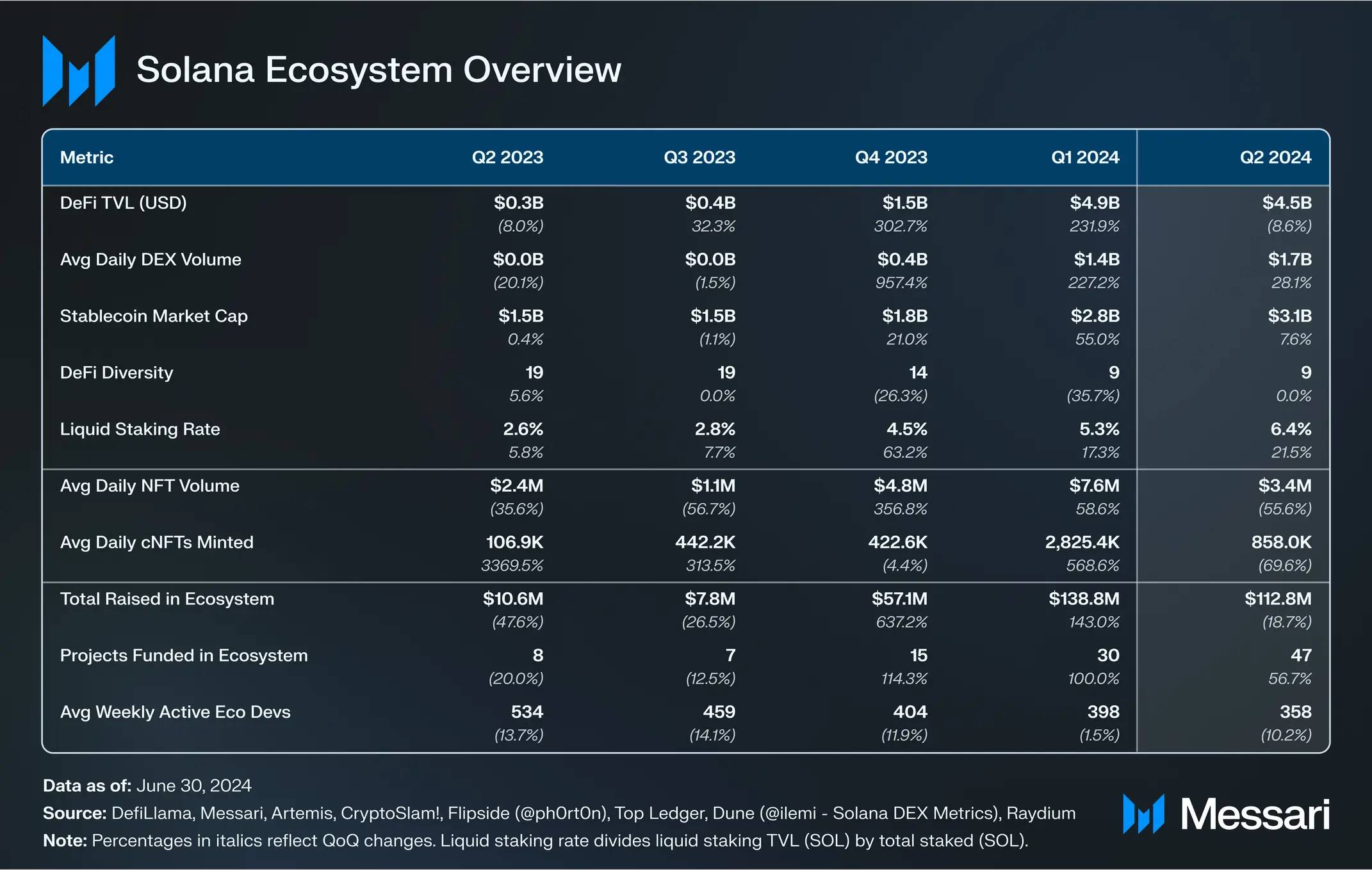

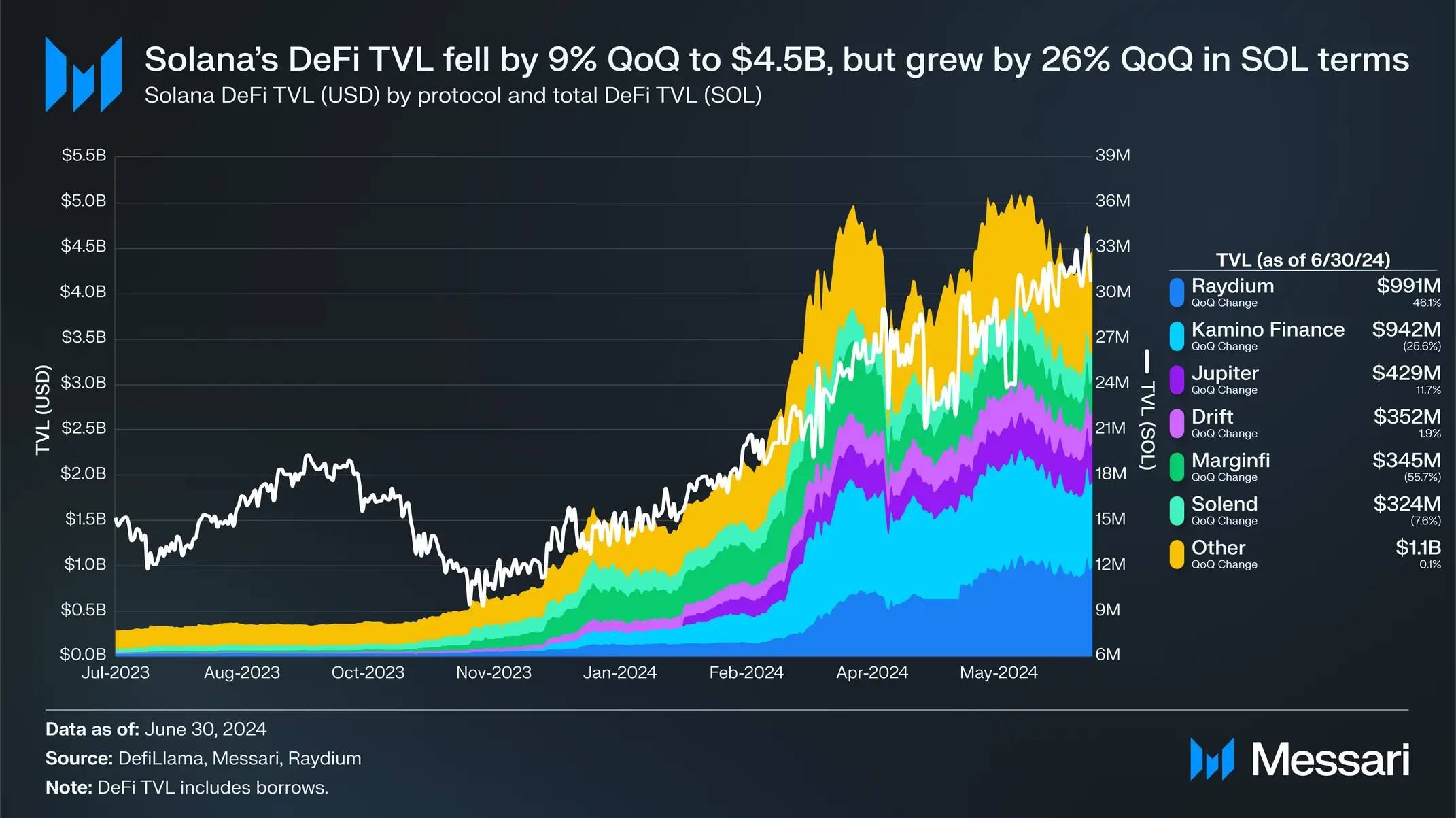

DeFi

Solana's DeFi TVL decreased by 9% to $4.5 billion in the second quarter, ranking fourth in the network. However, DeFi TVL priced in SOL increased by 26% on a quarter-over-quarter basis, indicating that the decrease in USD valuation may be more driven by token price depreciation rather than capital outflows.

Lending

Kamino Lend's TVL decreased by 26% to $942 million on a quarter-over-quarter basis. The decrease occurred after strong growth in March, when future token snapshots were announced. Kamino launched its token on April 30, airdropping 7.5% of the total supply. KMNO had a market value of $33 million at the end of the quarter, with a circulating supply of 10%. In the second quarter, Kamino also added support for token extensions, allowing borrowers to repay debts with collateral assets, and introduced notification features supported by Dialect functionality.

After significant growth in the second half of 2023, MarginFi's lending protocol lost market share in TVL in the first half of 2024. Its TVL decreased by 56% to $341 million on a quarter-over-quarter basis, mainly due to withdrawals of over $200 million within 24 hours in April. This outflow was a response to the Twitter controversy and the resignation of MarginFi leader Edgar Pavlovsky citing internal disputes. MarginFi's token program had been running for over a year, and some users were dissatisfied with the lack of token issuance. Nevertheless, MarginFi successfully processed all withdrawals during the turmoil and saw some deposits return later. In the second quarter, MarginFi also introduced its liquidity layer and improved its onboarding experience.

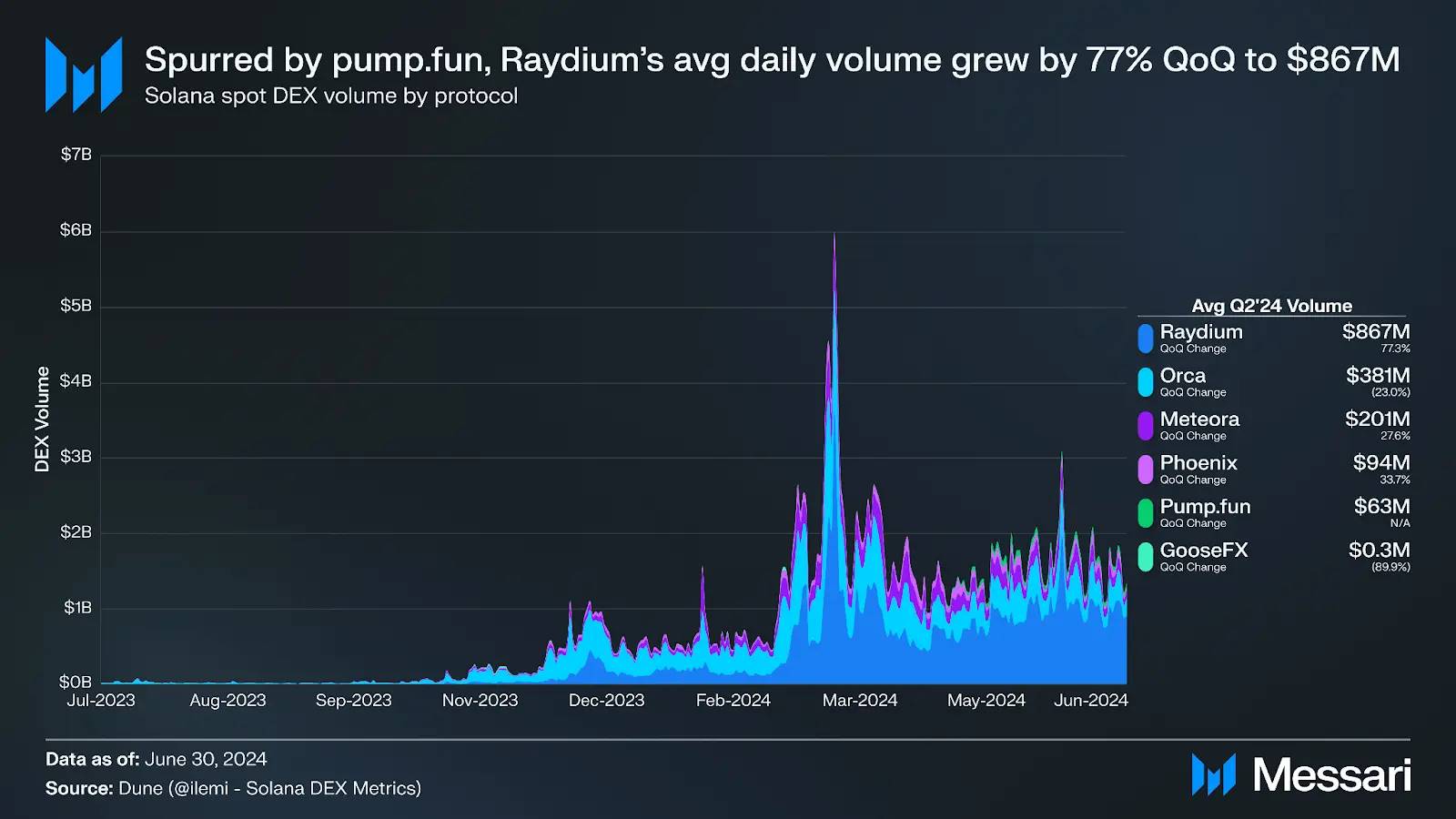

DEXs

Compared to the peak activity in March, DEX trading volume has slightly decreased but remains at a high level. The daily average spot DEX trading volume increased by 32% to $16 billion on a quarter-over-quarter basis. DEX activity continues to be driven by meme coin trading, with WIF, MEW, POPCAT, and GME being among the top ten token pairs in trading volume in the second quarter.

In the second quarter, meme coin activity shifted to pump.fun, a gamified token issuance platform that became one of the most widely discussed applications in the crypto space. In the second quarter, it collected an average of $525,000 in fees per day. At the end of May, several celebrities began launching their own tokens on pump.fun, sparking a celebrity memecoin craze and causing some controversy. The popularity of pump.fun has spawned forked projects such as Dexscreener's Moonshot, Whales Market's whales.meme, and Meme Royale.

Raydium is the main beneficiary of pump.fun, as all liquidity obtained from pump.fun's bond curve is transferred to Raydium once the token reaches the market value threshold. Raydium's daily trading volume increased by 77% to $8.67 billion on a quarter-over-quarter basis, and its market share increased from 40% in the first quarter to 54%. Its DeFi TVL also increased by 46% to $9.91 billion on a quarter-over-quarter basis, making it the highest TVL DeFi protocol on Solana. In the second quarter, Raydium also released its V3 user interface and introduced a new stable product AMM plan.

Jupiter remains the primary source of trading on Solana, accounting for 51% of spot DEX trading volume in the second quarter. However, its market share decreased throughout the quarter, dropping to 37% in the last week, surpassed by Raydium's 38% market share. Significant updates for Jupiter this quarter include:

Metropolis: At the end of June, Jupiter announced Metropolis, its V3 exchange protocol upgrade. New features include instant routing support for new tokens on Raydium, Meteora, and Orca; dynamic slippage settings; improved token search functionality; new token list labels; and simplified user experience warnings.

Tokenomics Proposal: Jupiter founder meow shared a proposal suggesting a 30% reduction in the total supply of JUP, with a 30% reduction in team supply and future airdrop issuance.

GUM: At the end of May, Jupiter announced its Giant Unified Market (GUM) plan, collaborating with RWA token issuers, liquidity providers, and investors to bring more types of assets onto the chain.

Ultimate Acquisition: At the end of April, Jupiter acquired the mobile wallet Ultimate and its team to support its plan for the Jupiter Mobile application.

The daily average trading volume of Jupiter's perpetual contracts is $370 million, an increase of 13% quarter-over-quarter. Other major perpetual contract exchanges include:

Drift: Drift's daily average perpetual contract trading volume decreased by 11% to $127 million quarter-over-quarter. In mid-May, the Drift Foundation released the DRIFT token, airdropping 12% of its total supply. The token is managed by the Drift DAO, which consists of an elected security council and Realms DAO, as well as a Futarchy DAO for allocating grants. DRIFT had a market value of $76 million at the end of the quarter, with approximately 17% of the tokens in circulation.

Zeta: Zeta's daily average perpetual contract trading volume increased by 212% to $82 million quarter-over-quarter. In mid-May, it announced a $5 million funding round led by Electric Capital and plans to build a dedicated rollup on Solana. At the end of the quarter, Zeta launched its token, airdropping 10% of its total supply. ZEX had a market value of $18 million at the end of the quarter, with approximately 16% of the tokens in circulation.

FlashTrade: After a full launch in the previous quarter, FlashTrade gained traction at the end of the second quarter, with a daily average trading volume of $104 million in March.

Stablecoins

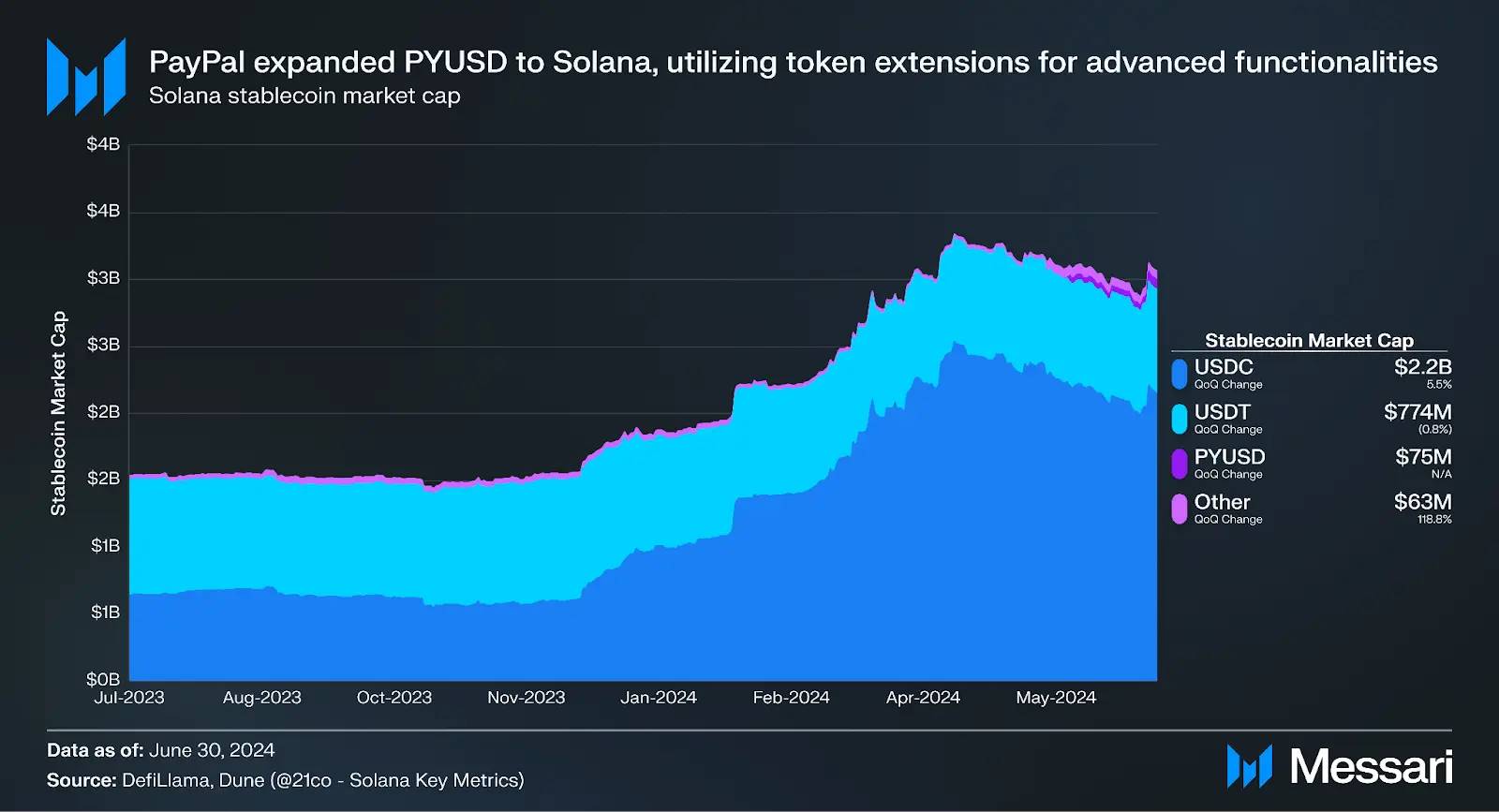

The market value of stablecoins on Solana increased by 8% quarter-over-quarter to $3.1 billion, ranking sixth among all blockchain networks.

At the end of May, PayPal expanded its stablecoin, PayPal USD (PYUSD), to Solana, making it the second supported network after Ethereum. The stablecoin is issued by Paxos and has received approval from the New York State Department of Financial Services. In addition to low transaction costs and high throughput, PayPal also highlighted token extension functionality as a key reason for deploying on Solana.

PYUSD has several extension features, especially the privacy transfer feature, which keeps the transfer amount hidden from everyone except the sender, recipient, and optional third-party auditor. The privacy transfer feature has not been activated on Solana yet due to the need for further system calls. PayPal also emphasized memo fields and transfer hooks, allowing developers to add programmable logic to transfers.

At the end of the quarter, the circulating market value of PYUSD on Solana was $75 million, but the distribution was relatively concentrated. While the token has been officially launched, it is still awaiting more integrations to promote wider adoption. Several centralized exchanges are working to integrate token extension functionality to support PYUSD. Shortly after the end of the quarter, several Solana dApps, including Jupiter and Kamino, as well as an incentive campaign, have integrated PYUSD.

Despite these developments, USDC remains the dominant stablecoin on Solana, with its Solana market value increasing by 5.5% to $2.2 billion quarter-over-quarter. In June, Circle expanded its Web3 services to Solana, bringing its programmable wallets and gas station functionality. These APIs enable developers to embed secure multi-chain wallets into their applications and pay transaction fees on behalf of users. The promotion will be phased, with future releases supporting NFT transfers and program interactions.

Other notable DeFi-related events include:

RWA: Token issuance for Parcl, $5 million funding for BAXUS, $5 million funding for AgriDex, MXNe issuance for etherfuse, Solana migration for MetaWealth, tokenized commodities introduction for elmnt, collaboration between Drift and Ondo, closed beta release for Bridgesplit, collaboration between VNX and Sygnum Bank, and collaboration between Velo and Solana Foundation.

Bitcoin-related: $8 million funding and token issuance for Zeus Network, WBTC issuance for Wormhole, issuance for 21BTC, and APOLLO alpha testnet release for Zeus Network.

Re-staking: Release for Picasso re-staking, introduction of Mantis for Composable, and introduction of re-staking for Solayer.

Others: $20 million funding for Ellipsis Labs, testnet release for DFlow, release for C3, perpetual contract introduction for Adrena, perpetual contract aggregator introduction for Ranger Finance, limit order release and incentive measures for Photon, Sandglass release for Lifinity, Telegram bot release for Bullpen, RugCheck Token Verification release, V4 release for Prism, and Solana integration for Coinhall.

Liquidity Staking

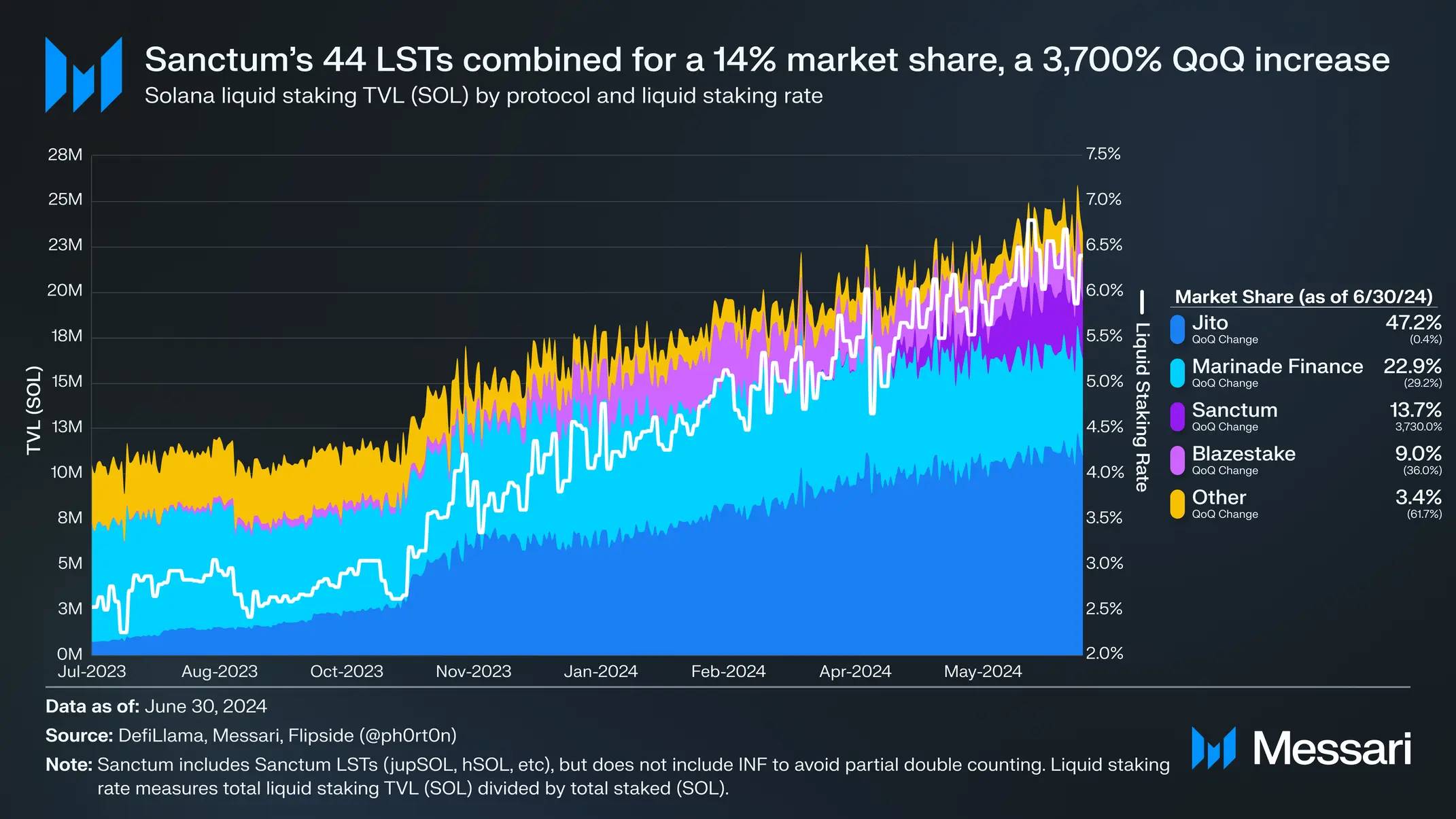

The liquidity staking rate on Solana (the percentage of staked SOL in total staked amount) increased by 22% quarter-over-quarter to reach 6.4% in the second quarter. With 65% of eligible SOL supply staked, the liquidity staking rate needs to continue to grow to support a yield-based SOL ecosystem.

Since its launch last quarter, Sanctum has rapidly gained market adoption, with its Sanctum LSTs accounting for nearly 14% of the Solana LST market share, representing a 3700% increase quarter-over-quarter. Its adoption has accelerated due to several market structure changes, particularly the Stake Weighted Quality of Service (SWQoS). To address network congestion issues in April, the Solana network upgrade further leveraged SWQoS. SWQoS incentivizes applications and infrastructure providers to run validators and accumulate stakes to provide a better user experience for their users.

As a result, several projects have launched their own validators, including Jupiter, Drift, DRiP, and Helius. Like other projects, these four projects have also launched single-validator LSTs to improve distribution and provide unique benefits. For example, DRiP distributes free Droplets to hausSOL holders, and dSOL can be used as collateral on Drift.

Currently, Solana does not support validators returning block rewards (base and priority transaction fees) to delegators. This native feature only applies to inflation rewards. Historically, this has not been significant as fees typically only account for 1% of the total validator rewards (excluding MEV). However, since the end of March, this proportion has risen to 5-10%, prompting validators to reallocate fees to compete in annual percentage yield (APY). As a result, many validators choose to use single-validator LSTs because of their simpler fee reallocation mechanism.

LSTs are also experimenting with different methods of distributing staking rewards. For example, Cubik's iceSOL allocates all staking rewards to public goods funding, while wifSOL dollar-cost averages all staking rewards to WIF and distributes WIF back to delegators.

Overall, Sanctum has 44 LSTs, with over 20 new LSTs added in the second quarter. The richness of LSTs benefits from Sanctum Infinity, a multi-LST liquidity pool that allows supported LSTs to leverage each other's liquidity. The top-ranked Sanctum LSTs by staked amount include Jupiter's jupSOL (2.3 million SOL), Helius's hSOL (403,000 SOL), and Solana Compass's compassSOL (340,000 SOL).

In early April, Sanctum announced a $6.1 million funding round led by Dragonfly, followed by the launch of the Sanctum Wonderland points program, where participants can collect pets representing LSTs and upgrade them through community tasks. In early June, it launched CLOUD, announcing future airdrops and token sales through Jupiter's LFG and Meteora Alpha Vault.

Jito's jitoSOL remains the leader in Solana's LST. Its supply increased by 22% to nearly 1.1 million SOL, capturing 47% of the market share. The community is currently discussing a governance proposal to begin transitioning the management of Jito's staking pool to StakeNet. StakeNet is an open-source protocol for decentralized Solana staking pool operations. The proposed transition will bring higher transparency, enhanced security, greater efficiency, and community governance to Jito.

Marinade's mSOL supply decreased by 13% to 5.3 million SOL, capturing 23% of the market share. Its native staking product, Marinade Native, has an additional 2.7 million SOL. In mid-June, Marinade launched its Stake Auction Marketplace, where validators can bid on staked SOL. The feature will be rolled out in phases and is expected to go live in the third quarter of 2024.

Consumer

NFT

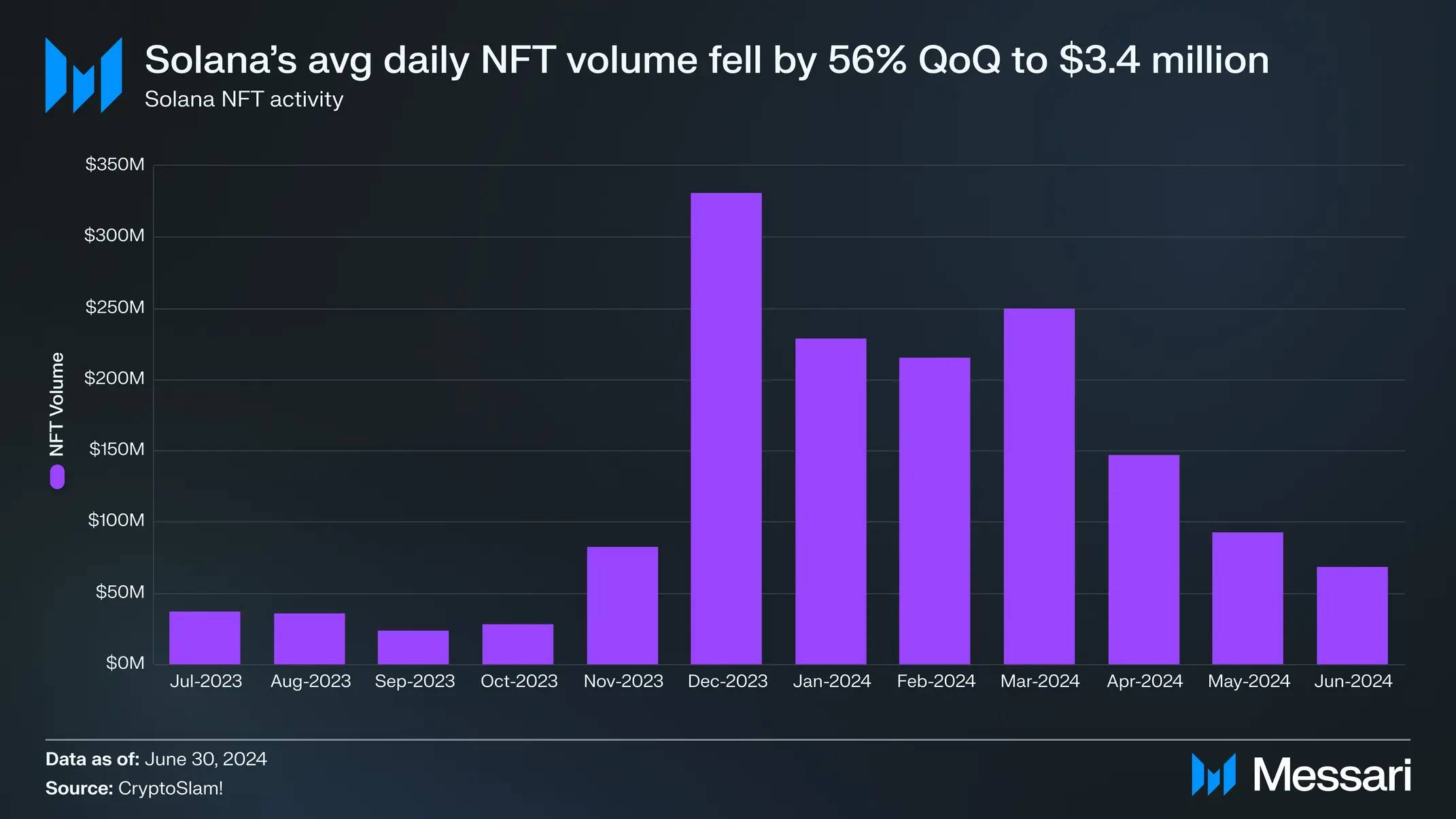

After experiencing a period of activity at the end of 2023 and the beginning of 2024, NFT trading volume decreased in the second quarter. The average daily trading volume decreased by 56% to $3.4 million. This quarter, there has been a shift in the NFT market landscape, with Magic Eden reclaiming the majority of the organic trading volume, increasing from 25% to 59%. In contrast, Tensor's market share decreased from 71% to 35%.

In early April, the Tensor Foundation released the TNSR token and airdropped 14.8% of the total supply. Since the token's release, its market share is at 31%. As of the end of the quarter, the market cap of TNSR is $73 million, with approximately 13% of the total supply in circulation. Magic Eden continues to operate its reward program and is expected to launch its own token.

Mads Lads is the series with the highest trading volume, with a total trading volume of 230,000 SOL. At the end of the quarter, an address purchased 59 Mad Lads, spending approximately 5,600 SOL (about $800,000). Other top-ranked series by trading volume in the second quarter include Solana Monkey Business (104,000 SOL), Tensorians (91,000 SOL), Froganas (74,000 SOL), and Famous Fox Federation (51,000 SOL).

Most Solana NFTs are minted using the NFT standard from Metaplex. In early April, Metaplex introduced a new NFT standard called Core. Core is designed with a single account for cost and performance optimization and features a flexible plugin system for further customization. The first external plugin is the Oracle plugin, enabling digital assets to react to real-world data.

At the end of May, Metaplex launched MPL-404, a hybrid token standard protocol developed in collaboration with Mutant Labs, who first introduced the SPL-404 standard. Dubbed "hybrid DeFi," the token standard aims to bring more liquidity to NFTs while preserving their unique characteristics.

Other NFT-related events include the issuance of SHARK by SharkyFi announcement, the token announcement by Exchange Art announcement, the introduction of Artrade introduction, the sale of Picasso by Artrade sale, the release of Garden Labs' owner-editable metadata program release, the open-source cNFT minter by 3.land minter, and the selection of Claynosaurz as a finalist for the Collision Choice Awards finalist.

Social and Creator Platforms

Blinks are shareable links that convert Solana Actions into URLs with rich metadata. These links allow supported clients (such as browser extension wallets or bots) to display enhanced functionality, making transaction previews in wallets or expanded interactive buttons immediately visible. Currently, only blinks from registered partners will expand directly on Twitter. Users also need to enable blinks in the settings of their browser extension wallet to expand.

Many top Solana projects have already created blinks, including Jupiter, Tensor, Sphere, and TipLink. Blink builders can apply for small grants (up to $1,000 per grant) through Superteam Earn or directly from the Solana Foundation for larger grants (with a total distribution of up to $400,000).

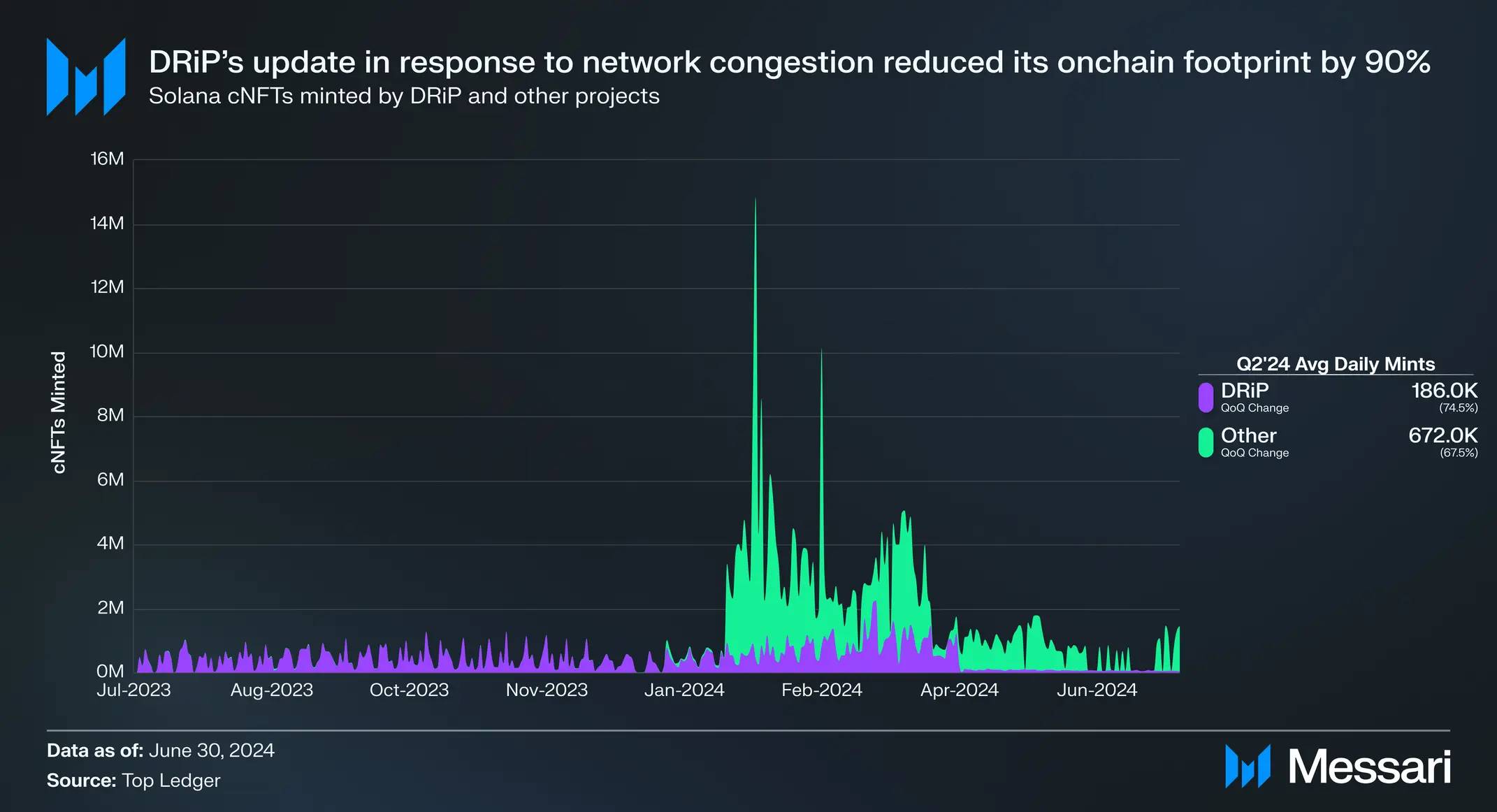

Like other applications, DRiP's user experience was affected by network congestion in early April. In mid-April, it released an update to address this issue. Now, DRiP only mints collectibles on-chain when claimed by users, resulting in a 90% decrease in the daily minting of cNFTs.

In mid-April, DRiP introduced comic artist Todd McFarlane, the creator of "Spider-Man" and "Spawn." In an auction on DRiP, a 1:1 digital scan of the original artwork "Spawn #1" was sold for over 110 SOL (16,000 USD) price. Other creators who joined DRiP in the second quarter include Rockstar Games artist Stephen Bliss, wallstreetbets, and singer Jason Derulo.

Other consumer-related events include:

Solana Labs' Bond: In mid-June, Solana Labs launched the customer loyalty platform and API Bond. It aims to open up new revenue streams, provide product traceability and authenticity, enhance customer insights, and protect data privacy by enabling brands to easily launch NFTs and integrate blockchain-based payment rails.

Audius Update: Audius is a music streaming platform aimed at redistributing power to artists. At the end of June, it introduced real-time streaming payments, allowing artists to receive immediate payments for tracks and albums to Coinbase or other Solana wallets. Subsequently, it announced licensing agreements with all major U.S. performing rights organizations (PROs).

Others: Cupcake's beta release, a $1.3 million funding round led by Newman Group for Only1 financing, the acquisition of Solarplex by Forward Research of the Arweave ecosystem acquisition, dReader's Cubik funding round distributing $40,000 to comic creators distribution, the release of transferable subscription feature by Access Protocol release, the app release by Crowny release, the release by GigHub, the iOS app release by Nina, and the introduction of Popset.

Gaming

While some on-chain games are entirely built on the Solana mainnet, others have opted for scaling solutions to achieve customizability and higher performance. In the second quarter, several projects announced Solana-based scaling frameworks designed for games:

MagicBlock: In mid-June, MagicBlock launched the MagicBlock Engine, a framework that enhances performance and virtual machine (VM) customizability without sacrificing composability. The engine deploys "ephemeral rollups," settling state to a temporary runtime on Solana when closed. The entire lifecycle of ephemeral rollups is abstracted to users, who still transact and hold assets on the Solana mainnet. Although the MagicBlock Engine is built for full-chain games, the team noted that it has already sparked interest from non-gaming projects.

Sonic: In mid-June, Sonic announced a $12 million funding round led by Bitkraft and launched its testnet. Sonic is a Layer-2 stack that supports a shared orderer network and game-specific rollups settled on Solana. Sonic leverages SVM and supports EVM code through its HyperGrid interpreter.

In early May, Solana Labs partnered with Google Cloud to bring its Web3 game development API, GameShift, to game developers on Google Cloud. After exiting the beta phase last quarter, GameShift added several new features this quarter, including asset creation, in-game token support, and developer wallets.

Other gaming-related developments in the second quarter include the Surge release of Star Atlas, STEPN's collaboration with Adidas, Blockasset's partnership with UFC, the early access release of Seekers of Tokane by Aurory, the token release and esports collaboration of Nyan Heroes, the Solana Speedrun 3 game creative competition, the Virtual Kentucky Derby by Photo Finish LIVE, and the collaboration with Pace Advantage by Photo Finish LIVE. Additionally, there were developments such as the conclusion of the burger game by Blessed Burgers, the public beta release of Chomp, updates by BetDEX, an airdrop by Portals, the $12 million funding of Bladerite developer Seeds Labs, Solana integration by MON Protocol, the release of The Backwoods, the release of SolForge Fusion, the Solana Games Ambassador Program for creators, teasers by Lowlife Forms and Valannia for their gameplay, and the Solana expansion plan by Love Monster.

DePIN

Solana is becoming the center for DePIN applications, hosting projects such as Helium, Hivemapper, Render, and Teleport.

Notable events in the second quarter include:

Helium Licensing Program: In mid-June, Helium Mobile announced its licensing program for its tech stack, allowing third-party manufacturers to produce and sell hotspot devices. The program aims to generate licensing fees and expand the Helium Mobile hotspot network, reducing reliance on T-Mobile. After the quarter ended, the Helium Foundation announced the expansion of the Helium network beyond wireless.

Shaga Financing: Shaga, a P2P network for game computing, announced a $1 million financing round led by Arca, close to the end of June. Shaga was previously a winning project at the Solana Foundation Q3’23 Hyperdrive hackathon and is currently in the closed testing phase.

Io.net Token Release and Criticism: In mid-June, decentralized GPU aggregator io.net released its token, IO, along with Binance Launchpool and a community airdrop. IO had a market value of over $325 million at the end of the quarter, with just over 10% of the total supply in circulation. Earlier in the quarter, the project faced criticism for the number of GPUs displayed on its UI. Just two days before the token release, its CEO resigned, and the former COO took over.

Ambient Financing: In May, Ambient announced a $2 million seed round led by Borderless Capital. Ambient also announced the acquisition of the decentralized environmental monitoring network PlanetWatch. In the third quarter, Ambient plans to migrate the PlanetWatch token and network from Algorand to Solana, and launch a new mobile application and upgraded backend.

Teleport in Austin: After launching in its first city (University City in Texas) last quarter, the decentralized carpooling protocol Teleport went live in Austin, Texas at the end of May.

Roam Migration: In early April, the decentralized WiFi network Roam announced its migration to Solana. The Roam application later went live on the Solana Mobile dApp store.

Payments

With low transaction costs, sub-second finality, and a network of thousands of nodes, Solana aims to help drive mainstream payment flows. Visa announced that it will pilot its USDC settlement on Solana in the third quarter of 2023.

Notable events from Solana-native payment infrastructure companies and applications this quarter include:

Stripe Crypto Payments: In its 2024 keynote, Stripe announced that it will re-enable crypto payments in the summer. It will initially support USDC payments on Solana, Ethereum, and Polygon.

TipLink Update: In its 2024 keynote, TipLink launched two new products. The TipLink Wallet Adapter creates a browser-based wallet linked to the user's Google account, eliminating the need for traditional wallet browser extensions and mnemonic phrases. The Wallet Adapter has been integrated with multiple Solana applications, including Jupiter, DRiP, Tensor, Drift, Sphere, and Helio. TipLink also introduced TipLink Pro, a set of tools that allow developers to distribute tokens through activities.

Sphere Update: In May, Sphere introduced Offload Wallet, allowing users to make offline payments immediately by sending USDC to a wallet address linked to a connected bank account. It also launched SphereBot, enabling direct payments via Telegram. Finally, its on/offramp product exited private beta and was opened to all users in June.

Helio Shopify Pay Plugin Update: In April, Solana Labs shut down credit card payments for Solana Mobile Chapter 2, now only accepting payments through the Solana Pay Shopify plugin. Since the open booking of Chapter 2 in January, the plugin has helped Solana Labs save over 1 million USD in fees compared to traditional payment methods. The payment platform Helio introduced a set of new features for the plugin, which it has been managing since December. The new features include:

Multi-token payments, allowing buyers to use hundreds of tokens, which are automatically exchanged for the merchant's preferred currency through Jupiter.

Support for stablecoins other than USDC, including PYUSD, EURC, and USDY.

Improved UI with faster transaction confirmations and automatic offline payments.

A loyalty program with cNFT airdrops, Discord membership, and NFT holder discounts.

Coinflow Labs Financing: At the end of May, payment infrastructure provider Coinflow Labs announced a $2.25 million financing round led by CMT Digital. Coinflow Labs helps companies integrate blockchain-based payments, with clients including Solana Labs and Audius.

Other Developments: Decaf's on/offramp release, Code's release on Google Play store, Phantom's integration with Meso for onramping, Brazilian digital bank Nubank's support for Solana, and XPOS's Solana integration.

Infrastructure

Notable infrastructure-related events in the second quarter include:

ZK Compression: At the end of June, Light Protocol and Helius launched the ZK Compression extension primitive. The functionality of ZK Compression is similar to compressed NFTs: it stores account data in an off-chain Merkle tree and publishes its root on-chain. However, it applies to any token or account, not just NFTs. Additionally, it uses SNARKs technology to compress Merkle proofs, making the verification process more efficient. Helius co-founder Mert stated that the cost of using ZK Compression for airdropping to 1 million addresses is only $50, compared to $260,000 without it. In addition to supporting new use cases, ZK Compression may also provide an alternative solution for some applications that require a large amount of state storage on Solana. A short-term trade-off is the reliance on indexers to ensure access to compressed accounts and related data. During periods of high traffic, this reliance may lead to the inability to update the Merkle tree. However, with economic incentives and open-source indexer implementations bringing more indexer options, this may not be a long-term issue. ZK Compression is currently running on the testnet.

Squads Financing and Fuse Release: In mid-June, Squads Labs announced a $10 million financing round led by Electric Capital and publicly launched the Fuse test version. Fuse is a mobile-first smart wallet that replaces traditional mnemonic phrases and single key pairs with multi-factor authentication. Each wallet is a 2/3 smart wallet controlled by local device keys (protected by Apple Face ID), 2FA keys (encrypted and stored in iCloud or cold wallets), and recovery keys (other wallets or email). It also features spending limits, key rotation, and gas abstraction to enhance security and user experience. Fuse is supported by the same multisig protocol as Squads, which protects over 10 billion USD in assets.

Modular SVM: SVM is increasingly being used as an alternative to EVM for L2, app chains, and other environments. At the end of June, Anza released a new SVM crate, making it easier to use SVM outside of the Solana mainnet. The crate modularizes SVM, decoupling the low-level SVM components from the rest of Agave's validator runtime. Other SVM-related plans and projects announced in the second quarter include the formation of SVM-focused development shop ABK Labs by former Solana Foundation employees here, the launch of the testnet for SVM Bitcoin L2 Yona Network here, the introduction of Solana extension solutions by MagicBlock and Sonic, and the release of the whitepaper for the Solana SVM aggregation framework Lollipop by Popsicle Network and MultiAdaptive here.

Introduction of Bonsol: At the end of April, Anagram introduced the open-source verifiable computing system Bonsol. Leveraging the risc0 toolchain, Bonsol enables developers to perform verifiable computing on private and public data and integrate the results into Solana programs.

Introduction and Financing of Arcium: In May, Arcium (formerly Elusiv) announced a $5.5 million financing round led by Greenfield Capital here and launched its private incentive testnet. Arcium is a parallelized secure computing network that enables developers to run encrypted computations.

Other developments include:

Wallets and FinTech Apps: Phantom acquires embedded wallet provider Bitski, Coinbase Wallet integrates Solana DEX (supported by Jupiter), Kraken launches Kraken Wallet and supports Solana, Portal integrates Solana, Backpack Wallet updates, Moongate adds Apple ID login feature, Infinex integrates Solana, Squads Labs partially acquires the codebase of Fibonacci Finance, Safeheron integrates Solana, SwissBorg integrates Solana, xPortal integrates Solana, and Orbit's release.

Interoperability and Modularity: Token release by Wormhole, LayerZero integrates Solana, Mayan completes a $3 million seed round financing, deBridge launches a points program and tokens, Neon EVM upgrades, Entangle integrates Solana, Jupiter integrates deBridge into its bridging widget, and Eclipse integrates Neon EVM into its Neon Stack.

Developer Tools: Anchor 0.30.0 released, Trident released, RugCheck API released, NovaNet testnet, Spiderswap released public API, LiteSVM released program tester, Lighthouse Protocol released documentation and integrated Blowfish, Flare released, Mollusk released program testing tool, and Triton released Vixen.

Explorers and Data: SolanaFM 2.0 updated, Rated integrated Solana, Bubblemaps integrated Solana, Top Ledger received funding from The Graph Foundation, Solscan added transfer labels, Reclaim Protocol integrated Solana, SonarWatch released validator, and SlamNet's introduction.

AI: DainTrader released, Wayfinder launched PRIME cache, and Gather AI's incentive beta.

Governance and Identity: MetaDAO launched futarchy-as-a-service platform and adopted by Drift, Deans List, and FutureDAO, Wormhole received funding to bring Worldcoin's World ID to Solana, Bonfida and Civic launched secondary voting feature, and Civic Pass integrated token extension.

Oracles: Switchboard completed a $7.5 million financing and Pyth released Solana pull oracle.

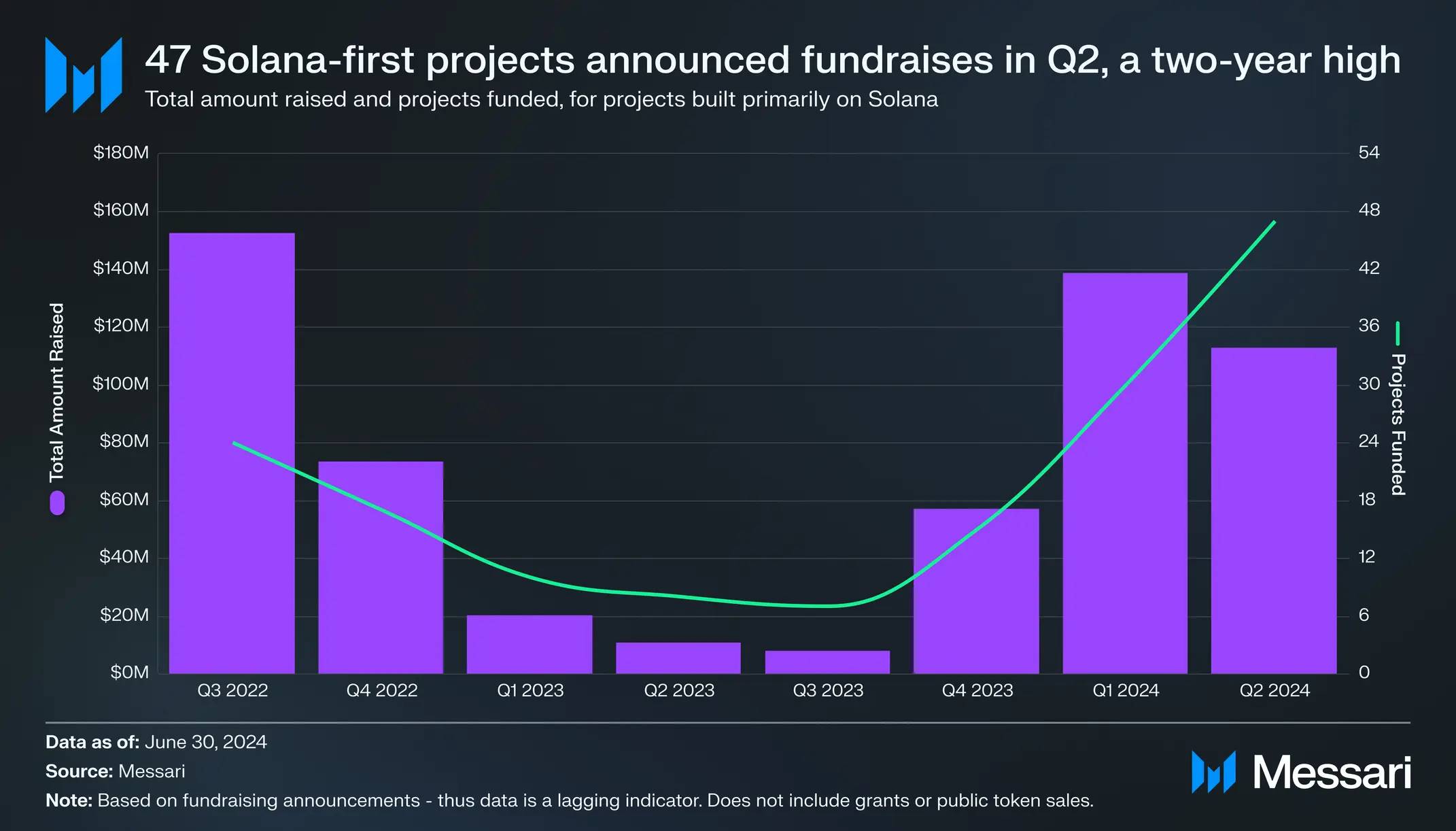

Growth

After a long bear market, financing in the Solana ecosystem is on the rise. In the second quarter, 47 major projects built on Solana announced financing rounds, the highest level in two years. These projects raised a total of $113 million, a 19% decrease from the previous period. From the fourth quarter of 2023 to the second quarter of 2024, Solana projects raised a total of $309 million, compared to only $39 million in the first three quarters.

Hackathons and Accelerators

After its unveiling in the first quarter, Colosseum hosted its first hackathon, Renaissance, from March 4th to April 8th. The hackathon attracted over 8,300 participants from more than 95 countries, who submitted 1,071 projects. The grand prize winners in each track are as follows:

Grand Prize ($50,000): Ore, a digital currency mined using a novel Proof-of-Work (PoW) mechanism. Ore launched in early April and became the largest program for Solana trading volume. Due to miners competing to get their mining transactions on-chain, their efforts exacerbated Solana's network congestion issues, detailed in the network usage section below. Ore has paused mining since mid-April and is focusing on developing V2, aiming to implement a new, more resistant PoW algorithm and introduce ORE staking to better align miner incentives with the project.

Consumer Apps Track First Prize ($30,000): Banger, a marketplace for buying and selling screenshots of tweets.

Crypto Infrastructure Track First Prize ($30,000): High TPS Client, a modified Solana client with scheduling and pipeline optimizations built by Rakurai team.

Gaming Track First Prize ($30,000): Meshmap, a crowdsourced 3D map builder for augmented and mixed reality games and applications.

DeFi and Payments Track First Prize ($30,000): Urani, an intent-based trading suite aimed at preventing harmful Maximum Extractable Value (MEV).

DePIN Track First Prize ($30,000): Blockmesh, an open network for monetizing excess bandwidth.

DAO and Community Track First Prize ($30,000): DeTask, an AI-driven product development platform.

Colosseum also runs an accelerator with a venture capital arm—participants must win one of its hackathons to qualify. In mid-May, Colosseum announced the 10 Renaissance winners accepted into its first accelerator cohort. These include Ore, Banger, High TPS Client, Meshmap, Urani, Blockmesh, and:

DBunker, a financial derivatives platform for DePIN projects.

DeCharge, a DePIN network for electric vehicle charging.

Torque, a protocol for builders to deploy on-chain marketing strategies.

Runepunk Legends (formerly Legends of the Sun), a retro-style combat arena game with on-chain betting.

At the end of the quarter, Colosseum announced raising a $60 million fund to continue supporting early-stage Solana builders.

Many projects and organizations, including DRiP, Wormhole, and several Superteam community conducted a Renaissance side event on Superteam Earn, distributing over $140,000 in additional rewards.

The Solana Foundation also sponsored the Renaissance Continuation track of Bonkathon, providing a total of $50,000 in prizes for builders to expand on their Renaissance submissions. Bonkathon was sponsored by Bonk DAO and hosted on Align by Radiants at Phase Labs. It offered a total of $350,000 in prizes, with winners of 314 submissions to be announced in mid-September.

Other hackathons and accelerators in the second quarter included Solana Labs' ongoing incubator, Kumekathon, Solana Summit hackathon, Metaplex's launch program, FluxBeam's token expansion hackathon, SpringX Solana accelerator, Crossroads content sprint, and Superteam Germany's Berlin 24-hour hackathon.

Events

Second Quarter Events

Solana Crossroads: A conference hosted in Istanbul by Step Finance that attracted over 3000 attendees.

IslandDAO: A month-long coworking space event held in Greece.

Solana Summit: A summit held in Malaysia targeting Solana founders and developers.

Other events: Including Hacker House in Dubai and London, Startup Village by Superteam Malaysia and Superteam UK, Solana Summer Startup events in over 60 cities, as well as side events at NFTNYC and Consensus, and SolVan.

Upcoming Events

Breakpoint: Solana Foundation's annual Breakpoint conference will take place in Singapore at the end of September, with tickets already on sale. The Solana Foundation also announced five one-day sister conferences to be held during Breakpoint: Block Zero (focused on Solana's validator community), MEV and DeFi Day, Network Status Conference, Stakepoint conference hosted by Marinade, and a conference hosted by DRiP. For those looking to participate in more activities around Breakpoint, IslandDAO announced ThailandDAO, a month-long coworking space in Thailand after Breakpoint. Additionally, there is the one-week After Breakpoint Bali event.

mtnDAO: A month-long coworking space returning to Salt Lake City in August.

Other events: Including Hacker House in Hong Kong, Startup Village in Bangalore, and Hacker House, Founders’ Villa Season 2, and more community gatherings.

Grant Programs

Cubik Grants Round 1: Cubik is a platform for facilitating secondary funding for public goods, similar to Gitcoin. In early April, it announced the winners of the first round of public goods grants, which received over $100,000 in community donations from 3,500 contributors.

Cubik Comic Kickstart Round: Cubik, in collaboration with dReader, launched a funding round for comic creators, providing a matching fund pool of $30,000, as announced.

BuildwithMonkes Grant Program: MonkeDAO reopened its grant program for applications and received a new round of funding from the Solana Foundation and Metaplex, as announced.

Solana Art Ambassador Program: The Solana Foundation extended its funding and announced that Bonk DAO will provide matching funding for the Solana Art Ambassador Program to support Solana-based creatives.

Developer Workshops

Developer workshops and educational projects in the second quarter included Turbin3's Q2 Developer Academy, XFounders' Solana Bootcamp, Encode's Coding Bootcamp, Ackee's Solana School Season 5, RareSkills' 60-day Solana course, Heavy Duty Builders' Spain Developer Camp, Alyra's French Developer Course, Comets of Web3's Romanian Developer Project, and M Accelerator project applications.

Media

Two new Solana-focused newsletters were launched in the second quarter: Blockworks' daily Lightspeed newsletter and Solfate's bi-weekly Solfate Snapshot newsletter.

Network Analysis

Usage

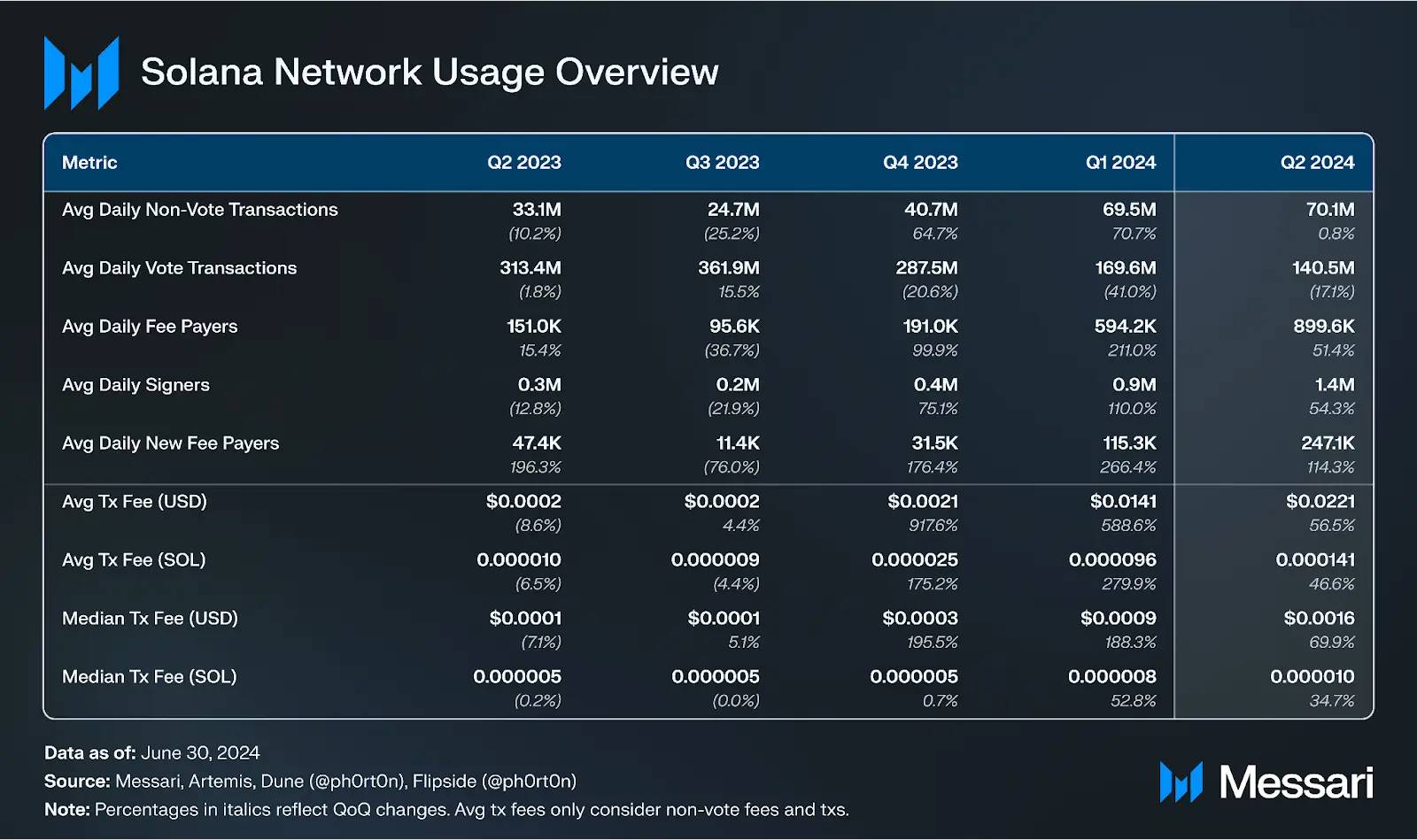

Following the growth in network activity in the fourth quarter of 2023 and the first quarter of 2024, Solana's network activity continued to remain at a high level in the second quarter of 2024. The average daily active users increased by 51% to reach 900,000, and the average daily new active users increased by 114% to reach 247,000. The average daily non-voting transaction volume remained at 70 million transactions, unchanged from the previous quarter.

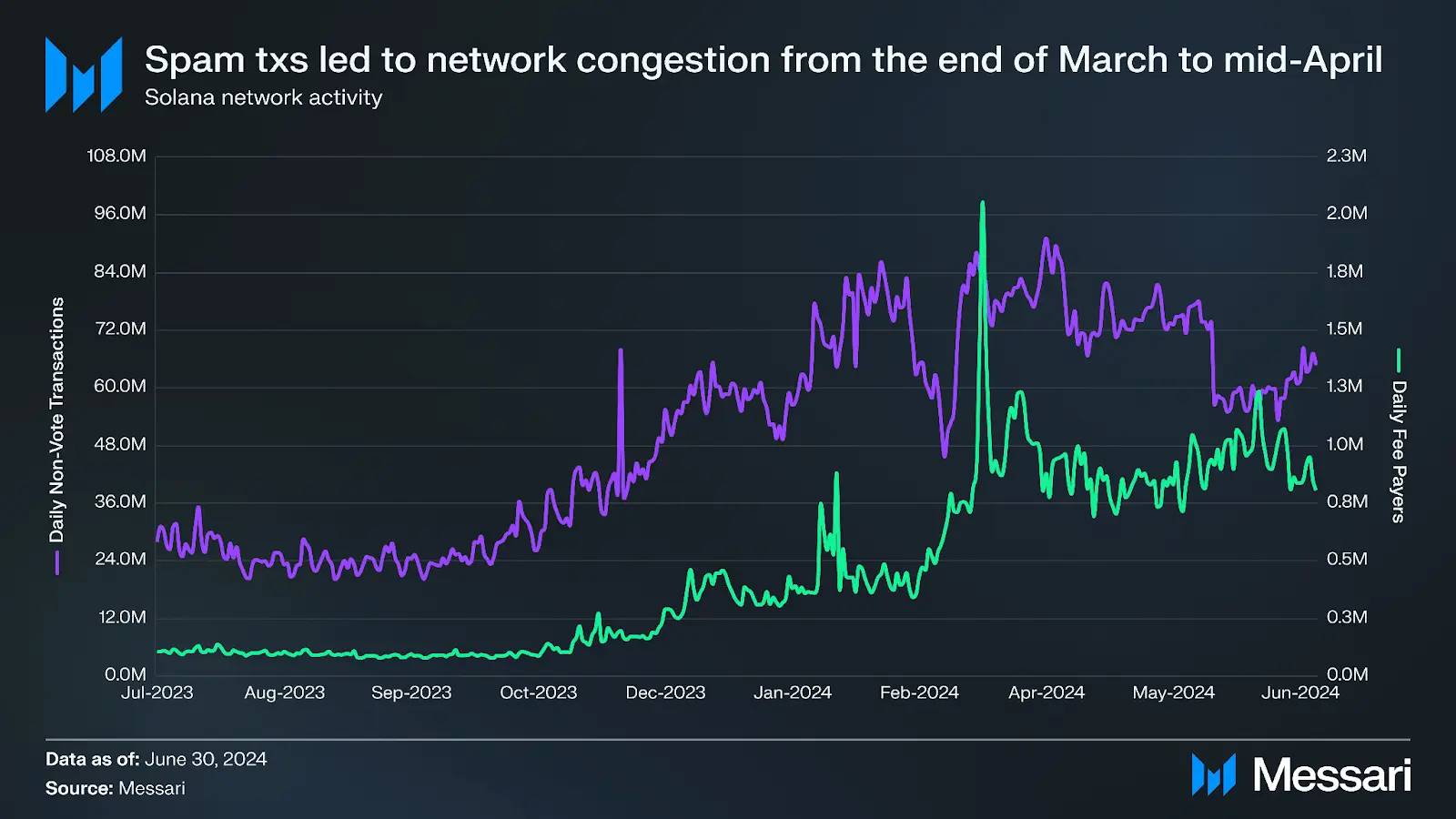

From the end of the first quarter to the beginning of the second quarter, network congestion issues arose due to memecoin trading and junk transactions generated from Ore mining. Transactions were more frequently dropped, and processed transactions took longer than usual. Because these dropped transactions are not visible on-chain, it is difficult to measure the total transaction requests and their success rate. Therefore, the above data only includes processed transactions (both successful and failed). The congestion issues seemed to be alleviated around mid-April when Ore paused its mining program and introduced a network upgrade. The performance, upgrade, and roadmap section will detail the root causes of congestion and solutions.

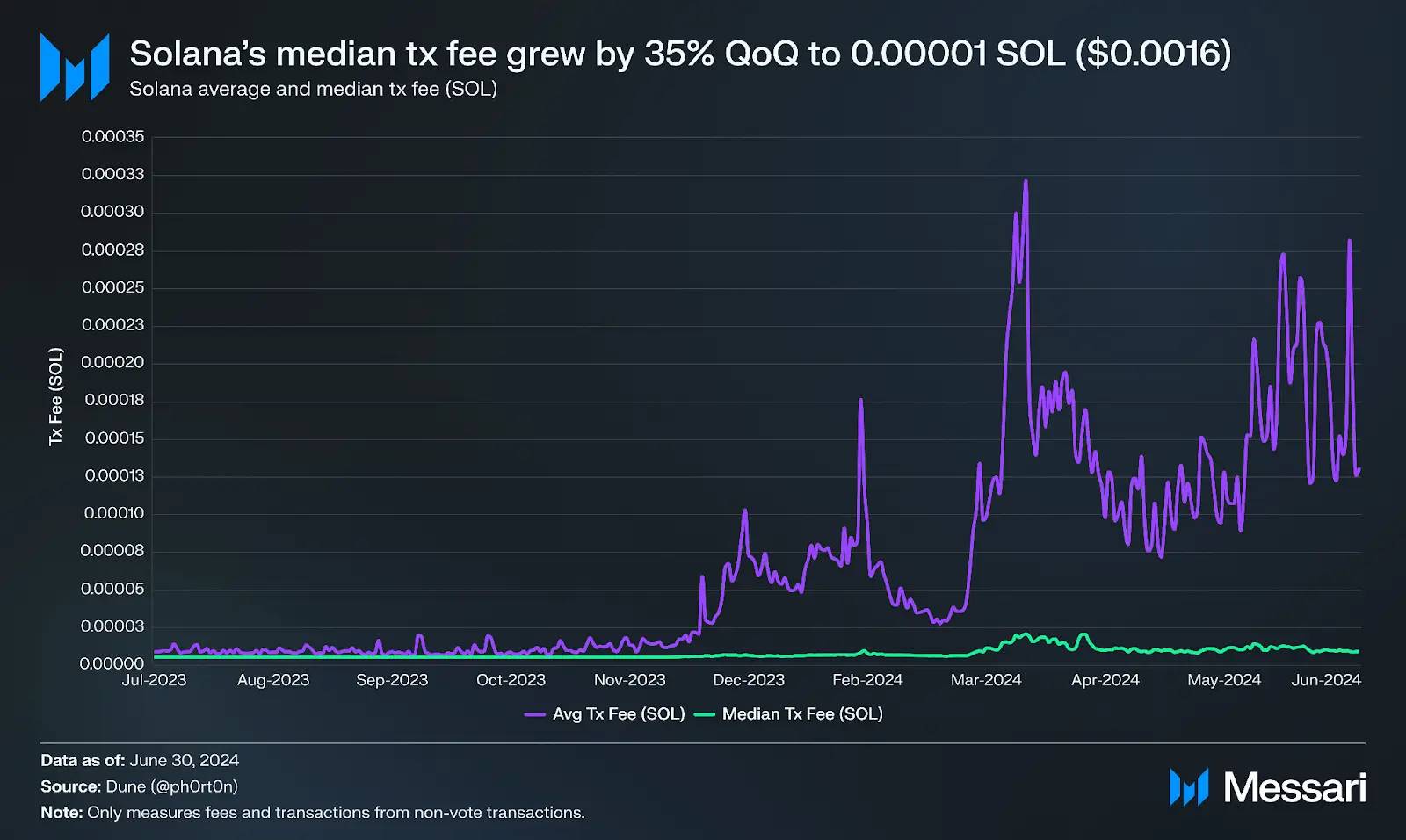

The increase in network activity led to a rise in transaction fees, but Solana's transaction fees remain cheaper than most other active blockchain ecosystems. The average transaction fee increased by 47% to reach 0.00014 SOL (approximately $0.022), and the median transaction fee increased by 35% to reach 0.00001 SOL (approximately $0.0016).

Security and Decentralization

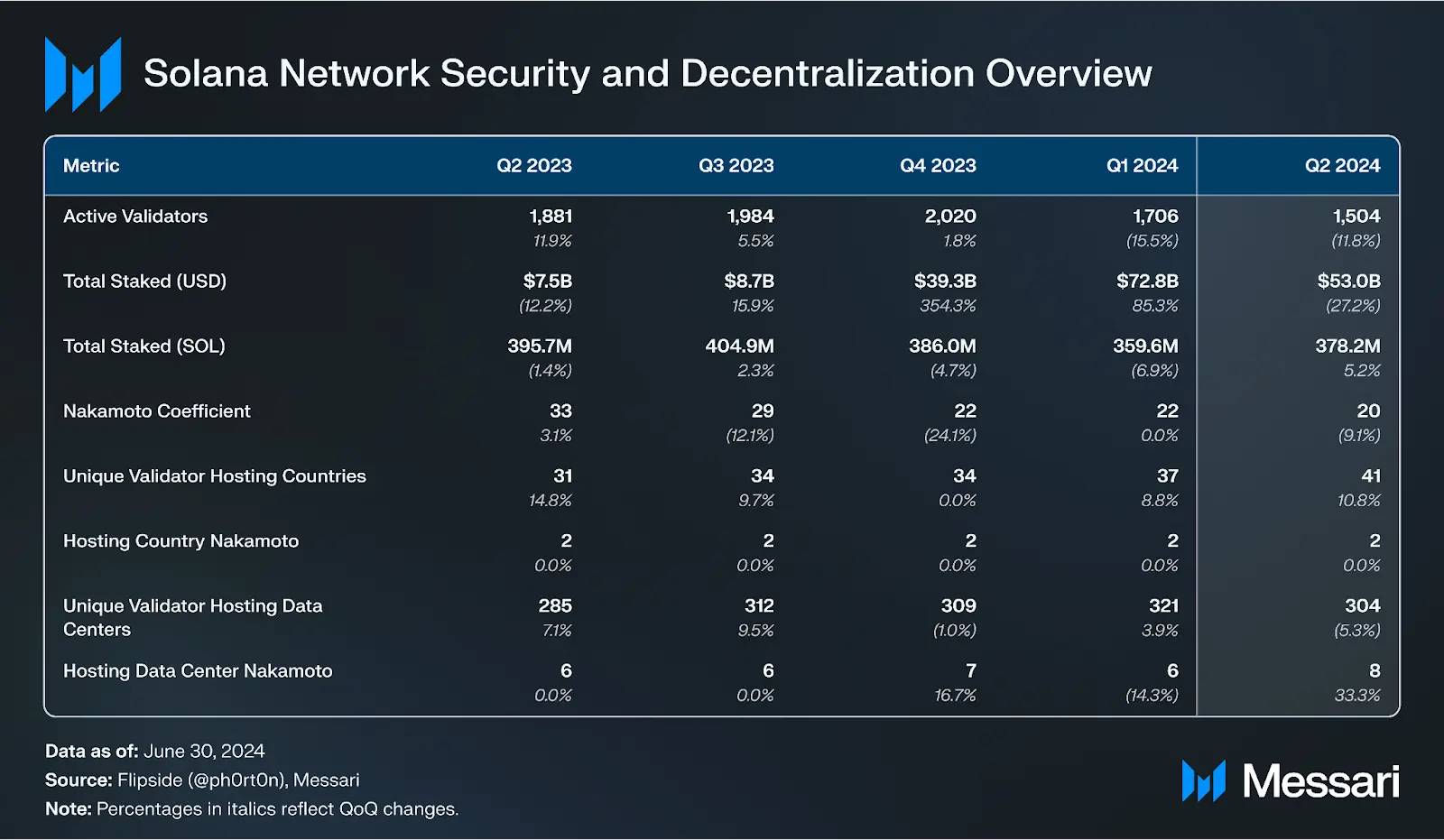

The staked SOL decreased by 5% in the fourth quarter of 2023, then dropped by 7% in the first quarter of 2024, mainly due to FTX Estate unstaking during its token unlock. However, the staked SOL rebounded at the end of the second quarter, increasing by 5% to reach 378 million SOL. This may be due to the re-staking of SOL sold by FTX Estate. Due to the decrease in SOL price, the staked SOL in USD decreased by 27% to $53 billion, second only to Ethereum.

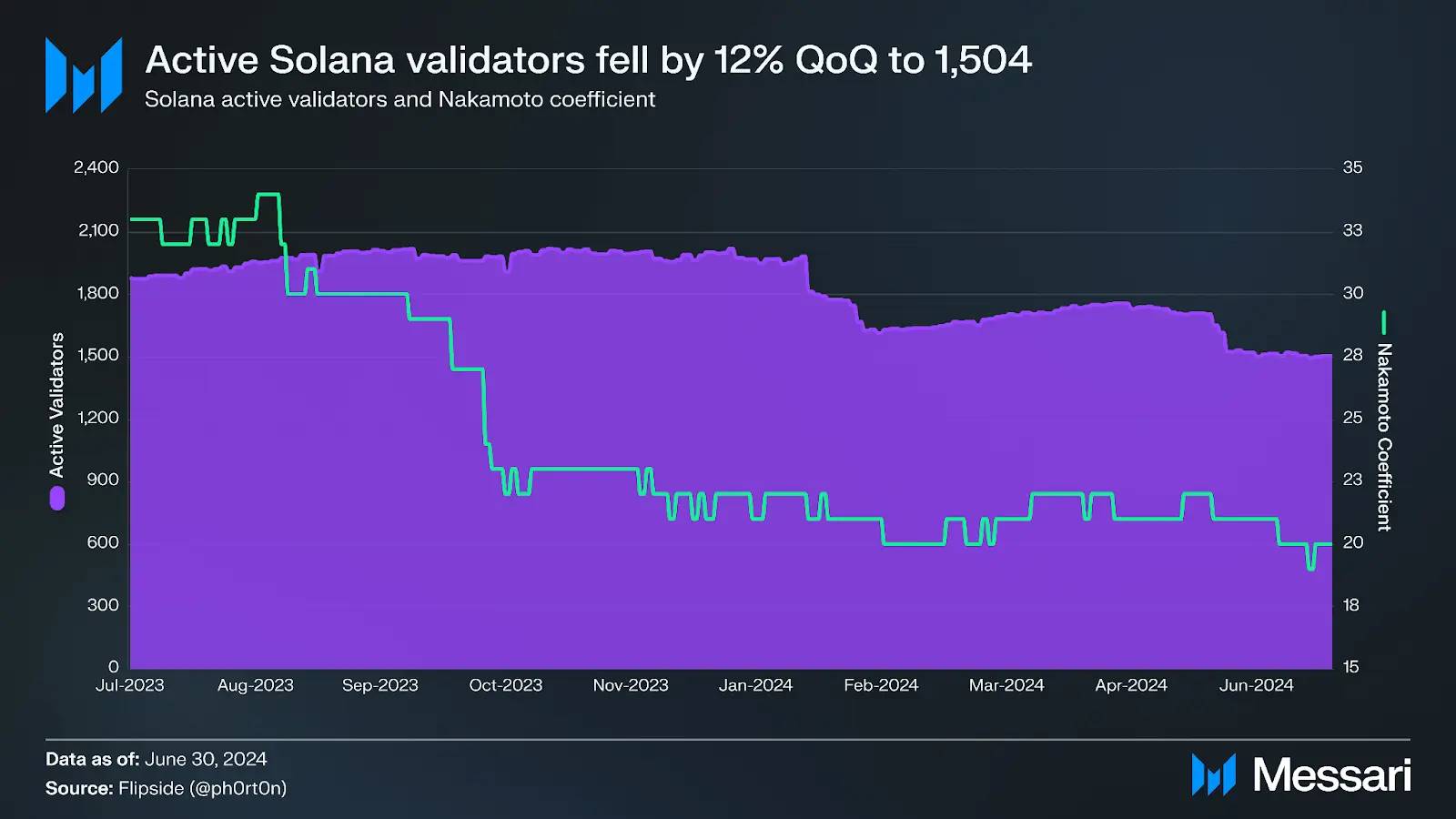

The Nakamoto coefficient represents the minimum number of nodes required to break network activity. This metric can also measure the resilience of the validator network through other dimensions, including the distribution of staking by geographical location, hosting service providers, and clients.

The Solana network currently has 1,504 active validator nodes, distributed across 41 countries, an 11% increase quarter-over-quarter and a 32% increase year-over-year. At the end of last year, the staking ratio in the United States was close to 33%, but has now dropped to 21%. The staking ratio in the UK is 13%, resulting in a geographical Nakamoto coefficient of 2 for Solana. Solana's validator nodes are distributed across 304 independent data centers, a 5% decrease quarter-over-quarter, but the Nakamoto coefficient of its data centers increased by 33% to reach 8.

With the increase in DEX trading by regular users, the opportunity for malicious MEV has also increased. Different participants—validator nodes, delegators, RPC, and applications—have taken measures to address this issue. In particular, Jito Labs announced in early March that it would suspend the mempool service in its validator node client, which covers 80% of the network staking. Subsequently, private mempool services began to appear, attempting to exploit this opportunity.

In June, the Solana Foundation announced the removal of a group of validator nodes from its Solana Foundation Delegation Program (SFDP) because these nodes participated in sandwich attacks through private mempools. The SFDP aims to guide new validator node operators and improve network decentralization by providing 1:1 matching for external staking (up to 100,000 SOL) and covering the voting costs for the first year (100% coverage for the first three months, 75% for the next three months, 50% for the third three months, and 25% for the last three months). Validator nodes must apply, including KYC, and must be outside the top third of staking.

As of mid-June, the SFDP has provided staking of 48 million SOL (13% of the total staked amount) for over 1,100 participating validator nodes, representing 71% of the total validator nodes. Although these validator nodes are no longer eligible for SFDP staking, they can still operate on the network and receive staking from other delegators. Overall, this reallocation represents approximately 0.5% of the total network staking.

On the same day, the Jito Foundation proposed to remove validator nodes participating in private mempools from its staking pool, which delegated 11.5 million SOL. The proposal cited an investigation that found approximately 30 validator nodes (10%) in its staking pool engaged in such activities. The proposal is actively being discussed.

To increase transparency, GhostLogs released a real-time dashboard to track sandwich attacks. As the dashboard indicates, validator nodes containing sandwich transactions are not necessarily colluding, as these may be transactions forwarded to them from the previous leader. Stakewiz also added warnings to its validator dashboard for the 51 nodes it believes are participating in private mempools.

Performance, Upgrades, and Roadmap

The garbage transactions from memecoin activity and Ore mining led to network congestion from the end of the first quarter to the beginning of the second quarter. Anza released the V1.17.31 update in mid-April to alleviate these issues. One of the main changes was the use of Stake Weighted Quality of Service (SWQoS). This feature enables validator nodes to allocate most of their bandwidth to staked connections. "Virtual staking" as a quality signal for leaders helps them determine which connections to listen to. SWQoS was implemented in 2022, but the V1.17.31 update made several changes, including classifying nodes with less than 15,000 SOL staked as "unstaked." While this solution has potential centralization issues and is favorable to RPC and exchanges, it also introduces new demand for SOL tokens and keeps the incentive mechanism for on-chain applications consistent.

After a phased rollout, the V1.18 update reached the supermajority of validator node staking in mid-June. The main new feature of V1.18 is the anticipated update to the Solana transaction scheduler, which is responsible for building blocks. The previous implementation had limitations that led to transaction ordering and included non-determinism. In other words, it could not guarantee that higher fee transactions would be ordered or have a higher probability of block inclusion. Instead, ordering and inclusion relied partially on variance and FIFO, which incentivized garbage transactions. To address these issues, a central scheduling thread was introduced, which receives incoming transactions and assigns them to one of four threads for processing. Since the optional scheduler update was enabled, several validator nodes have reported block rewards higher than the cluster average.

In addition to improvements to the Agave client, the network will also benefit from the upcoming client written from scratch. Specifically, Jump Crypto is developing Firedancer in C language. Its first version, Frankendancer, went live on the testnet in the fourth quarter of 2023 and will begin a $1 million bug bounty program in mid-July. Frankendancer uses the code of Firedancer for network functionality while still using the original Labs client code for runtime and consensus mechanisms. Firedancer engineers pointed out that Frankendancer addresses network issues faced by Solana and shared their findings with Anza to improve the Agave client. In mid-May, Syndica announced the completion of the rewrite of its upcoming client Sig's gossip and accounts-db.

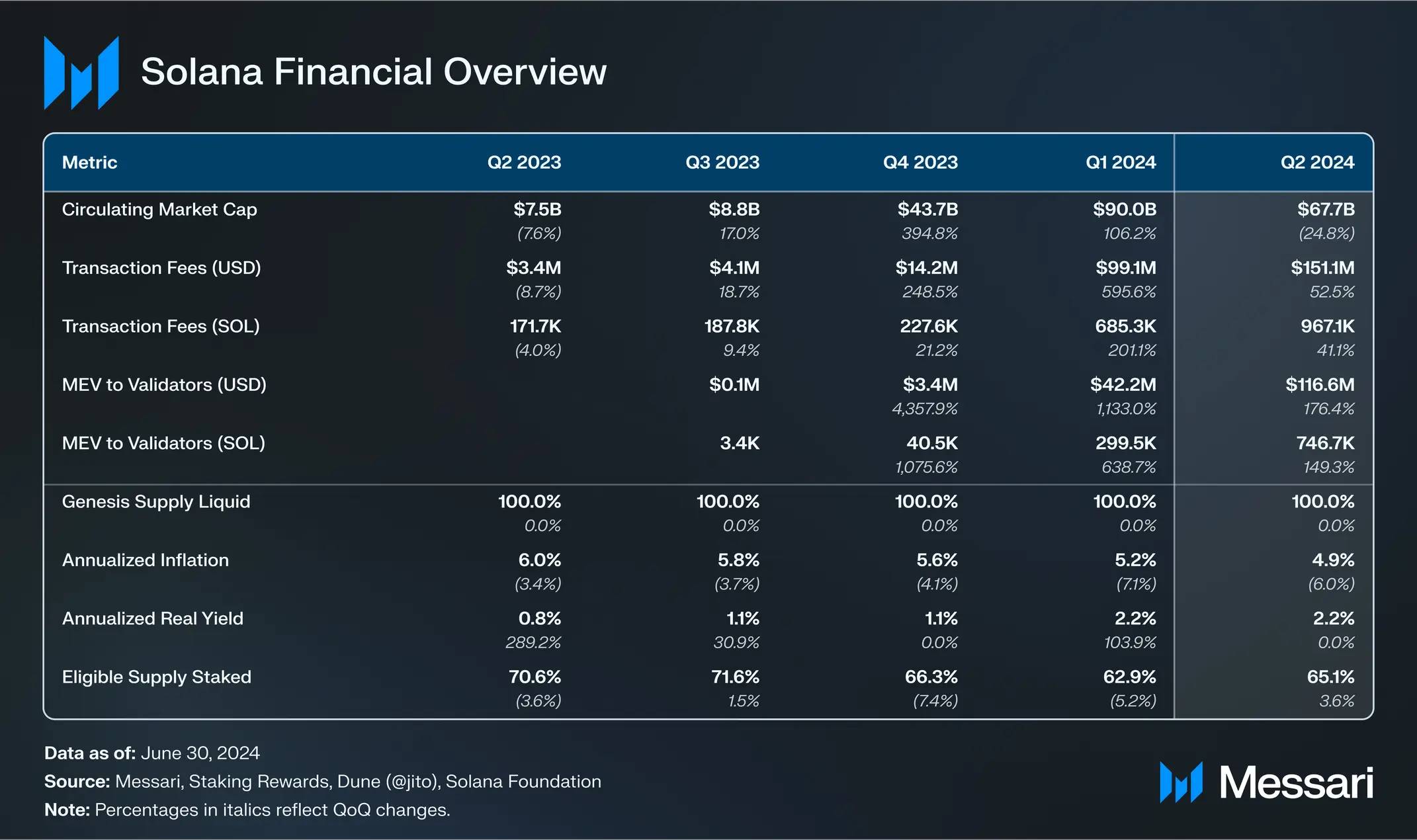

Financial Analysis

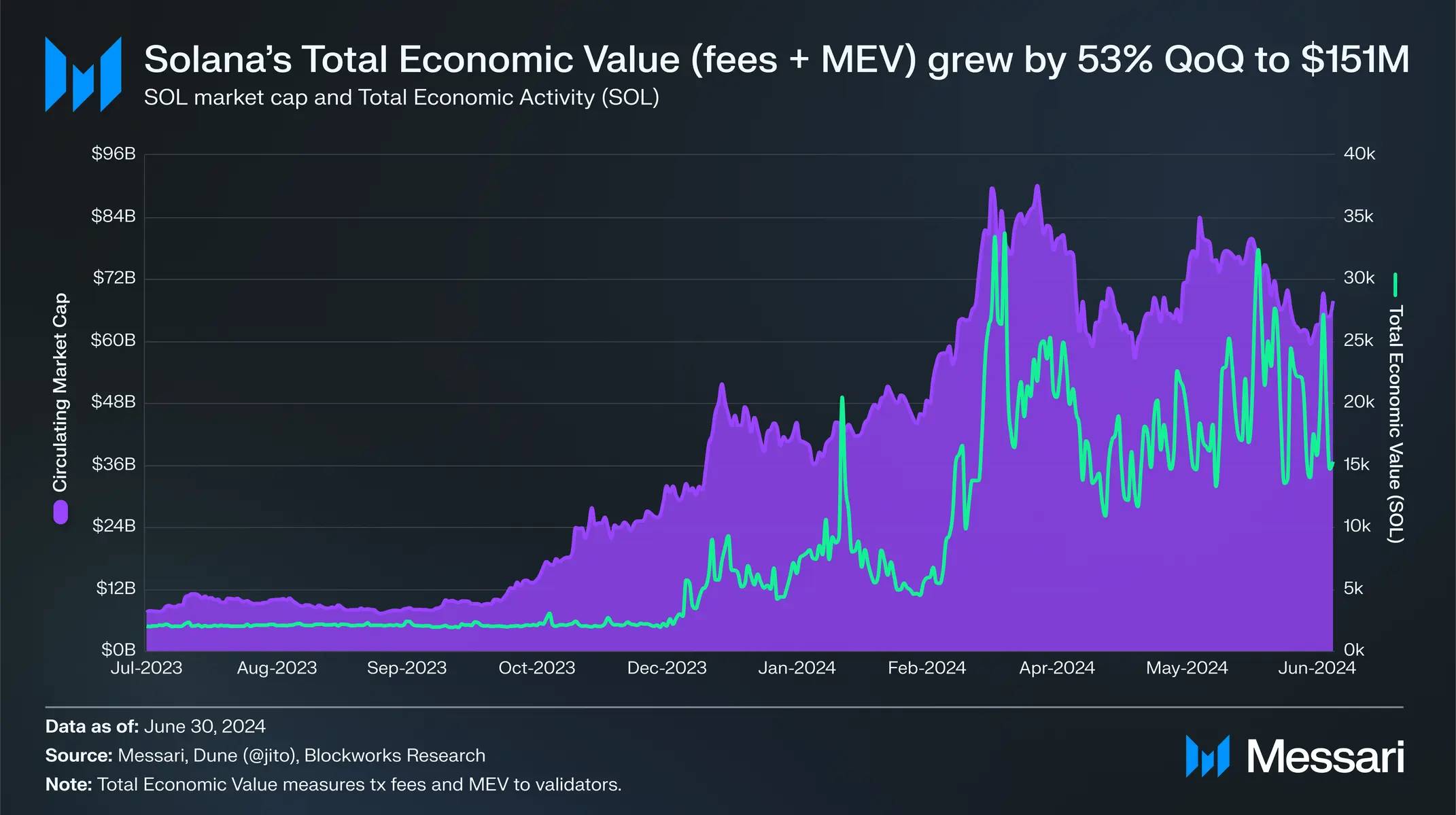

The market value of SOL decreased by 25% quarter-over-quarter in the second quarter, dropping to $68 billion, consistent with the overall market cooling trend. Nevertheless, SOL still ranks 5th in market value among all tokens, second only to BTC, ETH, USDT, and BNB. The Total Economic Value of Solana, which is the sum of all transaction fees and MEV (Maximum Extractable Value) earnings, increased by 41% quarter-over-quarter to reach 967,000 SOL (approximately $151 million). Of this, 56% comes from transaction fees, with the remainder coming from MEV tips.

Currently, 50% of Solana's transaction fees are burned, and the other half is allocated to block producers. These burned tokens reduce Solana's quarterly annualized inflation rate from 5.2% to 4.9%.

However, at the end of May, the SIMD-0096 proposal was passed, proposing to allocate 100% of the priority fee to validator nodes while continuing to burn 50% of the base fee. The purpose of this is to prevent off-protocol transactions with validator nodes. Since the increase in network activity at the end of 2023, the priority fee has accounted for a large portion of the transaction fees. Therefore, after the implementation of SIMD-0096, the amount of burned SOL will significantly decrease, and the proposal is currently awaiting the testnet activation.

As mentioned earlier, validator nodes currently do not have native functionality to share transaction fees with delegators (including base fees and priority fees). By default, most validator nodes only share inflation rewards and MEV tips. To address this issue, the SIMD-0123 proposal was introduced in May, aiming to achieve native allocation of transaction fees.

In the second quarter, SOL experienced several significant off-protocol events, including FTX Estate's token sale and the SOL ETF application.

FTX Estate has been auctioning off its 41 million locked SOL acquired from the Solana Foundation and Solana Labs. In early April, there were reports stating that FTX Estate sold 30 million SOL at a price of $64 per token. At the end of April, there were further reports stating the sale of 1.8 million SOL at prices ranging from $95 to $110. By the end of May, FTX Estate had sold the final batch of tokens, with one buyer paying approximately $102 per token. According to reports, buyers included Pantera Capital, Figure Markets, Galaxy Trading, and Neptune Digital. The sale of these tokens follows the same unlocking schedule as the original purchase from Alameda and FTX. The tokens' average unlocking date is in the fourth quarter of 2025, with the largest unlock in March 2025 (at least 7.5 million tokens). The upcoming unlocked tokens can be viewed on Solana Compass and Gelato.

After the waning expectations for an ETH ETF at the end of May (the Polymarket market reached 0.06 USD in early May), the SEC seemed to change course and approved eight ETH ETFs on May 23. Subsequently, speculation began about which tokens might be next in line for an ETF, with many pointing to SOL. At the end of June, VanEck surprised the market by submitting a SOL ETF application, followed by 21Shares also submitting an application. Some doubt the near-term approval of a SOL ETF due to the lack of a SOL CME futures market, and the SEC's claims in June 2023 complaints against Binance and Coinbase that SOL is a security. However, Matthew Sigel, Head of Digital Research at VanEck, believes that a shared supervision agreement with spot crypto exchanges can replace the need for a futures market. He also stated that the application is a bet on leadership changes in Washington, D.C. The current odds of SOL ETF approval in 2024 are trading at 0.09 USD on Polymarket.

Conclusion Summary

In the second quarter, Solana continued to be a major platform for cryptocurrency activity. Its Total Economic Value (including transaction fees and Maximum Extractable Value MEV) increased by 53% quarter-over-quarter to reach $151 million, primarily driven by increased activity of regular users trading on decentralized exchanges (DEX). Pump.fun, as a gamified token launch platform, collected $48 million in fees in the second quarter, becoming one of the most hotly discussed applications in the crypto space.

However, with increased activity, Solana faced network congestion from the end of the first quarter to the beginning of the second quarter. In mid-April, this issue was alleviated through the introduction of Stake-Weighted Quality of Service (SWQoS) updates. In mid-June, the upgrade to the Solana transaction scheduler further enhanced its transaction processing capabilities. Several ecosystem teams also introduced solutions to help Solana scale while maintaining user experience on Layer 1 (L1), including Light Protocol and Helius' zero-knowledge (ZK) compression technology, as well as MagicBlock's MagicBlock engine.

While Solana has been the preferred network for regular users, it is also gaining institutional favor in the payments space. PayPal expanded its stablecoin PYUSD to the Solana network, leveraging token extension features such as confidential transfers. Stripe also announced support for payment services on Solana.

At the end of the second quarter, Dialect and the Solana Foundation jointly launched Solana Actions and Blockchain Links (Blinks), aiming to revolutionize the way users interact with blockchain. This solution enables users to directly preview and execute transactions in various digital environments, first launched on Twitter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。