Author: Jack, BlockBeats

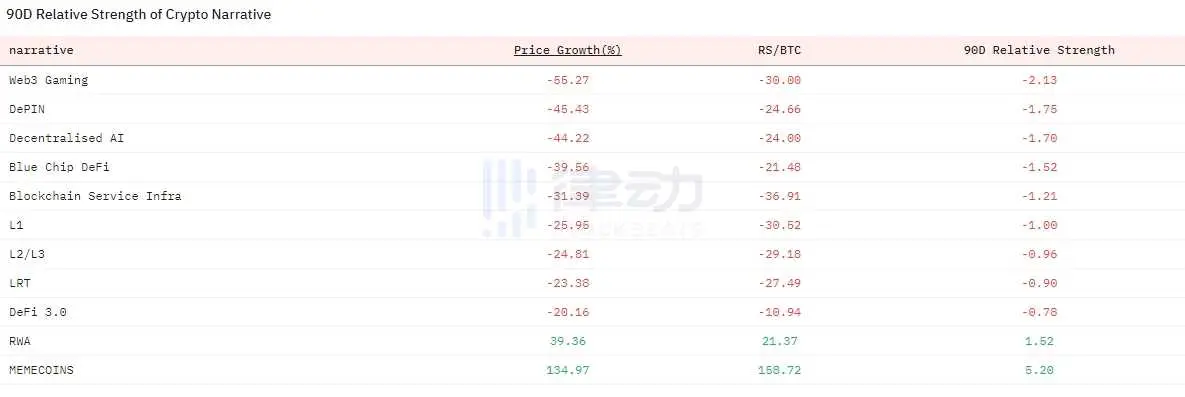

According to the data from Dune Analytics, RWA has become the only crypto narrative that has seen an increase in the past 3 months, apart from memes, in a market environment that has generally stagnated. This performance has caught our attention. In fact, the discussion about RWA has been ongoing since June last year, and the narrative was thoroughly ignited after BlackRock launched the BUIDL on-chain fund.

In the crypto field, RWA has become a "well-worn story." Despite RWA being a new concept, the decentralized connection and impact on real industries seem to have always been the "intuitive direction" for entrepreneurs in the crypto industry: blockchain, like the internet, is bound to completely change traditional businesses. However, putting everything on the chain is not as simple as everyone imagines. From the early days of Paxos Gold's on-chain gold to Power Ledger's on-chain energy ledger during the ICO period, and to the previous cycle's luxurious on-chain credit from Maple Finance and Goldfinch, RWA seems to have been constantly failing.

Interestingly, the native users of the crypto industry seem to have consistently underestimated the vitality of this narrative. By carefully examining the timeline clues, we can clearly see the continuous changes in the fundamental aspects of the RWA narrative. Behind this narrative revival is the alignment of RWA product positioning and user demand, as well as the huge incremental opportunity driven by traditional financial institutions.

In the face of opportunities, everyone's sense of smell is not bad, but there are not many who can truly "seize the opportunity." Over the past six months, numerous teams have been transforming into RWA, but there are few projects that have successfully seized the opportunity and shown initial results. Whether it is transformation or entry, identifying the opportunity is the key for teams to obtain tickets, and among the many competitors, a project called Jiritsu has caught our attention.

Always Failing RWA

On December 6, 2022, the smart contract auditing platform Sherlock updated a blog post on Mirror, informing the community that the team would incur approximately $4 million in losses due to Maple Finance borrowers' default. Prior to this, Sherlock had about 5 million USDC stored in the Maple lending pool managed by M11 Credit, but now the overall funds of the pool pledgers will suffer a loss of over 30%. On the same day, the DeFi insurance platform Nexus Mutual also expected to incur approximately $3 million in losses in the Orthogonal Trading default event.

The day before, the crypto hedge fund and credit investment company Orthogonal Trading defaulted on its $36 million loan on Maple Finance, accounting for about 30% of Maple Finance's active loan amount. Just half a year ago, Maple had just suffered a nearly $10 million loan default from Babel Finance, and at that time, it was Orthogonal Trading's $10 million USDC position in the lending pool that suffered the most.

In the span of a year, a series of default events have made the once shining RWA lending stars suffer. After LUNA and 3AC defaulted one after another, the chain reaction in the crypto market quickly intensified, and the liquidation of mainstream ecosystems and institutions led to a rapid shrinkage of the overall credit scale in the market, resulting in continued deleveraging events. After FTX's default, the total value of active loans in the market plummeted by 80%, from $1.58 billion to $270 million in early 2023. Even as the market declined, Maple's days were not easy, and default events continued to occur even after announcing tightened loan standards in October.

Many attribute Maple's setbacks to the market, believing that Maple was just unlucky. But even in a market recovery situation, default events have been frequent on many RWA lending protocols. In April of this year, the startup credit company Lend East stated that it would only be able to repay about $4 million of the approximately $10 million loan it had obtained through the RWA lending protocol Goldfinch, with the remaining $6 million all in default. Since its inception, Goldfinch has experienced three large defaults, and this project, born with a golden key, has also failed to bring magic to RWA.

From June 2021 to January 2022, a16z invested nearly $30 million in Goldfinch twice, but in the following month, Goldfinch experienced a $20 million bad debt due to the borrower's "investment not meeting expectations." In October last year, the governance platform of Goldfinch also released a report pointing out a bad debt in a lending pool on the platform, with a $7 million risk of loss.

Unlike the over-collateralized lending in conventional DeFi, private credit protocols (i.e., RWA lending protocols) are designed to provide unsecured loans to real-world businesses based on their credit records, with on-chain funds earning off-chain returns through the protocol. These protocols involve third-party institutions evaluating borrowers and providing potential borrowers with liquidity through establishing a fund pool. Compared to concepts like "gold on the chain" and "real estate on the chain," on-chain credit is a relatively mature RWA model in the industrial chain. However, even so, these protocols still struggle to gain momentum.

One direct reason is the extremely high threshold for guiding users. In most cases, users must go through KYC procedures to participate in the protocol's lending pool, which deviates from the image most DeFi users pursue of "permissionless" and "code is law," to some extent turning the protocol into a B2B product. In fact, this is also the main problem faced by most RWA projects, namely the misalignment of product positioning and user image. In an industry where high ROI is everywhere, most "degen" seem uninterested in the off-chain assets' earning opportunities, whether it's gold, real estate, or art, as their growth is difficult to match with popular tokens.

On the other hand, the stability and security of off-chain returns are also the main problems faced by RWA lending protocols. From 2021 to 2022, almost all of Maple Finance's active credit was lost to native institutions in the crypto industry, and most of them experienced defaults during the bear market. At the end of 2021, Maple had provided $25 million to Alameda Research, the trading company behind FTX, on the grounds that Alameda promised to increase the loan amount to $1 billion within 12 months. To prove that the on-chain credit model works, Maple prioritized the consideration of returns when choosing borrowers, and the ultimate result was that the so-called off-chain returns brought by RWA actually came from the crazy leverage of crypto institutions.

The plight encountered by Goldfinch reflects an even more frustrating fact, that entities and businesses that can obtain financing through conventional channels often do not choose on-chain financing. Goldfinch is indeed earnestly seeking lending scenarios outside the crypto industry, mostly revolving around startups and small loans in developing countries and regions, the former often being the "leftover horses" picked by top VCs, and the latter inherently carrying a high failure rate. On one hand, they need to bear high risks, and on the other hand, the return rate is not as expected from trading coins, the double debuff of product and user, has always made RWA progress difficult.

This Time, the Fundamentals Have Changed

Interestingly, since June last year, the narrative of RWA has once again risen, but this time, its fundamentals have undergone significant changes.

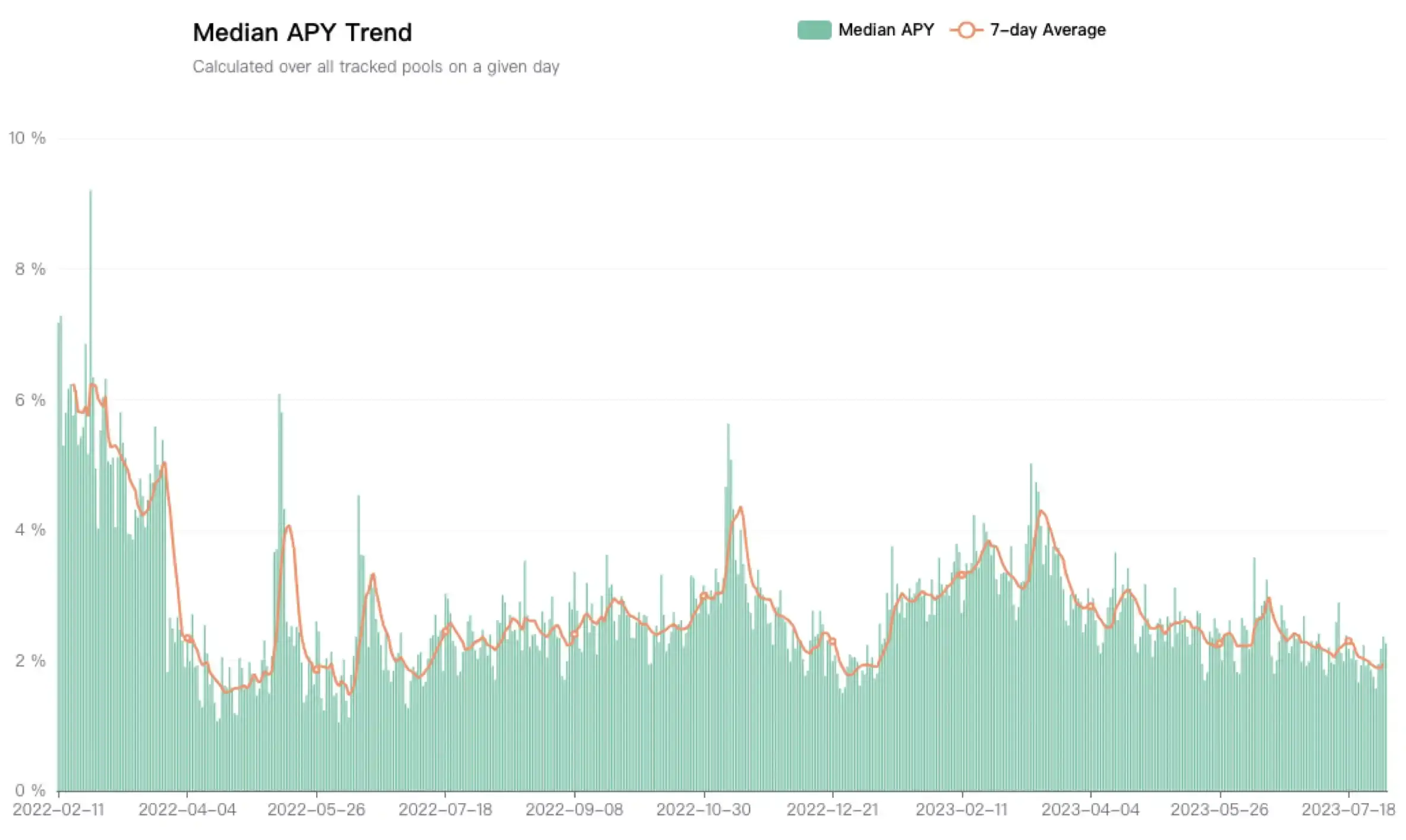

When On-Chain Whales Set Their Sights on 5% Annualized

On the eve of the collapse of Three Arrows Capital, the team found that it was almost impossible to find scenarios for generating expected returns from the assets they managed. As the Federal Reserve began the interest rate hike process, liquidity tightening eroded various markets globally, with cryptocurrencies, defined as risky assets, being particularly affected. Corresponding to the steady increase in yields since the end of 2021, the yield levels of DeFi have gradually declined, with the median yield dropping from 6% in early 2022 to 2% in July 2023. This was almost unprofitable for large holders, as risk-free returns had already reached 5%.

When on-chain returns were quite low, real-world yields became much more attractive, indicating a shift in the main bottleneck that had been troubling RWA protocols, namely the crypto industry's growing interest in off-chain returns. To address the continuous outflow of funds from the industry, the industry began to consider how to bring the risk-free returns of US Treasuries onto the chain, making RWA once again the savior in people's eyes.

In August 2023, the lending protocol Spark Protocol under MakerDAO displayed that the DAI Savings Rate (DSR) had been increased to 8%, reigniting the long-dormant DeFi. Within a week, the protocol's DSR earnings surged by nearly $1 billion, and the circulating supply of DAI increased by $800 million, reaching a historic high in three months.

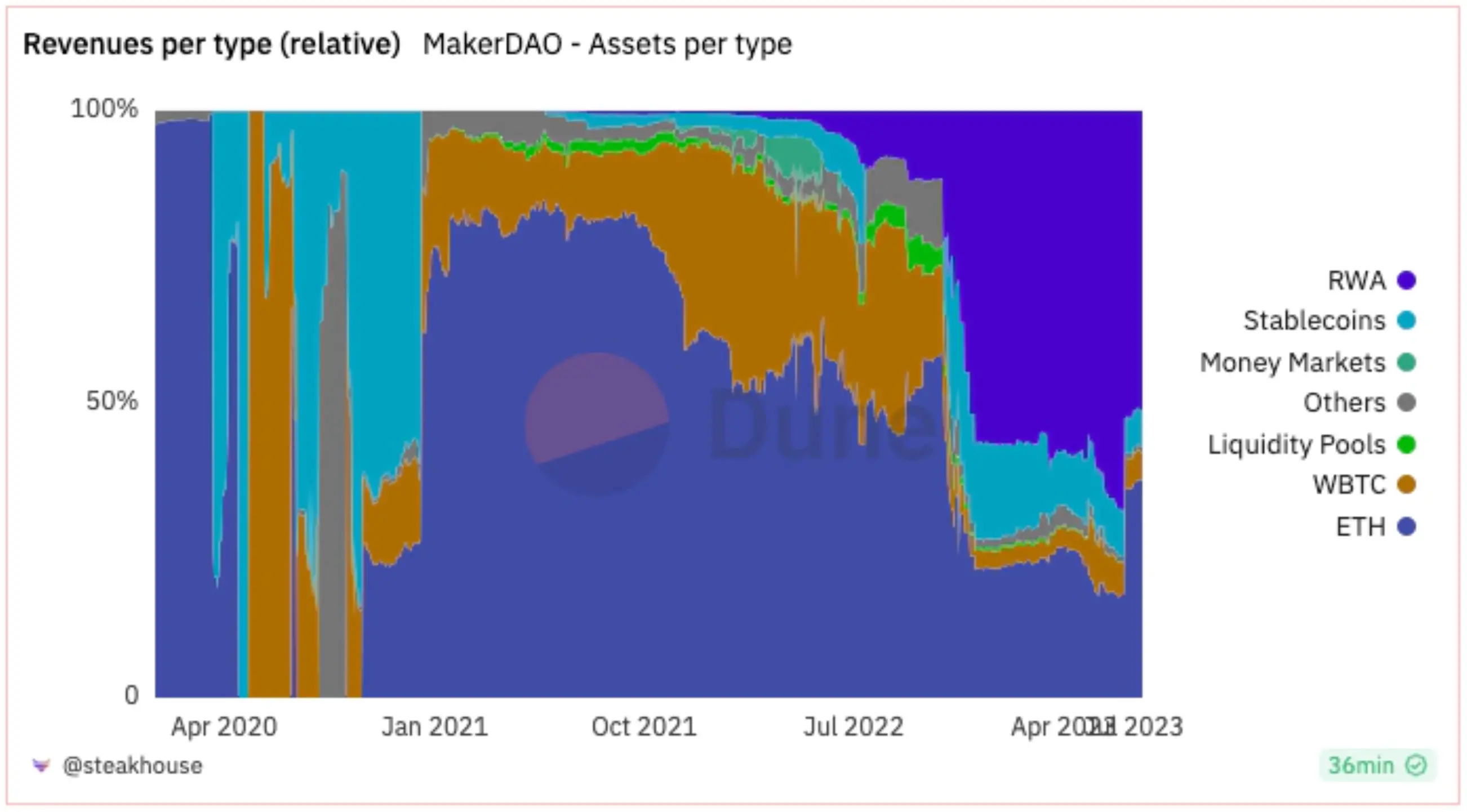

Providing huge returns in a deep bear market, Maker's secret weapon is RWA. According to statistics from The Defiant, MakerDAO has generated nearly 80% of its fee income from RWA assets in the past year, based on total TVL. Starting from May 2023, MakerDAO gradually increased its exposure to RWA, deploying funds not only to Coinbase Prime but also purchasing large batches of US Treasuries through its entities Monetalis Clydesdale and BlockTower, with BlockTower Credit deploying up to $220 million in loan funds on the RWA lending protocol Centrifuge. According to Dune Analytics data, as of July 2023, MakerDAO had a portfolio of nearly $25 billion in RWA investments, including over $10 billion in US Treasuries.

The sudden high returns made RWA the most controversial topic in the Maker community. After the Tornado Cash incident, the desire of native crypto users to break free from centralized power constraints became stronger, and the increased dependence of DAI on US Treasuries not only reduced DeFi's resistance to regulation but also meant that once the Federal Reserve reversed course, RWA protocols relying on US Treasuries would fail again.

However, concerns at the visionary level did not hinder the motivation of the crypto industry to make money, and RWA once again sparked people's interest in DeFi. The high returns of blue-chip stablecoins triggered a chain reaction in the DeFi ecosystem, and the Aave community quickly proposed to list sDAI as collateral to indirectly gain exposure to US Treasuries. DAI transformed from a liquidity product into the "yield Lego" of the DeFi world, allowing any protocol seeking RWA exposure to build sustainable returns based on DAI. As a result, there was a significant influx of funds from MakerDAO governance token holders, with MKR's monthly increase exceeding 35%, making it one of the best-performing tokens in the market.

MakerDAO's successful exploration in the RWA field has sparked another wave of RWA enthusiasm in the industry. In June of the same year, the founder of Compound announced the establishment of his new company, Superstate, dedicated to bringing bonds and other assets onto the chain to provide potential clients with real-world returns. After the announcement, the price of the COMP token rose by over 23% within 24 hours. Subsequently, protocols such as Ondo Finance and Matrixdoc also began their exploration in the tokenization of US bonds.

The "Regular Army" Gears Are Turning

In June last year, the world's largest asset management group, BlackRock, submitted an application for a physically-backed Bitcoin ETF to the US SEC through its subsidiary iShares, ushering in a new bull market for crypto. Since its launch in January this year, IBIT has continuously set new fund records for BlackRock, and the first-quarter financial report of BlackRock in April showed that IBIT had attracted approximately $13.9 billion in net inflows, accounting for 21% of its total net inflows for ETF products. This figure increased to 26% in June, and BlackRock CEO Larry Fink even referred to IBIT as the "fastest-growing ETF in history."

The exploration of institutional on-chain initiatives began to gain momentum after the Web3.0 Summit in Hong Kong in April 2023. In July of the same year, Helen Loh, head of the Financial Technology Group at the Securities and Futures Commission (SFC) of Hong Kong, stated in an interview that the SFC would change its views on STOs, and securities tokens or RWA would not be defined as complex products. RWA would be regulated based on the underlying asset types and have the opportunity to be opened to retail investors.

The ambitions of institutions to lay out in the crypto industry go far beyond ETFs. At the end of 2022, BlackRock CEO Larry Fink stated that "the next generation of markets, the next generation of securities, will be tokenized securities," while Tyrone Loban, head of blockchain at JPMorgan Onyx, envisioned "bringing trillions of dollars of assets into DeFi, making it as large as institutional assets, so that these new mechanisms can be used for trading, lending, and borrowing."

In addition to internal driving forces from the industry, a key reason for the resurgence of the RWA narrative this time is the exploration interest from external forces such as governments and large financial institutions. The active participation of traditional institutions means that the situation where RWA protocols are chasing attention from the real world has changed, and "putting their financial products on the chain" has become the demand of external institutions for the crypto industry.

In March of this year, BlackRock launched its first tokenized fund, BUIDL, on the public blockchain, providing qualified investors with the opportunity to earn USD returns. BlackRock announced that tokenization is still a focus of its digital asset strategy, and through the tokenization of the fund, it aims to expand investors' access to on-chain products, providing instant and transparent settlement and cross-platform transfers.

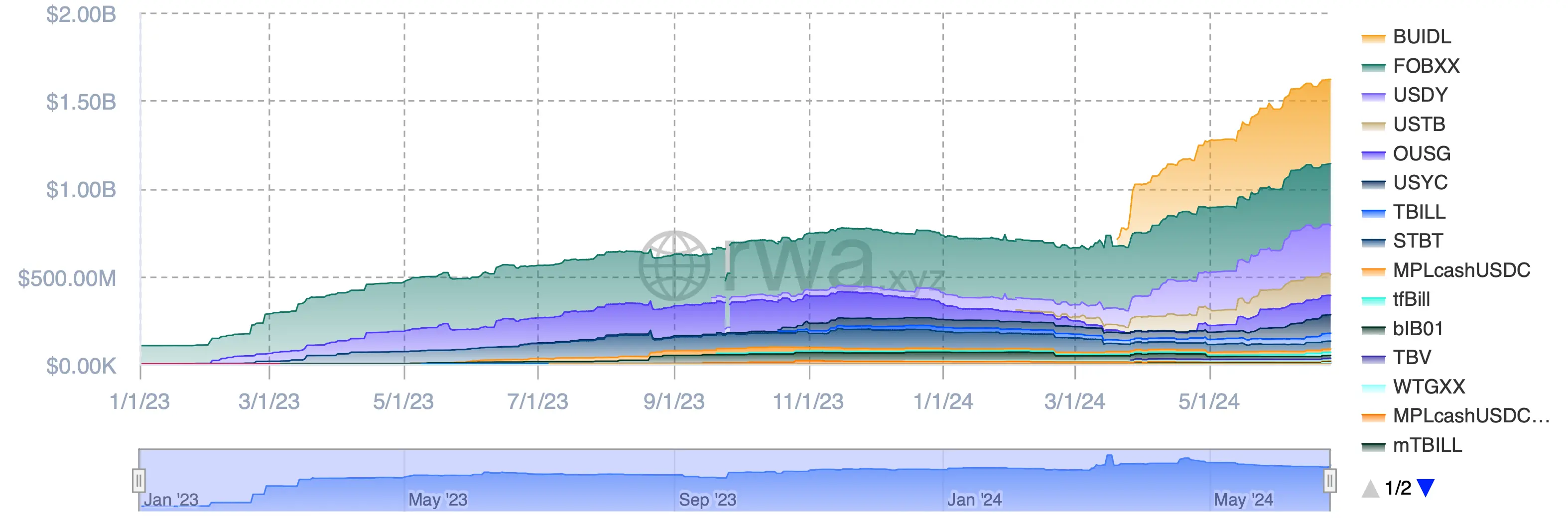

Similar to the Bitcoin physically-backed ETF application, the emergence of BUIDL once again ignited the concept of RWA, with traditional financial giants beginning to explore on-chain initiatives. Many analysts even referred to it as bringing "legitimacy" to public smart contract chains such as Ethereum. Within less than 10 days of its launch, the BUIDL fund grew to $274 million in size, accompanied by a substantial increase in the market value of tokenized RWA (including US Treasuries, bonds, and cash equivalents), which grew by nearly 35% since early April, reaching over $1.5 billion.

The entire on-chain US Treasury market showed a clear upward trend after the launch of BUIDL, and the previously relatively quiet Franklin Dampston on-chain US government currency fund FOBXX rapidly increased by nearly 27%. Within the crypto industry, Ondo Finance, which also transformed into a US Treasury RWA protocol, doubled its TVL to $500 million under the impetus of the "BlackRock concept."

The gears of the massive machine have begun to turn, and it is almost undeniable that after the new policies of Web3 in Hong Kong and BlackRock's pioneering tokenization exploration, the process of institutions "dabbling in on-chain" will become increasingly apparent, and their demand for blockchain infrastructure will also grow and become more diverse. For native crypto projects struggling to find better business models, this is a rare and huge B2B opportunity.

Massive To B Business, Who Is Riding the Wave?

After the trend emerged, the amount of financing in the RWA field has surged this year, and many teams are hoping to seize this opportunity. However, for most people, the motivation is still to "ride the wave," with even the former meme coin project TokenFi expressing its intention to enter the RWA field. However, accurately seizing the opportunities in the market at the right time is not something everyone can do.

RWA Public Chains

In addition to Polygon, which has the second-highest TVL of tokenized US Treasuries, Avalanche can be considered the first L1 public chain to fully embrace RWA. As one of the new "big three" public chains in the previous cycle, Avalanche chose a development path opposite to that of Solana after entering the bear market. Since the end of 2022, Avalanche has begun high-frequency exploration in the direction of enterprise applications, and its unique subnet structure has allowed the team to make rapid progress in this area. Avalanche's subnet architecture allows institutions to deploy custom blockchains optimized for their specific use cases and seamlessly interoperate with the Avalanche network, achieving unrestricted scalability. From the end of 2022 to the beginning of 2023, entertainment giants from South Korea, Japan, and India have established their own subnets on Avalanche.

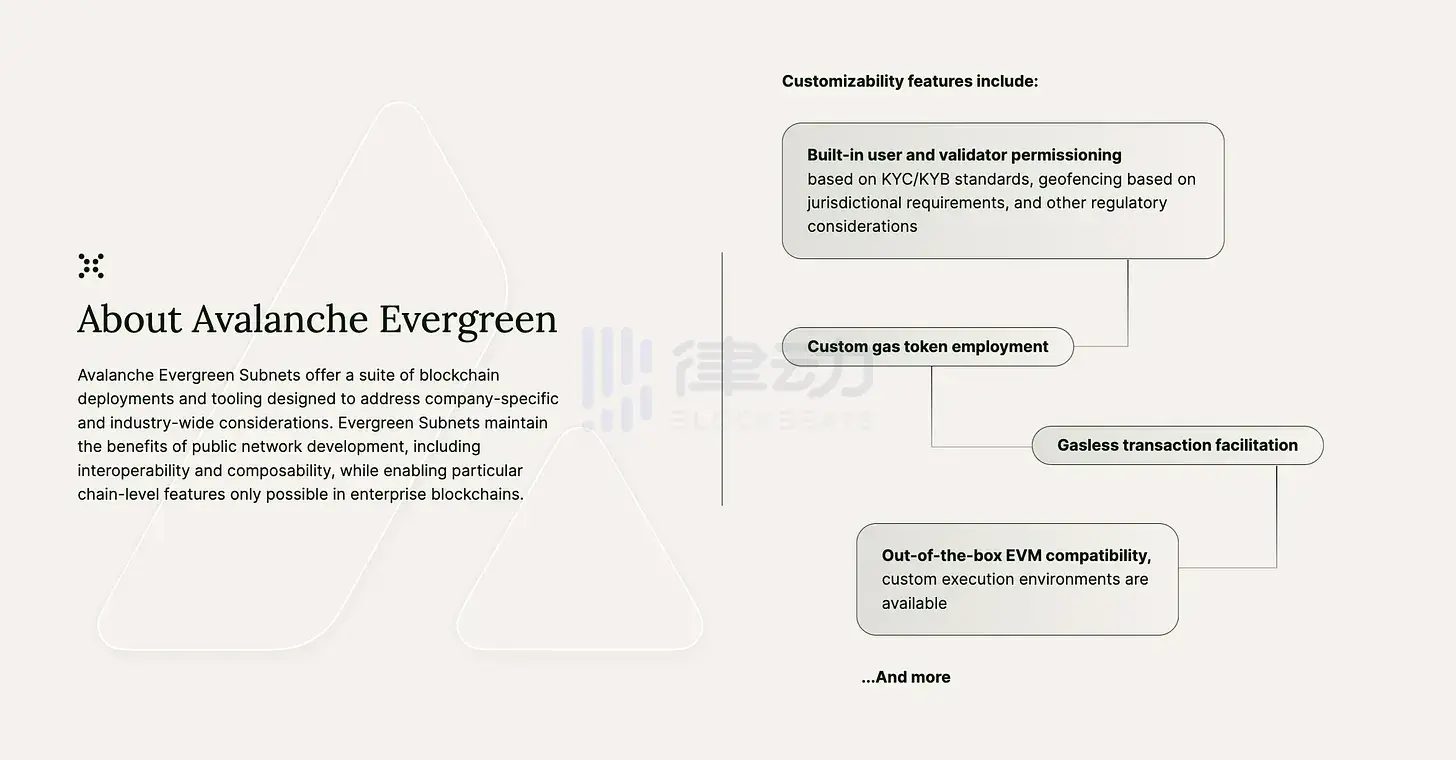

Avalanche was also the first to observe the trend of asset tokenization in Hong Kong due to its sensitivity to institutions. During the Web3.0 Summit in Hong Kong in April 2023, Avalanche launched the Evergreen subnet, aimed at meeting the specific financial service requirements of specific companies and the entire industry. Evergreen is a set of institutional blockchain deployment services and tools designed specifically for financial services. Institutions can deploy blockchain settlement strategies on private chains with licensed counterparties based on the Evergreen subnet and maintain interoperability with other subnets through the Avalanche Local Communication Protocol (AWM).

Evergreen's solution directly meets the needs of institutions to combine public and private blockchains. After its launch, it immediately attracted the attention of institutions such as WisdomTree and Cumberland, who participated in the development and testing of the network after the launch of the Evergreen testnet Spruce. In November of the same year, Avalanche partnered with JPMorgan's digital asset platform Onyx to use the LayerZero full-chain interoperability protocol to connect Onyx with Evergreen, promoting the tokenization of assets offered by WisdomTree Prime. This collaboration was also included in the "Guardians Program" launched by the Monetary Authority of Singapore (MAS) and the financial industry.

Subsequently, Avalanche announced various RWA collaborations with institutions. In November, it helped financial services company Republic launch its tokenized investment fund Republic Note. In February 2024, it helped Citibank and WisdomTree, among other institutions, conduct a conceptual trial of tokenizing private equity funds on the Spruce testnet. In March, it collaborated with ANZ Bank and Chainlink to settle tokenized assets using CCIP, connecting Avalanche and Ethereum blockchains. In April, it also helped integrate the payment giant Stripe.

The ecosystem's foundation is also making efforts in the RWA direction, launching the Avalanche Vista program and investing $50 million to purchase tokenized assets issued within the ecosystem, including bonds and real estate. Additionally, the ecosystem fund Blizzard Fund is actively investing in and attracting RWA projects such as Balcony and Re into the ecosystem. According to John Wu, CEO of Ava Labs, Avalanche's mission is to "present the world's assets on-chain." Unlike traditional financial rails, blockchain can achieve immediate settlement, and institutions now see this real-world instant settlement solution that cannot exist in the traditional world. The rise of RWA can bring regulated entities into the on-chain space, unlocking more possibilities, and Avalanche will strive to be their best choice for on-chain activities.

"BlackRock Concept"

Although RWA encompasses a wide range of assets, after MakerDAO and BlackRock entered the game, tokenized US Treasuries undoubtedly became the most popular RWA product, with its market value increasing nearly tenfold in about a year, from approximately $100 million in early 2023 to nearly $1 billion in early 2024.

Unlike tokenized assets such as gold and real estate, tokenized US Treasuries are not directly backed by the US Treasury but are often introduced to the market in the form of money market funds. Therefore, the issuer of tokenized US Treasuries is a licensed fund manager responsible for creating and managing money market funds and issuing fund units as tokenized US Treasuries to holders.

However, money market funds are regulated capital market products, and investors' investments are subject to relevant rules and regulations, meaning investors need to undergo KYC verification before purchasing. Additionally, since the fund's assets are held by a custodian, the fund manager must work directly with the custodian to conduct operations such as new user onboarding, net settlement, and reconciliation, in addition to buying and selling assets. The custodian will have a complete and updated list of holders and their balance sheets.

The BUIDL fund issued by BlackRock in March of this year is such a tokenized money market fund. It invests all of its assets in cash, US Treasuries, and dollar cash equivalents such as repurchase agreements. BlackRock pays the daily accrued dividends directly to investors' wallets as new tokens, allowing investors to earn returns while holding tokens on the blockchain. Under the spotlight of BlackRock, the issuer and manager of the BUIDL fund, Securitize, quickly entered people's field of vision, becoming the "hot cake" in the RWA field.

Securitize, which partnered with BlackRock, has long been focused on the RWA field and has provided services to many large-scale asset securitization companies. After obtaining SEC transfer agent registration in 2019, Securitize raised $48 million in funding led by Blockchain Capital and Morgan Stanley in 2021. In September 2022, the team helped one of the largest investment management companies in the United States, KKR, tokenize part of its private equity funds on Avalanche. The following year, also on Avalanche, Securitize issued equity tokens for Mancipi Partners, a Spanish real estate investment trust, becoming the first company to issue and trade tokenized securities under the new EU digital asset pilot regime.

After hitching a ride on BlackRock in 2024, Securitize once again received a strategic investment of $47 million led by BlackRock in May, with the funding to be used to further accelerate its partnerships in the financial services ecosystem. As part of the investment, Joseph Chalom, Global Head of Strategic Ecosystem Collaboration at BlackRock, was appointed to the board of Securitize. In the RWA new wave sparked by BlackRock, Securitize is undoubtedly the biggest winner.

Another type of native crypto RWA protocol, after sniffing the wind, also accurately seized the opportunity to take off, with Ondo Finance being a typical representative.

In August 2021, Ondo Finance announced the completion of a $4 million financing round with participation from Pantera Capital, DCG, and others, preparing to provide sustainable returns for on-chain investors. In January 2023, Ondo officially launched three tokenized funds, including OUSG (US Government Bond Fund), OSTB (Short-Term Investment Grade Bond Fund), and OHYG (High-Yield Corporate Bond Fund), charging a management fee of 0.15% per year. However, similar to the situation mentioned earlier, Ondo's tokenized funds have always struggled on the PMF.

But when the industry once again picked up the RWA trend, Ondo immediately responded. In January of this year, Ondo Finance announced its "ecosystem directory" on social media, including cooperation providers in the areas of RWA business liquidity, custody, and asset management, with the names of financial giants such as BlackRock and Morgan Stanley. The official statement indicated that this directory aims to help the protocol "focus its work on these partners," with the unexpected implication that they would "closely cooperate" with BlackRock.

Following the launch of the BUIDL fund, Ondo announced a significant adjustment to its US Treasury product OUSG. In addition to improvements in the purchase and redemption mechanisms, the most notable aspect of this adjustment was the decision to reallocate most of OUSG's assets (approximately $95 million) to the BUIDL fund. The team stated that this action would help them move token-backed assets from "less than ideal trading funds" to blockchain-based tokenized funds. As a result, Ondo quickly became the leading speculative target in the RWA and "BlackRock concept," with the token price rising by over 110% in a week.

Economies of Scale, the Ultimate Winner

Whether it's "To RWA" public chains or issuers and managers of on-chain assets like Securitize, their development and launch are largely determined by the interest of financial institutions such as BlackRock. In other words, the opportunities in the current RWA narrative come entirely from the customized needs of traditional financial institutions. For the industry, relying on the actions of financial giants is not the optimal solution for growth. Instead, solving the fragmented issues of internal infrastructure and liquidity and achieving economies of scale is the key to self-reliance.

Fragmented Liquidity

The greatest benefit of tokenizing real-world assets is the ability to provide faster and more efficient trading and settlement processes for these assets, which is undoubtedly the main reason why institutions are interested in RWA. While this idea makes sense logically, it faces many technical difficulties in practice, one of which is the fragmentation of liquidity for on-chain assets.

When it comes to the complexity of on-chain and trading for RWAs, the fragmented market exacerbates this issue. A report from Digital Asset Research in July of last year emphasized that over 60% of RWA institutions currently conduct trading through their own tokenized asset markets, meaning that after "enduring hardships" to be on-chain, assets can only attract a small portion of fixed customers.

According to data from The Block, the total financing scale of the RWA track has also reversed its downward trend this year, rising to $300 million. The trend of RWA's recovery has led many entrepreneurs to see new "narrative opportunities," and RWA concept projects in the market are increasing at a visible speed. However, most funded projects tend to focus on very small vertical areas, such as natural resources, specific commodities, and art, with RWA projects in the real estate sector being particularly prominent in this regard.

This specialization can be further subdivided to what extent? Platforms like Balcony and Mnzl provide tokenization processes for regional real estate resources, and the buying and selling parties using on-chain assets and on-chain tools are often local institutions or government departments, essentially creating a semi-closed asset market.

The specialization and regionalization of RWA projects are understandable, as many real-world assets have strong regional characteristics and often require specialized and targeted approaches. However, due to different regulatory restrictions in different regions, each RWA project is almost building its on-chain process and trading platform from scratch, and there are also different choices when it comes to the underlying public chain and smart contract development tools, posing a huge challenge to the interoperability between different RWAs.

Many entrepreneurs have seen this fragmentation of liquidity, leading to the emergence of platforms such as Midas and Plume, which aggregate RWA assets or serve as RWA launch platforms. However, upon further consideration, it becomes clear that they still face a dilemma: if they want to establish a unified market, they must first have a certain level of compatibility in token and contract standards, which hinders the aggregation of RWA assets on a large scale and across multiple categories. On the other hand, if they aggregate different RWA protocols first, they will be limited to the role of a "launch platform" due to the technical stack differences between protocols. Although this brings some liquidity to small projects, it still faces the problem of fragmented markets for on-chain assets.

Even the tokenized US Treasury market, which has the best liquidity, faces the same issue. While it has solved the scalability problem of single-category products under the impetus of institutions such as BlackRock and Franklin Templeton, you will still find that in order to provide more choices for potential investors and cooperative projects in the future, these assets are also distributed across different public chains such as Ethereum, Stellar, and Avalanche.

This has also brought a narrative window for cross-chain interoperability protocols that have been slow to gain traction, such as Axelar, which has been early in laying out RWA. It has collaborated with Centrifuge and Ondo to launch Centrifuge Everywhere and Ondo Bridge, optimizing protocols for tokenized RWA products and interoperability and liquidity between chains. In the current fragmented market environment, cross-chain interoperability is not without its merits as a solution.

Self-Reliance in the Weakest Links

In fact, the bottleneck for RWA to break through the scalability limitation is not difficult to see, which is the lack of automated processes or technologies like AMM in the DeFi field. For RWA products, tokenization is often just the beginning, and ensuring continuous asset updates and transparency after the product is on-chain is the key to testing efficiency and cost. This typically includes the following aspects:

Financial reports: Asset managers need to regularly publish financial and performance reports for the assets. For example, real estate managers need to regularly provide details of payment dates and amounts for rental income, as well as details of arrears and vacancy situations, to provide investors with a clearer understanding of the cash flow dynamics of the property.

Debt management: Products like RWA credits require regular updates on details such as collateral, repayments, interest rate adjustments, and refinancing activities to help investors understand their health, which is the basis for maintaining investor trust in such products.

Ownership changes: If there are changes in the basic ownership of the underlying assets or legal entities owning the assets, timely announcements are also necessary.

Market supervision: When there are changes in the market supervision environment where the underlying assets are located, managers also need to report and make corresponding adjustments to ensure the compliance of the products.

In addition to these, there are also various complex details such as asset insurance and risk management strategies, asset valuation and inspection, and the legal entities issuing the assets, all of which require asset managers to invest a lot of effort and attention to various details throughout the investment lifecycle. In summary, in the current "redundant infrastructure" market environment, getting assets on-chain is no longer the most difficult part of RWA development. Continuous verification and legal supervision off-chain are the main reasons for slowing down the growth and erosion of the value of on-chain assets. All of this can only be discussed under the premise of setting aside the centralized audit risks off-chain.

The scale and growth of RWA assets depend entirely on the strength of off-chain issuing and managing institutions. This is also the main reason why US Treasury RWA products have grown rapidly after BlackRock's entry, while other assets such as real estate and commodities have struggled to achieve economies of scale due to the lack of automation in their processes. Of course, the erosion of the value of on-chain assets also means huge business opportunities, and currently, most of this potential income has flowed into the hands of asset issuers and managers such as Securitize.

Is it possible to build its own automated "asset oracle" system in the RWA field, similar to what ChainLink has done in the DeFi field? We found some answers in the Jiritsu project.

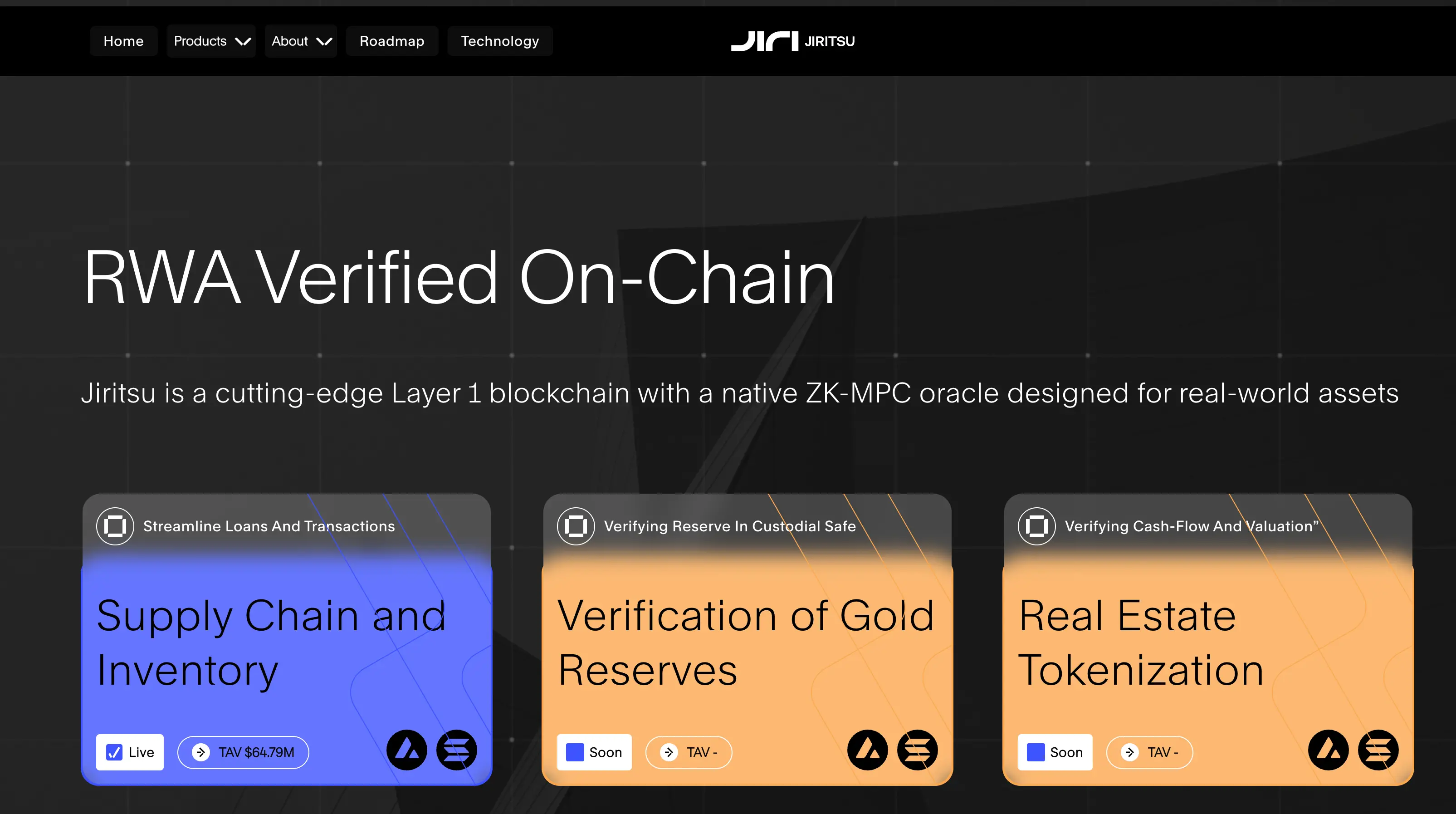

Jiritsu is a specialized Avalanche L1 focused on off-chain asset verification, aiming to achieve automated and trustless off-chain asset registration and verification, while reducing on-chain erosion and costs, and improving the economic efficiency and transparency of RWA tokenization. By integrating ZK proofs and MPC multi-party computation, Jiritsu ensures secure and private automated verification of asset details, embedding regulatory compliance and asset integrity into tokenized products. Interestingly, the name "Jiritsu" comes from the Japanese word "じりつ," meaning self-reliance. In the RWA field, which currently heavily relies on centralized human resources in critical areas, this is exactly what enhances its native encryption properties and achieves economies of scale.

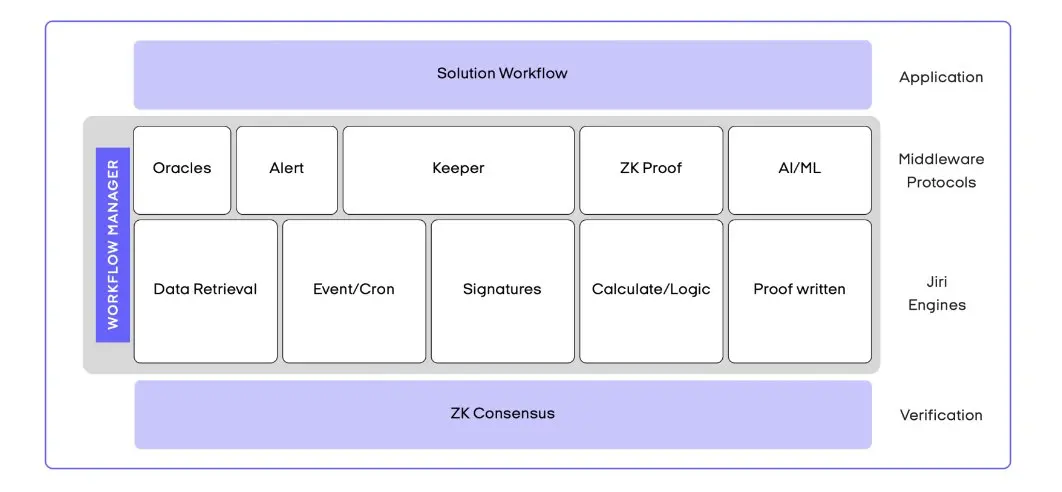

The Jiritsu ZK-MPC oracle aggregates data from multiple sources and verifies related calculations, using a multi-functional data retrieval mechanism to enhance the integration depth of different types of assets. The oracle includes two main mechanisms: "Push" and "Pull." The former allows data providers (such as asset managers) to directly send information to the oracle, while the latter allows the oracle to retrieve data directly from integrated information suppliers' systems, such as supply chain software and banking information, through APIs.

In terms of consensus mechanism, Jiritsu introduces the concept of Proof of Workflow (PoWF), where nodes in the network run an operating system driven by a computational engine and workflow manager, using generated ZK proofs to ensure consensus mechanisms for verifiable computation and smart contract execution, directly integrating the consensus mechanism into its MPC framework. Compared to existing oracles like ChainLink or Pyth, Jiritsu does not require cross-chain bridges for information transmission when aggregating information, and it adds analysis and verification functions to simple data feedback.

After users or asset managers register assets and their detailed information in Jiritsu, the ZK-MPC validator analyzes this information and confirms the value and compliance status of the assets. The analysis process involves two types of validators: one for reviewing business policies and regulatory compliance, and the other for handling financial data, executing spot price retrieval, and market valuation tasks. After the information is analyzed and verified, ZK-MPC generates ZK proofs and stores them on-chain, allowing users to claim these proofs and embed them into their smart contracts, completing the entire process of tokenizing the assets.

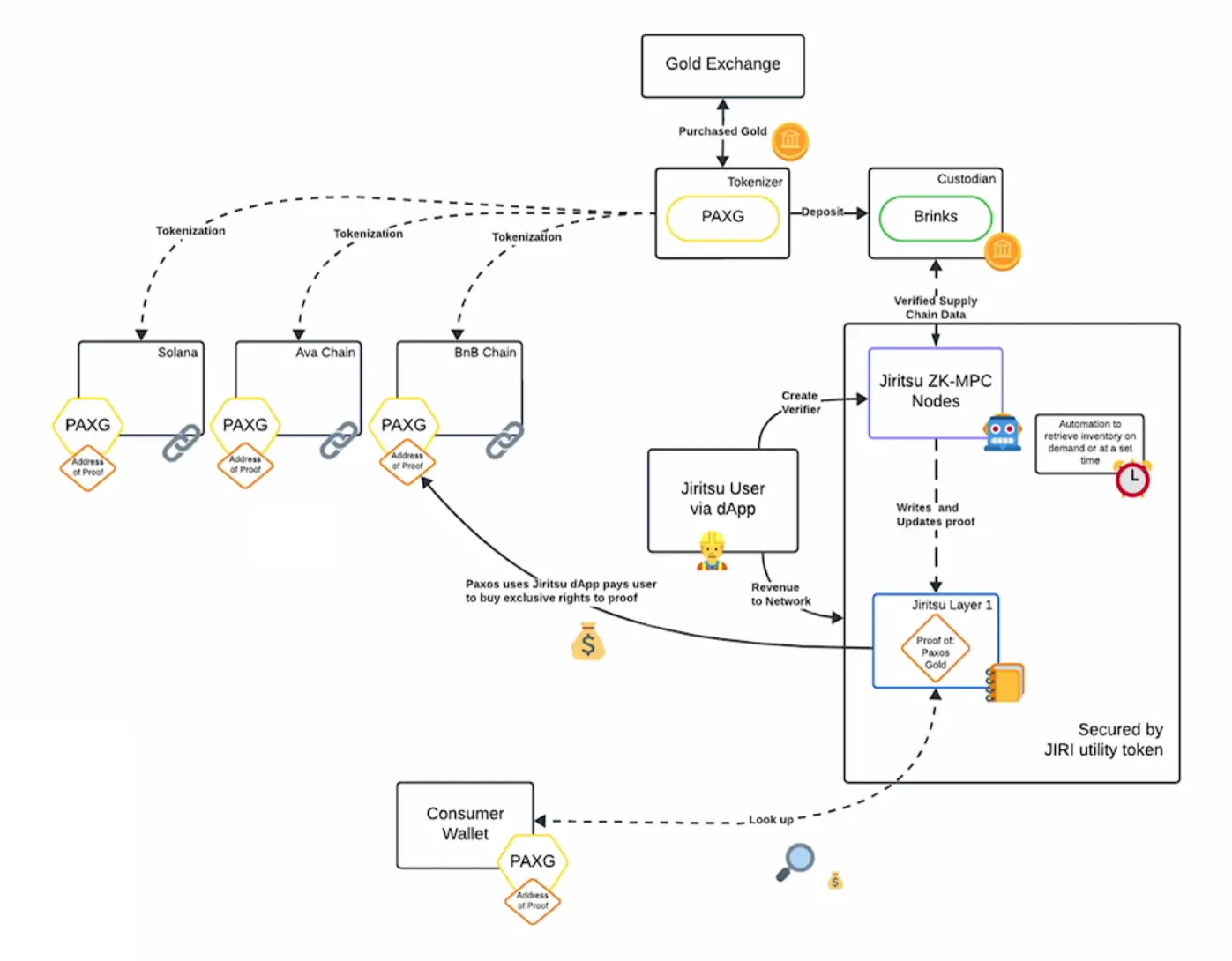

The official demonstration of Jiritsu's product usage process uses Paxos' tokenized gold product PAXG as an example:

First, Paxos purchases gold through a reliable gold exchange and deposits it with a custody service provider. Then, Jiritsu users can use the Jiritsu dApp on supported public chains to create validators on the ZK-MPC nodes in the Jiritsu network. The ZK-MPC nodes, upon retrieving information about Paxos' gold custody, generate relevant ZK proofs.

During the verification process, ZK-MPC nodes are responsible for off-chain verification calculations, and the generated ZK proofs have different levels of access and confidentiality, allowing auditors to have full access to all information, while asset managers can only see specific information related to their roles. This verification process can be updated at preset times or on demand, making it more efficient and reliable than Paxos' current manual quarterly inventory verification method.

After the ZK proofs are uploaded to the Jiritsu network, Paxos can proceed with the tokenization of its custody gold. At this stage, Jiritsu also implements the concept of "chain abstraction," allowing asset issuers like Paxos to mint corresponding tokens on ideal target chains such as Solana, Avalanche, or BNB Chain.

After token generation, Paxos pays fees to nodes and validators through the Jiritsu dApp, with a portion allocated to the Jiritsu network. The PAXG tokens purchased by investors contain proof of the underlying gold and can be used to access gold custody status information on the Jiritsu network, allowing Paxos to pass on the cost to investors at this stage.

The dApps on the Jiritsu network are designed to facilitate the writing of specific data, allowing users to create validators for any business logic, data reader, and smart contract integration, ensuring that Jiritsu can provide customized solutions for a wide range of business needs. In addition, the Jiritsu Proof under its ZK-MPC cloud service significantly expands the asset categories for information verification, beyond traditional financial verification such as bank information and corporate credit, to include status information for a range of real-world assets, such as equipment, inventory, and transaction and income information for a warehouse of an Amazon supply chain company worth approximately $20 million with over 100,000 SKUs.

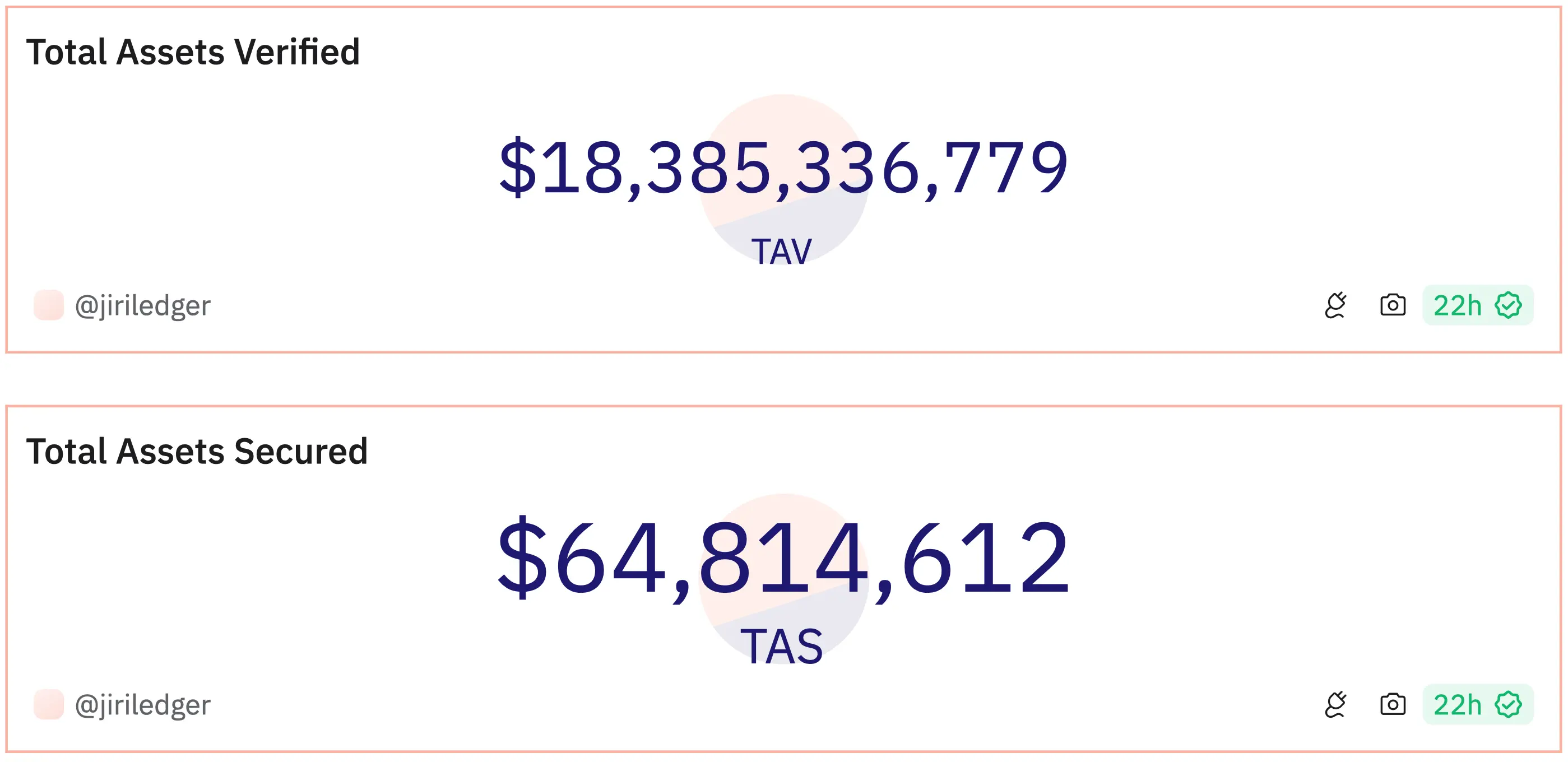

Based on this, Jiritsu uses two data metrics, "Total Asset Verified" and "Total Asset Secured," to measure its impact on the on-chainization of real-world assets, providing more compatible and interoperable underlying assets for DeFi protocols using these data metrics. According to officialDune dashboard data, Jiritsu has verified over $18 billion in assets to date, with over $60 million in assets waiting for use by various protocols.

Recently, Jiritsu integrated BlackRock's RWA ecosystem, providing automated on-chain proofs for the valuation and verification, compliance, and KYC platform information of its Bitcoin spot ETF and BUIDL fund reserve assets, making it easier for other protocols to use these on-chain assets. On the other hand, although iBIT and BUIDL bring significant incremental funds to the crypto market and RWA, their asset verification still relies on self-reporting and only provides annual audits, while Jiritsu provides a more transparent and cost-effective solution for these products.

Jiritsu also integrated with the Republic platform, which is deeply involved in the RWA field, allowing any asset manager to directly implement and use similar solutions, improving compliance and operational efficiency while providing a mature infrastructure for asset managers in tokenization, compliance, marketing, and customer service. Through automated and trustless verification and auditing, Jiritsu moves the work traditionally completed by institutions such as Moody's and KPMG onto the chain, with the traditional market's fee income exceeding $150 billion. Even if calculated at 10%, this is an incredibly imaginative business ceiling.

Good Money Drives Out Bad

From DeFi, GameFi to NFT, the successful cases in the crypto industry in the past have relied on the innovation of native on-chain assets and interactive forms to attract new users and funds. However, the concept of RWA is to bring the value of the external world onto the chain. Therefore, many native crypto users have always been resistant to the RWA narrative, believing that bringing real-world assets onto the chain is first and foremost a "targeted harvest" of crypto users, and secondly, it squeezes the value growth space of native crypto assets. In addition, crypto users accustomed to high volatility are not interested in the "low returns" of real-world assets. RWA has been tepid in the past, largely due to the misalignment of product positioning and user needs.

However, since the second half of last year, there has been a significant change in the fundamentals of the RWA field. On the one hand, native crypto protocols have begun to demand sustained and stable income-generating capabilities, and on the other hand, traditional financial institutions, influenced by BlackRock, have begun to actively explore on-chain financial products. For traditional institutions, blockchain's real-time settlement not only reduces erosion but also brings a broader investor base to high-threshold financial products, increasing the trading volume and fee income of financial products. With the alignment of product positioning and user needs, the narrative revival has become inevitable.

For the crypto industry, although RWA cannot bring super high returns to retail investors like native on-chain assets, it is starting to usher in the "use case era" for blockchain. For traditional financial institutions, RWA assets not only have the characteristics of low cost and high trading volume but also have the feature of transparency. In the short term, this may not seem to have much impact on the financial industry, but let's imagine that when economies of scale are achieved, this characteristic of RWA assets will become an extremely important reference for investors when making decisions: on one side are the "black box products" of traditional institutions, and on the other side are on-chain products with real-time settlement and transparency. When the asset targets are the same, how would you choose? Undoubtedly, for traditional financial institutions, RWA is a game of good money driving out bad.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。