In the field of restaking, EigenLayer is facing competition from the new protocol Symbiotic supported by Lido.

Author: DONOVAN CHOY

Translation: Blockchain in Plain Language

The restaking war is heating up. Challenging EigenLayer's monopoly position is another new protocol, Symbiotic, supported by Lido. This new entrant brings competitive advantages in protocol design and business development cooperation. Before delving into the new competitive situation in the restaking field, we need to first understand the key risks in the existing system.

1. Issues with Current Restaking

Here is how restaking works today: Bob deposits ETH/stETH into liquidity restaking protocols like Ether.Fi, Renzo, or Swell, which then delegate it to EigenLayer's node operators, who use it to secure one or more AVS to generate some returns for Bob.

There is a compounded risk in the existing system, which lies in its one-size-fits-all nature. EigenLayer's node operators manage assets worth thousands, which are used to validate multiple AVS. This means Bob has no say in the risk management of the AVS chosen by the node operators.

Certainly, Bob can try to choose a "safer" node operator, but these operators are in fierce competition with hundreds of others, all vying to get your restaking collateral and are incentivized to validate as many AVS as possible to maximize your returns.

This competitive state could lead to a terrible outcome that no one wants to see: each node operator will protect the AVS they consider foolproof. When that AVS is compromised and a slashing event occurs, Bob will be affected regardless of which operator he chooses.

2. Introduction of Mellow Finance

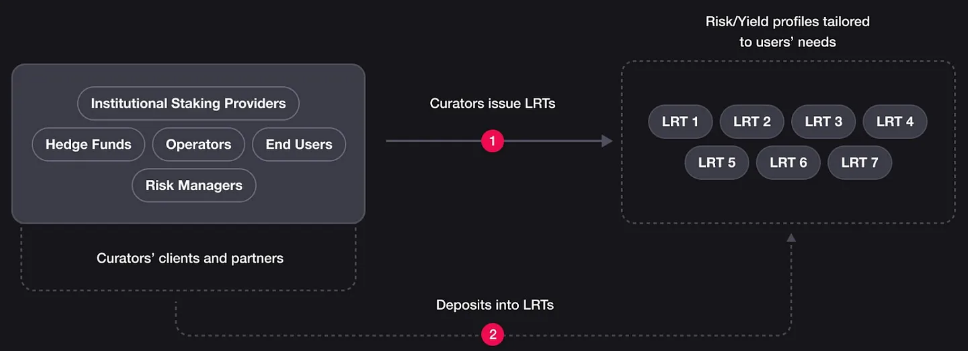

Mellow partially addresses this issue. Mellow, known as "modular LRT," is an intermediate layer in the restaking stack, providing customizable liquidity restaking treasuries. With Mellow, anyone can become their own Ether.Fi or Renzo and launch their own LRT treasury. Third-party "curators" on Mellow will have complete control over which restaking assets to accept, allowing users to choose based on their risk preferences and pay fees.

Here's an absurd example: Alice is a fervent DOGE enthusiast looking to earn returns on her DOGE assets. She sees a treasury called DOGE4LYFE on Mellow. She deposits her DOGE into the DOGE4LYFE treasury, earns restaking returns, pays a small fee to the operator, and receives an LRT token called rstDOGE, which she can use as collateral in DeFi. This is currently not possible because EigenLayer does not whitelist DOGE. Even if Sreeram eventually accepts DOGE, the incentive imbalance issue faced by node operators still exists.

If this sounds familiar, it's because similar services have been provided in DeFi lending protocols by protocols like Morpho and Gearbox, or the now-defunct Fuse protocol that seasoned DeFi participants from the previous cycle may remember. For example, Morpho allows the creation of lending treasuries with customized risk parameters, allowing users to borrow from treasuries with unique risk characteristics rather than from a single risk pool on Aave. In the upcoming V4 upgrade, Aave also plans to upgrade the protocol by isolating lending pools.

As Mellow is just an intermediate restaking protocol, the assets in its treasuries need to be restaked somewhere. Interestingly, Mellow has chosen to strategically partner with the upcoming restaking protocol Symbiotic instead of EigenLayer. Symbiotic is supported by Lido's venture arm cyber•Fund and Paradigm (also a supporter of Lido).

Unlike EigenLayer or Karak, Symbiotic allows multi-asset deposits of any ERC-20 token, making it the most permissionless protocol to date. Any token from ETH to the most extreme memecoin can be used as restaking collateral to secure AVS. This could open the floodgates to excessive speculation in cryptocurrencies: imagine a Mellow treasury composed of restaking DOGE collateral to secure Symbiotic's AVS.

3. Mellow x Symbiotic x Lido Strategy

While technically all of this is possible, it overlooks the key point of Mellow's product modularity, which allows for unlimited restaking yield combinations designed by third-party treasury curators. Here, the rationale for Mellow's integration with Symbiotic becomes clear, as assets are still restricted on other restaking protocols (such as EigenLayer or Karak).

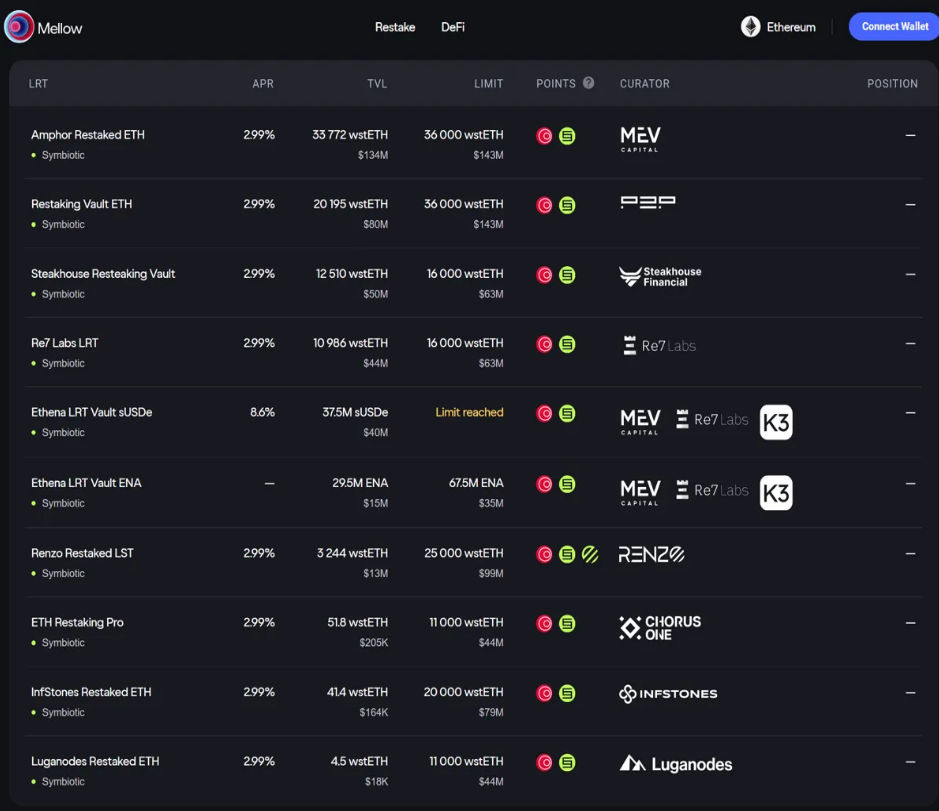

To date, a large number of curators have joined Mellow and opened their own LRT treasuries. Not surprisingly, most curators use stETH as collateral, due to the deep collaboration between Lido and Mellow (which will be detailed later).

The exceptions are two treasuries from Ethena, which accept sUSDe and ENA. Yes, Mellow has successfully attracted Ethena—its first sUSDe treasury is already fully subscribed.

The final part of Mellow's strategy lies in its participation in the recently announced "Lido Alliance," an official guild aligned with the Lido project. Mellow benefits from a direct channel to receive stETH deposits from Lido, which also explains why it has committed to providing 10% of its MLW token supply for the partnership (out of 100B). On the other hand, Lido also benefits from this, as it aims to reclaim stETH capital from liquidity restaking competitors. Since the outbreak of the Restaking Era in 2024, Lido's growth has stagnated due to liquidity being drawn away from LRT competitors.

4. Market Trading Volume

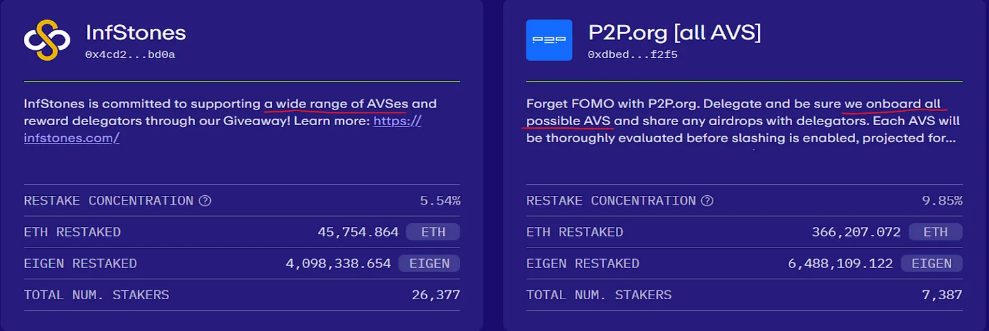

Symbiotic's competitive advantage over EigenLayer or Karak comes from its close integration with Lido. The idea is that Lido's node operators can release their own LRT through Mellow/Symbiotic and internalize an additional layer of wstETH returns within the Lido ecosystem, creating value return for the Lido DAO.

Now, depositing stETH into Mellow treasuries can yield the following four layers of returns:

stETH annualized return rate

Mellow Points

Symbiotic Points

Annualized restaking yield when AVS goes live on Symbiotic

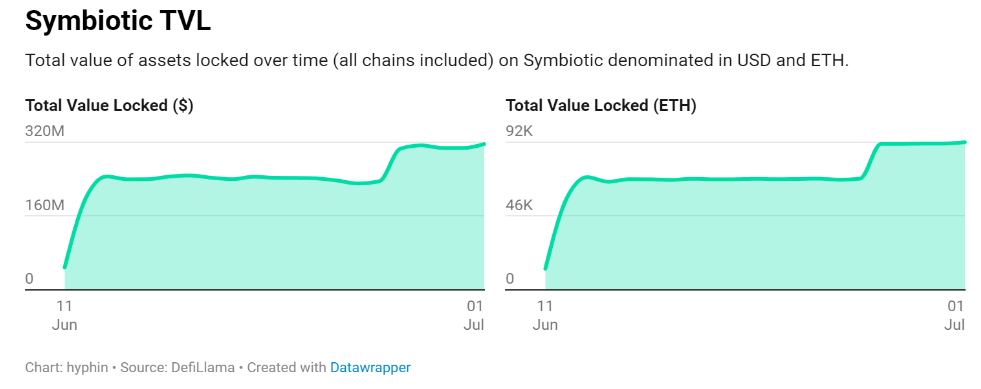

Symbiotic has attracted a total locked value (TVL) of $316 million within just two weeks of opening deposits.

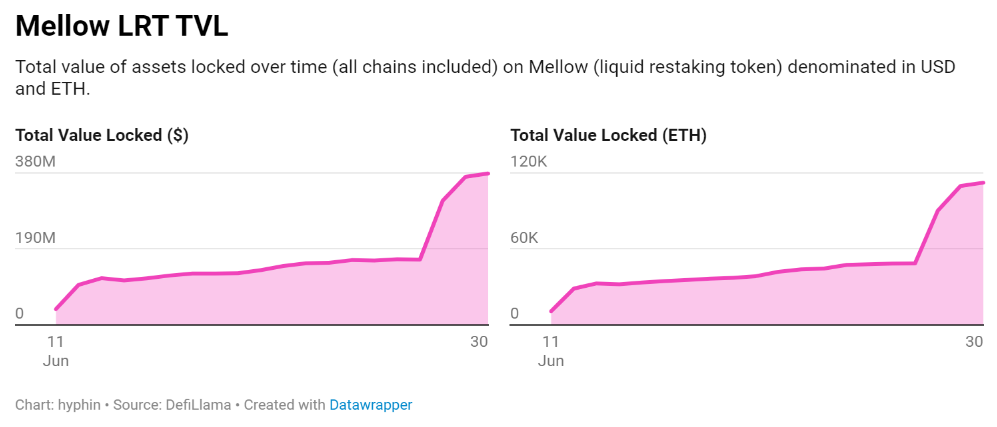

On the other hand, Mellow has attracted a TVL of $374 million. Both are still in the early stages, but this is a positive signal of Lido's path to success.

As of June 20th, four Mellow pools have been launched on Pendle:

Currently, these pools only accept Mellow points until the limit on Symbiotic is raised. To compensate, Mellow is rewarding triple points for deposits (compared to 1.5x for direct deposits in Mellow). Due to the very short maturity date, the liquidity of these pools is quite low, so if you try to buy YT, the slippage will be quite high. The current optimal strategy may be to choose PT fixed income, with annualized returns ranging from 17% to 19% (ranked by highest fixed income).

5. Overview of the Restaking Field

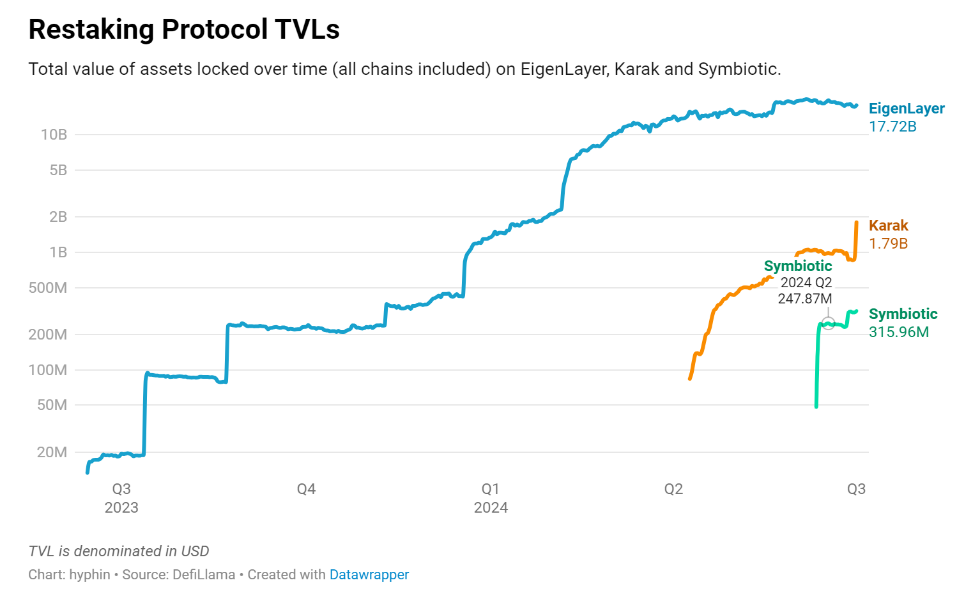

The restaking market competition is becoming complex, so let's quickly summarize. As of today, there are three main restaking platforms. In order of total locked value (TVL), they are EigenLayer, Karak, and Symbiotic.

All three restaking platforms offer services to sell security to AVS. Due to Ethereum's dominance and deep liquidity, stETH has become EigenLayer's obvious staking choice. As we have reported before, Karak has expanded its restaking collateral beyond ETH LSTs to stablecoins and WBTC collateral. Now, Symbiotic is challenging the limits by allowing the use of any ERC-20 collateral.

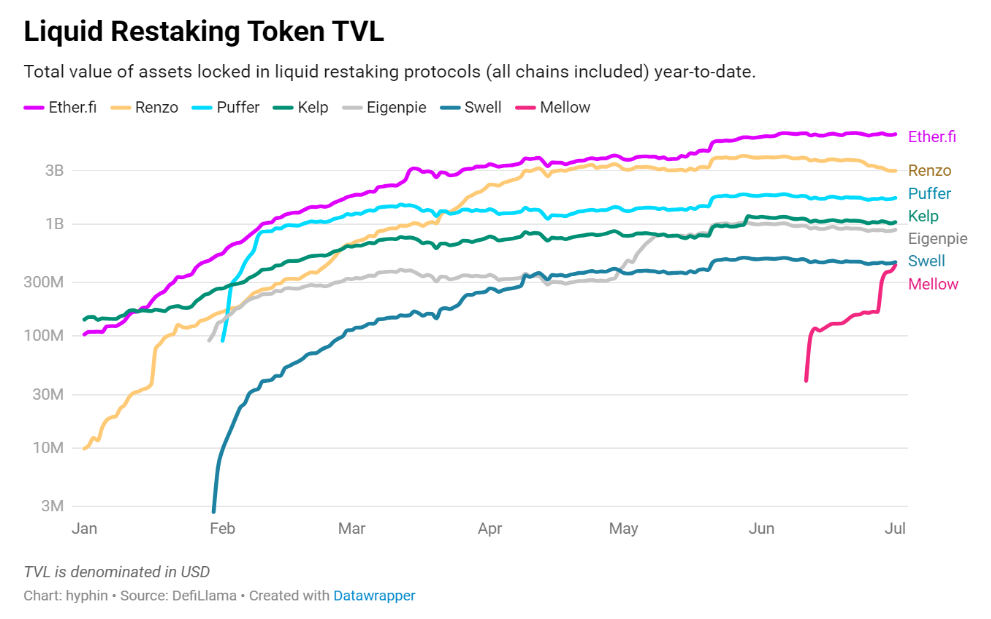

Meanwhile, LRT protocols like Ether.Fi, Swell, and Renzo have found opportunities and are starting to compete for collateral through their own point activities with Lido.

Lido enjoys dominance with stETH in DeFi, but is starting to lose market share to LRT protocols. For Lido, the simple reaction may be to transform stETH from LST to LRT assets, but it chooses to keep stETH as LST and cultivate its own restaking ecosystem internally. For this, Lido is supporting Symbiotic and Mellow as part of the "Lido Alliance," providing a permissionless, modular restaking product. The sales pitch can be summarized as:

Dear project teams, don't wait for EigenLayer to whitelist your token, come to Symbiotic and launch your own LRT without permission.

Dear users, don't deposit your wstETH into LRT competitors, give it to Mellow for better risk-adjusted returns.

6. Conclusion

With the intensifying competition in the restaking field, here are some points to consider:

1) Demand for AVS and the necessity of restaking platforms

AVS demand: Currently, only EigenLayer has active AVS. Out of a total locked value (TVL) of approximately 5.33 million ETH, about 22.6 million ETH is restaked in 13 AVS, assuming a collateralization ratio of approximately 4.24x.

Is the number of restaking platforms necessary: The main trend of restaking platforms is to integrate as many restaking assets as possible. Latecomers to EigenLayer like Karak differentiate by using WBTC collateral, stablecoins, and Pendle PT assets. Symbiotic goes further, allowing the use of any ERC-20 token but leaving the asset curation to third-party Mellow treasury creators. Despite being the most stringent, EigenLayer still maintains a huge lead in TVL. The discussion on allowing non-ETH assets for chain security is still pending.

2) Prospects for LRT protocols

Integration with Symbiotic: There is nothing stopping them from also integrating with Symbiotic, in fact, Renzo has already done so. Symbiotic is designed to be as permissionless as possible, and LRT protocols have no reason to be loyal to EigenLayer. They will hope to gain some market share in the Lido restaking ecosystem, especially before Mellow monopolizes this secondary market.

Competitive relationship: Lido's goal is to reassert the dominance of stETH, while Symbiotic and Mellow are projects supported by this liquidity restaking giant. This goal is fundamentally contradictory to the strategy of introducing eETH, ezETH, swETH, etc. to Symbiotic. It will be interesting to see how Lido balances between these.

3) Impact on developers

Easier to launch your own chain with economic security: EigenLayer makes this process convenient, but permissionless treasuries on Mellow x Symbiotic stack make it even easier. Major players like Ethena have already announced plans to allow sUSDe and ENA to be restaked in Symbiotic to protect their upcoming Ethena chain, rather than expecting EigenLayer or Karak to whitelist ENA as restaking collateral.

4) Impact on Lido DAO and LDO Token holders

DAO revenue: The DAO charges a 5% fee on all stETH staking rewards, which is distributed among node operators, the DAO, and the insurance fund. Therefore, the more ETH staked in Lido (rather than in LRT protocols), the more revenue for the DAO. However, Lido's efforts to build its own restaking ecosystem have not provided a clear path for value accumulation for LDO tokens, which still only serve as governance tokens.

Original link: https://www.hellobtc.com/kp/du/07/5281.html

Source: https://www.onchaintimes.com/p/the-restaking-wars-are-heating-up

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。