Author: Matrixport

In recent months, with the approval of spot ETH in Ethereum and the approaching US election, the cryptocurrency market has once again attracted widespread attention. Although the current market is in a downturn, not long ago the market experienced a small bull market, and Bitcoin also slightly broke through its historical high. While most people are familiar with exchange platforms such as Binance, OKX, and Coinbase, there are still some outstanding companies in the cryptocurrency industry worth paying attention to.

In today's article, we will introduce a recently valued at $11 billion and selected by the Hurun Research Institute for the 2024 Global Unicorn List - the cryptocurrency company Matrixport (referred to as "M station" by its loyal fans). The company was rated by CB Insights as one of the 50 most promising blockchain and cryptocurrency companies globally in 2022.

Matrixport vs. Exchange Brief

As the largest cryptocurrency asset appreciation management platform in Asia, Matrixport's business covers services such as lending, wealth management, asset appreciation, and custody. Its product line covers various risk levels, suitable for most users who want to profit from cryptocurrencies.

Founded in 2019, Matrixport is headquartered in Singapore and has offices in multiple countries and regions around the world. Its founding team includes leaders in the cryptocurrency industry, including Wu Jihan, one of the co-founders of Bitmain. Despite having such a strong background, Matrixport has been operating quietly for the past five years, which is quite rare in the cryptocurrency industry. After all, traffic is like money in the cryptocurrency industry, and many cryptocurrency companies are accustomed to gaining attention and attracting traffic through high-profile operations. However, Matrixport has chosen to remain pragmatic and focus on improving the quality of its products and services.

In contrast, most cryptocurrency users are already very familiar with exchange platforms, so we will not go into further detail here. However, the cryptocurrency asset appreciation management track where Matrixport operates is often overlooked. As the world's leading and largest cryptocurrency asset appreciation management platform in Asia, Matrixport provides users with comprehensive asset appreciation management solutions, with a business model that significantly differs from exchanges.

This article will explore the differences in business models between Matrixport and exchanges, analyze their performance in terms of user interests, and fundamentally compare who is truly a cryptocurrency financial service platform that aims to make money for users.

Comprehensive Comparison of Matrixport vs. Exchanges

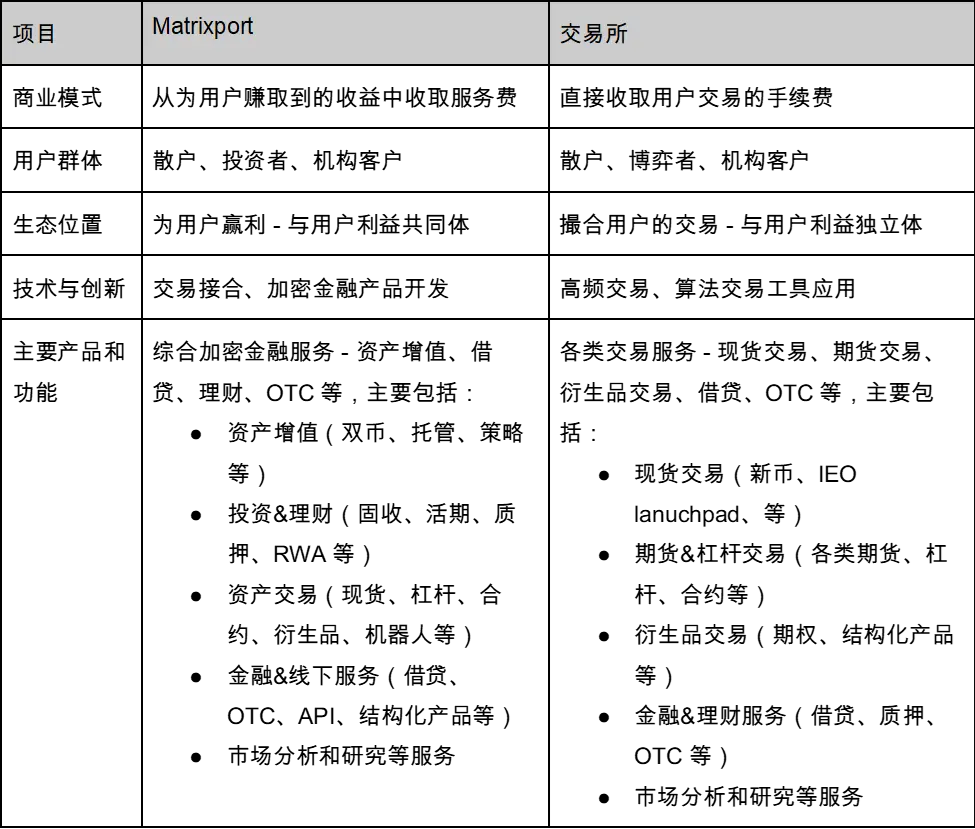

Key comparisons between Matrixport and exchanges:

A simple comparison from the table above shows that Matrixport and exchanges have fundamental differences in their business models. Exchanges generate revenue by directly charging users transaction fees, which means that regardless of whether users make a profit or a loss, exchanges can profit from it, making the relationship between exchanges and users relatively independent.

In contrast, Matrixport's business model is more unique: it generates profits by extracting a portion from the actual profits earned by users as service fees. This means that Matrixport can only profit when users actually make money, ensuring that the platform's interests are always aligned with those of the users.

Matrixport's business model dictates that the platform must prioritize and make it a mission to make money for users, and this is how Matrixport actually operates. Therefore, Matrixport has been able to maintain a good track record over more than five years of steady operation.

Development History and Advantages of Matrixport

Founded in 2019, at a time when most cryptocurrency companies were exchanges, Matrixport chose the track of cryptocurrency asset appreciation management and innovatively developed a series of high-quality products, including dual-currency wealth management.

In the over 5 years since its establishment in 2019, Matrixport has experienced market fluctuations, witnessed the ups and downs of the cryptocurrency industry, and the rise and fall of so-called "competitive platforms." For example, the series of chain reactions caused by the 2021 FTX bankruptcy event led to the closure of many cryptocurrency asset appreciation management platforms. However, Matrixport has always adhered to its original intention of making money for users, strictly controlled asset risks, and maintained a good track record.

In the rapidly changing field of cryptocurrencies, a company that has operated stably for over 5 years has fully proven its reliability and reputation, and Matrixport is now entering its sixth year. Matrixport has obtained licenses such as the Hong Kong Trust Company License, Money Lender License, UK FCA Compliance Representative Company, and US Money Service License, and is a member of the Swiss FINMA SRO-VFQ, further proving the compliance and reliability of its platform.

Today, Matrixport has developed into the world's leading and Asia's largest cryptocurrency financial services hub, with its product and service portfolio covering users in multiple countries and regions around the world, providing a seamless connection to trading services from major exchanges (supporting Binance and OKX trading products), lending, wealth management, and a range of cryptocurrency asset appreciation management services. The platform's current asset management and custody volume exceeds $10 billion, with a monthly trading volume of over $5 billion.

Core Tenet of Matrixport - Putting User Interests First

Information obtained from official channels of Matrixport indicates that Matrixport is committed to building an entry-level cryptocurrency asset ecosystem, providing users with a super account that integrates asset trading, investment, OTC trading, investment research, and other functions, helping users achieve continuous asset appreciation by providing diversified products and professional services.

As mentioned earlier, Matrixport's business model is completely different from that of exchanges. Exchanges mainly derive their revenue from charging users transaction fees, while Matrixport generates revenue by charging service fees from the profits earned for users. This model determines that the relationship between the platform and users is always a true community of interests, meaning that Matrixport must prioritize user interests and create actual profits for users. This is the most fundamental difference between Matrixport and exchanges.

Recently, Matrixport's exposure in the market has significantly increased, including its product development, app upgrades, and brand upgrades. These series of measures indicate that Matrixport will continue to expand its user base while continuously practicing the company's philosophy of putting user interests first. As a well-established company founded by leaders in the cryptocurrency industry and operating steadily for nearly six years, Matrixport brings new hope to cryptocurrency industry users. The recent series of bankruptcy events in the cryptocurrency industry in recent years has caused varying degrees of harm to retail investors, and Matrixport's steady operation and user-centric philosophy are exactly what the current cryptocurrency market urgently needs.

Let's look forward to more developments from Matrixport and expect this unicorn company to continue bringing more surprises to the cryptocurrency industry and users.

Below are the official links for Matrixport:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。