Original author: Yat Siu, Co-founder of Animoca Brand

Translation: Odaily Planet Daily (@OdailyChina)_

Translator: Azuma (@azuma_eth)_

We are often asked the question: What is the exact meaning of tokens? Why do projects need tokens?

Generally speaking, tokens are often seen as a more efficient fundraising tool that allows equity holders to avoid dilution risk; on the other hand, tokens are also seen as practical tools that can be used in games and other virtual environments, similar to virtual currency.

However, the function of tokens is not limited to these scenarios. In fact, they can have all of the above characteristics at the same time. In our view, tokens represent a completely new way of owning a certain type of asset, which did not have a clear ownership structure before the appearance of tokens.

In summary, we see tokens as a completely new way of having partial network effects.

Network Effects

Some readers may already have a basic understanding of the concept of network effects.

As the number of users of a product, service, or platform increases, the overall value of the network to users also increases. Network effects are an important indicator of the valuation of large companies, whether they are luxury brands or tech giants. Investors often evaluate the value of a company by measuring its network effects (including the growth expectations and impact effects of these effects).

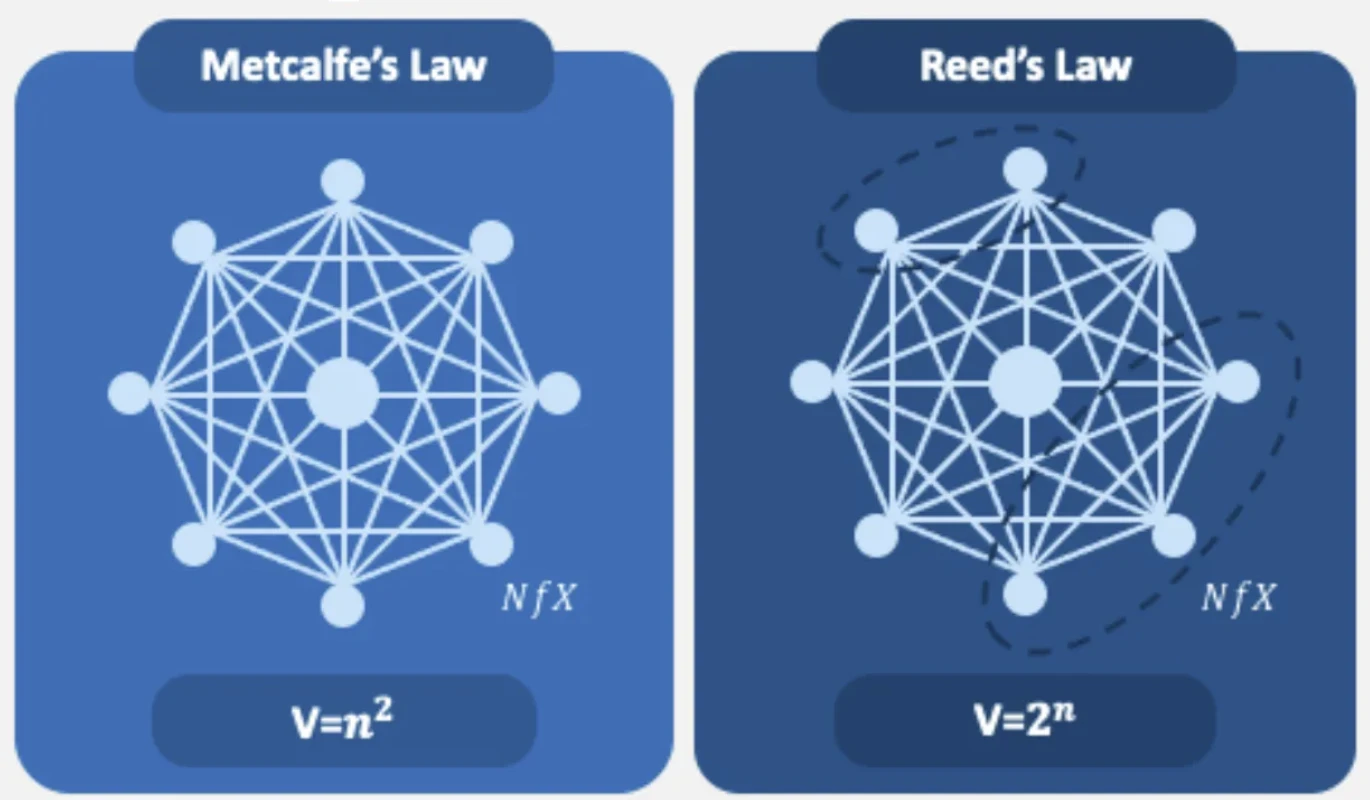

Metcalfe's Law shows that the value of a telecommunications network is proportional to the square of the number of users or compatible devices connected to it. In other words, the more people or devices participating in a network, the greater its value. We can roughly assess the value of networks such as Facebook, Google, and LinkedIn based on the number of users. The more users there are, the higher the value of the network and the potential valuation ceiling.

The same evaluation method is also used to estimate the potential of Web3 networks, such as focusing on the number of addresses, transaction volume, number of developers, and so on. Although some people like to directly apply Metcalfe's Law, we believe that Reed's Law (i.e., the utility of a large network can grow exponentially through subgroups of network participants) may be more appropriate here.

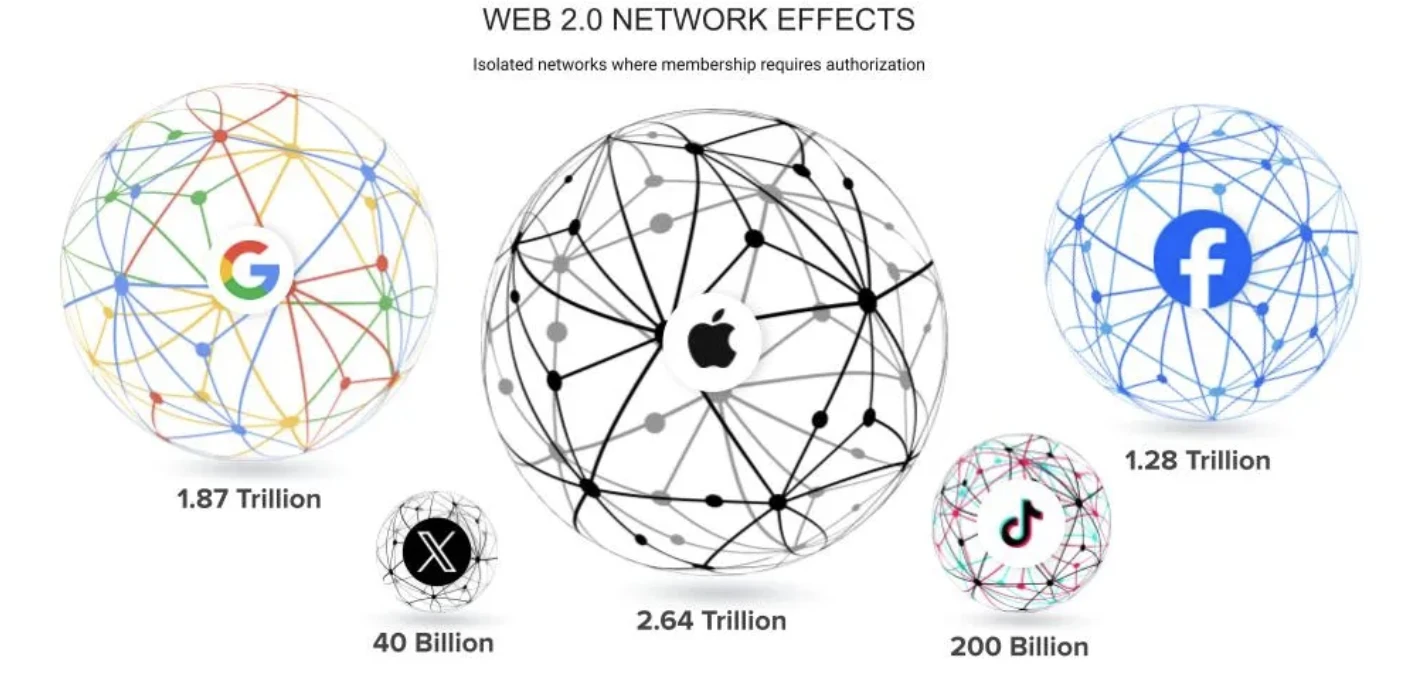

In general, tokens represent the network effects of a specific network, platform, or ecosystem. The emergence of tokens allows users to have partial ownership of the network for the first time, which is significantly different from traditional equity tools. In addition, because tokens themselves have multiple functionalities and are often open and permissionless, this makes it easier for tokens to support various practices and innovations, allowing Web3 to create network effects more quickly and effectively than the closed networks of Web2.

Inequality of "Individual" Value

Both Metcalfe's Law and Reed's Law are difficult to use to evaluate the value of infrastructure projects or large social networks, as they assume that each user and device in the network has more or less equal value and contributes equally to the overall value of the network and its network effects. However, the reality is different. Having more users in a network does not necessarily mean it has greater value, or better network effects than a network with a smaller user base. The value of individual users in the network is also an important factor.

For example, in an economy, the population of an economy can be seen as its network size, and its gross domestic product (GDP) can indicate the network's value.

Hong Kong has a population of about 7.5 million and a GDP of about 407 billion US dollars; North Korea has a population of 27.5 million and a GDP of 48.3 billion US dollars. The difference in the value (GDP) of these two networks is mainly due to the difference in the value of network nodes (i.e., the population or enterprises in the economy). Although North Korea's network is more than 3.5 times the size of Hong Kong's, because North Korea's economy is isolated, its network effects are closed, and its value is relatively low, making the value of its entire network far lower than that of the smaller-scale Hong Kong.

The same is true in the Web3 world, where networks with lower potential are less attractive in terms of investment, developers, and users. Therefore, anyone building in Web3 should strive to create a network with higher value and stronger network effects.

How to Measure Network Effects?

There is no single path to driving the growth of network effects. Project teams must combine multiple appropriate methods to create lasting appeal for the network, including emphasizing user reach (similar to TON), attracting more developers and investors (such as Ethereum and other Layer1, Layer2 solutions), or increasing total transaction volume through various measures.

In addition to focusing on the number of network users, another commonly used measure of network effects is to focus on the total investment within the network. Many blockchains focus on increasing the total value locked (TVL), which is an indicator of the total value of assets locked or staked in the network and has some impact on attracting investment and entrepreneurial activities.

In the current Web3 world, perhaps the most important metric to focus on is user stickiness, as Web3 networks are generally designed to be open and permissionless, meaning that users can freely enter and exit, rather than being trapped in a "closed network." This is in stark contrast to Web2, where network effects are not owned by end users, but are strongly monopolized by the network itself (e.g., it is difficult to transfer data and network effects from Facebook to TikTok).

Web3 provides users with greater flexibility than Web2, so when building decentralized networks, user retention will become crucial, and an effective measure to increase user stickiness is to invest in "cultural capital."

"Cultural Capital" and NFTs

According to Pierre Bourdieu's theory of capital and class division, "cultural capital" consists of intangible resources such as knowledge, skills, and experience, which play an important role in social mobility and opportunities. "Economic capital" and "cultural capital" can complement each other—joining exclusive clubs, attending top schools, or living in specific communities can significantly increase opportunities for personal economic and social advancement.

NFTs, due to their unique nature and their ability to reflect individual identity and "cultural capital," can create network effects that are more profound and complex than fungible tokens (FT). The network effects driven by NFTs may not grow as rapidly as fungible tokens, but they can establish deeper and more loyal relationship networks based on common "cultural capital," thereby forming stronger defenses and more powerful network effects.

In the real world, this phenomenon is already very evident, such as the loyalty people show to brands like Hermès, Nike, or Apple. In the virtual world, we are also beginning to see the emergence of similar cultures, such as in projects like Pudgy Penguins, Bored Ape Yacht Club, and Animoca Brands' Mocaverse.

Vision of Mocaverse

One of the key indicators of measuring the potential of a network is to observe the scale of investment it has received, which often represents the growth potential of the network, similar to the investment a country makes in infrastructure development— the more investment, the greater the development potential.

Animoca Brands is one of the most active investment institutions in the Web3 space, with over 450 companies under its umbrella and a balance sheet size of several billion dollars. We will continue to invest to expand our network and its related economic and cultural network effects, laying the foundation for the expansion of the Moca Network (an interoperable economic entity composed of interconnected "subnets" and users within Mocaverse). At the same time, we will use the native token MOCA to drive the growth of the Animoca Brands network.

So, what is Mocaverse? It is an interoperable infrastructure stack designed to enhance network effects and bring together various "cultural capital" and "economic capital" for mutual benefit. Mocaverse will integrate multiple domains including games, music, sports, anime, NFTs, digital identity (DID), and more to build a collaborative ecosystem where each component can contribute to the development of the entire ecosystem.

Mocaverse is currently developing Moca ID, a universal identity and reputation layer across the entire chain, which will serve as a connector across the ecosystem. Given that Animoca Brands is already one of the most active investment institutions in the Web3 space, this will help drive the growth of the entire Web3 industry. Both Mocaverse and MOCA itself are forms of "cultural capital," which may still appear somewhat "isolated" today (similar to most NFTs), but as the reputation layer of Mocaverse grows, its significance will become more socialized.

Our goal is to create a truly reciprocal set of relationships that will bring more value to our portfolio network and incentivize users of Mocaverse based on time, loyalty, and attention. All participants will be able to benefit from this common network effect, which is the embodiment of the core spirit of Web3.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。