IX Swap is telling a fascinating story that is gaining significant attention and showing huge growth potential.

Author: Greythorn

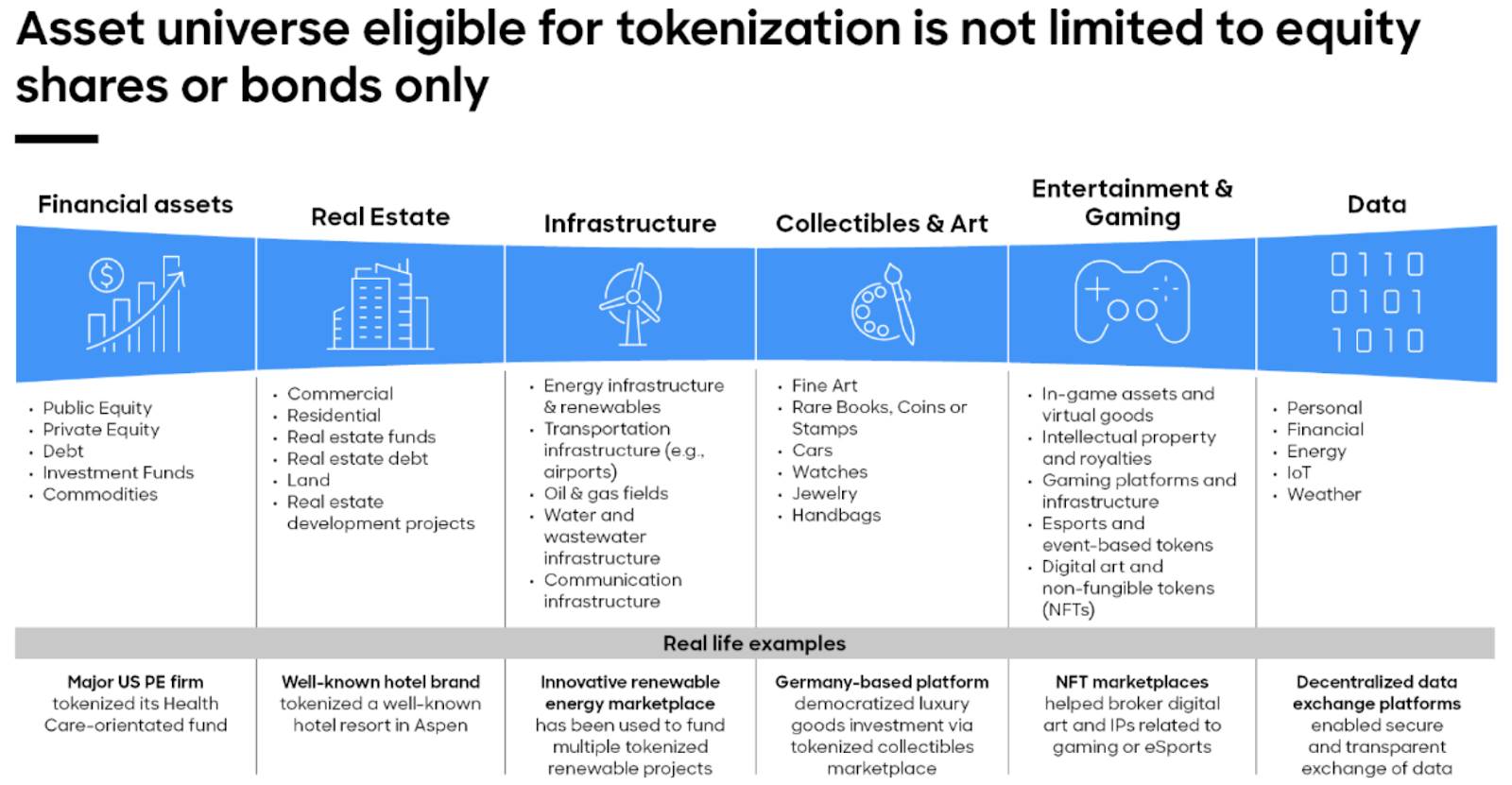

BlackRock's CEO Larry Fink believes that tokenization is the future of finance and a key market evolution, influencing other major financial players. Our research indicates that Dusk Network and Ondo Finance demonstrate that real-world assets (RWA) are becoming a critical part of the cryptocurrency industry. As of May 2024, the RWA market has exceeded $6.6 billion, and asset tokenization is expected to reach $100 trillion by 2030.

Earlier this month, the World Federation of Exchanges (WFE) published a paper on tokenization, calling it a natural progression for finance. JP Morgan has also been active in this area, and Fidelity International utilized JPMorgan's Onyx Digital Assets platform to tokenize shares in money market funds.

The Depository Trust & Clearing Corporation (DTCC) recently completed a pilot test to assess fund tokenization technology and standards. Deutsche Bank has joined the Monetary Authority of Singapore's Project Guardian, a blockchain alliance including JPMorgan, Citibank, BNY Mellon, UBS, and HSBC, to explore an interoperable tokenized fund blockchain platform.

Source: Roland Berger Research

The growing public interest in blockchain narratives has led to intense competition among many projects aiming to become leaders in the field. Among these projects, IX Swap stands out with its unique approach and ambitious goals. IX Swap is a real-world asset tokenization launch platform and decentralized exchange (DEX) that facilitates the trading of security tokens through licensed custodians and broker-dealers. Its aim is to democratize opportunities for private market investments and address the liquidity challenges faced by the tokenization industry.

Now, let's delve into what this means.

Let's go back to 2017. As IX Swap co-founder Julian Kwan explained in a recent interview, at that time, if you were one of the top ten cryptocurrencies, you would have significant market support and could afford to list on major exchanges. However, most altcoins were limited to basic listing platforms, lacking order books, market makers, or liquidity.

The emergence of Uniswap was a transformative innovation in the DeFi space, allowing anyone with two cryptocurrencies to create liquidity pools through smart contracts. This enabled asset holders to earn fees and trade directly on the platform.

Today, with more asset tokenization, the RWA space also faces similar liquidity challenges. IX Swap aims to be the Uniswap of security tokens, allowing anyone with RWA and USDC (or other cryptocurrencies) to legitimately create liquidity pools. This facilitates the buying and selling of tokenized assets, resolves liquidity issues, and makes private market investments more convenient.

Source: InvestaX

There's a lot of information here, so let's start by gradually analyzing the products offered by IX Swap.

Overview of IX Swap's Products

IX Swap Secondary Trading Products

In the past decade, private market capital growth has been stronger than the public market, especially since around 2016. Additionally, the private market has shown greater resilience in the face of market sentiment fluctuations. IX Swap aims to leverage these advantages by opening up the private market to everyone, providing access to assets that were previously inaccessible.

Source: EY Research

The platform allows trading of security tokens (STOs) and fractionalized NFTs (F-NFTs), digitizing traditional asset portfolios and providing access to real-world assets such as private equity, real estate, infrastructure, natural resources, and private debt. IX Swap achieves this goal by providing compliant liquidity pools and automated market-making (AMM) functionality. Serving as a bridge between CeFi and DeFi, IX Swap facilitates trading through licensed custodians and broker-dealers, ensuring true ownership and claims to these assets.

Source: IX Swap

IX Swap Launchpad

The IX Swap Launchpad is a crowdfunding platform that offers investment opportunities in promising startups in finance, blockchain, energy, technology, real estate, healthcare, gaming, and other fields.

Each investment opportunity on the platform is vetted by the team to ensure the safety and reliability of investments. The IXS Launchpad complies with regulatory requirements, providing a secure investment environment and using security tokens to represent investors' equity, ensuring transparent and secure transactions on the blockchain.

IX Swap SaaS Solution

IX Swap's SaaS Liquidity Solution enhances the liquidity of real-world asset platforms through automated market-making and liquidity pools. IX Swap connects security token issuers with liquidity providers through a monthly subscription-based SaaS solution, automatically matching buy and sell orders to ensure continuous liquidity for security tokens. The service leverages smart contracts to facilitate secure and transparent transactions, making it easier for token holders to buy and sell tokens without significant price fluctuations.

Key advantages of this solution include regulatory compliance, ensuring safe and legal operations, and cross-chain compatibility, allowing the solution to operate on different blockchain networks. IX Swap also provides comprehensive consulting and support services.

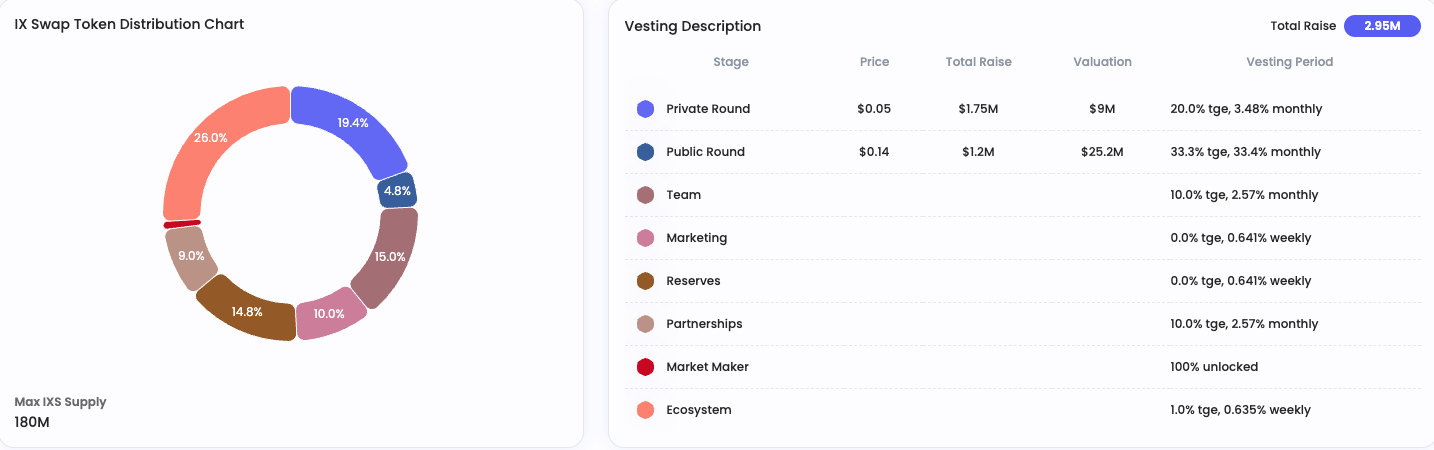

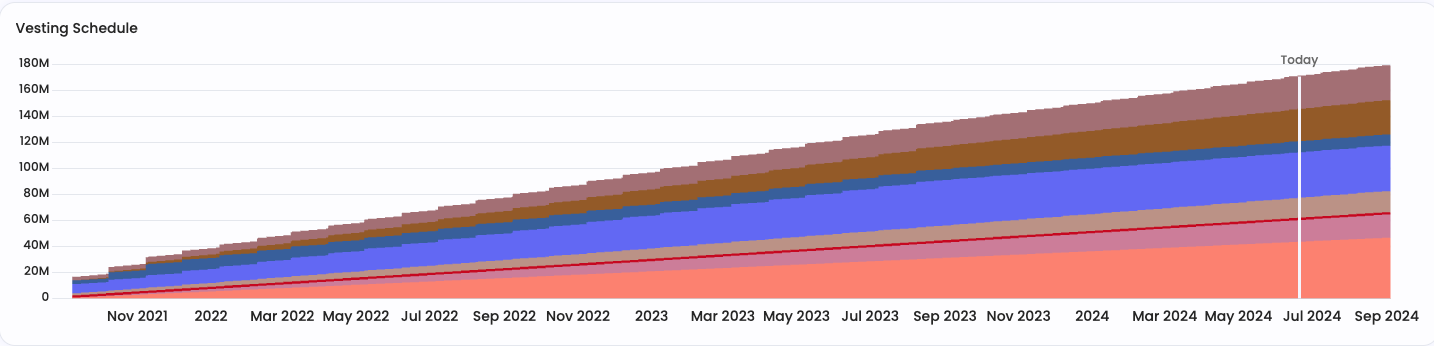

IXS Token

The IXS token is the native token of the IX Swap platform and forms the foundation of its ecosystem. Through built-in deflationary mechanisms, the IXS token incentivizes ecosystem growth and increases scarcity and value through buyback and burn operations. Benefits of using IXS include discounted fees, access to the IXS Launchpad and SaaS Liquidity Solution. The IXS token also serves as the native payment token for InvestaX, supports staking for rewards, and enables liquidity mining for increased returns. Additionally, holding the IXS token grants governance capabilities to participate in the management of its ecosystem.

Here are the current market statistics for the IXS token as of June 20, 2024:

● Market Cap: $121,211,081

● Fully Diluted Valuation: $124,855,283

● 24-hour Trading Volume: $1,624,331

● Circulating Supply: 174,746,266 IXS

● Total Supply: 180,000,000 IXS

● Max Supply: 180,000,000 IXS

● Network: Ethereum (Mainnet), Polygon (Bridged)

Source: ChainBroker

Source: ChainBroker

For more information about IX Swap products, visit their website to explore further. In the next section, we will share some initial thoughts and reflections on exploring IX Swap.

Exploring IX Swap: Insights and Reflections

Source: IX Swap

Understanding Fractional Ownership

Fractional ownership is often seen as a key advantage in increasing liquidity. It divides assets into smaller shares, allowing more investors to participate, thereby increasing the potential number of buyers and sellers, enhancing liquidity. However, fractional ownership is not a new concept; traditional financial systems have long offered fractional shares. For example, through services like Robinhood, you can own fractional shares of stocks, or through companies like Fundrise, you can own fractional real estate. Additionally, fractional ownership does not create demand on its own; it simply makes a smaller portion of the asset available for trading. Demand depends on the value of the asset and market conditions.

IX Swap achieves fractional ownership through asset tokenization and simplifies the issuance and trading process through its decentralized exchange, potentially enhancing liquidity. While blockchain technology can streamline the creation and transfer of fractional shares, it does not automatically increase demand for the assets. Understanding the difference between fractional ownership and issuance convenience is crucial for evaluating its impact on liquidity.

For example, the IXApe token represents fractional ownership of Bored Ape #2371 NFT from Howey Tez's Bored Ape Yacht Club. Fractionalizing this NFT into 5,000 IXApe tokens democratizes ownership and distributes the economic benefits associated with this high-value digital asset.

Compliance and Legal Considerations

By law, fractional ownership of digital real-world assets (RWAs) and NFTs is classified as securities. This makes it impossible for IX Swap to trade as simply and without intermediaries as Uniswap. Security tokens need to comply with laws involving broker-dealers and custodians.

This is why Uniswap is unlikely to list RWAs. When you participate in IX Swap's liquidity pool, your RWA is held by a licensed custodian, not just managed by smart contracts. The wrapped tokens representing your RWA enter the pool and calculate your share. This structure allows IX Swap to bridge the gap between traditional finance and the decentralized world, providing a legal way to trade tokenized RWAs.

Therefore, while IX Swap cannot be as fully decentralized, universal, and permissionless as Uniswap, it doesn't necessarily mean it's not good. Most markets still require regulatory frameworks, especially for security tokens, and there are still many exciting opportunities within legal boundaries.

Despite the presence of financial heavyweights, the advantages of IX Swap

While large institutions are exploring tokenization, IX Swap democratizes access to tokenized assets by providing accessible services within the KYC scope, allowing more users to participate in the asset game. IX Swap democratizes access to tokenized assets, providing opportunities for small investors who may struggle to compete in large institutions. Unlike traditional exchanges, on-chain trading on public chains is open to everyone, enhancing transparency.

IX Swap bridges the gap between traditional finance and the decentralized market, complementing the efforts of large institutions while expanding access to public chain technology. Uniswap's growth demonstrates retail investors' demand for cryptocurrency trading, and IX Swap aims to meet similar demand for tokenized assets.

However, questions still remain: Is there really demand for these assets? While experiments in tokenization like Galaxy Digital's Stradivarius violin are interesting, the long-term sustainability of demand for such assets is uncertain. How many people get excited about co-owning a Ferrari or an NFT? Assuming everything should be tokenized is questionable.

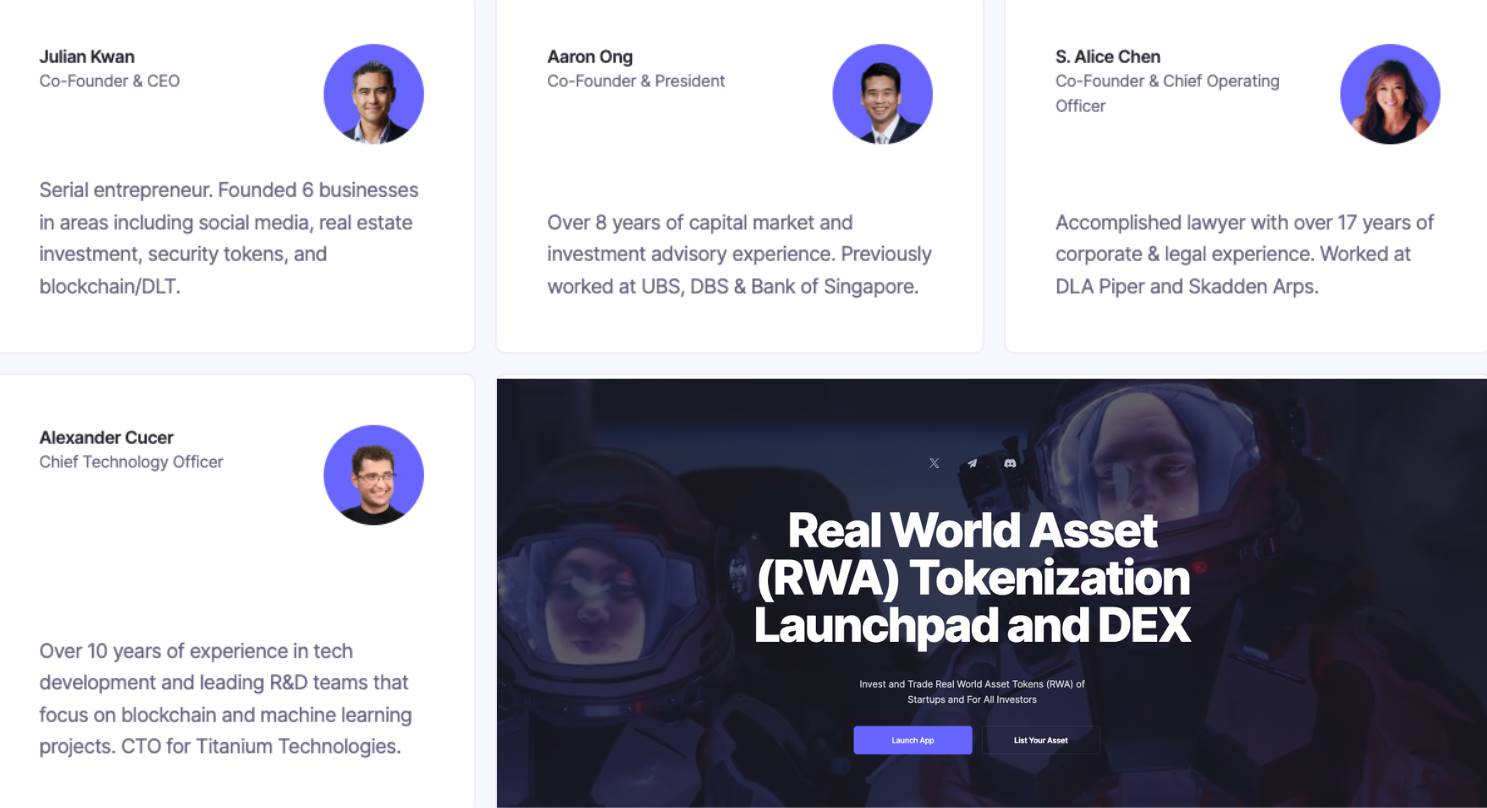

Team, Funding, and Partnerships

The IX Swap team has been working on the concept of automated market makers for security tokens since 2017. The platform officially launched in September 2021 and was founded by Julian Kwan, Alice Chen, and Aaron Ong. Julian is an experienced entrepreneur in digital platforms and blockchain, Alice has a background in business and law, and Aaron focuses on capital markets and investment consulting.

Source: IX Swap

Recently, IX Swap was acquired by the parent company of InvestaX, a leading licensed tokenization platform in Singapore. This acquisition aims to enhance its capabilities, address liquidity issues in the industry, and expand its market presence and products.

Funding Rounds

IDO Round 1 (September 7, 2021): Raised $186,165 at a price of $0.389 per token on the OccamRazer platform, achieving a 2x USD return on investment. Pre-money valuation for this round was $70.02 million.

IDO Round 2 (September 8, 2021): Raised $100,000 at a price of $0.14 per token on the Poolz platform, achieving a 5.56x USD return on investment. Pre-money valuation for this round was $25.2 million.

KuCoin IEO (September 3, 2021): Raised $700,000 at a price of $0.14 per token on the KuCoin Spotlight, achieving a 5.56x USD return on investment. Pre-money valuation for this round was $25.2 million.

Private Round (June 2021): Raised $1.75 million at a price of $0.05 per token, achieving a 15.55x USD return on investment. Pre-money valuation for this round was $9 million.

Partnerships

This year, IX Swap has established several key partnerships to enhance its platform. The partnership with Electrowizy will focus on gamifying renewable energy asset management, while the partnership with Nanuhm Angels aims to promote the tokenization of Korean content globally. Support from Spartan Group and Faculty Group reflects IX Swap's commitment to democratizing access to RWAs. Partnerships with Cogito Finance and QuillAudits enhance liquidity and security, while alliances with AlphaX and RealtyX aim to revolutionize real estate tokenization. Through these strategic partnerships, IX Swap is committed to pushing the boundaries of the RWA market and driving innovation in decentralized finance.

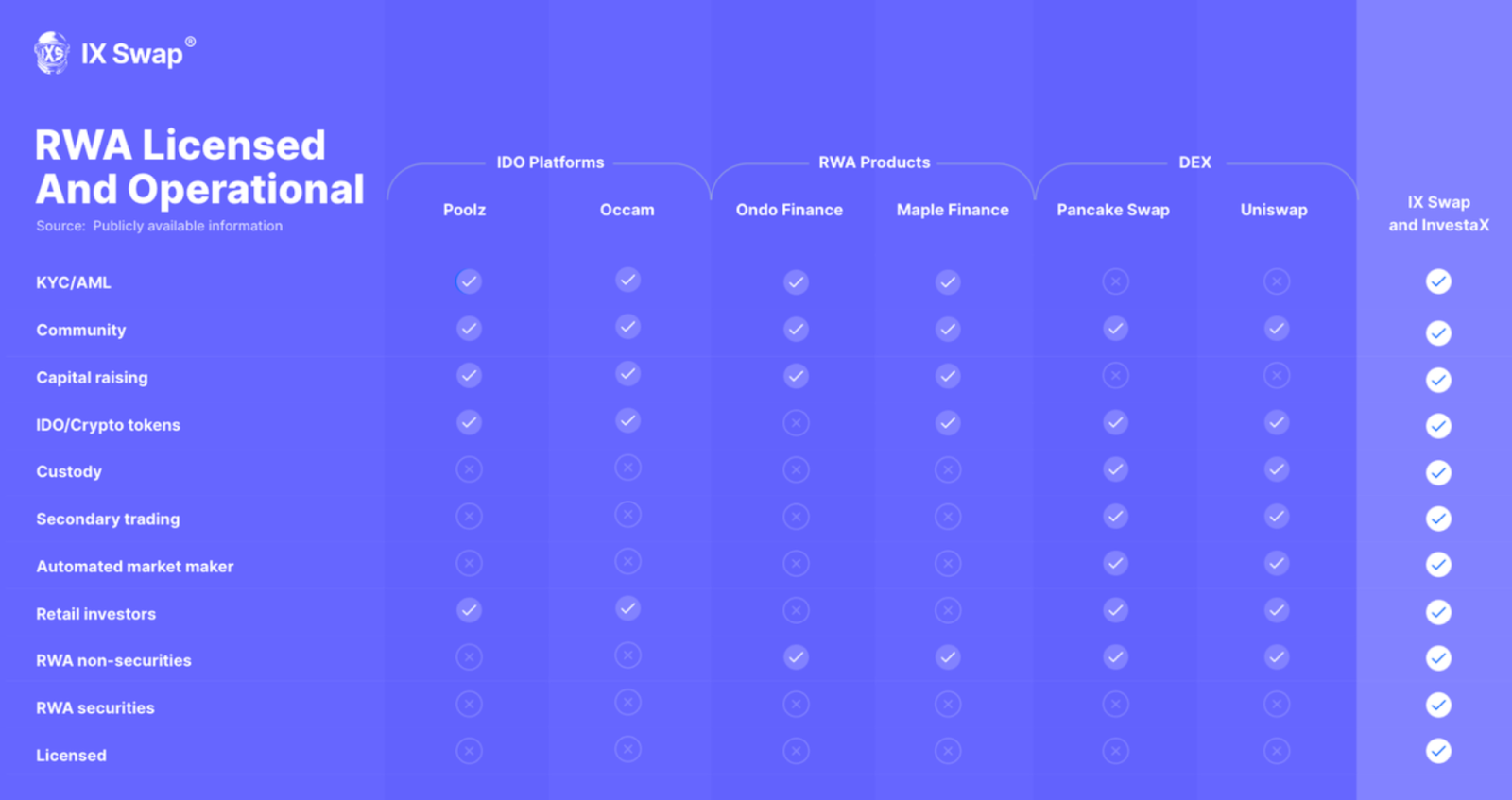

Competitors

IX Swap offers a unique, legal, and compliant secondary trading platform for RWA tokens. Unlike other platforms, IX Swap has a functioning AMM model and provides securities licensing for retail investors, which sets it apart in the industry.

Source: IX Swap

Besides the RWA projects already assessed by Greythorn, Centrifuge is a key player in the RWA field, specializing in tokenizing assets such as invoices, royalties, and real estate. It integrates well with DeFi protocols like MakerDAO, increasing liquidity. However, its focus on specific asset types may be limiting, and it lacks the same user base or liquidity as some larger platforms.

One of Centrifuge's projects, Tinlake, allows for the creation of asset-backed pools, providing flexibility in managing different assets. It ensures transparency and on-chain securitization, but may be challenging to understand and use, and faces liquidity issues.

RealT focuses on tokenizing real estate, allowing partial ownership of properties and providing rental income dividends. While this is great for real estate enthusiasts, its narrow focus and primary concentration on the US market may not attract investors seeking more diversified or international investments.

Maple Finance targets institutional borrowers and lenders, providing a secure platform with credit risk assessment and low-collateral loans. It is well-suited for institutional use, but may not be ideal for those seeking broader RWA investments, and faces regulatory challenges due to its lending model.

Goldfinch aims to provide credit to emerging markets, offering a unique investment opportunity and allowing community participation in underwriting and governance. However, this focus comes with higher risk due to the unstable economic conditions of emerging markets, and its liquidity is limited.

Tokeny offers a comprehensive asset tokenization solution, including compliance and issuance, and has strong partnerships with financial institutions. However, it primarily focuses on token issuance and compliance, with less emphasis on secondary market liquidity, and has not gained the same adoption and user base as some larger platforms.

IX Swap aims to connect DeFi with security tokens, providing liquidity and compliance for tokenized real-world assets. This gives it a unique advantage, but IX Swap still needs to establish its liquidity and user adoption to compete with larger players in the field.

On-chain Analysis

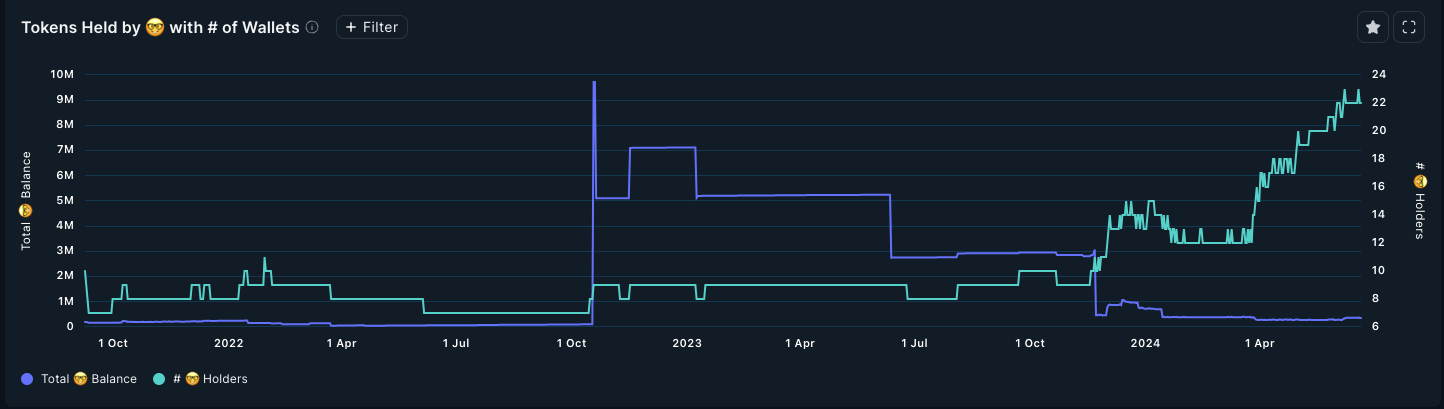

Since November last year, the IXS token has consistently outperformed the market, entering a sustained upward trend with several consolidations. Despite its strong performance, the project's market cap is relatively small, leading to occasional fluctuations and high volatility. While technical analysis may have limited effectiveness for such projects, here is an overview of its token performance since then.

Source: TradingView

Data from Nansen's Smart Money feature shows a steady increase in the number of smart wallets and holders since the beginning of the year. However, this growth has not been accompanied by a significant increase in balances. It's important to note that this feature only considers wallets that have performed well over a longer period. In today's market, individual investors often use multiple wallets, so these data may not fully reflect the whole picture. Nevertheless, it's an interesting trend.

Source: Nansen

Last week, one of the largest wallets accumulating IXS was identified, holding assets worth $1.1 million, including 198,839 IXS tokens, equivalent to about $150,000. The wallet belongs to the well-known KOL and investor Chicken Genius, who publicly disclosed his wallet this year. The wallet address is: 0xeb2eb5c68156250c368914761bb8f1208d56acd0. There were no significant IXS sells from this large wallet in the past week.

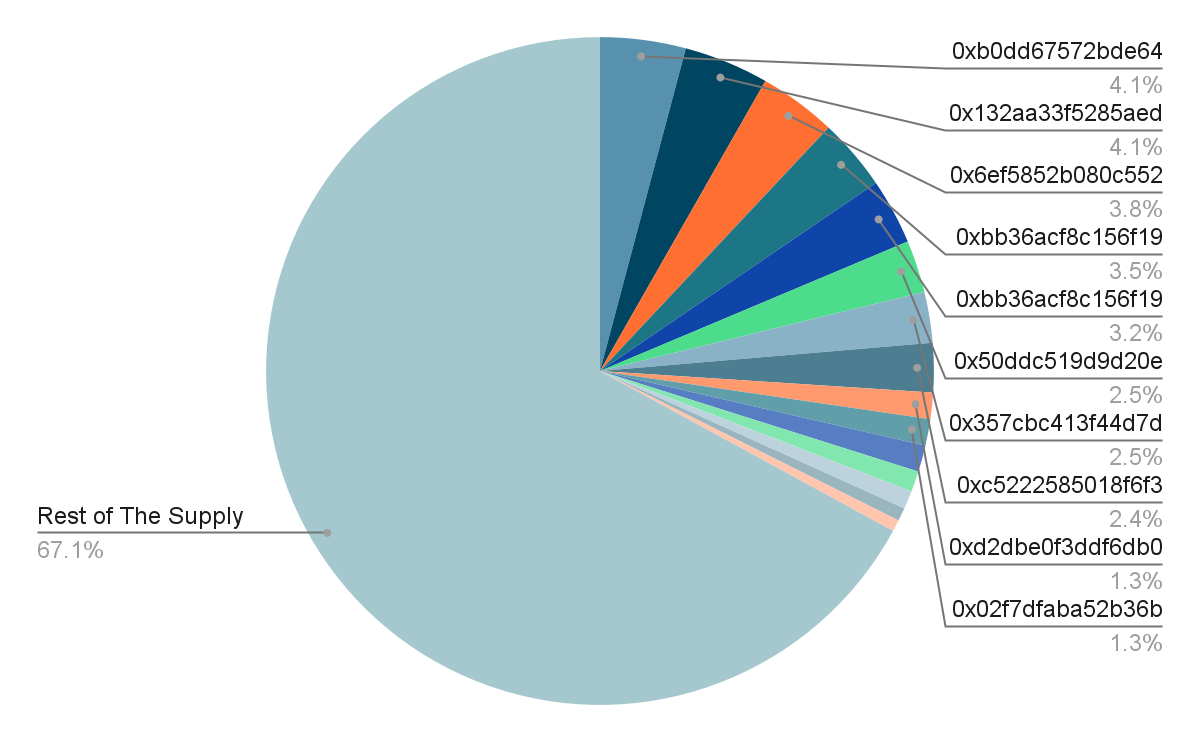

According to Bubble Maps, the distribution of tokens excluding exchange balances and bridged assets is as follows:

Bullish Factors

● IX Swap is telling a compelling story that is gaining significant attention and showing enormous growth potential. If this momentum continues and the project can maintain consistent, credible activity, it may eventually be considered a pioneer in its field with higher valuation potential.

● Many newly launched projects in the current market have high fully diluted valuations (FDV), indicating that they may be overvalued relative to their fundamentals and market position. However, IX Swap's FDV is approximately $135 million, which is in line with its market cap. This provides a more balanced valuation and attractive risk-return ratio.

● The project prioritizes security and compliance, crucial for gaining investor trust. This focus reduces the risks associated with fraud and legal issues, making it a more reliable investment.

● IX Swap is led by a transparent and experienced team, essential for understanding the market, avoiding common pitfalls, and effectively executing its vision.

Bearish Factors

● Despite IX Swap's market cap being less than $200 million and somewhat attractive, there are still risks in the highly volatile cryptocurrency market. Sudden market downturns may negatively impact the value of IXS tokens and investor sentiment, leading to potential losses. Investors should be prepared for possible market fluctuations.

● The regulatory environment for DeFi and tokenized RWAs is constantly changing, meaning IX Swap may not be able to operate in many countries. Regulatory changes or stricter compliance requirements may adversely affect IX Swap's operations and growth prospects.

● DeFi, including real-world assets, is highly competitive. IX Swap faces fierce competition from established players and new entrants, which may limit its market share and growth potential.

● Achieving widespread adoption and maintaining liquidity for tokenized RWAs may be challenging. If IX Swap cannot attract enough user base or liquidity providers, it may struggle to achieve its growth and revenue targets.

Disclaimer

This document is prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) ("Greythorn"). The information contained in this document is for general reference only and is not intended to provide investment or financial advice. This document is not an advertisement, offer or invitation, or intended to buy or sell any financial instruments or engage in any specific trading strategy. When preparing this document, Greythorn did not consider the investment objectives, financial situation, or specific needs of any recipient. Therefore, individuals or institutions receiving this document should assess their personal circumstances and consult their accounting, legal, or other professional advisors for professional advice before making any investment decisions.

This document contains statements, opinions, forecasts, and forward-looking statements based on several assumptions. Greythorn does not assume any obligation to update such information. These assumptions may be correct or incorrect. Greythorn and its directors, employees, agents, and advisors make no warranties or representations regarding the accuracy or likelihood of achievement of any forward-looking statements or their underlying assumptions. Greythorn and its directors, employees, agents, and advisors make no warranties or commitments regarding the accuracy, completeness, or reliability of the information contained in this document. To the fullest extent permitted by law, Greythorn and its directors, employees, agents, and advisors are not liable for any losses, claims, damages, costs, or expenses arising from the information contained in this document.

This document is the property of Greythorn. Individuals or entities receiving this document agree to keep its contents confidential and agree not to copy, provide, disseminate, or disclose any information in this document in any form without the written consent of Greythorn.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。