Author of the original article: Viet Anh

Original translation: Deep Tide TechFlow

Key points summary

The bubble-like growth of the number of altcoins in 2024 and the risks it brings.

The surge in the number of users participating in tap-to-earn games in 2024.

The heat growth and bubble signs of Nvidia (NVDA) stock in 2024.

Between 2023 and 2024, the overall market value of the crypto market did not show a parabolic rapid growth, and it has not even returned to the historical peak of 2021. These growth bubble predictions are not for the crypto market, but for other data and objects that have a significant impact on the crypto market.

Here is a summary and evaluation of these growth phenomena.

The growth of the number of altcoins in 2024 and the risks that come with it

Although the market value has not returned to its peak, the number of altcoins and new projects has already exceeded the peak, and it has increased many times more than the previous cycle. This has led to a situation where there are too many projects competing for an increasingly smaller market value cake.

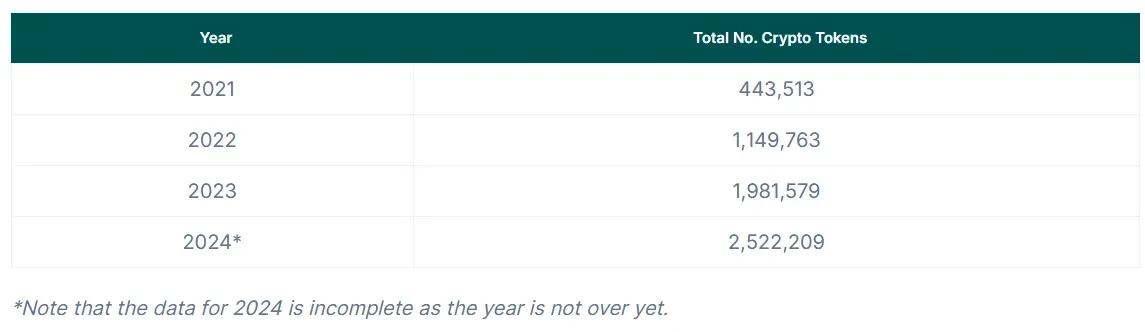

Data from Coingecko Research shows that as of April 2024, the number of tokens in the market has exceeded 2.5 million, compared to 1.98 million in 2023. This means that in less than half a year in 2024, over 500,000 tokens have been created. Coingecko stated that an average of 5,300 new tokens are created every day.

At the same time, market trading volume is gradually decreasing, and the market value has not returned to the high point of 2021. Recently, Binance took unprecedented measures to launch an early warning feature, reminding users which tokens may be delisted. This is because there are too many tokens on the market, but the liquidity is very poor.

It is expected that in the near future, the number of tokens with low liquidity and low trading volume will increase. Many tokens/altcoins will be delisted, and investors need to re-evaluate their portfolios and reallocate funds to truly high-quality tokens.

The surge in the number of users participating in tap-to-earn games in 2024

Since the beginning of 2024, various tap-to-earn games on Telegram have caused a craze in the community.

Hamster Kombat announced that as of June, their user base has reached 200 million, making it the app with the most users in the tap-to-earn category.

Tapswap announced that they have 55 million global players and 18 million daily active users.

Yescoin also announced that in just over a month, their user base has reached 18 million, with over 6 million users connecting their wallets.

All of these projects are highly anticipated to become the next "Notcoin." But the question is, how to provide enough liquidity for hundreds of millions of users? Will user growth continue? At the same time, many experts believe that the crypto market in 2024 lacks inflow of funds from retail investors, who were a strong driving force in previous cycles.

It is expected that with the recent drop in the market value of altcoins to below $100 billion, the popularity of these Mini-app users on Telegram will cool down or saturate in the second half of 2024.

The rapid growth of Nvidia (NVDA) stock in 2024 and signs of a bubble

Nvidia (NVDA) stock is a major representative of the so-called "AI stock" wave in 2024. Taking Apple's stock as an example, with the company entering the AI market through collaboration with OpenAI, AAPL's market value has increased by $600 billion. NVDA's market value has risen nearly 900% in the past two years, surpassing Google and Amazon, becoming the world's top 4 asset in market value (second only to gold, Microsoft, and Apple).

The Financial Times believes that this phenomenon is a sign of bubble growth, where bubbles form when investors overestimate the potential of something and have high expectations for it. It is currently unclear what impact the bursting of the AI bubble will have, but the positive correlation between US stocks and Bitcoin suggests that this may seriously affect the entire crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。