On the afternoon of July 1st, AICoin researchers conducted a live graphic and text sharing session titled "Ethereum ETF is Coming, Worth Paying Attention to ETH Investment Strategies" in the AICoin PC-end Group Chat Live. Here is a summary of the live content.

I. ETH Related Information

Take a look at the situation in July in the following figure:

There will be ETF information on Friday. With the expectation of ETF, currently, from the perspective of market funds, institutions have also conducted some leveraged operations on ETH. As ordinary retail investors, we can actually classify these market hotspots and summarize where institutional funds and leveraged funds are moving at this time.

II. Reasons for Recommending ETH

The gas fees for ETH are showing an upward trend, indicating that the on-chain activity of ETH is increasing. Market news and fund flows indicate that ETH is attracting significant attention from large funds. Aicoin has also released many flash news reports on on-chain news.

Based on previous news and policy aspects, it is evident that in the second half of 2024, the first round of high attention coins will be ETH and projects in the ETH ecosystem.

III. ETH Investment Strategy

It's simple, since ETH is the next market center. From various news and data perspectives, the probability of attracting institutional funds is high. From this perspective, we believe that the probability of its rise is high, and there are many forms of rise, such as oscillating consolidation and rise, downtrend rebound and rise, and the possibility of a direct large bullish candlestick.

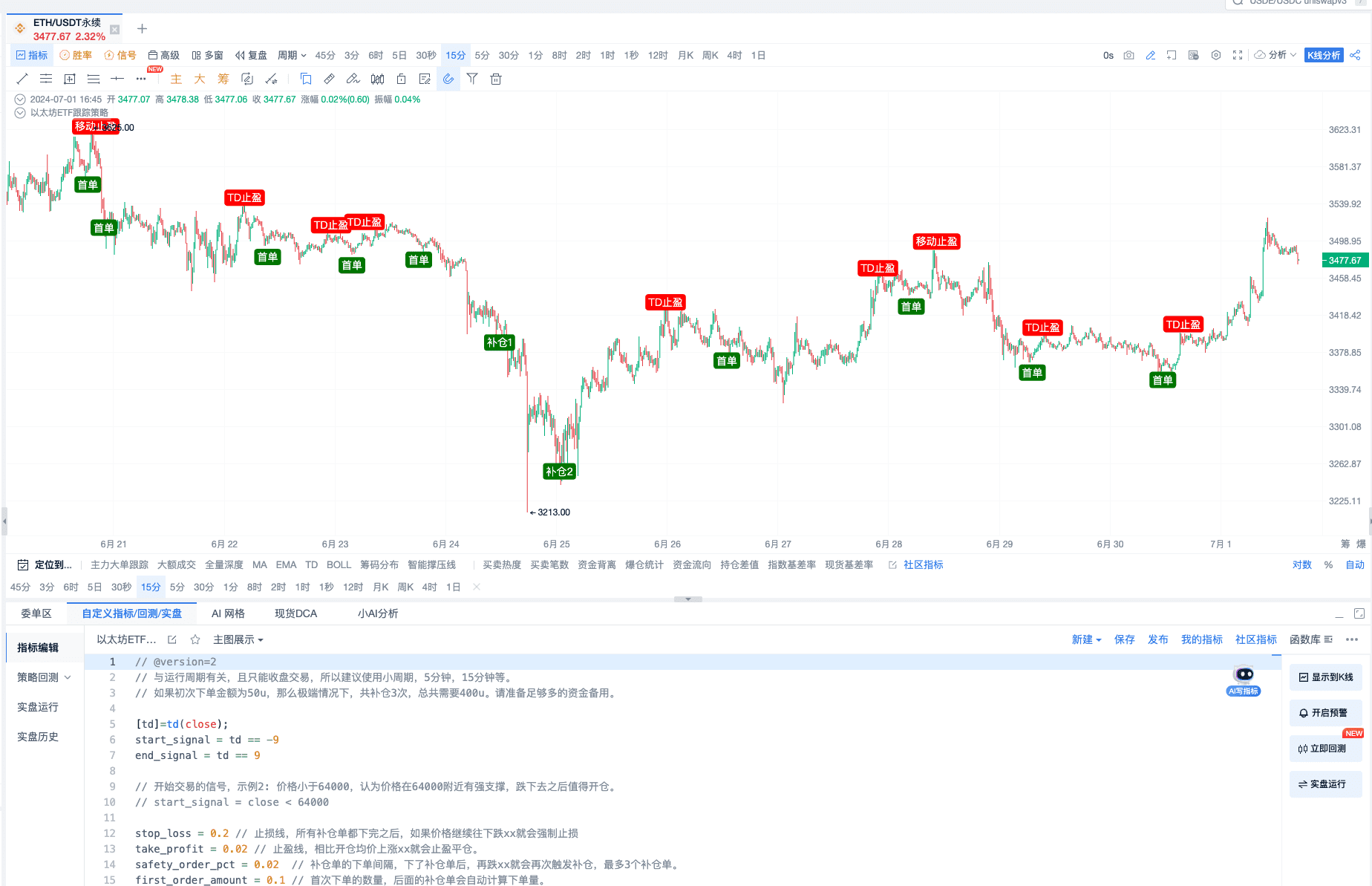

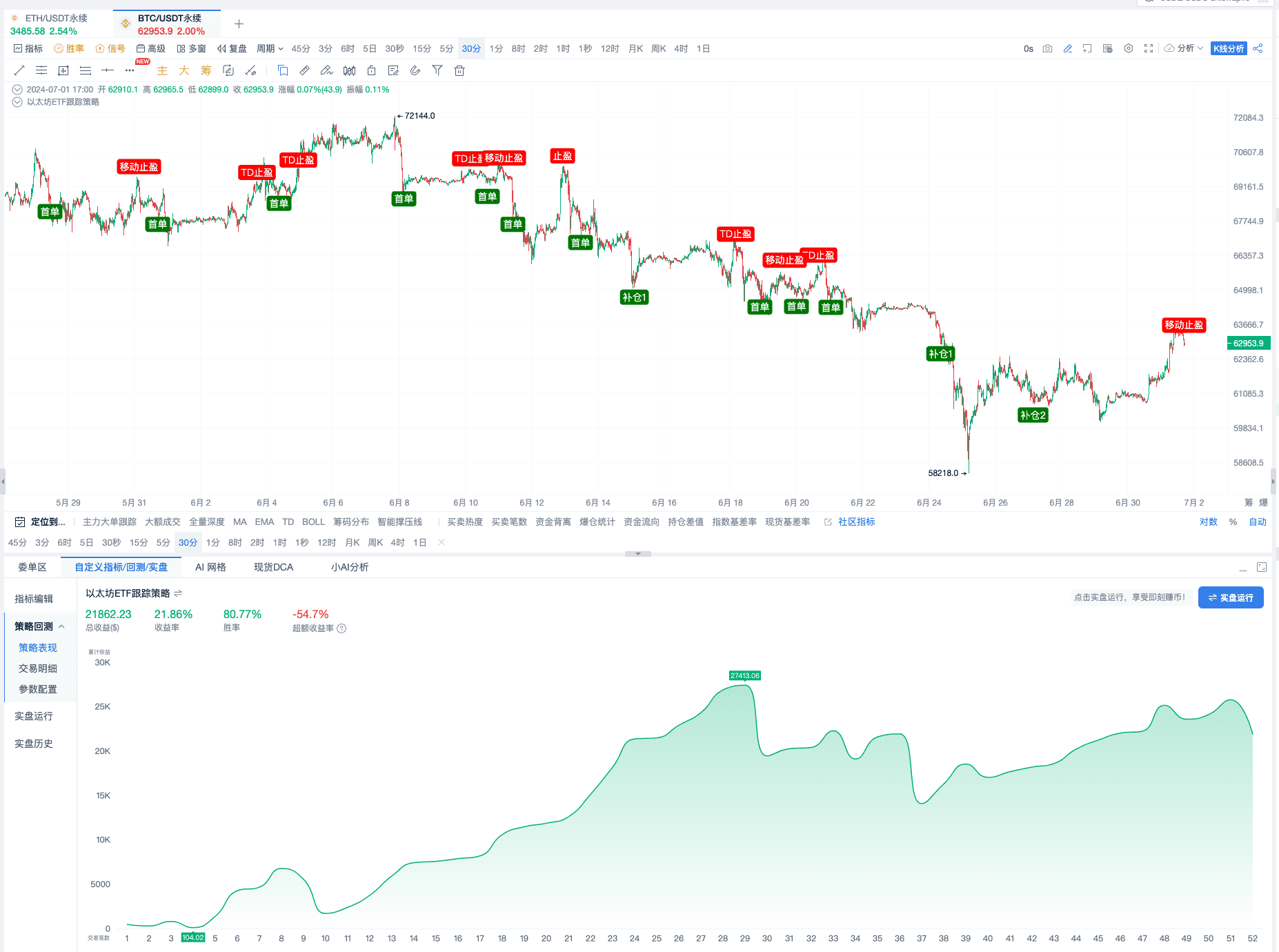

A good tracking strategy is needed. Let's take a look at Binance ETH. After backtesting, this is a relatively high winning rate Ethereum tracking strategy, with the latest real-time results.

- Of course, it also has its drawbacks. The drawback is that it has not generated excess returns; the advantage is a high winning rate and good signal quality.

IV. Ethereum ETF Tracking Strategy Principle

The core underlying principle is very simple; first, it is bullish, but it needs to find a downtrend signal within the uptrend.

- The most basic signal is TD. We know that TD is very suitable for oscillating upward trends.

Using TD as the signal source and DCA as the trading logic.

- How to use TD and Ethereum ETF strategy

The core is a position replenishment mechanism; when it falls to TD9, we open a position. If the price continues to a certain stage, we can use the DCA mode to replenish and lower the cost, triggering 3 replenishments, and be aware of the risk of sustained unilateral decline.

- How to deal with strategy risks

In the first stage, we need to identify the fundamentals and fund flows; if this replenishment continues to decline, we can set a stop loss. Therefore, the strategy still needs to include some stop-loss operations.

Show it on the candlestick chart, and see what the first order explained by this strategy means.

There are related risks if the replenishment is not sufficient.

- The reason this strategy is currently suitable for ETH

The reason is the recent ETF expectations, increased institutional holdings of ETH, etc.; in fact, as long as it is a coin you are bullish on, you can use this strategy. However, this strategy, like its backtesting results, is not 100% accurate, with a close to 20% stop loss probability; but the winning rate will decrease, with only a 73% winning rate.

It will perform better in a 15-minute chart, as shown in the figure below.

An invitation system has been set up for those interested.

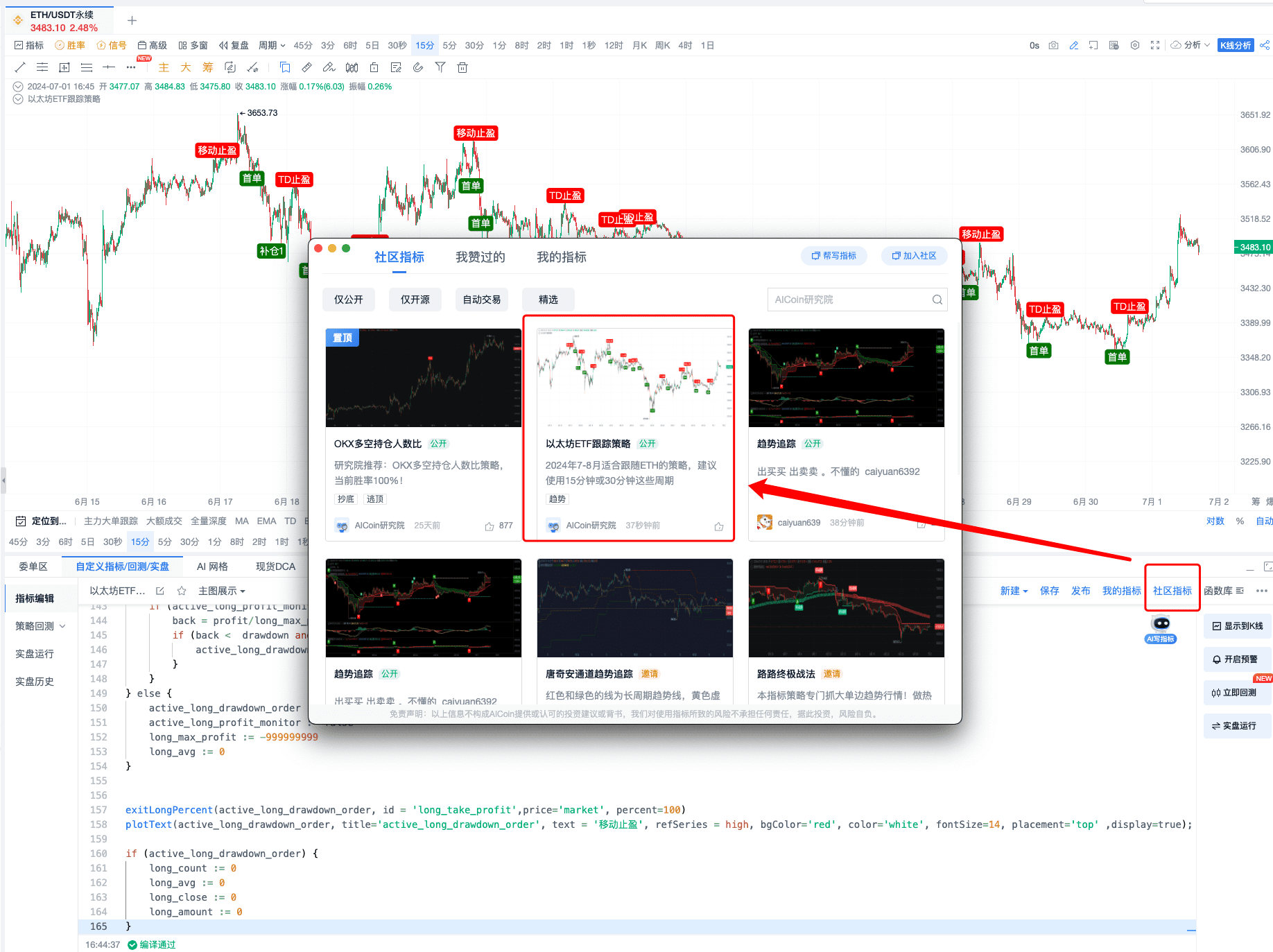

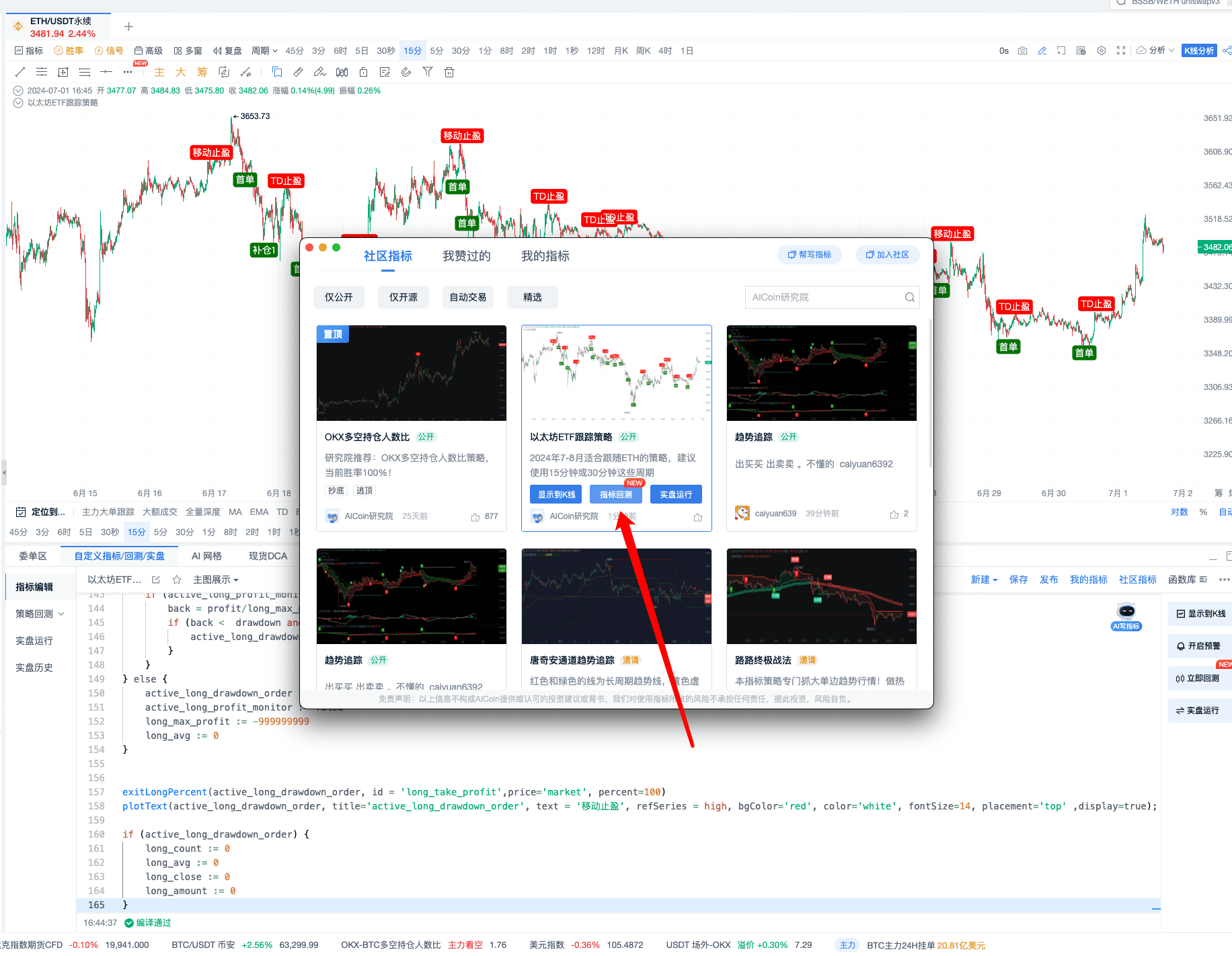

As shown in the figure below, you can click to subscribe and view.

V. Strategy Backtesting Inclination

It is recommended to conduct backtesting on coins with relatively high certainty, such as ETH, which is suitable for your own investment. You can also use it to backtest the currency pairs you want.

Tools are always at our service; you can directly search for and use the latest version of the backtesting tool on your computer.

- After opening the ETH currency pair, click on the community indicators at the bottom.

- Try backtesting BTC with this strategy; BTC will lose on a 15-minute cycle.

But if you look at a longer period, such as 30 minutes, this strategy is also suitable for BTC.

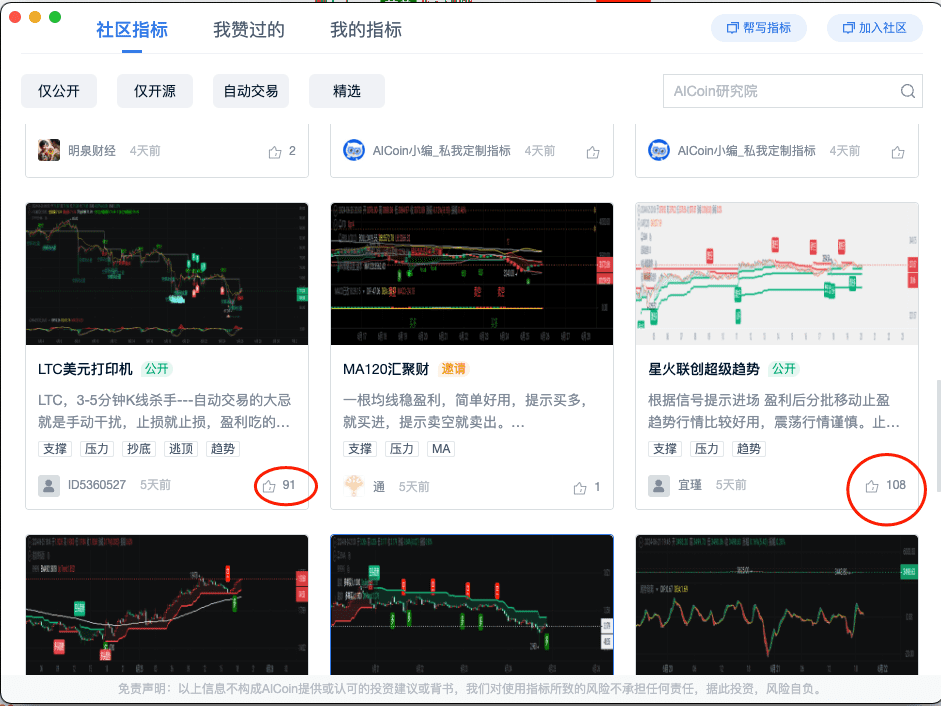

- These two strategies have a high number of likes; let's see how their quality is.

The first one has a good winning rate, but currently has some losses.

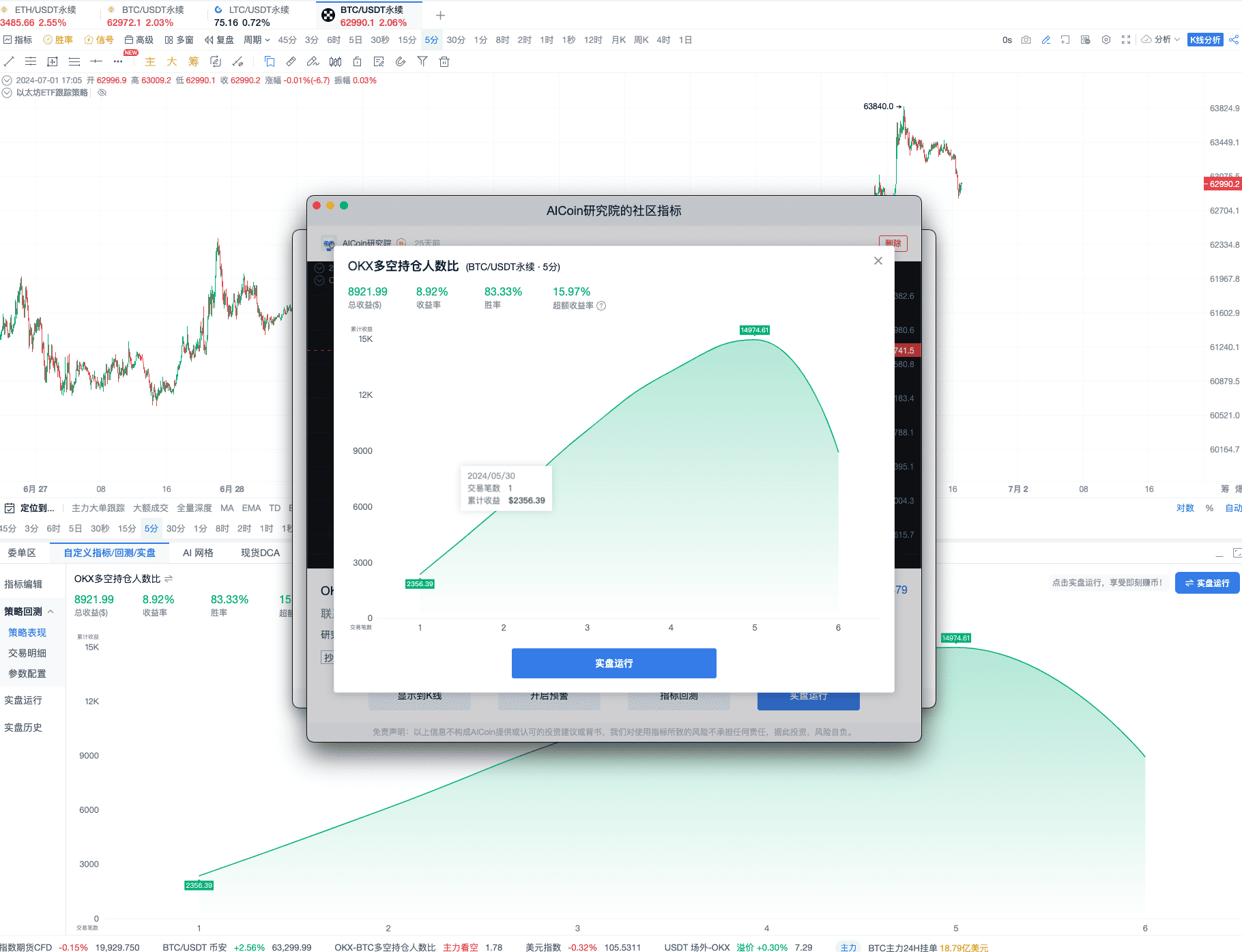

The second one has not opened for backtesting, so it will not be evaluated. The first OKX long/short position ratio I pinned also has a high winning rate.

Members will have more rights, similar to just now, backtesting indicators, and members have many similar indicators in the indicator community; there are also many in the member benefits, and they also have a member identity label, which can be seen in the Aicoin dynamic square and group chat.

If you encounter any problems after opening, you can join Aicoin's PRO membership, and we will have a professional member team for interaction in the PRO CLUB group chat with friends. https://www.aicoin.com/zh-Hans/vip

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。