Hello everyone, I am your friend Lao Cui Shuo Bi, focusing on the analysis of digital currency market trends, striving to deliver the most valuable market information to the majority of coin friends. Welcome the attention and likes of the majority of coin friends, and refuse any market smokescreens!

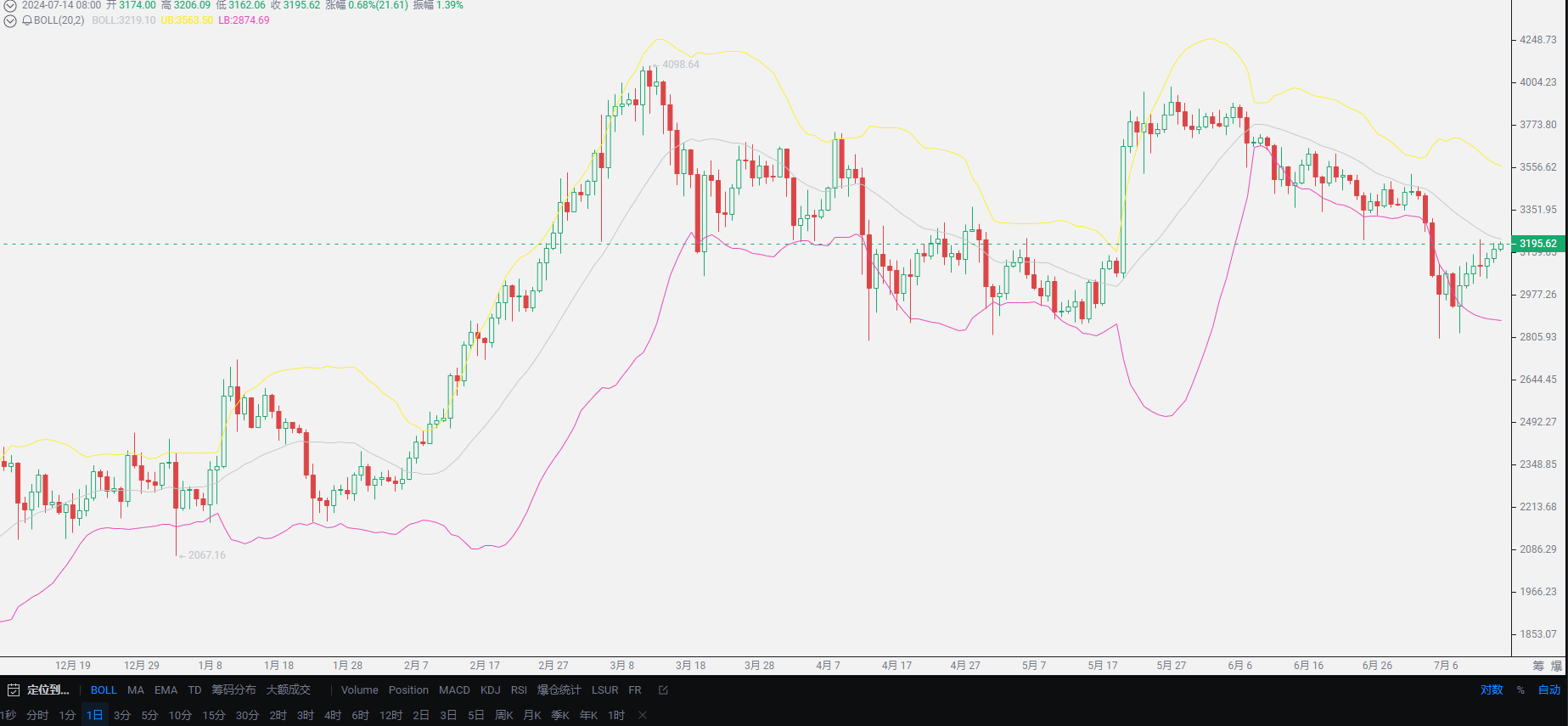

Finally, I have some time to share the recent trends with everyone. Once again, for those who only want to join the group, there is no need to look for Lao Cui. Lao Cui has always been focused on the operation of the user base in the circle, so those who want to join the group can bypass Lao Cui directly. As for the recent trend, Lao Cui feels that fatigue has already appeared, so let's not waste each other's time. Moving on to the main topic, many friends are concerned about whether Ethereum will really be listed in July. As for the listing result, there may be a conclusion in July, but the specific listing time has not been notified. It is hoped that everyone can have a clear understanding of this point. The appearance of the result will only bring short-term growth. For the long term, a formal listing is still needed to attract external funds with a breakthrough volume, in order to enter a long-term upward trend.

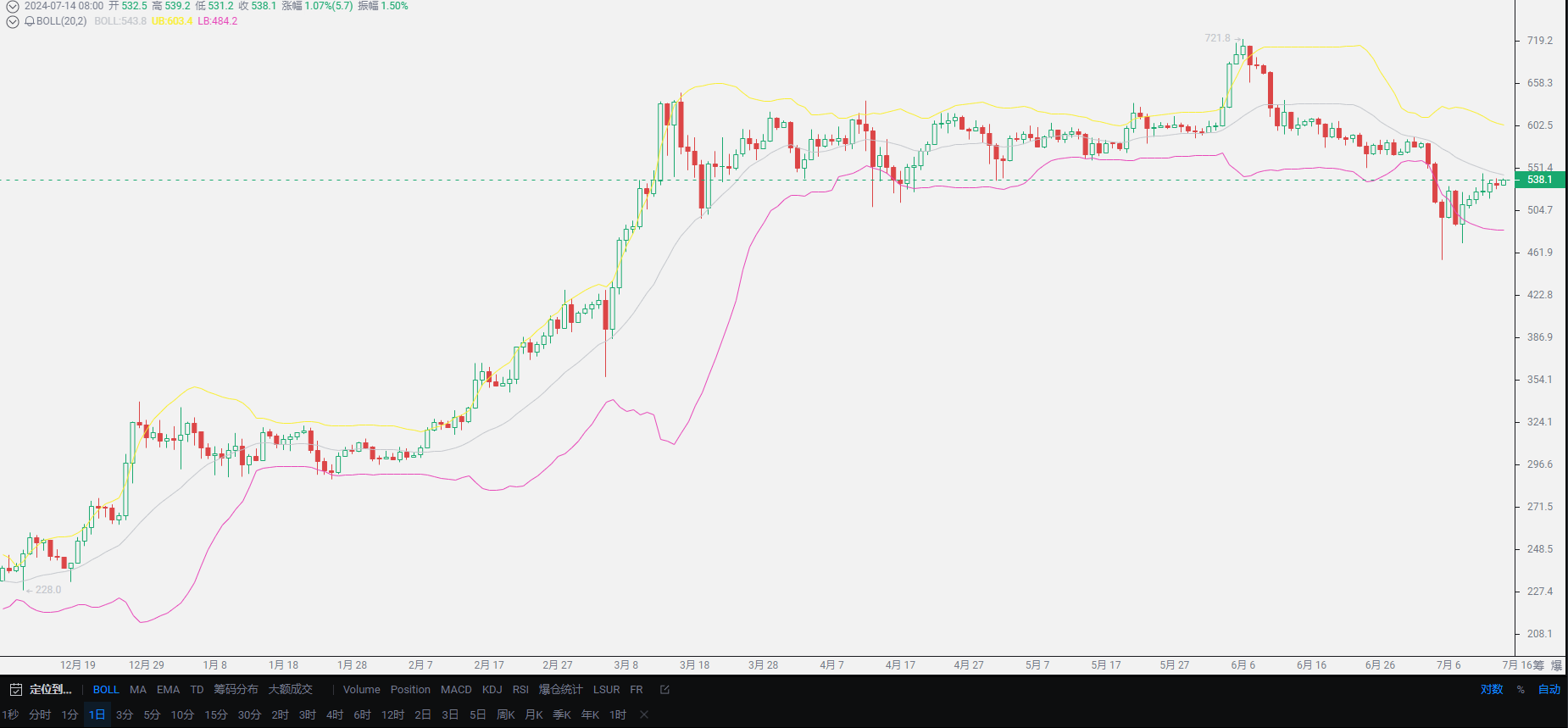

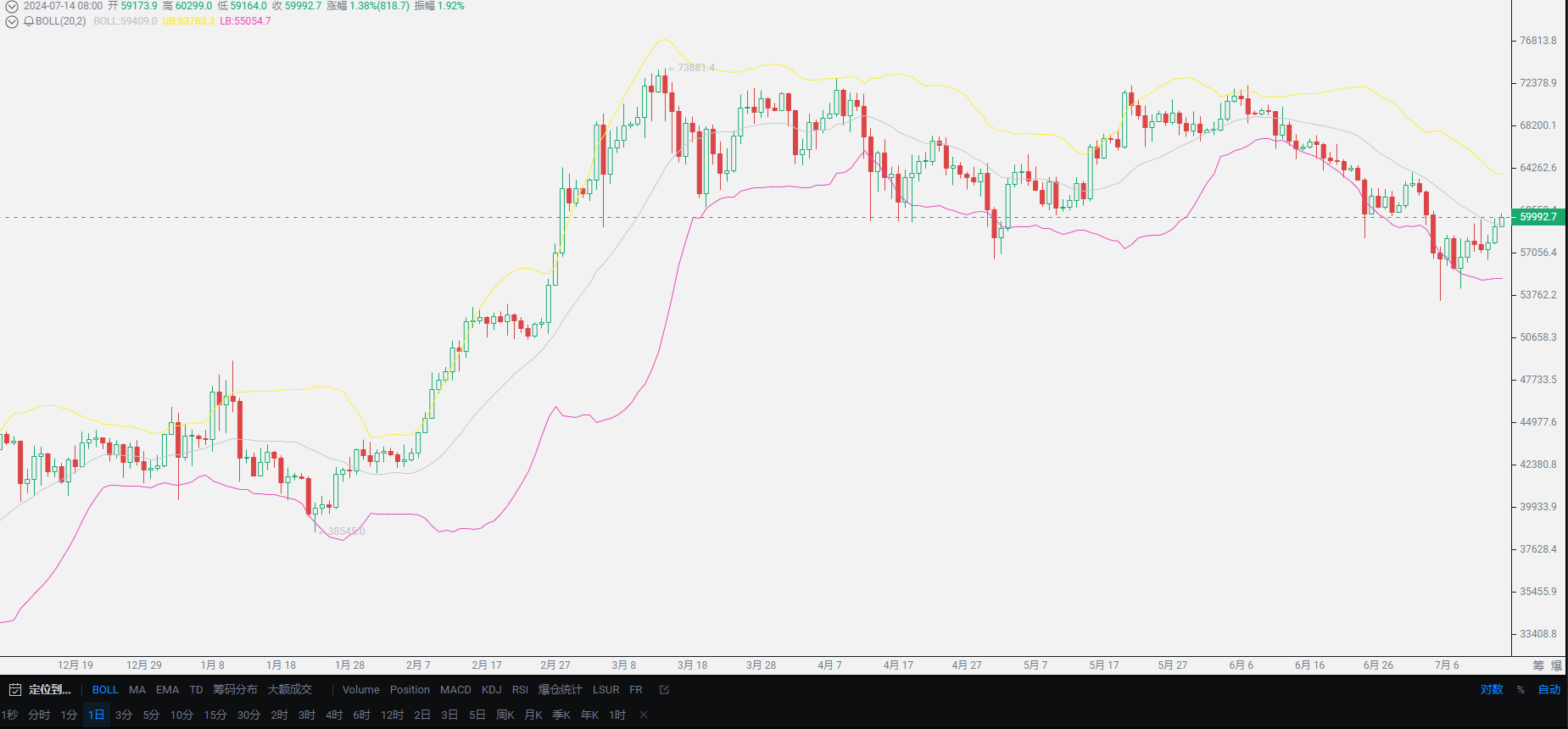

The impact of the upcoming trend is still within a controllable range. For the daily chart, the past two days have been in a phase of recovery after a downturn, and the overall trend will depend on the situation of the recovery to determine the later trend. The shipment from Germany has not stopped, which will to a certain extent affect the increase in Ethereum's listing. The entire coin circle is in a state of recovery, and it is understandable for funds to exit at this level, especially with the speed of large funds backing the shipment, the entire situation will be affected. Everyone is still doubting whether there will be signs of improvement in the current financial situation. From Lao Cui's perspective, it has become a conclusion that the overall global situation has basically become chaotic. From the stabbing of the former Prime Minister of Japan to the shooting of the former President of the United States today, the political arena can be said to be completely off track.

The chaos in the political arena has spread to the financial level, making it impossible for a bull market to appear. Especially in the United States, the stock market has been leading the way, and since the self-growth, it has formed a completely opposite state to the coin circle, with no obvious pullback in several instances of hitting historical highs in the gold market at the beginning of the year. The lack of signs of a pullback indicates that the amount of funds has not fled, and a large amount of funds has poured into other markets, which is a sign of unrest. Under the crazy interest rate hikes in the United States, the current strategy has indeed caused the US dollar to appreciate again, and the appreciation of the US dollar will inevitably lead to the decline of other markets. The impact of the coin circle market basically comes from these two points. It can be said that if Bitcoin was listed before 2019, the historical high of 70,000 would not have been possible. The sluggish amount of funds has affected the recent growth of the coin circle, which can also be considered as a side limit. No one wants to see the emerging market determine the fate of the world.

In short, the overall trend is basically determined by spot users. Yesterday, I forgot to talk to contract users about the mid-term situation. Today, I will focus on contract users. For contracts, the current situation is a phase of recovery after a downturn, and both the fund level and the technical plate level are basically in a slow growth state. The strength of the growth is not strong, and the rate of decline is more rapid when the market reverses, which is a mid-term trend. For contracts, it is only necessary to find the support and resistance levels to enter the market. As long as Bitcoin's 60,000 mark and Ethereum's 3200 position stand firm, there will still be a phase of recovery in the future. Overall, it is still a box oscillation. At present, both long and short positions will not incur significant losses. Even if Bitcoin's 60,000 mark stands firm in the short term, positive news will appear, it will still fall below this level. At present, there is no positive news for trading, only a bearish trend will appear.

For contract users, the most important indicator in the near future is always to look at the price of USDT. As long as this exchange rate continues to decline, the market will steadily rise. The change in this indicator has always been a short-term directional decision. It has been mentioned many times that when Ethereum's lowest point was at 2800, the USDT price had already reached around 7.35. At the current stage, it has returned to 7.28, and the market has also returned to 3200 and Bitcoin's 60,000 mark. The trends of these two are in a reverse state. Everyone cannot grasp the decision of the market, just look at the indicator of the exchange rate. Currently, the USDT exchange rate is the benchmark for the market trend. Everyone should not think too much. All measures will affect USDT, and this reaction is also a short-term trend. Today's explanation ends here. In conclusion, if you cannot determine the market trend, it is best to communicate with Lao Cui before making a conclusion.

Lao Cui's summary: For spot users, if you want to have substantial short-term gains, you still need to hold for the long term and wait for positive news to emerge. It will definitely bring profits to everyone within the year. However, for contract users, after the short-term repair, coupled with the positive news of Ethereum's listing, it can give users who have been trapped in long positions a chance to exit. Of course, this is not to let everyone blindly go long. The profits from going long are only possible in the short term. In the mid-term, waiting for the positive news to dissipate, the bears will ultimately have the upper hand. Therefore, for users in the market, holding short positions is possible, but it is necessary to ensure the safety of the position. In the short term, if the 60,000 mark of Bitcoin stands firm, positive news will appear, and it will still fall below this level.

Original article created by public account: Lao Cui Shuo Bi. For assistance, you can contact directly.

Lao Cui's message: Investment is like playing chess. Masters can see five steps, seven steps, or even a dozen steps ahead, while those with lower skills can only see two or three steps. The high-level players consider the overall situation and plan for the general trend, not focusing on individual moves or territories, but aiming for the ultimate victory. On the other hand, the lower-level players fight for every inch, frequently switching between long and short positions, only focusing on short-term gains, and frequently getting trapped.

This material is for learning and reference only and does not constitute investment advice. Buying and selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。