Author: Koroush AK

Translator: Chris, Techub News

One of the biggest mistakes a trader can make in trading may come more from a lack of balance in mentality rather than technical errors, and similar situations have occurred to countless traders. As a trader, you should avoid making these mistakes:

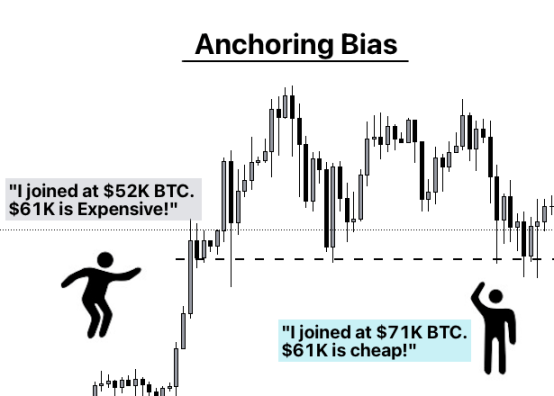

1. Anchoring Bias

Traders often subjectively fix themselves on a certain price (anchor), which can affect their decision-making.

- If trader A enters the cryptocurrency market when the price of Bitcoin is $52,000, then Bitcoin at $61,000 looks expensive.

- If trader B enters the cryptocurrency market when the price of Bitcoin is $71,000, then Bitcoin at $61,000 seems cheap.

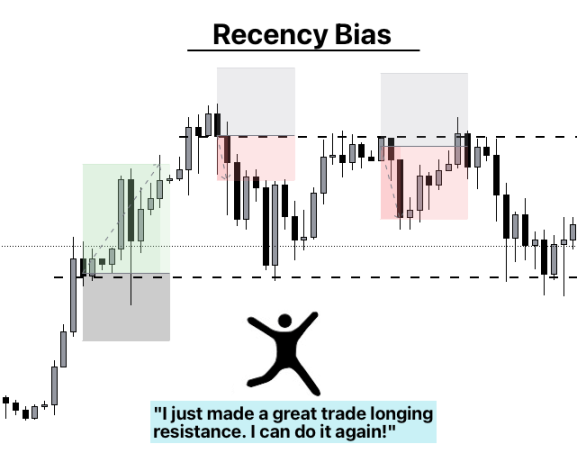

2. Recency Bias

This refers to people's tendency to remember the most recent information and consider it important.

Traders may bring information from recent trades into the next trade, leading to mistakes during the trading process.

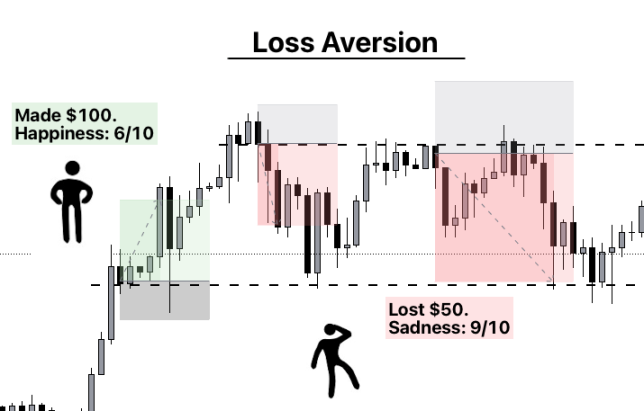

3. Loss Aversion

Traders often experience greater emotional fluctuations when facing losses than when facing profits. For example, the pain of losing $100 in a trade is often greater than the joy of earning $100. This mistake may lead traders to lock in profits prematurely because they fear a decrease in these gains or a turn into losses.

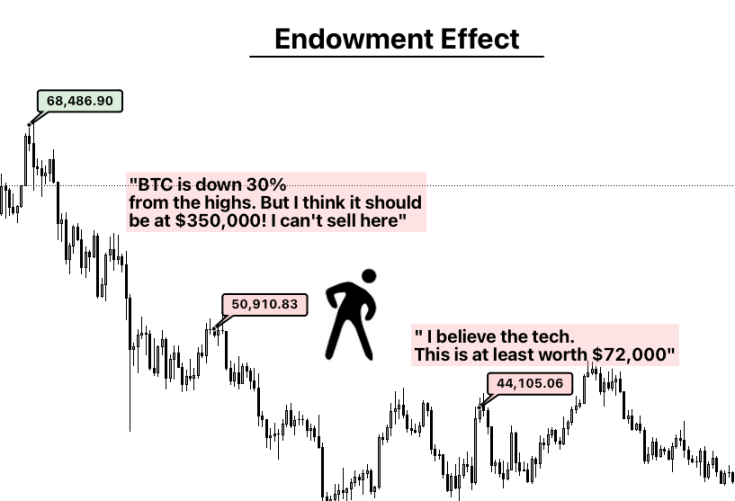

4. Endowment Effect

When traders hold a certain asset, they often overestimate its value. This subjective emotion makes it difficult for them to sell at a loss or take profit, as they rely more on their own expectations rather than the actual market situation to judge the future price of the asset.

5. Herd Mentality

Whether blindly following the crowd or deliberately going against it, there are risks. Traders should stick to their trading plans and avoid acting impulsively due to herd mentality. Only when conducting objective market sentiment analysis should the behavior of the crowd be considered.

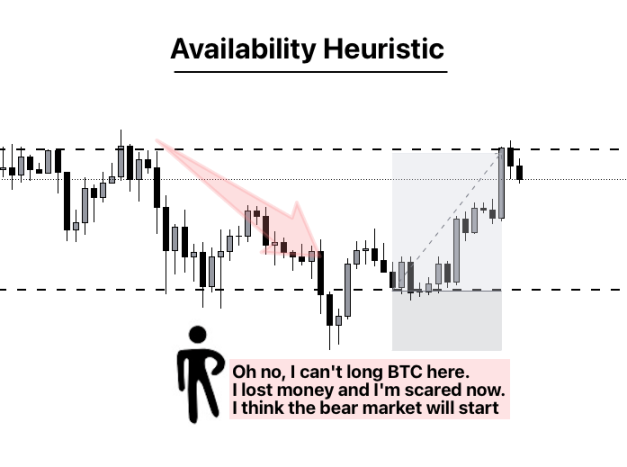

6. Availability Heuristic

Traders often pay too much attention to recent market sentiment and events in the market. For example, a recent market crash may still lead traders to be overly cautious.

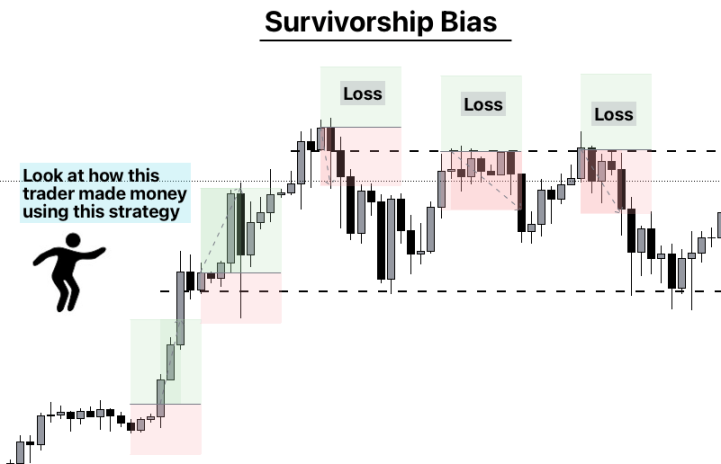

7. Survivorship Bias

Because we often hear success stories and rarely hear about failures, traders often subjectively believe that their chances of success are very high.

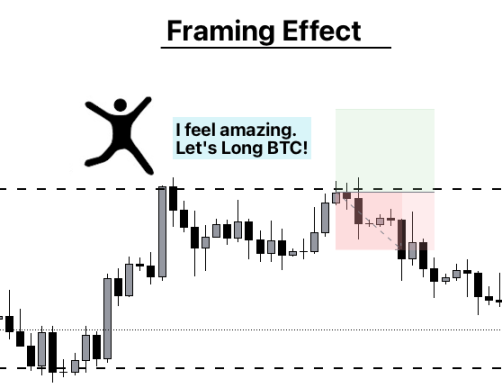

8. Framing Effect

Traders' emotions and confidence play a crucial role in the trading process. Positive emotions often lead to underestimating risks, while negative emotions may lead to overestimating risks.

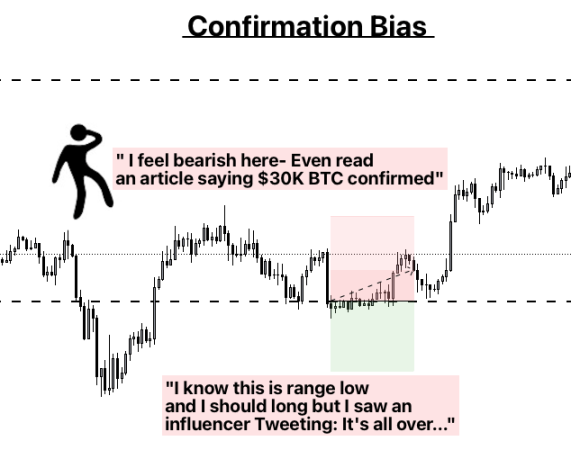

9. Confirmation Bias

Traders often tend to seek out data that supports their views. For example, if you are bullish on a certain asset, you will search for all the information that supports its rise and ignore the bearish information.

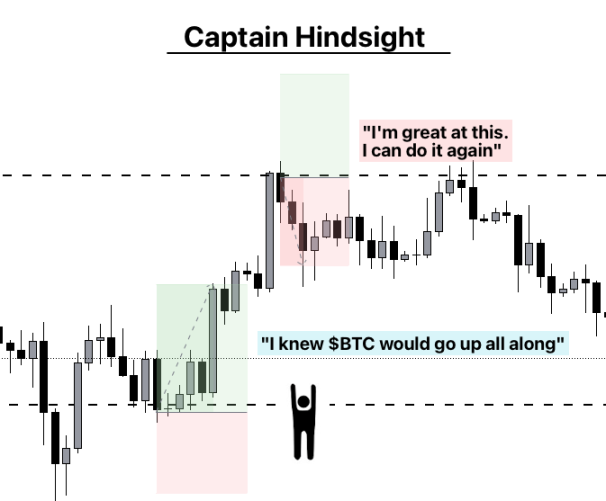

10. Captain Hindsight

Traders often feel that they had already foreseen the results after an event has occurred.

This mistake can lead to overconfidence in predicting the future and incorrect judgments about their trading abilities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。