Token economics is composed of two words: "Token" and "Economics." It covers aspects such as token issuance, supply, distribution, and liquidity provision. Understanding token economics is one of the most important skills in the cryptocurrency field. Without a deep understanding of a project's token economics, you may be at the mercy of the market or make speculative investments, which often makes it difficult to achieve investment success.

The Importance of Understanding Token Economics

A project's token economics demonstrates to potential investors that the cryptocurrency's developers have built a strong ecosystem for it. Well-constructed token economics means that over time, demand for such digital assets will increase exponentially, and investors' investments may potentially yield substantial returns.

Investors delve into token economics to identify whether a cryptocurrency has a sustainable economic model. Well-thought-out token economics is crucial for the longevity and success of a cryptocurrency project, as it can significantly impact the attractiveness and value of the cryptocurrency to investors. For example, poorly designed economic models, if the supply far exceeds demand, may lead to inflation, causing the token's value to decrease over time.

Metrics Investors Need to Pay Attention To

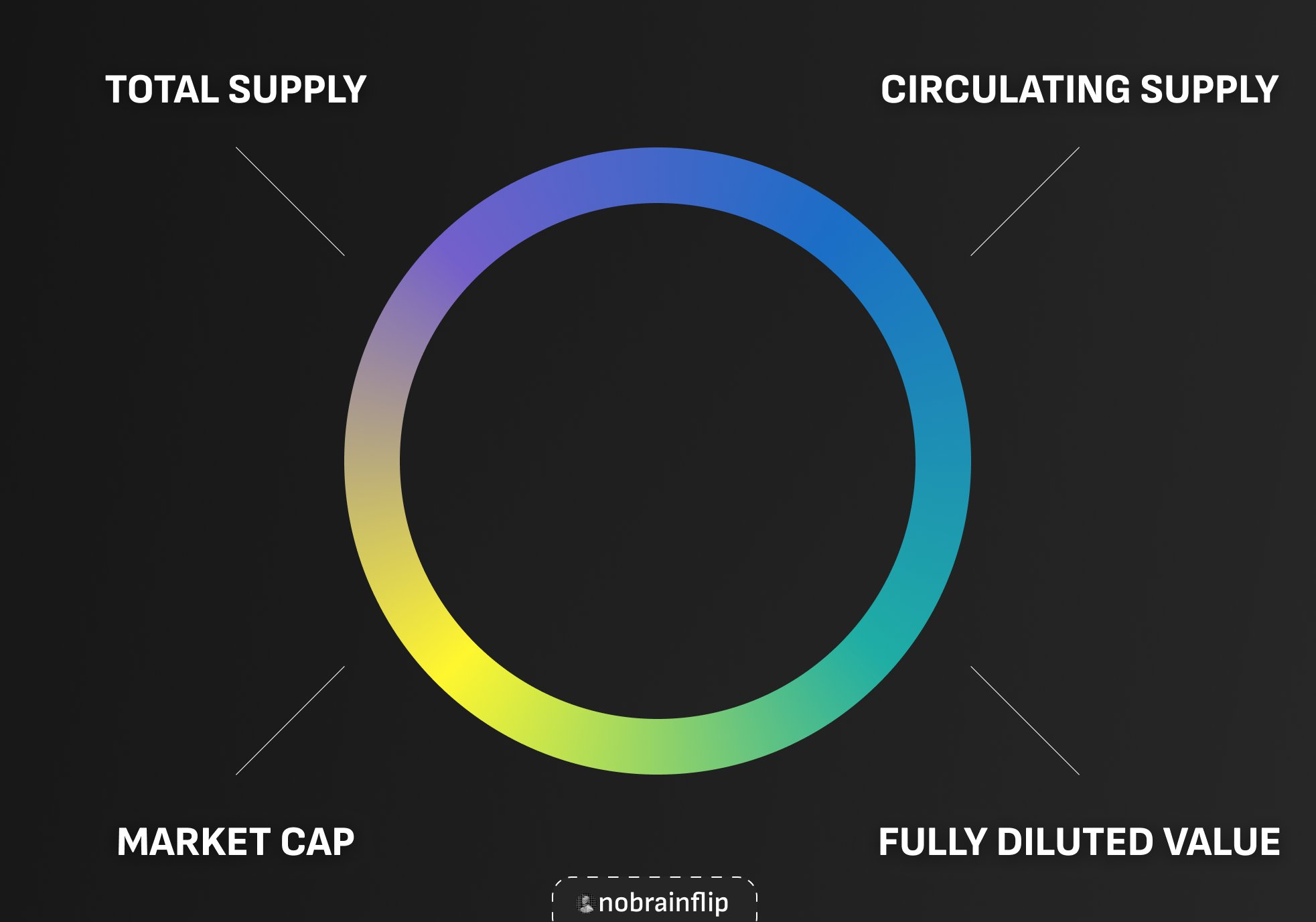

1. Market Cap

Market cap is the total value of all circulating tokens in the current market. It is an important metric for evaluating the token's market size and potential for growth.

2. Fully Diluted Value (FDV)

FDV refers to the total value of all tokens (including unreleased tokens). It helps investors understand the full potential and future market size of the token.

3. Circulating Supply and Total Supply

Circulating supply is the actual number of tokens in circulation in the current market, while total supply is the maximum number of tokens set at the project's creation. These two data points help investors evaluate the scarcity and potential for growth of the token. For example, Bitcoin will only ever have 21,000,000 coins, and currently, its circulating supply is 19,719,000 coins.

4. Inflation and Deflation

Understanding whether a token is inflationary or deflationary is crucial for evaluating its long-term value. Inflationary tokens may decrease in value due to increased supply, while deflationary tokens may increase in value due to decreased supply. For example, Bitcoin's issuance is halved approximately every 4 years, introducing a deflationary mechanism into Bitcoin's economic model.

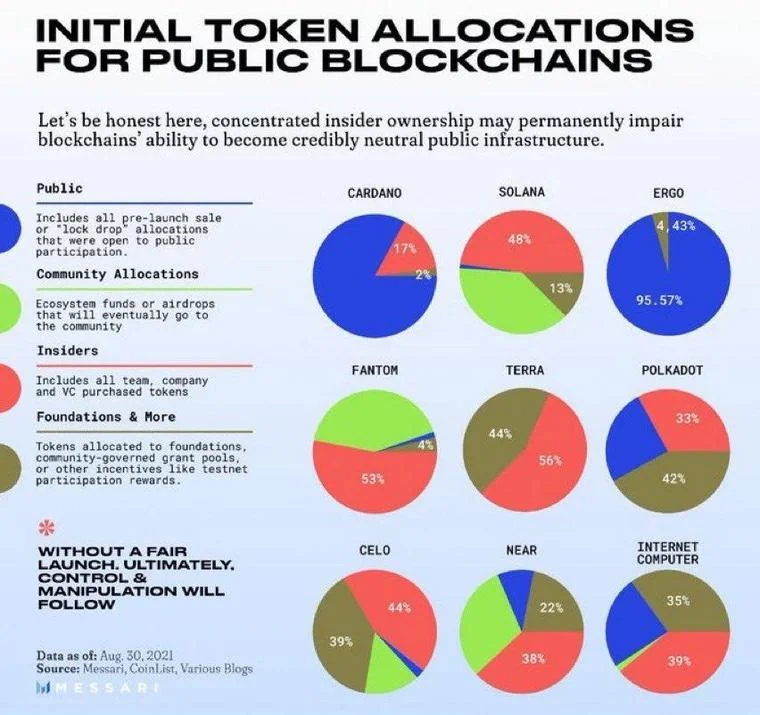

5. Distribution and Allocation Mechanism

The distribution and allocation mechanism of a token, such as pre-mining and fair distribution, directly impact the token's liquidity and price stability in the market. Understanding the token's distribution, especially lock-up periods and cliffs, can help investors assess market risks.

The Role of Token Economics in Investment Decisions

Token economics is crucial because traditional asset valuation methods (such as stock or bond valuation methods) cannot be directly applied to the cryptocurrency world. Each cryptocurrency has a unique set of rules involving supply, issuance, and other technical factors. Therefore, token economics is something investors must study before making investment decisions.

By delving into token economics, investors can better understand the sustainability and potential value of a project, thus making wiser investment decisions.

The following is a complete guide to token economics in Chinese, reorganized by the editor based on the social media posts of the crypto KOL Cyclop.

Initial Understanding of Tokens

When you start researching a potential token, such as on the CoinMarketCap, you will see the following information:

- Market Cap (MC): The total value of all circulating tokens in the current market.

- Total Supply: The total quantity of tokens that can exist.

- Circulating Supply: The actual number of tokens in circulation in the current market.

- Fully Diluted Value (FDV): The total value of all tokens (including unreleased tokens).

Understanding these basic supply metrics can help you evaluate the potential of the token. However, to do this, you need to understand how they operate and their impact on prices.

Supply Types

Tokens have two supply paths:

- Inflation: Token supply can increase, a situation known as release. This typically leads to a decrease in token value, but if the release rate is slow and the quantity is small, the impact may not be significant.

- Deflation: Token supply decreases over time. This occurs when a project repurchases and burns tokens. In theory, reducing supply should increase value, but this is only theoretical.

Distribution and Allocation

The primary factors determining token issuance and lifespan are the distribution and allocation methods. There are two main methods:

- Pre-mining: Distribution among early investors, teams, advisors, etc.

- Fair distribution: Equal purchasing eligibility for everyone.

Most projects use the pre-mining method, and it is crucial to understand the token's distribution and unlocking situation.

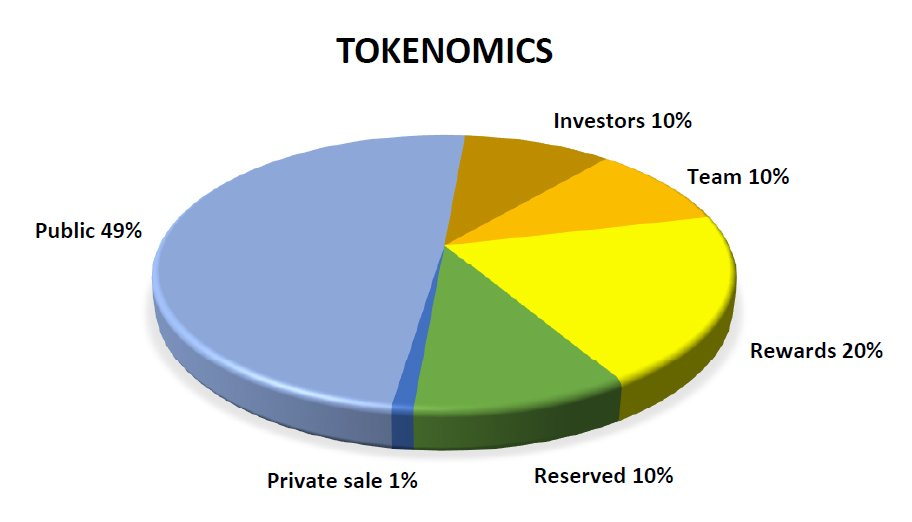

Key Metrics

- Token Generation Event (TGE) Allocation: Percentage of tokens allocated to all the above individuals (10-20%).

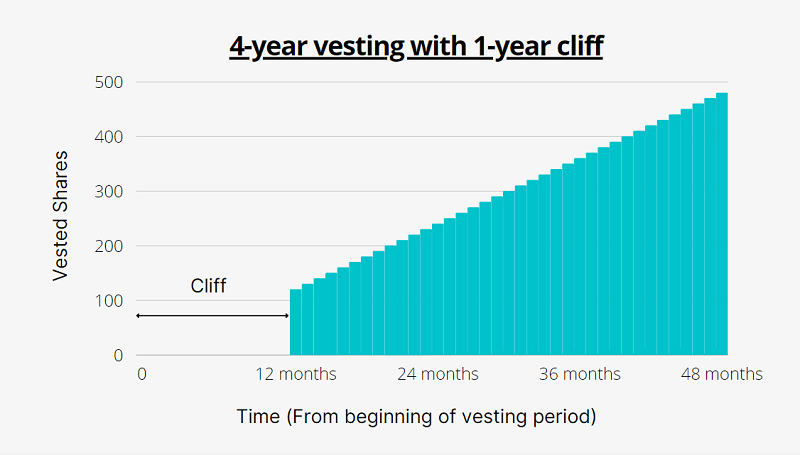

- Cliff: The period between TGE and the next Vesting (token lock-up) period.

- Vesting: Gradual release of a certain percentage of tokens monthly.

Token allocation typically includes the following recipient types:

- Private sale (investors, KOLs, etc.)

- Public sale (retail investors)

- Marketing

- Ecosystem (equity, rewards, etc.)

- Airdrop

How are tokens sold?

If the TGE is 100%, and 50% of the tokens are allocated to investors, investors can sell tokens at any time, while retail investors may become the buyers of liquidity exits.

Recently, some projects have adopted a method with a smaller TGE percentage (up to 20%), followed by several months of cliff and over 12 months of vesting. This method is more suitable for the long-term success of the project, so it is crucial to verify all these details before investing.

Another key factor for the success of any token today is demand. This is why project teams incentivize retail investors to purchase specific tokens. For example, despite severe inflation, people still buy the US dollar because they need it to live.

Demand-Driven

Demand is a key factor for the success of any token. The following four factors can drive demand for a token:

- Store of value: Cryptocurrencies can serve as a store of value, with Bitcoin often being likened to "digital gold."

- Community-driven: The power of the community can strongly drive demand, as seen in the rise of meme tokens.

- Utility effect: When holding a token provides some utility, it stimulates demand, such as staking tokens.

- Value accumulation: By rewarding equity holders, long-term token holding is encouraged.

To incentivize holders, there are various methods to reduce selling pressure:

VeToken

Accumulate voting power by holding tokens to receive VeTokens, where "Ve" stands for voting custody. The longer you hold, the greater the accumulated voting power, which can influence project decisions.

Mining

The more tokens held, the higher the mining yield. Token holders can increase their yield by locking up tokens.

Key Checks Before Investment

Before making an investment, the following points need to be analyzed in detail:

- Total supply and circulating supply: Understand the scarcity of the token.

- Distribution and allocation: Ensure the distribution method is reasonable and avoids concentration of holdings.

- Lock-up period/unlocking date: Understand when the tokens will enter the market.

- Percentage of release: Analyze the quantity of tokens released each time.

- Demand: Evaluate the market demand for the token.

Through this analysis, you can better determine whether the project is worth investing in. Although projects with poor token economics may rise, and those with good token economics may fall, conducting this analysis can significantly increase your investment success rate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。