Hello everyone, I am your friend Lao Cui Shuo Bi, focusing on the analysis of digital currency market trends, striving to deliver the most valuable market information to the majority of currency friends. Welcome the attention and likes of the majority of currency friends, and refuse any market smokescreen!

When I woke up and checked the market, the situation of this correction is really fierce. Approaching the announcement node, it can be said that the market is beginning to lean towards the bullish side. Many friends may think that Lao Cui's analysis yesterday was wrong at this point. The short-term situation has clearly given everyone the direction after probing the 2800 bottom. Currently, it is definitely a corrective market. Coupled with the recent news of Ethereum's listing, this wave of corrective situation will definitely become stronger. For users who are trapped in long positions in the contract, Lao Cui's suggestion is to try to seize this opportunity. Judging from the overall trend, the growth of this round will not be too long-lasting, but it will not be stagnant either. There will be a sign of a short-term warming trend for the bullish side, at least to digest the impact of the recent listing.

From the perspective of favorable factors, it is nothing more than the increased probability of Trump being assassinated, indirectly affecting the currency circle. Many people will think that these two are somewhat related. But for politicians, Lao Cui thinks that everyone still needs to think carefully. Many things may not meet our expectations after they come to power, but this will indeed have a certain effect in the short term. Therefore, the current corrective situation is likely to show a certain rebound effect. But this is not sustainable, meaning it will not last long. Talking about the later trend, Lao Cui has always maintained a positive view on the overall trend, especially in the currency circle market. Whether it is a new low or a new high within the year, neither has officially arrived, and this point is before and after the US election. Based on recent events, most predictions are that Trump will be re-elected. Maybe everyone in the currency circle feels that this is a good thing.

Lao Cui needs to remind everyone here that although it may be favorable in the currency circle, it may not necessarily be a good strategy for our domestic economy. Because most of Lao Cui's users in China are users with certain assets, this article is also a reminder that exports in the second half of the year may be affected to a certain extent. For those engaged in this industry, everyone needs to think calmly. Trump's strategy has always been to increase tariffs and suppress us with a strong country strategy. For his re-election, it is very likely to be more extreme, directly confronting the financial market. This has always been his trump card, and he only has a few tricks. Coincidentally, the maturity of US interest rates will also happen in the second half of the year. There will definitely be a compromise on the interest rate level, but it will definitely not be achieved in the short term. So everyone should be prepared to withdraw from other markets before and after the US election in the second half of the year.

The exchange rate has been declining basically, and there is basically nothing to say about the short-term trend. The decline in the exchange rate will definitely lead to an increase in the currency circle, which is beyond reproach. The biggest difference with everyone is that many friends feel that we are not currently in an economic recession, especially those with investment experience, who have a certain investment perspective on the entire economy. Most currency friends feel that we are currently in an economic recovery stage, which Lao Cui does not agree with. Of course, many users have provided Lao Cui with a lot of data. Here, Lao Cui will briefly express his personal opinion. The main form of economic recession is overcapacity and inflation. Due to restrictions in other aspects, let's take the United States as an example. The United States is a typical economic recession power.

Overcapacity means that products cannot be sold, and inflation means that raw material and physical prices rise. Everyone can take a look at the growth of bulk commodities and the stock and gold markets in the United States. Both of these have risen and have not experienced a callback phase after the rise. Although they have passed the early growth stage, the focus is still on the inability to return to the prices of the period of economic prosperity. The appearance of a financial crisis only requires inflation, and this round of financial crisis happens to have both. If a financial crisis is a minor cold, then an economic recession is a major depression, which is a long process to cure. The most difficult problem in an economic depression is having funds with nowhere to invest, having factories but unable to produce, having a market but no business, having products but nowhere to sell, having skills but no work. This is why trade declines, unemployment rises, various companies go bankrupt, and even countries decline.

All the reasons accumulate, leading to the current problems. So if you want to understand the market trend of the currency circle, you need to understand the overall environment. In the current environment, it is impossible for companies and markets like Alibaba and Wanda to appear. This kind of outbreak is absolutely impossible to appear in the current environment. And the corresponding to these two is the current currency circle. If the currency circle has not encountered this recession environment, it can be said that the listing of Bitcoin and the current preheating stage of Ethereum's listing could have allowed Bitcoin to reach a price of 80,000-100,000. It is indeed the support of funds that has led to a new round of callbacks, and it is more appropriate to call it a slow growth rather than a callback. This is also why Lao Cui has always emphasized that it is difficult for the currency circle to achieve breakthrough growth in the short term. Although there is growth in the short term, it will not be long-lasting and sustainable. This also leads to a large number of currency friends starting to clamor when Ethereum grows by 100 points, "Lao Cui, how can you be wrong again?"

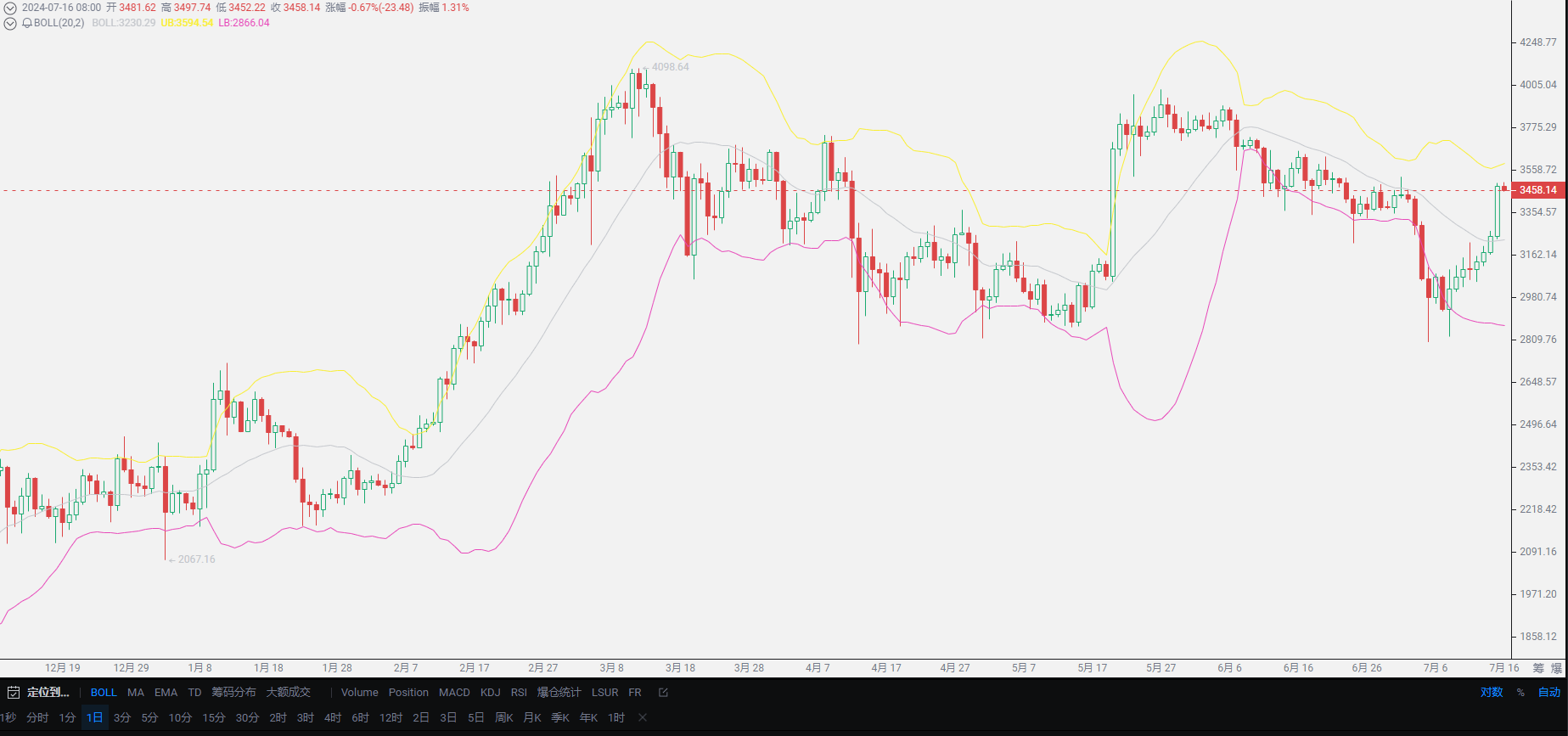

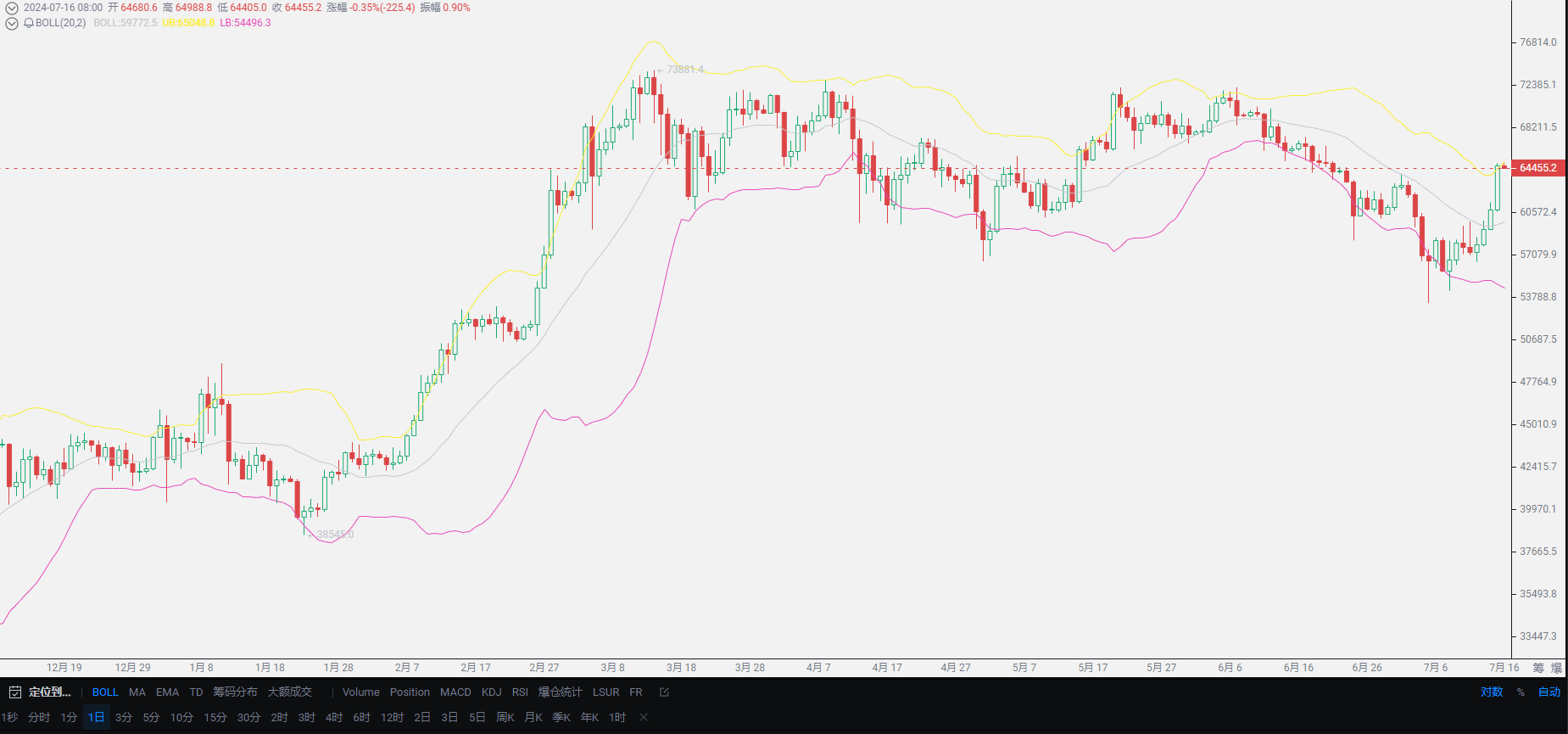

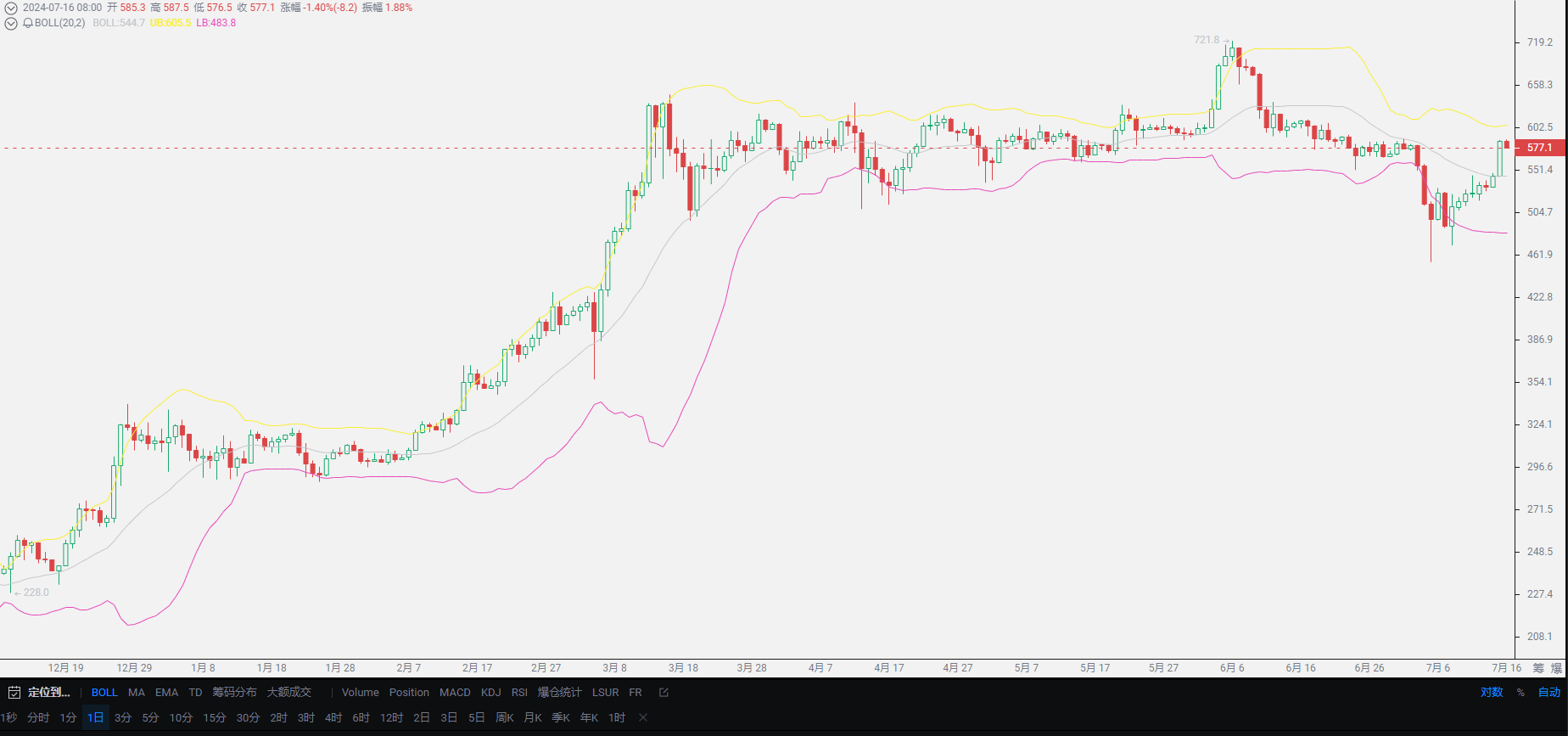

If Ethereum fluctuates up and down by a few hundred points, everyone cannot bear it, and looking forward to a bull market may not be a good thing for everyone. Lao Cui is not speaking with hindsight. Everyone can watch the previous articles by themselves. The predictions for the trend of the currency circle are basically accurate, bullish in the short term, bearish in the medium term. As for the long term, it depends on the strategy of the United States, the timing of interest rate cuts, and the listing of Ethereum. During this period, everyone does not need to question. With the announcement of Ethereum's listing and the short-term decline in the exchange rate, it will cause a rebound in the currency circle market. But in Lao Cui's eyes, this is just an illusion, without enough support for growth, it will eventually return to the previous low point (this sentence is for the medium term). Of course, the previous points have passed, and today I will give everyone the points again. Ethereum's 3200 and Bitcoin's 60,000 have been broken through, and it is consistent with our previous predictions. The breakthroughs of both have brought short-term growth, congratulations to everyone.

Lao Cui's conclusion: After reading this article for so long, the most concerned topic for everyone has finally arrived, the next trend. It depends on whether Ethereum can break through and stabilize at the 3500 position in the short term, which will determine the short-term and even medium-term trend. The breakthrough of the high point above will depend on the 3700-3900 pressure, which is difficult to break. This round of rebound will see the high point reach this position. Under the pressure of the medium term, everyone must not think that they can create historical high points in the short term. Historical high points have absolute discourse power at present. The turning point of the market will not be too long, and the continuation of the bullish side is difficult to sustain. Large capital is basically in the final stage, and it is likely to encounter a small waterfall after a breakthrough, so everyone needs to be mentally prepared. In the short term, it is still bullish. After today's pullback adjustment, just observe whether the high point can break through.

Original article created by public account: Lao Cui Shuo Bi. Contact directly for assistance.

Lao Cui's message: Investment is like playing chess. Masters can see five steps, seven steps, or even a dozen steps ahead, while those with lower skills can only see two or three steps. The master considers the overall situation, plans for the general trend, and does not focus on individual moves or territories, with the goal of winning the game in the end. The lower skilled players fight for every inch, frequently switching between long and short positions, only fighting for short-term gains, and frequently end up in trouble.

This material is for learning and reference only and does not constitute buying or selling advice. Buying or selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。