Yesterday, Master Chen placed a long position in the 53000-53400 range, and the market dropped to around 53329 at noon. Subsequently, the price surged to a high of 55916 in the evening, hitting the precise target of 54800-55900 for the long position mentioned in the article, resulting in a profit of 2500 points.

In the 55900-56300 range, a short position was placed. After the market surged to a high of 55916 in the evening, the price dropped to 54827 in the early morning. The first target of 54800 for the short position mentioned in the article was accurately reached, resulting in a gain of 1000 points. In summary, the long and short positions mentioned in the article yesterday resulted in a total profit of 3500 points!

Hot Topics from Master Chen:

After the release of the non-farm payroll data last night, the market experienced a decent rebound in the evening. Master Chen believes that one of the reasons for the recent rapid decline in the market is the decrease in market absorption capacity due to the shortage of ETF funds.

There is definitely a shortage of liquidity and the exacerbation of liquidation behavior. In fact, a large part of the main trading volume of ETFs is for hedging and arbitrage.

This also means that they will engage in futures trading on CME, including yesterday's afternoon options settlement. There are different price clearing points in these, and these jumping points will inevitably cause the currency price to be oversold.

Therefore, Master Chen believes that the reason why the market is still unclear is because the ETF trading, as the main force of the market, has stopped, leading to the recent continuous decline in the market to find the final support and rebuild the bottom.

Trend Analysis from Master Chen:

BTC 1-hour chart:

After Bitcoin broke through the resistance of 56K and the 20-day moving average mentioned by Master Chen yesterday, it has now stabilized at 56K. It is currently consolidating and has broken through the downtrend channel.

Although there are signs of a trend reversal, due to the consolidation and the lack of a new high, Master Chen does not expect a significant increase in the short term, but rather expects a range to form between 56K and 56.6K.

Considering the situation over the weekend, Master Chen expects the price to consolidate within this range.

Resistance Levels for Reference:

First Resistance Level: 56650

Second Resistance Level: 57200

If the price breaks through the first resistance level, it will increase the possibility of an uptrend. Therefore, it is necessary to observe whether the first resistance level will turn into a support level and consider making short-term long trades through pullbacks.

When the price breaks through the high point, it needs to be accompanied by trading volume. There may be a lack of trading volume over the weekend, so it is advisable to adjust positions after observing.

Support Levels for Reference:

First Support Level: 56000

Second Support Level: 55450

For Bitcoin to rebound, it needs to hold the first support at 56K. Master Chen also suggests paying attention to the trend of the 20-day moving average on the 1-hour chart.

During the consolidation period, the price may temporarily fall below the moving average. If the candlestick approaches the moving average and is near 56K, it is necessary to carefully adjust positions after thorough observation.

Today's Trading Suggestions:

In today's trading, although the price has broken through the short-term downtrend channel, due to the lack of trading volume, it is advisable to flexibly adjust positions within the range of 56K to 56.6K.

As the short-term trend is consolidating and has not reached a new high, Master Chen believes that the probability of a trend reversal is low. Therefore, it is recommended to engage in conservative trading when entering the market.

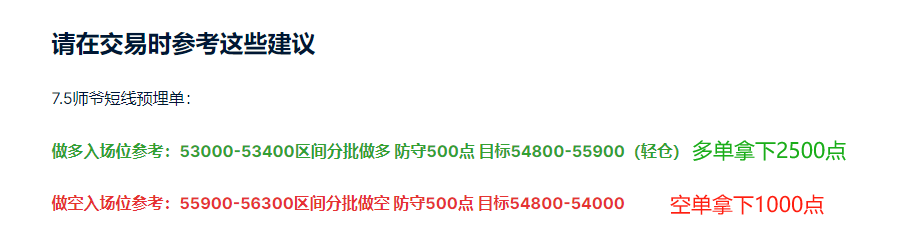

Please refer to these suggestions when trading

Short-term Pre-set Orders by Master Chen on 7.6:

Long Entry Reference: 55100-55500 range, gradually enter long positions, defend 500 points, target 56000-56650

Short Entry Reference: 57200-57600 range, gradually enter short positions, defend 500 points, target 56650-56000

This article is exclusively planned and published by Master Chen (WeChat public account: 币神师爷陈). If you want to learn more about real-time investment strategies, how to get out of a predicament, spot contract trading techniques, operational skills, and candlestick knowledge, you can add Master Chen for learning and communication. Hopefully, it can help you find what you want in the currency circle. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% going with the trend; daily updates on macro analysis articles across the web, technical indicator analysis of mainstream coins and altcoins, and spot medium to long-term replay price forecasts.

Friendly reminder: Only the column public account (as shown in the picture above) is written by Master Chen. The end of the article and other advertisements in the comment section are not related to the author. Please discern carefully between true and false. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。