Author: Gyro Finance

The recent story of Polkadot (referred to as "Polka" hereinafter) has been quite eventful.

First, the uproar caused by the 2024 first-half Polkadot treasury operation report on June 29, with a half-year expenditure of up to 87 million US dollars, including a marketing budget of 37 million US dollars and a significant investment of 300,000 US dollars in KOL platforms that were clearly inflated, led users to jokingly comment that "the speed of spending money is faster than hackers stealing money." This was followed by a frenzy of black material being exposed by Asian project parties, claiming that the spiritual leader was all talk and that internal politics were full of tricks. At one point, accusations against Polkadot were incessant. In fact, signs of trouble had long been apparent. As early as a year ago, Polkadot was rumored to have made significant staff cuts due to poor cost management, which led to a wave of developers leaving one after another.

However, if we rewind the timeline back five years, at that time, Polkadot was known as the "Ethereum killer," a cross-chain star highly praised by developers and a team that was widely admired in the community for its "doer" attitude.

In just a few years, from being envied by everyone to relying on scandalous marketing, Polkadot has played its good hand poorly, which is truly regrettable.

When it comes to Polkadot, it's hard to overlook two key words: the highly esteemed founder and the forward-looking cross-chain star.

Gavin Wood is one of the founders of Polkadot. Prior to this, he was the first CTO of Ethereum. Among many introductions, V God (Gavin Wood) is credited with proposing technical concepts, but the designer of the technical architecture, the first founder of the client, and the inventor of the advanced language Solidity for smart contract development all point to Gavin Wood. It is worth emphasizing that the widely circulated concept of Web3.0 also owes its clarity to Gavin Wood's concept in a speech in 2014. The title of technical genius is fully deserved in his case.

After leaving the Ethereum Foundation in January 2016, Gavin Wood, together with Jutta Steiner, founded the development team Parity Technology and the Web3 Foundation for funding and operation. The foundation's first project at the time was Polkadot.

The original intention of the project was actually quite simple. Gavin Wood stated frankly, "The initial design logic did not consider interoperability. We were waiting for Ethereum's sharding technology to be released. But sharding has not been implemented, and it still hasn't been released. So I wanted to create a more scalable Ethereum myself, and in the design process, I took the concept of sharding to an extreme, simply not using sharding and designing independent chains, allowing different chains to communicate with each other, and the ultimate result is to achieve communication through a shared consensus layer."

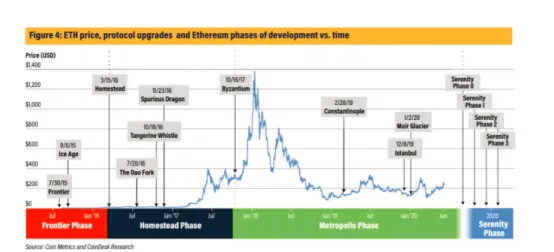

A brief introduction to the background at the time: Ethereum was thriving due to the rapid development of smart contracts, but the redundancy brought about by Ethereum's architecture destined it to face bottlenecks in efficiency and scalability. To illustrate, V God once calculated that the cost of executing calculations or storing data on Ethereum was 1 million times higher than completing the same calculations or storing the same data on a commercial cloud platform. Among many technical solutions, in addition to the governance perspective of delegation, the most feasible paths were layering and sharding. Layering included state channels and sidechain technologies, while sharding focused on Rollup as the mainstream direction. At the time, Ethereum was moving towards ETH2.0 and was in the construction phase of the beacon chain in the Serenity Phase.

In response, Polkadot made choices and put forward forward-looking technical concepts, constructing a heterogeneous multi-chain network using a layered architecture that separates consensus from computation. Its main architecture consists of three parts: relay chain, parachains, and bridges. The relay chain is the core of the network, also known as the main network, and is a consensus ledger built on blockchain technology. Parachains are independent blockchains based on this, and bridges are a special type of blockchain that allows Polkadot to connect and communicate with external networks such as Ethereum.

The overly technical content is not delved into, but the problems that Polkadot attempts to solve can include cross-chain communication, sharding for scalability, multi-chain architecture, and abstraction. It can be seen that these are actually the focus of Ethereum's recent efforts in the past two years, but they were envisioned by Polkadot as early as 2016.

The vision is grand, and the engineering implementation also faces correspondingly greater challenges. In October 2016, the first draft of the Polkadot white paper was officially released, after which Polkadot fell into a period of stagnation, with the main network being repeatedly delayed. During this time, a bug in the first private placement resulted in 300,000 ETH being locked. It wasn't until 2019 that Polkadot began to make rapid progress, with Substrate being released in June, an important development component for parachains, and the Polkadot test network Kusama being released in August, laying an important foundation for subsequent development.

While technology may attract attention, it is also a tree without roots if it cannot attract users. Upon closer examination, the key reason for Polkadot's rise lies in telling a good story in China.

In 2019, along with the development of its technical path, Polkadot also carried out extensive publicity, drawing on the experience of EOS. Its target audience was the large-scale Chinese community. In the first half of the year, the Polkadot China Roadshow began, with the team holding frequent sharing sessions in Hong Kong, Hangzhou, Shanghai, Beijing, and Chengdu, with all core members in attendance and the events being quite large in scale. The founder's background also helped the project's development. He was semi-permanently based in the Shanghai area and had a Chinese name, "Lin Jiawen," which attracted investment from several local capital firms in Shanghai. The combination of technical experts, large-scale marketing, and a blue ocean market quickly drew Chinese participants into the Polkadot ecosystem.

Data from 2020 shows that Chinese developers are particularly active in the Polkadot community. Among the 200 projects funded by the Web3 Foundation, nearly 20% of the beneficiaries are from China. With the support of Chinese developers, the number of active developers in Polkadot increased by 44% in May 2020, far exceeding the growth rates of Bitcoin and Ethereum. The PolkaWorld Chinese community also played a crucial role, with daily reports and weekly live broadcasts, frequent community reports, and activities serving as a driving force. Even the foreign media Decrypt reported at the time that Polkadot, supported by Chinese capitalists, was widely regarded in China as a renewed and improved version of EOS.

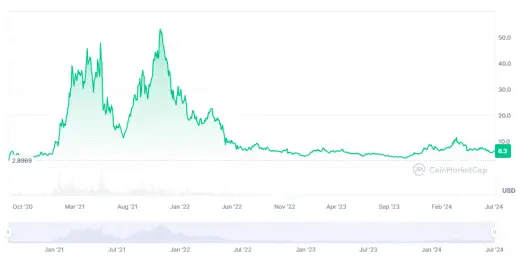

Backed by the traffic and funding from the Chinese, coupled with the favorable news of token splits, Polkadot lived up to expectations. By the end of 2020, the governance token DOT had surged by over 45% in a year, reaching a market value of 4.7 billion US dollars, surpassing Chainlink at one point to become the fifth largest cryptocurrency.

The next development climax came with slot auctions. For project parties, in order to connect to the relay chain as a parachain of Polkadot, they needed to obtain a slot. The number of available slots is limited, and the official estimate is that the maximum number of slots running simultaneously on Kusama is around 100. Therefore, selection is necessary. The official decision was to complete the auction of staked DOT through candle auctions on Kusama. The core of this proposal is for project parties to stake DOT to ensure the security of the main network through a large amount of lock-up, but the problem is obvious: it sacrifices user liquidity.

However, in order to secure more chips, project parties need to accumulate more chips, and users can also participate through staking, resulting in a significant reduction in circulation in the short term, which will inevitably lead to an increase in DOT. In November 2021, the first parallel chain slot auction of Polkadot concluded, with the winners being Acala, Moonbeam, Astar, Parallel, and Clover. Acala attracted over 80,000 members and accumulated over 3.2 million DOT in support. In the same month, DOT also reached a historical high, rising to 54.98 US dollars, once again earning Polkadot the title of Ethereum killer. As of now, Kusama has completed 128 slot auctions.

However, with the arrival of the bear market, Polkadot's fate took a sharp turn for the worse.

After the candle auction, the price of DOT quickly declined, leading investors to doubt the intrinsic value of DOT. Additionally, due to the 2-year lock-up period, the number of active users also began to decline.

On the other hand, Polkadot is heavy on technology and light on user experience, and its technical architecture is more complex, causing its ecosystem development to gradually fall behind. Compared to competitors like Cosmos and other new public chains, Polkadot has not been able to keep up with the fast pace of DeFi due to the staking nesting problem. In 2023, the daily transactions on the Polkadot network were only around 10,000, and even with the surge in activity at the end of the year, the daily active users were only 7-8 thousand, while Cosmos had around 20,000 daily active users, showing a clear gap. However, given the many infrastructure projects in its ecosystem, Polkadot has become a gathering place for developers.

In 2021, Polkadot had the second-largest developer community after Ethereum, with a total of 1,400 developers by the end of the year. Even after the turmoil in 2023, the total number of developers reached 2,100, maintaining a leading position. Some have questioned this, claiming that Polkadot is completely a developer ghost chain, lacking a strong application ecosystem.

In terms of technology alone, Polkadot has made considerable progress in recent years, such as the successive launch of XCM V3, system parallel chains, asynchronous support, and parallel threads. However, even for developers, Polkadot is not user-friendly, especially for Asian developers.

The project Manta, which once won a slot auction, was the project with the largest TVL and market value/fully diluted market value (non-DOT) last year, but it left Polkadot. Founder Victor Ji posted on X platform last year, expressing disappointment with the Polkadot ecosystem and team, and no longer wishing to be associated with it. He also emphasized that the Polkadot ecosystem is highly toxic, lacks real value for Web3, and does not focus on users or adoption. He also pointed out that the Polkadot team provides far more support to European/American projects than to Asian projects, leading to discrimination and stagnation in the entire ecosystem.

This is not an isolated case. Under the crisis caused by the treasury, several Asian projects have criticized Polkadot. Harold, the founder of the Din project, formerly known as Web3 Go, a Polkadot ecosystem data analysis platform, stated that as an Asian-led project, it is quite difficult to build in the Polkadot ecosystem and requires facing and solving many additional issues, such as politics, relationships, and cliques.

This situation had already been hinted at. Many people had previously exposed the autocratic behavior surrounding Gavin in Polkadot, with major decisions being made by him. Perhaps because of this, in October 2022, Gavin announced that he was stepping down as Parity CEO and taking on the role of Chief Architect. However, there is no doubt that he is still the absolute spiritual leader of the Polkadot project. But the inaction of the spiritual leader has clearly hindered the development of Polkadot. Internal staff had previously revealed, "He does not prioritize clearly and does not assist in promoting Polkadot."

Another typical example is the OpenGov governance, which was completely proposed and upheld by Gavin with the decentralized concept, removing the elite decision-making model of the previous technical committee and board of directors, and allowing a broader group of DOT holders to decide on treasury development through public voting.

However, it is obvious that firmly implementing completely decentralized governance in an immature community has also led to chaos and controversy. In September last year, after the largest unofficial Chinese Polkadot community, PolkaWorld, had its funding proposal rejected, it announced that it would cease operations. In response, PolkaWorld blamed OpenGov, stating that to maintain the token price, DOT holders tended to reject funding proposals. At the time, Markian Ivanichok, founder of Brushfam, also expressed disappointment with the Polkadot governance system on X, stating that proposal funding was becoming increasingly difficult, and the team eventually left the Polkadot ecosystem.

However, the funding responsible person sarcastically stated, "Over the past two years, Polkadot has allocated $694,000 to PolkaWorld, and it was only reported when the funding was stopped."

In any case, just from the above description, it can be seen that in 2023, Polkadot experienced a wave of team departures. According to Electric Capital's statistics, the number of developers for most projects sharply declined in the fourth quarter of 2023. Returning to the team itself, in 2023, Polkadot also experienced turmoil, with Parity announcing a 30% staff reduction in October, leading to a sharp drop in code development progress for Polkadot from September.

However, it is quite ironic that, according to employees, Parity's extensive recruitment led to financial difficulties, with high executive salaries, often exceeding $1 million, and even in the bear market, the company spent money without any restraint, as if it were in a bull market.

If there was no real feeling at the time, this was completely confirmed this year. In the treasury financial report on June 29, Polkadot spent a staggering $87 million in just the first half of the year, which can be described as burning money. Shockingly, the marketing expenses reached $37 million. Furthermore, the destination of this $37 million is even more laughable. According to the data released by Polkadot, KOL expenses were the absolute majority of Polkadot's marketing, accounting for more than half of the overall budget. In the first half of the year, Polkadot conducted four promotions targeting North America and three promotions targeting Europe, with around 40 KOLs for the North American events and around 15 for the European events. Based on the budget, the average budget for each promotional event for KOLs was around $300,000.

However, according to an investigation by a law firm, the number of fake followers among KOLs was astonishing. Some accounts had fewer than 100 followers, but their YouTube subscriptions exceeded 70,000, indicating a significant amount of inflated numbers, and there were even bot accounts among the followers. In the field of advertising, Polkadot's choices were also puzzling, as it even placed ads with some general investment and gaming YouTubers, resulting in only a few hundred views. The official explanation was that they were "precisely targeting high-net-worth audiences."

Not only did they not care about ineffective advertising, but their media placements and displays also revealed Polkadot's quirks. They spent money to purchase exclusive logo dynamic display services on the two major cryptocurrency price websites, Coingecko and Coinmarketcap. The exclusive logo dynamic display on Coingecko cost $50,000 for six months, and the logo dynamic display on Coinmarketcap for two years, including management fees, cost nearly $480,000. It is jaw-dropping, "Can the cool dynamic logo make DOT move too?"

What is even more noteworthy is that despite spending so much on marketing, many industry insiders did not even feel a ripple. If it wasn't for corruption in the treasury, it can only prove the extreme gap in governance efficiency. Just a few months ago, members of the Polkadot community were still saying, "For community participants, the greatest value of Polkadot lies in the treasury."

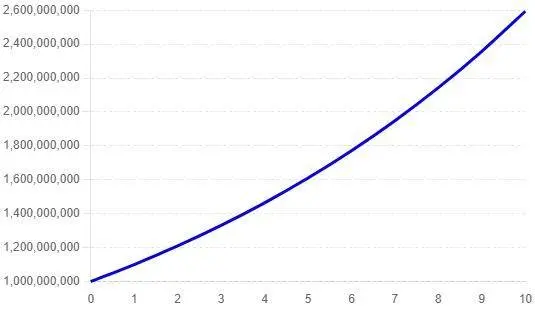

Currently, the remaining total value of the Polkadot treasury is 245 million US dollars, equivalent to 38.2 million DOT. In terms of income, the regular network fee income for Polkadot is only 20,000 DOT per quarter. Regarding treasury spending, Fabian Gompf, CEO of the Polkadot development organization Web3 Foundation, clarified that "this is not Web3 Foundation's expenditure, but rather on-chain treasury expenditure, decided by community vote. The foundation has over 5 years of operating funds even without selling any DOT," but he also acknowledged that "in the past few months, the on-chain treasury has spent too much on activities with potentially low returns."

Looking at the development path of Polkadot, it has done many things right and made many wrong choices. In terms of ecosystem development, Polkadot has been too slow. After 7 years of development, the mature mainnet system has not even been fully tested, and even a user-friendly wallet is hard to find. The cross-chain bridge Snowbridge, which should have existed 2 years ago, has only just started to be put on the agenda this year, and another high-demand hybrid bridge, Hyperbridge, is not even in the plans for this year. In terms of governance, Polkadot has moved too fast, prematurely introducing a centralized governance framework, allowing an immature community to control voting, posing challenges for incubation and venture capital. And other more controversial issues, such as severe centralization, constantly changing plans, discrimination against Asian teams, and disregard for user experience, need not be mentioned.

Fortunately, the Polkadot team has already made some changes. For example, in response to the liquidity shortage and increased development costs caused by slot auctions, Gavin mentioned canceling slot auctions and shifting the focus to the application side as early as November last year. This year, Polkadot also launched the JAM chain and attempted to use Agile Coretime to change the auction mode of parallel chains by purchasing usage time.

It cannot be denied that Polkadot's vision is very ambitious, and even now, the challenges of a multi-chain ecosystem are palpable. Does the market demand proposed at inappropriate nodes imply a mistake? This question is thought-provoking.

But with the weak departure from Ethereum and revenue generation, and Polkadot passing by numerous hotspots, perhaps time is really running out.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。