The easing of inflation and strong employment figures indicate a healthy economic condition, while cautious consumer spending and a decline in commodity spending may be early signs of an economic slowdown.

Author: Greythorn

Opening

Welcome to Greythorn Asset Management's June 2024 Monthly Market Update. We are pleased to share our insights and analysis of market trends with you. Our mission is to invest in breakthrough technologies and asset classes aimed at creating significant value and positively impacting the industry.

At Greythorn, we provide monthly updates on the cryptocurrency market, including detailed analysis of market dynamics, regulatory developments, and macroeconomic factors affecting digital currencies.

For more information about Greythorn, we invite you to visit our website.

Market Analysis

BTC Patterns and Market Liquidity

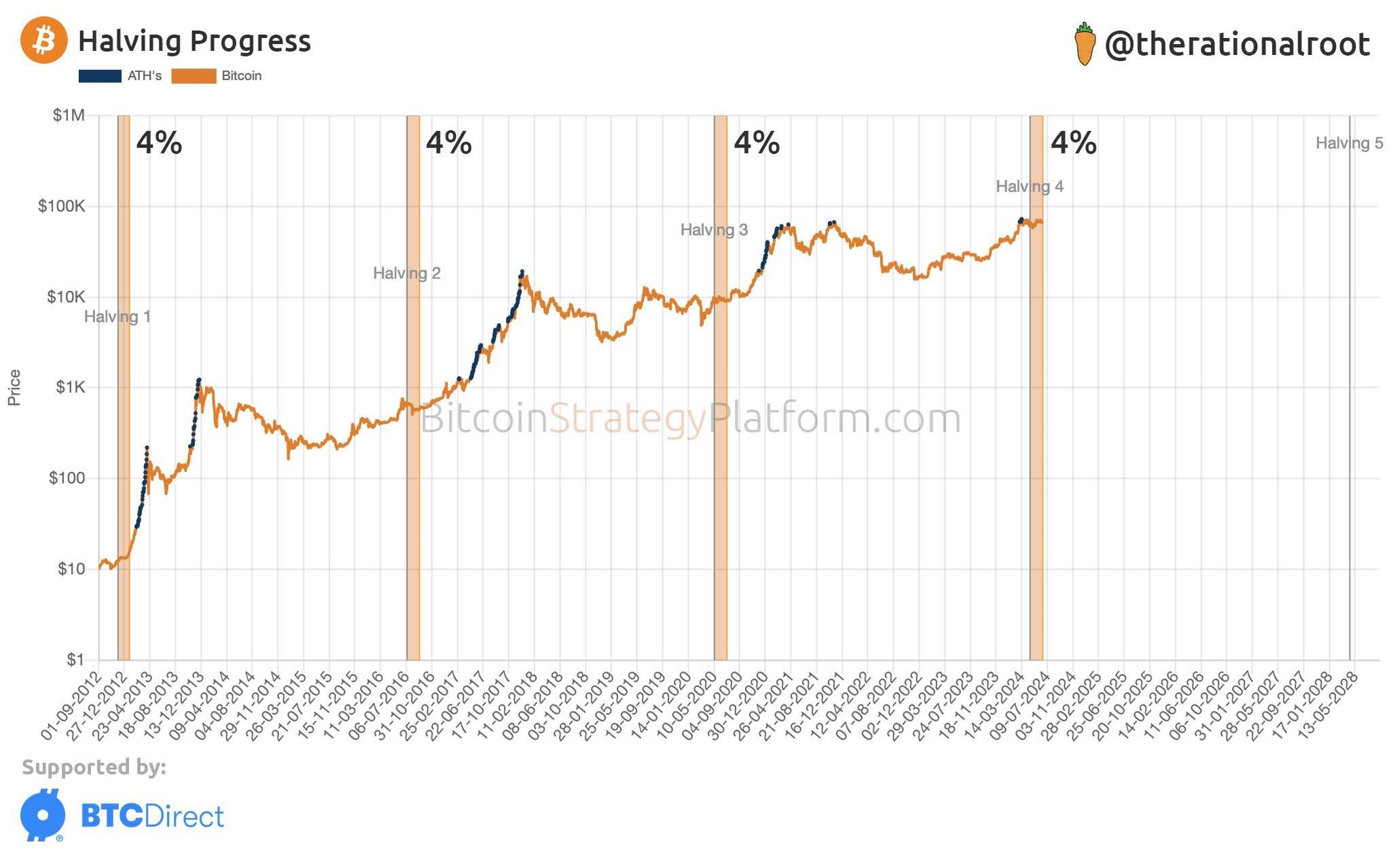

BTC is currently trading within a relatively tight range, with selling pressure possibly coming from some miners selling BTC to cover post-halving operating costs. This pattern may indicate a mild upward trend until September, similar to the post-halving pattern in 2020. However, the current macro environment is different, with the US interest rate at 5.25%, compared to 0% in 2020, which may reduce liquidity injection to avoid market instability.

Source: TradingView

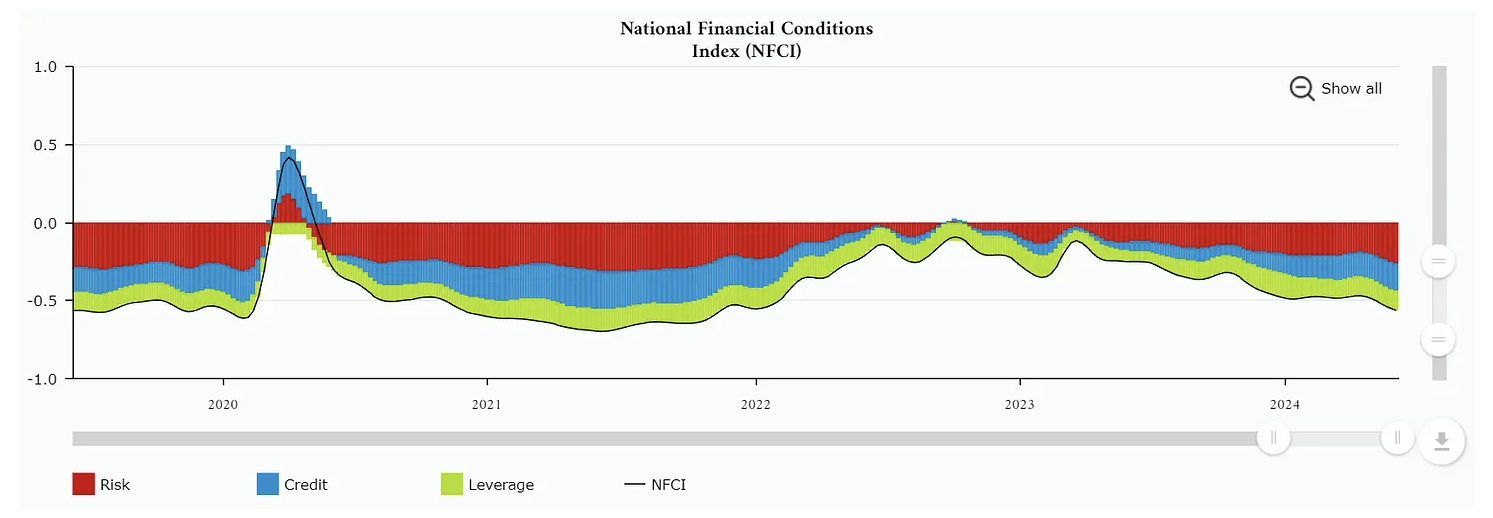

The financial conditions index of the Federal Reserve Bank of Chicago indicates that liquidity is much looser now than during the last halving, suggesting that BTC's sensitivity to market inflows will continue to play a significant role. It is expected that ETFs outside the US market and smoother on-ramps will attract new funds into the market, supporting BTC and other crypto assets.

Source: Chicago Fed

ETH ETFs and ETH Supply

Arca's Chief Investment Officer Jeff Dorman recently emphasized the potential impact of ETH ETFs on supply. Unlike BTC, which may have more potential funds entering, ETH's supply may be negative when demand is high due to transaction fees being burned. Therefore, less new demand is needed to sustain or increase ETH prices.

Despite underperforming earlier this year, ETH has caught up with BTC in year-to-date price changes, but still needs to make up for its poor performance in 2023. Given that the US government does not hold a large amount of ETH for settlement, we do not need to worry about post-halving miner sell-offs, and the launch of US spot ETFs is increasingly imminent, which is likely to happen at some point. Additionally, the SEC has terminated its investigation into Ethereum 2.0, confirming that it does not intend to classify ETH as a security. This is good news for businesses and developers building on Ethereum, although risks associated with ETH staking or exchanges still exist. Nevertheless, ETH continues to follow the downtrend of BTC, reflecting the current market weakness.

Stablecoins for Cross-Border Trade

Two major Russian metal producers have started using stablecoins and other cryptocurrencies to settle cross-border trade with Chinese customers and suppliers. Turning to stablecoins provides a faster and cheaper settlement method, even for businesses that can use traditional cross-border payment methods. Additionally, Russian and Chinese businesses may be formulating contingency plans in case they are cut off from traditional financial systems.

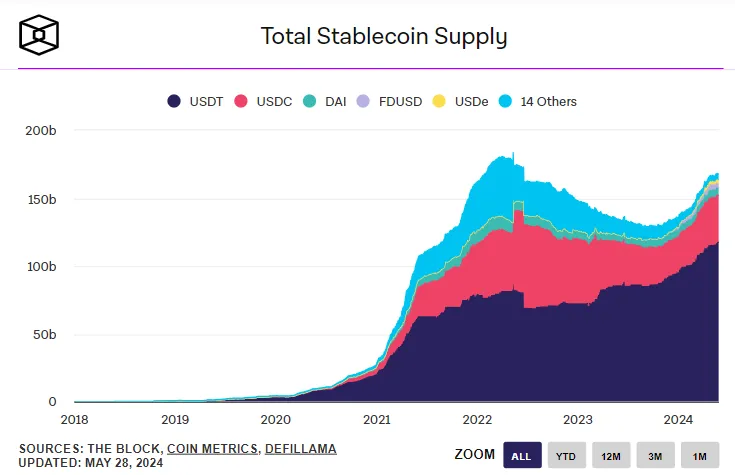

This move may attract more attention from US regulatory agencies to the stablecoin market, potentially leading to a more proactive regulatory approach. The stablecoin market is significant, settling an increasingly growing share of global trade, but the US has been hesitant to legalize its issuance.

The total issuance of USD-backed stablecoins has grown by nearly 25% this year, reaching $167 billion, exceeding Ukraine's GDP and being twice that of Luxembourg.

Source: The Block Data

The successful use of stablecoin payment processes may impact discussions around a common BRICS currency, which has received different levels of support due to the complexity of reaching a consensus. Fiat-backed stablecoins may serve as a simpler alternative.

Cryptocurrency ETFs in South Korea

While many countries have launched BTC spot ETFs with little effect, South Korea may be an exception. A recent report from the Korea Institute of Finance warned that cryptocurrency ETFs could divert funds from more "productive" enterprises and disrupt the economy by eradicating retail savings during economic downturns. The Democratic Party, which has promised to review the current ban on cryptocurrency spot ETFs, has not committed to their listing. This highlights the political consequences of market decisions.

Telecom Giants Mining Bitcoin

Deutsche Telekom, Europe's largest telecommunications provider, will soon start mining Bitcoin, given that the German government holds over 30% of the company's shares, this move is significant. This highlights the increasing interest of traditional network providers in participating in new networks.

Coinbase's Smart Wallet: Redefining Digital Identity

Coinbase's new "Smart Wallet" may signal a solution to the complexity of self-custody in crypto, potentially evolving into a broader concept of online identity. The smart wallet is a smart contract that can reflect balances and interact with applications without the need for a unique recovery phrase, using "passkey" identity verification technology. This technology may ultimately hold critical identity data and automatically authorize certain applications and smart contracts.

Coinbase and other validators can pay users' transaction fees, making certain applications free for users. This can make the on-chain experience more practical, especially for gaming applications and blockchain-based social platforms, where users would otherwise have to pay for each operation.

Tokenization Overview

JPMorgan's tokenization platform Onyx Digital Assets is now opening up to third-party developers, allowing external innovation to enhance the platform's utility and value. Additionally, JPM Coin will be used to settle transactions on Broadridge's distributed ledger repo platform, marking its first use on a third-party system. Fidelity International has tokenized shares of a money market fund using Onyx, indicating JPMorgan's commitment to expanding the use cases of Onyx.

Franklin Templeton's on-chain money market fund FOBXX has enabled peer-to-peer transfers with other registered investors and now allows purchases and redemptions using USDC. While this adds convenience, it is primarily targeted at institutional investors and does not pose a significant threat to BlackRock's leadership position in tokenized assets.

Review and Outlook

Recently, the crypto market has experienced a significant downturn, with BTC prices falling below $60,000. The distribution of Mt. Gox's bankruptcy estate is expected to take place in July, leading to the market downturn, although the actual market impact is expected to be less severe. Technical factors, macroeconomic concerns, and potential ETH performance also influence market trends.

Despite these challenges, the developments in stablecoins, ETH ETFs, and tokenization highlight the increasing complexity and potential of the crypto ecosystem. With new funds entering the market and improvements in awareness and infrastructure, the long-term prospects for crypto assets remain positive.

Source: @therationalroot

Macro Insights

Economic Overview and Inflation Trends

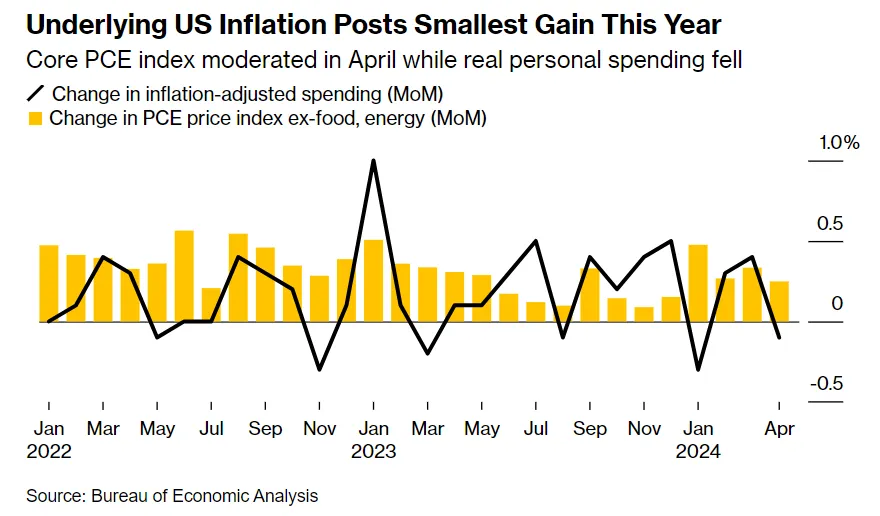

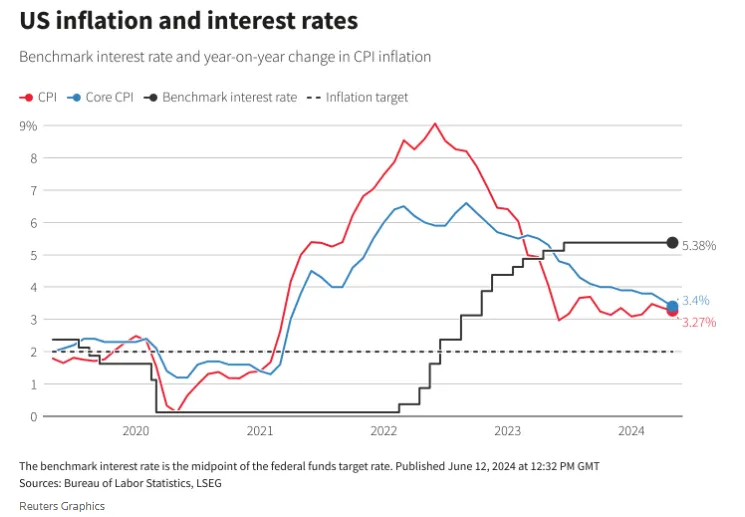

In June, signs of inflation were mixed, showing a slow but steady easing. The US core personal consumption expenditures (PCE) index, excluding food and energy prices, only increased by 0.2% this month, lower than expected. This is the smallest monthly increase in a year. The growth rates of the core index and the overall index are close to the 2.9% and 2.8% seen in March last year, which is in line with expectations.

Source: Bloomberg

May's inflation figures unexpectedly remained flat, with no monthly increase compared to 0.3% in April. This lowered the annual inflation rate to 3.3%, below expectations. This decline is mainly due to a decrease in energy prices, helping to ease overall inflation. This unexpected result may positively impact consumer confidence and play a significant role in future monetary policy decisions.

Source: Reuters

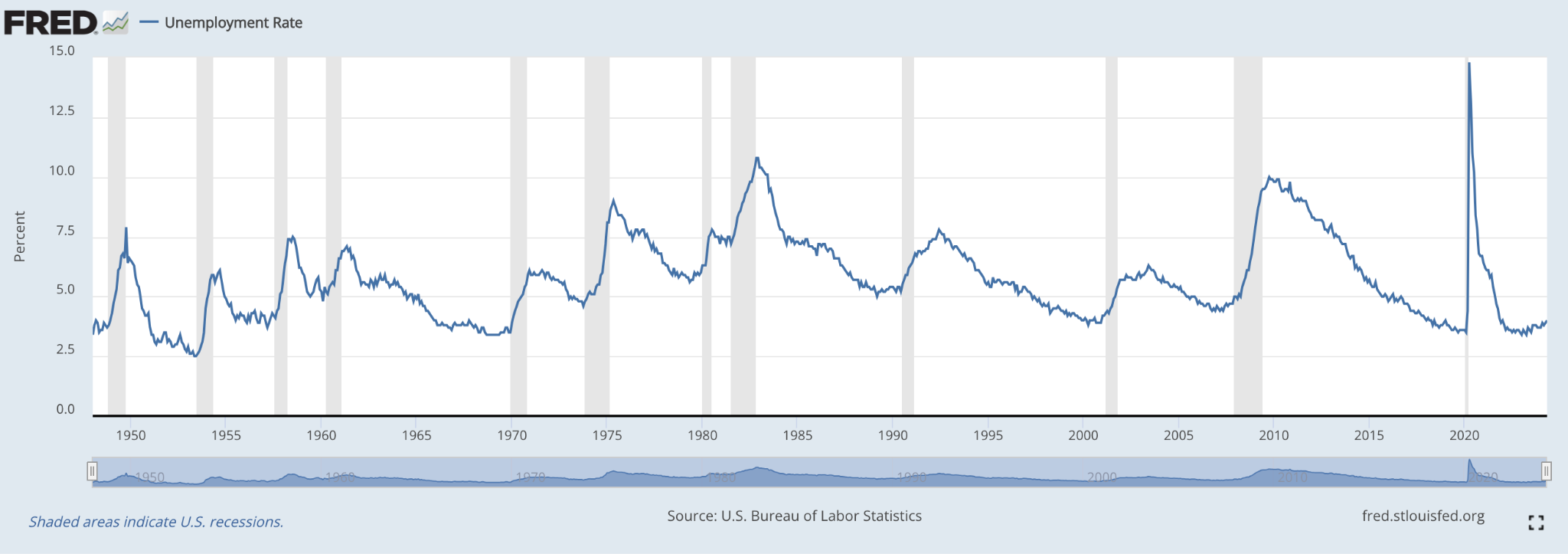

On the other hand, June's employment data presented a complex situation: nonfarm payrolls increased by 272,000, exceeding expectations, but the unemployment rate also rose to 4.0%, the highest level in over a year. This discrepancy stems from using two different data sources—establishment surveys reported strong employment growth, while household surveys showed a decrease in employment. This mixed data presents a challenge for the Federal Reserve in navigating between controlling inflation and supporting a stable job market.

Source: St. Louis Fed

Major investment firms now expect the first rate cut to occur in the fall, with the likelihood of a rate cut in September seen as fifty-fifty.

Source: Jim Bianco

Global Economic Landscape

Internationally, we have also seen some interesting developments. In the Eurozone, inflation results were higher than expected (2.9% compared to the previous and forecasted 2.7%), which may lead to a quick rate cut by the European Central Bank—this move may imply a similar action by the US.

In the commodity market, when OPEC+ announced earlier production cuts, oil prices initially fell. However, this decline was short-lived, and Brent crude has been on the rise, driven by skepticism about OPEC+ commitment to these cuts and concerns about increased air conditioning and travel demand during the hot summer.

Source: TradingView

Digital Economic Development

The launch of retail central bank digital currencies (CBDCs) continues to face complex challenges such as legal and design issues, slowing down its adoption. Meanwhile, Paxos announced the launch of a new interest-bearing stablecoin—Lift Dollar (USDL), choosing the UAE as its base due to more favorable regulatory conditions, highlighting the ongoing adaptation in the digital currency market.

Review and Outlook

This month's economic indicators paint a complex picture for us. On one hand, the easing of inflation and strong employment numbers indicate a healthy economic condition. On the other hand, cautious consumer spending and a decline in commodity expenditures may be early signs of an economic slowdown. These factors will play a crucial role in the Federal Reserve's upcoming decisions, especially as more data on employment and consumer prices is set to come.

Disclaimer

This report is prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this report should be considered as general information and not investment advice or financial advice. It is neither an advertisement nor a solicitation or proposal to buy or sell any financial instruments or engage in any specific trading strategy. When preparing this document, Greythorn did not take into account the investment objectives, financial situation, or specific needs of any recipient receiving or reading it. Before making any investment decisions, recipients of this report should consider their own personal circumstances and seek professional advice from their accountant, lawyer, or other professional advisors. This report contains statements, opinions, forecasts, predictions, and other materials (forward-looking statements) based on various assumptions. Greythorn is not obligated to update the information. These assumptions may or may not prove to be correct. Greythorn and its officers, employees, agents, advisors, or any other person mentioned in this report make no representations about the accuracy or likelihood of achievement of any forward-looking statements or their underlying assumptions. Greythorn and its officers, employees, agents, and advisors do not provide any warranty, representation, or guarantee regarding the accuracy, completeness, or reliability of the information contained in this report. To the extent permitted by law, Greythorn and its officers, employees, agents, and advisors do not accept any liability for any loss, claims, damages, costs, or expenses arising from the information contained in this report. This report is the property of Greythorn. Recipients of this report agree to keep its contents confidential and agree not to reproduce, provide, distribute, or disclose any information related to its contents without written consent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。