Original Compilation | Odaily Planet Daily (@OdailyChina)

Author | Wenser (@wenser2010)

Editor's Note: After the market flash crash in April due to the war situation, shortly after, the market once again welcomed a "period of darkest moment" - according to OKX market data, Bitcoin once fell to $53,296, with a 24-hour decline of nearly 10%; Ethereum once fell to $2,806, with a 24-hour decline of over 10%. Such a huge decline is not only influenced by news such as Mt.Gox's multi-billion-dollar debt repayment, continuous transfer of Bitcoin addresses by the German government, but also related to Bitcoin's price repeatedly breaking the shutdown price of miners and mining companies, continuous net outflow of Bitcoin spot ETFs, and the continuous liquidation of some Bitcoin and Ethereum whales.

In view of this, Odaily Planet Daily will summarize the views of some research institutions and individuals in this article for readers' reference.

10xResearch: Bitcoin's Sharp Decline is Underway, What Should You Do?

As the market continues to decline, the well-known research institution 10x Research once again published an article stating "I told you," the following is a compiled version of its content:

The market performance once again proves that 10x Research is the only major research company that predicts price crashes (Odaily note: of course, this is 10x's usual self-promotion) - when the price of Bitcoin reached $67,300, we made a downward estimate. Even after the "Trump effect" over the weekend (Odaily note: referring to the impact of Trump's better performance in the US presidential debate, resulting in a slight increase in the market and related political meme coins), we warned that this rebound was not sustainable and reiterated our estimated target prices for Bitcoin at $55,000 and $50,000 - the current spot trading price of Bitcoin is around $54,000, a 20% drop from when we issued the warning signal.

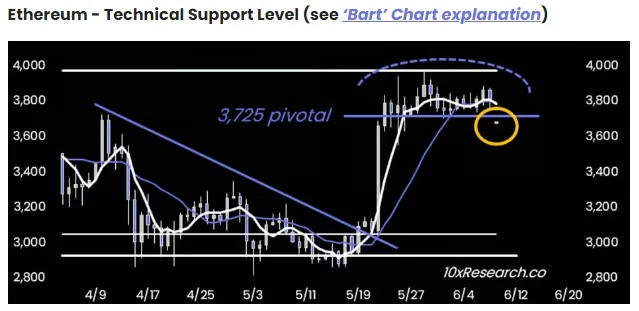

Before Ethereum fell below $3,725, we mentioned in a report that there might be a chain liquidation in the market, causing its price to fall back to the price level before the rise due to ETF expectations. These liquidations did not wait long, and the open futures contracts dropped sharply last night. Since the report was released on June 7, Ethereum has fallen by 22%, with the current trading price around $2,900.

It is worth noting that now is not the time to rush to buy the dip, but rather to sit back and let the bears continue to perform.

At the same time, many readers may have been prepared for this sell-off, and although we prefer bull markets, locking in profits at high levels is sometimes the right strategy.

There are always opportunities to make money in the crypto market, and our investment approach has once again proven that price trends can be predicted, whether it's an uptrend or a downtrend. Our research has always been at the forefront of this downturn (Odaily note: 10x's tone, you know).

Crypto Analyst: Mixed Feelings with a Bit of Stubbornness

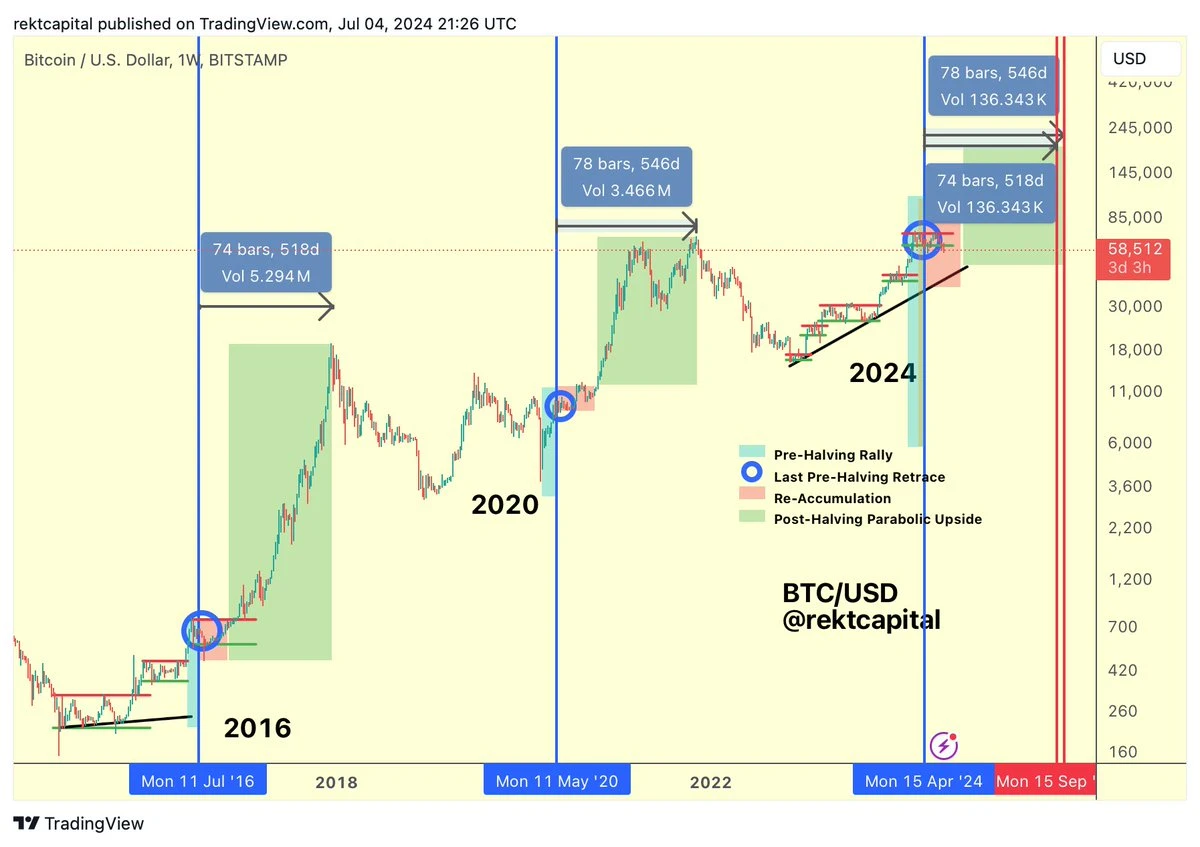

From the perspective of market cycles, crypto analyst Rekt Capital analyzed, "In the 2015-2017 cycle, Bitcoin reached its price peak on the 518th day after the halving; in the 2019-2021 cycle, Bitcoin reached its price peak on the 546th day after the halving. If history repeats itself, the next price peak of the bull market will occur on the 518th-546th day after the halving, which means Bitcoin may reach a new price peak in mid-September or mid-October 2025. Previously, Bitcoin accelerated to 260 days in this cycle. However, due to the recent consolidation phase of over 3 months, its acceleration rate has sharply decreased, now at about 150 days. Generally, Bitcoin maintains a longer consolidation period after the halving, and the effect of resynchronizing with the traditional halving cycle will be better."

Synchronization of Cycle Structure

On the other hand, from the perspective of the structure of long and short-term Bitcoin holders, Cauê Oliveira, Director of Research and On-chain Analyst at BlockTrends, stated that novice investors are struggling and losing money. During the downturn, approximately $2.4 billion worth of Bitcoin (purchased in the last 3-6 months) was sold during the price decline. This selling pressure comes from individuals or organizations who bought Bitcoin at the beginning of the year, who may have speculated on Bitcoin spot ETFs and events related to the halving, but now may have to reluctantly exit. They may be classified as "long-term holders," but their actual behavior resembles that of short-term investors, as they entered the market at relatively high levels at the beginning of the year. On the other hand, individuals or organizations holding for over a year have not sold more, indicating that true long-term holders continue to HODL.

Amount of Bitcoin transferred in the last 3-6 months

Regarding specific long and short positions and whether to buy, the well-known crypto KOL il Capo of Crypto, who was once "firmly bearish" during the market's continuous rise, expressed his belief of "firmly holding" this time, stating in a post, "The market's downturn is indeed more brutal than expected. However, at this point where many people panic and sell, I don't think it's appropriate to turn bearish or choose to sell now. It's time to 'broaden your horizons and stay calm.' There may be mistakes in the short term, but hold firm. Time will prove everything."

Conclusion: Recognize the Situation, Abandon Illusions

As senior author Fu wrote in the latest market article "Mt.Gox's Selling Pressure Strikes, BTC 24H Drops by 10% to Below $54,000, Where is the Bottom?" on Odaily Planet Daily, "The main reason for the current market downturn is the selling pressure from Mt.Gox, but the market may have exaggerated its impact."

The market is sometimes slow to react, slow to the point where real news does not ferment immediately; but sometimes sensitive, sensitive like a startled bird, thinking that "there is no way back" at the slightest movement. But in fact, "the most important factor affecting the future market trend is the result of the US election and the expectation of the Fed's interest rate cut."

Therefore, for market participants, including retail and institutional investors, the best choice now may be to switch from "long-term thinking" to "short-term thinking," making trades within 6 hours, or even 4 hours, 2 hours, more inclined to trend trading, rather than being overly concerned about the unanswered question of "whether Bitcoin and the market are in a bull market."

In summary, it can be put into 16 words - recognize the situation, abandon illusions, short-term operations, and wait patiently for positive news.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。