Introduction

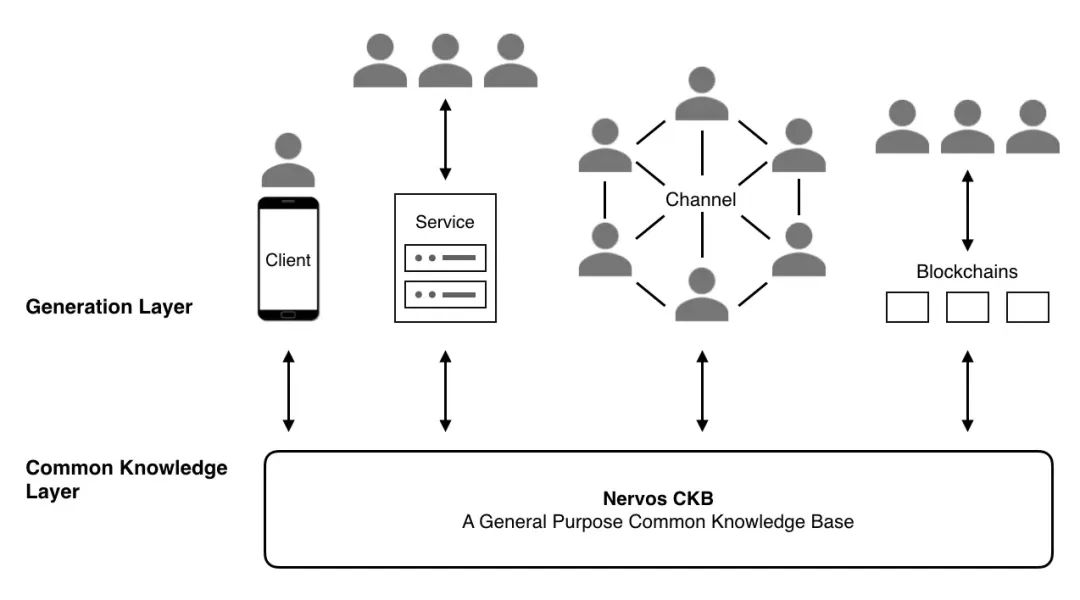

As a public chain, Nervos Network aims to solve the scalability limitations faced by traditional networks such as Bitcoin and Ethereum.

The Nervos blockchain uses the Proof of Work (PoW) consensus and supports Layer-1 protocol for smart contract development, along with a series of Layer-2 scaling solutions to facilitate large-capacity use cases. Nervos' native token (CKByte or CKB) allows users and developers to apply for storage space on the Nervos blockchain based on their holdings.

On February 13, 2024, Nervos Network announced the launch of a new product: RGB++. Nervos Network has embarked on a transformation journey from Layer-1 to Bitcoin Layer-2, leveraging its own advantages to focus on Bitcoin's second-layer expansion.

Project Basic Information

Project Team

Core Team

Jan Xie: Founder and Chief Architect. Also the founder of Cryptape, former researcher and developer at the Ethereum Foundation, focusing on Casper and Sharding, co-founder of ethfans.org, and former architect of Peatio.

Inal Kardan: Co-founder and CEO. Core developer at Yunbi & Peatio, co-founder of Teahour, with extensive development experience.

Kevin Wang: Co-founder. Graduated in Telecommunications and Networking from the University of Pennsylvania, with a bachelor's degree. Previously worked on enterprise data solutions at IBM Silicon Valley Lab. Also a co-founder of Khalani, an intent-driven centralized solver infrastructure.

Daniel Lv: Co-founder and COO. Former Chief Technology Officer at imToken (the world's largest Ethereum wallet), former Chief Technology Officer at Yunbi, co-founder of ruby-china.org, and former senior engineer at Intridea.

Cipher Wang: Co-founder. Graduated from Peking University. Chief Product Officer at Cryptape, former director of the Blockchain Laboratory of China Banknote Printing and Minting Corporation.

Funding Status:

Nervos Network has raised approximately $100 million through two rounds of financing.

Seed Round

In August 2018, led by Polychain Capital, with participation from Sequoia China, Matrix Partners China, Blockchain Capital, and others. The amount raised was $28 million.

Series A

On October 16, 2019, Nervos Network completed its ICO on Coinlist, raising $72 million.

During the two rounds of financing, Nervos Network raised a total of $100 million, with significant investments from well-known investment institutions such as Polychain Capital, Sequoia China, Matrix Partners China, and Blockchain Capital, indicating strong support from renowned capital sources.

Development Strength

In 2018, Nervos Network was initiated by founder Jan Xie. Key events in the project's development are as follows:

Year

Key Event

Progress

2018

Jan Xie announced the launch of Nervos Network

Completed

2018

Nervos Network completed the first round of financing, raising $28 million

Completed

2019

Nervos Network's mainnet launched, and related code was open-sourced

Completed

2021

Nervos Network's token CKB listed on exchanges

Completed

2024

Release of RGB++ protocol v0.1 standard, and open-sourcing of fungible and non-fungible token standards

Completed

2024

Integration of JoyID Passkey wallet with RGB++ assets

Completed

2024

Launch of interchangeable and non-interchangeable coin issuance SDK and toolkit for RGB++

Completed

2024

Release of RGB++ smart contract development documentation and SDK

Completed

2024

Code audit and open-sourcing of RGB++ protocol implementation

Completed

From the key events in Nervos Network's project development, it is evident that Nervos Network has been deeply involved in the UTXO model within the Bitcoin network, positioning itself as a leader in the UTXO model research field, which has formed a technological barrier for Nervos Network. Additionally, Nervos Network has consistently met project development milestones, indicating the robust technical strength of its team.

Operating Mode

On February 13, 2024, Nervos Network upgraded its business by introducing the RGB++ product, transitioning the project from its original public chain to the current BTC-L2 track.

RGB

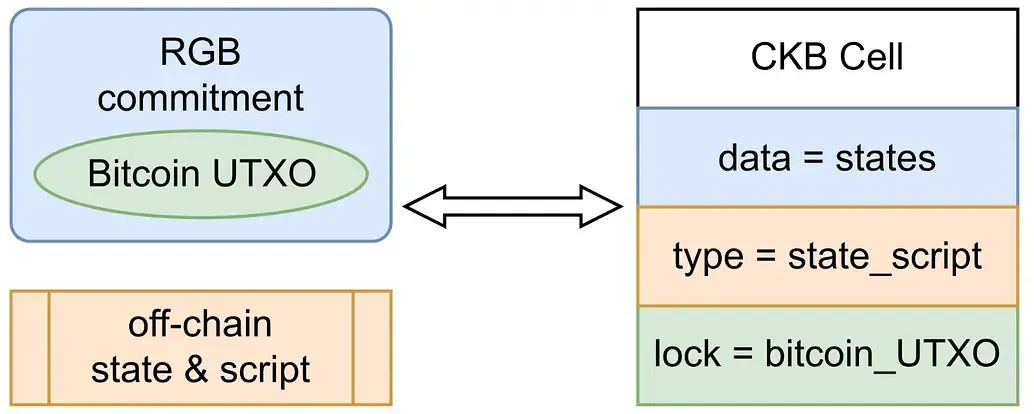

The RGB protocol is an extension protocol for BTC, essentially a layer-2 computation system. It adopts a similar approach to the Lightning Network: users personally verify and authorize asset changes related to themselves, and submit the results/commitments approved by the transaction initiator to the Bitcoin chain.

The main focus of the RGB protocol is to establish a mapping relationship between off-chain transaction data commitments and Bitcoin UTXOs, storing commitments of off-chain transactions on the Bitcoin chain instead of publishing complete DA data like the Ordinals protocol. With the commitments recorded on the Bitcoin chain, RGB clients can verify whether the historical data provided by other clients is valid. Additionally, the commitment alone cannot reveal the underlying data, providing privacy protection and saving space compared to plaintext. RGB also leverages the one-time spend feature of Bitcoin UTXOs, associating RGB asset ownership with Bitcoin UTXOs to benefit from Bitcoin's strong security and prevent double spending of RGB assets (as long as Bitcoin UTXOs are not double spent, RGB assets will not be double spent).

However, RGB also has some obvious issues:

As a smart contract system implemented under the Bitcoin chain, it relies on different clients storing historical data locally, with each client only storing data relevant to themselves, creating data silos that protect privacy but pose challenges for large-scale adoption, resembling a P2P network composed of OTC traders (ultimately, this is a problem of the DA layer not being effectively resolved);

To successfully transfer funds to others, users need to obtain the other party's consent and confirmation, with both parties needing to be online simultaneously;

Due to the lack of a globally visible data recording method, contract users need to obtain information about the contract's interface functionality in advance from the contract issuer, typically through email or QR code scanning.

In summary, RGB operates in a relatively "primitive" mode!

RGB++

Nervos Network itself is an extended UTXO model (Cell), capable of writing off-chain information of RGB assets into Cells and establishing a 1-to-1 mapping relationship between Cells and Bitcoin UTXOs, implementing a data custody and verification solution for RGB assets based on the Nervos Network. This addresses usability issues and serves as a strengthened complement to the original RGB solution.

The process of implementing RGB++ technology uses the Cell on the Nervos Network to express the ownership relationship of RGB assets. It moves the asset data originally stored locally in the RGB client to the Nervos Network in the form of Cells, allowing the Nervos Network to act as a public database for RGB assets. The Cells representing RGB assets will have a 1-to-1 mapping relationship with the UTXOs on the Bitcoin chain, and this mapping relationship will be directly displayed in the Lock field of the Cell.

The workflow related to commitments on the BTC chain still takes place on the BTC mainnet, meaning that RGB++ still needs to publish Commitments on the Bitcoin chain to associate with the RGB asset transaction records occurring on the Nervos Network. The responsibilities that clients handle off-chain in the RGB protocol are now handled by the Nervos Network, addressing the data silo issue of RGB clients and the lack of global visibility of contract states. Additionally, RGB contracts can be directly deployed on the Nervos Network chain, providing global visibility for RGB Cells to reference, thus avoiding the series of peculiar operations required when deploying RGB protocol contracts.

Essentially, RGB++ trades privacy for usability, while also enabling scenarios that the RGB protocol cannot achieve. Users who value simplicity, usability, and comprehensive functionality will favor RGB++, while those who prioritize privacy and "Verify by yourself" security will prefer the traditional RGB protocol. It ultimately depends on the users' preferences (similar to Vitalik's comments on Ethereum Layer 2: use Rollup for security, and non-Rollup solutions like Validium and Optimium for cost-effectiveness).

In summary, after the launch of RGB++, Nervos Network has changed its original narrative and become a BTC-L2 project. It mainly uses Cells to express the ownership relationship of RGB assets and establishes a 1-to-1 mapping relationship between Cells and Bitcoin UTXOs, addressing the data silo and operational difficulty issues of the original RGB, enhancing the local Bitcoin experience without adding complexity or compromising decentralization. Nervos Network has managed to retain the transaction purity of the Bitcoin UTXO model while making it possible to deploy smart contracts on BTC-L2.

Technical Features

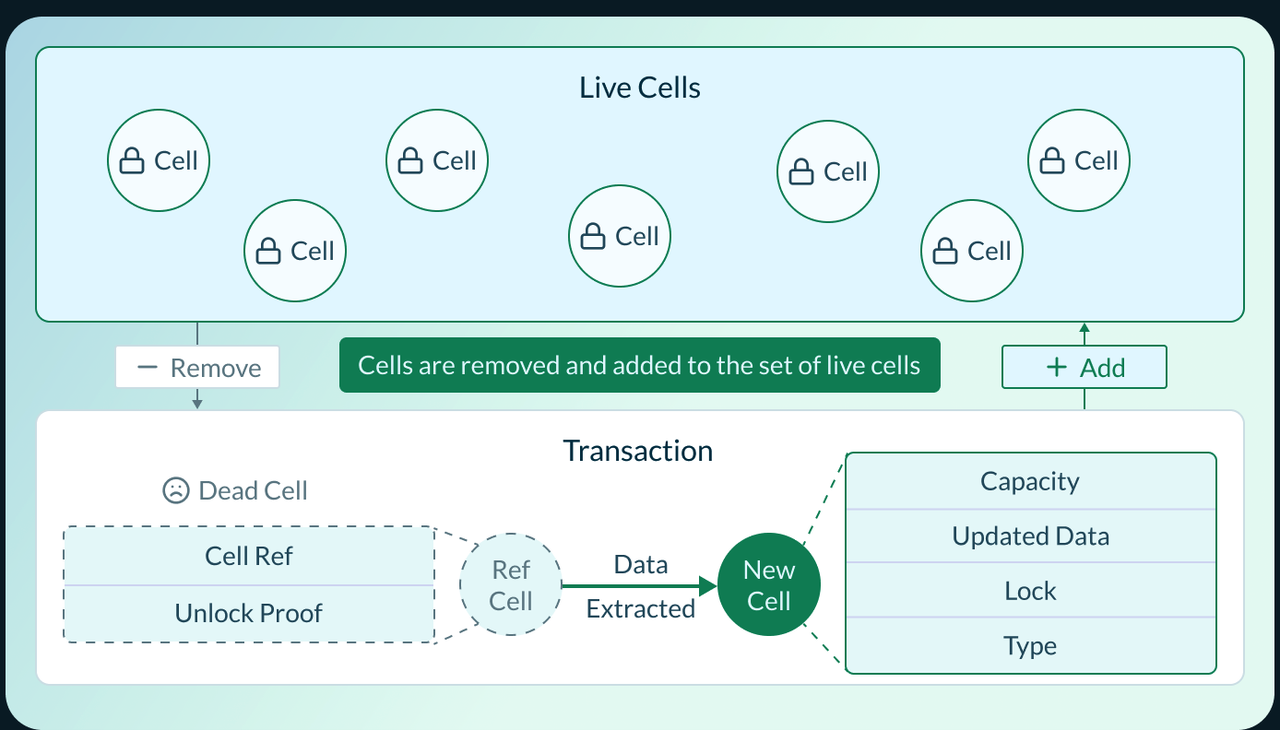

Cell Model

The construction of the Cell model is the key to Nervos Network's successful transformation and to RGB++. The Cell model is an upgraded version of UTXO, retaining the transaction purity of the Bitcoin UTXO model while providing the data state of account models like Ethereum.

The Cell model includes four fields: Capacity, Type, Data, and Lock:

Capacity represents the size of the space that this Cell owns on the chain;

Data refers to the data set contained within the Cell, which can be read or modified;

Type is the program code bound to this Cell, restricting the modification conditions of the data;

Lock represents the ownership verification logic of the Cell, similar to the unlocking script of a Bitcoin UTXO.

From these fields, it can be seen that the Cell is an upgraded version of UTXO, with the addition of the Capacity and Type fields, and the Data field allowing for custom data types. As for the change of ownership of the Cell, it is similar to that of a Bitcoin UTXO, achieved through the unlocking script. The most important field is the Data field, which is primarily used to store any form of data, such as historical transaction states, similar to the DA layer in Ethereum's modularity. The biggest issue with the previous RGB project was the lack of data availability.

Non-Interactive Transactions

An important issue with the RGB protocol is that the payee must first send a message to the payer, indicating the binding of one of their UTXOs with the RGB asset, before an RGB transfer can be successfully implemented. This requires multiple interactive communications between the payee and the payer to complete a regular transaction, which clearly increases user understanding difficulty and product complexity. RGB++ utilizes the characteristics of the Nervos Network as a data custody and computation platform, allowing parties to complete transfers asynchronously and non-interactively.

Interaction with Bitcoin Chain Assets without Cross-Chain Transactions

As a layer-2 settlement layer, Nervos Network aggregates a batch of transactions after multiple RGB transfers occur, generates a Commitment for the corresponding batch of transactions, and publishes it once on the Bitcoin chain. After establishing the associated mapping between Bitcoin UTXOs and Nervos Network Cells, RGB++ can directly achieve interoperability without the need for cross-chain asset transactions. Through RGB++ transaction declarations, you can transfer your Bitcoin UTXOs to others, and the recipient can transfer their CKB asset ownership to you. This model has great potential and theoretically enables BTC-Nervos Network asset interoperability without the need for BTC asset cross-chain transactions.

Payment Channels

As a foundational public chain, Nervos Network has the ability to extend through payment channels, such as the payment channel framework Perun developed by Polycrypt. These payment channels can process transactions off-chain and settle on-chain, supporting various applications such as micropayments to payment gateways, thereby improving the performance of Nervos Network. Perun utilizes the Cell model of Nervos Network, where Cells carry capacity, Lock Script, Type Script, and data to manage the channel's state. One implementation of the channel (PerunLockScript) can manage real-time access permissions for the channel's Cells, while another implementation (PerunTypeScript) can handle the verification logic of state transitions. From obtaining funds to closure, these transitions are automatically managed. Nervos core developers are also working to connect CKB to Bitcoin's Lightning Network, enabling users to exchange BTC and Nervos Network without relying on third parties.

Project Model

Business Model

The Nervos Network economic model consists of three roles: POW miners, application developers, and blockchain application users.

POW Miners: Nervos Network adopts the Proof of Work (PoW) consensus mechanism, using an upgraded version of the Bitcoin algorithm called NC-MAX, and employs the Eaglesong function to ensure network security. Eaglesong is an ASIC-resistant custom hash function that can replace the widely used SHA256 hash function. POW miners protect the security of the chain and maintain the normal operation of Nervos Network by adhering to the consensus mechanism, and in return, they receive block rewards as economic incentives. After the halving in 2023, the annual issuance of CKB decreased from 4.2 billion to 2.1 billion.

Application Developers: As a BTC-L2 project, the success of Nervos Network depends in part on the prosperity of its own ecosystem. Therefore, Nervos Network places great importance on its ecosystem development, providing greater innovation space for developers. Application developers will occupy a certain on-chain space when developing projects, and will pay a certain storage fee to Nervos Network, which is also one of Nervos Network's sources of income.

Blockchain Application Users: The gas fees paid by users on Nervos Network are the main source of income for Nervos Network.

From the above analysis, it can be seen that Nervos Network's income comes from:

- Gas fees paid by blockchain application users

- Storage fees paid by application developers

Token Model

Token Allocation

The unique economic model of CKB ensures that miners receive rewards permanently regardless of transaction volume, incentivizing them to provide security for the network. It also ensures that CKB tokens can act as hard assets, preventing dilution of the interests of long-term holders. The economic model of CKB creates a flywheel effect, where the demand for holding CKB blockchain assets directly generates demand for CKB tokens. This creates a value capture mechanism for the native token CKB, ensuring that the security of the CKB blockchain is directly proportional to the value of the assets it protects.

The total supply of CKB is unlimited, with the initial issuance totaling 33.6 billion tokens, which have already been fully unlocked.

The allocation of CKB in the Genesis block is as follows:

- Private Sale: 14%, 4,704,000,000, 2/3 in circulation at mainnet launch, fully unlocked by May 1, 2020

- Public Sale: 21.5%, 7,224,000,000, 1/5 in circulation at mainnet launch, no lock-up

- Team: 15%, 5,040,000,000, 1/3 in circulation at mainnet launch, 50% unlocked by May 1, 2020, 66.66% unlocked by May 1, 2021, 100% unlocked by May 1, 2022

- Strategic Partners: 5%, 1,680,000,000, 25% unlocked by May 1, 2020, 50% unlocked by May 1, 2021, 100% unlocked by May 1, 2022

- Ecosystem Fund: 17%, 5,712,000,000, not in circulation at mainnet launch, 25% unlocked by July 1, 2020, 50% unlocked by December 31, 2020, 100% unlocked by December 31, 2022

- Foundation Reserve: 2%, 672,000,000, used for "public interest" state storage capacity, and in circulation at mainnet launch

- Testnet Rewards: 0.5%, 168,000,000, used for mining competitions and bug bounty program rewards for testnet participants

- Burn: 25%, 8,400,000,000, burned in the Genesis block and will never enter circulation

To provide continuous rewards to miners, the Nervos team has designed a secondary issuance.

The purpose of the secondary issuance is to collect state rent, ensuring that miners receive compensation for protecting the network's security regardless of the on-chain transaction volume. The secondary issuance has no limit and follows a fixed issuance plan of 1.344 billion CKB per year. However, unlike the base issuance, which is entirely for miners, the secondary issuance is allocated among miners, NervosDAO depositors, and the treasury fund.

The specific allocation ratio of the secondary issuance depends on how circulating CKB is used on the network. For example, if 50% of circulating CKB is used for state storage, 30% is locked in NervosDAO, and 20% is fully liquid, then 50% of the secondary issuance will be allocated to miners, 30% to NervosDAO depositors, and the remaining 20% to the treasury fund. Currently, the secondary issuance deposited into the treasury fund is directly burned, but this may change in the future through community-initiated hard forks. It is important to note that the inflationary impact of the secondary issuance is limited and only affects state occupiers, meaning that CKB can serve as both a deflationary token for long-term holders and an inflationary token for blockchain users.

Nervos' token economics aims to address the issues of state explosion and value consistency that plague mainstream blockchains. This is achieved through three main ways: tying state growth to CKB token, privatizing state space, and introducing secondary issuance to transfer state rent from state occupiers to miners or state protectors.

Token Empowerment

Originally designed as a Layer-1, the native token CKB primarily serves as the network transaction fee within Nervos Network, also known as gas fees. All operations on Nervos Network require payment in CKB.

Staking: Users can stake CKB in NervosDAO and receive secondary issuance CKB tokens as inflation rewards based on the proportion staked.

Store of Value: Storing data or occupying state space on the chain requires locking CKB, creating direct long-term demand for CKB tokens. This means that holding non-native assets on the blockchain requires holding native tokens, increasing the value of the native token and subsequently increasing miner rewards, thereby enhancing the security of the chain. This incentive structure aligns with the goal of CKB as a "asset storage" platform, as its primary goal is not to facilitate as many transactions as possible, but to securely store and protect assets in the long term.

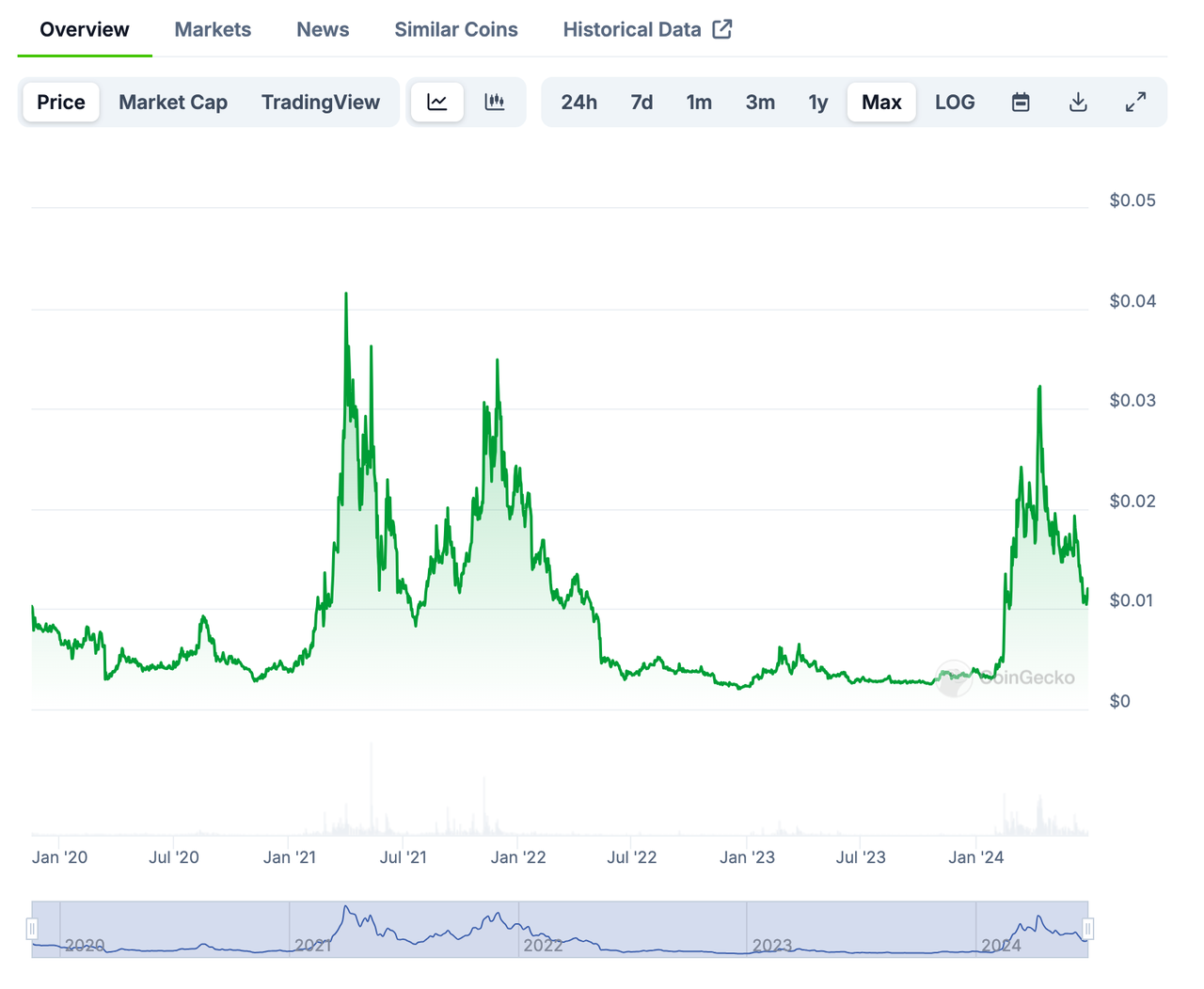

Token Price Performance

According to Coingecko statistics, CKB has increased in price by over 11 times in the past year since June 2023 (from a low of $0.0028 to a high of $0.0322), with major trading venues including Binance and HTX.

The current price of CKB is $0.0115, with a circulating supply of 44,442,588,518 tokens, and a market capitalization of $514.83 million.

The daily trading volume of CKB is $36 million, with a circulating market capitalization of approximately $514.83 million, resulting in a turnover rate of 6.99%, which is relatively low.

Therefore, compared to similar projects, CKB's value is significantly undervalued.

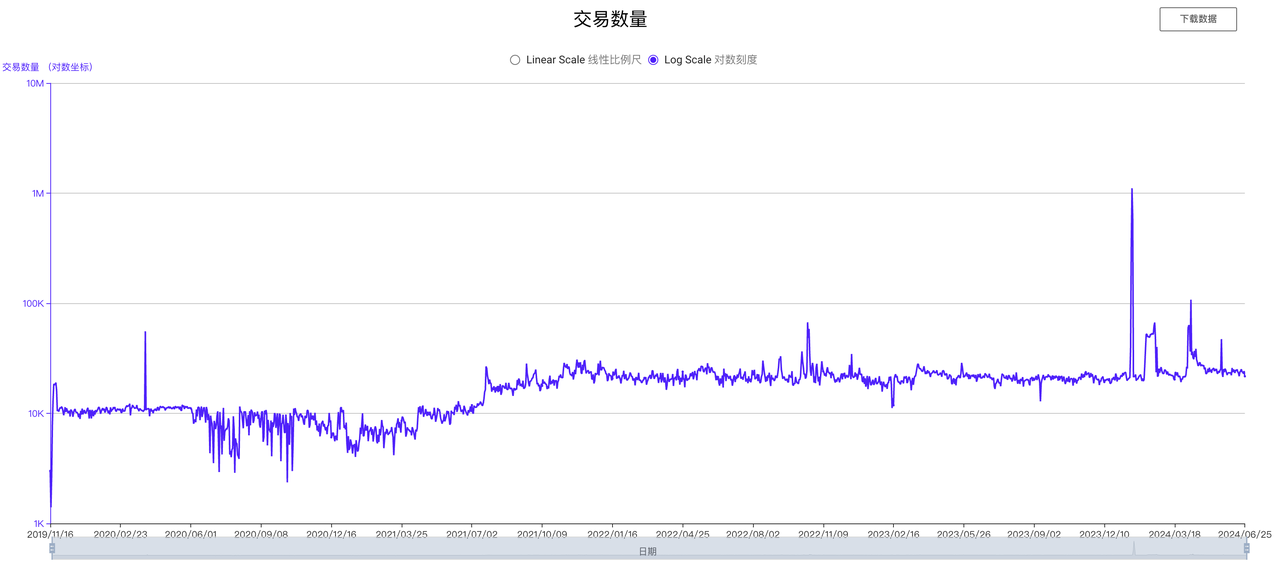

On-Chain Transaction Volume

Source: Nervos Explorer

The on-chain transaction volume of Nervos Network has remained stable.

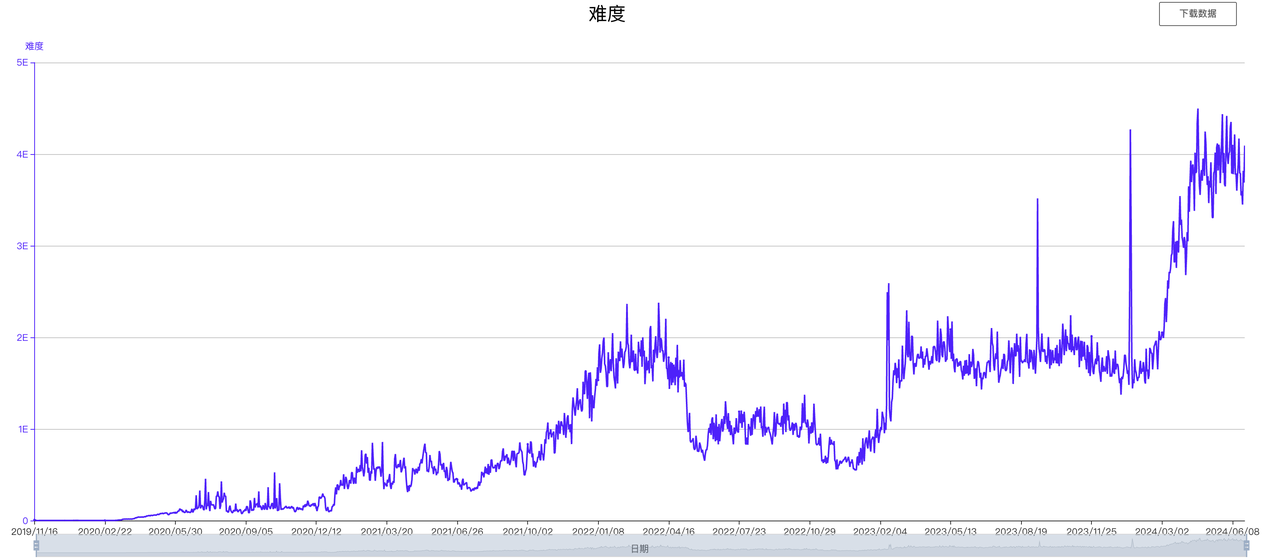

Mining Difficulty

The mining difficulty of Nervos Network has been on an upward trend. Despite a price correction, the difficulty remains high, indicating an increasing number of miners joining Nervos Network.

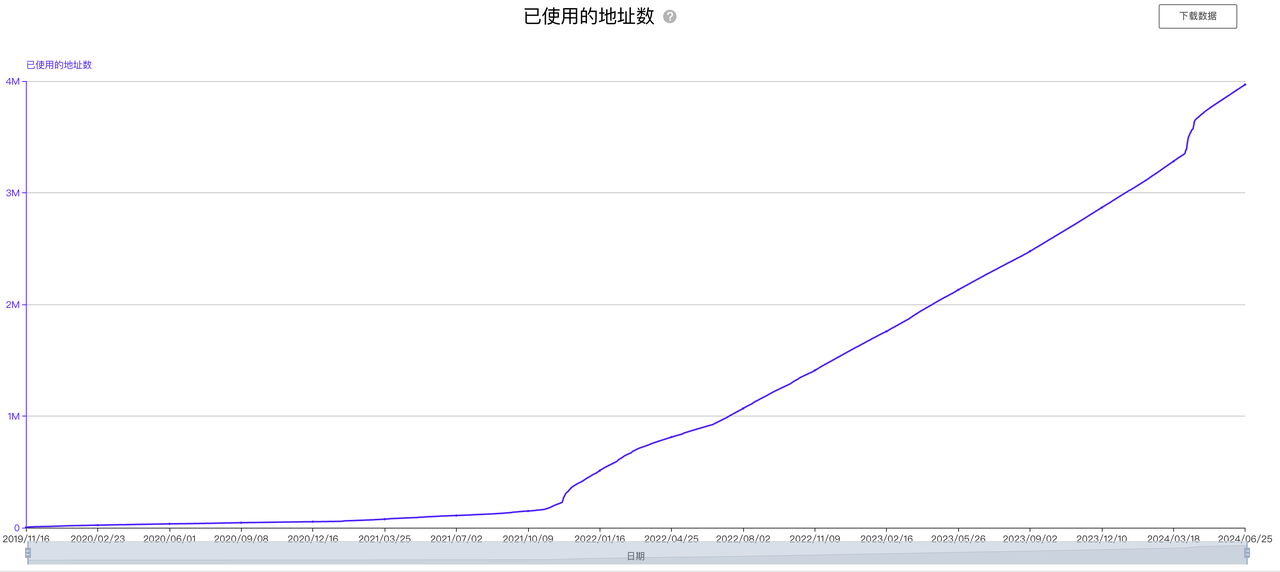

Address Count

The number of addresses on Nervos Network has consistently shown high growth.

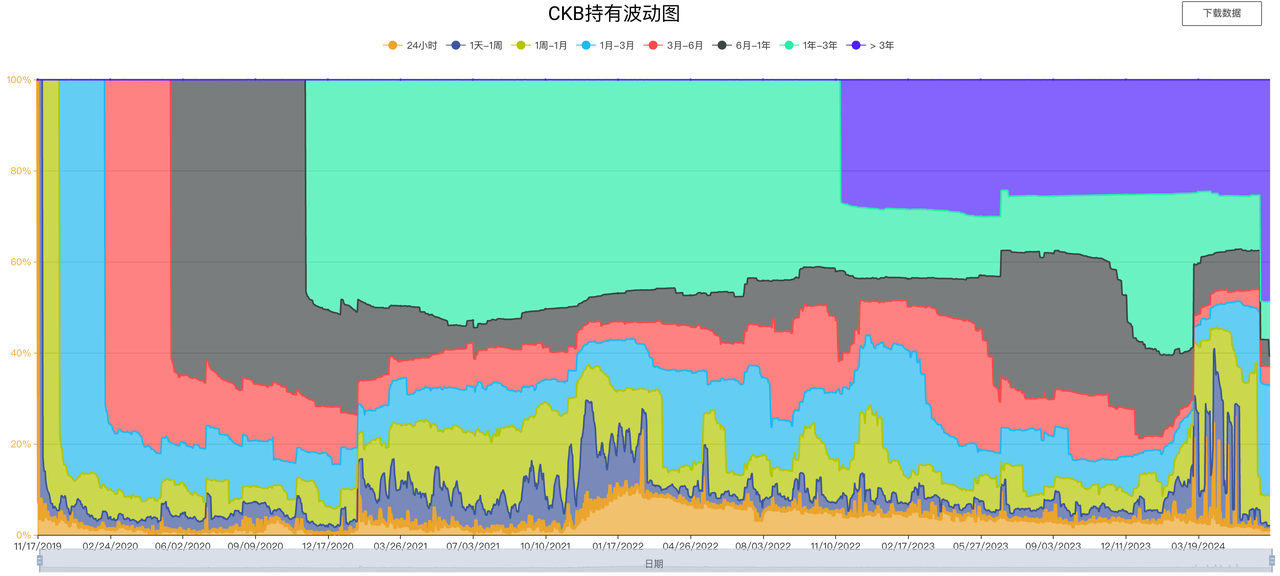

CKB Holding Wave

The chart indicates that 48.77% of CKB has been held for over 3 years, demonstrating significant long-term confidence in the development of Nervos Network.

Project Ecosystem

Nervos Network is committed to driving ecosystem development by providing continuous support in terms of funding, infrastructure, and tools. Since the mainnet launch in November 2019, approximately 5.7 billion CKB has been allocated to the ecosystem fund. The CKB ecosystem fund aims to provide initial funding for various ecosystem development initiatives and focuses on nurturing and investing in early and seed-stage projects that use the RGB++ protocol to connect CKB and Bitcoin. The fund aims to promote the development of important infrastructure and decentralized applications across multiple domains, including DeFi, gaming, tools, and NFT markets. In January 2024, the CKB ecosystem fund launched the BTCKB program, aiming to strengthen the integration between the Bitcoin and CKB blockchains through the PoW consensus mechanism and UTXO model. The BTCKB program introduces new smart contract functionality to integrate BTC, Taproot Assets, and RGB++ assets into the CKB blockchain, enhancing the functionality of the Bitcoin blockchain.

Since the launch of RGB++, over 15 existing ecosystem projects have conducted asset issuance. Notable ecosystem projects include:

- UTXO Stack: A Bitcoin L2 "OP Stack" based on the RGB++ protocol.

- JoyID: A non-custodial wallet that uses biometric technology for user authentication, supporting multiple networks including Ethereum, Bitcoin, and RGB++ assets.

- HueHub: A decentralized trading platform and launchpad supporting RGB++ assets on Bitcoin.

- Stable++: A decentralized stablecoin protocol supporting CKB and BTC.

- World3: A self-sovereign world game based on the RGB++ protocol and DOB.

- Nervape: A multi-chain composable digital item based on Bitcoin, with "base assets" issued on Bitcoin and "auxiliary assets" issued on CKB.

- Haste: An RGB++ asset management solution.

- d.id: A decentralized identity protocol for the Bitcoin ecosystem.

Project Risks

The Nervos Network team primarily focuses on technical development, with insufficient efforts in project promotion, leading to many users in the market being aware of the project's existence but not its superior performance. Additionally, Nervos Network's community operations are not ideal, lacking a strong consensus among users.

The use of on-chain + off-chain technology in Nervos Network makes it more convenient for users to use the network. However, this approach makes the project more dependent on external networks for data availability and asset issuance. Any failure in the off-chain network could result in asset loss and network downtime for the entire Nervos Network.

Nervos Network lacks comprehensive development tools and multi-party interaction solutions, limiting its effective support for decentralized applications. Furthermore, Nervos Network's essence of prioritizing usability over privacy may compromise the privacy advantages initially provided by the RGB protocol.

Conclusion

RGB++ demonstrates the potential of CKB as a Bitcoin layer-2 settlement layer, a concept that is likely to be adopted by more Bitcoin Layer 2 or asset protocols in the future. With its focus on PoW and UTXO, and years of technical accumulation, CKB may be able to demonstrate its technological advantages in the modular blockchain competition.

Nervos' token economics directly addresses the challenges of state explosion and misalignment of value capture mechanisms. The CKB blockchain ties state explosion to its native CKB token, effectively limiting the rapid growth of blockchain state. Treating state as a first-class private asset can encourage optimization and efficiency, limiting unnecessary state expansion. Additionally, Nervos introduces state rent, targeting state occupiers for inflation. This solution provides miners with a predictable source of income, preventing excessive state expansion and ensuring long-term blockchain security.

The CKB blockchain adopts a unique value capture mechanism, requiring the locking of CKB tokens for on-chain data storage and operations, creating direct long-term demand for the token. This increases the token's value and enhances the security of the blockchain, aligning with its goal of becoming an "asset storage" platform.

However, Nervos Network's team primarily focuses on technical development, with shortcomings in project promotion, leading to many users being aware of the project's existence but not its superior performance. Additionally, Nervos Network's community operations are not ideal, lacking a strong consensus among users.

In summary, Nervos Network enhances the on-chain experience of the local Bitcoin blockchain without increasing complexity or compromising decentralization. Its technology holds a leading position in the BTC-L2 race, and its long-term focus on the UTXO model has formed a solid technological barrier. Therefore, the future development of Nervos Network is promising.

References

In-depth Analysis: CKB Public Chain - How It Can Accelerate BTC's Orthodox Layer 2?

From RGB to RGB++: How CKB Empowers Bitcoin Ecosystem Asset Protocols

RGB++: Adding Bricks and Tiles to Orthodox Bitcoin L2

Regarding the Controversy of RGB++

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。