Author: 0xFacai, BlockBeats

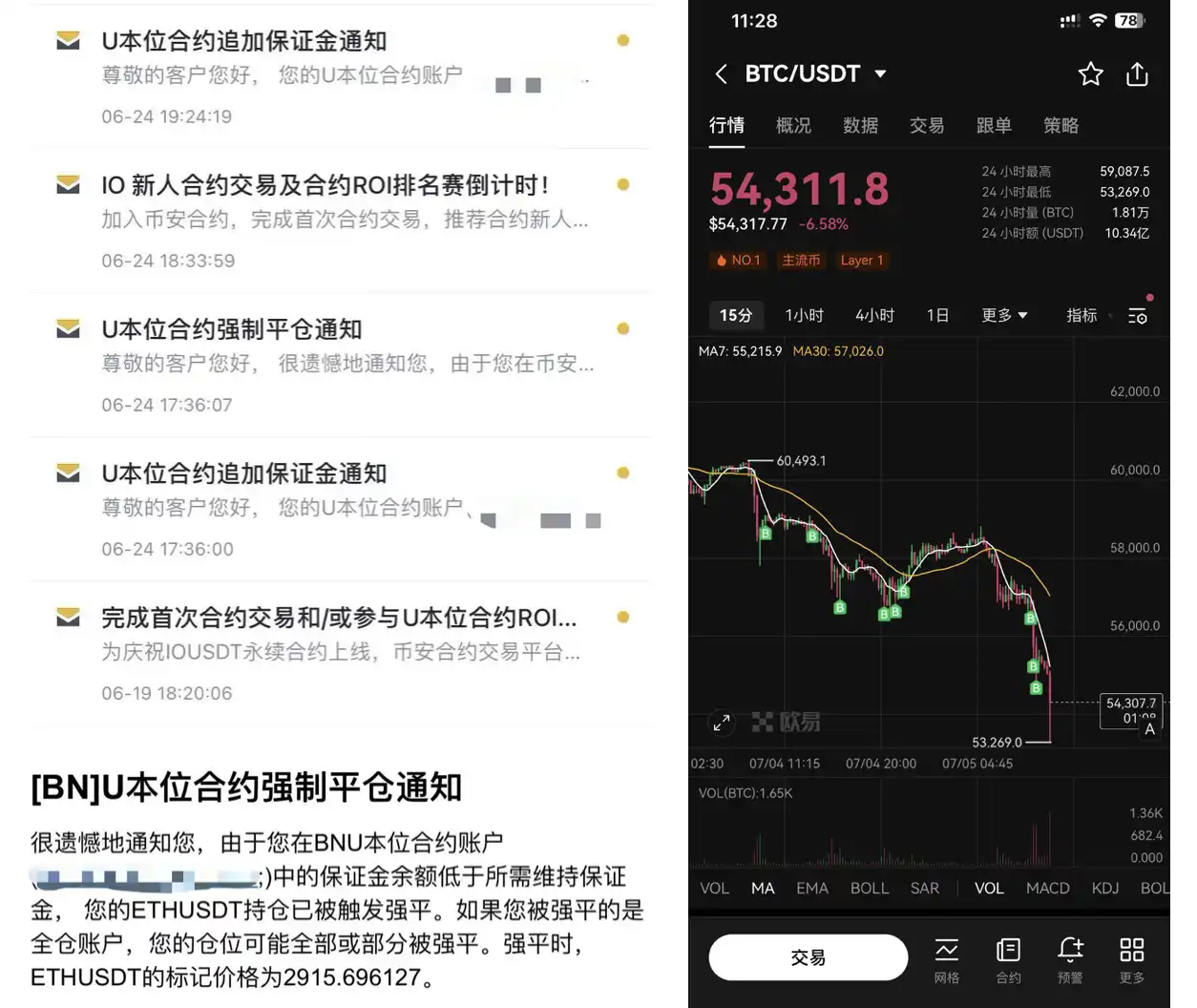

I woke up this morning and found that I was completely back to zero. For the past period of time, I have been buying the dip and adding to my positions every day. Everyone said, "The real bull market is still ahead," and I believed it, until I received the last liquidation news today.

My wallet is the same, with less than $500 left. I just entered the circle less than a year ago, and I was very happy with the profits in March and April. At its peak, my assets were 50 times the value when I entered the circle. As a recent graduate, I earned in three months what my classmates could only earn in a few years. At that time, I felt a sense of superiority, but today the market has taught me a lesson.

When I opened Binance this morning, I thought they had changed the homepage to display the customized list, but later I realized it was the list of biggest gainers. It was the first time I had seen the red Binance gainers list since I entered the circle. I never thought that falling less could also be a skill.

Recently, everyone has been saying that this bull market is of "hellish difficulty." Every meal I have had recently has been spent listening to others complain about how difficult it is, whether it's retail investors, VCs, or project parties.

After calming down a bit, I have been reviewing the past six months. From DePIN going to zero, to AI being debunked, and then to meme PVP, from the death of Mingwen to the death of VC coins, and then to the death of rug pulls, it seems that it's not just me and my friends who are finding it difficult to make money, but rather most people in the industry are struggling to make a profit.

ETF is the last hit of heroin

When the Bitcoin spot ETF was approved six months ago, everyone thought a raging bull market was coming. At that time, a colleague told me that he felt this bull market was coming in a twisted way, and he hadn't seen anything interesting in terms of innovation and narrative in the industry. Now it seems he was right.

Looking back, the circle at that time was like taking heroin, and the ETF was the last hit.

After exchanging ideas with peers over the past six months, since a series of institutional thunderstorms last year, the circle has become more open to terms like "ponzi" and "pyramid scheme," and has completely embraced scams. Once, while having dinner with a VC friend, he half-jokingly said to me, "Nowadays, calling a project a pyramid scheme is a compliment." But upon careful consideration, I found that it was indeed true.

It is clear that projects and institutions like LUNA, Three Arrows, and FTX have set a very bad example for people in the circle. Now, everyone thinks that the more it is a capital pool, the more it is a pyramid scheme, and the higher the leverage, the faster the rise. Most institutions and retail investors don't really care about the value of blockchain; they just want their $5000 to turn into $50 million in a month.

So, when people complain that there are no new narratives, I don't think that's true. As a newcomer to the circle, I could still feel that there were many new things in the industry in the first few months, whether it was Mingwen, AI, or meme. Every day was refreshing, but later, after more exchanges with peers, I realized that many of these so-called new concepts were just old wine in new bottles.

Therefore, I have formed a worldview of this industry. This circle doesn't really care about innovation; new narratives are just a mouthful of heroin that mesmerizes others and oneself. When the vitality is gone, take another hit, but after the addiction, all that's left is pain and confusion.

Think about it carefully, really think about it. Which narrative in this cycle is not like this? Take Mingwen, for example, from being criticized for plagiarizing ERC20 in March last year, to a big surge in May and being listed on OKX, and finally at the end of the year, VC institutions and public chains entered the market for no reason, throwing a bunch of money, and then this thing went from being a "plagiarized dog coin" to a "golden shovel." But in reality, who doesn't know that this thing is garbage?

After the Mingwen heroin was consumed, everyone suddenly realized, "Oh! It turns out the new token standard is innovation, it's the next hundredfold!" So, Analysoor on Solana went from being a Mingwen to a shovel and then to (ZERO, ONE), and then a NUTS that couldn't do anything because its token price multiplied by 10 in a day, leading to a series of 404 image-text conversions and self-entertainment.

And AI, I've been thinking about it these past few days. Isn't the logic simply that AI is the hottest in the US stock and venture capital circles right now, and if you can't find any other reason, you'll find that the one that rises the most is a meme coin, $GPU, with a logo and name that imitates NVIDIA. Once, I had a conversation with the founder of an AI project that had been invested in by a major exchange. His project was to do decentralized large model aggregation. At the time, he clearly told me that it was impossible to compete with the giant AI companies using a decentralized approach. I asked him why he still wanted to do it, and he replied, "But I think it's worth a try," which left a deep impression on me. This is the funniest part; everyone knows that decentralized AI is nonsense, but from entrepreneurs to VCs to exchanges, everyone is pretending so seriously, from IO to ATH, it's all a huge waste of resources, and in the end, Amazon becomes the big winner.

I don't know what it was like before, but at least since I entered the circle, the feeling the circle has given me is like a crocodile farm, where everyone is waiting for liquidity to come and take a big bite. But everyone has taken out their money and found that there is nothing new, so they can only take a hit, hoping that ETF liquidity will come to save them, only to find that ETF is actually the last hit of heroin they washed themselves. Without liquidity in the market, no one can save you.

After the addiction, everyone sobered up, and the expected bull market became the most brutal PVP battlefield in the history of the circle. There was nothing left to speculate on, so everyone chose to entertain themselves to death with memes. The frequency of speculation went from once a year to once a month and finally to once a day, the doubling time of the token price went from a week to a day and finally to an hour, and the market value of the tokens went from several billion dollars to several million dollars and finally to several thousand dollars, and the motto of speculation changed from "diamond hands" to "don't have a big picture." Without heroin, everyone is going crazy and running away.

Value coins cut me the hardest, but VCs are not having it easy either

There was a phenomenon before that was heavily criticized, "high FDV and low market value." For a while, I also criticized it very harshly because I found that I no longer knew what logic to use to analyze and make money. Every day, I was writing seemingly well-founded in-depth analyses, but in reality, my gambling spirit was revealed after one or two in the morning. I found it increasingly difficult to find legitimate reasons for these high valuations, and I found it harder and harder to believe what I was saying. I felt like I was aiding and abetting, helping institutions cut newbies, and in the end, I got cut along with them.

I used to read an article written by Cobie and thought he was right. All the value discoveries of tokens/projects/opportunities have been completed in the primary market, leading to no one being able to enter the secondary market. Some time ago, I had coffee with a top VC friend in China, and he told me a case: a small project doing ZK privacy infrastructure was valued at $5 million on the day of the event, and the next day it was re-financed at a valuation of $20 million. It's not that there was no increase, it's just that you couldn't see it, it's not that there was no opportunity, it's just that you didn't qualify.

Last month, when chatting with a peer, we debated. He said that the first few hundred million dollar coins that rose at the beginning of the bull market were TIA, the leader in the sector, a typical VC coin, but even after a wide range of airdrops, it went from $2 to $17, and was even said to be the "best profit strategy of this bull market." There's also SOL, TON, ENA, NOT, all of them are like this, with a large market value, but just a straight rise.

At the time, I didn't know how to refute it. In fact, I had even summarized a logic for myself before, that in this cycle, we should play "strong institutional coins," they have a big picture, they have ideals, until recently when I saw the trends of these "strong institutional coins," I realized that talking about a big picture without liquidity is like talking about love without money.

The loudest multi-chain narratives are now falling so hard that even their mothers wouldn't recognize them.

One good thing about the media is that sometimes you can perceive that there are some forces behind the narratives. For example, around April and May last year, there was a sudden increase in articles on the website about "SOL's new opportunities." I was puzzled at the time, thinking, have these people all gone crazy? It wasn't until the price rose to forty or fifty dollars that I understood that there had been a lot of OTC trading behind the scenes.

The same goes for TON. After the TON Foundation linked up with Telegram at Token2049, a series of submissions came rushing in, and various ecological projects actively sought interviews. Later, a friend who used to work at Alibaba showed a very strong sense of optimism when chatting with me. All of these were actually "signals" that I had overlooked, and now I regret it.

However, even for strong institutions, it's a pain in the butt without liquidity. I still vividly remember that at the time, Twitter was full of people resolutely re-entering SOL at the high point of $190, as new believers in SOL. When people finally had a new consensus and belief, the rise came to the "last blow" stage. Now, looking back, TIA, ENA, NOT, which one isn't like this?

But thinking the other way around, VCs and market makers are also struggling. Their scale is there, their KPIs are there, and their funds must be deployed, and there really is no other way. Today, I saw an article on ChainCatcher interviewing VCs, and sometimes they are also in a tough spot, buying into narratives or chasing hotspots, pushing valuations to the sky, only to find that retail investors don't buy it, and a bunch of tokens in their hands are locked up in various ways, leaving only "paper wealth."

Many VC friends have given me feedback on the issue of exiting, and the summary is two words: anxiety. Although their investments still have a return of two to three times on paper, everyone knows that when their shares unlock, it definitely won't be at the current price, and with the market liquidity still drying up, they have to find ways to recover. From what I understand, many VCs have started OTC trading their locked-up quotas off the market recently. In the past, a discount of 30-40% was harsh enough, but now it's directly at 20-30%, with the main focus on survival.

My personal view on this matter is really pessimistic, that is, a batch of VCs will have to die. Because if the market starts to turn around from here, these VCs with extremely high risk preferences and low industry responsibility, along with their bags, will survive, and then no one will receive any education. The problems that have emerged now will re-emerge in the future, so what's the difference between us and Wall Street?

I sympathize with VC friends who are struggling in this "hellish difficulty," but the situation ahead may get even worse.

So where is the problem?

Some time ago, I was chatting with a post-00s junior friend who has been trading coins since 2020. He has now withdrawn all the money he earned and borrowed a lot of Japanese yen to buy US bonds. Now, he can make several thousand dollars a month from the interest spread, and he told me that he can lie flat until 2030. When I heard this, I realized that it seems like every rich person is playing this blood-sucking game, so how can there still be money in the market? That conversation was the first time I truly felt the real impact of interest rate hikes on the coin circle. I used to think that interest rate cuts were just expectations, but now I think that interest rate cuts are the only way to survive.

Returning to the industry itself, I often discuss with our deputy editor whether this industry is a scam. One point he often defends for VCs is: in the last cycle, applications had a big explosion, leading to overloading of public chains, so the focus of capital began to shift to infrastructure. However, infrastructure does not directly interact with the user end, causing retail investors to feel that there is no narrative. He always tells me that this industry still has value and innovation, such as DeFi and NFT.

Well, I also admit that they have value, but if they have value, why isn't anyone continuously innovating in these matters? Why choose to give up past successful narratives and weave new lies? I think the coin circle is currently in the most serious existential crisis in history, where everyone realizes that although blockchain or Web3 has many promising applications, no one seems willing to admit that the current user profile of this industry is that of a gambler.

The other day, I interviewed an AI entrepreneur, and although they are doing an AI model distillation platform, the actual product is AI astrology. His explanation was: you have to serve your real users well, and then think about other things after surviving. I think the coin circle is the same. Uniswap's success has led us to make a wrong judgment about the industry's development. When you think about it carefully, you'll find that Uniswap is just a more reserved version of pump.fun. Perhaps we should return to the essence and serve our current real users well. But what do I know, I'm just a small retail investor who entered the circle not long ago and went back to zero.

Okay, I'm done complaining. Thank you for wasting your time reading this far.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。