The original author: Will Awang, investment and financing lawyer, Digital Assets & Web3; independent researcher, tokenization & RWA & payments.

If I were to imagine how finance should operate in the future, I would undoubtedly introduce the numerous advantages brought by digital currency and blockchain technology: 24/7 availability, instant global liquidity, fair access without permission, asset composability, and transparent asset management. This imagined future financial world is gradually being built through tokenization.

Blackrock CEO Larry Fink emphasized the importance of tokenization for the future of finance in early 2024: "We believe that the next step in financial services will be the tokenization of financial assets, which means that every stock, every bond, and every financial asset will operate on the same ledger."

Asset digitization can unfold alongside the maturity of technology and measurable economic benefits, but the widespread adoption of asset tokenization will not happen overnight. The most challenging aspect is the transformation of the infrastructure of traditional finance in this heavily regulated industry, which requires the participation of all players in the entire value chain.

Nevertheless, we can already see the first wave of tokenization arriving, mainly benefiting from investment returns in the current high-interest rate environment and actual use cases (such as stablecoins and tokenized US Treasury bonds). The second wave of tokenization may be driven by use cases of asset categories with smaller market share, less obvious returns, or more daunting technical challenges.

This article attempts to analyze the tokenization framework from the perspective of traditional finance, examining the potential benefits and long-term challenges brought by tokenization, and drawing conclusions based on real and objective cases: despite the ongoing challenges, the first wave of tokenization has arrived.

TL;DR

Tokenization refers to the process of creating digital representations of assets on the blockchain;

Tokenization can bring many advantages: 24/7 availability, instant global liquidity, fair access without permission, asset composability, and transparent asset management;

In the field of financial services, the focus of tokenization is shifting to "blockchain, not cryptocurrency";

Despite the challenges, with the widespread adoption of stablecoins and the launch of tokenized US Treasury bonds, and the clarification of regulatory frameworks, the first wave of tokenization has arrived;

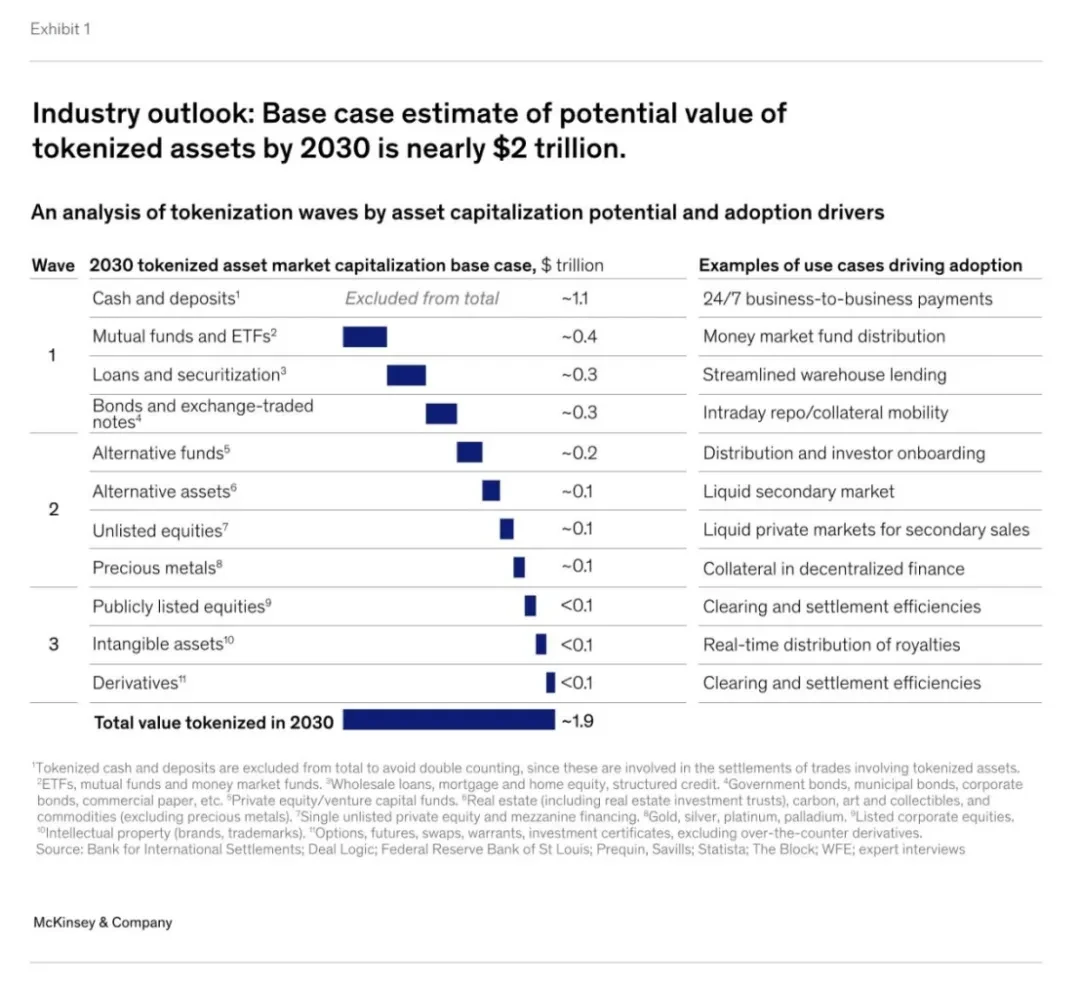

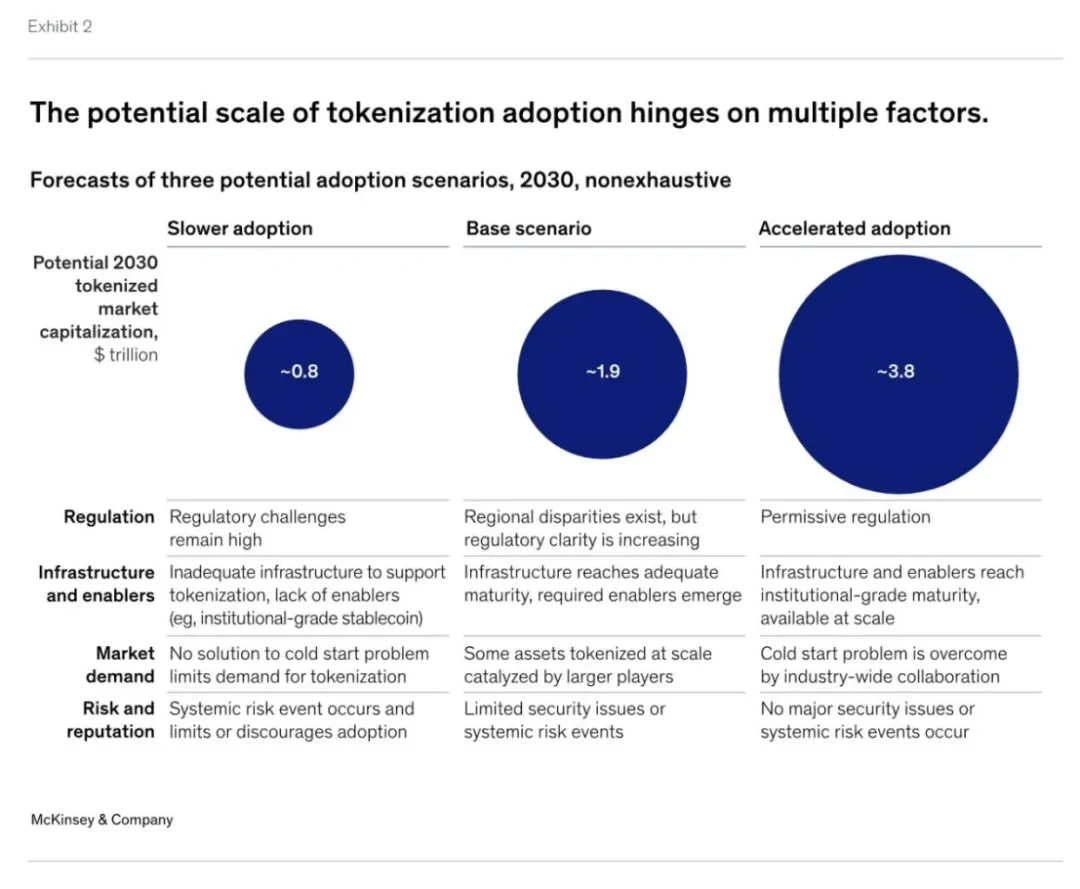

McKinsey & Co expects the total market value of the tokenization market to reach approximately $20 trillion to $40 trillion by 2030 (excluding the market value of cryptocurrencies and stablecoins);

Comparing the current state of the tokenization market with other major paradigm shifts in technology indicates that we are in the early stages of the market;

The next wave of tokenization may be led by financial institutions and market infrastructure participants.

I. What is Tokenization?

"Tokenization" refers to the process of recording ownership of financial or real assets that exist on traditional ledgers onto a programmable blockchain platform, creating digital representations of assets. These assets can be traditional tangible assets (such as real estate, agricultural or mineral commodities, simulated artworks), financial assets (stocks, bonds), or intangible assets (such as digital art and other intellectual property).

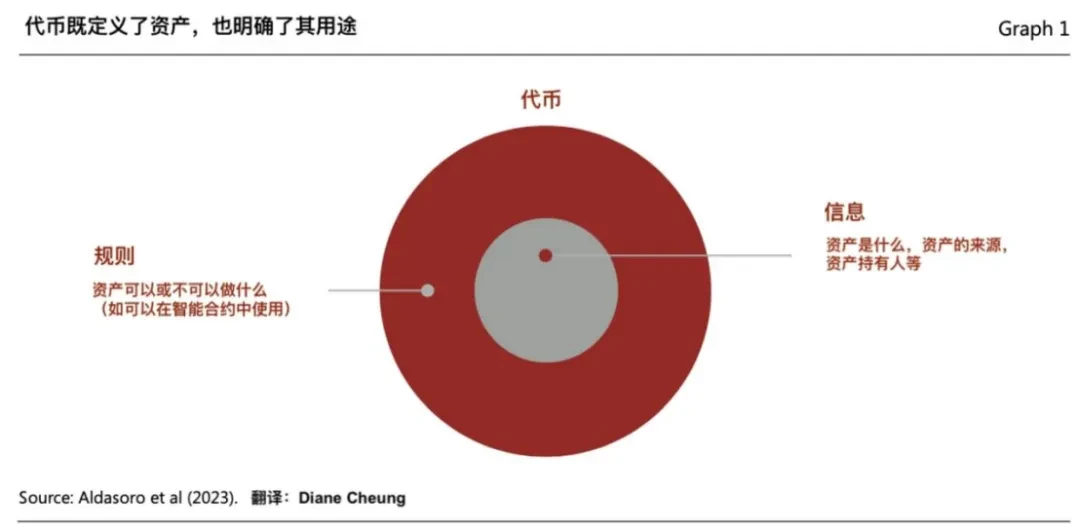

The resulting "tokens" are certificates of ownership recorded on a programmable blockchain platform available for trading. Tokens not only represent a single digital certificate, but also typically encapsulate the rules and logic governing the transfer of underlying assets in traditional ledgers. Therefore, tokens are programmable and customizable to meet personalized scenarios and regulatory compliance requirements.

(Tokenization and Unified Ledger - Blueprint for Future Monetary System)

The "tokenization" of assets involves the following four steps:

1.1 Determine Underlying Assets

When asset owners or issuers determine that assets will benefit from tokenization, the process begins. This step requires a clear understanding of the tokenization structure, as specific details will determine the design of the entire tokenization scheme, such as the tokenization of a money market fund being different from the tokenization of carbon credit limits. The design of the tokenization scheme is crucial, as it helps to clarify whether tokenized assets will be considered securities or commodities, which regulatory frameworks will apply, and which partners will be involved.

1.2 Token Issuance and Custody

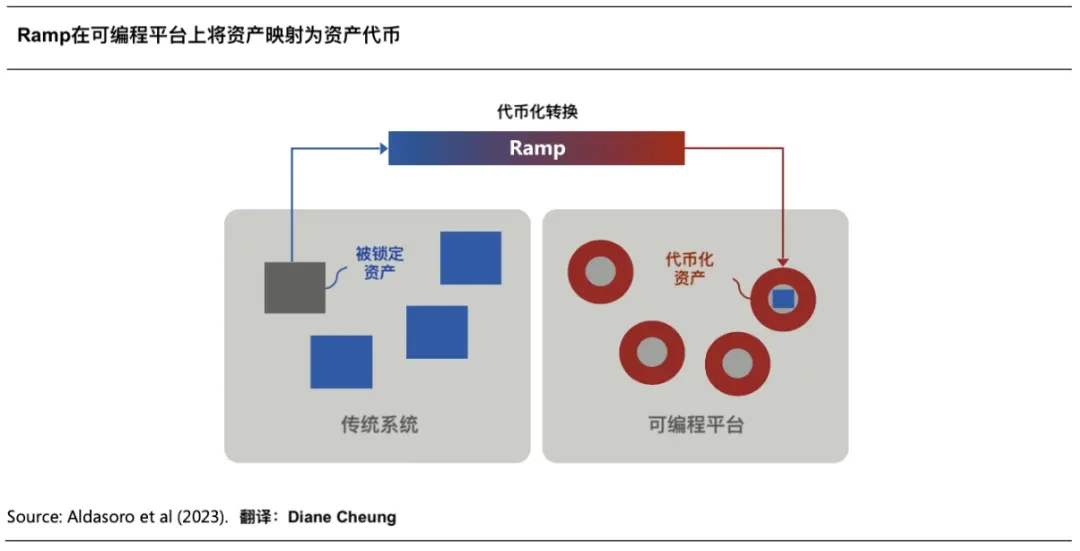

Creating digital representations of underlying assets based on the blockchain requires first locking the range of digital representations corresponding to the underlying assets, whether physical or virtual, usually managed by qualified custodians or licensed trust companies.

Then, specific forms of tokens are adopted on the blockchain to create digital representations of underlying assets, with embedded functions for executing code. For this, asset owners choose specific token standards (ERC-20 and ERC-3643 are common standards), networks (private or public blockchains), and embedded functions (such as user transfer restrictions, freezing functions, and retrieval), which can be implemented by tokenization service providers.

1.3 Token Distribution and Trading

Tokenized assets can be distributed to end investors through traditional channels or new channels such as digital asset exchanges. Investors need to establish an account or wallet to hold digital assets, while any physical asset equivalents remain locked in the issuer's account with traditional custodians. This step typically involves distributors (e.g., private wealth departments of large banks) and transfer agents or trading brokers.

Depending on the issuer and asset category, tokenized assets can also be listed on secondary market trading venues to create liquidity markets for these tokenized assets after issuance.

1.4 Asset Servicing and Data Reconciliation

Digitally distributed assets to end investors still require ongoing servicing, including regulatory, tax, and accounting reporting, as well as regular net asset value (NAV) calculations. The nature of servicing depends on the asset category. For example, the servicing of carbon credit tokens requires different audits than fund tokens. Servicing requires coordination of on-chain and off-chain activities, handling a wide range of data sources.

The current tokenization process is quite complex. In a money market fund tokenization scheme, it may involve as many as nine parties (asset owners, issuers, traditional custodians, tokenization service providers, transfer agents, digital asset custodians or trading brokers, secondary markets, distributors, and end investors), two more than traditional asset processes.

II. Advantages of Tokenization

Tokenization allows assets to harness the enormous potential brought by digital currency and blockchain technology. Broadly speaking, these advantages include: 24/7 operation, data availability, and so-called instant atomic settlement. In addition, tokenization also provides programmability - the ability to embed code in tokens, and the ability for tokens to interact with smart contracts (composability) - enabling a higher degree of automation.

More specifically, as asset tokenization advances on a large scale, in addition to concept validation, the following advantages will become more prominent:

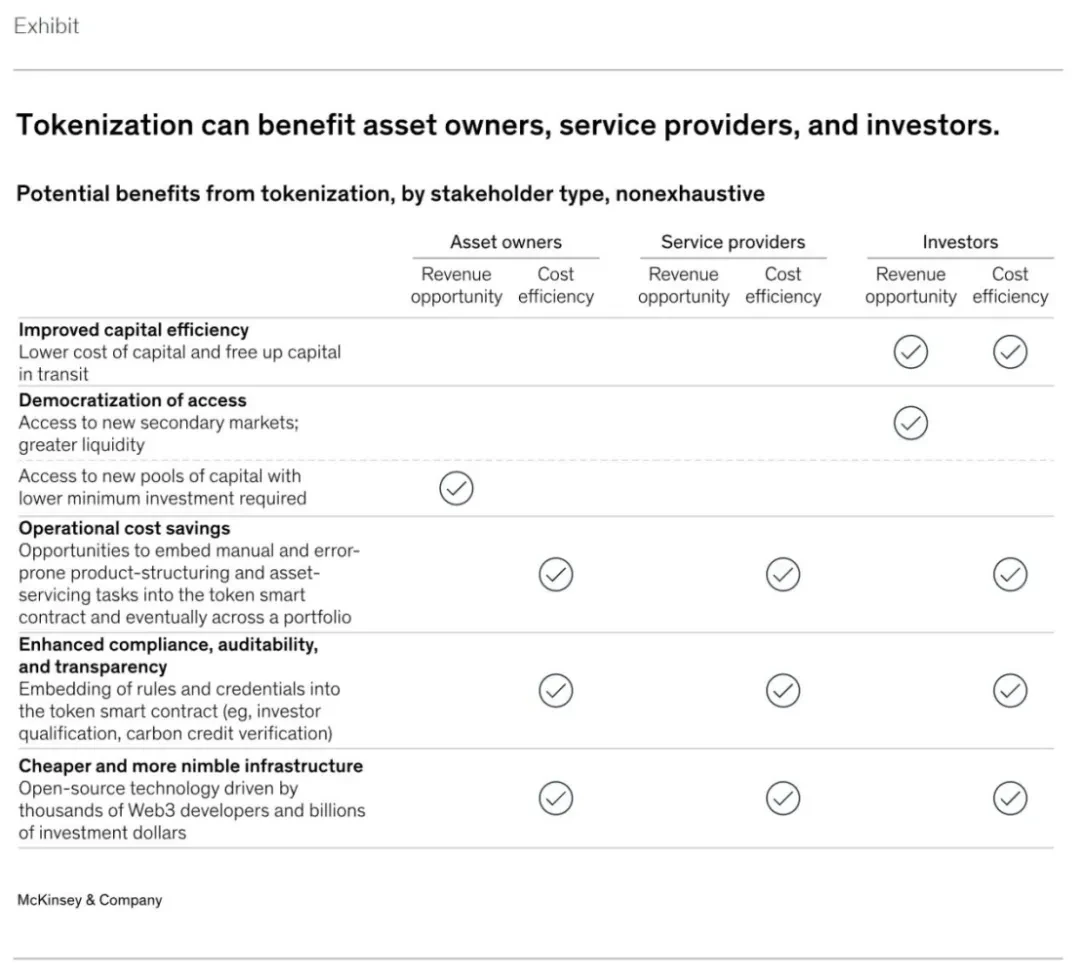

2.1 Improve Capital Efficiency

Tokenization can significantly improve the capital efficiency of assets in the market. For example, repurchase transactions (Repo) or redemptions of money market funds after tokenization can be completed instantly within a few minutes (T+0), while the current traditional settlement time is T+2. In the current high-interest rate market environment, shorter settlement times can save a significant amount of funds. For investors, these savings in funding costs may be the reason why recent tokenized US Treasury bond projects can have a huge impact in the near term.

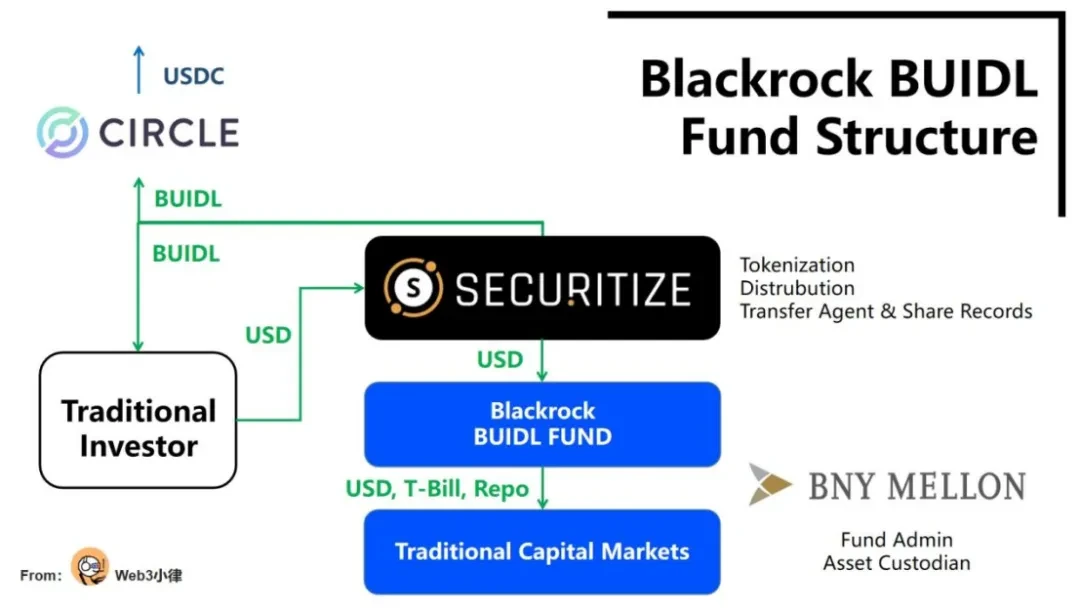

On March 21, 2024, Blackrock partnered with Securitize to launch the first tokenized fund BUIDL on the public blockchain Ethereum. After the fund was tokenized, it was able to achieve real-time settlement on the chain, greatly reducing transaction costs and improving capital efficiency. It can achieve (1) 24/7/365 fund subscription/redemption in fiat USD, and the instant settlement and real-time redemption feature is something many traditional financial institutions are eager to achieve. At the same time, in collaboration with Circle, it enables (2) the stablecoin USDC to be exchanged 1:1 with the fund token BUIDL in real-time 24/7/365.

This type of tokenized fund that links traditional finance with digital finance is a milestone innovation for the financial industry.

(Analyzing Blackrock's tokenized fund BUIDL, opening the door to a beautiful new world for RWA assets in DeFi)

2.2 Democratic Access without Permission

One of the most touted benefits of tokenization or blockchain is democratic access, which, combined with the fragmentation of ownership (dividing ownership into smaller shares, reducing investment thresholds), may increase asset liquidity, but the precondition is that the tokenization market becomes widespread.

In certain asset categories, simplifying intensive manual processes through smart contracts can significantly improve unit economics, thereby providing services to smaller investors. However, access to these investments may be subject to regulatory restrictions, meaning that many tokenized assets may only be available to qualified investors.

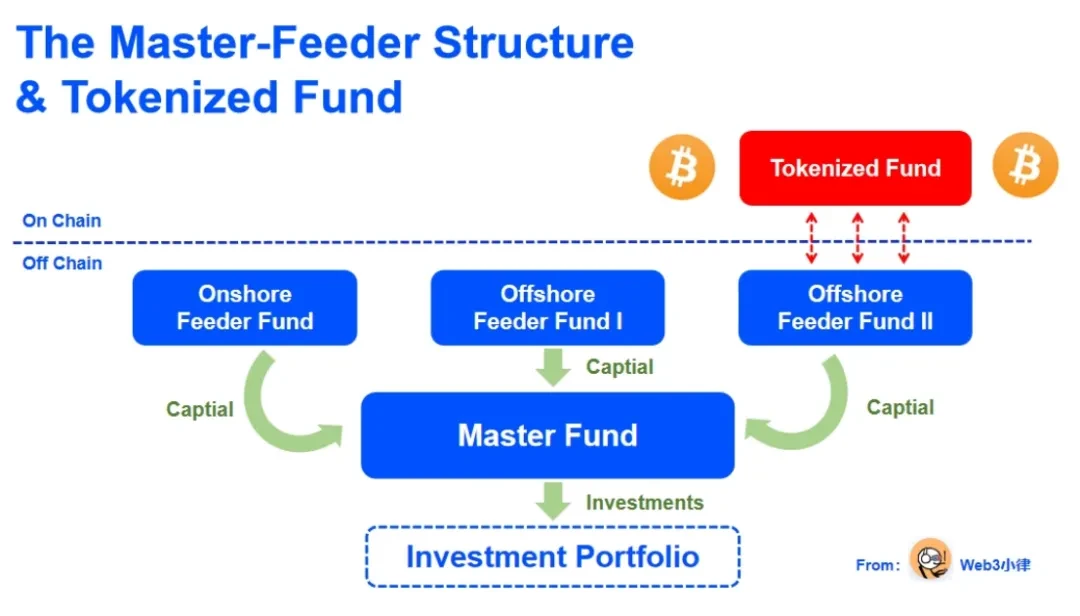

We can see that the well-known private equity giants Hamilton Lane and KKR have partnered with Securitize to offer a "fair" way for a wide range of investors to participate in top-tier private equity funds by tokenizing their managed feeder funds. The minimum investment threshold has been greatly reduced from an average of $5 million to just $20,000, but individual investors still need to undergo qualified investor verification through the Securitize platform, which still presents a certain threshold.

(RWA's extensive report: The value, exploration, and practice of fund tokenization)

2.3 Cost Savings

The programmability of assets can be another source of cost savings, especially for asset categories where services or issuance are often highly manual, error-prone, and involve numerous intermediaries, such as corporate bonds and other fixed-income products. These products often involve custom structures, imprecise interest calculations, and coupon payment expenses. Embedding interest calculations and coupon payments into smart contracts of tokens will automate these functions, significantly reducing costs; system automation achieved through smart contracts can also reduce the cost of securities lending and repurchase transactions.

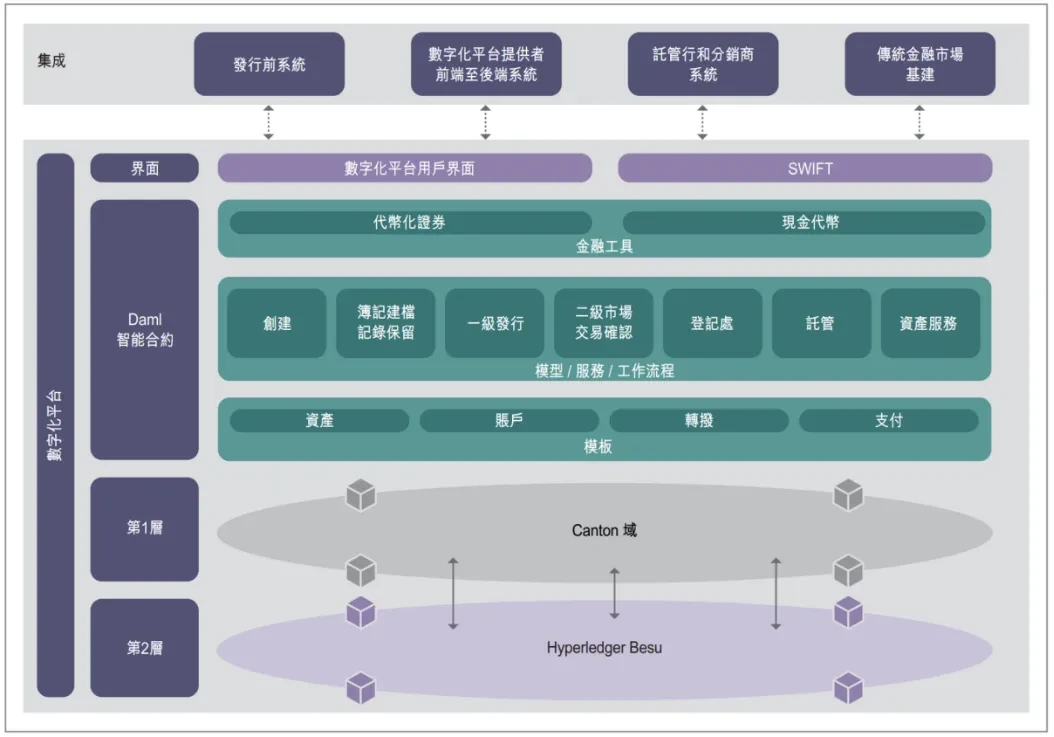

In 2022, the Bank for International Settlements (BIS) and the Hong Kong Monetary Authority launched the Evergreen project, using tokenization and unified ledgers to issue green bonds. The project fully utilized the distributed unified ledger to integrate the participants involved in bond issuance on the same data platform, supporting multi-party workflows and providing specific participant authorization, real-time verification, and signing functions, improving transaction processing efficiency. Bond settlement achieved Delivery versus Payment (DvP), reducing settlement delays and settlement risks, and real-time data updates on the platform also improved transaction transparency for participants.

(https://www.hkma.gov.hk/media/chi/doc/key-information/press-release/2023/20230824c3a1.pdf)

Over time, the programmability of tokenized assets can also create benefits at the portfolio level, allowing asset managers to rebalance portfolios in real-time automatically.

2.4 Enhanced Compliance, Auditability, and Transparency

Current compliance systems often rely on manual checks and retrospective analysis. Asset issuers can automate these compliance checks by embedding specific compliance-related operations (such as transfer restrictions) into tokenized assets. Additionally, the 24/7 data availability based on blockchain systems creates opportunities for simplified consolidated reporting, immutable record-keeping, and real-time auditability.

(Tokenization and Unified Ledger - Blueprint for Future Monetary System)

An intuitive example is carbon credits, where blockchain technology can provide immutable and transparent records for credit purchase, transfer, and retirement, and embed transfer restrictions and Measurement, Reporting, and Verification (MRV) functions into smart contracts of tokens. When initiating carbon credit token transactions, the tokens can automatically check the latest satellite images to ensure that the underlying energy-saving emission reduction projects are still operational, thereby enhancing trust in the project and its ecosystem.

2.5 Cheaper, More Flexible Infrastructure

Blockchain is inherently open-source and constantly evolving with the push from thousands of Web3 developers and billions of dollars in venture capital. Assuming financial institutions choose to operate directly on public permissionless blockchains, or public/private hybrid blockchains, the innovations in blockchain technology (such as smart contracts and token standards) can be easily and quickly adopted, further reducing operational costs.

(Tokenization: A digital-asset déjà vu)

Given these advantages, it is not difficult to understand why many large banks and asset management companies are so interested in the prospects of this technology.

However, due to the lack of use cases and adoption scale of tokenized assets, some of these notable advantages remain theoretical.

III. Challenges of Large-Scale Adoption

Although tokenization may bring many benefits, there have been few assets tokenized on a large scale so far, and the potential influencing factors are as follows:

3.1 Insufficient Technological and Infrastructure Readiness

Challenges of Adoption

The adoption of tokenization is hindered by limitations in existing blockchain infrastructure. These limitations include a continuous shortage of institutional-grade digital asset custody and wallet solutions, which cannot provide enough flexibility to manage account policies, such as transaction limits.

Furthermore, blockchain technology, especially public permissionless blockchains, has limited capacity to operate normally under high transaction throughput, which cannot support tokenization use cases, especially in mature capital markets.

Finally, decentralized private blockchain infrastructure (including developer tools, token standards, and smart contract guidelines) poses risks and challenges for interoperability between traditional financial institutions, such as interoperability between different chains, cross-chain protocols, and liquidity management.

Limited Current Business Cases and High Implementation Costs

Many of the potential economic benefits of tokenization will only be realized on a large scale when tokenized assets reach a certain scale. However, this may require an educational cycle to transition and adapt to back-office workflows that were not designed for tokenized assets. This situation means that short-term benefits are unclear, and business cases are difficult to gain organizational approval.

Not everyone can master digital currencies and blockchain technology from the start, and operations during the transition period can be complex, potentially involving the simultaneous operation of two systems (e.g., digital and traditional settlement, on-chain and off-chain data coordination and compliance, digital and traditional custody and asset services).

Finally, many traditional clients in the capital markets have not shown interest in 24/7 infrastructure for trading and liquidity enhancement, posing further challenges for the listing of tokenized products.

Market Maturity Needed

To achieve faster settlement times and higher capital efficiency, tokenization requires instant cash settlement. However, although progress has been made in this area, there is currently no large-scale cross-bank solution: tokenized deposits are currently only piloted within a few banks, stablecoins currently lack regulatory clarity and cannot be considered anonymous assets, and cannot provide real-time ubiquitous settlement. Furthermore, tokenization service providers are still in their early stages and currently lack the ability to provide comprehensive and mature one-stop services. In addition, the market lacks large-scale distribution channels for appropriate investors to access digital assets, which contrasts sharply with the mature distribution channels used by wealth and asset managers.

Regulatory Uncertainty

So far, the regulatory framework for tokenization varies by region or simply does not exist. Participants in the United States face challenges, including unclear finality of settlement, lack of legal enforceability of smart contracts, and unclear requirements for qualified custodians. There are still more unknowns regarding the capital treatment of digital assets. For example, the U.S. Securities and Exchange Commission has stipulated through "SAB 121" that when providing custody services, digital assets must be reflected on the balance sheet - a standard stricter than traditional assets, making the cost of holding or distributing digital assets too high for banks.

Industry Coordination Needed

Participants in the capital market infrastructure have not shown a consistent willingness to build a tokenized market or move the market onto the chain, and their participation is crucial because they are the ultimate recognized holders of assets on the ledger. The motivations of various parties to shift from tokenization to new on-chain infrastructure are not consistent, especially considering the significant changes in the functions of many financial intermediaries in this process, or even their disintermediation.

Even carbon credits, as a relatively new asset class, faced challenges in the initial establishment and operation on the blockchain. Although tokenization can bring enhanced transparency and other obvious benefits, it seems that only Gold Standard is the only publicly supported registry for tokenized carbon credits.

The First Wave of Tokenization Has Arrived

Despite the many challenges and unknown unknowns, we can see from the trends and large-scale adoption in recent months that tokenization has reached a turning point in certain asset categories and use cases, and the first wave of tokenization has arrived.

Widespread Adoption of Stablecoins

Tokenized assets that require 24/7 real-time settlement must be supported by tokenized cash, and stablecoins, the representatives of tokenized cash, are crucial in the tokenization market.

Stablecoin definition: Most cryptocurrencies have high price volatility and are not suitable for payments, such as Bitcoin, which may experience large fluctuations within a day. Stablecoins are digital currencies designed to solve this problem by maintaining a stable value, usually pegged 1:1 to a fiat currency (such as the US dollar). Stablecoins have the advantage of maintaining low daily volatility while providing the benefits of blockchain - efficiency, cost-effectiveness, and global usability.

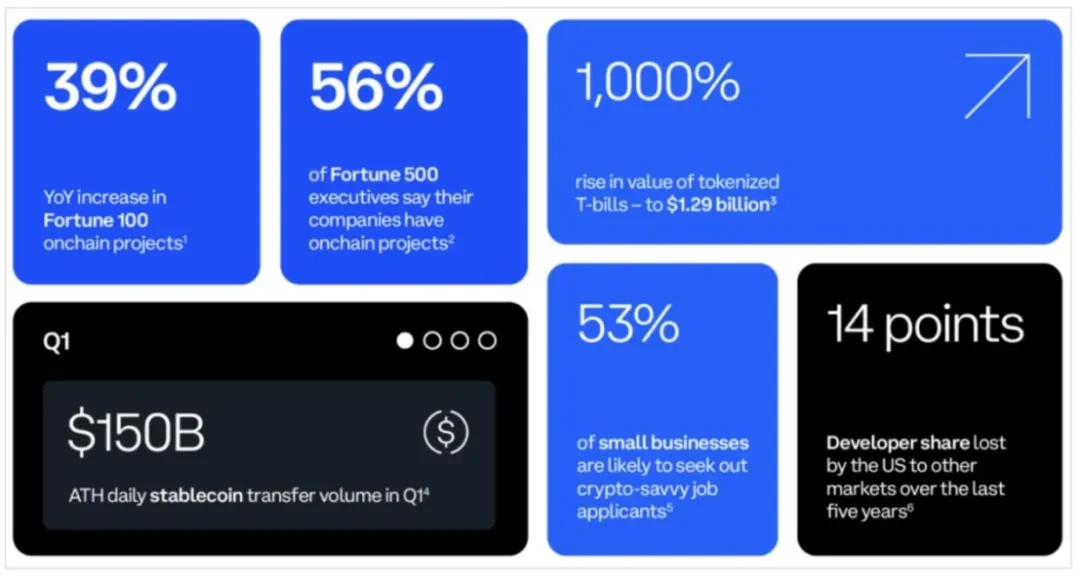

According to SoSoValue data, there is currently approximately $153 billion in circulation in the form of stablecoins (such as USDC, USDT). Some banks have already launched or are about to launch tokenized deposit functions to improve the cash settlement process for commercial transactions. These new systems are not perfect; liquidity is still dispersed, and stablecoins have not yet been recognized as anonymous assets. Nevertheless, they have proven to be sufficient to support meaningful trading volumes in the digital asset market. Monthly on-chain trading volume of stablecoins typically exceeds $500 billion.

Tokenized US Treasury Bonds for Short-Term Business Needs

The current high-interest rate environment has attracted market attention to tokenization use cases based on US Treasury bonds, and these products can indeed achieve economic benefits and improve capital efficiency. According to RWA.XYZ data, the market size of tokenized US Treasury bonds has increased from $770 million in early 2024 to $1.75 billion as of July 1, representing a 227% increase.

At the same time, short-term liquidity trading, such as tokenized repurchase agreements and securities lending, becomes more attractive as interest rates rise. Onyx, JPMorgan's institutional blockchain payment network, is currently able to process $20 billion in transactions per day. Onyx's transaction volume can be attributed to JPMorgan's "Coin System" and "Digital Asset" solutions.

Furthermore, in the United States, traditional banks have attracted a group of large (usually profitable) digital asset business clients, such as stablecoin issuers. Retaining these clients requires 24/7 real-time value and tokenized cash flow, further promoting business cases for accelerated tokenization capabilities.

Gradual Clarity of Tokenization Regulatory Framework

At the end of June, the European Union implemented regulatory requirements for stablecoins in the Markets in Crypto-Assets Regulation (MiCA), and Hong Kong is also seeking feedback on the implementation of stablecoins. Other regions such as Japan, Singapore, the United Arab Emirates, and the United Kingdom have also issued new guidelines to increase regulatory transparency for digital assets. Even in the United States, market participants are exploring various tokenization and distribution methods to mitigate the impact of current regulatory uncertainty using existing rules and guidance.

Following the hearing on "Next-Generation Infrastructure: How Tokenization of Real-World Assets Can Promote Efficient Market Operation" held by the House Committee on Digital Assets, Fintech, and Inclusion on June 7, SEC Commissioner Mark Uyeda emphasized the potential of tokenization to change capital markets at a securities market event on June 14. With the important issue of digital currencies advancing in the U.S. election process, the focus of traditional financial capital on digital currencies has shifted from the previous negative "speculation" to how to "actively" transform traditional finance, whether it is the demand for financial innovation or regulatory relaxation.

Market Popularization and Infrastructure Maturity

The First Wave of Tokenization Has Arrived

In the past five years, many traditional financial services companies have increased their digital asset talent and capabilities. Several banks, asset management companies, and capital market infrastructure companies have established digital asset teams of 50 people or more, and these teams continue to grow. At the same time, the understanding of this technology and its prospects among traditional market participants is also increasing.

(Source: Coinbase, The State of Crypto: The Fortune 500 Moving Onchain)

According to Coinbase's second-quarter cryptocurrency conditions report, 35% of the Fortune 500 companies are considering launching tokenization projects. Executives from 7 of the top 10 Fortune 500 companies are seeking more information about stablecoin use cases, primarily interested in the low-cost, real-time settlement of stablecoin payments. 86% of Fortune 500 executives recognize the potential benefits of asset tokenization for their companies, and 35% of Fortune 500 executives indicate that they are currently planning to launch tokenization projects (including stablecoins).

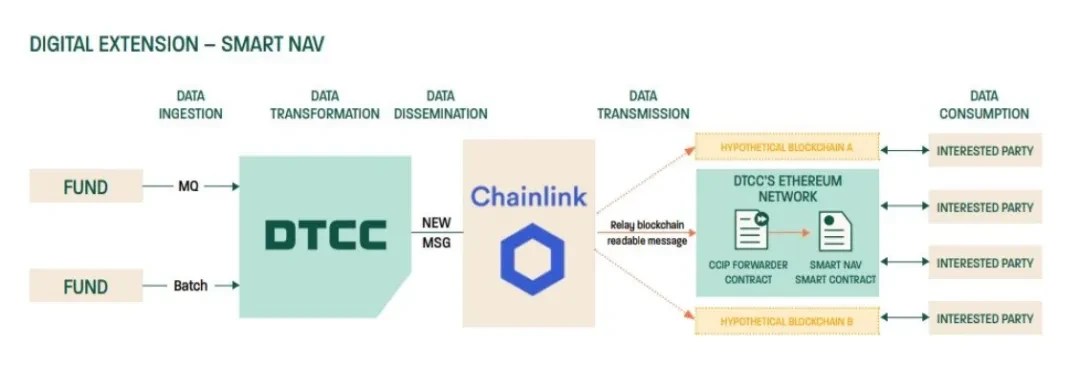

Additionally, we are currently seeing significant financial market infrastructure conducting more experiments and planned feature expansions. For example, on May 16, the Depository Trust & Clearing Corporation (DTCC), the world's largest securities settlement system that processes over $200 trillion in transactions annually, completed a pilot Smart NAV project with blockchain oracle Chainlink. The project used Chainlink's Cross-Chain Interoperability Protocol (CCIP) to introduce net asset value (NAV) quote data for mutual funds on almost all private or public blockchains.

The pilot's market participants included American Century Investments, BNY Mellon, Edward Jones, Franklin Templeton, Invesco, JPMorgan, MFS Investment Management, Mid-Atlantic Trust Company, State Street, and U.S. Bank. The pilot found that by providing structured data on-chain and creating standard roles and processes, foundational data can be embedded into various on-chain use cases, opening up multiple innovative applications for fund tokenization.

(Source: DTCC, Smart NAV Pilot Report: Bringing Trusted Data to the Blockchain Ecosystem)

While tokenization has not yet reached the scale needed to realize all its benefits, the ecosystem is maturing, and potential challenges are becoming clearer, leading to a gradual increase in the adoption of tokenization business cases.

Especially benefiting from the argument that tokenization can improve capital efficiency in a high-interest rate environment, the successful launch of tokenized funds by Blackrock (from a traditional finance perspective) and Ondo Finance's tokenized US Treasury bond product (from a crypto finance perspective), as well as the widespread adoption and popularity of the $ONDO token, provide strong support for the first wave of tokenization.

As for the argument that tokenization can provide liquidity for traditional illiquid assets, further market validation is needed. This argument will be built on the large-scale adoption of tokenized assets.

In any case, these real-world use cases demonstrate that tokenization can continue to attract attention and create meaningful value for global markets over the next two to five years.

The Most Widely Adopted Asset Categories

Asset categories with large market volumes, high value chain friction, immature traditional infrastructure, or low liquidity are likely to reap huge benefits from tokenization. However, the most profitable does not necessarily mean the most prioritized for implementation.

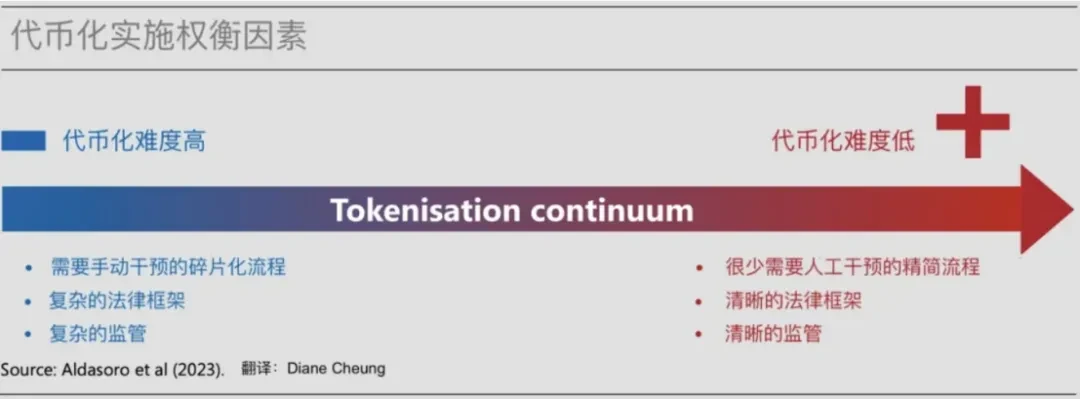

The adoption rate and timing of tokenization will depend on the attributes of the asset category, including expected returns, feasibility of implementation, timing of impact, and risk preferences of market participants. These factors will determine whether the related asset category can be widely adopted and when.

Specific asset categories can lay the foundation for the adoption of other asset categories by introducing clearer regulations, more mature infrastructure, better interoperability, and faster and more convenient investments. Adoption will also vary by region, influenced by dynamic and evolving macro environments, including market conditions, regulatory frameworks, and buyer demand. Finally, the success or failure of flagship projects may drive or limit further adoption of tokenization.

(Source: Tokenization and Unified Ledger - Blueprint for Building the Future Monetary System)

5.1 Mutual Funds

Tokenized money market funds have attracted over $1 billion in managed assets, indicating a significant demand for tokenized money market funds among investors with on-chain capital in a high-interest rate environment. Investors can choose funds managed by established companies such as Blackrock, WisdomTree, Franklin Templeton, as well as Web3-native projects like Ondo Finance, Superstate, and Maple Finance. The underlying assets of these tokenized money market funds are primarily U.S. Treasury bonds.

This marks the current first wave of tokenization, with the widespread adoption of tokenized funds. As the scope and scale of tokenized funds continue to expand, additional related products and operational advantages will be realized.

Just as PayPal launched its stablecoin on Solana at the end of May, the first step towards mass adoption is cognitive awakening - simply introducing the fact that new technology exists to people. The next step in adopting new payment technologies is utility realization, transforming initial cognitive awakening into practical utility in daily life. The approach taken by PayPal to promote its stablecoin can also be applied to the mass adoption of tokenization in the market.

(Source: Analyzing the Inherent Logic of PayPal's Stablecoin Payments and the Evolutionary Thinking Towards Mass Adoption)

The transition to on-chain tokenized funds can greatly enhance the utility of funds, including instant 24/7 execution, real-time settlement, and using tokenized fund shares as a payment tool. In addition, based on on-chain composability, Web3-native project issuers are enhancing the utility of tokens based on their characteristics. For example, the team behind $USTB, Superstate (founded by the creator of Compound), announced that their token can now be used to collateralize trades on FalconX. The team behind $USDY and $OUSG, Ondo Finance, announced that $USDY can now be used to collateralize trades on the Drift Protocol's perpetual contracts.

Furthermore, through the composability of hundreds of tokenized assets, highly customized investment strategies will become possible. Placing data on a shared ledger can reduce errors associated with manual reconciliation and increase transparency, thereby reducing operational and technical costs.

While the overall demand for tokenized money market funds partly depends on the interest rate environment, it undoubtedly plays a crucial role in driving the development of the tokenization market. Other types of mutual funds and ETFs can also provide on-chain capital diversification for traditional financial instruments.

5.2 Private Credit

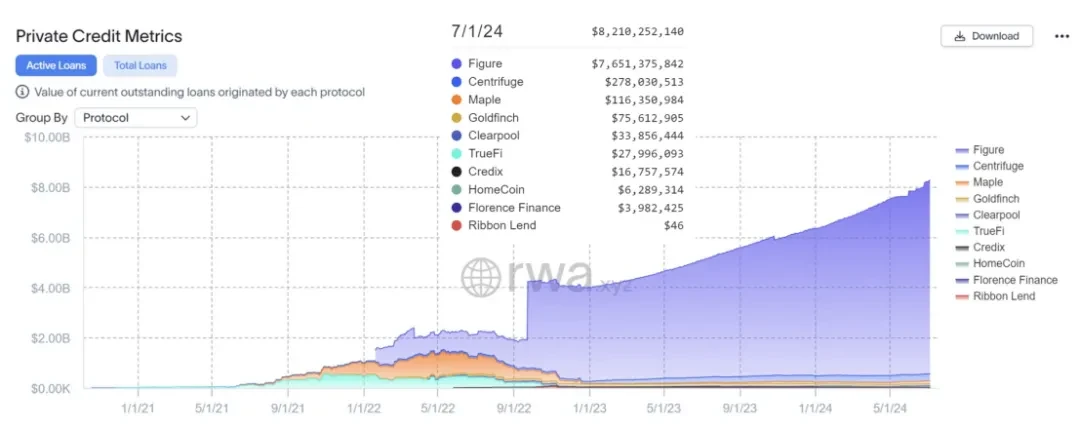

Although blockchain-based private credit is still in its early stages, disruptors have begun to succeed in this area: Figure Technologies is one of the largest non-bank home equity line of credit (HELOC) lenders in the United States, with loan issuance reaching billions of dollars. Web3-native projects such as Centrifuge and Maple Finance, together with companies like Figure, have facilitated over $10 billion in on-chain credit issuance.

(https://app.rwa.xyz/private_credit)

The traditional credit industry is a labor-intensive process with high intermediary involvement and high entry barriers. Blockchain-based credit offers an alternative with many advantages: real-time on-chain data stored in a unified ledger serves as a single source of truth, promoting transparency and standardization throughout the loan lifecycle. Smart contract-based expenditure calculations and simplified reporting reduce costs and labor. Shortening settlement cycles and accessing a broader pool of funds can expedite transactions and potentially lower the cost of funds for borrowers.

Most importantly, global liquidity can provide funding for on-chain credit without the need for permissioned access. In the future, tokenizing a borrower's financial metadata or monitoring their on-chain cash flow can enable fully automated, fairer, and more accurate project financing. Therefore, more loans are turning to private credit channels, making cost savings and fast, efficient financing highly attractive to borrowers.

The non-standardized nature of private credit may have even greater potential for explosive growth, as Securitize's CEO has expressed optimism about the development of the tokenized private credit industry.

5.3 Bonds

In the past decade, over $10 billion in tokenized bonds have been issued globally (compared to the total outstanding nominal bond value of $140 trillion worldwide). Recent notable issuers include Siemens, City of Lugano, World Bank, as well as other companies, government-related entities, and international organizations. Additionally, blockchain-based repurchase agreements (Repo) have been adopted, with monthly trading volumes in North America reaching trillions of dollars, creating value through the operation and capital efficiency of existing fund flows.

The issuance of digital bonds may continue, as once scaled, the potential returns will be high, and the current barriers to entry are relatively low, partly due to the desire to stimulate the development of certain regional capital markets. For example, in Thailand and the Philippines, tokenized bond issuance allows small investors to participate through decentralization.

While the advantages so far have mainly been in the issuance aspect, end-to-end tokenized bond lifecycle can improve operational efficiency by at least 40% through data clarity, automation, embedded compliance (e.g., coding transferability rules into tokens), and streamlined processes (e.g., asset servicing). Furthermore, cost reduction, accelerated issuance, or asset fragmentation can improve financing for small issuers by achieving "instant" financing (optimizing borrowing costs by raising a specific amount at a specific time) and leveraging a global pool of investors.

5.4 Repurchase Agreements

Repurchase agreements (Repo) are an example of tokenization adoption and its benefits that can be observed today. Broadridge Financial Solutions, Goldman Sachs, and JPMorgan currently trade trillions of dollars in repos each month. Unlike some tokenization use cases, repo transactions do not require the entire value chain to be tokenized to realize real-world benefits.

Tokenizing repos primarily achieves operational and capital efficiency for financial institutions. In terms of operations, automated lifecycle management supported by smart contract execution reduces errors and settlement failures, and simplifies reporting. In terms of capital efficiency, 24/7 real-time settlement and on-chain data analysis can meet intraday liquidity requirements through short-term borrowing, while enhancing collateral to improve capital efficiency.

Historically, most repo agreements have had terms of 24 hours or longer. Intraday liquidity can reduce counterparty risk, lower borrowing costs, achieve short-term incremental borrowing, and reduce liquidity buffers.

Real-time, 24/7, cross-jurisdictional collateral movement can provide channels for higher returns and high-quality liquid assets, optimizing their availability among market participants.

After the First Wave of Tokenization

The tokenization market is currently steadily advancing and is expected to accelerate with the strengthening of network effects. Given its characteristics, certain asset categories may enter the stage of meaningful large-scale adoption more quickly, with tokenized asset values exceeding $100 billion by 2030.

McKinsey expects the first asset categories to be realized will include cash and deposits, bonds, mutual funds, ETFs, and private credit. The adoption rate for cash and deposits (stablecoin use cases) is already high, thanks to the efficiency and value benefits brought by blockchain, as well as greater technical and regulatory feasibility.

McKinsey estimates that by 2030, the tokenized market value of all asset categories could reach approximately $20 trillion, with pessimistic and optimistic scenarios ranging from about $10 trillion to about $40 trillion, primarily driven by the following assets. This estimate does not include stablecoins, tokenized deposits, or central bank digital currencies (CBDC).

(From ripples to waves: The transformational power of tokenizing assets)

Previously, Citigroup also projected that, excluding tokenized cash, the market size of tokenization will reach $5 trillion by 2030.

(Citigroup RWA Research Report: Money, Tokens, and Games - The Next Billion Users and Trillion Value of Blockchain)

The first wave of tokenization, as described earlier, has completed the daunting task of achieving widespread market adoption. The tokenization of other asset categories is only more likely to scale up after the foundation laid by the first wave of asset tokenization, or when clear catalysts emerge.

For other asset categories, the adoption rate may be slower, either because the expected returns are only incremental or due to feasibility issues, such as difficulty in meeting compliance obligations or lack of incentives for key market participants. These asset categories include publicly traded and unlisted stocks, real estate, and precious metals.

(From ripples to waves: The transformational power of tokenizing assets)

How Financial Institutions Should Respond

Regardless of whether tokenization is at a turning point, a natural question is how financial institutions should respond to this moment. The specific timeframe and ultimate adoption of tokenization are not yet clear, but early experiments by institutions with certain asset categories and use cases (such as money market funds, repos, private equity funds, corporate bonds) indicate the potential for tokenization to scale up in the next two to five years. Those looking to establish a leading position in this ecosystem may consider the following steps.

7.1 Reassess Core Business Cases

Institutions should re-evaluate the specific advantages and value propositions of tokenization, as well as implementation approaches and costs. Understanding the impact of higher interest rates and volatile public markets on specific assets or use cases is crucial for correctly assessing the potential benefits of tokenization. Similarly, continuously exploring the landscape of providers and understanding early applications of tokenization will help refine estimates of the technology's costs and benefits.

7.2 Build Technical and Risk Capabilities

Regardless of the position of existing institutions in the tokenization value chain, they will inevitably need to build knowledge and capabilities to prepare for the new wave. The first and most important step is to establish a basic understanding of tokenization technology and its related risks, especially regarding blockchain infrastructure and governance responsibilities (who can approve what and when, token design (limitations on assets and enforcement of these limitations), and system design (decisions about ledger and record storage locations and their impact on asset holder nature). Understanding these basic principles can also help maintain proactivity in subsequent communications with regulatory agencies and clients.

7.3 Establish Ecosystem Resources

Given the relatively decentralized nature of the current digital world, institutional leaders must timely develop ecosystem strategies to integrate them into other (traditional) systems and partners to maintain a competitive advantage.

7.4 Participate in Standard Setting

Finally, institutions aiming to take a leading position in tokenization should maintain communication with regulatory agencies and provide input on emerging standards. Some examples of key areas for standard setting could include controls (i.e., appropriate governance, risk, and control frameworks to protect ultimate investors), custody (what constitutes qualified custody of tokenized assets on private networks, when to use digital twins and digital native records, what constitutes good control positions), token design (support for types of token standards and related compliance engines), and blockchain support and data standards (which data is stored on-chain versus off-chain, reconciliation standards).

Eight, The Road Ahead

Comparing the current state of the tokenization market with other significant paradigm shifts in technology indicates that we are in the early stages of the market. Consumer technologies (such as the internet, smartphones, and social media) and financial innovations (such as credit cards and ETFs) typically show the fastest growth in the first five years after their inception (exceeding 100% annually). After that, we see the annual growth rate slow to around 50%, eventually achieving a more moderate compound annual growth rate of 10% to 15% over a decade.

Although tokenization experiments began as early as 2017, it was only in the last few years that a large number of tokenized assets were issued. Based on McKinsey's assumptions about the tokenization market in 2030, the average compound annual growth rate for all asset categories is 75%, with the asset categories that appeared in the first wave of tokenization leading the way.

While it is reasonable to expect that tokenization will drive the transformation of the financial industry over the next few decades, and mainstream financial institutions such as Blackrock, Franklin Templeton, and JPMorgan are actively participating, more institutions are still in a "wait-and-see" mode, waiting for clearer market signals.

We believe that the tokenization market is at a tipping point, and once we see some important signs, the process of tokenization will rapidly advance, including:

Infrastructure: Blockchain technology supporting trillions of dollars in transactions;

Integration: Seamless integration of blockchain for different applications;

Enablers: Widespread availability of tokenized cash (e.g., CBDCs, stablecoins, tokenized deposits) for instant settlement transactions;

Demand: Buyer participants' interest in large-scale investment in on-chain investment products;

Regulation: Actions that provide certainty and support a more fair, transparent, and efficient financial system across jurisdictions, with clear data access and security.

While we still await the emergence of more catalytic signs, we expect the wave of large-scale adoption to follow closely behind the first wave of tokenization described earlier. This will be led by financial institutions and market infrastructure participants, jointly capturing market value and establishing a leading position.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。