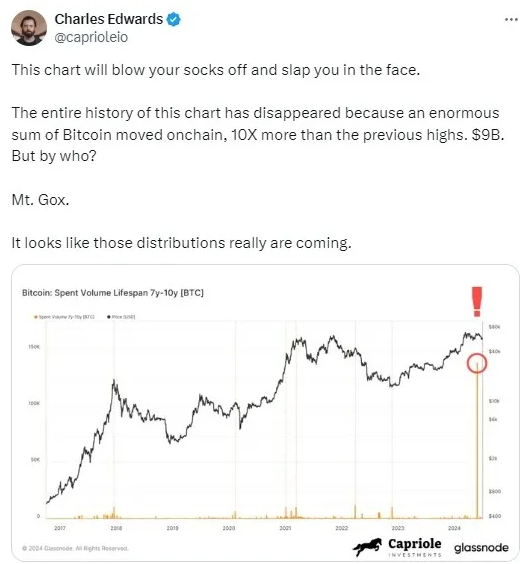

On Wednesday (July 3), in the Asian market, Bitcoin fell below $61,000 in the short term. The news of Mt.Gox's repayment of 142,000 bitcoins has struck a blow to the market, and creditors may consider profit-taking, exacerbating the selling pressure and panic in the cryptocurrency market. Former Chinese richest man Zhao Changpeng (CZ) is in prison, and the U.S. Securities and Exchange Commission (SEC) is still pressing hard on Binance.US, emphasizing its readiness for a long-term legal battle.

The news of Mt.Gox compensating creditors was released earlier this year. However, the current market concern is that since February 2014, Bitcoin has risen from $850 to over $60,000. Creditors may trigger a wave of selling.

Industry insiders believe that since 2014, Bitcoin has risen nearly 74 times. After receiving compensation, creditors are likely to create selling pressure, especially those holding a large amount of Bitcoin who may take partial profits. This could also trigger panic among other investors, leading to further selling of Bitcoin.

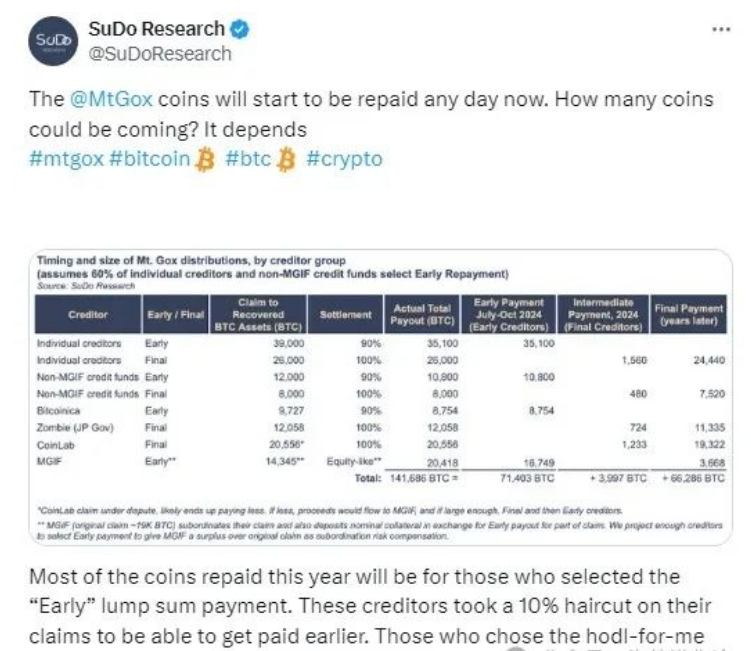

Furthermore, looking at the repayment plan provided by Mt. Gox to creditors, it includes basic and proportional repayments. The basic repayment allows creditors to receive the first 200,000 yen in Japanese fiat currency, while the proportional repayment offers the option of early lump-sum repayment or midterm and final repayments. The former involves partial cash payment, partial Bitcoin payment, or Bitcoin Cash (BCH) payment, while the latter will be repaid in installments at the end of September and in the coming years. This means that creditors may not receive full compensation in Bitcoin at once, reducing the possibility of a single creditor selling a large amount of Bitcoin.

However, selling pressure does not necessarily lead to a drastic price drop. Industry insiders analyze that the news of Mt. Gox's compensation has already caused significant panic, and the early investors in the cryptocurrency market, who have been waiting for a decade to claim compensation, may not be in a rush to liquidate their virtual assets. This is especially true for investors who are committed to long-term holdings.

Nevertheless, in the short term, the selling pressure sentiment remains strong.

The regulatory uncertainty of the U.S. SEC towards the cryptocurrency industry persists. The regulatory agency has previously sued Binance.US and its founder Zhao Changpeng. Binance.US, the U.S. branch of the world's largest cryptocurrency exchange Binance, is currently preparing for a legal battle with the U.S. SEC.

Binance.US stated that it is prepared for a long legal investigation. The company emphasized, "Last Friday, the court ruled that the U.S. SEC's lawsuit against Binance.US will continue. We are prepared and look forward to the case progressing through the judicial process."

The SEC's charges against Binance.US revolve around violations of securities laws, including offering unregistered investment products and anti-fraud violations.

Binance.US reiterated its commitment to serving its U.S. customers in full compliance with U.S. regulations.

The exchange stated, "We maintain a 1:1 reserve for all customer assets and have a strong compliance and risk management program to ensure the security, safety, and integrity of our platform."

Binance.US also criticized the SEC's regulatory approach, describing it as "regulation through enforcement." The company attributed its legal challenge to the political motivations of the government led by SEC Chairman Gary Gensler. Binance.US emphasized, "Unfortunately, like many companies in the industry, we have become victims of the political overreach and enforcement-based regulation under the current leadership of the U.S. SEC."

Binance believes that after 11 months of investigation, the U.S. SEC has still not found any evidence of illegal behavior by Binance.US. The company believes that the SEC's case does not align with the facts or the law.

However, the U.S. court did not dismiss most of the SEC's charges against Binance.US in the court documents filed on June 28. The document also supports the regulator's accusation that Zhao Changpeng acted as a "controller," while Binance attempted to dismiss this accusation.

Bitcoin Technical Analysis

CMTrade stated that Bitcoin's RSI is below 50, the MACD is below its signal line and is negative, indicating a negative configuration.

In addition, the price is below its 20 and 50-period moving averages, which are $62,265 and $62,653, respectively.

"Our pivot point is at $62,730, and our preference is for a downward trend as long as $62,730 is a resistance level."

"An alternative scenario is a rise above $62,730, targeting $63,610 and $64,130."

If you are not good at selecting strong coins, then I suggest you pay attention to me. Whether it's spot or contract trading, a slight move may be your limit. Opportunities are fleeting, so be sure to seize them! Success is not just about luck; choice is greater than effort. In the cryptocurrency circle, apart from having a keen eye for the market, you also need to follow a good team and a good leader. By following me, you are already halfway to success in the cryptocurrency circle!

If you want to learn more about the cryptocurrency circle and get firsthand cutting-edge information, feel free to consult me. We have the most professional cryptocurrency community, and we publish market analysis and recommend high-quality potential coins daily. If you want to navigate the bull and bear markets, make your profits double in the bear market, and break free from the constraints of the market,

feel free to message me to join us → VX: BTC0700

Join the group to discuss and learn professional knowledge about the cryptocurrency circle, and avoid being a victim in the market.

(You can receive position allocation strategies, learn how to make money in the bull market, and earn coins in the bear market.)

Investment carries risks, so be cautious when entering the circle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。