Author: Wenser, Odaily Planet Daily

Editor's note: After the market flash crash in April due to the impact of the war situation, shortly after, the market once again ushered in a "period of darkest moment" - according to OKX market data, Bitcoin once fell to $53,296, with a 24-hour decline of nearly 10%; Ethereum once fell to $2,806, with a 24-hour decline of over 10%. Such a huge decline is not only influenced by news such as Mt.Gox's multi-billion-dollar debt repayment, continuous transfer of Bitcoin addresses by the German government, but also related to Bitcoin's price repeatedly breaking through the shutdown price of mining companies, continuous net outflow of Bitcoin spot ETFs, and the continuous liquidation of some Bitcoin and Ethereum whales.

In view of this, Odaily Planet Daily will summarize the views of some research institutions and individuals in this article for readers' reference.

10xResearch: Bitcoin's plunge in progress, what should you do?

As the market continues to decline, the well-known research institution 10x Research once again stated "I told you" in a published article. The following is a compiled version of their content:

The market performance once again proves that 10x Research is the only major research company that predicts price plunges (Odaily note: of course, this is 10x's usual self-promotion). When the price of Bitcoin reached $67,300, we made a downward estimate. Even after the "Trump effect" over the weekend (Odaily note: referring to the impact of Trump's better performance in the US presidential debate, resulting in a slight increase in the market and related political meme coins), we warned that this rebound was not sustainable and reiterated our estimated target prices for Bitcoin at $55,000 and $50,000. The current spot trading price of Bitcoin is around $54,000, a 20% decrease from when we issued the warning signal.

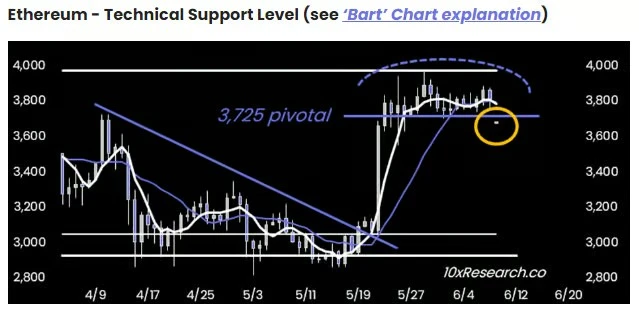

Before Ethereum fell below $3,725, we mentioned in a report that the market might experience a chain liquidation, causing its price to fall back to the price level before the rise due to ETF expectations. These liquidations did not wait long, and the open futures contracts sharply declined last night. Since the release of the relevant report on June 7, Ethereum has fallen by 22%, with the current trading price around $2,900.

It is worth noting that now is not the time to rush to buy the dip, but rather to sit back and let the bears continue to perform.

At the same time, many readers may have been prepared for this sell-off. Although we prefer bull markets, locking in profits at high levels is sometimes the right strategy.

There are always opportunities to make money in the crypto market. Our investment method has once again proven that price trends can be predicted, and money can be made whether the price is rising or falling. Our research has always been at the forefront of this decline (Odaily note: 10x's tone, you know).

Crypto Analyst: Mixed feelings with a bit of stubbornness

From the perspective of market cycles, crypto analyst Rekt Capital analyzed, "In the 2015-2017 cycle, Bitcoin reached its price peak 518 days after the halving; in the 2019-2021 cycle, Bitcoin reached its price peak 546 days after the halving. If history repeats itself, the next price peak of the bull market will occur 518-546 days after the halving, which means Bitcoin may reach a new price peak in mid-September or mid-October 2025. Previously, Bitcoin accelerated to 260 days in this cycle. However, due to the recent consolidation phase of over 3 months, its acceleration rate has sharply decreased to about 150 days. Generally, Bitcoin maintains a longer consolidation period after the halving, and the effect of resynchronizing with the traditional halving cycle will be better."

Synchronization of cycle structure

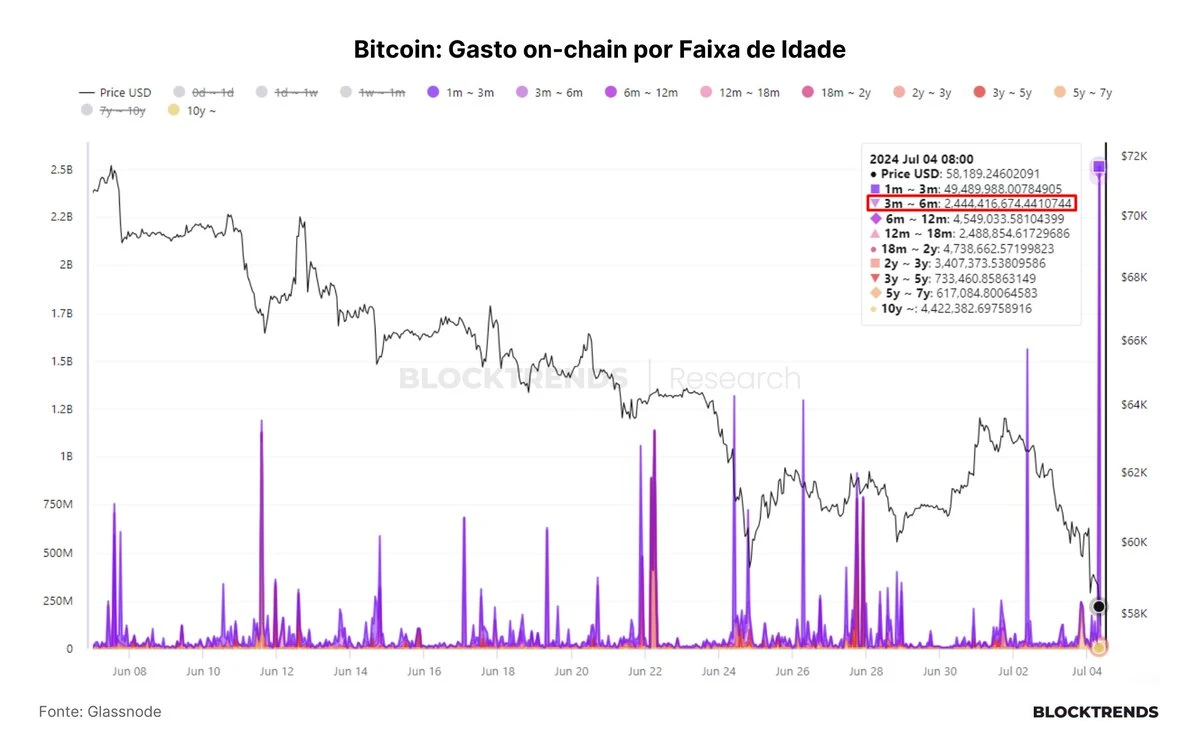

On the other hand, from the perspective of the structure of long and short-term Bitcoin holders, Cauê Oliveira, the research director and on-chain analyst of BlockTrends, stated that novice investors are in distress and losing money. During the decline, approximately $2.4 billion worth of Bitcoin (purchased in the last 3-6 months) was sold. This selling pressure comes from individuals or organizations who bought Bitcoin at the beginning of the year, who may have speculated on Bitcoin spot ETFs and halving events, but now may have to reluctantly exit. They may be classified as "long-term holders," but their actual behavior resembles that of short-term investors, as they entered the market at the beginning of the year (at relatively high levels). On the other hand, individuals or organizations holding for more than a year have not sold more, indicating that true long-term holders continue to HODL.

Amount of Bitcoin transferred in the last 3-6 months

Regarding specific long or short positions and whether to buy, the well-known crypto KOL il Capo of Crypto, who was once "firmly bearish" during the market's continuous rise, expressed his belief in "firmly holding" this time. He stated, "The market's downturn is indeed more brutal than expected. However, at this point where many people panic and sell, I don't think it is appropriate to turn bearish or choose to sell now. It's time to 'broaden your horizons and stay calm.' There may be mistakes in the short term, but hold firm. Time will prove everything."

Conclusion: Recognize the situation and abandon illusions

As senior author Fu of Odaily Planet Daily wrote in the latest market article "Mt.Gox's selling pressure hits, BTC's 24-hour decline of 10% falls below $54,000, where is the bottom?," "The main reason for the current market downturn is the selling pressure from Mt.Gox, but the market may have exaggerated its impact."

The market is sometimes slow to react, slow to the point where real news does not ferment immediately; but sometimes sensitive, sensitive to the point of being like a startled bird, thinking that "there is no turning back" at the slightest movement. But in fact, "the most important factor affecting the future market trend is the result of the US election and the expectation of the Fed's interest rate cut."

Therefore, for market participants including retail and institutional investors, the best choice now may be to shift from "long-term thinking" to "short-term thinking," making trades within 6 hours, or even 4 hours and 2 hours, leaning more towards trend trading, rather than being overly concerned about the unanswered question of "whether Bitcoin and the market as a whole are in a bull market."

In summary, it can be put into 16 words - recognize the situation, abandon illusions, trade in the short term, and wait patiently for positive news.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。