Trading philosophy: Look at the trend in the big cycle, and find the position in the small cycle.

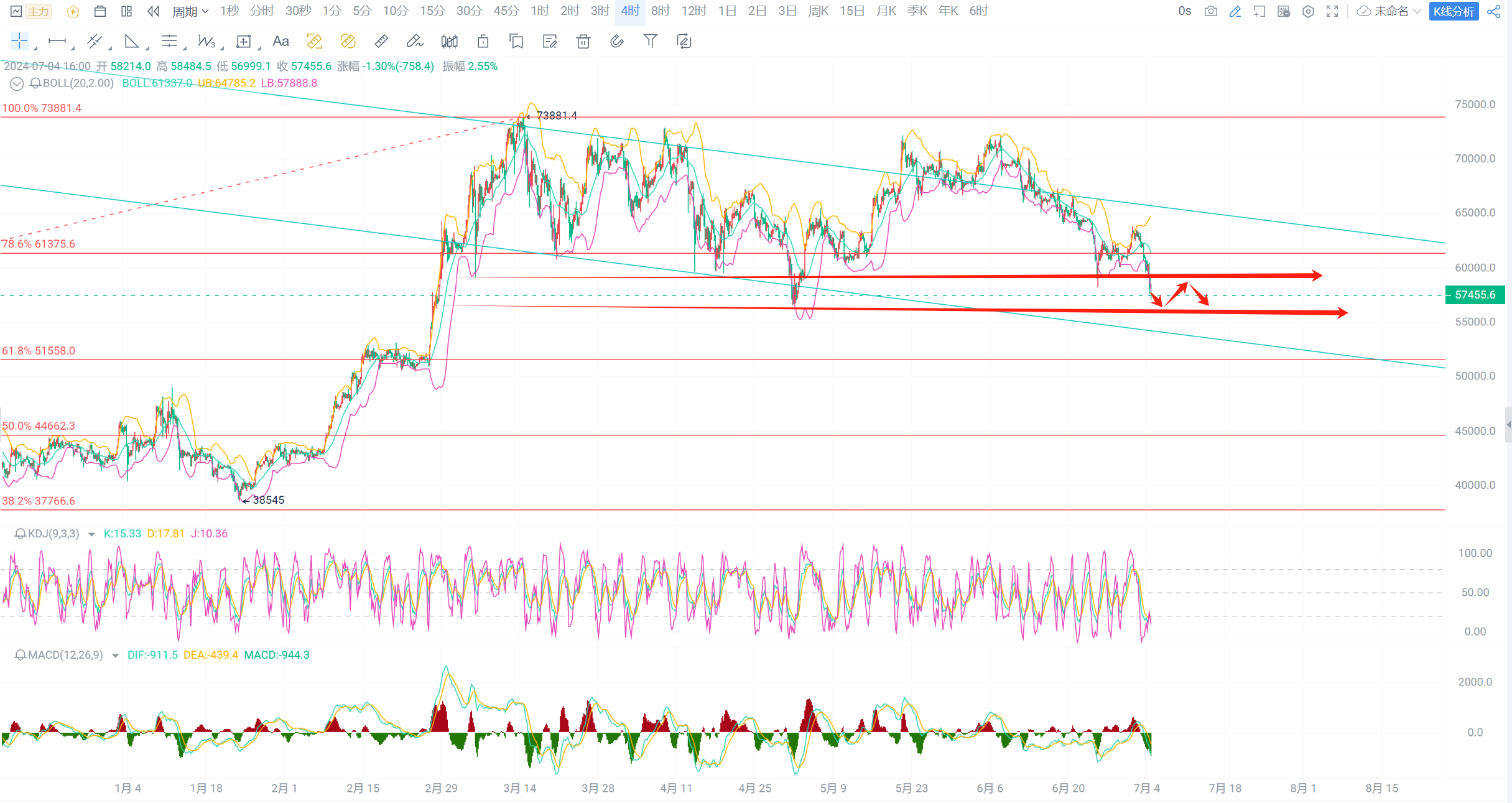

Technical analysis: Regarding Bitcoin, after the daily level rebounded to the middle track and then fell under pressure, it continued to receive two consecutive negative K-lines, and the Bollinger Bands continued to run downward. The MACD moving average and KDJ line are running downward, and the selling volume has gradually started to increase again. At the 4-hour level, the Bollinger Bands continue to run downward, the MACD moving average is running downward, the selling volume continues to increase, and the KDJ line is running downward. As for Ethereum, the technical indicators at various cycle levels are basically synchronized with Bitcoin.

Overall, the current trend is still leaning towards the short side. The strategy of going long and then short yesterday basically met expectations. In the evening market, Bitcoin fell to around 59500, rebounded to around 60500, and then fell again to around 57000. Ethereum fell to around 3250, rebounded to around 3320, and then fell again to around 3120. The strategy of going long and then short in the early morning basically hit the key points for Ethereum, and the returns on both orders were very good. The Bitcoin position was not accurately grasped. Subsequent operations can similarly be aggressively long in the short term, and patiently short on the rebound.

Reference:

Long position at 56500-57000 for Bitcoin, target 58000-59000, stop loss at 56000; Short position at 58500-59000, target 57500-56500.

Long position at 3100-3130 for Ethereum, target 3200-3250, stop loss at 3080; Short position at 3220-3250, target 3150-3100.

The strategy is time-sensitive, and specific guidance should be based on real-time instructions.

Follow WeChat public account "允彦"!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。