"Weekly Editor's Picks" is a "functional" section of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes many high-quality in-depth analysis content, which may be hidden in the information flow and hot news, passing by you.

Therefore, our editorial department will select some high-quality articles worth reading and collecting from the content published in the past 7 days every Saturday, providing new inspiration for those in the encrypted world from the perspectives of data analysis, industry judgment, and opinion output.

Below, let's read together:

Investment and Entrepreneurship

GSR: Will Solana ETF be Approved? What Potential Impact Will It Have on the Price?

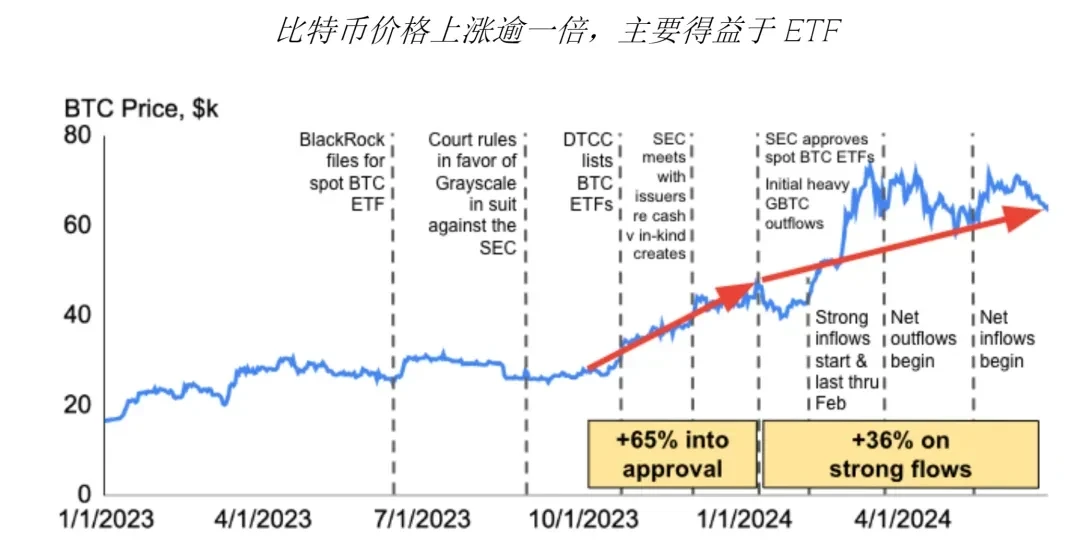

The two key factors determining the next spot ETF are the degree of decentralization and potential demand. Through analysis, if the United States allows additional spot digital asset ETFs, Solana will be the next one.

The inflow of funds for spot Solana ETF may account for 2%, 5%, or 14% of Bitcoin respectively (pessimistic, neutral, optimistic). The conclusion is as shown in the following figure, referring to the impact of spot Bitcoin ETF on Bitcoin (2.3 times growth):

Also recommended: "LUCIDA: Unveiling the Macro Analysis Methodology of Top Researchers in Crypto", "On-chain Smart Money Tracking Finale: A List of 10 Ecosystem Coin Ambush Master Addresses", "Rise or Fall in the Next Three Months? Bankless Predicts the Trends of 16 Tokens".

In-depth Discussion: Is There Still a Need for Governance Tokens?

The article proposes a four-quadrant framework for evaluating governance tokens based on the reliability of token holders' rights and their control over economic value, and studies tokens in each quadrant through example cases, providing recommendations for builders and investors on how to build and evaluate governance tokens.

Governance tokens can appreciate through two main avenues: helping applications manage inherent risks in their business models; and providing utility to their holders in the form of tangible economic value (such as GMX).

Regardless of whether a cryptocurrency project is new or mature, it is not too late to identify shortcomings and make changes.

In the Era of Commercialization of Blockchain Space, Will "Fat Applications" Eventually Rise?

Valuable order flow is more important than the quantity of order flow. Applications will occupy the largest proportion of total value.

Looking ahead, applications should focus on creating new types of order flow, including: creating new assets (such as Pump and memecoins), building applications for new user scenarios (such as Worldcoin, ENS), creating better vertically integrated consumer experiences and supporting valuable transactions, such as Farcaster and Frames, Solana Blinks, Telegram and TG applications, or on-chain games.

Airdrops

Odaily Exclusive Interview with Luma Studio: Revealing the "Brushing" World of Web3

A story-type article containing the unique architecture of Luma Studio and the competitive cooperation relationship between Luma Studio and project parties.

Meme

How to Choose Promising Meme Coins Based on TVL Changes?

The Memecoin TVL Boost Theory believes that major memecoins or a basket of major memecoins will serve as leverage bets on on-chain TVL.

Taking Base and TON as examples, TVL inflow = performance of major memecoins. If TVL growth can be predicted, then holding major memecoins on that chain can serve as a leverage bet on TVL predictions.

Predicting TVL growth can be divided into two categories: long-term and short-term. Long-term prediction is actually predicting the flow of TVL over several months. Short-term methods consider incentives such as point plans or airdrops as reasons for TVL growth.

Ethereum and Scalability

With L1 and L2 Piling Up, What Other L3 Projects Are Worth Paying Attention To?

The overall idea of Layer 3 is to further expand Ethereum by creating highly customizable, cheap, fast, and interoperable chains with varying degrees of security and decentralization. Examples of Layer 3 frameworks include Arbitrum Orbit and zkSync Hyperchains. The article briefly introduces Degen Chain (DEGEN) and Sanko (DMT).

Also recommended: "2024 Ethereum Staker Report: What Issues Are Independent Stakers Concerned About?".

Multi-Ecosystem

Blinks Fantasia: Exploring the Most Promising Application Scenarios from the Ground Up

"Immediacy" and "facilitating the purchase of value information" are the real battlefields for Blinks.

Blinks are effective in reaching new users, converting new users, and reactivating old users.

Potential use cases include investment, consumption, community governance, decentralized social networking, and on-chain games.

Also recommended: "Exploring 50+ Innovative Use Cases of Solana Blinks".

Beginner's Guide: How to Navigate the TON Ecosystem

The article introduces wallets, cross-chain bridges and CEX, some on-chain applications, and believes that the gameplay of TG APP, transfers, transactions, games, etc., can all be completed in TG, which is a more mobile-friendly environment compared to other public chains.

Grasping TON Ecosystem Game Alpha, You Need These Tools

This article includes configuring wallets, how to find popular TON ecosystem games, and methods for running multiple game simulators.

Shitcoins Continue to Decline, It's Time to Refocus on DeFi

The sharp decline in the price of shitcoins by 30% is due to insufficient demand growth, excessive supply growth, and continuous unlocking.

It's the right time to focus on DeFi because of PMF products, moving out of the bubble period—From a business perspective: mature business models and profit models, leading projects have moats; Supply side: low emissions, high circulation ratio, small scale of tokens to be unlocked; Valuation: market attention and business data deviate, valuation levels fall into historically low ranges; From a policy perspective: FIT 21 bill favors compliance in the DeFi industry and may trigger potential mergers and acquisitions.

The article further analyzes Aave, Uniswap, Raydium, Lido, and GMX as examples.

Will the RWA Track Experience an Outbreak After the Launch of Ethereum ETF?

Key directions: national debt, credit, real estate. Private RWAs are still largely undeveloped. Regulatory and poor value accumulation are major risks.

Also recommended: "RWA Narrative Revival: Massive To B Business, Who Has Seized the Opportunity?".

GameFi, SocialFi

Exploring the Future Development of Blockchain Games from the Perspectives of VCs and Builders

If the technology is strong, consider decentralized casual games based on a social platform.

If the operational capability is strong, consider centralized GameFi mini-games based on a social platform, with TON being the preferred choice.

It is not recommended to invest in or create large-scale 3A blockchain games targeting Web3 users, as it is a pit.

The total number of Farcaster users has reached 540,000, and the daily active users have surged from 2,000 at the beginning of the year to the current 56,000, achieving over 28 times growth.

Farcaster protocol data is stored in on-chain and off-chain hubs, and developers can choose to run hub nodes on their own or use third-party service providers like Neynar to access data. All this data is permissionless, and based on this available data, developers can build various clients and applications, greatly enriching the richness and innovation space of the Farcaster ecosystem.

Users can track the progress of the ecosystem through the decaster website. The article also introduces some highlight projects: WrapCast, Jam, Clubcast, BountyCaster, AlfaFrens.

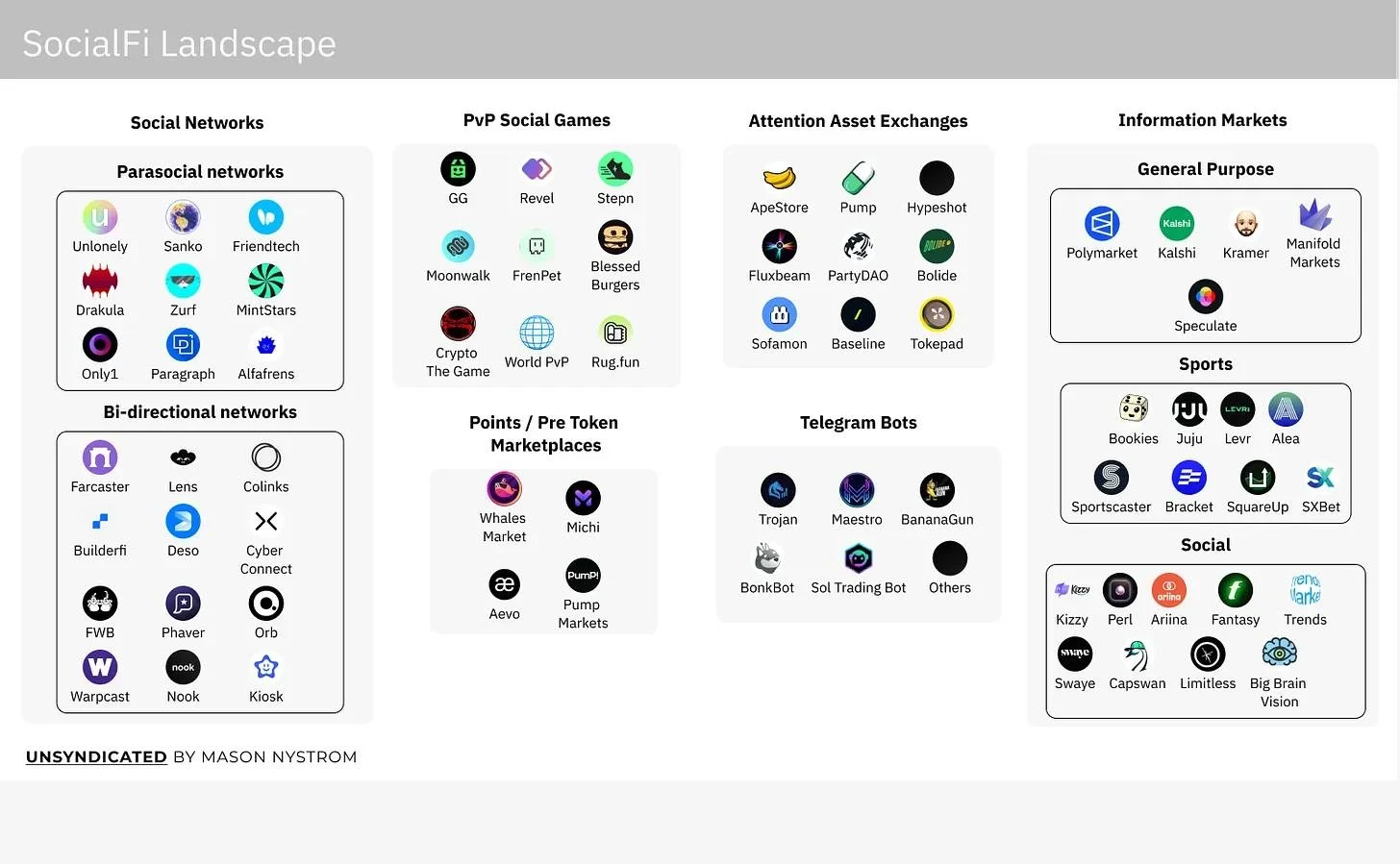

Built for the New Generation of Attention Merchants, Crypto Products are Converging towards SocialFi

Web3

Opinion: Web3 Needs Mass Admission, Not Mass Adoption

Crypto has boundaries. All its features (privacy, decentralization) come from its core value—permissionlessness, which is not something most people on Earth can use. We feel that there are no new users now because the market is about to reach its actual TAM limit.

The stock market has never been a problem; high-frequency users are. The essence of crypto growth is the process of cultivating high-frequency and large holders. What Crypto/Web3 needs to be clear about is "let them come to make money," allowing the "merchants" of the world to come here and try to make money, with the condition of learning the rules of Crypto. The way they make money is by engaging in games involving money flow (trading, staking, borrowing, etc.), everything revolves around this logic.

Web3 Mini Programs? Understanding MetaMask Snaps

The number of available Snaps listed on the official website is actually not very large. As of June 2024, there are only a maximum of 68. Due to understandable security considerations, a basic Snap can't do much. Most of its functions require corresponding permissions, so Snaps need to request relevant permissions from users when installed. Available permissions include lifecycle, transactions, signatures, CRON, and more. Compared to the thriving Web3 ecosystem, the currently available Snaps are pitifully few.

According to the MetaMask official website's classification, they can roughly be divided into 4 types: account management, interoperability, notifications and chat, security.

For most of MetaMask's current users, Snaps are not yet a particularly essential feature. MetaMask probably needs to do more work on how to promote it more effectively. But in any case, it is at least a product built by a group of passionate developers who want to solve real problems, rather than a scam initiated by a group of financial experts.

Weekly Hot Topics Recap

In the past week, the US and German governments transferred Bitcoin; Mt.Gox has officially started compensating creditors in the form of BTC and BCH; Japanese creditors: have received Mt.Gox compensation, with the amount of compensation being 13% of the holdings at the time; the market plunged; Bloomberg: Mt.Gox, government, and miners' selling pressure caused Bitcoin to fall, and a potential policy shift by the Fed may reverse market sentiment.

In addition, in terms of policy and macro markets, the SEC has sued Consensys, accusing MetaMask of engaging in securities offering and sales and acting as an unregistered broker; a US judge rejected the SEC's allegations against Binance's BNB secondary sales and Simple Earn, approving other charges to proceed; the SEC has returned the S-1 form to the issuer of the ETH spot ETF and requested a resubmission by July 8.

Viewpoints and Voices: Glassnode: Volatility continues to historically compress, potentially leading to greater volatility in the future; Matrixport Research: Summer consolidation combined with "market selling," suggests holding BTC options until the favorable outcome of the US election; Arthur Hayes: Looking back at the century-long economic cycle, Bitcoin is about to enter a macro turning point; Galaxy Research Director: Mt. Gox's repayment will not have a significant impact on the price of Bitcoin; Andrew Kang: We may see an extreme pullback of Bitcoin to the $40,000 range; German lawmakers urge the government to stop selling Bitcoin, stating that this may affect the stability of the crypto market; Casey: Runes and inscriptions will have the same programmability as Bitcoin, according to Casey; Vitalik Buterin: Cryptocurrency regulation has led to "anarchy," pushing honest crypto developers into a corner; Vitalik discusses methods to provide faster transaction confirmation times for Ethereum users and appoints the Epoch and slot route; Vitalik: Prediction markets and Community Notes are becoming the two flagship social cognitive technologies today; Justin Sun: The goal this year is to bring TRON's protocol income to $1 billion; Starknet founder: Approximately 400 million STRK tokens are reserved for future airdrop rounds; friend.tech: Based on community feedback, FRIEND will not migrate from Base; STIX founder: The off-chain reasonable valuation of locked ENA tokens should be discounted by 70%.

Institutional, Corporate, and Leading Projects: Controversy over the high expenditure in the Polkadot Treasury Operations Report for the first half of 2024 (Polkadot official response); Telegram introduces the feature for channel owners to post paid photos and videos, which users can purchase with Stars; Blast launches a governance system and initiates the first proposal "Enable points for BLAST holders"; Blast announces the detailed distribution of points for the second phase airdrop, distributing 10 billion BLAST tokens; Lido launches the Community Staking Module testnet; Notcoin plans to launch a feature for trading bots to support the buying and selling of tokens on Telegram; Ava Labs introduces the Avalanche Inter-Chain Token Transfer (ICTT) scheme; ZKsync introduces the Elastic Chain; marginfi will launch mrgnswap, allowing users to leverage long/short any Meme token; Aevo announces the launch of the Automated Trading Vault "Aevo Strategies"; WELL3 faces controversy during its opening.

Data Perspective: Vitalik Buterin's net worth is estimated to be at least $830 million… Well, it's been another eventful week.

Attached is the "Weekly Editor's Picks" series portal.

Until next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。