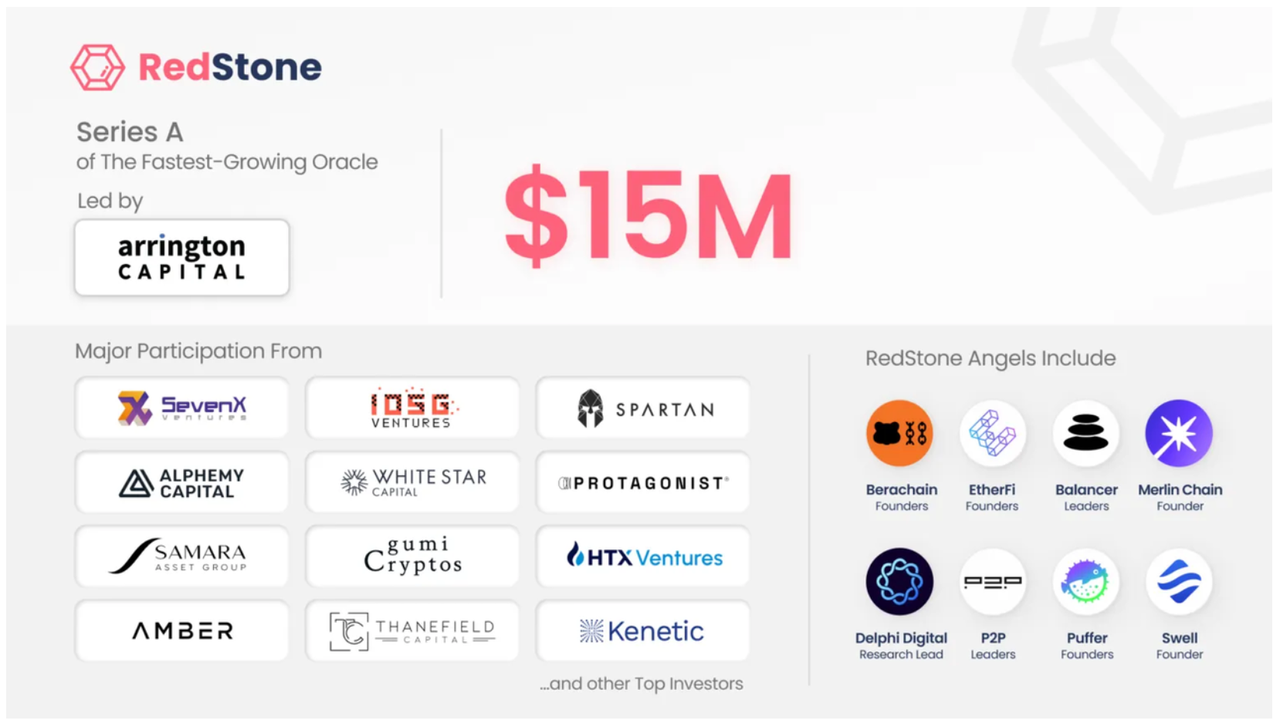

RedStone, as a modular blockchain oracle provider, successfully raised $15 million in Series A financing on July 2nd, led by Arrington Capital.

Other investors in this round of financing include Kraken Ventures, White Star Capital, Spartan Group, Amber Group, SevenX Ventures, and IOSG Ventures.

In addition, angel investors such as Smokey the Bera and Homme Bera from Berachain, Mike Silagadze, Jozef Vogel, and Rok Kopp from Ether.Fi, as well as Amir Forouzani, Jason Vranek, and Christina Chen from Puffer Finance, also participated. Furthermore, on July 4th, the Zircuit mainnet has undertaken the emerging oracle project Redstone.

With the total locked value in the DeFi market doubling over the past year, especially accumulating over $50 billion in assets in the field of liquidity staking, RedStone's modular design has positioned it uniquely in the market.

The financing round not only demonstrates investors' confidence in RedStone's future development but also signifies its further consolidation in the blockchain oracle field.

01. The Next-Generation Oracle RedStone

RedStone is a modular blockchain oracle, similar to Chainlink and Pyth Network, but it stands out with its unique advantage of modular design.

Jakub Wojciechowski, the founder and CEO of RedStone, emphasized that the modular architecture enables RedStone to launch on new networks faster and adjust traffic flexibly according to market demand.

With the rise of the token re-collateralization wave, RedStone has become the first oracle to support projects such as Ether.Fi, Renzo, Puffer, and Swell.

The main function of a blockchain oracle is to provide real-world data to smart contracts, ensuring that smart contracts can make decisions based on the latest external information. The advantage of a modular oracle lies in the independent update or replacement of its components, ensuring scalability and integrability on different blockchains.

The integration of RedStone with the Open Network (TON) is a typical example. Wojciechowski pointed out that the architecture of TON made the integration of oracles very cumbersome, but the RedStone team spent four months ensuring the smooth completion of end-to-end integration work.

According to DeFiLlama's data, RedStone is currently the fifth largest blockchain oracle, with a total value of approximately $3.5 billion.

Established during the 2020 Arweave Chain incubation program, RedStone currently supports over 60 blockchains, including Layer 1 and Layer 2 networks such as Ethereum, Base, Arbitrum, and Merlin Chain. In the future, RedStone also plans to support Berachain and Monad blockchains and will launch the Active Verification Service (AVS) on EigenLayer.

It is reported that RedStone has been promoting an on-demand approach for the past three years and is currently used on over 40 L1 and L2, leading its competitors.

In the future, with the Ethereum upgrade Dencun (EIP-4844), the increase in liquidity staking and re-staking, and the addition of L2 as well as Optimistic and ZK rollups, the industry's demand for reliable price data will further increase. With its forward-looking design, RedStone is prepared to maintain its leading position in this rapidly developing field.

02. Unique Features of RedStone

RedStone's oracle adopts a unique approach, storing non-standard data on Arweave and transmitting it to all EVM-compatible chains.

As a middleware, the oracle realizes communication between the blockchain and off-chain systems (such as data providers, cloud providers, IoT devices, and payment systems). Smart contracts on various blockchains, including Ethereum, can use the data provided by the oracle to determine whether to execute protocols or commands. Therefore, platforms and enterprises using smart contracts directly rely on oracles to obtain data from the external world.

However, centralized and third-party oracles are not in line with the values of blockchain technology and decentralization. The uncertainty and asynchrony of external data make it difficult for nodes to reach consensus.

Moreover, the risk of direct access to an insecure external environment has made many projects hesitant, which is the so-called oracle problem. The decentralized nature of blockchain prevents it from extracting or pushing data from any external system. Blockchain nodes must be kept in isolated sandboxes and cannot directly access traditional services or generate data internally.

RedStone alleviates the problems faced by blockchain projects by providing a flexible and cost-effective oracle solution.

Its modular design is suitable for DeFi, similar to L2 of the blockchain, enabling it to provide push and pull oracle data services to multiple EVM and non-EVM ecosystems, Rollups, and various application chains.

RedStone's data is cryptographically signed by providers and can be verified on any chain that supports basic cryptographic primitives.

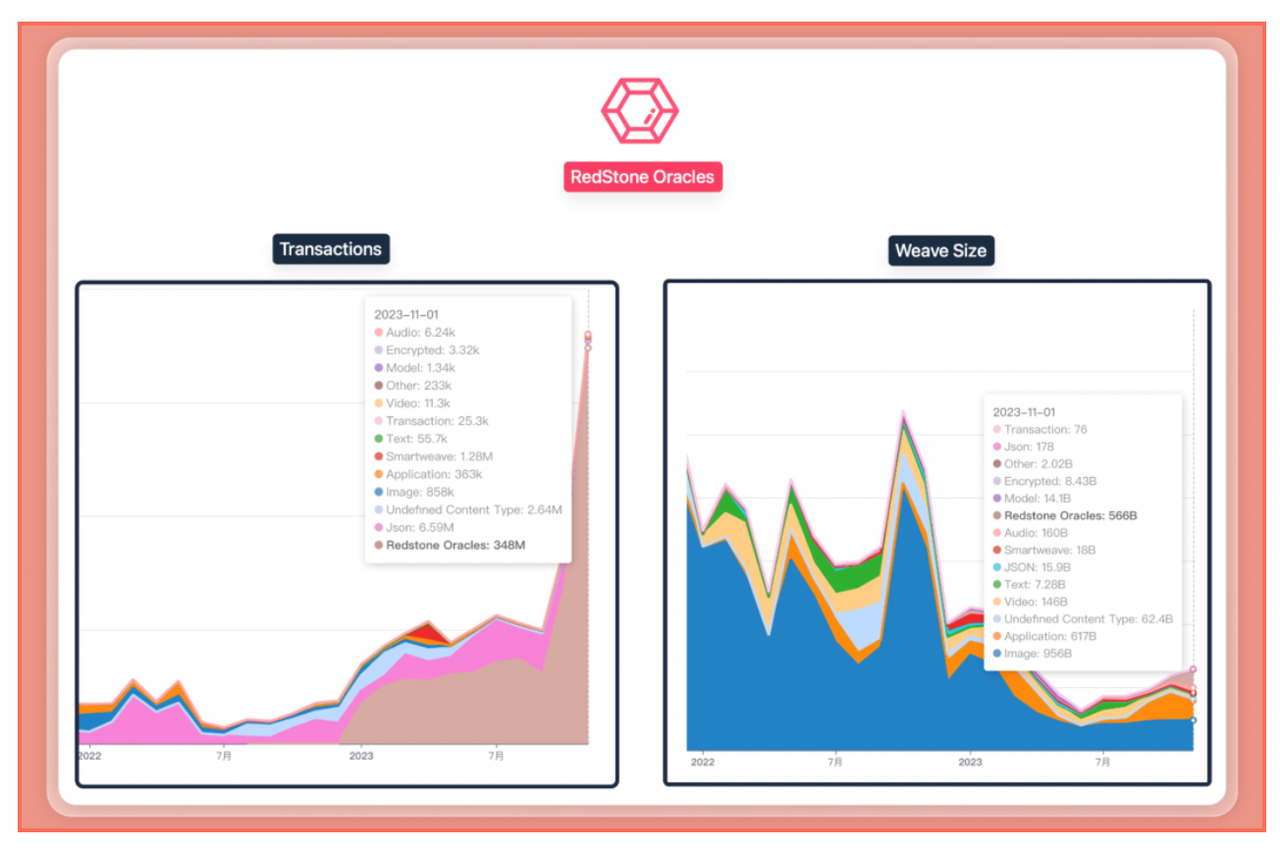

RedStone leverages Arweave's next-generation blockchain storage to store a large amount of data at low cost, enabling it to process more data at a higher update frequency.

Unlike traditional oracles, RedStone's data is stored on Arweave, and nodes and partner networks provide them to DeFi projects in the form of decentralized public caches. The EVM-Connector allows these data to be injected into the target chain only when needed, ensuring the integrity and security of the data.

Furthermore, RedStone allows multiple data providers to enter the blockchain ecosystem, with each data provider applying different aggregation rules to provide customized services tailored to the demand of DeFi protocols. RedStone's design also ensures the integrity of the data, as data providers need to stake RedStone tokens as collateral to ensure that they can continue to operate and provide high-quality data.

Through its innovative approach, RedStone not only provides a secure, flexible, and efficient alternative to existing oracle solutions but also brings reliable real-world data support to DeFi and smart contract applications. As the blockchain ecosystem continues to evolve, RedStone will continue to maintain its leading position in the oracle field.

Conclusion

RedStone is hailed as the next-generation oracle, and its trading volume data has been impressive in 2023 and early 2024.

This is certainly due to the hard work of the RedStone team during the bear market. Through carefully planned activities, continuous integration cooperation, and continuous polishing and exploration of product innovation, they have become the biggest contributor to the growth of Arweave's trading volume and have gradually gained market recognition.

In the first half of 2024, RedStone has delivered good results, and it remains to be seen whether it will become a leading project in the oracle race alongside Chainlink in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。