Performance of Tokens Listed in 2024

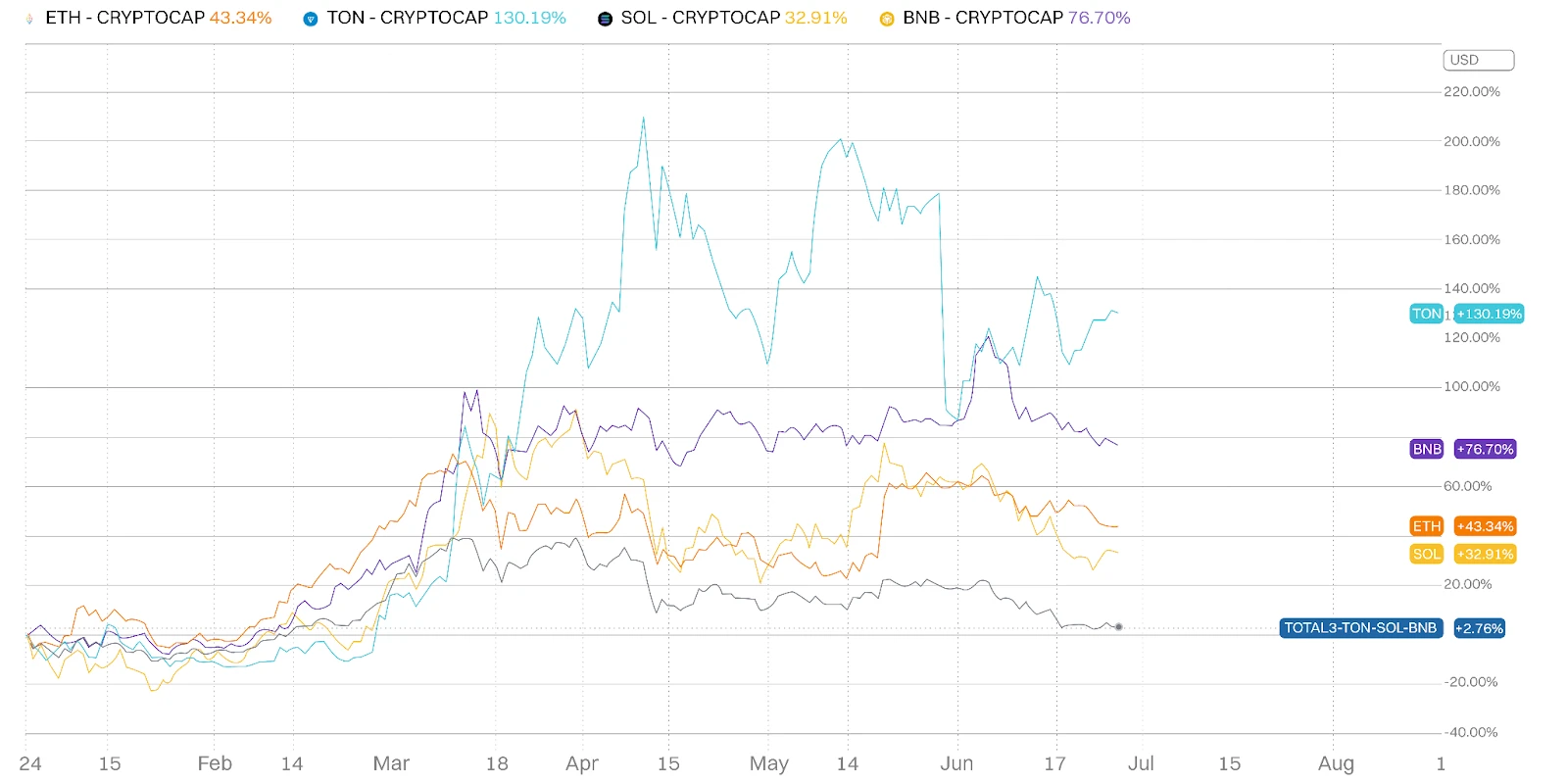

As we enter 2024, the cryptocurrency market continues to develop and the bull market is beginning to emerge. However, this market trend has brought new challenges for investors and projects. Referring to the performance of previous cycles, a top-tier new project supported by major venture capital (VC) and launched on a well-known centralized exchange (CEX) usually performs strongly in a bull market under the positive development of Bitcoin and cryptocurrencies. However, the current market is showing different characteristics, with the overall performance of newly listed tokens being poor. More than half of the new tokens listed on the four major exchanges this year have negative returns. The overall altcoin market also appears weak, with altcoins (excluding ETH) falling by 17% relative to BTC since the beginning of 2024. The TOTAL3/BTC chart, which compares the total market value of BTC with the top 125 cryptocurrencies (excluding BTC and ETH), also intuitively reflects this trend.

What unique features of this market cycle have led to this phenomenon?

Institutional Influence and ETF Impact

Unlike previous market cycles, the current bullish sentiment is mainly driven by ETFs and institutional assets. At the end of October 2023, the initial expectation of BTC ETF approval injected strong confidence into the market, leading to a price increase from below $30k to $40k within a month. Since the approval of the U.S. spot Bitcoin ETF on January 10, 2024, over 70 spot Bitcoin ETFs globally have attracted over $28 billion in new funds. Institutions now hold over $72 billion worth of Bitcoin through these ETFs and funds, pushing the Bitcoin price to repeatedly reach new all-time highs. Similar impacts are also evident in Ethereum and the SEC's approval of its ETH ETF in May 2024.

This mini bull market seems to be driven by institutions and only benefits mainstream currencies. Apart from Memecoin, ETH, SOL, TON, and BNB are leading the race among mainstream currencies, becoming the best-performing large-cap currencies.

Although Bitcoin reached a new all-time high of $73,750 on March 14 due to institutional enthusiasm, the same situation was not reflected in the broader altcoin market.

New Projects with High FDV and Low Liquidity

New projects in the current market generally face the problem of high fully diluted value (FDV), low circulating supply, and limited liquidity. For example, StarkNet (STRK), launched in late February, has a market value of $895 million, but its FDV has reached $6.9 billion. Only 13% of the maximum supply of 1 billion STRK tokens is in circulation, and in the following months, there were multiple unlocks, leading to a 50% drop in token price to $1.3 when the market value doubled to nearly $2 billion.

This combination of high FDV and low liquidity has increased retail investors' skepticism and perception of overvaluation, making it difficult for these projects to sustain investor confidence and maintain price stability.

Discrepancy Between VC and Retail Investors

For new narratives such as AI, DePin, and RWA, which are highly praised by VCs and the market, retail investors initially gave similar endorsements. They actively bought into these trends earlier this year, but often found that the projects were already overvalued at the time of their release. After a series of high-profile launches such as Sui, Starknet, Eigenlayer, ZkSync, Layer-Zero, and now Blast, retail investors found that the previous VC-following approach did not reward them accordingly. As a result, retail investors seem to have turned their attention and funds to the memecoin race, betting on undervalued projects in the "cultural casino" to seek profits. This ultimately led to a situation where VCs and retail investors are not matching each other's demands.

Four Major Exchanges

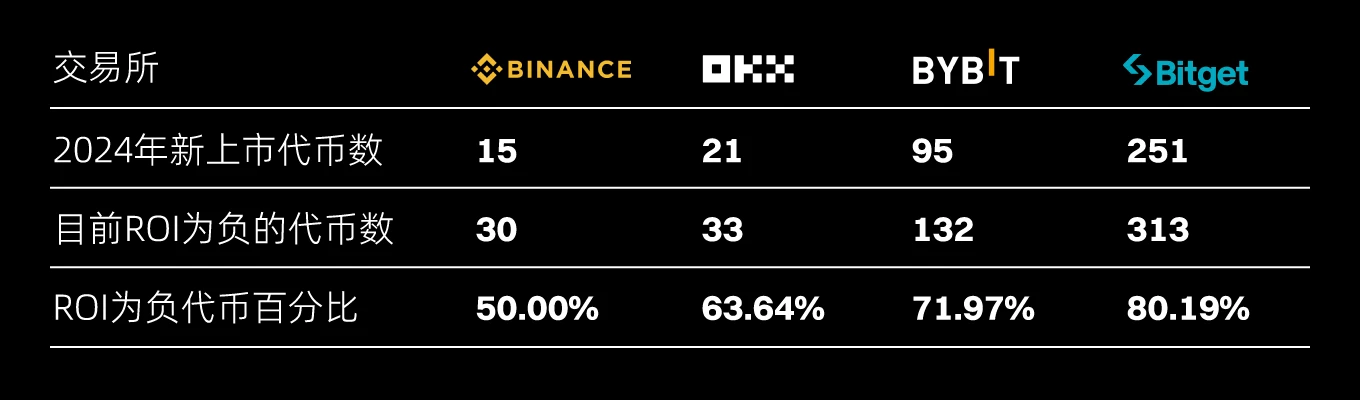

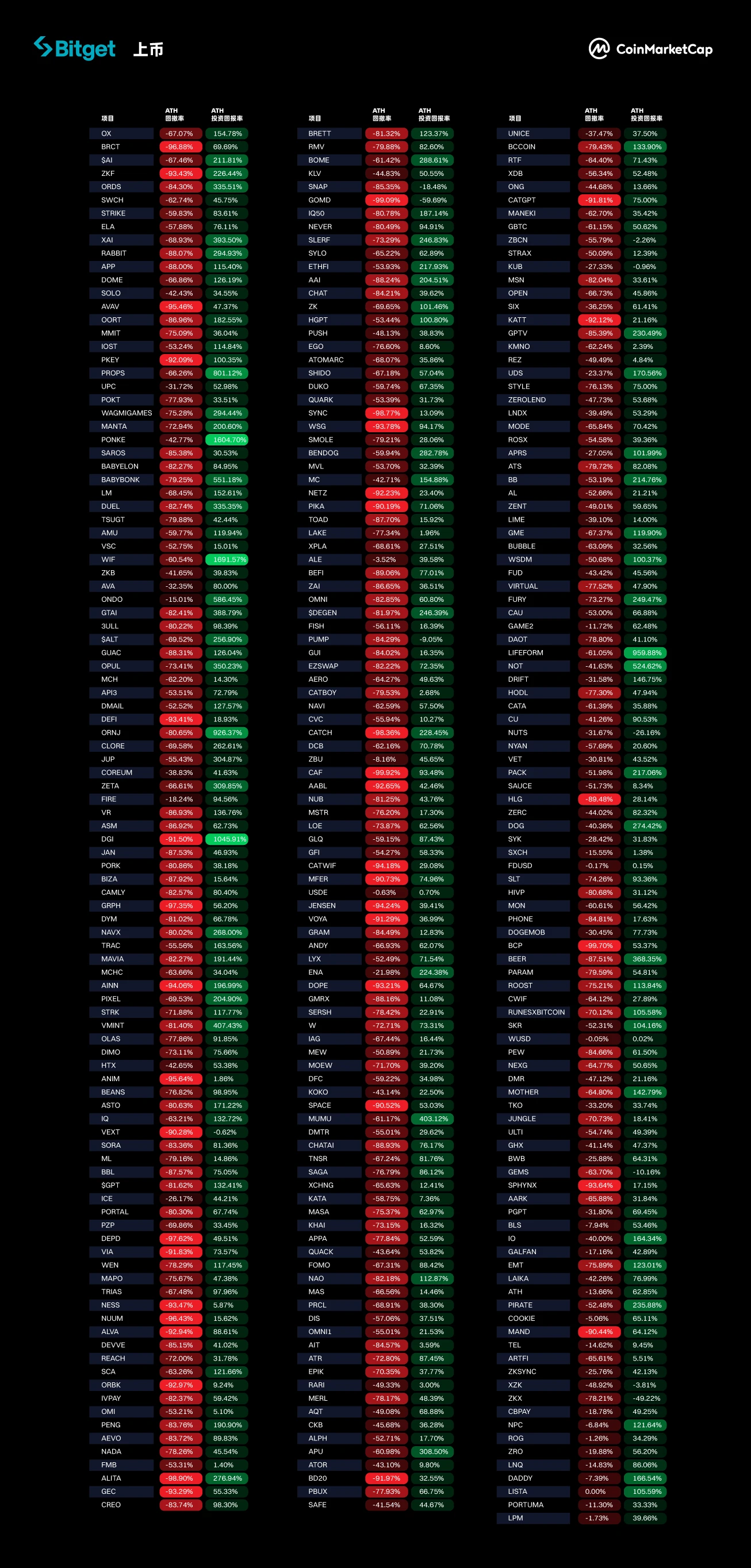

The projects listed on the four major exchanges - Binance, Bybit, OKX, and Bitget - have also been affected by these market conditions, with most projects performing poorly since their initial listing.

* Data as of 25.06.2024

In addition to external market conditions, their different listing strategies may also be one of the reasons for the differing performance of tokens listed on the four major exchanges. For example, Bitget and Bybit have listed the most tokens this year, with Bitget listing over 310 tokens and Bybit listing over 130 tokens, focusing on memecoins and related tracks. This strategy aims to actively cater to the market's need for high-volatility token types this year. As an industry leader, Binance has adopted a different strategy, listing a relatively small number of tokens, around 30, possibly to take a more cautious approach and thoroughly conduct due diligence before listing projects. However, even so, Binance has not been immune to the overall market's downturn, with around 50% of new projects currently experiencing negative ROI. Furthermore, the projects listed on Binance generally have a larger market cap, which will have a greater impact on the overall market. This also highlights the general downturn in the current market from another perspective.

The different strategies of these exchanges essentially represent different business models within the crypto ecosystem. Some have chosen a wide-net strategy, listing numerous projects to provide users with a wider selection and entry path. Others have taken a more selective approach, focusing on first-tier projects with a verified track record and community support.

Will There Be Another Altcoin Season? As the cryptocurrency market continues to decline in the slow summer market of 2024, concerns about whether we will see a resurgence in altcoin performance are growing. To help users see the latest data for reference in this complex and rapidly changing environment, CoinMarketCap recently launched the new CMC Altcoin Season Index. This index selects the top 100 cryptocurrencies ranked by CoinMarketCap, excluding stablecoins such as USDT and DAI, as well as projects pegged to other tokens such as WBTC, stETH, etc. If over 75% of the top 100 cryptocurrencies have outperformed Bitcoin in the past 90 days, it indicates that the market has entered the altcoin season, and vice versa.

Embracing the Complexity of the Crypto Market

Currently, institutional interest remains strong, and the market widely expects Bitcoin to reach new highs under the current squeeze, especially with the supply shock stacking up after the halving. However, on the retail side, the low circulation/high FDV of new projects provides insufficient risk-return for investors, making them unwilling to be the blood bag for the liquidity withdrawal of major VCs and less willing to actively participate in projects endorsed by these large institutions.

The different strategies of major exchanges and the ongoing tension between VCs and retail investors add more complexity to an already complex ecosystem.

However, this complexity also signifies opportunities. Despite the challenges, the current market conditions also provide strategic investment opportunities for high-potential projects, if approached with clear understanding and insight. The dominance of Bitcoin was 65% in June 2020, and this ratio dropped to below 38% at the peak of the 2021 bull market, indicating that we officially entered the altcoin season. The opportunities and gains seen in the market at that time will also create similar miracles in the next altcoin season. Looking at the market in the second half of 2024, we can already see many opportunities, whether it's the supply shock after the halving, the first interest rate cut by the Federal Reserve since 2021, or the upcoming U.S. presidential election where both Trump and Biden have expressed support for the crypto industry, all of which will give the crypto market new momentum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。