Imagine in the future world, AI agent intelligent entities form a digital companionship/symbiotic relationship with humans, where autonomous agents can clearly understand the user's natural language requests in a conversation, automatically break down tasks, and achieve the expected results.

AO has established an Actor-based asynchronous parallel network, which does not achieve consensus on the entire contract calculation process, but achieves consensus only on the transaction order, assuming that the fixed transaction order will yield consistent results in the virtual machine. This choice allows the computation of the AO network to be massively scaled up, supporting arbitrary types of computation. The AR network serves as the consensus layer for transaction order and the storage layer for transaction results.

Compared to most other mainstream blockchain projects, which are mostly single-chain blockchains and only support native state machine smart contracts from the bottom layer, AO's infrastructure is compatible with more complex computing capabilities, including the operation of AI models.

After the recent update of the WASM virtual machine, AO's computing unit (Compute Unit) can now access 16GB of memory, which means we can download and execute 16GB models on AO. 16GB is sufficient to run large language model calculations, such as the unquantified version of the Falcon series of Llama 3 and many other models.

At the same time, AO uses WeaveDrive, allowing users to access Arweave data inside AO like accessing a local hard drive, and enabling highly heterogeneous processes of different types of virtual machines to interact in a shared environment, which means we have access to more data sources and combination possibilities. This also means that in the future, when building applications, users' motivation to upload data to Arweave increases, as this data can also be used in AO programs. The AO development team has already uploaded approximately $1000 worth of model data to the network when testing large language models running in the AO+AR system, but this is just the beginning.

AO's system design makes it possible to implement smart contracts integrating AI agents. By programming in AO, we create AI agents to make intelligent decisions in the market. The agents may compete with each other or represent humans against humans. "When we look at the global financial system, approximately 83% of trades on the Nasdaq are executed by robots." Current quantitative trading is the precursor to AI agent trading, and in the future, the process of designing and selecting machine learning models to execute automated trading will be more easily "unboxed" and automated by AI.

In the past few years, the development of DeFi has made it possible to execute various financial operations on-chain without the need for trusted centralized entities, such as lending, token trading, or derivatives. However, when we truly talk about the market, it is not just the reliability of these operations. In fact, reliable execution of various operations is only the foundation. The core factor that determines whether a market is vibrant is still the flow of capital, which determines the buying, selling, lending, or participation in various financial games by people. Currently, if you want to participate in cryptocurrency investment without doing all the research and participation yourself, you have to find a reliable fund, trust them to manage your funds, and empower fund members to make intelligent decisions. But with the development of AO applications, we may be able to expand the intelligent decision-making part of the market, filter information in the network, process data, combine strategies, and integrate the wisdom of AI agents to make real-time decisions in the network, creating a very rich decentralized autonomous agent financial system.

Some projects have already begun to realize this vision, and we will introduce Autonomous Finance (AF), Dexi, and Outcome, among which the achievements of AF are the most eye-catching.

Autonomous Finance

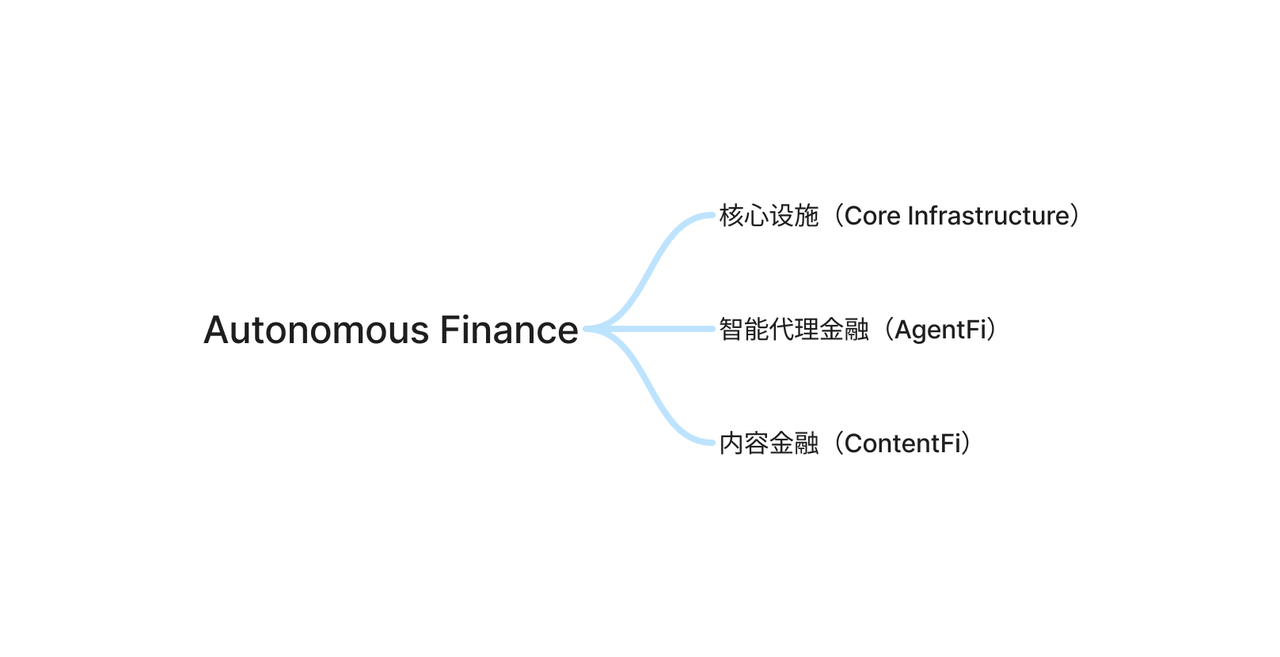

AF focuses on researching and developing AI-integrated financial applications on AO, attempting to put the intelligent decision-making layer on the chain by building AI models and data-driven financial decisions on the AO chain. The main business consists of three parts: Core Infrastructure, AgentFi, and ContentFi.

The Core Infrastructure includes decentralized exchanges (DEX), lending, derivatives, and synthetic assets protocols.

AgentFi mainly refers to the execution of trading strategies through composable semi-autonomous and fully autonomous agents. Unlike autonomous agent frameworks that rely on off-chain programs for signal processing and logic processing, the autonomous agents provided by AF use on-chain data streams for self-learning and execute investment strategies on various liquidity pools and financial bases within the AO ecosystem. These agents can operate autonomously without off-chain signals or human intervention.

Typical autonomous agents include:

- Dollar-Cost Averaging (DCA) asset management agents

- Self-balancing autonomous index funds

- Autonomous hedge funds with customized risk strategies

- Yield aggregation agents

- On-chain prediction agents

- High-frequency trading agents

The DCA agent, as a fundamental agent, is frequently called upon in the execution logic of more complex agents, so it is a frequently used composable agent module with many customizable parameters for users to adjust according to their needs, such as triggering trades within specific price ranges, adjusting fixed interval trade lengths, weighted trading based on asset prices (e.g., buying more when prices are lower), and data-driven signals for profit-taking and reinvestment.

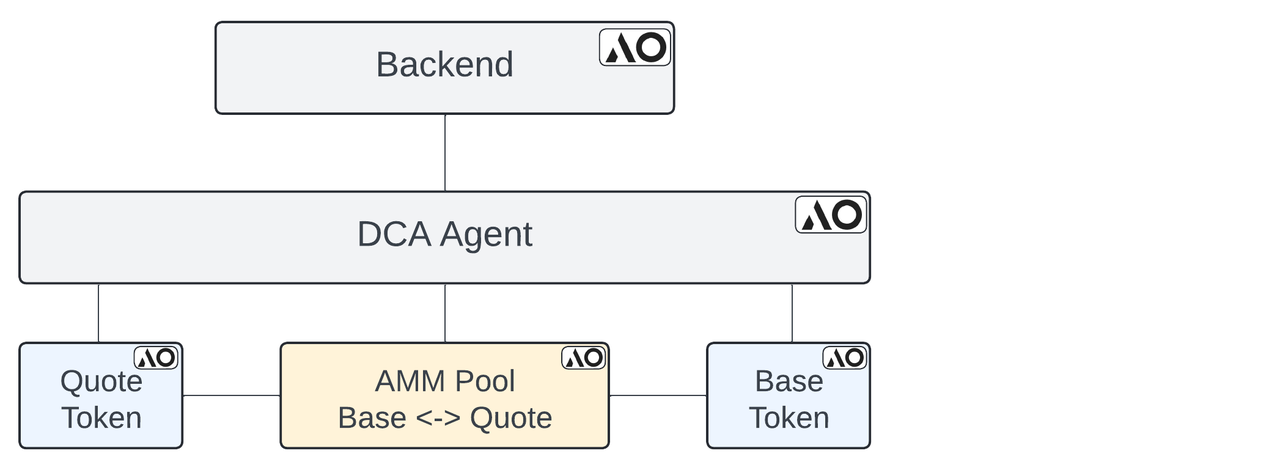

The DCA agent application is built around two key AO processes:

- Agent processes triggered by Cron (a time-based task management system commonly used for triggering task execution at specific times): mainly responsible for initiating user and automatic scheduled DCA trades, managing recorded funds, and updating the backend AO processes in a timely manner

- Backend AO processes: manage the agents associated with the username and track and record the historical trades of each agent

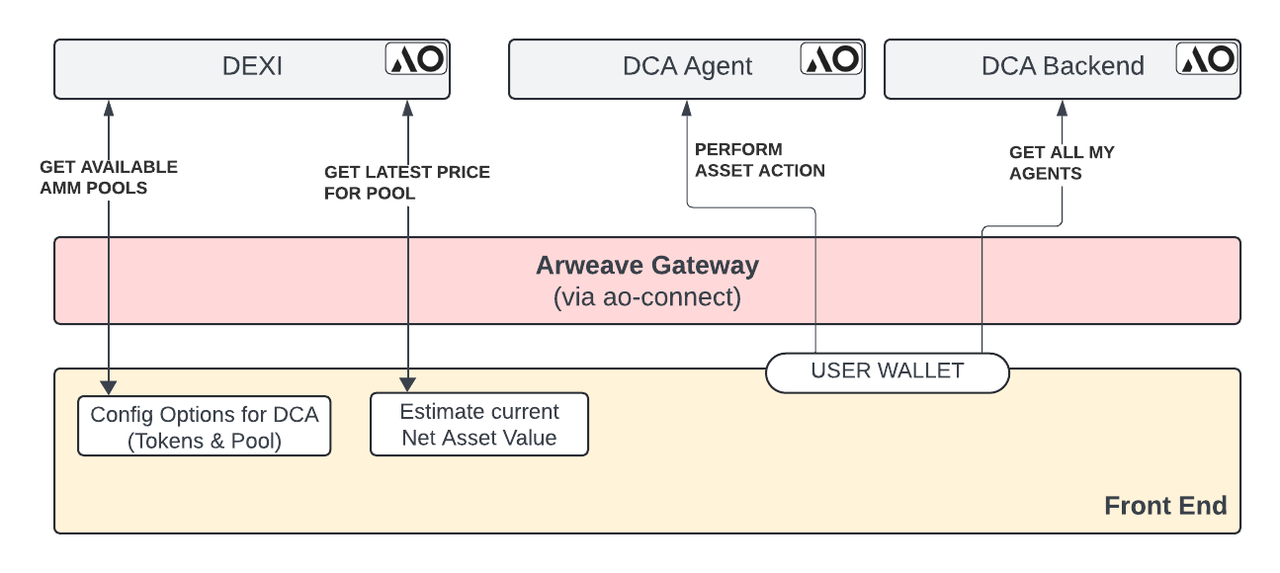

The following diagram illustrates the design architecture and interaction components of the DCA agent:

For users using the front end, the DCA agent's front end is built on DEXI, and users can set up DCA agents by connecting their AO Connect wallet on the DEXI website. DEXI accesses information about available AMM pools and retrieves the latest prices, while the DCA agent is responsible for executing specific trading logic, and the backend AO process retrieves all agents associated with the user.

ContentFi is a framework used to attribute and monetize data stored on the Arweave permanent network as composable assets in AO processes. AF is building applications that allow data contributors or content funds to contribute data to the permaweb, such as historical and real-time market intelligence data. This content will serve as on-chain signals for autonomous agents and machine learning. For example, autonomous agents will create new markets based on social media sentiment and historical data. Some examples include:

- Monetizing data signals

- Content-driven financial agents

- Subscription-based data recommendation agents

- Influential individuals contributing data for autonomous financial strategies

- Aggregating various data sources related to data contributions, DAOs, and content funds to provide dynamic on-chain signals

Currently, AF has launched two main products, AO Link and Data OS.

AO Link is a message browser for the AO network, providing similar functionality to a block explorer in traditional blockchain systems. It includes message computation, graphical visualization of message links (clear and understandable), real-time message flow (latest information), and a list of linked messages (for easy organization and navigation). Users can also view their token balances and message inboxes. This tool provides a professional and efficient way to interact with and analyze the structure and activities of the AO network.

Data OS is a ContentFI protocol developed on the AO Network, using autonomous AI agents to acquire content and generate derivative content. Through this innovative approach, DataOS not only enhances the relevance and accessibility of content but also establishes a reward mechanism for content creators. Currently, various data on the AO network can be viewed at https://stats.dataos.so/, observing network activity, but various data related to content is not currently displayed.

Dexi

Dexi is a crucial interactive interface for ordinary users to participate in Agent Fi in AO, and it is also an application implemented by agents on the AO network, capable of autonomously identifying, collecting, and summarizing various financial data of various events in the AO network (equivalent to Dexscrenner on AO). This data covers asset prices, token exchanges, liquidity fluctuations, and token asset characteristics (such as detailed information on smart contracts). Dexi primarily serves two types of users: end users accessing the platform through a web terminal and AO applications that interact with Dexi by sending messages to utilize the collected data (understood as Bots/Agents). As a core infrastructure, Dexi primarily provides data subscription services, where processes on the AO network can subscribe to Dexi's data stream for a fee and immediately receive alerts for price adjustments and updates.

Outcome

Outcome is a prediction market built by the @puente_ai team, supported by @fwdresearch, @aoTheVentures, and @aoComputerClub. Outcome provides a platform for users to bet on various events in the market, with current prediction topics covering technology, memes, business, gaming, DeFi, and AO. The project claims that in the future, users will be able to make automatic bets in the prediction market by building autonomous agents based on real data and large language models.

AgentFi on AO provides us with a new perspective, exploring the future deployment of AI models directly on the blockchain and using various AI agents to execute automated trades. The limitations of traditional single-chain blockchains are broken by the novel underlying innovation of AO+AR, and we look forward to seeing more applications on AO and use cases of implementing financial strategies with AI agents.

References

https://www.theblockbeats.info/news/53865

https://permadao.com/permadao/AI-on-AO-AO-AI-224ba15c840a4309972fec5350d9ed90

https://www.communitylabs.com/blog/ao-in-ai-key-highlights?utmsource=Blog&utmmedium=X&utmcampaign=AI+on+AO&utmid=Community+Labs

https://www.autonomous.finance/research/en-US

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。