Original Author: BITCOIN MAGAZINE PRO, LANDON MANNING

Original Translation: Block unicorn

After Germany suddenly sold a large amount of Bitcoin reserves, both the German and US governments transferred hundreds of millions of dollars worth of Bitcoin from private wallets to exchanges, sparking speculation of an imminent large-scale sell-off.

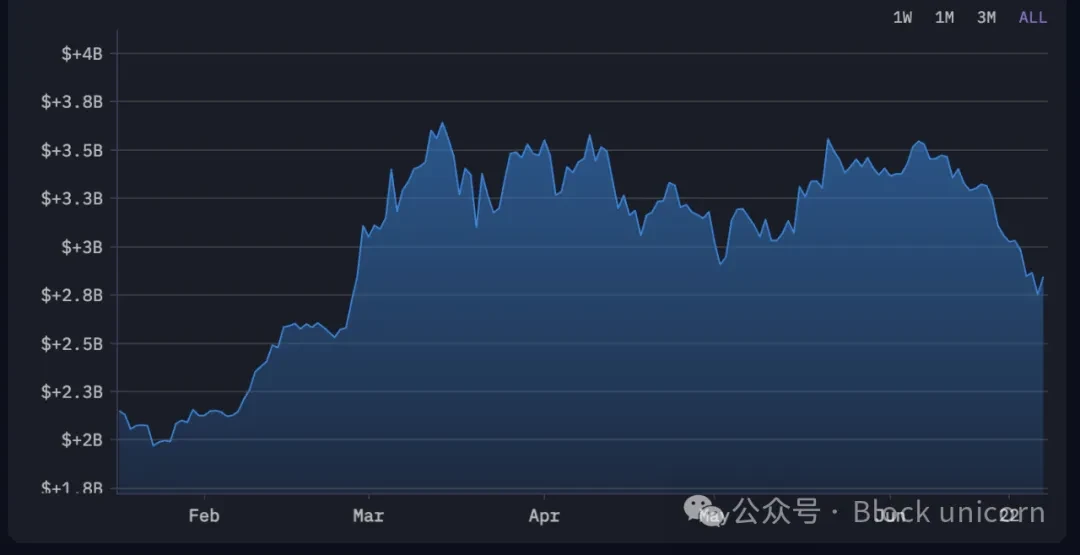

Despite various speculations about Bitcoin's performance in late June, it is easy to forget that the actual value of this cryptocurrency is just a step away from its historical peak valuation, and the time span is very long. For a long time, certain world governments, especially the United States, have acquired so much Bitcoin through the confiscation of criminal assets that these insignificant amounts, by the standards of ten years ago, have developed into a treasure worth hundreds of millions of dollars. More urgent is the fact that the federal government has been particularly slow in auctioning off these assets, while continuing to make new confiscations, making it one of the largest whales in the entire industry.

This situation is a well-known factor in the Bitcoin community and has sparked much speculation about the potential impact of future government sales on prices. After all, any relationship with the market or profits is largely unrelated to the speed of these auctions, which is set by the bureaucratic agencies managing the confiscation of assets. In short, the Bitcoin hoarded by these governments is a true unknown factor that could be intentionally manipulated by specific participants in government power, or sold without consideration for the potential market impact.

Although the US federal government is the largest government holder, claiming jurisdiction over Bitcoin-heavy enterprises such as Silk Road and once holding over 1% of circulating Bitcoin, another auction process seems to have triggered a chain reaction. Specifically, the German government's $325 million sale shocked the entire community with almost no prior announcement. These major transactions were completed within 2 days, and the resulting Bitcoin sell-off pressure caused a 3.5% price drop. Bitcoin's price had already been fluctuating before this event, and these sales certainly did not inspire further bullish sentiment among traders.

Robert Quartly-Janeiro, Chief Strategy Officer of Bitrue, even claimed that this decision was a deliberate strategy rather than a planned release of Bitcoin. "Seeing the BTC price drop, the German government released a large amount of Bitcoin," Quartly-Janeiro said, even adding that the German government "believes that the Bitcoin price will remain weak in the near future." In other words, not every jurisdiction has to operate under the same agreements as the United States did in the past. The Bitcoin sold in this auction was obtained by Germany after an investigation in 2020, but the actual arrest did not result in all related Bitcoin being confiscated. In fact, local officials claim that the confiscation related to this case is still ongoing, with over $3 billion seized in January of this year. Clearly, unlike some assets of the US government ten years ago, these Bitcoin are just sitting idle in their pockets.

This brings us to recent developments. There are clear signs that the Germans have not stopped their actions. On June 25, the government transferred more Bitcoin from private wallets to well-known exchanges. Assets worth $24 million were transferred to the platforms of Coinbase and Kraken, while another $30 million was transferred to an unknown wallet. It should be noted that the data shows that Germany still controls the vast majority of its overall confiscated Bitcoin reserves. Nevertheless, it transferred over $425 million in less than a week, causing panic in the market.

What truly turned this event from a minor episode into a source of panic was the decision by the US government to take similar measures. On June 27, over $240 million worth of Bitcoin was transferred from private wallets to the Coinbase platform, particularly wallets associated with institutional traders. Furthermore, blockchain tracking shows that these Bitcoin were seized from drug dealer Banmeet Singh in 2024. Some of the federal government's Bitcoin has been in bureaucratic limbo for over five years, yet these Bitcoin may be auctioned off in less than six months.

Of course, the presence of these assets in Coinbase wallets does not guarantee that the actual auction date is imminent. However, this move still instilled fear in the Bitcoin community as the price had already plummeted. Is the US government, a giant holding over $13 billion worth of Bitcoin, ultimately deciding to manipulate the market consciously? Or, more accurately, are they steadfastly shorting Bitcoin? Officials in Germany who suddenly sold off Bitcoin clearly wanted to make a quick profit before Bitcoin entered a long bear market. Such sentiments can have particularly harmful effects on the collective behavior and attitudes of traders, and when these decisions are made by industry whales, this impact is multiplied. If the US government rapidly sells off the $240 million worth of Bitcoin it acquired just a few months ago, who knows if it will continue this behavior and sell off billions of dollars? Such sell-off pressure could trigger a real bear market.

It may be particularly difficult to identify different motivations and participants from these opaque bureaucratic agencies (such as the agencies actually making these decisions). Therefore, studying some actual constraints may be more effective in understanding why this sell-off scenario may not materialize. First, while Germany transferred its Bitcoin to several different wallets, the US sold them all to Coinbase. As of June 27, this exchange is simultaneously being sued by the Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC). Coinbase accuses these regulatory agencies of deliberately stifling the cryptocurrency industry and cites events as evidence of government distrust. The most credible part of their argument seems to be a series of Freedom of Information Act (FoIA) requests that Coinbase has made, which these agencies have refused or delayed without any explanation.

This lawsuit reminds us that many exchanges that may handle rapid auctions of billions of dollars worth of Bitcoin are currently in legal battles with the federal government! Coinbase is currently embroiled in other legal disputes; the alternative exchange Kraken in Germany was also targeted at the end of last year; and Binance was involved in a devastating lawsuit that led to its CEO being imprisoned. These are just a few of the cryptocurrency-related companies and exchanges facing various lawsuits in the past few months. In any case, such companies are unlikely to completely prevent the government from conducting auctions, but the entire business may become more difficult. If a faction within the relevant agencies seeks faster profits from the auction system, they may not proceed smoothly.

Ultimately, we have no way of knowing the intent behind the US government's transfer of these funds. Many questions remain unanswered, and it may remain a mystery in the foreseeable future. However, Bitcoin holders can rest assured, as extremely pessimistic scenarios are unlikely to materialize. The Bitcoin held by the US government exceeds that of Germany by billions of dollars, and it is unlikely that these Bitcoin will be exchanged for cash unnoticed. We just need to see what actions these and other confiscated Bitcoin reserves will take in the near future, but until then, any doomsday predictions are purely speculative.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。