In the heart, there is sunshine, and everywhere is a scenery. With a willing attitude, live a life of contentment. In the face of life, there is no today that cannot be overcome, only emotions that cannot be overcome. Stay positive and optimistic, and you will find beauty everywhere.

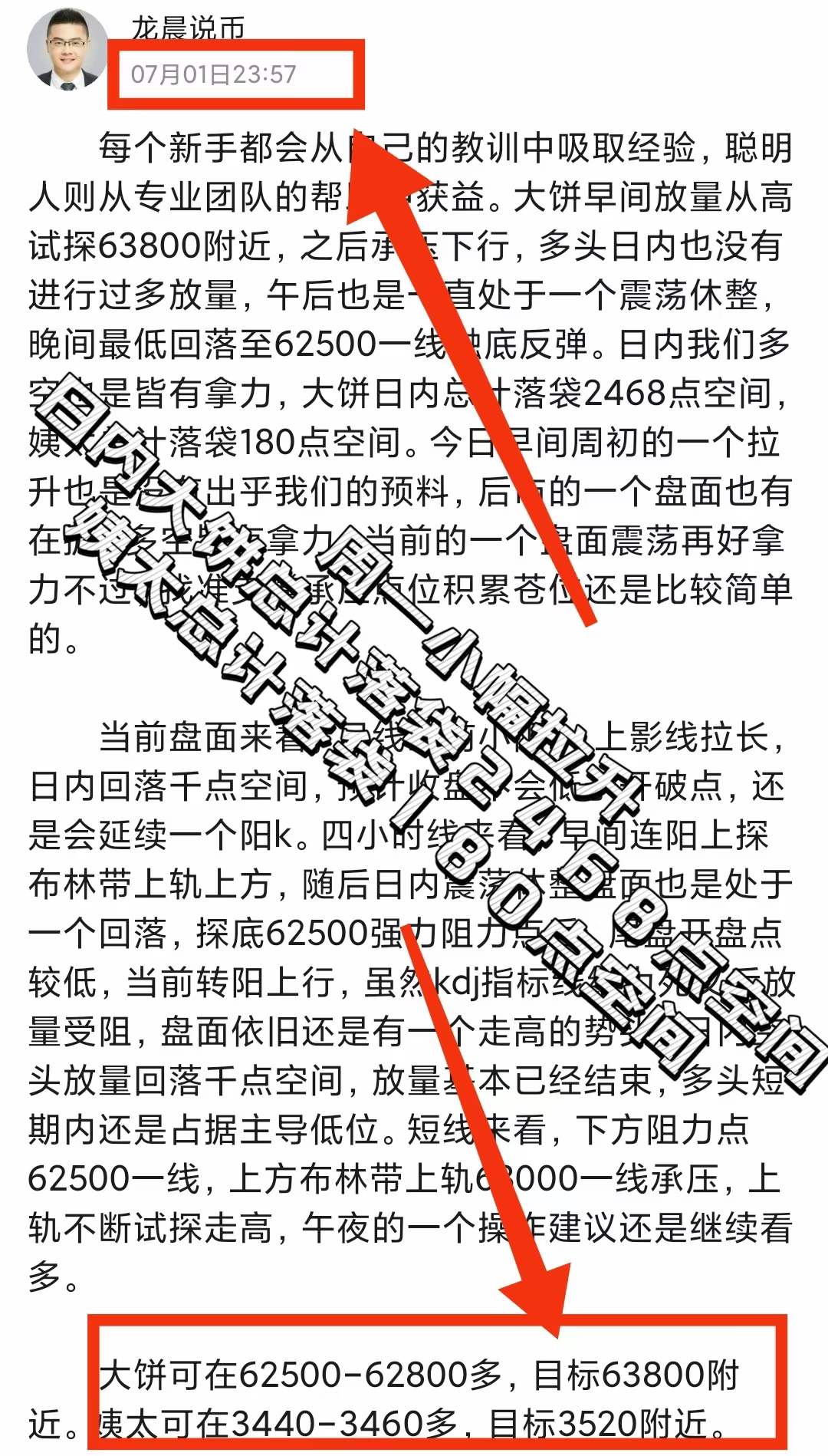

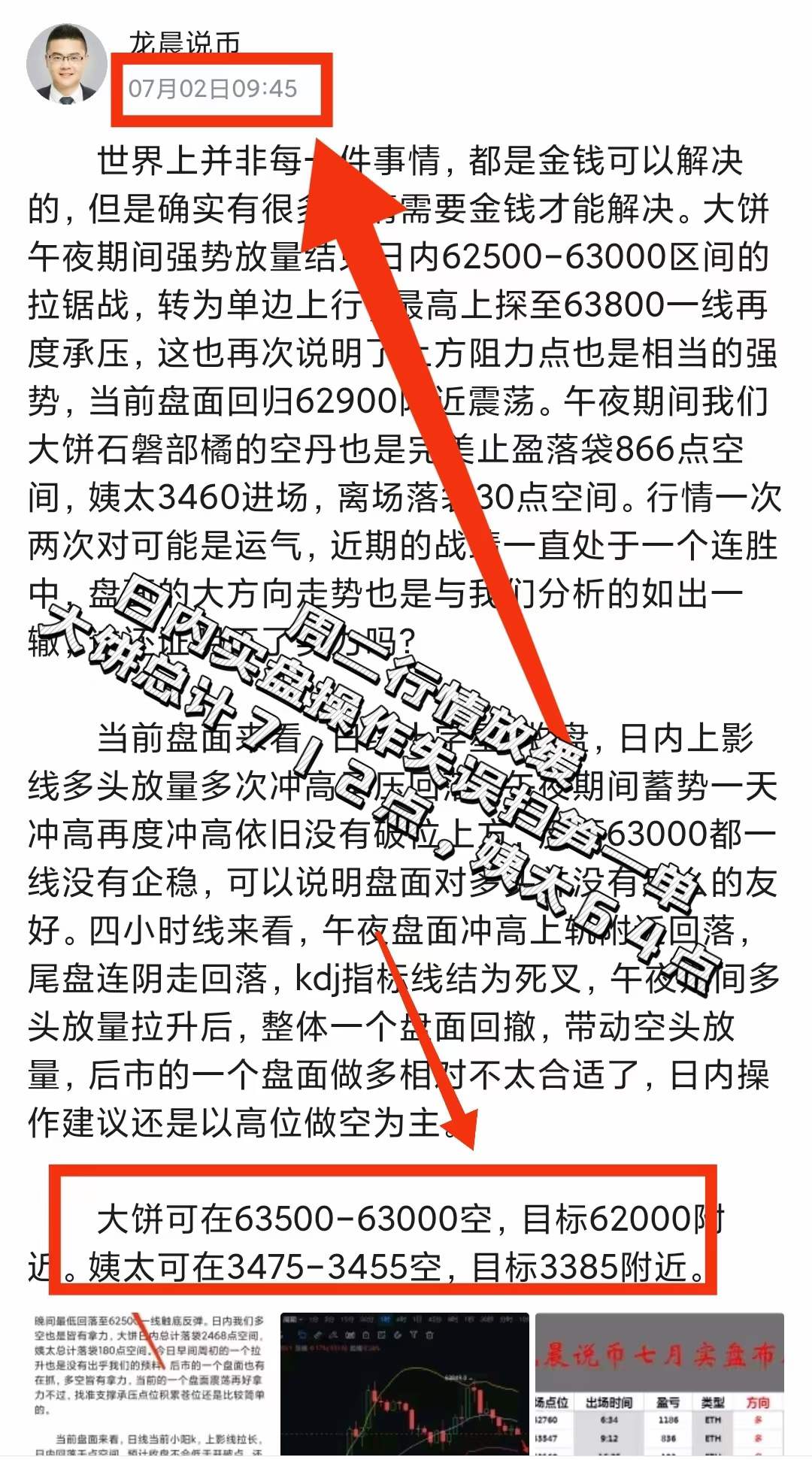

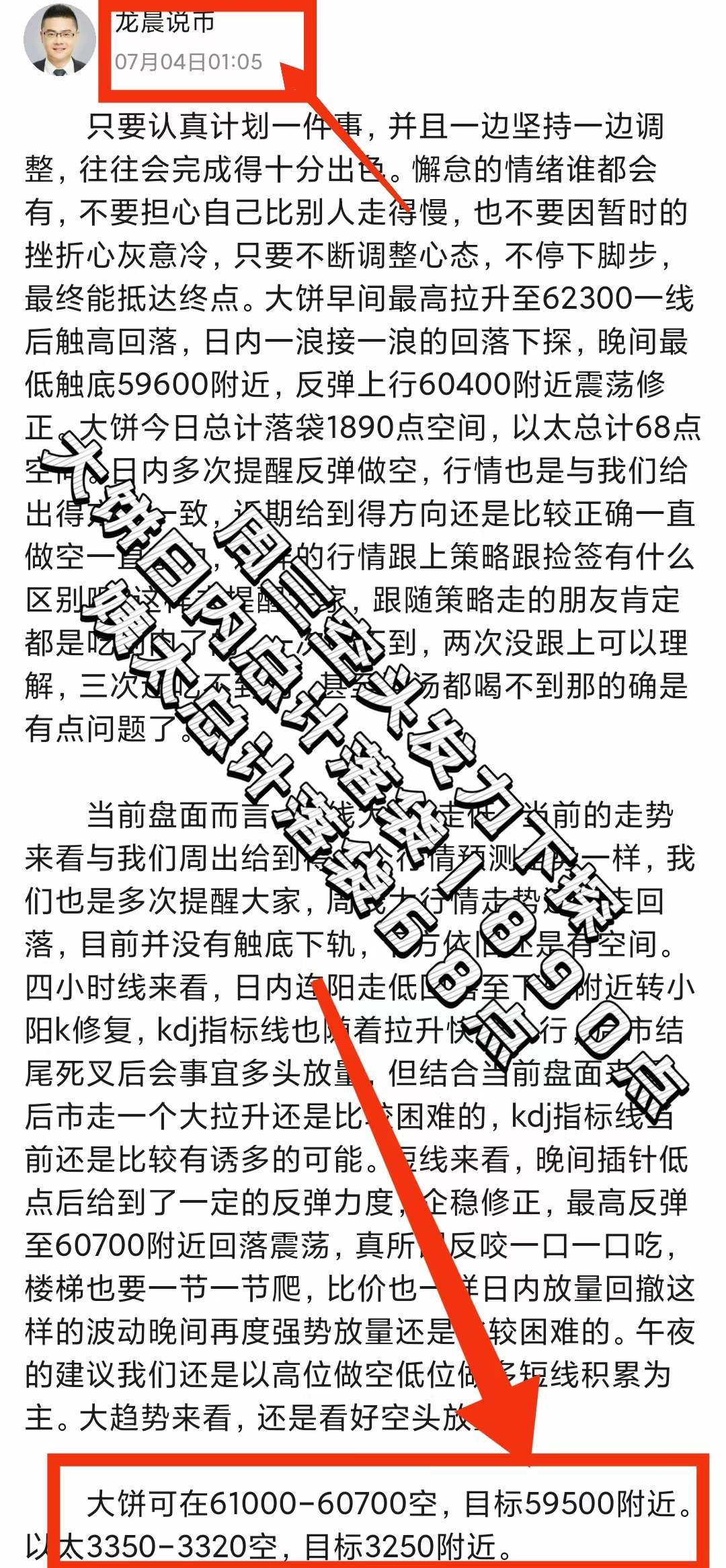

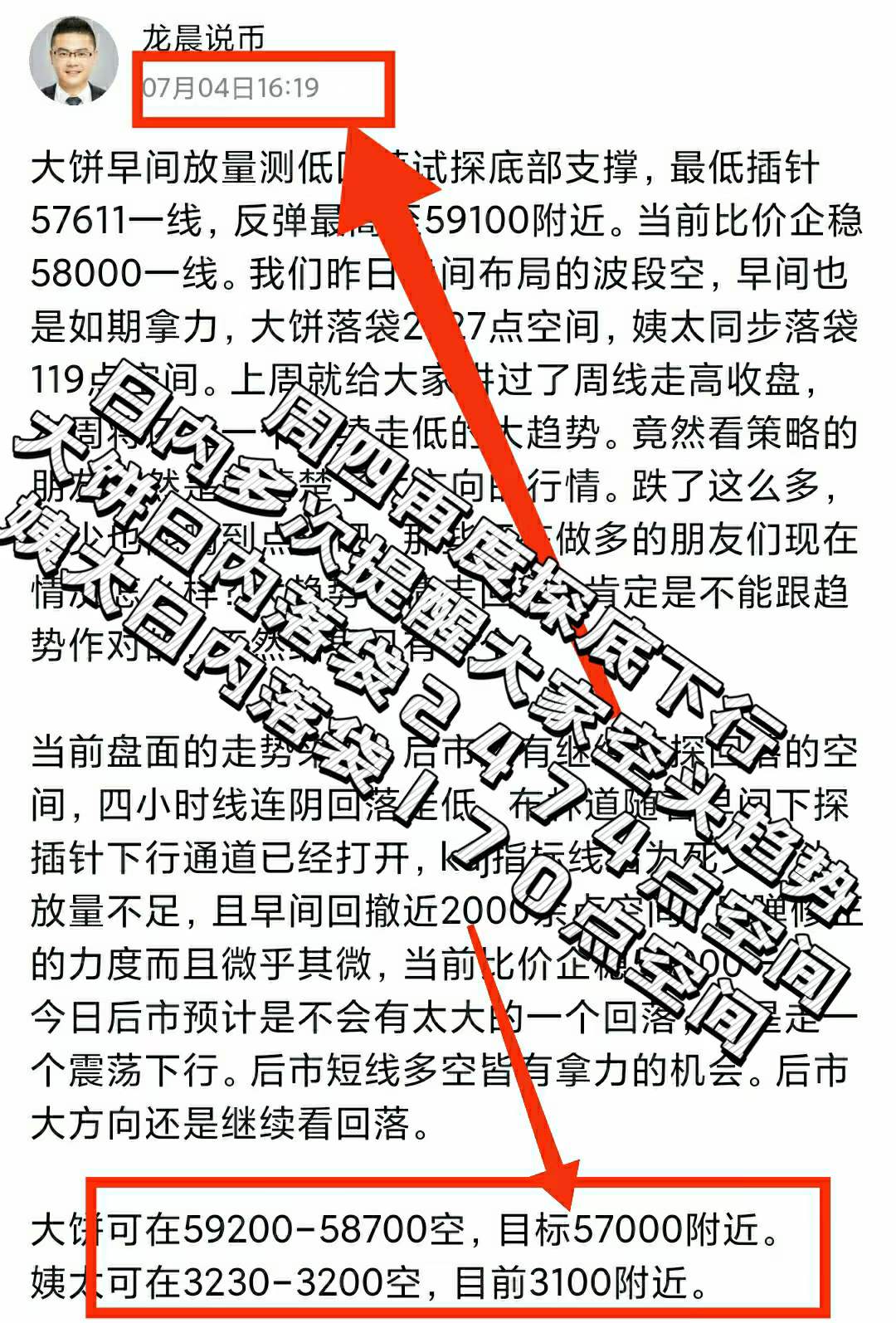

The first week of July has passed, time always passes by so quickly. Let's briefly review the market this week. At the beginning of the week, the price of Bitcoin surged to around 63800 and then fell back under pressure. The intraday market was in a state of fluctuation. On Tuesday, it broke below the support at 62000 and continued to decline. Subsequent market movements were driven by bearish news, leading to a significant drop in volume and a low of around 533300. The weekend market was in a state of recovery. The market this week was as predicted in our summary last week. The weekly closing with an upward trend means that the market will continue to decline unilaterally this week. This week, we strictly executed the strategy and reaped rich rewards. This week, we shorted Bitcoin twice, with a total profit of 10442 points. Ethereum yielded 758 points this week. Overall, the gains were very considerable. The strategy accurately predicted each wave of the market this week, and repeatedly warned everyone publicly that the overall trend is a unilateral decline. This week, many friends encountered problems with bottom fishing, as the data shows. Most of the students under Shiban's guidance had very considerable profits. Those who followed the strategy this week at least made a small profit, which reflects the success rate of the strategy this week. Let's continue to work hard next week.

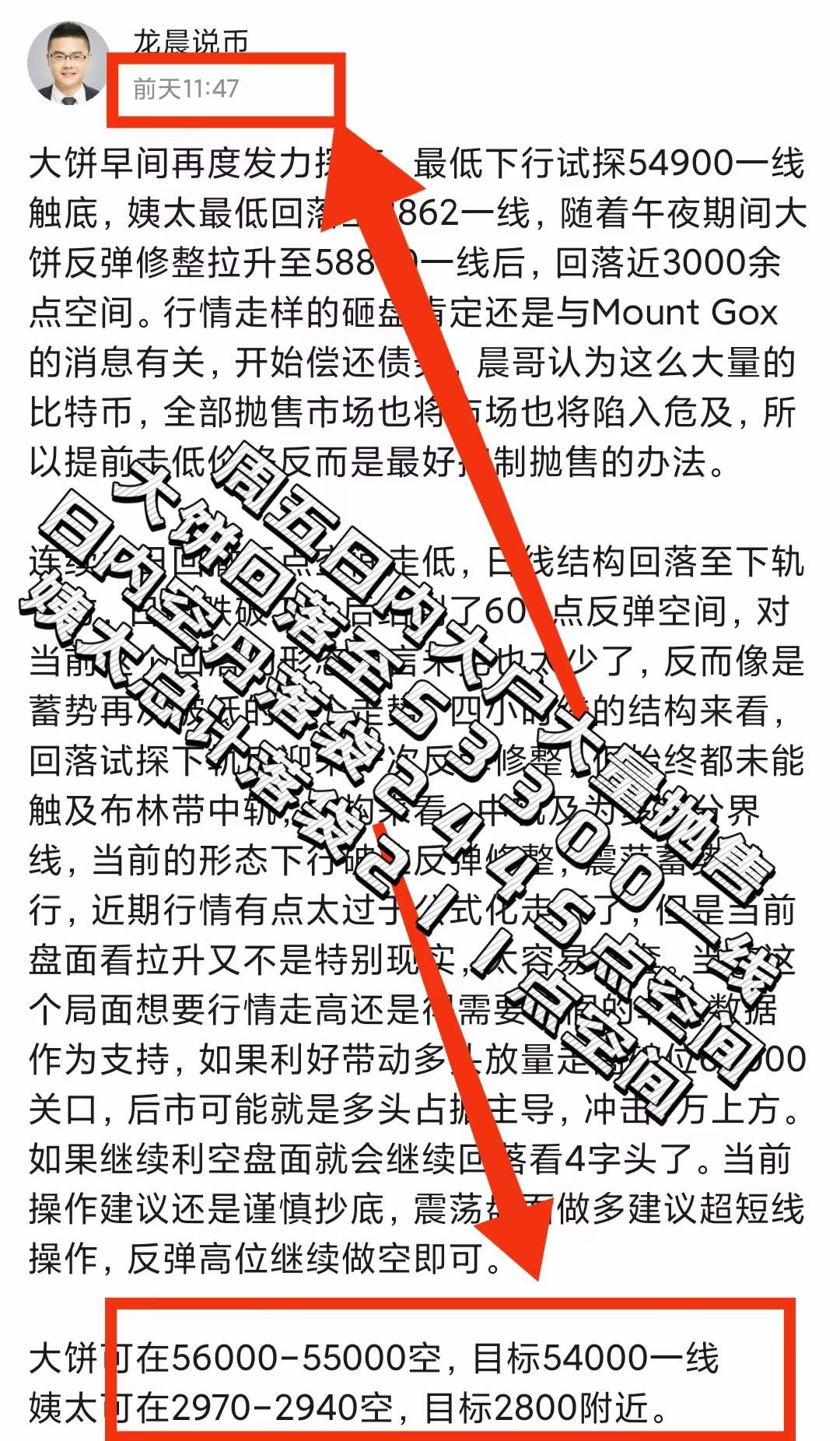

Looking at the monthly chart, the first week of July saw a 10,000-point range with upper and lower shadows. The current market has recovered to the mid-level. It will be quite difficult for the market to rise to 70000 this week based on the current structure. Looking at the weekly chart, the current candlestick is running below the lower Bollinger Band, and the M-shaped ending is basically over. The Bollinger Band on the weekly chart is contracting, and the subsequent market will not provide a significant rebound. There is strong support at the bottom, and the weekly chart is expected to be in a state of fluctuation. The closing position this week is quite important. Looking at the daily chart, the overnight bullish candlestick rose nearly 2000 points, but today's upper shadow pressured the price down from 58400, with support at 57000 below. The resistance above is quite far, and there is strong support at the bottom. The current market does not provide a clear long or short signal. Looking at the four-hour chart, after hitting the support near the middle rail in the afternoon, the market fluctuated upward. The KDJ indicator formed a dead cross, indicating a bearish volume, but the long and short signals in the current market are not clear. In terms of the news, concerns about the possible sale of Bitcoin by Mt.Gox creditors to repay debts led to a market decline. However, due to the belief that the decline was excessive, buying orders poured in, so the rebound view is dominant. Concerns about the amount of Mt.Gox repayment may cause a short-term decline, but it is expected to rise again in the long term, and can be seen as a short-term buying opportunity. The closing point this week is still quite important for the overall direction analysis next week. Due to excessive decline and the large amount of selling by major players this week, the current strategy is to continue to look for a correction. The specific strategy for next week will depend on the closing point.

You can go long on Bitcoin at 57000-57300, with a target near 58400, and go long on Ethereum at 2980-3010, with a target near 3070.

Scan the QR code below to follow Longchen's cryptocurrency insights and get the latest strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。