Original Title: How to STOP Losing Money in Crypto!

Original Translation: Golem, Odaily Planet Daily

Yesterday, the cryptocurrency market once again experienced a sharp decline, with BTC briefly falling below $54,000 and ETH briefly falling below $2,900. In the past 24 hours, the entire network has seen nearly $590 million in liquidation of long positions.

The future market trend is difficult to predict, but we must learn to face losses regardless. Whether one can navigate through the loss period correctly will determine whether they can ultimately become a winner in the market. Crypto educator and technical analyst Duo Nine shares 6 strategies for dealing with losses for readers to reference.

Lock in Profits in a Timely Manner

Short-term gains or unrealized profits are not enough; profits must be locked in. Without a clear strategy, the cryptocurrency casino is likely to take them away immediately.

In the example below, a user lost $400,000 in a single trade. He gradually earned $400,000 from $500. However, he lost all the profits in this one trade.

In addition to market FOMO, every lucky person will eventually run out of luck. You can win the market a hundred times, but the market only needs to win against you once.

To avoid this situation, if you are lucky enough to turn $500 into $400,000, the first task should be to lock in some profits and keep them in cash. Then you can continue to trade with a little more than the principal, even if the subsequent market performance is poor and the principal is lost, you still have nearly $400,000 in profits in hand. Over time, this will make you a better trader/investor and allow you to adjust your mindset more quickly after a loss and refocus. Only when a strategy produces good results over the long term can you increase your principal, trading account, or investment portfolio.

Stay Put and Look for the Best Buying Opportunity

A bear market is the best layout opportunity. Usually, when people say Bitcoin is dead on social media, it is the best time to buy and take risks. Strive to maximize the risk/reward ratio, i.e., find high-odds bets.

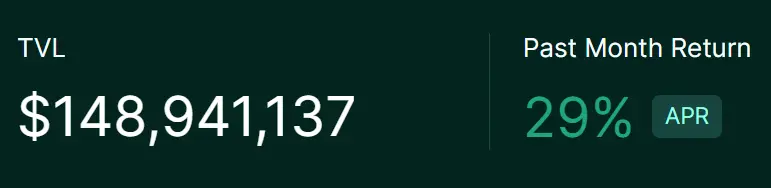

In the example above, in the current market conditions where BTC is performing weakly, I would convert the $400,000 profit into USDC and participate in staking to enjoy passive income.

If calculated at an annual return rate of 29% according to the previous guide, $400,000 can bring in about $10,000 per month. Of course, you can also choose more conservative staking income. In any case, when the market continues to decline, the income will still be positive.

It is not advisable to buy Bitcoin or any tokens at the moment. If the market continues to decline, consider bottom fishing at the right time. Remember, not buying will not result in any loss, and you will still retain the $400,000 profit.

Once there are signs of a market bottom, you can gradually buy Bitcoin in batches, just as you would in a bear market. This way, even if BTC continues to decline or trade sideways, you can reduce some risk, and there will eventually be a chance for the price of Bitcoin to recover and reach new highs. With patience, a good entry point can easily double that $400,000.

Looking at the current cycle, if you bought Bitcoin at a price lower than $20,000 in the previous bear market, you would already be outperforming the market. However, the more diversified your investment portfolio, the more BTC you should hold.

Do Not Trust Shitcoins

Shitcoins are not reliable currencies and have very poor value storage in the long term. Most chains and applications do not need tokens; at best, they are good technology.

A common way to lose in cryptocurrency is to buy the latest shitcoins and hold them for the long term, just like buying tulips back in the day and hoping to get rich from them, which is not feasible.

Shitcoins are suitable for short to medium-term speculation, nothing more. Any investment in shitcoins for more than a year is likely to result in losses. Although there are some exceptions, generally speaking, shitcoins are not a ticket to long-term success.

They may make you rich overnight, but if you do not follow the first point of this article, you will lose it all immediately as well. Most shitcoins will plummet by 90% to 99% in a bear market due to insufficient liquidity. This also means that insiders can easily pump them up, and once they profit, no one can stop the price from crashing. As the most liquid cryptocurrency, Bitcoin does not have this problem.

Fundamentally, only Bitcoin, known as "digital gold," is a reliable currency. Ethereum is more like oil. Its price fluctuates with changes in network usage.

Do not bet too much on shitcoins, even though they may bring returns of 10 to 100 times. As you age and accumulate wealth, reduce your exposure to shitcoins and focus on Bitcoin to achieve inner peace; it is worth it.

Do Not Quit Your Job to Trade Cryptocurrency Full-Time

95% of traders lose money, only 5% are winners. Trading cryptocurrency is harder than working because it is 24/7. Quitting your job to trade cryptocurrency full-time may be a bad decision; instead, keeping your job or finding a job you enjoy and investing in cryptocurrency (mainly Bitcoin) is more suitable.

In fact, a good way to avoid losses in cryptocurrency is to avoid frequent trading. Instead, we can invest in this emerging industry, treating it as if we are buying into a casino when investing and playing its games when trading, meaning we can invest in the infrastructure of the cryptocurrency industry from a long-term perspective.

In this sense, Ethereum and its DeFi derivatives are a good example. Although it is difficult to predict, DeFi has contributed to today's Ethereum, and Bitcoin remains and will continue to be the most reliable currency.

If you want to protect your wealth, buying Bitcoin at a low point will never be a bad choice. Buying Bitcoin is not for selling it tomorrow but for long-term holding and retirement.

Reject Greed and Get Rich Slowly

Making a quick 10x profit on a meme will bring pleasure and allow greed to take over, which is likely to lead to bad trades shortly after. Never go all-in on a shitcoin. You can speculate, but always maintain a small position.

Earning a year's salary in a single trade can change your life, but losing everything in a single trade is also true. Meme coins are attractive because you can get rich overnight (or become poor overnight). They are high-risk, and it is only worth it when the scale of your participation is small.

In this case, taking greater risks makes sense. If you already have a considerable amount of cryptocurrency assets (mainly Bitcoin), then using a small percentage of your total assets to speculate on meme coins or similar high-risk coins is enough.

If you make a big profit on a meme, sell and never look back, and follow the first point of this article. Never sell Bitcoin to buy shitcoins; if you find yourself doing so, there is only one reason: greed.

Accept Losses and Manage Risks

Failure and losses are unavoidable in this field, but we can mitigate their impact and reduce losses. The market does what the market does, and our role is that of risk managers.

Making money should not be our ultimate goal; instead, we should strive to maximize our time and freedom. Bitcoin is the answer, and most people need to lose a considerable amount by playing shitcoins before realizing this.

By accepting losses, we can refocus on important matters more quickly and improve our risk management capabilities. The reason why the top 5% of traders in this game can win is that they manage risks properly; they may also incur losses frequently, but on a small scale, and they can make big profits several times a year.

Losses are common, but they need to be small enough not to throw you off balance.

Be patient with yourself, find your rhythm, and it can be useful not only in the cryptocurrency field but also in other areas.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。