2024 is a year full of challenges and opportunities for the cryptocurrency market. Bitcoin reached a historic high due to the launch of ETF, while Ethereum and other major digital assets also experienced significant development and volatility.

Authors: Jason Shubnell and Brian McGle

Translated by: Plain Blockchain

The launch of the Bitcoin ETF has driven the world's largest cryptocurrency to a historic high this year. The U.S. presidential election continues to shake the market, with Trump embracing cryptocurrency while Biden has not yet taken a clear position. Below is a brief review of the major milestones in the 2024 market and an outlook for the market prospects before the end of the year.

For the cryptocurrency market, this has been an extraordinary year, and we are only halfway through 2024. The price of Bitcoin (BTC) has significantly outperformed the S&P 500 index, rising by over 46% in the first six months, while the S&P 500 index has risen by 15%.

Most importantly, the U.S. Securities and Exchange Commission approved the first batch of spot Bitcoin trading platform exchange-traded funds (ETF), greatly increasing institutional investment in cryptocurrencies. At the same time, Bitcoin experienced its fourth halving, an event that occurs approximately every four years after mining 210,000 blocks.

However, at the beginning of the second half of the year, Mt. Gox once again disrupted the market. Last month, the bankrupt Bitcoin exchange announced that it would begin distributing over $9 billion to its creditors in early July. These payments—made in the form of Bitcoin, Bitcoin Cash, and fiat currency—began last Friday, causing the price of Bitcoin to briefly drop below $55,000.

Despite the potential short-term impact on the market, some market makers and investors remain optimistic about the long-term prospects for Bitcoin. Below is a brief timeline of the major milestones in the 2024 market and an outlook for the cryptocurrency market prospects before the end of the year.

1. Bitcoin ETF Makes Its Debut on Wall Street

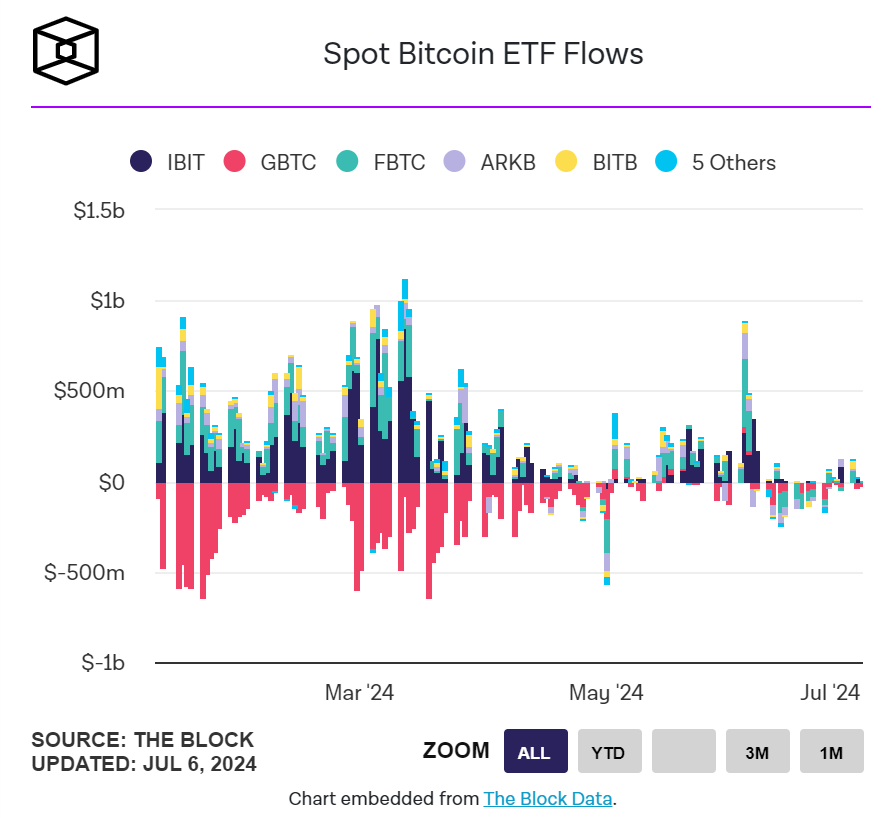

The U.S. Securities and Exchange Commission (SEC) approved the first batch of Bitcoin ETFs on January 10, and they debuted on the stock market the following day. These ETFs, totaling 11, have seen a cumulative net inflow of $14.64 billion and a cumulative trading volume of over $310 billion since their launch.

Bitcoin surged to new highs due to increased institutional adoption and favorable regulatory developments.

After reaching a new high of $73,794 on March 14, Bitcoin experienced dramatic fluctuations in the following months, dropping to between $60,400 and $71,700. Some factors driving this volatility include:

The approval of spot Bitcoin ETFs in the United States.

Runes, launched in April, is a decentralized protocol that creates replaceable tokens directly on Bitcoin, enhancing the functionality, scalability, and security of Bitcoin, while also driving increased demand and trading of Bitcoin.

The Bitcoin halving event on April 19 was expected to push Bitcoin to new highs, but market dynamics delayed the sustained rebound. Analysts stated that historical price surges typically occur 8-9 months after a halving event.

Meanwhile, Ethereum (ETH) also had its own highlights this summer.

Ethereum was driven by two major events in the first half of the year: the Dencun upgrade in March, which reduced transaction costs on Ethereum's second-layer network, and the approval of eight spot Ethereum ETFs by the SEC on May 23. Trading of Ethereum ETFs may begin in the coming weeks.

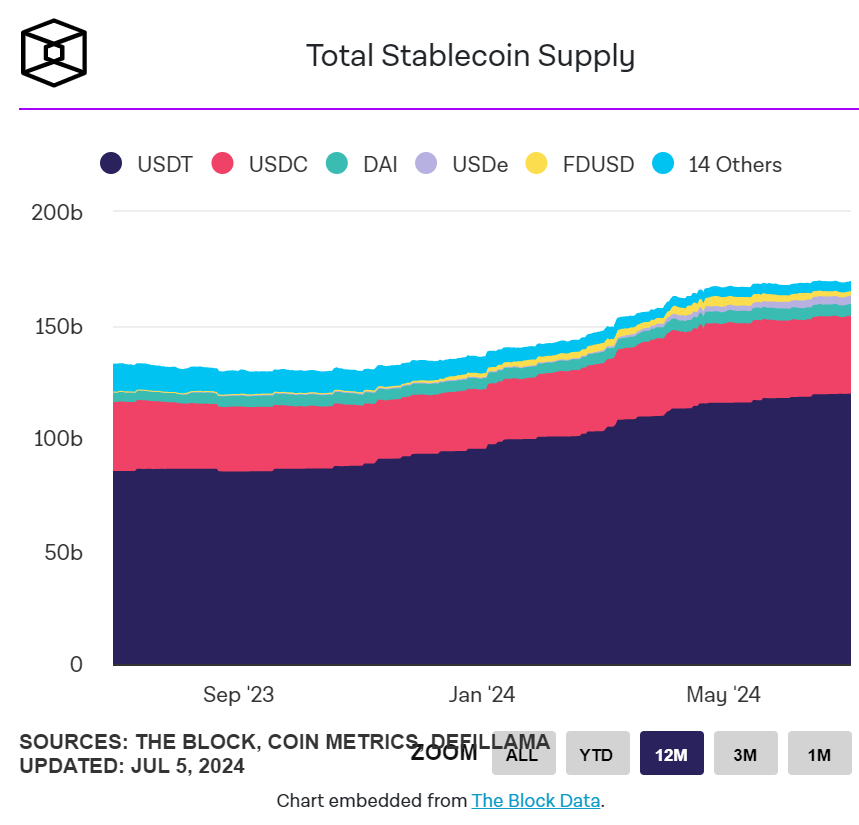

2. Expansion of the Stablecoin Market

Amid increased demand for safe-haven assets during market volatility, the stablecoin market continued to grow.

Circle's USDC market cap exceeded $60 billion, while Tether's market cap also grew significantly, consolidating its position as the leading stablecoin with a circulating supply of over $80 billion.

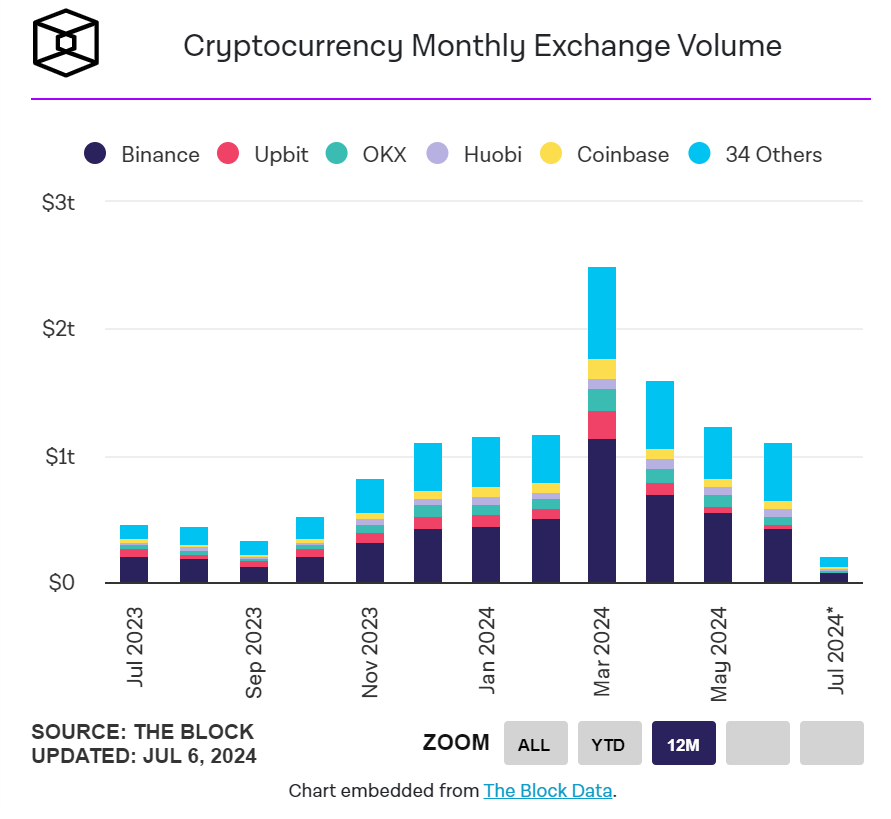

3. Increase in Trading Volume

With the rise in Bitcoin prices, cryptocurrency trading volume surged. While Binance remains a market leader, two of the most popular U.S. trading platforms also continued to grow.

Coinbase reported that trading volume in the first quarter reached a historic high, generating $1.6 billion in revenue, compared to $736 million in the same period in 2023. Trading revenue from institutional and individual clients increased to $1.08 billion.

Cryptocurrency trading volume on Robinhood increased by 224% year-on-year, reaching $36 billion, far surpassing the platform's 40% growth in stock trading volume. Trading-based revenue increased by 59% year-on-year, reaching $329 million, with Robinhood stating that this was mainly driven by cryptocurrency revenue, reaching $126 million, a 232% increase year-on-year.

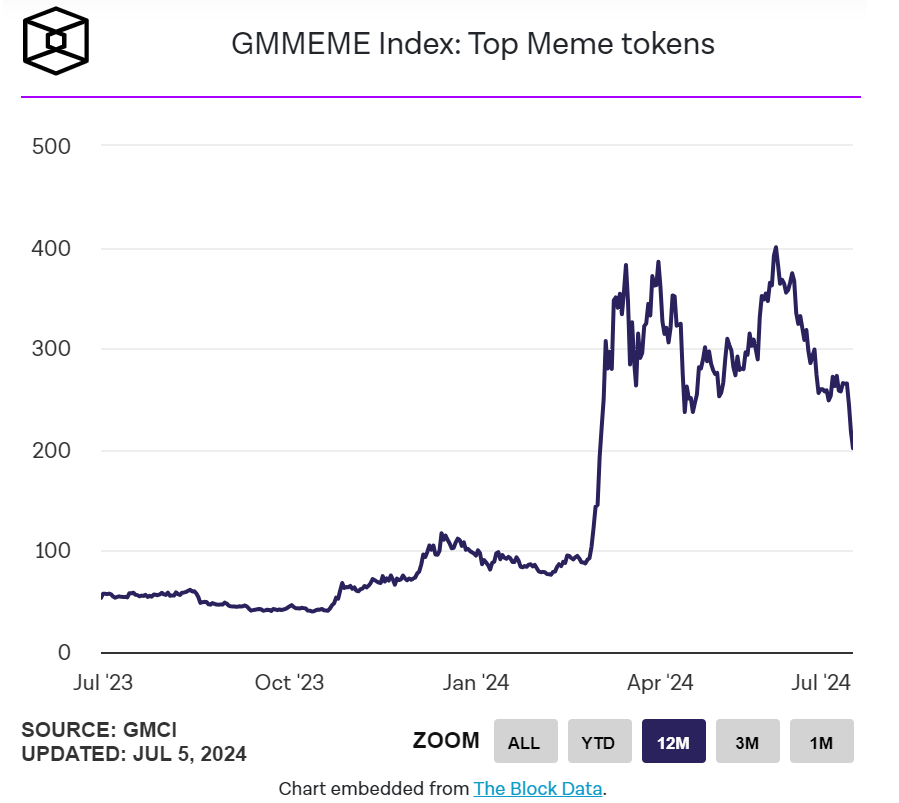

4. Memecoin Once Again in the Spotlight

Although the Memecoin platform Pump.fun is not the most profitable or widely used protocol (recently surpassing Ethereum in 24-hour revenue), it can be said to be one of the representative new products of 2024 so far, as many cryptocurrency traders are once again obsessed with speculating on tokens that they often admit have no greater purpose.

The appeal of certain Memecoins is obvious: TRUMP and BODEN sometimes outperform the cryptocurrency market, possibly as an alternative bet on which candidate will win the November presidential election. The image that initially inspired the Memecoin Dogwifhat was sold as an NFT for $4.3 million, and its community has set its sights on the Sphere in Las Vegas. The easy issuance of Memecoins led to the creation of nearly 500,000 tokens in May alone.

Recently, celebrities have also joined this trend, although Ethereum founder Vitalik Buterin is not excited about the so-called "celebrity coins" launched by prominent figures such as Iggy Azalea, Caitlin Jenner, Hulk Hogan, and Wacka Flocka Flame. Whether Memecoin is truly the next "Trojan horse" for cryptocurrency adoption remains to be seen.

5. Analyst Predictions for Ethereum and Bitcoin

Looking ahead to the second half of the year, Geoffrey Kendrick, Head of Foreign Exchange and Digital Assets Research at Standard Chartered Bank, predicts that the price of Bitcoin will rise to $100,000 in November during the U.S. presidential election. According to Kendrick's forecast, "…Bitcoin may hit a new high in August and then reach $100,000 on the day of the U.S. election."

However, Kendrick's prediction depends on whether Joe Biden continues to participate in the U.S. presidential election—market sentiment favors a victory for Donald Trump in this scenario.

Analysts at Standard Chartered Bank believe that Trump has a positive attitude towards Bitcoin and point out a positive correlation between the former president's election odds and the price of Bitcoin.

"The logic is that under a Trump administration, regulation and mining would be treated more favorably," Kendrick said.

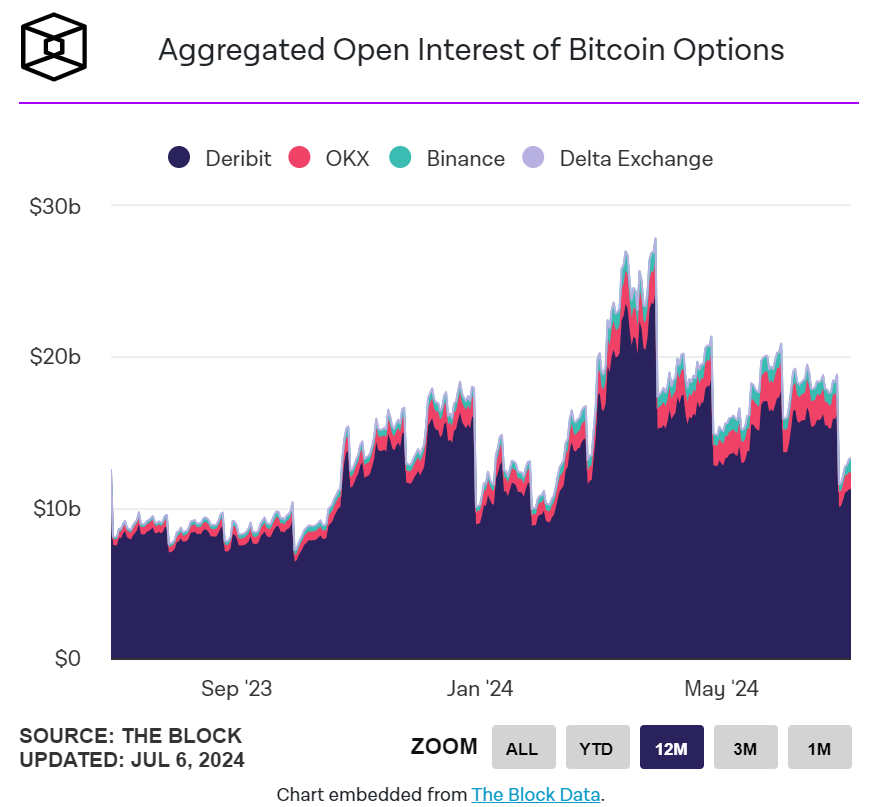

Kendrick expects more bullish options when Bitcoin options expire on August 30, and data from CF Benchmarks also shows a high implied volatility for Bitcoin options after August.

"This indicates that traders are still seeking long-term opportunities for the price of Bitcoin to rise," analysts at CF Benchmarks told The Block.

However, there is a difference in implied volatility indices between Ethereum and Bitcoin, reflecting the market's excitement about the potential launch of spot Ethereum ETFs in the coming months. Expectations for the imminent trading of spot Ethereum ETFs have led investors to anticipate higher volatility for Ethereum compared to Bitcoin.

Source: The Block

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。